AUDI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

AUDI faces intense competition from established luxury automakers and emerging EV players, highlighting the significant threat of new entrants and the power of buyers seeking innovative features. Understanding these forces is crucial for AUDI's strategic planning.

The complete report reveals the real forces shaping AUDI’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Audi's supply chain is incredibly complex, managing approximately 30,000 different parts. This intricate network, spanning the globe, means that specialized suppliers for critical components, such as semiconductors, can wield significant bargaining power. The automotive industry's reliance on these specialized inputs makes them particularly vulnerable to supply disruptions.

The semiconductor shortage, which significantly impacted global automotive production throughout 2021 and 2022, serves as a prime example. This scarcity forced manufacturers like Audi to face extended lead times and higher component costs, directly illustrating the bargaining leverage held by semiconductor suppliers during periods of high demand and limited availability.

Suppliers of cutting-edge technologies, particularly electric vehicle batteries and advanced electronic systems, wield considerable influence over Audi. These components are vital for Audi's push into electrification and for setting its vehicles apart in a competitive market. For instance, the automotive industry's rapid development in battery technology, with a focus on improving energy density and reducing costs, means that current battery manufacturers can command strong pricing power.

Furthermore, global events impacting the supply of essential raw materials like steel and aluminum can significantly shift bargaining power towards their suppliers. Tariffs and trade disputes, for example, can drive up the cost of these inputs, thereby enhancing the leverage of raw material providers in their negotiations with automakers like Audi. In 2024, the price of lithium, a key component in EV batteries, experienced volatility, underscoring the influence of raw material markets.

Labor shortages are a growing issue across the automotive supply chain, especially in North America. This scarcity of skilled workers means suppliers often have to pay more for talent.

For example, in 2023, the U.S. Bureau of Labor Statistics reported that manufacturing job openings remained elevated, indicating persistent demand for workers. These increased labor costs for suppliers can directly impact the prices Audi pays for its components, effectively increasing Audi's input costs.

To attract and retain workers, suppliers are compelled to offer higher wages and better benefits. This dynamic shifts more bargaining power to the labor force within the supply chain, as their availability and cost become critical factors for suppliers' operations and, consequently, for Audi.

Supplier Diversification and Reshoring Efforts

Automakers, including Audi, are actively pursuing supplier diversification and reshoring to counter the bargaining power of suppliers. This proactive approach aims to build more resilient supply chains and lessen dependence on any single supplier. For instance, the global semiconductor shortage highlighted the risks of concentrated supply, prompting many in the automotive sector to seek alternative sourcing and domestic production capabilities.

By forging strategic alliances with a broader range of suppliers and investing in localized manufacturing, companies can effectively diminish the leverage held by individual component providers. This strategy is crucial for maintaining production stability and controlling costs in an increasingly volatile global market. The push for reshoring, supported by government incentives in various regions, further strengthens this position.

- Diversification reduces reliance on sole suppliers, mitigating price hikes and supply disruptions.

- Reshoring efforts aim to bring production closer to home, shortening lead times and improving control.

- In 2023, the automotive industry saw increased investment in regionalizing supply chains, particularly for critical components like batteries and semiconductors.

- Strategic partnerships with multiple, geographically dispersed suppliers are key to enhancing supply chain resilience.

Regulatory and Cybersecurity Requirements

New regulations, like the UN 155 standard for cybersecurity, which became mandatory for the entire automotive supply chain starting July 2024, significantly impact suppliers. This requires them to establish robust cybersecurity management systems, adding considerable cost and complexity to their operations.

Suppliers who can effectively navigate and comply with these demanding regulatory and cybersecurity mandates are in a stronger position. Their specialized capabilities allow them to potentially charge premium prices, increasing their bargaining power.

- UN 155 Cybersecurity Regulation: Effective July 2024, mandating cybersecurity management systems across the automotive value chain.

- Increased Supplier Costs: Compliance with stringent standards adds operational and technological expenses for suppliers.

- Specialized Capabilities Command Higher Prices: Suppliers meeting high regulatory and cybersecurity demands can leverage this for better pricing.

Audi's bargaining power with suppliers is influenced by the concentration of suppliers for critical components and the importance of those components to Audi's product strategy. The automotive sector's reliance on specialized inputs means that key suppliers, particularly for electric vehicle technology and semiconductors, can exert significant leverage.

The semiconductor shortage, which persisted through 2021-2022, demonstrated this, forcing automakers to accept higher costs and longer lead times. In 2024, the volatility in raw material prices, such as lithium, further highlights the influence suppliers of essential materials can have on pricing.

Labor shortages in manufacturing, as indicated by elevated job openings reported by the U.S. Bureau of Labor Statistics in 2023, also increase supplier costs, which can be passed on to Audi. New regulations, like the UN 155 cybersecurity standard effective July 2024, add compliance costs for suppliers, potentially increasing their pricing power for specialized services.

Audi's strategies to mitigate supplier power include diversification and reshoring. The industry saw increased investment in regionalizing supply chains in 2023, aiming to reduce dependence on single suppliers and enhance control over production and costs.

What is included in the product

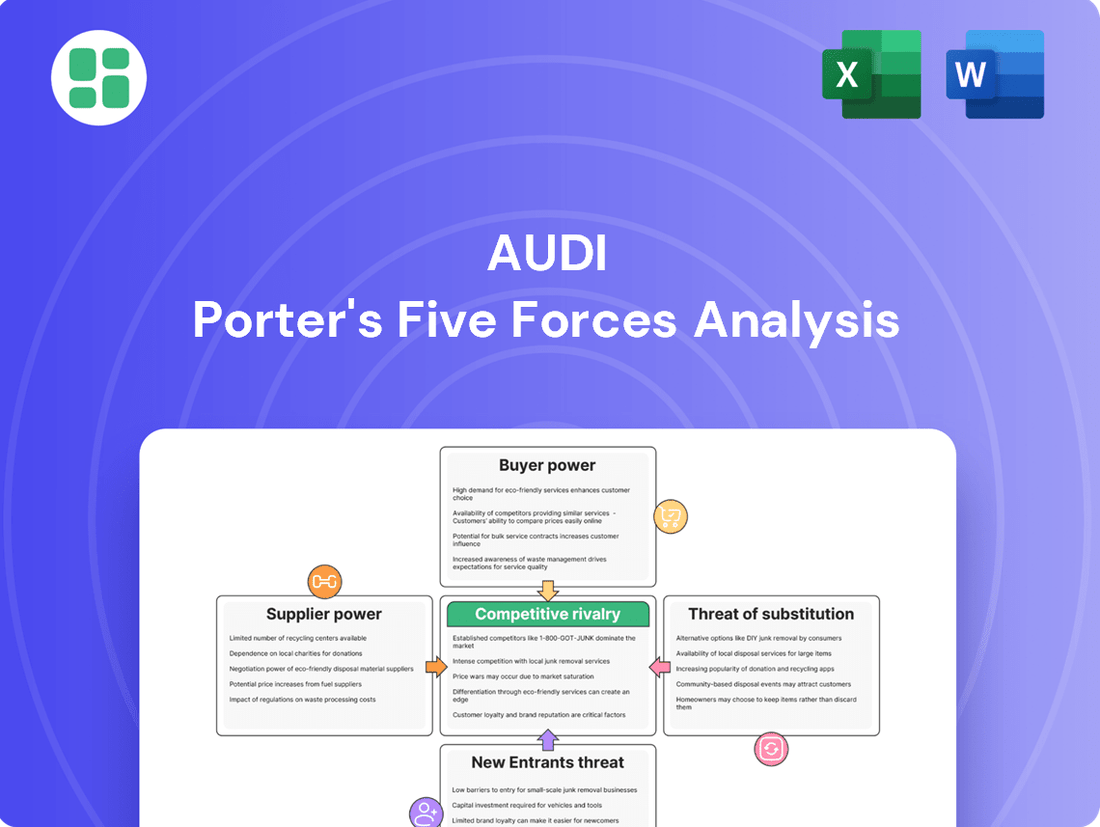

This analysis delves into the competitive forces shaping the automotive industry, specifically for AUDI, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitute products.

AUDI's Porter's Five Forces Analysis offers a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

Customers Bargaining Power

Audi's affluent and tech-savvy customer base, primarily urban dwellers, places a high value on luxury, performance, and advanced technology. This discerning segment is well-informed and expects a premium experience, demanding innovation and quality.

While this focus on high standards might suggest strong bargaining power, their willingness to pay for superior attributes somewhat mitigates extreme price sensitivity. For instance, in 2024, the luxury car market continued to see robust demand, with Audi reporting strong sales figures, indicating customers are still willing to invest in the brand's technological advancements and luxury offerings.

The burgeoning demand for electric vehicles (EVs) significantly enhances customer bargaining power. As more consumers seek greener transportation options, they have a wider array of manufacturers and models to choose from. This increased selection means customers can more readily switch brands if their expectations regarding price, performance, or features are not met.

Despite the upward trend in EV adoption, consumer concerns persist. High purchase prices, limited charging infrastructure, and range anxiety remain key considerations for many potential buyers. These persistent issues make consumers more price-sensitive and willing to explore alternative vehicle types or delay purchases if EV offerings don't sufficiently address these pain points.

In 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, indicating strong market growth. However, average EV prices in many markets still represent a premium over comparable internal combustion engine vehicles, a factor that directly influences consumer price sensitivity and their leverage in negotiations.

Modern car buyers, even in the luxury market, are incredibly well-informed thanks to readily available online research. They heavily weigh peer reviews and social proof, significantly shifting the power dynamic. For instance, a 2024 study indicated that over 80% of car buyers conduct extensive online research before visiting a dealership, scrutinizing everything from pricing to feature comparisons.

This digital empowerment grants customers unprecedented access to information and alternative options, bolstering their negotiation leverage. Consequently, dealerships are compelled to embrace an omnichannel approach, seamlessly integrating online browsing and configuration with in-person experiences. This shift mirrors customer expectations for a fluid and personalized journey, where digital touchpoints inform physical interactions.

Brand Loyalty Versus Willingness to Switch

Audi faces a dynamic challenge in the luxury car segment where brand loyalty, while present, isn't an insurmountable barrier to competitors. While loyalty programs aim to retain existing customers, the reality is that a notable portion of luxury car buyers are open to switching brands.

Data from 2024 indicates that only 59% of Audi owners expressed an intention to repurchase the brand, a figure that suggests considerable room for competitors to attract these customers. This willingness to switch highlights that customers in this premium space are actively evaluating alternatives based on factors like innovation, value, and overall ownership experience.

- Brand Loyalty Metrics: Only 59% of Audi owners surveyed in 2024 indicated they would buy from the brand again.

- Competitive Landscape: This repurchase intention is lower than some leading luxury automotive brands, underscoring customer openness to alternatives.

- Customer Expectations: The luxury market demands consistent delivery on performance, features, and service; unmet expectations can easily drive switching behavior.

- Strategic Implications: Audi must continuously innovate and offer compelling value propositions to counteract the inherent willingness of luxury buyers to explore competing marques.

Availability of Financing and Leasing Options

Audi’s diverse financing and leasing programs enhance vehicle accessibility, appealing to a wider range of affluent buyers. These options can significantly influence a customer's decision by lowering the upfront financial commitment, thereby strengthening the buyer's position.

However, the current economic climate, marked by elevated interest rates, can temper consumer enthusiasm for EV financing. For instance, in early 2024, average interest rates for auto loans remained notably higher than in previous years, potentially giving consumers more leverage to negotiate better terms or explore alternative options.

- Financing Accessibility: Audi's offerings make premium vehicles attainable for more customers.

- Interest Rate Impact: Higher rates in 2024 can empower buyers seeking favorable financing.

- Consumer Negotiation: Increased financing options can shift bargaining power towards the customer.

Audi's customers, particularly in the luxury segment, wield significant bargaining power due to increased market transparency and a growing array of choices, especially with the surge in electric vehicle (EV) options. While brand loyalty exists, a notable percentage of luxury buyers are open to switching, as evidenced by only 59% of Audi owners in 2024 expressing intent to repurchase. This openness, coupled with readily available online research influencing over 80% of car buyers in 2024, empowers consumers to demand better value and personalized experiences.

| Factor | Description | Impact on Bargaining Power |

|---|---|---|

| Information Availability | Extensive online research (over 80% of buyers in 2024) provides deep product and pricing knowledge. | Increases customer leverage; buyers can compare options and negotiate from an informed position. |

| Brand Loyalty (2024 Data) | Only 59% of Audi owners surveyed in 2024 intended to repurchase. | Weakens brand loyalty, making customers more receptive to competitor offers, thus boosting their power. |

| EV Market Growth | Global EV sales surpassed 13 million units in 2023, offering more choices. | Broadens customer options, allowing them to switch brands more easily if demands aren't met, enhancing their power. |

| Financing Sensitivity (2024) | Elevated interest rates in early 2024 can make consumers more price-sensitive. | Customers may leverage higher rates to negotiate better financing terms or explore alternative brands, increasing their power. |

Full Version Awaits

AUDI Porter's Five Forces Analysis

This preview showcases the complete AUDI Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape within the automotive industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or missing sections.

Rivalry Among Competitors

Audi navigates a highly competitive landscape in the luxury automotive sector, facing off against both seasoned global manufacturers and agile new entrants. This constant pressure to stand out fuels a relentless drive for innovation and unique product development.

The intense rivalry was evident in 2024, a year that saw a dip in Audi's worldwide sales figures, underscoring the challenging market conditions and the need for strategic adaptation.

Audi's competitive landscape is fiercely dominated by its German counterparts, BMW and Mercedes-Benz, collectively known as the 'German trio.' These brands engage in direct and intense rivalry across the entire spectrum of luxury automotive segments, from traditional sedans and versatile SUVs to the rapidly growing electric vehicle market.

The first half of 2024 underscored this intense competition, with BMW reporting the highest global luxury car sales. Mercedes-Benz secured the second position, and Audi followed closely behind. This ranking highlights the ongoing battle for market share and customer preference among these three premium manufacturers, each striving for leadership in the luxury automotive sector.

The electric vehicle (EV) market is a fiercely contested space, particularly within the luxury segment where Audi faces formidable rivals. Tesla continues to set benchmarks with its innovative technology and established charging network, while legacy automakers like BMW and Mercedes-Benz are aggressively expanding their EV portfolios, directly challenging Audi's market share. For instance, BMW's iX and Mercedes-Benz's EQS are direct competitors to Audi's e-tron models, showcasing advancements in battery technology, driving range, and luxury appointments.

This intense competition is driven by a shared focus on key differentiators beyond traditional performance metrics. Automakers are heavily investing in improving battery efficiency for longer ranges, developing robust charging solutions, and integrating advanced sustainable materials into their vehicles. Audi's own efforts, such as the Q8 e-tron Premium Plus, highlight this strategic pivot, aiming to capture consumers who prioritize both electric mobility and premium features. However, the rapid pace of technological evolution and the emergence of new, agile EV startups mean that Audi must continuously innovate to maintain its competitive edge.

Product Portfolio Renewal and Innovation Pace

Audi is aggressively revitalizing its product lineup, with plans to introduce more than 20 new models between 2024 and 2025. A significant portion of these, specifically half, will be fully electric vehicles. This strategic move aims to ensure Audi boasts the youngest product portfolio within the automotive industry.

This rapid model introduction is a direct countermeasure against intense competition and evolving customer expectations for cutting-edge technology and design. The speed of innovation, especially in software integration and autonomous driving capabilities, is paramount for Audi to retain its competitive edge.

- Product Renewal: Over 20 new models planned for 2024-2025.

- Electrification Focus: 50% of new models will be fully electric.

- Competitive Response: Aiming for the youngest portfolio in the segment.

- Innovation Imperative: Pace of software and autonomous driving development is key.

Global Market Share and Regional Performance

Audi operates in a fiercely competitive global automotive market, where its market share fluctuates significantly by region. In 2024, the company saw an 11.8% drop in worldwide deliveries, highlighting intense pressure.

The intensity of rivalry is particularly acute in key markets like China and North America, where Audi faced notable declines in sales. These regions are critical for Audi's overall competitive standing, demanding strategic maneuvers to counter aggressive competition and evolving consumer tastes.

- Global Deliveries Decline: Audi's worldwide deliveries fell by 11.8% in 2024.

- Regional Weakness: Specific drops were observed in North America and China.

- Market Importance: Success in these competitive regions is vital for Audi's global position.

- Strategic Imperative: Tailored strategies are needed to address regional rivalries and preferences.

Audi faces intense competition from established luxury brands like BMW and Mercedes-Benz, particularly in the burgeoning electric vehicle (EV) market. This rivalry is evident in sales figures, with BMW leading luxury car sales in the first half of 2024, followed by Mercedes-Benz, and then Audi.

Audi's strategy to combat this includes a significant product refresh, planning over 20 new models between 2024 and 2025, with half being fully electric. This aggressive rollout aims to present the youngest product portfolio in the industry, a direct response to the rapid pace of innovation in EV technology and software integration demanded by consumers.

The company's global sales performance in 2024 reflects this competitive pressure, with worldwide deliveries dropping by 11.8%. Key markets like China and North America showed particular weakness, underscoring the need for localized strategies to counter aggressive rivals and shifting consumer preferences.

| Competitor | 2024 H1 Global Luxury Sales Ranking | Key EV Competitors to Audi |

|---|---|---|

| BMW | 1 | iX, i4 |

| Mercedes-Benz | 2 | EQS, EQE |

| Tesla | N/A (EV Focus) | Model S, Model X |

SSubstitutes Threaten

The rise of affordable premium and near-luxury vehicles presents a significant threat of substitutes for Audi. Brands such as Acura, Mazda, and Genesis are increasingly closing the gap, offering features and performance that rival traditional luxury marques at a more accessible price point. For instance, Mazda's CX-5 and Acura's TLX have garnered praise for their upscale interiors and driving dynamics, directly competing for consumers who desire a premium experience without the full luxury car price tag. This trend is particularly impactful in 2024 as these brands continue to invest heavily in design and technology, making them attractive alternatives for a growing segment of the market.

The robust certified pre-owned (CPO) market, particularly for luxury vehicles, acts as a substantial substitute threat. Many consumers, attracted by more accessible pricing for premium options, increasingly opt for CPO vehicles.

Audi's own CPO sales saw a notable increase in 2024. This trend highlights a growing preference among buyers for well-maintained used luxury cars over new purchases, directly influencing Audi's new vehicle sales volume and market share.

The growing popularity of ride-sharing platforms like Uber and Lyft, and emerging car subscription services, presents a potential substitute for traditional car ownership, even in the luxury market. These alternatives offer convenience and flexibility, allowing consumers to access transportation without the long-term commitment and costs associated with purchasing and maintaining a vehicle. For instance, in 2024, ride-sharing services continued to see robust user engagement, particularly in metropolitan areas, indicating a shift in transportation preferences for some demographics.

Advanced Public Transportation and Urbanization

In major urban centers, advanced public transportation networks present a significant threat of substitution for personal vehicle ownership, even impacting the luxury car market. For instance, cities like Tokyo, with its extensive and highly efficient rail system, see many residents forgo car ownership entirely, opting for the convenience and cost-effectiveness of public transit for daily commutes.

The appeal of luxury vehicles, often tied to status and comfort, can be diminished by the growing emphasis on sustainability and the sheer practicality of well-developed urban transit. Consider the increasing investment in electric buses and high-speed rail; these are directly competing with the perceived necessity of owning a premium car for city travel.

By 2024, the global public transportation market was valued significantly, with projections showing continued growth, indicating a strengthening substitute for private vehicle sales. For example, the North American public transit market alone was estimated to be worth billions, reflecting substantial infrastructure development and ridership.

- Urban Mobility Trends: Cities are prioritizing integrated public transit solutions, including ride-sharing and micro-mobility options, as alternatives to private car use.

- Environmental Concerns: Growing awareness of climate change encourages a shift towards public transport, reducing demand for emission-intensive luxury vehicles.

- Cost of Ownership: The high cost of car ownership in urban areas, including parking, insurance, and fuel, makes public transit a more attractive financial substitute.

- Technological Advancements: Innovations in public transit, such as real-time tracking apps and contactless payment, enhance user experience and competitiveness against private cars.

Hybrid and Alternative Powertrain Vehicles

Hybrid and alternative powertrain vehicles present a significant threat of substitution for traditional internal combustion engine (ICE) vehicles, impacting Audi's market position. For consumers hesitant about full electrification, plug-in hybrid electric vehicles (PHEVs) and traditional hybrids offer a bridge, providing improved fuel economy and lower emissions without the range anxiety associated with Battery Electric Vehicles (BEVs). This segment is growing, with many manufacturers expanding their hybrid offerings to capture this cautious market.

The increasing availability and consumer acceptance of these hybrid models directly challenge the demand for Audi's ICE-powered vehicles. As of early 2024, hybrid sales continue to show robust growth, with many markets reporting double-digit year-over-year increases. For instance, the global market for hybrid vehicles is projected to reach over 12 million units annually by 2025, demonstrating a clear shift in consumer preference that directly substitutes for traditional gasoline or diesel cars.

- Growing Hybrid Market Share: Hybrid vehicle sales are steadily increasing, capturing market share previously held by ICE vehicles.

- Consumer Hesitation with BEVs: Many consumers still prefer hybrids due to concerns about BEV charging infrastructure and range, making them a strong substitute.

- Automaker Investment in Hybrids: Major automakers are investing heavily in hybrid technology, increasing the supply and variety of these substitute vehicles.

- Environmental and Fuel Efficiency Appeal: Hybrids offer a balance of environmental consciousness and traditional driving convenience, appealing to a broad consumer base.

The threat of substitutes for Audi is multifaceted, encompassing both direct and indirect alternatives. The rise of affordable premium brands and the robust certified pre-owned market directly challenge new Audi sales by offering comparable features at lower price points. Furthermore, evolving urban mobility trends, including enhanced public transportation and ride-sharing, present indirect substitutes by reducing the perceived need for personal vehicle ownership, even in the luxury segment.

Entrants Threaten

The automotive industry, particularly the luxury segment where Audi competes, demands colossal capital for research and development, state-of-the-art manufacturing plants, and widespread distribution channels. Newcomers must overcome significant financial hurdles to build production capacity and innovate in areas like electric vehicle technology and advanced driver-assistance systems.

For instance, developing a new vehicle platform can cost billions. In 2024, major automakers are investing tens of billions annually in R&D, with a significant portion allocated to electrification and autonomous driving, creating a formidable barrier for any potential new entrant aiming to match these capabilities.

New entrants face substantial challenges due to stringent regulatory and safety standards. Navigating complex emissions regulations, such as the EPA's proposed standards for 2027 and beyond, requires significant investment in research and development. Additionally, meeting global safety certifications and evolving cybersecurity mandates like UN 155 adds further layers of complexity and cost, deterring potential market entrants.

Established luxury brands like Audi benefit from robust brand recognition and a heritage that fosters deep customer loyalty. This brand equity presents a significant hurdle for newcomers, as building consumer trust and capturing market share requires substantial time and investment.

While brand loyalty in the automotive sector can shift, a considerable segment of luxury car buyers remains committed to established names. For instance, Audi consistently ranks high in customer satisfaction surveys, indicating a strong existing base that new entrants must work hard to sway. This means new players need to allocate significant resources to marketing and develop compelling unique selling propositions to attract Audi's loyal customer base.

Technological Complexity and Innovation Pace

The threat of new entrants in the automotive sector, particularly for luxury brands like Audi, is significantly shaped by technological complexity and the relentless pace of innovation. Modern luxury vehicles are essentially sophisticated tech platforms, featuring advanced infotainment, seamless connectivity, and increasingly, autonomous driving capabilities. This necessitates that any new player not only replicates but also surpasses current technological benchmarks, requiring substantial investment in research and development and access to highly specialized engineering talent.

The rapid evolution of automotive technology, often accelerated by agile competitors, presents a formidable barrier. For instance, Chinese manufacturers have demonstrated a remarkable ability to quickly adopt and integrate cutting-edge features, often at a lower cost point, thereby intensifying the pressure on established players to maintain their technological edge. This dynamic means new entrants must possess not just capital, but also a forward-thinking R&D strategy to remain competitive.

- R&D Investment: Leading automakers often invest billions annually in R&D, with figures for 2023 and projections for 2024 indicating continued high spending, particularly in areas like electrification and autonomous systems. For example, in 2023, major automotive groups reported R&D expenditures in the tens of billions of dollars globally.

- Talent Acquisition: The demand for software engineers, AI specialists, and battery technology experts is exceptionally high, with specialized recruitment firms reporting salary increases of 15-25% for these roles in 2023-2024.

- Innovation Cycles: The average development cycle for a new vehicle model has shortened, with some manufacturers introducing significant tech updates every 18-24 months, a pace that new entrants must match to be relevant.

- Autonomous Driving Milestones: Companies achieving Level 3 autonomous driving capabilities, a significant technological hurdle, are setting new industry standards, requiring new entrants to demonstrate comparable or superior advancements.

Supply Chain Integration and Management

Building and managing a resilient global supply chain for an automotive giant like Audi is a monumental task, requiring the coordination of thousands of components and a vast network of suppliers. Newcomers simply don't possess the deeply ingrained relationships and sophisticated logistical know-how that established players have cultivated over decades. For instance, in 2023, the automotive industry continued to grapple with supply chain disruptions, highlighting the critical importance of these established networks.

The automotive sector's increasing emphasis on supply chain diversification and the trend towards reshoring in 2024 further erects significant barriers for potential new entrants. These strategic shifts by incumbents necessitate that new players would have to invest heavily in building entirely new supplier relationships and logistical infrastructure from the ground up, a daunting and costly undertaking.

- Complexity of Global Automotive Supply Chains: Automotive manufacturers manage intricate networks involving thousands of suppliers and diverse components.

- Incumbent Advantage in Relationships and Logistics: Established players like Audi benefit from long-standing supplier partnerships and proven logistical expertise.

- Impact of Supply Chain Diversification and Reshoring: Trends in 2024 toward diversifying suppliers and bringing production closer to home increase the challenge for new market entrants.

- High Cost of Building New Supply Networks: New entrants face substantial financial and operational hurdles in replicating the established supply chain infrastructure.

The threat of new entrants for Audi is considerably low due to the immense capital required for research, development, and manufacturing. New players must also navigate complex regulations and stringent safety standards, demanding substantial investment in compliance and innovation. Furthermore, established brand loyalty and the rapid pace of technological advancement create significant barriers to entry.

| Barrier | Description | Impact on New Entrants | 2024 Data/Trend |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Formidable financial hurdle. | Automotive R&D spending in the tens of billions annually. |

| Regulatory & Safety Standards | Complex emissions, safety, and cybersecurity compliance. | Increases development time and cost. | Evolving mandates like UN 155 and stringent EPA standards. |

| Brand Loyalty & Equity | Established reputation and customer trust. | Requires significant marketing to attract customers. | Audi consistently ranks high in customer satisfaction. |

| Technological Complexity | Advanced features, connectivity, and autonomous driving. | Demands specialized talent and substantial R&D investment. | Shortened innovation cycles, with tech updates every 18-24 months. |

Porter's Five Forces Analysis Data Sources

Our AUDI Porter's Five Forces analysis leverages data from official company filings, automotive industry reports, market research databases, and economic indicators to provide a comprehensive view of the competitive landscape.