AutoNation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

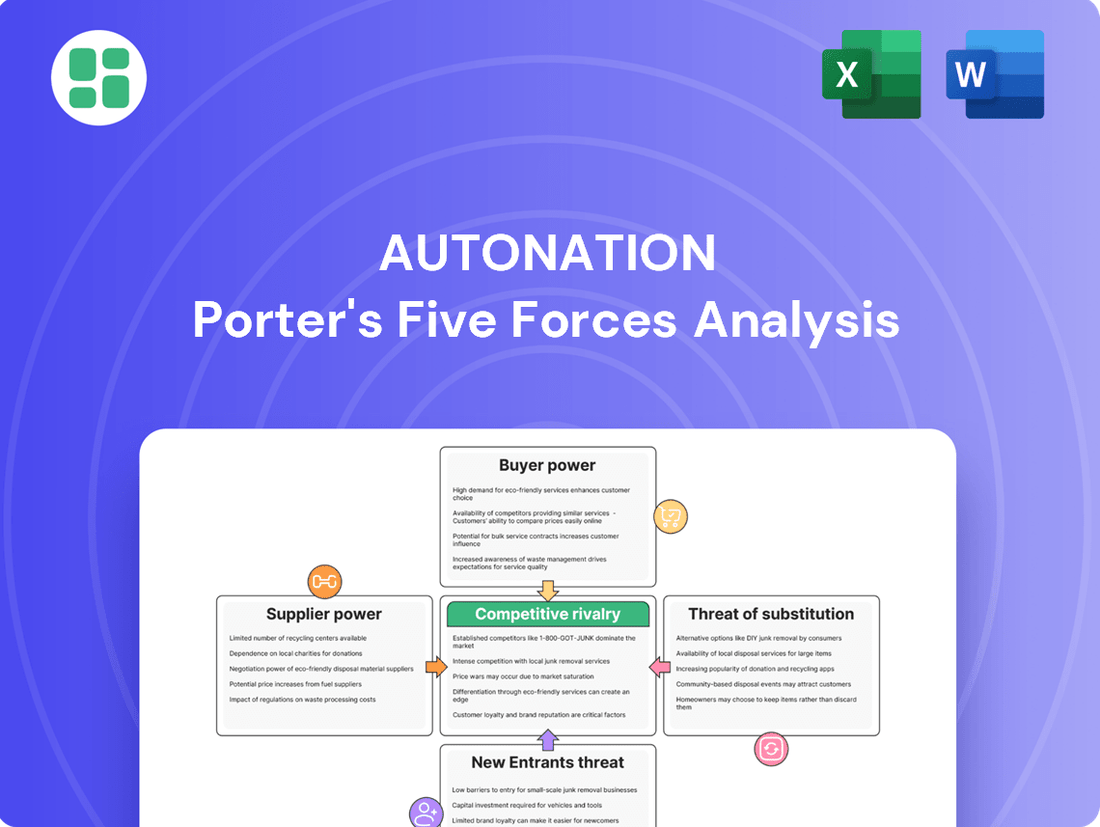

AutoNation faces intense competition, with significant pressure from rivals and the looming threat of new market entrants. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this dynamic landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AutoNation’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Automotive manufacturers, or OEMs, wield substantial power over dealerships like AutoNation. This stems from the franchise system, where retailers are reliant on specific brands for their inventory and access to popular models. In 2024, this dynamic was evident as OEMs continued to manage production schedules, influencing which dealerships received the most sought-after vehicles.

This OEM dominance directly impacts a retailer's ability to meet consumer demand. For instance, ongoing supply chain challenges, such as those experienced with semiconductor availability in recent years, can significantly constrain a dealership's stock of new vehicles. This scarcity empowers OEMs to dictate terms and pricing, as dealers have limited alternative sources for new car inventory.

Suppliers of unique parts and cutting-edge automotive technologies, particularly for contemporary vehicles and electric vehicles (EVs), hold significant sway. AutoNation's core parts and service operations, a segment experiencing growth and strong profit margins, are heavily dependent on these specialized suppliers.

The increasing complexity of vehicle technologies, such as advanced driver-assistance systems (ADAS) and EV powertrains, means that dealerships like AutoNation require specialized diagnostic tools and comprehensive technician training programs directly from the manufacturers or their authorized suppliers. For instance, in 2023, the average repair cost for advanced driver-assistance systems could range from $500 to over $2,000, highlighting the specialized nature of these components and the suppliers' control over their availability and servicing.

The automotive retail landscape is shaped by a relatively concentrated group of major global manufacturers. This means AutoNation, despite its scale, deals with a finite number of primary vehicle suppliers, often referred to as Original Equipment Manufacturers (OEMs).

This concentration grants significant leverage to these OEMs. For AutoNation, the ability to source popular or high-demand vehicle models can be significantly influenced by the manufacturer's terms. For instance, in 2024, the ongoing supply chain challenges, though easing, continued to give OEMs considerable power in allocating vehicles to dealerships, impacting AutoNation's inventory availability and negotiation power.

Supply Chain Resilience and Global Disruptions

Recent global supply chain disruptions, such as the persistent semiconductor shortage and widespread logistical bottlenecks, have significantly amplified the bargaining power of upstream suppliers in the automotive sector. These external pressures directly impact AutoNation by causing unpredictable inventory levels, which in turn can affect sales volumes and the gross profit margins achieved on vehicles.

For instance, during the peak of the chip shortage in 2022, many automakers were forced to reduce production significantly, leading to record-low inventory levels on dealer lots. This scarcity allowed suppliers of critical components to dictate terms more effectively. AutoNation, like other automotive retailers, experienced the ripple effects of these upstream power dynamics.

- Semiconductor Shortage Impact: In 2023, the automotive industry continued to grapple with the effects of the semiconductor shortage, though gradually improving. Reports indicated that the shortage still led to billions in lost revenue for automakers globally.

- Logistical Challenges: Port congestion and elevated shipping costs in 2023 and early 2024 continued to pose challenges, increasing the cost and lead times for vehicle delivery and parts procurement.

- Supplier Diversification Strategy: AutoNation's strategy to build relationships with a broader base of suppliers for both new and used vehicles, as well as parts and service, is a key tactic to mitigate the concentrated power of any single supplier or group of suppliers.

Financing and Incentives Provided by OEMs

Original Equipment Manufacturers (OEMs) frequently offer floorplan financing and various incentives to dealerships. This support can significantly ease the financial strain on retailers, but it simultaneously fosters a reliance on the manufacturer.

These financial arrangements effectively grant manufacturers considerable leverage over their dealership networks. This influence can manifest in dictating sales quotas, shaping marketing initiatives, and even guiding broader operational strategies, thereby increasing supplier bargaining power.

For instance, in 2024, many automotive OEMs continued to offer competitive financing rates and marketing co-op funds to their franchised dealers. These programs, while beneficial for dealer liquidity, tie dealership performance directly to OEM objectives.

- OEM Financing Dependency: Dealerships often rely on OEM-provided floorplan financing, which reduces immediate capital outlay but creates an ongoing financial relationship.

- Incentive-Driven Performance: Manufacturer incentives, tied to sales volume or specific model pushes, can compel dealerships to prioritize OEM goals over potentially more profitable independent strategies.

- Leverage in Negotiations: The ability of OEMs to adjust financing terms or incentive programs gives them significant bargaining power in discussions regarding inventory management, product allocation, and operational standards.

Automakers, as the primary suppliers of new vehicles, hold significant bargaining power over dealerships like AutoNation. This is largely due to the franchise model, which ties dealerships to specific brands for inventory. In 2024, OEMs continued to manage production and allocation, giving them leverage in supplying popular models.

The concentration of major global manufacturers means AutoNation deals with a limited number of key vehicle suppliers, amplifying OEM influence. This concentration grants significant leverage, impacting AutoNation's ability to source high-demand models and negotiate terms. For instance, in 2024, ongoing supply chain issues continued to give OEMs considerable power in vehicle allocation, affecting AutoNation's inventory and negotiation leverage.

Suppliers of specialized parts and advanced automotive technologies, particularly for EVs and complex modern vehicles, also possess considerable power. AutoNation's crucial parts and service operations rely heavily on these suppliers. The increasing complexity of vehicle technology, such as ADAS, requires specialized tools and training, giving suppliers significant control over availability and servicing, with average ADAS repair costs in 2023 ranging from $500 to over $2,000.

OEMs also exert influence through financial support like floorplan financing and incentives. While beneficial, these programs foster dealership reliance and grant manufacturers leverage in dictating sales targets and operational strategies. In 2024, many OEMs continued offering competitive financing and marketing funds, tying dealer performance to OEM objectives.

| Supplier Type | Bargaining Power Factor | Impact on AutoNation (2023-2024) | Example Data/Trend |

|---|---|---|---|

| Automotive Manufacturers (OEMs) | Franchise System, Inventory Allocation, Brand Dependency | High leverage in terms of vehicle supply, pricing, and model availability. | Continued impact of semiconductor shortages on production and allocation in 2023, though gradually improving. |

| Specialized Parts & Technology Suppliers | Technological Complexity, Unique Components, Service Requirements | Significant power in parts and service segment due to specialized nature of components and repair needs. | High costs associated with ADAS repairs highlight supplier control over specialized parts and diagnostics. |

| Financial Services (OEM-backed) | Floorplan Financing, Incentives, Marketing Support | Creates dealership reliance and allows OEMs to influence sales quotas and operational strategies. | OEMs continued to offer competitive financing and co-op funds in 2024, linking dealer performance to manufacturer goals. |

What is included in the product

This analysis dissects AutoNation's competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting AutoNation.

Customers Bargaining Power

Customers are increasingly sensitive to price, a trend amplified by rising new vehicle costs and higher interest rates projected through 2024 and 2025. This heightened affordability concern pushes buyers to meticulously compare prices across different dealerships.

The inclination to explore used vehicles as a more budget-friendly option is growing, directly impacting demand for new car sales. Dealerships, therefore, face pressure to offer compelling price points and adaptable financing solutions to secure customer loyalty.

The rise of online car shopping platforms and direct-to-consumer sales models has dramatically increased price transparency for AutoNation's customers. In 2024, it's estimated that over 80% of car buyers conduct extensive online research before visiting a dealership, comparing prices and features across numerous sources. This readily available information significantly shifts bargaining power towards the consumer, as they can easily identify competitive pricing and understand vehicle values.

By 2024 and into 2025, new vehicle inventory has largely rebounded to pre-pandemic levels. This means consumers have a much broader array of models and brands to choose from, a significant shift from the scarcity experienced in recent years.

This abundance of choice directly empowers the customer. They are no longer forced to accept limited options and can afford to be more discerning about features, pricing, and financing. This increased leverage allows buyers to negotiate more aggressively or simply wait for the most attractive deals to emerge.

Growth of Online and Omnichannel Buying Experiences

The growing preference for online and omnichannel shopping significantly boosts customer bargaining power. Consumers now expect seamless integration between digital research and physical dealership visits, forcing established players to adapt.

Digital-first strategies and direct-to-consumer models from new automotive entrants and some original equipment manufacturers (OEMs) offer customers more convenient choices. This compels traditional retailers, such as AutoNation, to invest heavily in improving their online presence and digital tools to remain competitive.

- Consumer Expectations: A 2024 Deloitte survey indicated that over 70% of automotive buyers utilize online resources extensively during their purchase journey.

- Digital Adoption: The automotive industry saw a significant uptick in online vehicle reservations and financing applications in 2023, a trend expected to continue.

- Competitive Landscape: New EV manufacturers, for instance, often operate with a direct-to-consumer online sales model, setting a benchmark for customer convenience.

Strong Used Vehicle Market as an Alternative

The strength of the used vehicle market significantly impacts the bargaining power of customers. A robust used car market, fueled by consumers prioritizing value and a generally increasing inventory of pre-owned vehicles, offers a compelling alternative to purchasing new cars. This is particularly relevant for AutoNation, as its substantial footprint in used car sales means it faces internal competition. Customers can readily shift their preferences between new and used vehicles, influenced by factors like upfront cost and the perceived value proposition, thereby increasing their leverage.

In 2023, the used car market continued to show resilience, with average prices remaining elevated compared to pre-pandemic levels, though some moderation occurred. For instance, data from sources like Cox Automotive indicated that while depreciation trends were normalizing, the overall value proposition of used cars remained strong for many buyers. This market dynamic directly empowers customers by providing a viable and often more affordable substitute for new vehicle purchases, intensifying price sensitivity.

- Strong Used Vehicle Market: Consumers actively seek value, making pre-owned vehicles a powerful alternative to new car purchases.

- Inventory Increases: A growing supply of used cars enhances customer choice and bargaining power.

- AutoNation's Internal Competition: AutoNation's significant used car operations mean customers can easily switch between new and used options, increasing their leverage.

- Price Sensitivity: Affordability and perceived value are key drivers, allowing customers to negotiate more effectively or opt for alternatives.

Customers possess significant bargaining power due to increased price transparency, a wider selection of vehicles, and the growing influence of online shopping. The affordability concerns, amplified by rising new car costs and interest rates through 2024 and 2025, push buyers to compare prices extensively. Over 80% of car buyers in 2024 conduct thorough online research, readily accessing pricing and feature comparisons, which shifts leverage towards consumers.

| Factor | Impact on Customer Bargaining Power | Data Point (2024/2025 Projection) |

|---|---|---|

| Price Transparency | High | >80% of buyers research online |

| Vehicle Selection | High | Inventory rebound to pre-pandemic levels |

| Online Shopping | High | >70% of buyers use online resources |

| Used Vehicle Market | Moderate to High | Resilient market, offering alternatives |

What You See Is What You Get

AutoNation Porter's Five Forces Analysis

This preview showcases the complete AutoNation Porter's Five Forces Analysis, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitutes. The document you see here is precisely the same professionally written and formatted analysis you’ll receive instantly after purchase, ready for immediate use.

Rivalry Among Competitors

The automotive retail sector is dominated by several substantial, national dealership groups, such as AutoNation, Lithia Motors, Penske Automotive Group, Group 1 Automotive, and Sonic Automotive. These significant entities engage in fierce competition for market share, valuable inventory, and skilled personnel.

This intense rivalry among these large players significantly shapes the competitive landscape, driving innovation and impacting pricing strategies across the industry. For instance, in 2023, AutoNation reported total revenue of $22.7 billion, showcasing the scale of operations these groups manage.

The automotive industry is experiencing a significant shift with the growing influence of online retailers and direct-to-consumer sales. Companies like CarMax have already established a strong online presence, offering a streamlined purchasing experience that traditional dealerships are working to replicate. This trend is further amplified by original equipment manufacturers (OEMs) exploring direct sales models, with Tesla being a prime example.

More recently, even tech giants like Amazon are venturing into automotive sales through partnerships, signaling a broader disruption. For instance, Amazon Auto facilitates car buying, connecting consumers with dealerships online. This digital-first approach challenges the established dealership model by setting new benchmarks for convenience and transparency, forcing traditional players like AutoNation to adapt their strategies to meet evolving customer expectations and pricing pressures.

AutoNation, like many automotive retailers, faces intense competition in the after-sales, parts, and service segments. As new vehicle sales margins can be thin, dealerships are increasingly prioritizing these higher-margin areas to boost overall profitability and cultivate lasting customer relationships. This strategic shift makes the quality and efficiency of service operations a critical differentiator in the market.

In 2024, the automotive service sector continues to be a vital revenue stream. For instance, AutoNation reported that its service and parts segment contributed significantly to its financial performance, highlighting the growing importance of this area. Dealerships are investing in advanced diagnostic tools and technician training to enhance service capabilities, directly impacting customer retention and revenue generation.

Digitalization and Technology Adoption

Competitive rivalry within the automotive retail sector is intensified by the relentless drive for digitalization and technology adoption. Companies like AutoNation must continuously invest in digital tools, artificial intelligence, and omnichannel strategies to satisfy increasingly sophisticated consumer demands. This arms race for technological superiority means that dealerships are increasingly competing on the fluidity of their online-to-offline customer journeys, the precision of personalized recommendations, and the overall efficiency of their digital operations.

The need for ongoing tech investment creates a dynamic competitive landscape where early adopters of innovative digital solutions can gain a significant edge. For instance, the automotive industry saw a substantial shift towards online car purchasing tools and virtual showrooms, with many consumers now expecting to complete a significant portion of their transaction digitally. In 2024, reports indicated that a growing percentage of car buyers preferred to start their research and even configure their vehicles entirely online before visiting a dealership, underscoring the critical importance of a robust digital presence.

- Digital Investment: AutoNation and its competitors are channeling significant capital into developing advanced digital platforms, AI-powered customer service tools, and seamless integration between online and physical dealership experiences.

- Omnichannel Expectations: Consumers now expect a unified experience, moving effortlessly from online research and virtual tours to in-person test drives and financing, placing pressure on dealerships to perfect this integration.

- Personalization and Efficiency: Success hinges on leveraging data analytics and AI to offer personalized vehicle recommendations and streamline digital processes, reducing friction for the buyer.

- Competitive Differentiation: Technology adoption is no longer optional but a key differentiator, allowing leading firms to capture market share by offering superior convenience and engagement.

Market Consolidation and Acquisition Strategies

The automotive retail sector is witnessing significant consolidation, a trend that directly impacts competitive rivalry. Larger entities, such as AutoNation, are actively acquiring smaller, independent dealerships. This strategy allows them to broaden their geographical reach and leverage economies of scale, which can lead to cost efficiencies in areas like marketing, inventory management, and administrative overhead.

This ongoing consolidation intensifies competition by diminishing the number of standalone competitors. As market share becomes concentrated among fewer, larger players, the pressure on remaining independent dealerships to compete on price, service, and selection increases. For instance, in 2023, AutoNation continued its strategic acquisitions, further solidifying its position in key markets.

- Industry Consolidation: Larger dealership groups are actively acquiring smaller, independent dealerships.

- Economies of Scale: Acquisitions enable expanded footprints and cost advantages.

- Intensified Rivalry: Fewer independent players mean greater pressure on remaining businesses.

- Market Position: Dominant groups strengthen their competitive standing through strategic M&A.

Competitive rivalry in automotive retail is fierce, driven by large national groups like AutoNation, Lithia Motors, and Penske Automotive, which vie for market share and talent. In 2023, AutoNation's revenue reached $22.7 billion, illustrating the scale of these major players.

The rise of online retailers and direct-to-consumer models, exemplified by CarMax and Tesla, further intensifies competition, forcing traditional dealerships to innovate and improve digital experiences. Even tech giants like Amazon are entering the space, creating new competitive pressures and influencing pricing.

AutoNation and its peers are heavily investing in digital transformation and omnichannel strategies to meet evolving customer expectations for seamless online-to-offline experiences. This technological arms race is crucial for differentiation, with a growing percentage of car buyers in 2024 preferring to start their purchase journey online.

Industry consolidation, with larger groups acquiring smaller dealerships, is also a significant factor, leading to economies of scale and concentrating market power, thereby increasing pressure on remaining independent businesses.

| Competitor | 2023 Revenue (approx.) | Key Competitive Factor |

|---|---|---|

| AutoNation | $22.7 billion | Digitalization, Omnichannel Experience |

| Lithia Motors | $21.5 billion | Geographic Expansion, Service & Parts |

| Penske Automotive Group | $20.8 billion | Brand Portfolio, After-Sales Services |

| Group 1 Automotive | $17.2 billion | Acquisition Strategy, Operational Efficiency |

| Sonic Automotive | $11.7 billion | Technology Integration, Customer Convenience |

SSubstitutes Threaten

The growing accessibility of public transportation and ride-sharing services presents a subtle but significant threat to AutoNation. While not replacing the desire for personal vehicle ownership entirely, these alternatives can diminish the perceived need for it, especially in densely populated urban centers. This shift could gradually erode demand for new vehicle sales over the long term.

In 2024, the ride-sharing market continued its expansion, with platforms like Uber and Lyft reporting increased ridership. For instance, Uber's global gross bookings reached an estimated $37.7 billion in the first quarter of 2024, indicating a strong user base. Similarly, public transit systems in major metropolitan areas saw a rebound in passenger numbers post-pandemic, with some cities reporting ridership levels approaching pre-2020 figures.

The used vehicle market presents a potent threat of substitution for new car sales. In 2024, as new car prices remained elevated and interest rates stayed relatively high, consumers increasingly turned to the pre-owned market for more affordable options. This trend directly siphons demand away from new vehicle showrooms.

Certified pre-owned (CPO) programs and a general increase in the quality of used vehicles have made them a more attractive alternative. For instance, in the first quarter of 2024, used car prices saw a slight dip compared to the previous year, making them even more compelling for budget-conscious buyers. This affordability directly impacts the volume of new cars sold by dealerships like AutoNation.

Leasing presents a significant threat by offering consumers an alternative to purchasing vehicles outright. This allows access to new models without the long-term financial commitment of ownership. For instance, in 2023, lease penetration in the US auto market hovered around 20-25%, demonstrating its substantial appeal as a substitute for buying.

Furthermore, the rise of vehicle subscription services poses an evolving threat. These models cater to consumers prioritizing flexibility and access over traditional ownership, potentially drawing market share away from both purchase and leasing. While still a nascent market, the growth in subscription offerings indicates a shifting consumer preference that AutoNation must monitor closely.

Extended Vehicle Lifespans and Maintenance

The increasing longevity of vehicles and a focus on maintenance present a significant threat of substitutes for new car sales. Consumers are opting to extend the life of their current vehicles through repairs and upkeep, diverting funds that might otherwise go towards a new purchase. This shift is fueled by improved vehicle durability and economic considerations.

This trend directly impacts the automotive retail sector, as fewer new vehicle transactions occur. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, up from 12.1 years in 2022, according to S&P Global Mobility. This extended lifespan means consumers are more likely to invest in the aftermarket service segment, which includes parts and labor, rather than upgrading to a new model.

- Increased Vehicle Lifespans: The average age of vehicles on U.S. roads hit 12.5 years in 2023.

- Consumer Preference Shift: Consumers prioritize maintenance and repairs over new vehicle purchases due to economic factors and enhanced vehicle durability.

- Aftermarket Growth: This trend diverts consumer spending from new car sales to the more robust aftermarket service and parts sector.

- Impact on New Sales: Extended vehicle lifespans directly reduce the demand for new vehicles, acting as a substitute for outright replacement.

Alternative Mobility Solutions Beyond Ownership

The rise of alternative mobility solutions, such as electric scooters, e-bikes, and other micro-mobility options, presents a growing threat to traditional personal vehicle ownership, particularly for short urban trips. These alternatives can diminish the necessity for multiple vehicles within households or reduce reliance on cars for daily commutes.

While not a direct replacement for all car usage, these options are gaining traction. For instance, the global micro-mobility market was valued at approximately $40 billion in 2023 and is projected to reach over $100 billion by 2030, indicating a significant shift in consumer behavior and preferences.

- Growing Adoption: Increased availability and affordability of e-scooters and e-bikes are making them viable alternatives for short-distance travel.

- Reduced Car Dependency: For urban dwellers, these options can substitute for one car in a multi-car household or replace car trips for errands and commuting.

- Market Growth: The expansion of shared mobility services and personal ownership of e-bikes and scooters highlights a tangible shift away from exclusive reliance on traditional automobiles.

The threat of substitutes for AutoNation is multifaceted, encompassing alternatives to traditional car ownership and purchasing new vehicles. These substitutes directly impact demand for AutoNation's core business. The increasing longevity of vehicles, coupled with improved repair services, means consumers are less compelled to upgrade frequently. Furthermore, the growing popularity of ride-sharing and micro-mobility options, especially in urban areas, offers viable alternatives for transportation needs.

| Substitute Category | Key Trends & Data (2023-2024) | Impact on AutoNation |

|---|---|---|

| Used Vehicles | Elevated new car prices and interest rates in 2024 drove consumers to the used market. Used car prices saw a slight dip in Q1 2024, increasing affordability. | Siphons demand away from new vehicle sales. |

| Leasing & Subscriptions | Leasing penetration remained significant (around 20-25% in 2023). Vehicle subscription services offer flexibility, catering to a segment prioritizing access over ownership. | Provides alternatives to outright purchase, potentially reducing new car sales volume. |

| Public Transit & Ride-Sharing | Ride-sharing platforms like Uber reported strong gross bookings (e.g., $37.7 billion in Q1 2024). Public transit ridership rebounded in major cities. | Diminishes the perceived need for personal vehicle ownership, especially in urban centers. |

| Extended Vehicle Lifespans | The average age of vehicles on U.S. roads reached a record 12.5 years in 2023. Consumers invest more in maintenance and repairs. | Reduces the frequency of new vehicle purchases and shifts spending to aftermarket services. |

Entrants Threaten

The automotive retail sector, particularly for new car dealerships, presents a formidable barrier to entry due to immense capital requirements. New entrants must secure significant funding for prime real estate, maintain a diverse and sizable new vehicle inventory, establish robust service facilities, and hire skilled technicians and sales staff. For instance, in 2024, the average cost to build a new car dealership can range from $5 million to over $20 million, depending on brand and location, making it a daunting prospect for smaller or uncapitalized businesses.

Established franchise laws and stringent regulatory hurdles significantly deter new entrants in the automotive retail sector. These state-level regulations often mandate that new vehicles must be sold through licensed dealerships, creating a substantial barrier for manufacturers seeking to implement direct-to-consumer sales models. For instance, in 2024, over 40 states had laws in place that either prohibit or severely restrict manufacturers from selling directly to consumers, effectively protecting existing franchise dealerships.

AutoNation and other established dealerships leverage strong, long-standing relationships with Original Equipment Manufacturers (OEMs) and a deeply ingrained customer loyalty. This history translates into a significant advantage, as consumers often trust these brands for quality, service, and reliability.

Newcomers to the automotive retail sector face a steep climb in cultivating similar trust and brand recognition. They must invest heavily in marketing and customer service to overcome the inertia of existing customer preferences and build a reputation that can rival decades of established presence.

For instance, in 2024, the automotive industry continues to see high customer retention rates for brands with a proven track record. This makes it particularly difficult for new entrants to capture market share without offering a demonstrably superior value proposition or a unique selling point that directly addresses unmet customer needs.

Emergence of Online-Only Retailers and Digital Platforms

The automotive retail landscape is experiencing a shift with the rise of online-only retailers and digital platforms. While traditional dealerships face high capital investment barriers, these new entrants can bypass some of those costs by focusing on digital customer acquisition and online sales processes. For instance, Amazon's increasing involvement with original equipment manufacturers (OEMs) signals a potential for streamlined online vehicle purchasing, directly challenging established dealership models.

These digital players can scale rapidly by leveraging technology, offering a potentially more convenient customer experience. Although they still require robust logistical networks for vehicle delivery and service, their initial overhead can be significantly lower than brick-and-mortar dealerships. This allows them to compete on price and accessibility, posing a credible threat of new market entry for companies like AutoNation.

- Digital Platforms Bypass Traditional Barriers: Online-only retailers can enter the market with lower upfront capital investment compared to building physical dealerships.

- Scalability Through Technology: Companies like Amazon can leverage existing technological infrastructure and customer bases to quickly scale their automotive offerings.

- Shifting Customer Expectations: The convenience of online purchasing, demonstrated by growth in e-commerce across sectors, influences automotive buying preferences.

- OEM Partnerships: Collaborations between OEMs and digital platforms can further lower entry barriers and create new distribution channels.

Access to Inventory and OEM Partnerships

New entrants, especially those looking to sell new cars, face a significant hurdle in getting franchise agreements with major car makers. These Original Equipment Manufacturers (OEMs) often favor established dealerships that have a solid financial footing and a history of strong sales and service. For instance, in 2024, the number of new franchised dealerships continues to be tightly controlled by OEMs, with few new franchises being awarded to independent operators.

This reliance on OEM partnerships creates a substantial barrier. Without access to new vehicle inventory directly from manufacturers, new entrants are largely confined to the used car market, which has different dynamics and profit margins. AutoNation, as a major franchised dealer, benefits from these long-standing relationships, securing consistent access to popular new models.

Consider these points regarding access to inventory and OEM partnerships:

- Franchise Agreements: Obtaining new car franchises from OEMs is highly selective, limiting the number of new entrants.

- OEM Preferences: Manufacturers prioritize established dealers with proven track records for financial stability and operational excellence.

- Inventory Access: Lack of OEM partnerships restricts new players primarily to the used vehicle market.

- Competitive Advantage: Existing franchised dealers like AutoNation possess a critical advantage through secured new vehicle supply chains.

The threat of new entrants in automotive retail remains moderate, largely due to substantial capital requirements and established franchise laws. While digital platforms are emerging, they still face challenges in replicating the comprehensive experience offered by traditional dealerships. Securing OEM franchise agreements is a significant hurdle, limiting direct competition for new vehicle sales.

However, the landscape is evolving. Digital-first companies can bypass some of the physical infrastructure costs associated with traditional dealerships. For instance, the increasing focus on online car purchasing, accelerated by the pandemic, suggests a growing acceptance of digital channels. By 2024, a significant portion of car research and even initial purchase steps are conducted online, indicating a shift that new entrants can leverage.

Despite these shifts, the need for physical service centers and the complexities of vehicle logistics still present barriers. Furthermore, the strong brand loyalty and established customer trust enjoyed by companies like AutoNation are not easily replicated. New entrants must offer compelling value propositions to overcome these ingrained preferences.

| Barrier Type | Description | Impact on New Entrants | 2024 Relevance |

|---|---|---|---|

| Capital Requirements | High costs for real estate, inventory, and facilities. | Significant deterrent, especially for traditional dealerships. | Average dealership build cost: $5M-$20M+ |

| Franchise Laws & Regulations | State laws restricting direct-to-consumer sales by manufacturers. | Protects existing franchised dealers, limits new models. | Over 40 states have restrictive laws in 2024. |

| OEM Relationships & Brand Loyalty | Established trust and access to new vehicle inventory. | Difficult for new entrants to match reputation and supply. | High customer retention for established brands. |

| Digital Disruption | Online platforms offering lower overhead and convenience. | Potential to bypass some traditional barriers. | Amazon's increasing OEM involvement signals new channels. |

Porter's Five Forces Analysis Data Sources

Our AutoNation Porter's Five Forces analysis is built upon a foundation of comprehensive data, including AutoNation's annual reports and SEC filings, alongside industry-specific market research from firms like Cox Automotive and JD Power.