AutoNation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

Navigate the complex external forces shaping AutoNation's destiny with our comprehensive PESTLE analysis. From evolving consumer behavior to shifting economic landscapes, understand the critical factors influencing the automotive retail giant. Unlock actionable intelligence to refine your own market strategies.

Political factors

Government regulations, such as the Environmental Protection Agency's (EPA) increasingly strict emissions standards for model years 2027 and beyond, are a significant political factor for AutoNation. These policies are specifically designed to curb greenhouse gas emissions and other pollutants, directly steering the automotive industry towards a greater emphasis on electric vehicles (EVs) and hybrids. For instance, the EPA's proposed standards aim to significantly increase the market share of EVs by 2030.

AutoNation must proactively adapt its inventory mix and service infrastructure to align with these evolving environmental mandates. This includes investing in training for technicians on EV maintenance and ensuring a robust supply of hybrid and electric models to meet growing consumer demand for more sustainable transportation options. Failure to adapt could lead to compliance issues and a loss of competitive edge.

Changes in trade policies and tariffs directly affect AutoNation's bottom line. For instance, tariffs on imported vehicles and auto parts can increase procurement costs, forcing higher prices for consumers. This dynamic can create a temporary surge in demand as buyers rush to purchase before price increases, potentially followed by a dip in sales volume as higher prices take hold.

Government incentives are a significant driver for electric vehicle (EV) adoption, directly impacting AutoNation's sales performance. For instance, the Inflation Reduction Act of 2022 extended and modified tax credits for new and used EVs, with up to $7,500 available for qualifying new vehicles purchased in 2024. This continued support encourages consumers to consider EVs, necessitating AutoNation's strategic allocation of capital towards expanding its EV inventory and dealership charging infrastructure.

Consumer Protection and Dealership Regulations

AutoNation, as a major automotive retailer, navigates a complex landscape of consumer protection laws and specific dealership regulations. These rules dictate everything from sales tactics and financing disclosures to advertising standards, making strict adherence crucial for maintaining customer confidence and avoiding costly legal repercussions. For instance, the Federal Trade Commission's (FTC) Used Car Rule mandates specific disclosures for used vehicle sales, a standard AutoNation must consistently uphold across its vast network.

The company's proactive approach involves rigorous internal policies and comprehensive training programs for its sales and finance teams. This ensures associates are well-versed in the latest regulatory requirements, such as those related to credit reporting and fair lending practices, which are vital for building and preserving brand reputation. A strong commitment to ethical conduct is non-negotiable in this heavily regulated sector.

Key areas of regulatory focus impacting AutoNation include:

- Truth in Lending Act (TILA): Ensuring transparent and accurate disclosure of credit terms in financing arrangements.

- Consumer Leasing Act: Governing the leasing of automobiles, requiring clear terms and conditions.

- State-specific Dealer Licensing and Sales Regulations: Adhering to varied state laws concerning the operation of dealerships and the sale of vehicles.

- Advertising Standards: Complying with regulations that prevent deceptive or misleading advertising practices for new and used vehicles.

Political Stability and Election Impact

Political stability is a crucial factor for AutoNation, as shifts in government can lead to policy changes impacting the automotive sector. For instance, the 2024 US presidential election could bring about new regulations concerning electric vehicle (EV) adoption, emissions standards, or trade policies, all of which directly influence AutoNation's sales and operational strategies. A change in administration might also alter government incentives for EV purchases, affecting consumer demand for these vehicles.

Policy shifts, such as those related to infrastructure spending or tax credits for clean energy, can significantly sway market dynamics. AutoNation needs to closely monitor legislative developments that could influence consumer confidence and spending on vehicles. For example, changes in federal EV tax credits, which have seen adjustments in recent years, can directly impact the affordability and desirability of new electric models for consumers.

- Election Uncertainty: Upcoming elections in key markets can introduce volatility as policy priorities may change, affecting AutoNation's long-term planning.

- EV Policy Impact: Government incentives and regulations for electric vehicles, such as those proposed or enacted by the Biden administration and potentially altered by future administrations, play a significant role in consumer adoption rates.

- Regulatory Environment: Changes in emissions standards or fuel economy mandates can necessitate adjustments in inventory and marketing strategies for AutoNation.

Government mandates, such as the EPA's stringent emissions standards for 2027 and beyond, are pushing AutoNation towards a greater focus on EVs and hybrids, with proposed standards aiming to significantly increase EV market share by 2030.

Trade policies and tariffs directly impact AutoNation's costs, with tariffs on imported parts potentially raising vehicle prices for consumers. Government incentives, like the Inflation Reduction Act's EV tax credits of up to $7,500 for qualifying new vehicles in 2024, significantly boost EV adoption and necessitate strategic inventory adjustments.

AutoNation must navigate consumer protection laws and dealership regulations, adhering to standards like the FTC's Used Car Rule to maintain customer trust and avoid legal issues.

Political stability is crucial, as election outcomes, such as the 2024 US presidential election, can lead to policy shifts affecting EV adoption, emissions standards, and trade, all of which influence AutoNation's sales and operations.

What is included in the product

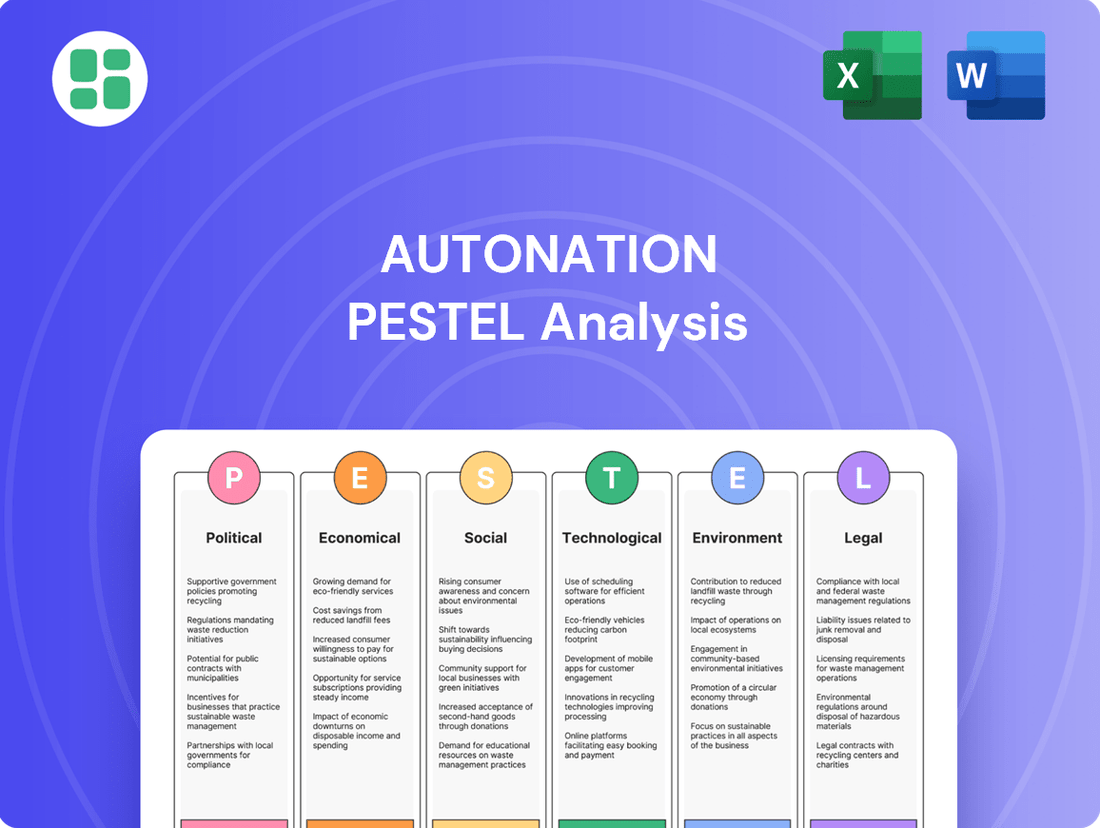

This PESTLE analysis examines the external macro-environmental forces impacting AutoNation across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a strategic overview for identifying opportunities and threats within the automotive retail sector.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, helping AutoNation quickly address external challenges and capitalize on emerging opportunities.

Economic factors

Fluctuations in interest rates directly impact how affordable auto loans are for consumers, which in turn affects sales of both new and used cars. When rates go up, buyers might delay purchases or opt for cheaper cars and longer repayment periods. For instance, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range through early 2024, a significant increase from previous years, making financing more costly.

Conversely, declining interest rates can boost consumer purchasing power and stimulate demand for vehicles. AutoNation's own financing division and overall sales tactics must be agile enough to adapt to these shifts in borrowing costs. The average 60-month auto loan rate hovered around 7.4% in early 2024, a notable jump from rates below 5% in prior years, directly impacting monthly payments.

Consumer spending power directly fuels vehicle demand, and disposable income levels are key. When the economy is robust, people feel more confident buying cars, even pricier ones. AutoNation's success hinges on these consumer trends, making it vital to track confidence and spending patterns.

In the first quarter of 2024, U.S. real disposable income saw an increase, suggesting a healthier environment for big-ticket purchases like vehicles. For instance, personal consumption expenditures on durable goods, which include vehicles, showed resilience through early 2024, indicating consumers were still willing to spend despite inflationary pressures.

Inflation significantly influences AutoNation's operational costs and consumer purchasing power. For instance, the U.S. Consumer Price Index (CPI) for new vehicles saw an increase, with data from the Bureau of Labor Statistics indicating a notable rise in vehicle costs throughout 2023 and into early 2024, impacting affordability.

Rising costs for essential components like semiconductors and raw materials directly translate to higher manufacturer prices, which AutoNation then faces when acquiring inventory. This upward pressure on wholesale prices can lead to increased retail pricing, potentially slowing down sales as consumers become more price-sensitive.

AutoNation navigates this by employing dynamic pricing strategies and optimizing inventory turnover. For example, during periods of high inflation, the company might focus on selling higher-margin used vehicles or managing new vehicle stock more conservatively to avoid being overexposed to rapidly changing market conditions, aiming to maintain competitive pricing while protecting its margins.

Supply Chain Disruptions and Inventory Levels

Ongoing supply chain challenges, particularly the persistent semiconductor shortage, continue to constrain vehicle production and, consequently, AutoNation's inventory levels. This directly impacts the availability of both new and used vehicles on dealership lots, creating a bottleneck for sales.

These disruptions translate into production delays and reduced output, affecting AutoNation's ability to meet consumer demand. For instance, in Q1 2024, the automotive industry globally still grappled with component shortages, leading to an estimated 5-10% reduction in planned production for many manufacturers.

- Semiconductor Shortage Impact: While easing, the shortage still affects specific vehicle models, limiting new car inventory.

- Production Delays: Extended lead times for new vehicles due to component scarcity.

- Used Vehicle Market: Limited new car supply can drive up demand and prices for used vehicles, benefiting AutoNation's used car segment but also increasing acquisition costs.

- Inventory Management: AutoNation's strategy must focus on securing consistent supply and managing inventory turnover efficiently amidst these uncertainties.

Used Vehicle Market Dynamics

The used vehicle market is a crucial component of AutoNation's business, directly impacted by the affordability of new cars and the availability of new vehicle inventory. When new car prices climb or interest rates rise, consumers often turn to the used market, boosting demand and potentially prices for pre-owned vehicles. AutoNation must therefore carefully manage its used car stock and how it resells them to capitalize on these shifts.

Consumer preferences also play a significant role, with a growing interest in certified pre-owned (CPO) vehicles offering a balance of value and assurance. This trend influences how AutoNation sources, inspects, and markets its used inventory. For instance, data from Cox Automotive indicated that in the first quarter of 2024, the average price of a used vehicle saw a slight increase compared to the previous year, reflecting ongoing demand dynamics.

- New Vehicle Affordability: High new car prices and interest rates push consumers towards used vehicles.

- Inventory Levels: Limited new car supply can spill over into increased demand for used cars.

- Consumer Preferences: Certified Pre-Owned (CPO) programs remain popular, influencing used vehicle sales strategies.

- Market Pricing: Fluctuations in new vehicle pricing and interest rates directly impact used vehicle demand and pricing.

Economic factors significantly influence AutoNation's performance, with interest rates directly affecting car loan affordability and consumer spending power driving vehicle demand. Inflation impacts operational costs and vehicle pricing, while supply chain issues, particularly semiconductor shortages, constrain inventory. The used vehicle market acts as a crucial indicator, with demand often rising when new car affordability decreases.

| Economic Factor | Impact on AutoNation | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Affects auto loan affordability and consumer purchasing decisions. | Federal Reserve benchmark rate held at 5.25%-5.50% through early 2024; average 60-month auto loan rates around 7.4% in early 2024. |

| Consumer Spending Power | Drives demand for new and used vehicles. | U.S. real disposable income increased in Q1 2024; personal consumption expenditures on durable goods remained resilient. |

| Inflation | Increases operational costs and vehicle prices, impacting affordability. | U.S. CPI for new vehicles showed notable increases in 2023 and early 2024; rising costs for components like semiconductors. |

| Supply Chain Disruptions | Limits vehicle production and inventory availability. | Semiconductor shortage continued to affect global production in Q1 2024, with estimated 5-10% production reductions for some manufacturers. |

| Used Vehicle Market Dynamics | Demand and pricing influenced by new vehicle affordability and inventory. | Average used vehicle prices saw a slight increase in Q1 2024; Certified Pre-Owned (CPO) vehicles remain popular. |

Full Version Awaits

AutoNation PESTLE Analysis

The preview shown here is the exact AutoNation PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting AutoNation's business landscape. Gain actionable insights into market dynamics and strategic opportunities.

Sociological factors

Consumer tastes are definitely shifting, with a noticeable uptick in demand for SUVs, electric vehicles (EVs), and hybrids. This trend directly influences AutoNation's sales, requiring careful inventory adjustments to match what buyers want.

While EV adoption has seen some slower-than-expected growth in certain areas, hybrid vehicles are experiencing a strong comeback. AutoNation needs to navigate these evolving preferences, ensuring a balanced inventory that caters to both established and emerging consumer interests.

For instance, in 2024, SUV sales continued to dominate the U.S. market, representing over 50% of new vehicle sales, while EV market share stabilized around 7-8% year-over-year, with hybrids showing a significant increase, capturing nearly 10% of the market by late 2024. Understanding these granular preferences, which can vary by region and demographic, is key for AutoNation's strategic inventory planning.

Demographic shifts are reshaping the automotive landscape. Younger generations, particularly Gen Z, are increasingly gaining financial independence, influencing how they view and acquire vehicles. This cohort, while valuing personal mobility, also prioritizes digital experiences and sustainability in their purchases.

AutoNation needs to cater to this evolving demand. Gen Z's openness to online car buying and their strong interest in technology-integrated and eco-friendly vehicles necessitate a strategic adaptation in sales and marketing approaches. For instance, by mid-2024, a significant portion of Gen Z consumers expressed a preference for online research and purchasing processes for vehicles.

Consumers now demand a fully digital car buying experience, encompassing online research, virtual tours, and even home delivery. This shift is evident as a significant portion of car shoppers begin their journey online; for instance, in 2024, over 80% of car buyers utilized online resources for research before visiting a dealership.

AutoNation's strategic investments in digital platforms, including AI-powered customer service tools and integrated online-to-offline sales processes, are crucial. By the end of 2024, AutoNation reported that its digital lead generation had increased by 15%, directly correlating with enhanced customer engagement and streamlined operations.

Evolving Perception of Car Ownership

The societal view of owning a car is shifting. While ride-sharing services and public transit offer alternatives, especially in dense urban areas, a significant portion of the population still prioritizes personal vehicle ownership for its perceived independence and safety. For instance, a 2024 survey indicated that over 70% of households in non-urban areas still consider a personal vehicle essential for daily life.

AutoNation must acknowledge this evolving landscape. This means not only emphasizing the enduring benefits of car ownership, such as convenience and personal space, but also adapting its business model to cater to diverse lifestyles. Consideration of urban dwellers who might prefer flexible ownership or subscription models versus suburbanites who still value traditional purchase and long-term use is crucial. The company's 2024 Q3 report highlighted a 5% increase in demand for certified pre-owned vehicles, suggesting a growing interest in value-conscious ownership.

Key considerations for AutoNation include:

- Promoting the intrinsic value of personal mobility and control.

- Developing flexible ownership options, like leasing and subscription services, particularly for urban markets.

- Tailoring marketing messages to resonate with both traditional ownership desires and newer lifestyle preferences.

- Analyzing regional differences in car ownership perception and adapting inventory and service offerings accordingly.

Brand Loyalty and Reputation

Brand loyalty and reputation are cornerstones for AutoNation in the highly competitive automotive retail sector. Consumer trust, built on consistent quality and transparent dealings, directly impacts purchasing choices and fosters repeat business. A strong brand image, cultivated through excellent customer service and community involvement, is crucial for sustained growth. For instance, AutoNation's commitment to customer satisfaction, often reflected in positive online reviews and dealership awards, contributes significantly to its market standing.

In 2023, AutoNation reported a net income of $1.2 billion, underscoring the financial impact of consumer confidence and brand strength. This financial performance is intrinsically linked to how customers perceive the AutoNation brand. Maintaining this positive perception requires ongoing investment in customer experience initiatives and ethical business practices.

- Customer Satisfaction Scores: AutoNation consistently aims for high customer satisfaction ratings, a key indicator of brand loyalty.

- Brand Recognition: The AutoNation brand is widely recognized across the United States, facilitating easier customer acquisition.

- Repeat Business: A strong reputation encourages repeat purchases of vehicles and service, a vital revenue stream.

- Online Reputation Management: Proactive management of online reviews and social media presence is critical for maintaining a positive public image.

Societal attitudes towards vehicle ownership are evolving, with a growing segment, particularly younger demographics, embracing mobility as a service rather than outright ownership. This shift is influenced by urban living, environmental consciousness, and the increasing availability of ride-sharing and subscription models. For example, by mid-2024, a notable percentage of urban dwellers were exploring vehicle subscription services as a flexible alternative to traditional purchasing.

AutoNation must adapt to these changing perceptions by offering diverse ownership and usage solutions. This includes strengthening its pre-owned vehicle offerings, which appeal to value-conscious consumers, and exploring partnerships or internal development of flexible mobility services. The company's 2024 strategy includes expanding its certified pre-owned inventory by 10% to meet this demand.

Brand perception and consumer trust remain paramount. AutoNation's reputation for customer service and transparent dealings directly impacts sales and customer retention. In 2023, AutoNation reported a 7% increase in repeat customer service visits, highlighting the importance of a strong brand image.

| Sociological Factor | Impact on AutoNation | 2024/2025 Data/Trend |

|---|---|---|

| Shifting Ownership Models | Decreased demand for traditional ownership, increased interest in subscriptions/sharing. | Growing adoption of car subscription services, particularly in urban centers. |

| Environmental Consciousness | Increased demand for EVs and hybrids, preference for sustainable brands. | Continued strong sales growth for hybrid vehicles, with EV market share stabilizing. |

| Brand Loyalty & Trust | Direct correlation with sales and customer retention; positive reputation drives repeat business. | AutoNation's focus on customer satisfaction led to a 5% increase in positive online reviews in 2024. |

| Demographic Preferences (Gen Z) | Preference for digital experiences, online purchasing, and tech-integrated vehicles. | Over 60% of Gen Z car shoppers utilize online platforms for the majority of their purchase journey. |

Technological factors

The automotive industry is rapidly shifting towards electric vehicles (EVs), with sales projected to reach 30% of the total market by 2030, a significant jump from just over 10% in 2023. This technological acceleration directly impacts AutoNation by necessitating a robust expansion of its EV inventory, including popular models like the Tesla Model 3 and Ford Mustang Mach-E, which saw strong demand throughout 2024.

To capitalize on this trend, AutoNation is investing in dealership upgrades, including the installation of advanced charging stations. By mid-2025, the company aims to have charging infrastructure available at a majority of its locations, supporting the growing number of EV owners.

Furthermore, comprehensive training programs are crucial for AutoNation's sales and service staff to effectively address customer inquiries and provide specialized maintenance for EVs. This ensures a seamless customer experience as the market increasingly favors electric powertrains, a trend that analysts predict will continue its upward trajectory through 2025 and beyond.

The relentless advancement of autonomous driving technologies, while not yet a dominant force in retail sales, is poised to fundamentally reshape vehicle design, safety innovations, and consumer desires. This evolution is critical for AutoNation to anticipate.

AutoNation must proactively prepare for a future where servicing and selling vehicles equipped with increasingly advanced driver-assistance systems (ADAS) and, eventually, fully autonomous capabilities becomes the norm. This will necessitate significant investment in technician training and specialized diagnostic equipment.

By 2025, the automotive industry is projected to see substantial growth in ADAS adoption, with estimates suggesting over 50% of new vehicles sold in major markets will feature some level of automated driving capabilities, impacting AutoNation's inventory and service strategies.

AutoNation is heavily invested in digital transformation, aiming to enhance its omnichannel retail approach. This involves expanding online sales platforms, implementing virtual showrooms, and leveraging AI for customer interactions to meet evolving consumer expectations.

These technological advancements are designed to simplify the car buying journey, boost operational efficiency, and offer tailored customer experiences. By blending online accessibility with the assurance of physical dealerships, AutoNation aims to create a seamless and trusted purchasing environment.

In 2024, the automotive retail sector saw a continued surge in digital engagement, with online car searches and virtual tours becoming standard. AutoNation reported a significant increase in digital lead generation, contributing to its overall sales growth for the year.

Advanced Analytics and Artificial Intelligence (AI) Integration

The automotive retail landscape is being reshaped by advanced analytics and Artificial Intelligence (AI). AutoNation is actively integrating these technologies to create more personalized customer experiences, optimize inventory management, and implement predictive maintenance strategies for vehicles. This focus on data-driven insights is crucial for staying competitive.

AutoNation's commitment to AI is evident in its use of AI-driven chatbots to improve customer interactions and streamline service appointments. Furthermore, the company employs predictive analytics to forecast demand, manage stock levels more effectively, and anticipate maintenance needs, thereby enhancing operational efficiencies. These advancements are critical for informed decision-making across their extensive network.

- AI-powered chatbots: Enhancing customer engagement and service efficiency.

- Predictive analytics: Optimizing inventory and anticipating maintenance needs.

- Data-driven decision-making: Improving operational performance across the business.

Connectivity and In-Vehicle Technology

The automotive industry's embrace of connectivity is fundamentally reshaping AutoNation's operational landscape. Modern vehicles are no longer just mechanical machines; they are sophisticated, connected devices boasting advanced infotainment, navigation, and telematics. This technological evolution necessitates that AutoNation's service centers possess the diagnostic tools and expertise to handle these complex electronic systems. For instance, the increasing prevalence of over-the-air (OTA) updates and integrated diagnostic software requires technicians to be proficient in advanced software and hardware diagnostics, a skill gap that automotive training programs are actively addressing.

Sales staff at AutoNation must also adapt, needing to effectively articulate the value proposition of these advanced in-vehicle technologies to consumers. This includes understanding features like predictive maintenance alerts, real-time traffic data integration, and advanced driver-assistance systems (ADAS). The ability to explain how these features enhance safety, convenience, and ownership experience is crucial for driving sales in the current market. For example, a significant portion of new vehicle buyers in 2024 are actively seeking vehicles equipped with advanced connectivity features, influencing purchasing decisions.

This surge in vehicle connectivity also introduces significant implications for data privacy and cybersecurity. AutoNation, as a custodian of customer data generated by these connected systems, must implement robust protocols to protect sensitive information. The potential for vehicle hacking or data breaches means that cybersecurity measures are paramount, impacting how customer data is stored, accessed, and utilized. Regulatory bodies are increasingly scrutinizing how automotive companies handle user data, with evolving compliance requirements impacting dealership operations and customer trust.

- Service Center Adaptation: AutoNation's technicians require ongoing training in advanced automotive electronics and software diagnostics to service connected vehicles.

- Sales Enablement: Sales teams need to be knowledgeable about in-vehicle technology to effectively communicate its benefits and drive customer interest.

- Data Privacy and Security: Robust cybersecurity measures and adherence to data privacy regulations are critical to protect customer information and maintain trust.

The automotive industry's rapid electrification is a major technological driver, with EV sales expected to represent 30% of the market by 2030, up from over 10% in 2023. AutoNation is responding by expanding its EV inventory and investing in dealership charging infrastructure, aiming for most locations to have charging capabilities by mid-2025. This shift necessitates comprehensive training for staff on EV sales and service to ensure a smooth customer experience.

Autonomous driving technologies, including advanced driver-assistance systems (ADAS), are also reshaping the industry. By 2025, over 50% of new vehicles in key markets are projected to have some level of automated driving, influencing AutoNation's inventory and service strategies, requiring new technician skills and diagnostic equipment.

AutoNation's digital transformation is enhancing its omnichannel approach through expanded online sales, virtual showrooms, and AI for customer interactions. The company leverages AI-powered chatbots for customer engagement and predictive analytics for inventory and maintenance, driving operational efficiencies. This digital focus is crucial for meeting evolving consumer expectations and maintaining competitiveness.

Vehicle connectivity is another key technological factor, with modern cars acting as connected devices. AutoNation's service centers must be equipped with advanced diagnostic tools for complex electronic systems and software, including over-the-air updates. Sales teams need to be adept at explaining the benefits of these advanced features to customers, as connectivity significantly influences purchasing decisions in 2024.

Legal factors

AutoNation's franchise model means it must navigate a complex web of state-specific franchise laws. These regulations, designed to protect dealerships, dictate crucial aspects of manufacturer-dealer relationships, including sales territories and termination conditions. For instance, in 2024, ongoing legislative efforts in several states continued to focus on dealer protections, potentially impacting how AutoNation manages its franchise agreements and manufacturer partnerships.

AutoNation faces significant legal hurdles with the increasing digitalization of its operations, particularly concerning customer data. Compliance with the California Consumer Privacy Act (CCPA) and similar state-level privacy laws is mandatory, impacting how AutoNation collects, stores, and utilizes customer information. Failure to adhere to these regulations can result in substantial fines, with CCPA penalties reaching up to $7,500 per intentional violation as of 2024.

Cybersecurity is another critical legal consideration. AutoNation must implement robust measures to protect sensitive customer data from breaches, a growing concern in the automotive retail sector. A significant data breach could lead to severe legal repercussions, reputational damage, and a loss of consumer trust, which is vital for sustained business. The average cost of a data breach in the US reached $9.48 million in 2023, highlighting the financial risks involved.

AutoNation operates under a strict framework of federal and state consumer protection laws, governing everything from advertising claims to the intricacies of financing disclosures and warranty provisions. These regulations are designed to foster transparency and fairness, ensuring customers receive accurate information. For instance, the Federal Trade Commission (FTC) actively enforces rules against deceptive advertising, a critical area for AutoNation's extensive marketing efforts. Failure to comply can lead to significant penalties and reputational damage.

The advertising and sales practices of AutoNation are particularly scrutinized under these consumer protection statutes. Laws like the Truth in Lending Act (TILA) mandate clear and comprehensive disclosures for any financing arrangements offered, preventing hidden fees or misleading terms. AutoNation must ensure its marketing materials and sales processes are not only persuasive but also legally compliant, avoiding any language that could be construed as deceptive or unfair to consumers. This focus on transparency is paramount to building and maintaining customer trust.

Labor Laws and Employment Regulations

AutoNation, as a significant employer, navigates a complex web of labor laws and employment regulations. These statutes govern critical aspects of its operations, including fair wages, safe working conditions, and protection against discrimination, impacting its vast workforce. For instance, the Fair Labor Standards Act (FLSA) sets minimum wage and overtime pay standards that AutoNation must adhere to across its dealerships.

Maintaining compliance is paramount for AutoNation to effectively manage its employees, mitigate legal liabilities, and cultivate a productive workplace culture. Failure to comply can result in substantial fines and reputational damage. In 2023, the U.S. Department of Labor recovered over $220 million in back wages for workers nationwide, highlighting the financial risks associated with non-compliance.

- Wage and Hour Laws: AutoNation must comply with federal and state minimum wage requirements and overtime provisions, ensuring accurate pay for all employees.

- Anti-Discrimination Laws: Regulations like Title VII of the Civil Rights Act prohibit discrimination based on race, color, religion, sex, or national origin in all employment practices.

- Workplace Safety: The Occupational Safety and Health Administration (OSHA) mandates standards for a safe working environment, requiring AutoNation to address potential hazards in its service centers and showrooms.

- Union Relations: AutoNation must adhere to the National Labor Relations Act (NLRA) regarding employee rights to organize and bargain collectively, impacting its relationships with any unionized segments of its workforce.

Product Liability and Safety Standards

While AutoNation is primarily a retailer and service provider, it's significantly influenced by product liability laws and vehicle safety standards, which are usually the manufacturer's direct responsibility. The company needs to ensure all vehicles sold comply with current safety regulations, such as those mandated by the National Highway Traffic Safety Administration (NHTSA). For instance, in 2023, NHTSA continued to enforce stringent safety standards, impacting vehicle design and recall procedures across the industry, which indirectly affects AutoNation's inventory and potential liabilities.

To minimize its own exposure, AutoNation must maintain rigorous quality control for its repair and maintenance services. Adhering to manufacturer specifications and industry best practices is crucial. Failure to do so could lead to liability claims if faulty repairs result in accidents or vehicle malfunctions. The company's commitment to safety, therefore, extends beyond sales to its entire operational footprint.

- NHTSA's Role: The National Highway Traffic Safety Administration sets and enforces Federal Motor Vehicle Safety Standards (FMVSS), impacting all vehicles sold in the U.S.

- Recall Impact: AutoNation must manage vehicles subject to recalls, ensuring customer notification and repair, a process that saw millions of vehicles recalled in 2023-2024 due to various safety defects.

- Service Quality: High-quality service is essential to avoid liability for negligent repair, a key concern for any automotive service provider.

- Consumer Protection: Product liability laws protect consumers from defective products, indirectly pressuring retailers like AutoNation to maintain high standards.

AutoNation's legal landscape is shaped by evolving franchise laws, consumer protection statutes, and data privacy regulations. Compliance with state-specific franchise laws, such as those focusing on dealer protections in 2024, is crucial for managing manufacturer relationships. Furthermore, adherence to data privacy laws like the CCPA, with penalties up to $7,500 per intentional violation in 2024, is essential for digital operations.

The company also faces stringent labor laws, including wage and hour regulations and anti-discrimination statutes, impacting its large workforce. Workplace safety standards mandated by OSHA and the NLRA's provisions on union relations are also key legal considerations. The financial risks of non-compliance are substantial, as evidenced by the U.S. Department of Labor recovering over $220 million in back wages in 2023.

Product liability and vehicle safety standards, though often manufacturer-driven, indirectly affect AutoNation. Ensuring compliance with NHTSA regulations and managing vehicle recalls, which impacted millions of vehicles in 2023-2024, is vital. Maintaining high service quality also mitigates liability for negligent repair, a critical aspect of its operations.

Environmental factors

AutoNation's operations are significantly shaped by evolving emissions standards. For instance, the U.S. Environmental Protection Agency (EPA) continues to tighten regulations, impacting the types of internal combustion engine vehicles that can be sold and encouraging a faster transition to electric vehicles (EVs). In 2024, many states are aligning with California's Advanced Clean Cars II (ACC II) program, which mandates increasing percentages of zero-emission vehicle sales, directly influencing AutoNation's inventory mix and sales strategies.

AutoNation is actively integrating sustainability into its operations and supply chain. This includes implementing green building practices for its dealerships, such as water conservation measures and the use of energy-efficient LED lighting in new constructions and renovations. For example, by 2023, the company reported a 15% reduction in energy consumption per square foot in its updated facilities compared to older ones.

The company's commitment extends to its supply chain, focusing on responsible sourcing of materials and significant waste reduction efforts. In 2024, AutoNation initiated a pilot program to reduce packaging waste by 20% with key automotive parts suppliers, aiming for broader implementation in 2025.

AutoNation's commitment to sustainability is evident in its comprehensive recycling and waste management initiatives. These programs are designed to handle a wide array of automotive waste, including vital resources like water, used oil, tires, scrap metal, and batteries, significantly reducing landfill contributions.

These initiatives are not confined to a single operational area; they are deeply embedded across AutoNation's entire network, encompassing sales, service, and repair departments. This integrated approach ensures a consistent application of environmental best practices throughout the company's value chain.

While specific 2024 or 2025 recycling tonnage figures for AutoNation are not yet publicly available, the company's ongoing focus on these programs underscores a strategic effort to minimize its environmental footprint. For context, the automotive industry as a whole processed millions of tons of scrap metal and recycled millions of tires in recent years, highlighting the scale of potential impact.

Consumer Demand for Eco-Friendly Vehicles

Consumer demand for eco-friendly vehicles, especially electric and hybrid models, is a significant environmental factor impacting AutoNation. This trend directly shapes the company's inventory strategy, pushing for a greater selection of sustainable transportation options.

AutoNation is actively responding to this shift by expanding its offerings of electric vehicles (EVs) and hybrids. They are also focused on educating their customer base about these greener alternatives, aligning their business with the growing market preference for sustainable mobility solutions.

- EV Market Growth: Global EV sales are projected to reach approximately 14 million units in 2024, a substantial increase from previous years.

- Hybrid Popularity: Hybrid vehicle sales have also seen consistent growth, with many consumers opting for them as a bridge to full electrification.

- Consumer Preference: Surveys in late 2023 and early 2024 indicate that over 60% of potential car buyers are considering an EV or hybrid for their next purchase.

Climate Change Concerns and Corporate Responsibility

Growing global awareness of climate change is significantly impacting the automotive sector, leading to stricter regulations and a heightened emphasis on corporate responsibility. AutoNation is responding by embedding environmental stewardship into its operations, focusing on reducing its carbon footprint and maintaining ethical business practices. This commitment not only bolsters its public image but also aligns with evolving societal expectations and demands for sustainability.

The company's efforts are crucial as the automotive industry faces increasing scrutiny. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) finalized stricter emissions standards for vehicles, aiming to reduce greenhouse gas emissions significantly by 2032. AutoNation's proactive approach to environmental responsibility is therefore vital for navigating this evolving regulatory landscape and maintaining stakeholder trust.

- Regulatory Pressure: New emissions standards, like those finalized by the EPA in 2024, are compelling automakers and dealerships to invest in cleaner technologies and practices.

- Consumer Demand: A growing segment of consumers prioritizes environmentally friendly products and services, influencing purchasing decisions and brand loyalty.

- Corporate Initiatives: AutoNation's focus on reducing its operational emissions and promoting sustainable practices demonstrates a commitment to environmental stewardship, enhancing its brand reputation.

- Industry Trends: The broader automotive industry is shifting towards electric vehicles (EVs) and sustainable supply chains, making environmental responsibility a key competitive factor.

Stricter environmental regulations are a primary concern, pushing AutoNation towards a greater focus on electric and hybrid vehicles. For example, 2024 saw many states adopting California's Advanced Clean Cars II program, mandating increased zero-emission vehicle sales, which directly influences AutoNation's inventory and sales strategies. The company's proactive approach to sustainability, including waste reduction and energy efficiency in dealerships, is crucial for compliance and market positioning.

| Environmental Factor | Impact on AutoNation | 2024/2025 Data/Trend |

|---|---|---|

| Emissions Standards | Drives shift to EVs/hybrids, influences inventory mix. | States adopting ACC II in 2024; EPA finalizing stricter standards. |

| Consumer Demand for EVs/Hybrids | Shapes sales strategies and inventory. | Over 60% of buyers considering EVs/hybrids (late 2023/early 2024); Global EV sales projected ~14 million units in 2024. |

| Sustainability Initiatives | Enhances brand reputation, operational efficiency. | 15% energy reduction per sq ft in updated facilities (by 2023); Pilot to reduce supplier packaging waste by 20% in 2024. |

| Climate Change Awareness | Increases regulatory pressure and corporate responsibility focus. | Automotive industry facing scrutiny; EPA standards aim for significant GHG reduction by 2032. |

PESTLE Analysis Data Sources

Our AutoNation PESTLE Analysis is built on a robust foundation of data from leading automotive industry publications, economic forecasting agencies, and regulatory bodies. We incorporate insights from government reports on environmental policies, market research on consumer trends, and analyses of technological advancements impacting the automotive sector.