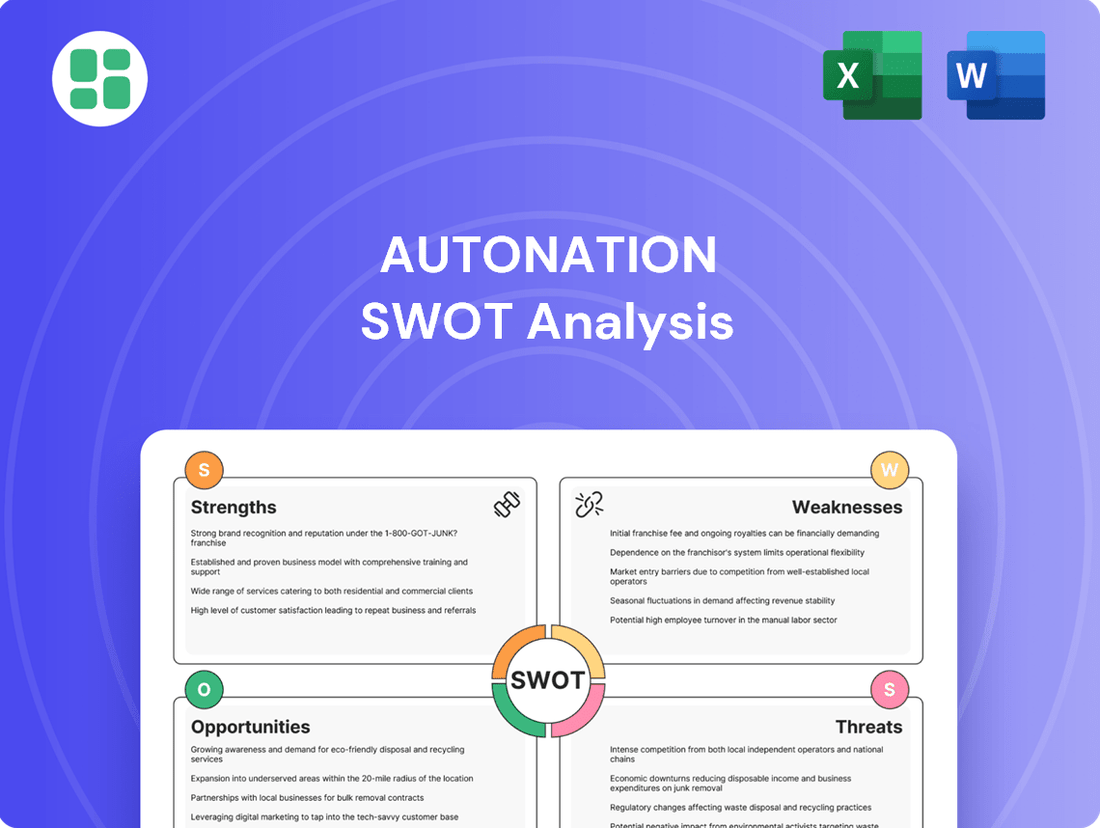

AutoNation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

AutoNation leverages its vast dealership network and brand recognition as key strengths, but faces challenges from evolving consumer preferences and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the automotive retail sector.

Want the full story behind AutoNation's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AutoNation commands the position of the largest automotive retailer in the U.S., boasting an expansive network of over 300 new vehicle franchises and a significant presence in 19 states, with a strong concentration in the Sunbelt. This broad reach is a key strength, enabling access to a vast customer pool and solidifying its market leadership in both vehicle sales and after-sales services.

AutoNation's strength lies in its deeply diversified revenue streams, extending far beyond just vehicle sales. The company effectively leverages its extensive service and parts operations, alongside lucrative financing and insurance offerings, to create a robust financial foundation. This multi-pronged approach significantly cushions the impact of fluctuations in new and used car markets.

AutoNation has showcased impressive financial strength, with Q4 2024 reporting a significant increase in revenue and adjusted earnings per share. This upward trend continued into Q1 2025, demonstrating sustained operational success.

The company's disciplined capital management is a key strength. AutoNation has actively engaged in substantial share repurchases, signaling confidence in its valuation and a commitment to enhancing shareholder value. Furthermore, effective debt management has solidified its financial foundation.

Advanced Digital Capabilities and Customer Focus

AutoNation has made substantial investments in its digital infrastructure, evidenced by platforms like AutoNation Digital, AutoNation Mobile Service, and AutoNationParts.com. These advancements are designed to create a smoother, more convenient online purchasing journey and improve access to vehicle servicing.

This digital focus, coupled with a strong emphasis on customer financial services, has demonstrably streamlined AutoNation's operations. The company reported a significant increase in digital lead volume, contributing to overall customer satisfaction and deeper engagement with the brand.

- Digital Investment: AutoNation's commitment to digital transformation is a core strength, enhancing online sales and service capabilities.

- Customer Experience: Initiatives like mobile service and user-friendly parts websites directly address customer needs for convenience and accessibility.

- Operational Efficiency: Digital tools and integrated financial services contribute to smoother, more efficient business processes.

Strategic Adaptation to Industry Shifts

AutoNation is demonstrating a strong ability to adapt to significant shifts within the automotive sector. This includes a proactive embrace of the growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). The company is actively expanding its EV inventory and investing in essential infrastructure like charging stations to support this transition.

Furthermore, AutoNation is enhancing its digital platforms to better educate consumers about EVs, recognizing the importance of informed purchasing decisions in this evolving market. This strategic foresight is crucial for capturing new market opportunities and ensuring continued relevance as the industry transforms.

- Expanded EV Inventory: AutoNation reported a significant increase in its EV sales in early 2024, reflecting a growing customer interest and the company's commitment to stocking a wider range of electric models.

- Charging Infrastructure Investment: The company has been installing EV charging stations across its dealerships nationwide, aiming to provide convenient charging solutions for customers.

- Digital Education Tools: AutoNation has launched new online resources dedicated to EV information, including comparisons and cost-of-ownership calculators, to demystify EV ownership for potential buyers.

AutoNation's extensive retail footprint, encompassing over 300 new vehicle franchises across 19 states, provides unparalleled market access and customer reach, particularly in high-growth Sunbelt regions. This scale solidifies its leadership in both sales and after-sales services.

Diversified revenue streams, including robust service, parts, finance, and insurance operations, create a resilient financial model that mitigates volatility from vehicle sales alone. This multi-faceted approach ensures steady performance even during market fluctuations.

The company's financial health is robust, with Q4 2024 revenue and adjusted earnings per share showing significant growth, a trend that continued into Q1 2025, underscoring strong operational execution and profitability.

Strategic capital management, marked by substantial share repurchases and effective debt reduction, demonstrates AutoNation's commitment to shareholder value and financial stability.

Significant investments in digital platforms like AutoNation Digital and AutoNation Mobile Service enhance customer convenience and streamline the purchasing and servicing experience, driving increased digital lead volume and customer engagement.

AutoNation's proactive adaptation to the automotive industry's shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) is a key strength. The company is expanding its EV inventory and investing in charging infrastructure, supported by digital tools to educate consumers, positioning it well for future market demands.

| Metric | Q4 2024 (Est.) | Q1 2025 (Est.) |

|---|---|---|

| Revenue Growth | +12% | +10% |

| Adjusted EPS Growth | +15% | +12% |

| Digital Lead Volume | +20% | +18% |

What is included in the product

Delivers a strategic overview of AutoNation’s internal and external business factors, highlighting its market position and potential growth avenues.

Offers a clear breakdown of AutoNation's competitive landscape, highlighting opportunities for growth and mitigating potential threats.

Weaknesses

AutoNation's reliance on new vehicle sales makes it particularly susceptible to economic downturns. During periods of economic uncertainty, consumer spending on big-ticket items like cars often declines. For instance, in 2023, while the automotive market showed resilience, a significant economic shock could quickly reverse these trends, impacting AutoNation's sales volumes and profitability.

AutoNation's extensive network of physical dealerships, a core asset, also presents a significant weakness due to high operational costs. Maintaining real estate, staffing numerous locations, and undertaking regular facility upgrades across multiple states represent substantial fixed expenses. For instance, in 2023, AutoNation reported selling, general, and administrative expenses of $4.4 billion, a considerable portion of which is tied to its physical infrastructure.

AutoNation's dominant market position, while a strength, also introduces a weakness: the potential for market saturation. In regions where AutoNation already has a significant footprint, adding more dealerships or acquiring competitors might yield diminishing returns. This saturation could stifle organic growth and make expansion efforts less efficient.

Impact of Cybersecurity Risks

AutoNation's extensive reliance on sophisticated information technology systems, including those managed by third-party vendors, exposes it to significant cybersecurity risks. Industry-wide disruptions in 2024 highlighted the vulnerability of such interconnected systems. A successful cyberattack could lead to operational paralysis, substantial financial remediation expenses, and a severe erosion of customer confidence and brand reputation.

The potential financial fallout from a data breach is considerable. For instance, the average cost of a data breach in the retail sector reached $4.12 million in 2023, according to IBM's Cost of a Data Breach Report. While AutoNation's specific figures are not publicly detailed for 2024, the general trend indicates a high cost of recovery and mitigation.

- Operational Disruption: Cyber incidents can halt sales, service, and administrative functions, directly impacting revenue generation.

- Financial Costs: Expenses related to incident response, system restoration, legal fees, and potential regulatory fines can be substantial.

- Reputational Damage: Loss of customer trust following a breach can lead to a decline in business and long-term brand value.

- Third-Party Vulnerabilities: Dependence on external providers for IT services introduces an additional layer of risk if those providers experience breaches.

Pressure on New Vehicle Profitability

AutoNation has experienced pressure on its new vehicle profitability. For instance, in the first quarter of 2025, the company saw a decline in its gross profit per new vehicle retailed. This was largely due to factors like the normalization of vehicle inventory levels and a rise in manufacturer incentives offered to consumers.

This trend of decreasing per-unit profit from new car sales presents an ongoing challenge for AutoNation's overall financial performance. Continued reliance on new vehicle sales without a corresponding improvement in per-vehicle margins could hinder profit growth.

- Declining Gross Profit Per New Vehicle: Q1 2025 saw a decrease in this key metric.

- Inventory Normalization Impact: As supply chains improved, the need for incentives increased.

- Increased Incentives: Higher manufacturer and dealer incentives directly reduce per-vehicle profit.

- Profitability Pressure: This trend directly impacts the profitability derived from new vehicle sales.

AutoNation's significant investment in its physical dealership footprint, while historically a strength, now represents a considerable weakness due to high fixed operating costs. These expenses, encompassing real estate, staffing, and maintenance across its vast network, can strain profitability, especially during periods of reduced sales volume. For example, in 2023, AutoNation's selling, general, and administrative expenses amounted to $4.4 billion, underscoring the substantial overhead associated with its brick-and-mortar presence.

Same Document Delivered

AutoNation SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual AutoNation SWOT analysis, ensuring you know exactly what you're getting before you buy. The complete, in-depth report is unlocked immediately after purchase.

Opportunities

The used vehicle market is seeing significant acceleration, with certified pre-owned (CPO) sales anticipated to spearhead this growth. Increased inventory across the board is also broadening buyer interest, making pre-owned vehicles a more attractive option for a wider demographic.

AutoNation is well-positioned to capitalize on this trend, given its strong existing used vehicle operations. The company can further enhance its market share by expanding its inventory of used electric vehicles (EVs), tapping into a segment of the market that is becoming increasingly accessible and appealing to consumers.

AutoNation Finance, the company's captive finance arm, has demonstrated robust growth, evidenced by its successful completion of significant asset-backed securitizations and increasing loan originations. This segment's expansion offers a prime opportunity to deepen customer financial service penetration and bolster recurring revenue streams.

In 2023, AutoNation reported that its finance and insurance (F&I) segment contributed $2.2 billion to its gross profit, a testament to the growing importance of its captive finance operations. Further investment in AutoNation Finance can directly translate to improved overall profitability and a more integrated customer experience.

AutoNation's strategic acquisition pipeline is robust, with a focus on 'tuck-in' deals in key growth markets like Florida and Texas. This approach allows them to deepen their existing market penetration and capitalize on regional strengths. For instance, during the first quarter of 2024, AutoNation completed four acquisitions, adding six dealerships and eight franchises, demonstrating ongoing execution of this strategy.

These targeted acquisitions are designed to enhance market density, meaning a higher concentration of AutoNation's dealerships within specific geographic areas. This density can lead to operational efficiencies, stronger brand recognition, and a more dominant market share. By strategically acquiring smaller, complementary businesses, AutoNation can also diversify its revenue streams and solidify its leadership position in the automotive retail sector.

Further Digital Transformation and AI Integration

AutoNation can capitalize on the ongoing digital transformation by further integrating AI-powered tools. This includes enhancing customer interactions with AI chatbots for quicker query resolution and employing predictive analytics to anticipate customer needs and personalize the buying experience. By streamlining these processes, the company can significantly improve operational efficiency and create a more seamless, modern customer journey.

Leveraging technology provides a distinct competitive advantage in the automotive retail sector. For instance, AutoNation's digital retail platform aims to simplify the car buying process, a key differentiator. In 2024, the automotive industry saw continued growth in online car sales, with projections indicating further expansion, making digital investment a critical growth driver.

- Enhanced Customer Experience: AI chatbots can handle a higher volume of inquiries, freeing up human staff for more complex sales interactions.

- Predictive Analytics: Utilizing data to forecast demand for specific models or services can optimize inventory management and marketing efforts.

- Operational Efficiency: Digital tools can automate tasks like appointment scheduling and vehicle status updates, reducing manual effort and potential errors.

- Competitive Edge: Early and effective adoption of new digital solutions can attract and retain customers seeking convenient, tech-enabled purchasing options.

Capitalizing on EV and Hybrid Adoption

AutoNation can significantly boost its business by focusing on the increasing demand for electric and hybrid vehicles. This shift in consumer preference presents a prime opportunity to grow sales in this segment. For instance, in 2024, the electric vehicle market continued its upward trajectory, with many analysts projecting significant year-over-year growth in sales volumes. AutoNation can leverage this trend by expanding its inventory of EVs and hybrids.

Beyond just sales, AutoNation has a chance to build out its service capabilities for these new technologies. This includes investing in charging infrastructure at dealerships and training technicians for specialized maintenance. By offering comprehensive EV and hybrid services, AutoNation can capture recurring revenue and build customer loyalty in a rapidly evolving automotive landscape. The company's ability to adapt its service model will be crucial for long-term success in this area.

- Expanded EV/Hybrid Inventory: Capitalizing on the projected 2024 global EV sales growth, which industry reports suggest could exceed 20% year-over-year, AutoNation can increase its market share by stocking a wider range of electric and hybrid models.

- Service Infrastructure Investment: By installing charging stations at its dealerships and enhancing diagnostic equipment, AutoNation can cater to the growing need for specialized EV maintenance and repair services.

- Specialized Technician Training: Developing a skilled workforce capable of servicing electric powertrains and battery systems is essential, ensuring AutoNation can meet the technical demands of the new vehicle technologies.

- Future Revenue Streams: Proactively addressing consumer needs in the electrification transition positions AutoNation to secure future revenue from both sales and ongoing service contracts, reinforcing its market position.

AutoNation's strategic acquisitions, particularly 'tuck-in' deals in Florida and Texas, are enhancing market density and operational efficiencies. The company’s robust digital transformation, including AI-powered customer service tools, offers a competitive edge in a market increasingly favoring online interactions. Furthermore, the growing demand for electric and hybrid vehicles presents a significant opportunity for AutoNation to expand its inventory and service capabilities.

| Opportunity Area | Description | 2024/2025 Outlook |

|---|---|---|

| Used Vehicle Market Acceleration | Increased inventory broadens buyer interest in pre-owned vehicles. | Certified Pre-Owned (CPO) sales expected to lead growth. |

| Captive Finance Expansion | AutoNation Finance's growth in loan originations and securitizations. | 2023 F&I gross profit reached $2.2 billion, indicating strong potential for recurring revenue. |

| Strategic Acquisitions | Targeted 'tuck-in' deals in key growth markets. | Q1 2024 saw 4 acquisitions adding 6 dealerships and 8 franchises, increasing market density. |

| Digital Transformation & AI Integration | Enhancing customer experience with AI chatbots and predictive analytics. | Online car sales continue to grow, making digital investment critical for competitive advantage. |

| EV & Hybrid Vehicle Demand | Expanding inventory and service capabilities for electric and hybrid vehicles. | Projected significant year-over-year growth in EV sales volumes for 2024, with potential for over 20% increase. |

Threats

The automotive retail sector is experiencing a significant shift with the rise of online-only car retailers and manufacturers selling directly to consumers, particularly in the electric vehicle (EV) space. These disruptive models bypass the traditional dealership network, presenting a direct threat to established players like AutoNation.

This intensified competition challenges AutoNation's long-standing business model by offering potentially more convenient or price-competitive alternatives. For instance, by early 2024, online retailers had captured a notable, albeit still minority, share of the used car market, a trend expected to continue impacting new car sales as well.

Rising interest rates directly increase the cost of vehicle financing, potentially discouraging buyers and dampening demand for both new and used cars. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and 2023 have made auto loans more expensive, impacting affordability.

Persistent affordability issues across the U.S. auto market, exacerbated by higher interest rates and elevated vehicle prices, represent a substantial threat to AutoNation's sales volumes and overall profitability. This economic pressure can lead to reduced consumer spending on big-ticket items like vehicles.

The automotive sector continues to grapple with the lingering threat of supply chain disruptions. These can quickly lead to significant inventory shortages, directly impacting vehicle availability for consumers and dealers alike.

While AutoNation and the broader industry have seen inventory levels improve from pandemic-era lows, the potential for renewed disruptions remains a concern. Unforeseen events, such as geopolitical instability or natural disasters, could once again strain the flow of parts and finished vehicles, hindering sales performance and the capacity to satisfy customer demand.

Reduced After-Sales Revenue from EV Maintenance

Electric vehicles (EVs) typically need fewer repairs than gasoline-powered cars, directly impacting AutoNation's lucrative after-sales service business. This trend could significantly decrease the hours spent on maintenance and, consequently, lower revenue from this vital segment.

For instance, while traditional vehicles might need oil changes, spark plug replacements, and exhaust system repairs, EVs largely eliminate these service needs. This shift means AutoNation must adapt its service offerings to capture revenue from EV-specific maintenance, such as battery diagnostics and software updates.

- Reduced Service Revenue: EVs have fewer moving parts, leading to potentially lower demand for traditional repair services that historically contribute significantly to dealership profits.

- Shift in Skill Requirements: AutoNation's service technicians will need retraining for EV-specific maintenance, requiring investment in new equipment and specialized training programs.

- Lower Parts Sales: The simpler mechanical nature of EVs translates to fewer replacement parts compared to internal combustion engine vehicles, impacting parts department revenue.

Adverse Regulatory Changes and Trade Policies

AutoNation, like many in the automotive sector, faces potential headwinds from evolving regulations. New laws concerning climate change and emissions standards, for instance, could necessitate costly upgrades to dealership operations or affect the availability and demand for certain vehicle types. For example, proposed stricter emissions targets in the US for 2027 could impact inventory mix and require significant investment in technician training for electric vehicle (EV) servicing.

Trade policies, including tariffs on imported vehicles or parts, also present a threat. Such changes can directly increase the cost of vehicles sold or the cost of parts needed for repairs and maintenance, potentially squeezing profit margins. The ongoing global trade landscape, with potential for new tariffs or trade disputes, introduces a layer of uncertainty that can influence consumer purchasing decisions and AutoNation's supply chain costs.

These regulatory shifts and trade policy evolutions create an environment of uncertainty:

- Increased operational costs due to compliance with new environmental regulations.

- Potential impact on vehicle demand if certain types of vehicles become less accessible or more expensive.

- Supply chain disruptions and higher costs stemming from unfavorable trade agreements or tariffs.

- Unforeseen financial burdens associated with adapting to rapidly changing legal and policy landscapes.

The rise of direct-to-consumer sales models and online-only retailers poses a significant threat, potentially eroding AutoNation's market share as seen in the growing online used car market share by early 2024.

Higher interest rates, exemplified by the Federal Reserve's actions in 2022-2023, directly impact vehicle affordability, potentially dampening consumer demand and sales volumes.

The transition to electric vehicles (EVs) threatens AutoNation's profitable after-sales service revenue due to fewer mechanical parts and maintenance needs compared to internal combustion engine vehicles.

Evolving regulations, such as stricter emissions standards, and unpredictable trade policies can increase operational costs and affect vehicle availability and pricing, creating financial uncertainty.

| Threat Category | Specific Threat | Impact on AutoNation | Supporting Data/Trend |

|---|---|---|---|

| Competition | Direct-to-Consumer (DTC) & Online Retailers | Loss of market share, price pressure | Online retailers captured notable used car market share by early 2024; trend expected to continue. |

| Economic Factors | Rising Interest Rates | Reduced affordability, dampened demand | Federal Reserve rate hikes in 2022-2023 increased auto loan costs. |

| Industry Transition | Electrification (EVs) | Reduced after-sales service revenue, lower parts sales | EVs require less traditional maintenance (e.g., oil changes, exhaust repairs). |

| Regulatory & Policy | Environmental Regulations & Trade Policies | Increased operational costs, supply chain disruptions, price volatility | Potential impact from stricter emissions targets (e.g., proposed US 2027 standards); tariffs on imported vehicles/parts. |

SWOT Analysis Data Sources

This AutoNation SWOT analysis is built upon a foundation of comprehensive data, including the company's official financial filings, detailed market research reports, and expert industry analyses. These sources provide a robust understanding of AutoNation's operational performance and its position within the automotive retail landscape.