AUDI SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

Audi boasts a strong brand reputation and a commitment to innovation, but faces intense competition and evolving market demands. Understand the full strategic picture, including detailed breakdowns of their opportunities and threats.

Want the full story behind Audi's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Audi's brand image is a significant strength, globally recognized for luxury, cutting-edge engineering, and elegant design. This strong reputation enables Audi to maintain premium pricing power and cultivate a loyal customer base in the highly competitive luxury car market.

The company's enduring legacy and consistent commitment to its 'Vorsprung durch Technik' philosophy solidify its appeal across international markets. For instance, Audi's brand value was estimated at over $15 billion in 2024, underscoring its powerful market presence and consumer trust.

Audi's dedication to electrification is a significant strength, with plans to launch more than 20 new models by the end of 2025, half of which will be all-electric. This aggressive push ensures Audi is at the forefront of the automotive industry's shift towards sustainable transportation.

The brand's commitment to a varied product lineup, encompassing sedans, SUVs, and a growing electric vehicle range, allows Audi to cater to a broad customer base. This diversity is crucial for capturing market share across different segments and responding to increasing consumer demand for eco-friendly vehicles.

Audi's technological leadership is a cornerstone strength, evident in its pioneering quattro all-wheel-drive system and ongoing innovation in infotainment and driver assistance. This commitment to cutting-edge tech, including advancements in electric powertrains, ensures a superior driving experience and solidifies its premium market position.

Robust Global Production Network

Audi boasts a robust global production network, featuring strategically placed manufacturing facilities in key markets like Germany, Belgium, Mexico, and China. This widespread presence allows Audi to efficiently cater to varied regional demands and offers a degree of resilience against potential supply chain disruptions, bolstering its international distribution.

This extensive network is a significant asset, enabling Audi to adapt production volumes and specifications to local market needs. For instance, its plants in China are crucial for serving the world's largest automotive market, while European facilities support demand across the continent and beyond.

- Global Footprint: Manufacturing sites in Germany, Belgium, Mexico, and China.

- Market Responsiveness: Ability to tailor production to regional demands.

- Supply Chain Mitigation: Diversified locations reduce reliance on single sources.

- Distribution Efficiency: Supports effective worldwide product delivery.

Strong Parent Company Support (Volkswagen Group)

Audi's position as a core brand within the Volkswagen Group (VW) provides substantial advantages. This affiliation allows Audi to leverage significant synergies in research and development, leading to shared platforms like the Premium Platform Electric (PPE) for its upcoming EV models. Financial backing from the parent company is substantial, enabling significant investments in future technologies and market expansion.

The benefits extend to efficient supply chain management and shared technological advancements across the group. For instance, VW Group's investment in battery technology and charging infrastructure directly supports Audi's electrification strategy. In 2024, the VW Group reported a strong financial performance, with Audi contributing significantly to overall sales volumes and profitability, underscoring the robust support available.

- Synergistic R&D: Access to shared development resources and expertise within the VW Group accelerates Audi's innovation pipeline, particularly in electric and autonomous driving technologies.

- Platform Sharing: Utilization of group-wide platforms, such as the PPE, reduces development costs and time-to-market for new Audi models, enhancing efficiency.

- Financial Strength: The financial backing of the Volkswagen Group provides Audi with the capital necessary for large-scale investments in electrification, digitalization, and global market presence.

- Supply Chain Integration: Benefits from the VW Group's established and optimized supply chain network, ensuring greater resilience and cost-effectiveness in component sourcing.

Audi's strong brand equity, built on decades of engineering excellence and design sophistication, translates into significant pricing power and customer loyalty. This allows them to command premium prices in the competitive luxury automotive sector, a testament to their global appeal and consistent quality.

The company's strategic focus on electrification is a major advantage, with ambitious plans to expand its electric vehicle (EV) portfolio significantly. By 2025, Audi aims for half of its new models to be fully electric, positioning it at the forefront of the industry's transition to sustainable mobility.

Audi's technological innovation, exemplified by its renowned quattro all-wheel-drive system and advanced driver-assistance features, reinforces its premium image and provides a superior driving experience. This commitment to cutting-edge technology ensures a competitive edge in the luxury segment.

Being part of the Volkswagen Group offers substantial benefits, including shared research and development resources, access to common platforms like the Premium Platform Electric (PPE), and considerable financial backing. This synergy accelerates innovation and supports Audi's large-scale investments in future technologies.

| Strength Category | Description | Supporting Data/Fact (2024/2025) |

|---|---|---|

| Brand Image & Loyalty | Globally recognized for luxury, engineering, and design. | Audi's brand value estimated over $15 billion in 2024. |

| Electrification Strategy | Aggressive expansion of EV models. | Plans for over 20 new models by end of 2025, half electric. |

| Technological Leadership | Pioneering technologies like quattro AWD and advanced driver assistance. | Continuous investment in R&D for next-gen infotainment and autonomous driving. |

| VW Group Affiliation | Leverages synergies in R&D, platforms, and financial backing. | Utilizes shared platforms like PPE for EV development, benefiting from VW Group's 2024 financial strength. |

What is included in the product

This SWOT analysis provides a comprehensive look at Audi's internal strengths and weaknesses, alongside external market opportunities and threats.

AUDI's SWOT analysis offers a clear roadmap to navigate competitive pressures and capitalize on emerging market trends.

Weaknesses

Audi's profitability and delivery numbers have been a significant concern. In 2024, the company saw a substantial drop in profit after tax, falling by 33 percent to 4.2 billion euros. This downturn wasn't isolated; the first half of 2025 continued this trend with a 38% slump in profits compared to the same period in 2024.

This persistent decline in financial performance has led Audi to revise its full-year forecast downwards, indicating a challenging period ahead. Such figures suggest potential issues with operational efficiency and market competitiveness, impacting the company's overall financial health and growth trajectory.

The automotive landscape, especially in crucial markets like China, is currently a battleground of fierce competition and aggressive price reductions. This intense rivalry, fueled by the swift growth of Chinese automakers and the persistent challenge from established luxury brands, directly pressures Audi's profitability and the volume of vehicles it sells.

In 2023, the global automotive market saw significant price adjustments, with some regions experiencing average transaction price increases of around 3-5%, but this was often offset by heavy incentives in competitive segments. For instance, reports in late 2024 indicated that incentives in the premium electric vehicle segment in China could reach up to 15% of the vehicle's sticker price, directly impacting brands like Audi.

Recent quality reports, like the J.D. Power 2025 U.S. Initial Quality Study, have placed Audi in a less favorable light, with the brand reporting the highest number of issues among surveyed manufacturers. This trend, with Audi ranking 24th out of 32 brands in the 2025 study, highlights a significant challenge.

While many of these concerns are tied to infotainment systems and interior controls, Audi itself has admitted to areas where interior quality needs improvement. These acknowledged shortcomings could potentially impact how customers perceive the brand and their long-term loyalty.

High Production Costs and Restructuring Expenses

Audi is navigating substantial restructuring expenses, including workforce adjustments and facility consolidations, designed to boost operational efficiency. These necessary but costly measures, coupled with considerable investments in developing new electric vehicle (EV) platforms and cutting-edge technologies, are anticipated to place pressure on the company's financial results over the short to medium term.

The financial impact of these initiatives is significant. For instance, Audi reported restructuring costs impacting its operating profit. In the first half of 2023, Audi's operating profit before special items was €4.1 billion, a decrease from €7.5 billion in the same period of 2022, partly due to higher upfront investments and provisions. The company's strategy for the coming years includes substantial investments in electrification and digitalization, estimated at over €10 billion by 2026, which will continue to affect short-term profitability.

- Restructuring Costs: Expenses related to workforce reductions and plant optimization impact near-term profitability.

- EV Investment Strain: Significant capital allocation towards electric vehicle technology and platforms diverts resources from other areas.

- Efficiency Drive Impact: While aimed at long-term gains, the immediate costs of restructuring can weigh on financial performance.

- Competitive Landscape: High production costs in a competitive EV market necessitate these investments, creating a financial balancing act.

Vulnerability to Market Volatility and Tariffs

Audi's financial performance in 2025 has been notably susceptible to global economic shifts and political instability, directly impacting its sales and profitability. The company has faced headwinds from rising import tariffs, especially within the United States, which have increased operational costs and complicated pricing strategies.

Trade volatility and unpredictable consumer spending patterns present ongoing challenges that directly threaten Audi's ability to meet its sales and profit objectives for the year. These external pressures create a significant vulnerability for the premium automotive segment.

- Impact of U.S. Tariffs: Increased costs due to tariffs directly affect Audi's profit margins on vehicles sold in the U.S. market.

- Global Economic Slowdown: A general economic downturn can lead to reduced demand for luxury vehicles, a key segment for Audi.

- Supply Chain Disruptions: Geopolitical tensions can exacerbate existing supply chain issues, leading to production delays and increased costs.

- Exchange Rate Fluctuations: Volatility in currency exchange rates can negatively impact Audi's international revenue and profitability when translated back to Euros.

Audi's profitability is currently under significant pressure due to intense competition, particularly in the electric vehicle (EV) market, and aggressive pricing strategies from rivals. The company's profit after tax saw a substantial 33 percent drop to 4.2 billion euros in 2024, with a further 38 percent slump in the first half of 2025 compared to the prior year. This financial strain has led to a downward revision of Audi's full-year forecast, highlighting operational efficiency and market competitiveness as key weaknesses.

Recent quality reports, such as the J.D. Power 2025 U.S. Initial Quality Study, have ranked Audi poorly, placing it 24th out of 32 brands, with the highest number of reported issues. While many of these are related to infotainment and interior controls, Audi has acknowledged the need for improvement in interior quality, which could impact brand perception and customer loyalty.

Audi is incurring substantial restructuring costs as it invests heavily in new EV platforms and technologies, with over 10 billion euros allocated by 2026. These upfront investments, alongside workforce adjustments and facility consolidations, are expected to continue impacting short-term financial results, as evidenced by the decrease in operating profit before special items from €7.5 billion in H1 2022 to €4.1 billion in H1 2023.

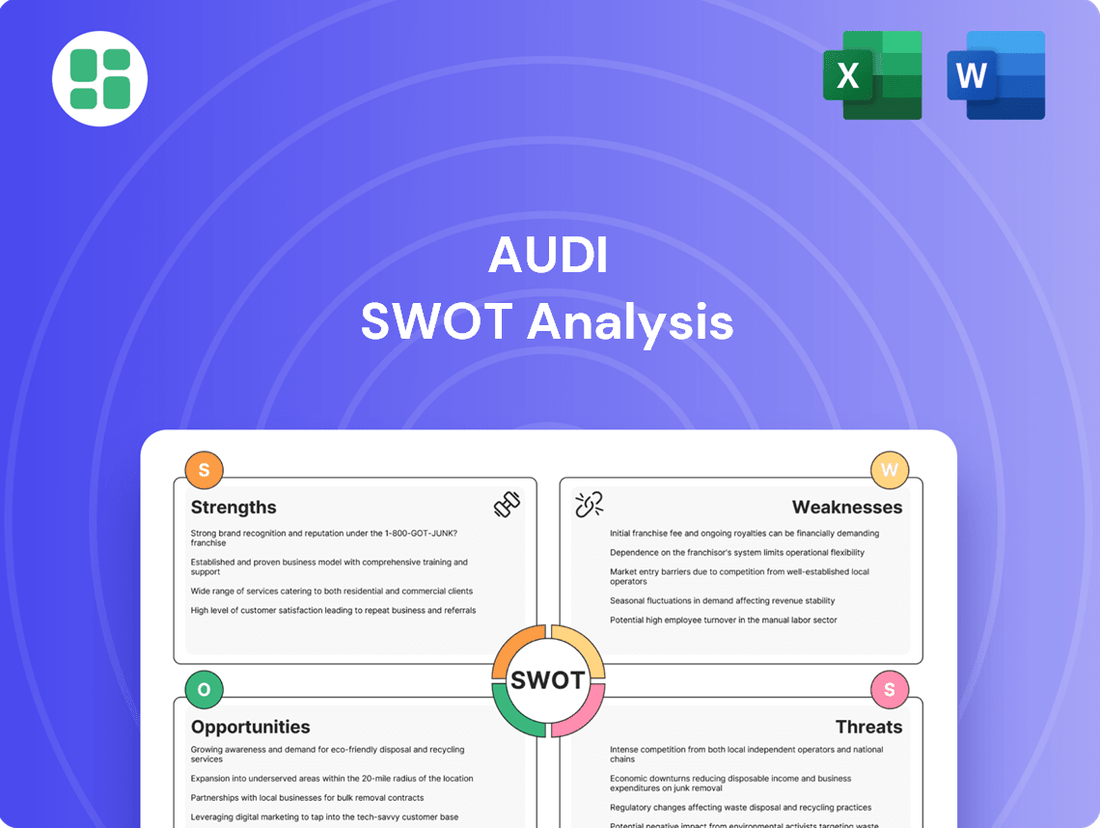

Preview Before You Purchase

AUDI SWOT Analysis

This is the actual AUDI SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Audi's internal Strengths and Weaknesses, alongside external Opportunities and Threats, allowing for strategic planning.

The preview below is taken directly from the full AUDI SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key factors influencing Audi's market position and future growth.

Opportunities

The global luxury electric vehicle market is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond, fueled by heightened environmental consciousness and a desire for advanced automotive technology. Audi is well-positioned to leverage this trend, having already introduced successful models like the e-tron and planning further expansion with vehicles such as the Q6 e-tron, directly addressing this burgeoning segment.

Audi's aggressive product rejuvenation, targeting over 20 new models by the end of 2025, with half being fully electric, presents a significant opportunity to capture market share in the rapidly growing EV segment. This extensive rollout aims to refresh its entire lineup, appealing to a broader customer base and countering competitive pressure.

The development of new, flexible platforms like the Premium Platform Electric (PPE) is crucial. This will enable Audi to efficiently introduce advanced electric and plug-in hybrid vehicles, ensuring technological parity and offering enhanced performance and range, which are key purchasing factors for EV consumers.

Growing consumer demand for sophisticated automotive technology, particularly autonomous driving and enhanced connectivity, offers a significant avenue for Audi's expansion. This trend is evident with projections indicating the global autonomous vehicle market could reach over $2 trillion by 2030, highlighting substantial market potential.

Audi's strategic investment in software-defined vehicles and artificial intelligence integration is poised to revolutionize the user experience, attracting a key demographic of affluent, tech-forward consumers. The company's focus on these areas aligns with the increasing expectation that vehicles will offer seamless digital integration and advanced driver-assistance systems.

Strategic Expansion in Key International Markets

Audi has a significant opportunity to bolster its standing in key international markets, particularly China and North America, by implementing highly specific strategies and introducing new vehicle models. This focus on regional adaptation is crucial for tapping into substantial growth potential.

The company can leverage its brand appeal by introducing models that specifically cater to the evolving preferences in these regions. For instance, the demand for electric vehicles (EVs) and SUVs remains strong in both China and North America.

- China's premium car market is projected to grow, with EVs expected to capture a larger share, presenting a prime area for Audi's expansion.

- North America continues to show robust demand for luxury SUVs and is increasingly embracing electrification.

- Audi's investment in localized production and R&D in China can further enhance its competitive edge.

- Targeted marketing campaigns highlighting technological advancements and sustainable mobility solutions will resonate well with consumers in these markets.

Development of New Revenue Streams and Services

Audi has a significant opportunity to develop new revenue streams by embracing the automotive industry's shift towards servitization and subscription-based models. This could involve offering premium connectivity packages, advanced driver-assistance features as a service, or even full vehicle subscriptions that include maintenance and insurance. For instance, by Q4 2024, the global automotive subscription market was projected to reach $10 billion, indicating substantial consumer interest in flexible ownership options.

Further diversification can be achieved through enhanced customization options and robust after-sales support. Offering personalized digital services, bespoke interior and exterior configurations, and proactive maintenance plans can deepen customer loyalty and create recurring revenue. Audi's focus on digital services, such as its myAudi app, already positions it well to expand these offerings, potentially capturing a larger share of the aftermarket services market, which is expected to grow by 6% annually through 2027.

- Expand subscription services for features like advanced navigation, enhanced audio, or performance upgrades.

- Develop personalized digital services tailored to individual driver preferences and usage patterns.

- Strengthen after-sales support with proactive maintenance alerts and mobile service options.

- Offer tiered ownership models that combine vehicle access with bundled services for a predictable monthly cost.

Audi can capitalize on the booming luxury EV market, with projections showing continued strong growth through 2025. Its commitment to electrifying its lineup, including models like the Q6 e-tron, directly addresses this expanding consumer demand.

The company's extensive product rejuvenation, aiming for over 20 new models by the end of 2025, half of which will be electric, presents a prime opportunity to capture significant market share. This strategic refresh is designed to appeal to a wider audience and fend off increasing competition.

Audi's investment in advanced platforms like PPE will enable efficient development of cutting-edge electric and plug-in hybrid vehicles, ensuring it remains competitive in performance and range. Furthermore, the growing demand for sophisticated automotive tech, including autonomous driving, offers substantial revenue potential, with the global autonomous vehicle market anticipated to exceed $2 trillion by 2030.

The company is well-positioned to tap into new revenue streams through servitization and subscription models, with the automotive subscription market projected to reach $10 billion by Q4 2024. Enhanced customization and digital services, like the myAudi app, also present opportunities to deepen customer loyalty and boost aftermarket revenue, a sector expected to grow by 6% annually through 2027.

Threats

Audi is navigating a highly competitive landscape, especially within the luxury and electric vehicle (EV) sectors. Established rivals like BMW and Mercedes-Benz continue to be formidable, while newer players such as Tesla and Lucid Motors are aggressively challenging market norms with their innovative EV offerings.

This intense rivalry, particularly in the fast-paced EV market, directly impacts Audi's ability to maintain pricing power, drive innovation, and secure market share. For instance, in the first quarter of 2024, Tesla's global deliveries, though facing some headwinds, still represented a significant benchmark for the industry, underscoring the pressure on all automakers to accelerate their EV strategies.

Global geopolitical tensions and the rise of trade barriers, exemplified by new U.S. import tariffs, directly affect Audi's financial performance and complicate its international operations. These challenges can lead to increased costs for components and finished vehicles, potentially reducing profitability and creating uncertainty regarding market access for its premium automobiles.

For instance, the ongoing trade disputes and the potential for further tariffs could significantly impact Audi's sales volumes and pricing strategies in key markets like the United States, a crucial region for its luxury vehicle segment. This volatility necessitates agile supply chain management and strategic market diversification to mitigate the financial repercussions.

Persistent supply chain issues, including semiconductor shortages and logistics bottlenecks, continue to impact Audi's production. These disruptions, coupled with rising costs for key materials like lithium and nickel, directly affect manufacturing expenses. For instance, the automotive industry experienced an average increase of 10-15% in raw material costs in 2023, which directly pressures Audi's profitability and ability to meet demand.

Shifting Consumer Preferences and Market Acceptance of EVs

While the demand for electric vehicles (EVs) is on an upward trend, a significant threat to Audi lies in the uncertainty surrounding the speed of consumer adoption. Rapid technological advancements in the EV sector could also negatively impact the resale value of current Audi EV models, making consumers hesitant. For instance, by the end of 2024, the used EV market saw significant price fluctuations, with some models depreciating faster than anticipated due to new, more advanced releases.

Shifts in consumer sentiment, driven by factors like increasing environmental awareness and evolving personal transportation needs, pose a direct challenge to Audi's traditional luxury vehicle segment. If Audi is too slow to adapt its product offerings and marketing strategies to these changing preferences, it risks losing market share to competitors who are more agile in the EV space. In 2024, surveys indicated that over 60% of luxury car buyers were considering an EV for their next purchase, highlighting a critical pivot point for established brands.

- Consumer adoption pace: Uncertainty remains regarding how quickly mainstream consumers will embrace EVs, potentially slowing down sales for brands heavily invested in electrification.

- Resale value concerns: Rapid technological upgrades in EVs can lead to faster depreciation of older models, creating anxiety for buyers concerned about long-term ownership costs.

- Shifting luxury market dynamics: Evolving consumer priorities, including sustainability and digital integration, may reduce demand for traditional internal combustion engine luxury vehicles if Audi doesn't innovate quickly.

Regulatory Changes and Environmental Standards

Audi, like all automakers, faces the significant threat of evolving regulatory changes, especially concerning emissions and sustainability. For instance, the European Union's stringent CO2 emission targets for 2030, aiming for a 55% reduction compared to 1990 levels, directly impact vehicle development and production costs. Failure to meet these benchmarks can lead to substantial fines, potentially impacting profitability and market competitiveness.

The increasing focus on environmental standards, such as those related to battery recycling and the sourcing of raw materials for electric vehicles, presents another challenge. Audi must navigate complex global supply chains and ensure compliance with diverse national regulations, which can slow down product launches and increase operational expenses. For example, the proposed EU Battery Regulation, effective from 2024, introduces requirements for battery passports and recycled content, necessitating significant investment in supply chain transparency and material sourcing strategies.

- Stricter Emissions Targets: EU 2030 CO2 targets necessitate rapid electrification and efficient internal combustion engine (ICE) technology, impacting R&D spend.

- Sustainability Mandates: Regulations on battery materials, recycling, and end-of-life vehicle management require significant operational adjustments and investment.

- Penalties for Non-Compliance: Failure to meet emission standards can result in substantial fines, as seen with past penalties levied against manufacturers in various regions.

- Regional Regulatory Divergence: Navigating differing environmental and safety regulations across key markets like China, the US, and Europe adds complexity and cost to product development and market entry.

Intensifying competition, particularly from EV-focused rivals like Tesla and emerging Chinese manufacturers, poses a significant threat to Audi's market share and pricing power. The rapid pace of innovation in the EV sector means Audi must constantly invest heavily in research and development to remain competitive, a challenge exacerbated by the fact that Tesla's Q1 2024 global deliveries still set a high bar for the industry.

Navigating complex and often diverging global regulatory landscapes, especially concerning emissions and sustainability mandates, adds considerable cost and complexity to Audi's operations. For instance, the EU's stringent 2030 CO2 reduction targets require substantial investment in electrification, and failure to comply can result in significant fines, potentially impacting profitability.

Supply chain disruptions, including ongoing semiconductor shortages and rising raw material costs for EV batteries, continue to impact production efficiency and increase manufacturing expenses. The automotive industry saw raw material costs rise by an average of 10-15% in 2023, directly pressuring Audi's profitability and its ability to meet demand.

Uncertainty surrounding the pace of consumer adoption for electric vehicles (EVs) and concerns about the resale value of current EV models present a threat to Audi's electrification strategy. By the end of 2024, the used EV market experienced significant price volatility, with some models depreciating faster than anticipated due to new technological releases.

SWOT Analysis Data Sources

This Audi SWOT analysis is built upon a foundation of robust data, including Audi's official financial reports, comprehensive market research from leading automotive analysts, and expert opinions from industry insiders to ensure a well-rounded and insightful assessment.