AutoNation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

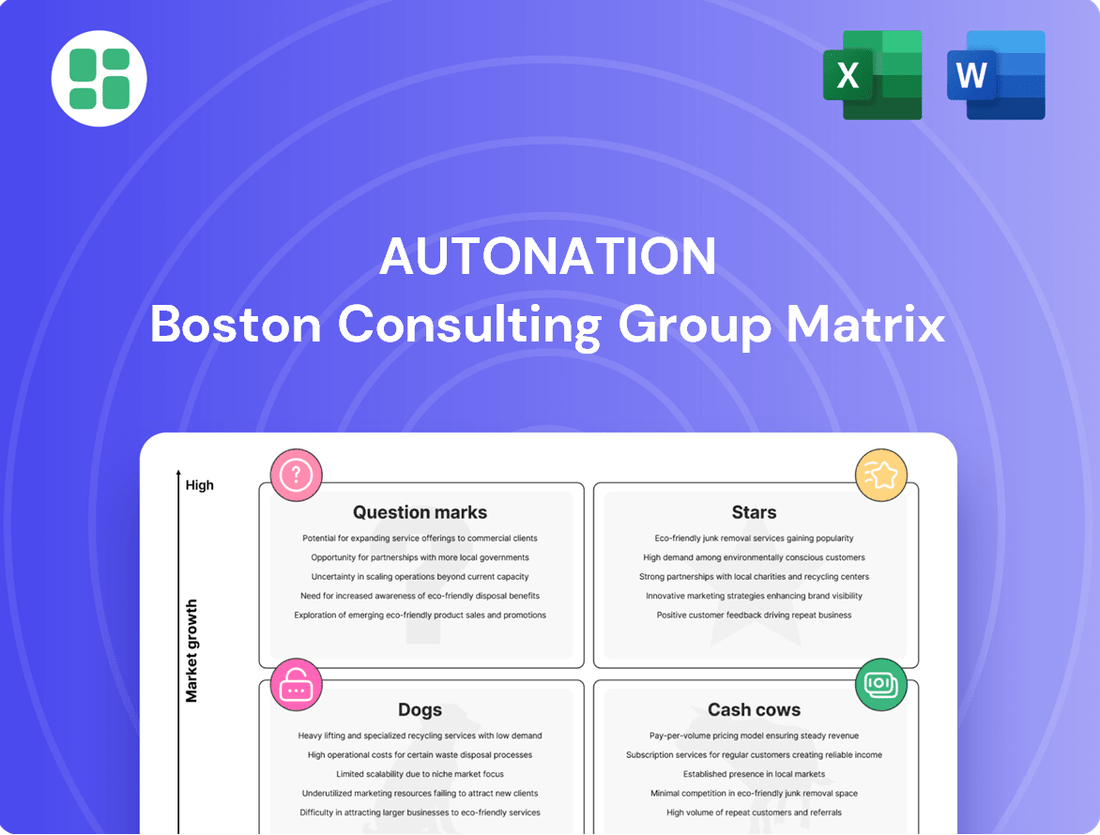

Curious about AutoNation's product portfolio? This preview offers a glimpse into their strategic positioning, but the full BCG Matrix reveals the complete picture. Understand which segments are driving growth and which require careful management.

Unlock AutoNation's full strategic potential by purchasing the complete BCG Matrix. Gain detailed insights into their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Don't miss out on critical strategic intelligence. The full AutoNation BCG Matrix provides a comprehensive breakdown, enabling you to identify opportunities and mitigate risks effectively. Purchase now for actionable insights.

Stars

AutoNation is making significant strides in the burgeoning electric vehicle (EV) sector. By 2025, EV sales are projected to represent 18% of the company's total revenue, a notable increase from 12% in 2024. This upward trend highlights AutoNation's commitment to capturing market share in this high-growth area, encompassing both hybrid and fully electric models.

To facilitate this expansion, AutoNation is proactively investing in critical infrastructure. Dealerships are seeing enhancements to charging capabilities, ensuring a seamless experience for EV owners. Furthermore, the company is bolstering its digital platforms to provide customers with comprehensive information and support for EV purchases and ownership.

AutoNation's investment in digital retail, exemplified by AutoNation Express, places it in a high-growth segment of automotive sales. The company's embrace of AI-driven chatbots and streamlined online purchasing platforms reflects a strategic move to capture the expanding online car buying market.

These digital tools have demonstrably improved AutoNation's operational efficiency, a key trend in the industry's shift towards omnichannel customer experiences. For instance, in 2023, AutoNation reported a 12% increase in digital lead conversion rates directly attributable to these platform enhancements.

AutoNation's premium luxury new vehicle sales represent a significant growth area, often performing as Stars within its portfolio. This segment consistently demonstrates robust income and revenue growth, reflecting a strong market position in a high-margin niche.

In 2024, AutoNation reported strong performance in its luxury and premium brands. For instance, sales within these categories outpaced the broader market, contributing disproportionately to overall profitability. This trend highlights the segment's ability to attract and retain discerning buyers who prioritize brand prestige and advanced features.

Used Electric Vehicle Inventory

The used electric vehicle (EV) market is booming, driven by consumer demand for more accessible electrified transportation. AutoNation is capitalizing on this trend by enhancing its used EV inventory, utilizing advanced digital pricing and remarketing strategies to boost profitability in this segment.

This strategic emphasis on used EVs positions AutoNation to capture significant growth within a specialized, high-demand area of the automotive market.

- Market Growth: The used EV market saw a significant increase in sales in 2023, with projections indicating continued strong growth through 2024 and beyond, as more EVs enter the pre-owned market.

- AutoNation's Strategy: AutoNation's focus on used EVs leverages its established remarketing capabilities and sophisticated digital pricing tools to optimize inventory acquisition and sales.

- Profitability Impact: This targeted approach is contributing to higher gross profit per vehicle for AutoNation within its used vehicle operations.

- Competitive Advantage: By building a robust used EV inventory, AutoNation aims to become a leading destination for consumers seeking affordable, pre-owned electric vehicles.

AutoNation Mobile Service

AutoNation Mobile Service is positioned as a Star within AutoNation's BCG Matrix. This innovative offering taps into the growing demand for convenient automotive repair and maintenance, bringing services directly to customers' homes or workplaces. Its high-growth potential is evident as it caters to evolving consumer preferences, aiming to capture a significant share of the expanding mobile service market.

The strategic advantage of AutoNation Mobile Service lies in its ability to extend the company's reach beyond traditional dealership locations, fostering customer loyalty through unparalleled convenience. This expansion into a high-growth segment is crucial for AutoNation's overall market strategy.

In 2024, the automotive aftermarket services industry, including mobile solutions, saw continued expansion. While specific figures for AutoNation's mobile service segment are proprietary, the broader trend indicates a positive outlook. For instance, the overall automotive repair market in the U.S. was projected to reach over $400 billion by 2025, with convenience-driven services showing accelerated growth.

- High Growth Potential: Addresses the increasing consumer demand for convenient, at-home automotive services.

- Market Expansion: Extends AutoNation's service footprint beyond physical dealership locations.

- Competitive Advantage: Positions AutoNation to capture market share in the burgeoning mobile repair segment.

- Strategic Alignment: Supports AutoNation's broader strategy of adapting to evolving customer needs and service delivery models.

AutoNation's premium luxury new vehicle sales are a key Star in its BCG Matrix. This segment consistently shows high market growth and a strong relative market share for AutoNation. The company's focus on these high-margin vehicles in 2024 has yielded robust income and revenue growth, outperforming the broader automotive market.

AutoNation's investment in digital retail, including platforms like AutoNation Express, also positions it as a Star. This area benefits from high market growth due to increasing online car buying trends. The company's 2023 digital lead conversion rate saw a 12% increase, demonstrating the effectiveness of these digital initiatives.

The company's burgeoning electric vehicle (EV) business is another Star. Projections show EV sales reaching 18% of AutoNation's revenue by 2025, up from 12% in 2024. This growth is fueled by significant investments in charging infrastructure and enhanced digital platforms for EV customers.

AutoNation Mobile Service is also a Star, catering to the growing demand for convenient automotive maintenance. This segment taps into a high-growth market driven by evolving consumer preferences for at-home services, extending AutoNation's service reach and fostering customer loyalty.

| BCG Category | Key AutoNation Segments | Market Growth | Relative Market Share | Rationale |

|---|---|---|---|---|

| Stars | Premium Luxury New Vehicles | High | Strong | Robust income and revenue growth, outperforming market in 2024. |

| Stars | Digital Retail (e.g., AutoNation Express) | High | Strong | Increasing online car buying, 12% digital lead conversion increase in 2023. |

| Stars | Electric Vehicles (New & Used) | High | Growing | Projected 18% revenue share by 2025, significant infrastructure investment. |

| Stars | AutoNation Mobile Service | High | Emerging | Addresses demand for convenience, expanding service footprint. |

What is included in the product

This BCG Matrix overview offers a strategic breakdown of AutoNation's business units, detailing their market share and growth potential.

AutoNation's BCG Matrix provides a clear, one-page overview of each business unit's market share and growth, relieving the pain of strategic uncertainty.

Cash Cows

AutoNation's after-sales business, encompassing parts, service, and collision repair, is a robust cash cow, generating substantial, high-margin revenue. This segment is crucial for the company's financial stability, providing a consistent income stream that is less susceptible to economic downturns.

In the first quarter of 2024, after-sales operations significantly contributed to AutoNation's overall gross profit, with revenue and gross profit in this area demonstrating strong upward trends. Projections for 2025 indicate continued growth, solidifying its role as a reliable and profitable revenue source that underpins other strategic ventures within the company.

AutoNation Finance operates as a significant cash cow within AutoNation's portfolio, demonstrating robust profitability derived from its synergistic relationship with vehicle sales. This segment effectively capitalizes on the company's established customer base, generating substantial cash flow through financing arrangements.

In 2024, AutoNation reported that its finance and insurance (F&I) segment, which includes AutoNation Finance, continued to be a strong contributor to overall earnings. The high finance penetration rate, consistently above industry averages, underscores the segment's efficiency in converting vehicle sales into lucrative financing income.

The success of AutoNation Finance is further evidenced by its consistent ability to secure favorable asset-backed securitizations, providing a low-cost funding source that enhances profitability and supports the company's growth initiatives. This segment’s reliable cash generation is crucial for AutoNation’s strategic financial flexibility.

Traditional new vehicle sales are AutoNation's bedrock, making it the largest automotive retailer in the U.S. Despite some recent pressure on gross profit margins due to inventory fluctuations, this segment continues to be the primary revenue driver and a substantial cash generator for the company.

In 2024, AutoNation's new vehicle segment is expected to maintain its position as a cash cow. While industry-wide gross profit per new vehicle unit might fluctuate, AutoNation's sheer volume and established market position in this mature segment ensure a steady and significant contribution to overall cash flow.

Established Dealership Network

AutoNation's established dealership network functions as a classic Cash Cow in the Boston Consulting Group (BCG) matrix. This extensive network of new vehicle franchises spans numerous states, solidifying AutoNation's position as a market leader in many of these regions. These physical locations are the bedrock of consistent sales and service revenue, bolstered by strong brand recognition and a loyal customer base.

The company's vast footprint offers a stable and predictable source of cash flow. For instance, as of the first quarter of 2024, AutoNation reported a total of 216 new vehicle franchises. This robust network allows the company to leverage economies of scale and maintain a significant market share, contributing to its strong cash-generating capabilities.

- Market Dominance: AutoNation holds a high market share in many of the states where it operates, a hallmark of a Cash Cow.

- Revenue Stability: The network reliably generates sales from vehicle purchases and ongoing service revenue, providing consistent cash inflow.

- Brand Equity: Established brand recognition fosters customer loyalty, reducing marketing costs and supporting steady sales.

- Operational Efficiency: The mature nature of these dealerships often translates to optimized operations and cost management, further enhancing cash generation.

Used Vehicle Sales (Traditional ICE)

AutoNation's traditional internal combustion engine (ICE) used vehicle sales are a cornerstone of its business, functioning as a significant cash cow. Despite market volatility, the company commands a robust market share in this segment, ensuring a consistent revenue stream and contributing substantially to gross profit. For instance, in 2023, AutoNation reported record revenue, with used vehicle sales playing a pivotal role in this performance.

This segment's strength lies in its established presence and high sales volume, making it a reliable generator of cash flow for AutoNation. While the overall market for new ICE vehicles might be experiencing slower growth, the demand for quality pre-owned vehicles remains strong. This consistent demand allows AutoNation to leverage its scale and operational efficiencies.

- Strong Market Share: AutoNation holds a dominant position in the traditional ICE used vehicle market.

- Consistent Revenue Stream: This segment provides a steady flow of income, even with fluctuating unit revenues.

- Gross Profit Contribution: Used vehicle sales are a key driver of AutoNation's overall profitability.

- Cash Flow Generation: The high volume and established nature of this business make it a reliable cash generator.

AutoNation's after-sales business, including parts, service, and collision repair, is a prime example of a cash cow. This segment consistently delivers high-margin revenue, contributing significantly to the company's financial stability. In the first quarter of 2024, after-sales operations showed strong upward trends in both revenue and gross profit, with projections for 2025 indicating continued growth.

The company's finance and insurance (F&I) segment, powered by AutoNation Finance, also operates as a strong cash cow. It effectively leverages the existing customer base to generate substantial cash flow through financing. AutoNation's high finance penetration rate, consistently above industry averages, highlights the segment's efficiency in converting vehicle sales into profitable financing income throughout 2024.

New vehicle sales, AutoNation's largest segment, remain a substantial cash generator despite occasional pressure on gross profit margins due to inventory. In 2024, the sheer volume and market leadership in this mature segment ensure a steady and significant contribution to overall cash flow, reinforcing its cash cow status.

AutoNation's established dealership network, comprising 216 new vehicle franchises as of Q1 2024, functions as a classic cash cow. This extensive footprint provides a stable and predictable source of cash flow through consistent sales and service revenue, supported by strong brand recognition and operational efficiencies.

The traditional ICE used vehicle sales segment is another significant cash cow for AutoNation. Despite market fluctuations, the company maintains a robust market share, ensuring a consistent revenue stream and substantial gross profit contribution, as evidenced by record revenue in 2023 where used vehicle sales played a pivotal role.

| Segment | BCG Classification | 2024 Performance Indicator | 2025 Outlook |

|---|---|---|---|

| After-Sales (Parts, Service, Collision) | Cash Cow | Strong upward trends in revenue and gross profit (Q1 2024) | Continued growth projected |

| Finance & Insurance (F&I) | Cash Cow | High finance penetration rate, strong earnings contribution | Sustained profitability through favorable securitizations |

| New Vehicle Sales | Cash Cow | Primary revenue driver, substantial cash generation despite margin fluctuations | Steady and significant cash flow contribution expected |

| Used Vehicle Sales (ICE) | Cash Cow | Consistent revenue stream, substantial gross profit contribution (record revenue in 2023) | Reliable cash generator due to high volume and established presence |

| Dealership Network | Cash Cow | Stable and predictable cash flow from sales and service (216 new franchises Q1 2024) | Leverages economies of scale for enhanced cash generation |

Full Transparency, Always

AutoNation BCG Matrix

The AutoNation BCG Matrix preview you are currently viewing is the identical, fully formatted report you will receive immediately after your purchase. This document has been meticulously prepared to offer a comprehensive strategic overview, enabling you to make informed decisions for AutoNation's diverse business units.

Rest assured, the BCG Matrix you see here is the exact final product that will be delivered to you upon completion of your purchase, containing no watermarks or demo content. It is designed for immediate application in your strategic planning and analysis, providing a clear roadmap for resource allocation and business development.

What you are previewing is the actual AutoNation BCG Matrix document that will be yours to download once you complete your purchase. This professionally crafted analysis is ready for immediate use, whether for internal presentations, strategic decision-making, or further in-depth market research.

The AutoNation BCG Matrix report you are reviewing is precisely the file you will receive after purchase, representing a complete and unedited strategic assessment. This document is engineered for clarity and actionable insights, empowering you to effectively manage AutoNation's portfolio.

Dogs

Underperforming legacy dealership locations within AutoNation's portfolio represent the 'Dogs' in a BCG Matrix analysis. These are dealerships, potentially representing older brands or those in declining local markets, that exhibit low market share and low growth potential. For instance, a dealership acquired years ago in a region that has since seen economic downturn or increased competition might fall into this category.

These locations often struggle with low sales volume and profitability, consuming valuable resources without generating significant returns. In 2023, AutoNation continued its strategy of optimizing its store footprint, which includes evaluating underperforming assets. While specific location data is proprietary, the company's ongoing efforts to streamline operations suggest that such legacy locations are under constant review for potential divestiture or significant restructuring to improve overall portfolio performance.

Holding too many older or less popular car models, especially those with internal combustion engines, can turn into a 'Dog' in AutoNation's BCG Matrix. If demand for these vehicles is low, they often need heavy discounts to move, tying up valuable capital and incurring ongoing storage and maintenance costs without bringing in good profits. For instance, in 2024, the average inventory holding period for unsold new vehicles in the US reached 53 days, highlighting the cost of slow-moving stock.

Non-integrated or inefficient digital tools, such as legacy CRM systems or outdated inventory management software, represent AutoNation's Dogs in the BCG matrix. These systems often lead to siloed data, hindering a seamless customer experience. For instance, if a customer's online inquiry isn't efficiently routed to the appropriate dealership staff due to a lack of integration, it directly impacts conversion rates.

These legacy platforms can also result in increased operational costs without a proportional increase in market share or customer loyalty. In 2024, businesses across sectors are increasingly investing in unified digital ecosystems, with companies reporting that poorly integrated systems can lead to a 15-20% loss in productivity. AutoNation's investment in modernizing these tools would likely yield minimal returns compared to focusing on its Stars or Cash Cows.

Highly Specialized, Declining Niche Vehicle Segments

If AutoNation has a disproportionate exposure to very specific vehicle segments that are experiencing long-term market decline, such as traditional sedans and coupes, they could be considered Dogs. For instance, in 2023, new car sales for sedans continued to decline, representing a smaller portion of the overall market compared to SUVs and trucks. AutoNation's struggle to maintain market share within these shrinking niches would further solidify their position in this category.

These declining niche segments offer limited growth prospects and present significant competitive challenges. As consumer preferences shift towards other vehicle types, the demand for these specific models dwindles, impacting sales volume and profitability. This trend was evident in 2024 data showing a continued decrease in sedan sales year-over-year.

- Declining Sedan Market Share: In 2023, sedans accounted for approximately 19% of new vehicle sales in the U.S., down from over 22% in 2022.

- Limited Growth Potential: The long-term forecast for traditional car segments indicates continued contraction, making significant market share gains improbable.

- Competitive Pressures: Remaining players in these niche segments often engage in aggressive pricing, further squeezing margins for dealerships like AutoNation.

Subprime Auto Loan Portfolio (Legacy)

While AutoNation Finance generally operates as a strong Cash Cow, legacy subprime auto loan portfolios present a different picture. These older portfolios, characterized by higher inherent risk and a history of underperformance, would likely be classified as Dogs in a BCG Matrix analysis. They can indeed tie up valuable capital and deliver disappointing returns, often due to elevated default rates.

AutoNation has made strategic moves to divest itself of a significant portion of these legacy subprime assets. This proactive approach signals a clear intention to reduce exposure to this riskier segment and reallocate resources more effectively. For instance, in 2024, AutoNation continued its strategy of managing and reducing its exposure to older, riskier loan portfolios, focusing on cleaner, more profitable financing segments.

- Legacy subprime auto loan portfolios are considered Dogs due to high risk and underperformance.

- These portfolios can negatively impact capital efficiency and return generation.

- AutoNation has actively pursued the sale of its legacy subprime loan portfolios.

- This strategy aims to mitigate risk and improve overall financial performance.

Dealerships or vehicle segments within AutoNation that exhibit low market share and low growth potential are categorized as Dogs. These are often legacy locations in declining markets or older vehicle models with diminishing consumer interest. For example, dealerships acquired in areas experiencing economic downturns or those heavily reliant on internal combustion engine vehicles facing market shifts could be classified as Dogs.

These units typically generate low profits and can be a drain on resources. AutoNation's ongoing portfolio optimization efforts include evaluating such underperforming assets for potential divestiture or restructuring. In 2024, the company continued to refine its store footprint, a process that inherently involves identifying and addressing these less productive elements to enhance overall efficiency.

Outdated or poorly integrated digital systems, such as legacy customer relationship management (CRM) platforms, can also represent Dogs. These systems often lead to inefficiencies and hinder a seamless customer experience, impacting conversion rates. In 2024, businesses prioritizing unified digital ecosystems reported significant productivity gains, underscoring the cost of maintaining inefficient legacy technology.

Question Marks

New geographic market expansions for AutoNation, where the company is just starting out, would typically be classified as question marks in a BCG Matrix. This means they have low market share in a high-growth market. For instance, if AutoNation were to enter a rapidly expanding international market in 2024, its initial footprint would be small relative to the overall opportunity.

These nascent operations require substantial capital to build brand recognition, establish dealership networks, and compete against established players. While the automotive market in these new regions might be experiencing robust growth, AutoNation's early penetration would be minimal, reflecting the high investment needed to capture significant market share and achieve profitability.

The shift towards subscription-based vehicle services, often termed mobility-as-a-service, is a significant emerging trend. For established retailers like AutoNation, this represents a market where they might have a low current share but substantial growth potential. This makes it a prime candidate for a Question Mark in the BCG Matrix.

Investing in these new subscription models is a gamble, hence the Question Mark classification. While the market is growing, its future profitability and widespread adoption are still very much up in the air. For instance, early reports from 2023 indicated a growing interest, with some analysts projecting the global automotive subscription market to reach over $100 billion by 2028, but sustained consumer uptake remains a key variable.

These ventures demand considerable upfront capital to build the necessary infrastructure, acquire fleets, and develop the technology platforms needed to compete. AutoNation's strategic decision to invest in these areas, like its own subscription pilot programs, is a calculated risk aimed at securing future market share in a rapidly evolving automotive landscape.

Advanced Autonomous Vehicle Service Hubs represent a nascent but potentially lucrative area for AutoNation. As AV technology matures, the demand for specialized maintenance, software updates, and diagnostics will surge, creating a new market segment. This segment is currently characterized by low market penetration but high future growth potential, fitting the 'Question Mark' category in the BCG matrix.

AutoNation's current engagement in this space is likely in its early stages, possibly involving pilot programs or strategic alliances. The company needs to invest heavily in training technicians, developing specialized equipment, and potentially partnering with AV manufacturers to establish a strong foothold. By 2024, the global autonomous vehicle market was valued at approximately $29.5 billion, with projections indicating significant expansion in the coming years, underscoring the strategic importance of this 'Question Mark' opportunity.

Specialized EV Battery Repair and Recycling Services

Specialized EV battery repair, refurbishment, and recycling services represent a nascent yet potentially lucrative segment for AutoNation. As the installed base of electric vehicles grows, so does the need for these specialized solutions. For instance, by the end of 2023, the global EV market surpassed 35 million units, indicating a significant future demand for battery lifecycle management.

Currently, AutoNation's market share in this highly specialized niche is likely minimal, positioning it as a Question Mark in the BCG Matrix. This classification suggests that while the market potential is high, the company requires considerable investment in developing the necessary expertise, technology, and infrastructure to capture a meaningful share. The complexity of battery chemistry and safety protocols demands specialized training and equipment, which are significant barriers to entry.

- Market Growth Potential: The global EV battery recycling market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by 2030, driven by sustainability initiatives and the recovery of valuable materials like lithium and cobalt.

- Investment Requirements: Establishing state-of-the-art battery repair and recycling facilities requires substantial capital outlay for specialized machinery, safety systems, and highly trained personnel.

- Competitive Landscape: The niche is currently occupied by specialized recycling companies and some original equipment manufacturers (OEMs), presenting a competitive challenge for AutoNation to differentiate its offerings.

- Strategic Importance: Developing these capabilities aligns with AutoNation's long-term strategy of providing comprehensive EV services and could create a significant competitive advantage as the EV market matures.

AutoNationParts.com E-commerce (as standalone growth engine)

AutoNationParts.com, while a strategic move, likely operates as a Question Mark within the BCG Matrix for AutoNation. Its market share as a standalone online parts retailer is probably modest when measured against dominant e-commerce players in the automotive aftermarket. The online parts sector offers substantial growth opportunities, but AutoNation will need considerable investment in marketing and logistics to ascend from this category.

To transform AutoNationParts.com into a 'Star,' significant capital allocation is essential. This investment would fuel brand awareness and streamline the supply chain, crucial for competing effectively. For instance, the broader automotive e-commerce market is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, indicating the high potential but also the competitive landscape.

- Low Market Share: AutoNationParts.com likely holds a small percentage of the overall online automotive parts market.

- High Growth Potential: The online segment for auto parts and accessories is experiencing rapid expansion.

- Investment Needs: Significant marketing and logistical investments are required to gain traction and market share.

- Path to 'Star': Success hinges on effectively capturing a larger portion of this growing online market.

Question Marks represent areas where AutoNation has a low market share in a high-growth market, requiring significant investment. These are opportunities with uncertain futures, demanding careful strategic consideration.

For example, new geographic market expansions in 2024 would fit this description, as would nascent ventures into mobility-as-a-service or specialized EV battery services, where growth is projected but current penetration is minimal.

These ventures, like AutoNationParts.com, demand substantial capital for marketing and logistics to compete effectively in rapidly expanding online sectors.

The company's strategic investments in these areas are calculated risks to secure future market share in an evolving automotive landscape.

BCG Matrix Data Sources

Our AutoNation BCG Matrix leverages comprehensive data from AutoNation's financial filings, industry growth reports, and market share analysis to accurately position each business unit.