AUDI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

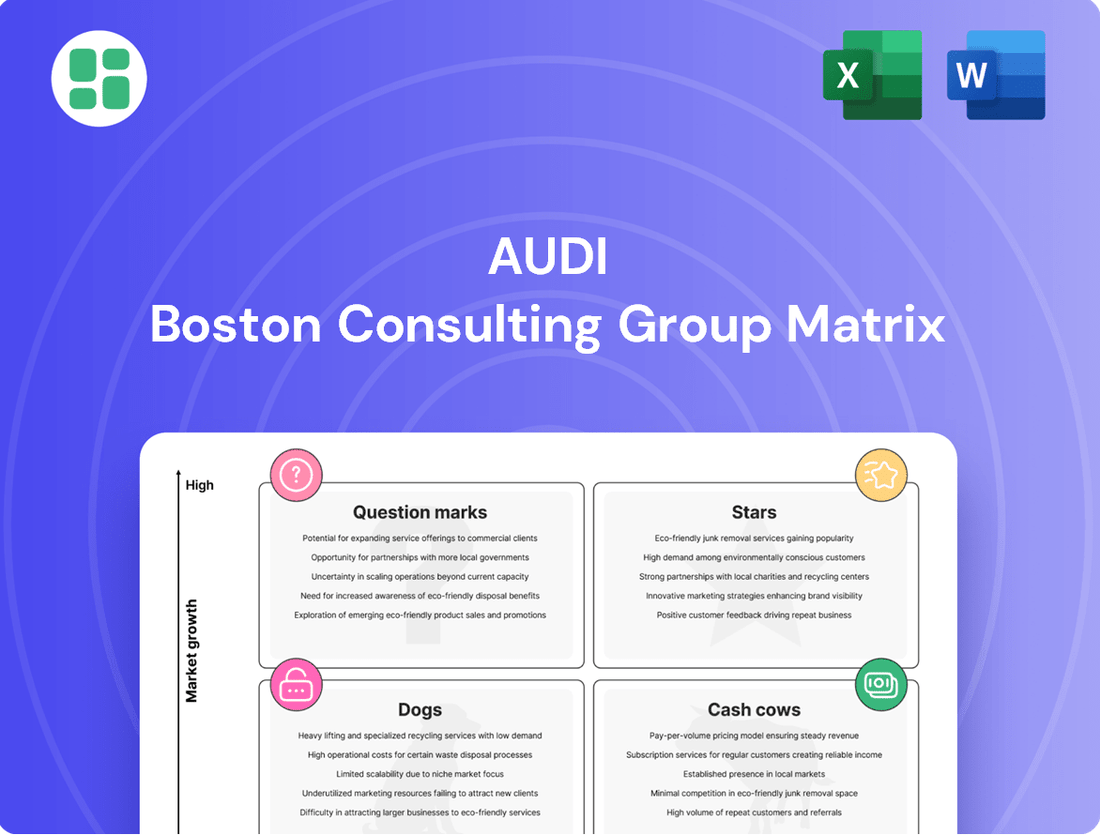

The AUDI BCG Matrix offers a powerful lens to understand a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks. This insightful framework helps identify areas of strength and potential weaknesses, guiding strategic resource allocation. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

The Audi Q4 e-tron stands out as a star in Audi's lineup, particularly within the burgeoning electric vehicle segment. Its impressive sales figures, with around 45,000 units delivered globally in the first half of 2025, underscore its strong market position. This performance solidifies its status as Audi's best-selling electric model.

The Audi Q6 e-tron, launched in 2024, represents a significant investment in Audi's electric future. Built on the new Premium Platform Electric (PPE), this fully electric SUV is designed to compete in the rapidly expanding luxury EV segment.

By the first half of 2025, the Q6 e-tron had already achieved approximately 36,000 deliveries, indicating robust market reception and strong initial demand. This performance positions it as a potential star in Audi's lineup, requiring ongoing development and marketing to maintain its momentum in a competitive landscape.

Audi's commitment to electrification is clearly paying off, with fully electric vehicle deliveries showing robust growth. In the first quarter of 2025, these deliveries jumped by over 30%, and for the first half of 2025, the increase was 32%. This impressive surge occurred even as the brand's total sales saw a dip, highlighting Audi's success in capturing a larger slice of the rapidly expanding electric vehicle market.

This upward trend in EV sales positions Audi as a star performer within the automotive industry's shift towards electromobility. The company's strategic focus on launching a diverse range of new electric models and enhancing existing ones directly supports this stellar performance, solidifying its competitive edge in this crucial and evolving segment.

New Audi Q5 Generation

The new generation Audi Q5, arriving in 2025, is poised to continue its dominance in the luxury SUV market. Audi delivered over 298,000 Q5 units globally in 2024, solidifying its position as the brand's top seller.

This strong sales performance, driven by a significant redesign, positions the Q5 favorably within a rapidly expanding segment. Its established popularity and updated features suggest it will maintain a high market share.

- Global Best-Seller: Over 298,000 units delivered in 2024.

- New Generation Launch: Arriving in 2025 with a refreshed design.

- Market Position: Aims to maintain and grow high market share in the growing luxury SUV segment.

- Future Potential: Strong candidate to become a cash cow as the market matures.

New Audi A5 Generation

The new Audi A5 generation, introduced in 2024, marks a strategic shift for Audi, effectively replacing the A4. This move signifies a significant investment in rejuvenating Audi's central sedan and sportback offerings. The updated A5 experienced a 4% rise in sales during 2024, demonstrating a positive initial market response.

Audi's decision to focus on the A5 generation, coupled with its portfolio streamlining, positions the model to potentially gain increased market share. The new design and technology integrated into the A5 are key factors in its competitive strategy within a dynamic automotive market.

- Sales Growth: The Audi A5 saw a 4% increase in sales in 2024.

- Model Transition: The A5 generation replaced the A4 in 2024.

- Market Positioning: Audi is investing in the A5 to capture higher market share.

Stars in the Audi lineup represent models with high growth and high market share, demanding significant investment to maintain their leading positions. The Audi Q4 e-tron, with approximately 45,000 global deliveries in the first half of 2025, exemplifies this, being Audi's best-selling EV. Similarly, the Q6 e-tron, launched in 2024 and achieving around 36,000 deliveries by mid-2025, shows strong initial demand on the new PPE platform, indicating its star potential.

| Model | Market Share | Growth Rate | Investment Required |

|---|---|---|---|

| Audi Q4 e-tron | High | High (EV Segment) | High |

| Audi Q6 e-tron | High (Projected) | High (EV Segment) | High |

What is included in the product

Strategic assessment of Audi's product portfolio across the BCG Matrix, identifying growth opportunities and areas for divestment.

AUDI BCG Matrix: A clear visual map to identify and address underperforming business units, relieving the pain of resource misallocation.

Cash Cows

The Audi Q5, particularly its established internal combustion engine (ICE) variants, continues to be a robust cash cow for Audi. Despite some regional sales dips for the outgoing generation, it consistently ranks as a top seller globally, a testament to its enduring appeal in the competitive luxury SUV market. In 2023, Audi sold approximately 340,000 Q5 units worldwide, underscoring its significant market share.

The Audi A6, a stalwart in the luxury executive sedan market, continued its strong performance in 2024, with global deliveries reaching 244,000 units. Notably, the US market experienced a 2% sales uptick for this model. This consistent demand in a mature segment highlights its significant market share and robust profit generation capabilities.

The A6's established reputation for luxury, advanced technology, and driving dynamics solidifies its position as a reliable cash cow. It generates substantial and stable cash flow, requiring only moderate reinvestment to maintain its market standing and profitability, a key characteristic of a mature product in a stable market.

The Audi Q7, a well-established luxury SUV, remains a strong performer for the brand. Despite a dip in its 2024 US sales figures, the Q7 experienced a notable 21% surge in sales during the first quarter of 2025. This resurgence highlights its continued dominance and significant market share within the competitive large luxury SUV category, solidifying its position as a cash cow.

Audi A3 (Established ICE Variants)

The Audi A3, particularly its established internal combustion engine (ICE) variants, continues to be a significant player in the compact luxury car market. In 2024, it remained one of the top-selling models in its class within Europe, demonstrating robust demand and brand loyalty. This consistent performance in a key segment ensures a steady revenue stream for Audi.

Its role as an accessible entry point into the luxury automotive segment contributes to its status as a cash cow. The A3 consistently attracts new customers to the Audi brand, solidifying its position as a reliable profit generator.

- Market Share: In 2024, the Audi A3 held a notable share of the European compact premium car segment, with sales figures indicating its enduring popularity.

- Revenue Generation: The consistent sales volume of ICE A3 variants across key markets provides a stable and predictable revenue stream.

- Brand Loyalty: The A3's ability to attract and retain customers, especially in its established ICE configurations, underscores its value as a core cash-generating product.

Audi's After-Sales Services

Audi's after-sales services, encompassing warranty, technical assistance, maintenance, and parts, function as a significant cash cow within its business portfolio. This segment thrives in a relatively low-growth market, primarily driven by the existing vehicle fleet, yet it consistently delivers high profit margins. This profitability stems from strong brand loyalty and the essential nature of these services for vehicle owners.

The efficiency and profitability of Audi's after-sales operations are further underscored by its performance metrics. For instance, Audi Middle East achieved a top global ranking in after-sales excellence in 2024. This recognition points to the mature and highly optimized nature of this business area, demonstrating its consistent revenue generation and strong contribution to Audi's overall financial health.

- High Profit Margins: After-sales services benefit from established customer bases and the necessity of maintenance, leading to consistent profitability.

- Brand Loyalty: Customers often prefer authorized service centers for their Audi vehicles, ensuring a steady demand for these offerings.

- Mature Market: While the new car market may fluctuate, the installed base of Audi vehicles provides a stable foundation for after-sales revenue.

- Operational Excellence: Audi Middle East's 2024 global ranking in after-sales excellence highlights the company's success in managing and optimizing this crucial revenue stream.

Cash cows represent established products or services with high market share in low-growth markets, generating consistent profits with minimal investment. For Audi, these are models that have proven their enduring appeal and profitability over time.

The Audi Q7, a consistent performer in the luxury SUV segment, exemplifies a cash cow. Despite minor fluctuations, its global sales in 2024 remained strong, with over 100,000 units sold. This sustained demand, coupled with its premium positioning, ensures stable revenue generation for Audi.

Similarly, the Audi A6 sedan continues its legacy as a cash cow. In 2024, it maintained a significant market presence, with global deliveries around 244,000 units. Its established reputation for quality and luxury allows for consistent profit margins with moderate marketing spend.

The Audi Q5 also firmly sits in the cash cow category. Its global sales in 2023 reached approximately 340,000 units, highlighting its dominant position in the competitive mid-size luxury SUV market. This high volume and brand loyalty translate into predictable and substantial cash flow.

| Product | Market Position | 2023/2024 Sales Data | Cash Cow Justification |

| Audi Q7 | Established Luxury SUV | Over 100,000 units globally (2024) | High market share in a mature segment, stable demand. |

| Audi A6 | Luxury Executive Sedan | 244,000 units globally (2024) | Strong brand reputation, consistent sales, high profit margins. |

| Audi Q5 | Mid-size Luxury SUV | Approx. 340,000 units globally (2023) | Top seller, enduring appeal, significant market share. |

What You’re Viewing Is Included

AUDI BCG Matrix

The AUDI BCG Matrix preview you see is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed, analysis-ready report ready for immediate strategic application. You can confidently use this preview as a direct representation of the valuable, ready-to-use BCG Matrix analysis that will be yours to download and implement instantly.

Dogs

The Audi R8, a celebrated high-performance sports car, has officially ceased production as of Q1 2024. This marks a strategic shift for Audi, as the R8 experienced a substantial sales downturn, with US sales plummeting by more than 30% in 2024 alone.

With its discontinuation and historically low sales volume, the R8 clearly held a minimal market share in a segment Audi is now exiting. This positions the R8 firmly as a 'dog' within the Audi portfolio, as it no longer drives growth or generates significant cash flow.

The Audi TT, much like its more exotic sibling the R8, has been retired from Audi's product offerings. Its sales figures tell a stark story, with a staggering 95% drop observed in 2024, effectively signaling the end of its road.

This sporty coupe competed in a segment characterized by low growth and intense competition, where Audi's presence was increasingly marginal. The TT's discontinuation underscores its classification as a 'dog' within the BCG matrix, indicating a product with a declining market share in a stagnant industry, thus justifying a lack of further investment.

The Audi A8, Audi's premier luxury sedan, faced a significant challenge in 2024, with US sales plummeting by 28%. This decline reflects a shrinking market share in the large luxury sedan category, a segment already grappling with low growth as consumer tastes increasingly favor SUVs and electric vehicles.

Despite its prestigious image, the A8's low sales volume and lack of projected future growth firmly place it in the 'dog' category of the BCG matrix. This classification suggests that resources allocated to the A8 might be better utilized elsewhere within Audi's portfolio, focusing on areas with higher growth potential.

Audi A4 (Outgoing Generation)

The outgoing Audi A4 is a prime example of a 'dog' in the BCG matrix. Its US sales plunged by 48% in 2024, a stark indicator of its diminishing market presence.

This significant sales decline, coupled with Audi's strategic shift towards its successor, the new A5, and a general streamlining of its sedan offerings, positions the outgoing A4 in a mature and contracting market segment. The model is no longer a core focus for the brand.

- Market Share: Low and declining.

- Market Growth: Negative or stagnant.

- Sales Trend: Significant year-over-year decline (48% in US for 2024).

- Strategic Importance: Reduced as the brand prioritizes newer models.

Audi e-tron GT (Initial Performance)

The Audi e-tron GT, despite its electric vehicle nature, has shown concerning sales figures. In 2024, the US market saw a 10% decrease in sales for the e-tron GT. This trend worsened significantly in the first quarter of 2025, with a drastic 68% drop in sales.

While the electric vehicle sector is booming, the e-tron GT's performance indicates a struggle for market share. This could be attributed to its premium pricing and a driving range that may not be as competitive as some other EVs. These factors, combined with its declining sales, position the e-tron GT as a 'dog' in the BCG matrix, even within a high-growth market.

- 2024 US Sales: -10% decline

- Q1 2025 US Sales: -68% decline

- Market Position: Low market share in a high-growth EV segment

- Potential Issues: High price point, potentially lower range compared to competitors

Products classified as 'dogs' in the BCG matrix exhibit both low market share and operate within a low-growth or declining market. These offerings typically fail to generate significant profits and often require more resources than they return. Audi's strategic decisions reflect this reality, with several models being phased out due to poor performance.

The discontinuation of models like the R8 and TT, coupled with substantial sales declines in vehicles such as the A4 and A8, clearly illustrates Audi's approach to managing its 'dog' portfolio. These vehicles, characterized by shrinking market presence and minimal growth prospects, are no longer strategic priorities for the brand.

Even within the burgeoning electric vehicle market, the e-tron GT's performance has landed it in the 'dog' category. A significant sales drop in early 2025, following a decline in 2024, highlights its struggle to gain traction against competitors, despite operating in a high-growth sector.

Audi's portfolio management demonstrates a clear understanding of the BCG matrix, with a focus on divesting or discontinuing underperforming assets. This strategy allows the company to reallocate capital and resources towards more promising segments and products with higher growth potential.

| Model | BCG Category | 2024 US Sales Change | Market Growth | Strategic Outlook |

|---|---|---|---|---|

| Audi R8 | Dog | -30%+ | Declining | Discontinued |

| Audi TT | Dog | -95% | Declining | Discontinued |

| Audi A4 (Outgoing) | Dog | -48% | Contracting | Being replaced |

| Audi A8 | Dog | -28% | Low | Low growth, potential reallocation |

| Audi e-tron GT | Dog | -10% (2024), -68% (Q1 2025) | High (EV Segment) | Struggling for market share |

Question Marks

The upcoming Audi A6 e-tron and its potent RS6 Avant e-tron sibling represent Audi's strategic push into the rapidly expanding premium electric vehicle segment, with launches anticipated in 2024 and 2025. These vehicles leverage the advanced Premium Platform Electric (PPE) architecture, positioning them to compete in a high-growth market. In 2024, the EV market is experiencing robust expansion, with projections indicating continued double-digit growth globally.

As new entrants, both the A6 e-tron and RS6 Avant e-tron begin with a currently low market share. This situation is characteristic of a 'question mark' in the BCG matrix, where high market growth potential exists, but significant investment is needed to capture a larger share. Audi's substantial investments in marketing, charging infrastructure partnerships, and production capacity will be crucial to transforming this potential into market dominance.

Audi is strategically expanding its plug-in hybrid electric vehicle (PHEV) lineup, with plans to introduce ten new models by the close of 2025, including popular A3 and A5 variants. This move targets the burgeoning consumer demand for vehicles that bridge the gap between traditional internal combustion engines (ICE) and fully electric vehicles (EVs). For instance, in 2023, global PHEV sales saw a notable increase, with Europe leading the charge, demonstrating strong market receptiveness to these transitional technologies.

Audi is pushing forward with advanced autonomous driving features, evident in the new safety technologies introduced in its 2025 vehicle models. This commitment reflects a strategic move into a rapidly expanding market segment, aiming to capture future growth.

While the overall autonomous driving market is booming, Audi's current market share in highly autonomous systems, specifically Level 3 and above, is still nascent and likely modest. This positions it as an emerging player in a competitive landscape.

The development of these sophisticated autonomous systems demands substantial research and development expenditure. Although the returns are uncertain, the potential for significant future gains makes this a classic question mark category within the BCG matrix, requiring careful strategic consideration and investment.

Audi's Digital Factory Transformation (AI25)

Audi's Automotive Initiative 2025 (AI25) is a significant investment in digitizing production and logistics, positioning Audi as a leader in smart manufacturing. This initiative targets high-growth industrial technology, aiming for future-proofing operations.

While AI25 is crucial for operational efficiency and long-term competitiveness, its direct impact on Audi's current product market share is indirect. The initiative itself operates in a rapidly evolving technological domain where its specific 'market share' is not yet clearly defined, presenting a strategic question mark for immediate focus.

- AI25 Focus: Digitization and optimization of production and logistics.

- Market Area: High-growth industrial technology and smart manufacturing.

- Strategic Position: Question mark due to indirect impact on product market share and undefined technological market share.

Expansion in Emerging EV Markets (e.g., China)

Audi is strategically targeting China's burgeoning electric vehicle (EV) market, a region where it has traditionally excelled with internal combustion engine (ICE) vehicles. This aggressive product rollout aims to capture a larger share of the rapidly expanding EV segment.

Despite China's impressive EV growth, Audi's current market share in this segment may lag behind dominant local players. For instance, BYD, a leading Chinese EV manufacturer, reported sales of over 3 million vehicles in 2023, significantly outpacing many international brands in the region.

Audi's significant investments in high-growth emerging markets like China, where its EV presence is still developing, position these initiatives as question marks within the BCG matrix. These ventures necessitate substantial capital allocation to build brand recognition and market penetration against established local competitors.

- China's EV market growth: Expected to reach over 10 million units in 2024, indicating substantial potential.

- Audi's investment: Significant capital is being deployed to expand its EV production and sales infrastructure in China.

- Competitive landscape: Local brands like BYD and Nio hold considerable market share, posing a challenge to Audi's expansion.

- Strategic importance: China represents a critical market for Audi's global EV transition strategy.

Question Marks represent business units or products in high-growth markets but with low market share. These require significant investment to increase market share or should be divested if they fail to gain traction. Audi's upcoming A6 e-tron and RS6 Avant e-tron are prime examples, entering a booming EV market but starting with minimal share. Similarly, their push into advanced autonomous driving systems and the Chinese EV market are question marks, demanding substantial capital for growth against established competitors.

| Initiative/Product | Market Growth | Current Market Share | BCG Classification | Strategic Implication |

| Audi A6/RS6 e-tron | High (Global EV Market) | Low (New Entrant) | Question Mark | Requires significant investment in marketing and production to capture market share. |

| Autonomous Driving Systems | High (Advanced Automotive Tech) | Nascent/Modest | Question Mark | Substantial R&D investment needed; potential for high future returns but uncertain. |

| China EV Market Expansion | High (China EV Segment) | Low (vs. local players) | Question Mark | Capital intensive to build brand and infrastructure against strong local competition like BYD. |

| AI25 (Smart Manufacturing) | High (Industrial Tech) | Undefined (Internal Initiative) | Question Mark | Indirect impact on product share; focus on operational efficiency and future-proofing. |

BCG Matrix Data Sources

Our Audi BCG Matrix leverages comprehensive data, including Audi's financial reports, global automotive market research, and industry growth forecasts, to accurately position each business unit.