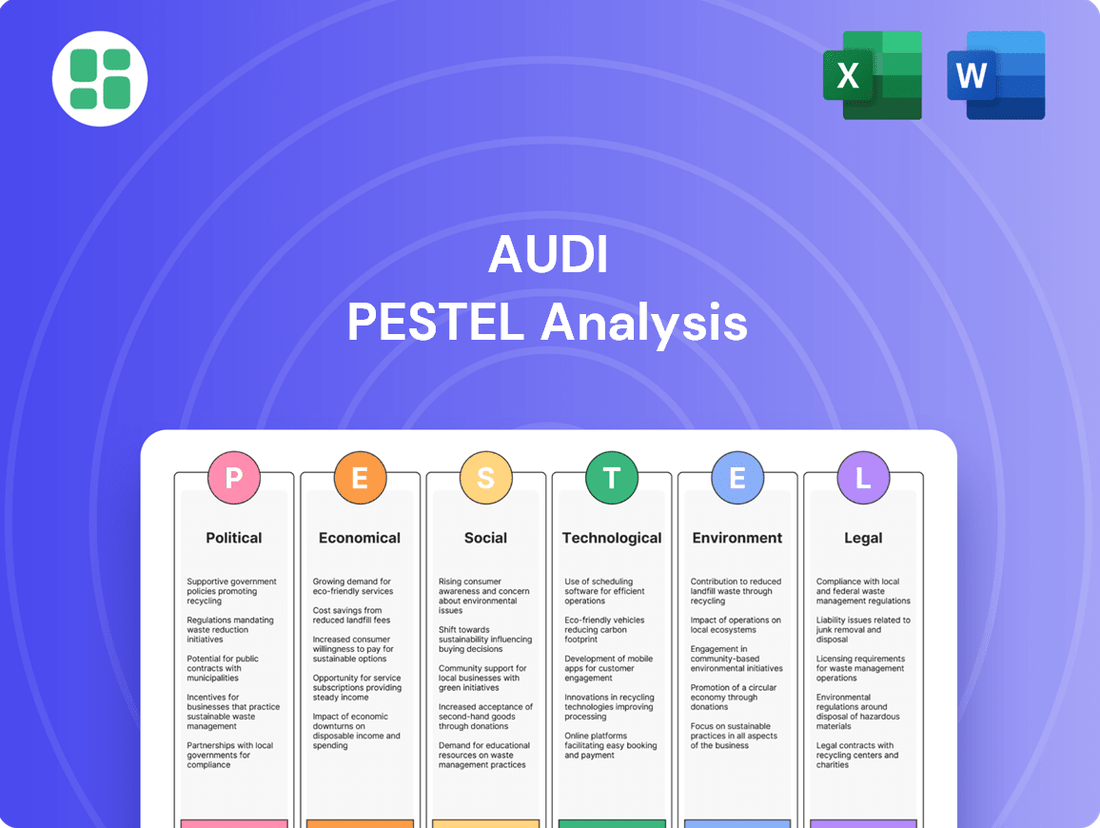

AUDI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

Curious about the external forces shaping AUDI's journey in the automotive industry? Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors impacting their strategic decisions and future growth. Gain a competitive edge by understanding these critical trends. Download the full PESTLE analysis now for actionable insights and a clearer vision of AUDI's landscape.

Political factors

The European Union is tightening its grip on vehicle emissions, setting a new average CO2 target of 93.6g/km for 2025. This represents a significant 15% reduction compared to 2021 benchmarks. Automakers like Audi face substantial financial penalties for failing to meet these increasingly strict regulations.

Further complicating matters are the forthcoming Euro 7 standards. These upcoming regulations promise to introduce even more rigorous requirements, expanding beyond tailpipe emissions to also encompass non-exhaust emissions, such as those from brakes and tires. This shift demands a more holistic approach to environmental compliance for the automotive industry.

Geopolitical tensions and trade policies, like the US tariffs on imported vehicles, directly affect Audi's profitability and supply chain. For instance, the US imposed a 25% tariff on imported steel and aluminum in 2018, which increased production costs for automakers, including Audi, impacting their bottom lines. These tariffs necessitate a re-evaluation of global production footprints, prompting Audi to consider localized manufacturing to mitigate these costs and ensure market competitiveness.

Governments globally are actively encouraging electric vehicle (EV) uptake through various incentives and subsidies. These financial aids directly impact consumer choices and shape Audi's strategic direction in its EV transition. For instance, in 2024, many countries continued to offer purchase grants and tax credits for EVs, though the specific amounts and eligibility criteria vary significantly.

However, the landscape isn't uniformly positive. A notable trend in some key European markets during late 2023 and early 2024 has been the reduction or complete removal of these crucial EV incentives. This policy shift has demonstrably contributed to a slowdown in EV sales growth in those specific regions, underscoring the critical dependence of the EV market's momentum on sustained government support.

Political Stability and Supply Chain Disruptions

Global economic shifts and ongoing geopolitical tensions continue to present substantial challenges for Audi, impacting vehicle delivery figures and overall financial performance. For instance, in the first quarter of 2024, Audi reported a 10.6% increase in deliveries compared to the previous year, reaching 406,500 vehicles, but this growth was achieved amidst persistent global uncertainties.

Supply chain disruptions, including limitations in parts availability, have directly impacted production capabilities and sales volumes. The semiconductor shortage, while easing, continued to affect automotive production throughout 2023 and into early 2024, forcing manufacturers like Audi to adjust production schedules. This volatile environment necessitates robust risk management and agile operational strategies.

- Geopolitical Tensions: Ongoing conflicts and trade disputes can lead to increased raw material costs and affect market access.

- Supply Chain Vulnerabilities: Dependence on specific regions for key components, like semiconductors and battery materials, creates significant risks.

- Regulatory Changes: Shifting government policies on emissions, trade, and manufacturing standards require constant adaptation and investment.

Automotive Industry Lobbying

The automotive industry, including major players like Audi, actively engages in political lobbying to influence regulations. A key area of focus for 2024 and 2025 is the challenge to the European Union's ambitious targets for phasing out internal combustion engine (ICE) vehicles and meeting stringent 2025 emissions standards. This lobbying is driven by concerns about the practicalities and economic implications of a swift transition to electric mobility.

The European People's Party (EPP), a significant political bloc, has been vocal in its efforts to push back against the EU's planned ban on new ICE vehicle sales, originally slated for 2035 but with earlier emissions targets impacting 2025. This reflects a broader industry sentiment that the pace of electrification may be too rapid for current infrastructure and consumer readiness.

- Lobbying Focus: Challenging the EU's ban on new ICE vehicle sales and 2025 emissions targets.

- Key Advocate: European People's Party (EPP) is actively involved in these discussions.

- Industry Concern: Feasibility and economic impact of a rapid transition to electric vehicles.

- Regulatory Impact: Lobbying aims to shape future automotive regulations and timelines.

Government policies significantly shape the automotive landscape, with stringent emission standards like the EU's 2025 target of 93.6g/km CO2 directly impacting Audi. Upcoming Euro 7 regulations further complicate compliance by addressing non-exhaust emissions. Geopolitical factors, such as US tariffs, increase production costs and influence global manufacturing strategies.

Governments worldwide are promoting electric vehicles (EVs) through incentives, influencing consumer choices and Audi's EV strategy. However, some European markets have reduced or removed these incentives, leading to slower EV sales growth in early 2024. Audi, like other manufacturers, engages in political lobbying, particularly concerning the EU's ICE phase-out targets and 2025 emissions standards, with groups like the EPP advocating for a more gradual transition.

| Policy Area | Impact on Audi | 2024/2025 Relevance |

|---|---|---|

| Emissions Standards (EU) | Requires significant investment in cleaner technologies; penalties for non-compliance. | New average CO2 target of 93.6g/km for 2025; Euro 7 standards development. |

| EV Incentives | Influences consumer demand for EVs; potential slowdown in markets reducing subsidies. | Continued, but varied, incentives globally; some European markets reducing support in late 2023/early 2024. |

| Trade Policy (e.g., US Tariffs) | Increases production costs; necessitates re-evaluation of global supply chains. | Ongoing impact from tariffs on materials like steel and aluminum. |

| Lobbying Efforts | Aims to influence regulatory timelines and feasibility of EV transition. | Focus on challenging EU ICE phase-out and 2025 emissions targets. |

What is included in the product

This AUDI PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the brand, providing a comprehensive understanding of the external forces shaping its strategic landscape.

Provides a clear breakdown of external factors impacting Audi, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

Audi's 2024 financial results were shaped by a complex global economic landscape, with projections for 2025 suggesting a slight deceleration in overall economic expansion. This challenging macroeconomic environment, coupled with heightened industry competition, is notably impacting Audi's revenue streams and profitability.

The automotive sector, in particular, faced headwinds in 2024, with global vehicle sales growth moderating. For instance, while specific Audi figures for 2024 are still being fully reported, broader industry analyses from organizations like the International Monetary Fund (IMF) in their October 2024 World Economic Outlook projected global growth to slow from an estimated 3.2% in 2023 to 2.9% in 2024, with a further slight dip to 2.8% anticipated for 2025, reflecting ongoing geopolitical uncertainties and tighter financial conditions.

Navigating this economic volatility while managing intense competition remains a critical strategic imperative for Audi, requiring agile operational adjustments and a keen focus on cost management to sustain performance.

Rising inflation and increased production costs present a significant hurdle for automotive manufacturers like Audi. For instance, the German automotive industry, a key market for Audi, experienced a notable rise in producer prices in late 2023 and early 2024, impacting raw material and component expenses. This trend is expected to continue into 2025, squeezing profit margins as manufacturers grapple with higher input costs.

While Audi's specific 2024-2025 inflation impact figures are not publicly detailed, the company's 2023 annual report mentioned "difficult economic conditions" and "high competitive pressure," which inherently includes managing rising costs. The automotive sector globally saw a significant increase in the cost of key materials like steel and aluminum throughout 2023, with these pressures persisting into the current period.

To counter these challenges, Audi, like other major automakers, is focused on efficient resource management and implementing cost-cutting programs. These strategies are vital for maintaining profitability in an environment where the cost of everything from energy to semiconductors remains elevated, directly affecting the bottom line.

Consumer purchasing power, particularly among affluent demographics, directly fuels demand for luxury vehicles like Audi. The global luxury car market is anticipated to experience significant expansion between 2024 and 2034, a trend bolstered by rising disposable incomes and an increasing population of ultra-high-net-worth individuals.

This robust growth trajectory in the premium segment offers a solid base for Audi's sales, even if certain market segments face headwinds. For instance, while Audi's overall delivery figures might fluctuate, the underlying resilience of the luxury market presents a clear opportunity for the brand's high-end offerings.

Exchange Rate Fluctuations

Fluctuations in exchange rates, especially between the Euro and key trading partners like the US dollar and Chinese Yuan, directly influence Audi's international sales revenue and the cost of essential imported parts. For instance, a stronger Euro can make Audi vehicles more expensive for buyers in countries with weaker currencies, potentially dampening demand.

While specific recent reports might not highlight currency volatility as a singular major challenge for Audi, it remains a persistent economic reality for any global automaker. This ongoing factor necessitates careful management of pricing strategies and directly impacts the competitive positioning of vehicles across diverse international markets.

- Impact on Revenue: A depreciating Euro against the USD could increase the reported revenue in USD terms for sales made in Europe, but conversely, a stronger Euro would reduce it.

- Component Costs: Audi sources components globally; a weaker Euro makes these imports more expensive in Euro terms, potentially squeezing profit margins if not passed on to consumers.

- Market Competitiveness: Exchange rate shifts can alter the price advantage of Audi vehicles compared to competitors from countries with more stable or favorable currency movements.

- Hedging Strategies: Automakers like Audi often employ financial instruments to hedge against adverse currency movements, but these strategies have costs and limitations.

Interest Rates and Financing Costs

Interest rates significantly impact Audi's sales by affecting consumer affordability for new vehicles. For instance, if the European Central Bank (ECB) raises its key interest rates, car loan rates typically follow suit, making financing more expensive for buyers. This can lead to a slowdown in demand for premium vehicles like Audis.

Higher interest rates also increase Audi's own cost of borrowing. This affects its ability to finance new plant expansions, research and development for electric vehicles, and other strategic investments. For example, a rise in the prime lending rate could mean higher interest payments on corporate bonds issued by Volkswagen Group, Audi's parent company, potentially reducing profitability and investment capacity.

- Interest Rate Impact on Demand: In 2024, as central banks continued to navigate inflation, benchmark interest rates in major markets like the Eurozone remained elevated. This has made auto loans more costly, with average new car loan rates in Germany hovering around 4-6% for prime borrowers, potentially impacting sales volumes.

- Financing Costs for Audi: Audi, as part of the Volkswagen Group, faces borrowing costs influenced by broader market conditions. The group's cost of capital is sensitive to changes in benchmark rates, affecting the feasibility and return on investment for large-scale projects, such as the €10 billion investment announced for electrification and digitalization up to 2025.

- Consumer Credit Availability: Changes in interest rates can also influence the availability of consumer credit. When rates rise, lenders may tighten lending standards, making it harder for some consumers to secure financing for a new Audi, further suppressing demand.

Economic factors significantly influence Audi's performance by shaping consumer purchasing power and overall market demand. While luxury segments show resilience, broader economic slowdowns and persistent inflation in 2024 and projected for 2025 continue to challenge profitability. Fluctuations in exchange rates and rising interest rates further complicate Audi's international sales and financing costs.

| Economic Factor | 2024 Impact/Projection | 2025 Projection | Audi Relevance |

|---|---|---|---|

| Global Economic Growth | Slowing to 2.9% (IMF Oct 2024) | Further slight dip to 2.8% | Affects overall market demand and premium segment growth. |

| Inflation & Production Costs | Elevated input costs (steel, aluminum, energy) | Continued cost pressures expected | Squeezes profit margins, necessitates cost management. |

| Interest Rates | Elevated in major markets (e.g., Eurozone) | Likely to remain a factor in monetary policy | Impacts consumer affordability via car loans and Audi's financing costs. |

| Exchange Rates | Ongoing volatility (e.g., EUR/USD) | Persistent factor for global operations | Influences international revenue, component costs, and market competitiveness. |

Full Version Awaits

AUDI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AUDI PESTLE Analysis dives deep into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive giant. You'll gain valuable insights into market trends, competitive landscapes, and strategic considerations for Audi.

Sociological factors

Consumer tastes are clearly leaning towards electric vehicles (EVs) and larger sport utility vehicles (SUVs). Audi is actively responding to this trend by broadening its range of offerings. For instance, by the close of 2025, Audi intends to introduce more than 20 new models, with a significant portion, half to be exact, being fully electric.

Consumers are increasingly driven by environmental concerns, actively seeking out sustainable and eco-friendly automotive choices. This trend significantly influences purchasing decisions, with a growing preference for brands demonstrating a genuine commitment to environmental responsibility.

Audi's proactive stance on sustainability, underscored by its objective to achieve carbon-neutral production by 2025 and a significant reduction in its overall carbon footprint, resonates strongly with this evolving consumer base. For instance, Audi is investing heavily in electric mobility, with plans to launch numerous fully electric models by 2026, aiming for over 20% of its sales to be electric vehicles by then.

This alignment between Audi's sustainability initiatives and consumer values directly bolsters its brand image and market standing. It fosters greater brand loyalty among environmentally-conscious buyers and attracts new customers who prioritize ethical and sustainable consumption, reinforcing Audi's competitive advantage in the evolving automotive landscape.

Audi's commitment to sustainability, particularly its push into electric vehicles (EVs), is reshaping its brand perception. For instance, Audi's investment in renewable energy for its production facilities, aiming for carbon neutrality by 2025, directly appeals to environmentally conscious consumers.

Ethical sourcing and supply chain transparency are becoming non-negotiable for maintaining consumer trust. Audi's efforts to ensure responsible cobalt sourcing for its EV batteries, a key component in the growing EV market, are crucial for its ethical standing.

In the competitive luxury automotive sector, a robust ethical framework is a powerful differentiator. Audi's emphasis on fair labor practices and responsible manufacturing can attract a discerning customer base that values more than just performance and design.

Urbanization and Smart Mobility Solutions

Urbanization continues to reshape how people move, with cities worldwide experiencing significant population growth. This trend typically fuels demand for smaller, more efficient vehicles and integrated mobility services. For instance, by 2050, it's projected that 68% of the world's population will live in urban areas, a substantial increase from 55% in 2018, according to the United Nations.

Audi's strategic investments in electric vehicle (EV) technology and its exploration of autonomous driving systems directly address these evolving urban needs. The company is well-positioned to provide solutions that align with smart city initiatives, offering alternatives to traditional car ownership and catering to the desire for seamless transportation networks.

These shifts are creating opportunities for new mobility models.

- Urban population growth: The UN estimates 68% of the global population will live in urban areas by 2050.

- Demand for compact and shared mobility: Urban dwellers often prefer smaller vehicles and shared transport options.

- Audi's EV and autonomous focus: This aligns with smart city goals and changing urban transportation patterns.

- Integrated transport solutions: The future of urban mobility likely involves interconnected systems.

Demographic Shifts and Younger Generations

The global rise in ultra-high-net-worth individuals (UHNWIs) and increasing disposable incomes are significant catalysts for the luxury automotive sector. For Audi, this translates into a robust demand for its premium, technologically advanced, and customizable vehicles. For instance, the number of UHNWIs globally was projected to reach over 700,000 by the end of 2024, a substantial increase that directly fuels the market for high-end goods like luxury cars.

Furthermore, understanding and adapting to the evolving preferences of affluent younger generations is crucial for sustained growth. This demographic, often prioritizing cutting-edge technology and environmental sustainability, presents a clear opportunity for Audi to tailor its offerings. Surveys from 2024 indicate that Gen Z and Millennials are increasingly influential in luxury purchasing decisions, with a strong inclination towards brands that demonstrate commitment to electric mobility and digital integration.

- Growing UHNWI Population: Global UHNWI numbers are on an upward trajectory, directly boosting demand for luxury vehicles.

- Affluent Younger Consumers: Younger generations, particularly Gen Z and Millennials, are becoming key luxury market participants.

- Preference for Technology and Sustainability: These younger demographics often prioritize advanced features and eco-friendly options, aligning with Audi's innovation focus.

- Personalization Demand: Affluent buyers increasingly seek personalized vehicle configurations and experiences.

Societal values are shifting towards sustainability and ethical consumption, prompting consumers to favor brands with strong environmental and social commitments. Audi's investments in carbon-neutral production by 2025 and a significant expansion of its electric vehicle lineup, with half of its new models being electric by the end of 2025, directly address these evolving consumer priorities.

The increasing urbanization trend, with a projected 68% of the global population living in urban areas by 2050, is driving demand for smaller, more efficient vehicles and integrated mobility solutions. Audi's focus on electric and autonomous driving technologies positions it to meet these urban mobility needs, aligning with smart city initiatives.

A growing segment of affluent consumers, particularly younger generations like Gen Z and Millennials, prioritize technology, sustainability, and personalized experiences. Audi's emphasis on cutting-edge features and its commitment to electric mobility resonate strongly with this demographic, influencing luxury automotive purchasing decisions.

Technological factors

Audi's commitment to electric mobility is substantial, with a strategic roadmap to launch 30 electrified models by 2025, a significant portion of which, 20, will be fully electric vehicles. This aggressive push underscores the importance of technological progress in battery development.

Ongoing improvements in battery energy density and charging infrastructure are paramount for enhancing electric vehicle range and minimizing downtime, directly influencing consumer acceptance and market penetration. For instance, by 2024, battery costs are projected to fall below $100 per kWh, a critical threshold for price parity with internal combustion engine vehicles.

These technological leaps are not merely incremental; they are foundational to Audi's competitive stance in the dynamic electric vehicle landscape. Innovations like solid-state batteries, expected to reach commercial viability by the late 2020s, promise even greater energy density and faster charging capabilities, further solidifying the EV market's trajectory.

Audi is heavily investing in autonomous driving, exemplified by its 'Artemis' project, which targets the creation of highly automated electric vehicles. This strategic push integrates advanced AI and driver-assistance systems (ADAS) to boost both safety and the overall driving experience.

The company's commitment to these cutting-edge technologies is substantial, with significant research and development expenditures directed towards shaping the future of personal mobility. For instance, in 2023, the Volkswagen Group, Audi's parent company, allocated a substantial portion of its R&D budget towards software and autonomous driving, underscoring the importance of these advancements.

Audi is heavily investing in digital features and connectivity, building future-proof software architectures into its vehicles. This focus is evident in advanced infotainment systems like Audi connect® and MMI®, alongside in-car entertainment platforms such as AirConsole, aiming to enhance the driving experience.

The company's commitment to digitalization is a key technological factor, transforming how drivers interact with their vehicles by offering greater convenience, real-time information, and immersive entertainment. This strategic push is designed to meet evolving consumer expectations for seamless integration of digital services.

Manufacturing Innovation and Efficiency

Audi is actively pursuing manufacturing innovations to boost efficiency. Programs like 'Performance Program 14' are designed to optimize operations across its production sites, aiming for streamlined processes and cost reductions. This focus on operational excellence is a key driver for maintaining competitiveness in the automotive sector.

A significant technological factor is Audi's commitment to sustainability in manufacturing. The company has set a goal for net carbon-neutral production at all its plants by 2025. This ambitious target underscores a strategic integration of environmental responsibility with technological advancement in their production methods.

- Net Carbon-Neutral Production Goal: Audi aims for all its manufacturing plants to be net carbon-neutral by 2025.

- Brussels Plant Certification: Audi's Brussels plant has already achieved carbon-neutral certification, demonstrating tangible progress towards this goal.

- Efficiency Programs: Strategic initiatives like 'Performance Program 14' are in place to enhance manufacturing efficiency and streamline operations.

Platform Strategy and Modular Architectures

Audi's platform strategy, particularly its use of modular architectures like the MEB and PPE (Premium Platform Electric), is a significant technological driver. The PPE platform, co-developed with Porsche, underpins vehicles such as the Audi Q6 e-tron and the Porsche Macan Electric, allowing for efficient production of a diverse EV lineup. This modularity means Audi can scale production and reduce development costs, aiming to bring new electric models to market faster across different vehicle segments.

This approach fosters flexibility, enabling Audi to adapt its offerings to evolving market demands. By sharing underlying architecture, the company can create differentiated products more cost-effectively. For instance, the MEB platform supports a wide array of Volkswagen Group EVs, demonstrating the broad applicability of such modular systems in accelerating electrification efforts and managing R&D expenditure in the competitive EV landscape.

The benefits are tangible: reduced development time and investment per model. This strategy is crucial as Audi aims to expand its electric portfolio significantly. The company has committed substantial investment towards electrification, with a significant portion of its 2024-2029 investment plan allocated to future mobility solutions, including platform development and software integration.

- Shared Platforms: MEB and PPE enable efficient production of diverse EVs.

- Cost Reduction: Modular architectures lower development and manufacturing expenses.

- Scalability: Facilitates faster rollout of new electric models across segments.

- Flexibility: Allows for differentiated products to meet varied market demands.

Audi's technological strategy centers on electrification, autonomous driving, and digital integration. The company plans to launch 30 electrified models by 2025, with 20 being fully electric, highlighting a significant investment in battery technology and charging solutions. By 2024, battery costs are expected to drop below $100 per kWh, making EVs more competitive.

The brand is also advancing autonomous driving capabilities through projects like 'Artemis' and investing heavily in vehicle software and connectivity, exemplified by its Audi connect and MMI systems. These efforts aim to enhance safety, convenience, and the overall user experience, aligning with evolving consumer expectations for smart, connected vehicles.

| Key Technological Focus Areas | 2024/2025 Projections & Investments | Strategic Impact |

| Electrification | Launch 30 electrified models by 2025 (20 BEVs); Battery costs < $100/kWh by 2024 | Increased EV market share, improved range and charging |

| Autonomous Driving | 'Artemis' project for highly automated EVs; Increased R&D in AI/ADAS | Enhanced safety, improved driving experience, potential for new mobility services |

| Digitalization & Connectivity | Advanced infotainment (Audi connect, MMI); In-car entertainment (AirConsole) | Greater driver convenience, real-time information, immersive entertainment |

Legal factors

The European Union's commitment to environmental protection is driving significant changes in the automotive sector, directly impacting Audi. For 2025, the EU has set a demanding average CO2 emission target of 93.6 grams per kilometer. This represents a substantial 15% reduction compared to 2021 emission levels.

Automakers like Audi face considerable financial repercussions if they fail to meet these increasingly strict emission standards. Penalties for non-compliance can be quite substantial, incentivizing a rapid shift in product development and manufacturing strategies.

Consequently, these regulations are a powerful catalyst, compelling Audi to accelerate its investment and rollout of electric vehicles and other more fuel-efficient models to meet future environmental mandates.

Audi, like all automakers, faces a complex web of data privacy regulations for its connected car services. The General Data Protection Regulation (GDPR) in Europe, for instance, sets a high bar for how customer data, including driving habits and location information collected by Audi vehicles, must be handled. Failure to comply can result in significant fines; in 2023, the European Data Protection Board reported that GDPR fines reached €2.74 billion across all sectors, underscoring the financial risks.

Ensuring the secure collection, storage, and processing of this vast amount of vehicle-generated data is not just a legal necessity but a critical component of maintaining consumer trust. Audi must demonstrate robust data protection measures to its customers, especially as the volume of data collected by advanced driver-assistance systems and infotainment platforms continues to grow. The automotive industry is increasingly scrutinized, with data breaches leading to substantial reputational damage and loss of market share.

Audi, like all automotive manufacturers, operates under strict global product liability and safety regulations. These rules are constantly updated, especially with the rise of electric and autonomous vehicles, demanding continuous adaptation in design and manufacturing. For instance, in 2024, the US National Highway Traffic Safety Administration (NHTSA) continued to emphasize robust testing for advanced driver-assistance systems (ADAS), with manufacturers facing significant penalties for non-compliance.

Intellectual Property Rights

Audi's significant investment in cutting-edge technologies, such as electric vehicle (EV) powertrains and autonomous driving, underscores the critical importance of intellectual property (IP) protection. Safeguarding patents, trademarks, and trade secrets is vital for maintaining its market leadership and preventing rivals from exploiting its innovations. For instance, in 2023, the Volkswagen Group, Audi's parent company, reported significant R&D expenditure, a portion of which directly relates to securing and developing new IP.

Robust IP strategies enable Audi to monetize its technological advancements and deter infringement. This legal framework is essential for securing its competitive advantage in the rapidly evolving automotive landscape. Without strong IP rights, the substantial financial outlays in research and development would be vulnerable to appropriation.

- Patents: Protecting novel inventions in EV battery technology, software algorithms for autonomous driving, and advanced manufacturing processes.

- Trademarks: Safeguarding brand identity, including the Audi rings logo and model names, to prevent counterfeiting and brand dilution.

- Trade Secrets: Maintaining confidentiality over proprietary manufacturing techniques, design blueprints, and software code that offer a competitive edge.

- Licensing: Exploring opportunities to license certain technologies, generating revenue while retaining core competitive advantages.

Labor Laws and Restructuring

Audi's restructuring efforts, particularly the planned elimination of up to 7,500 jobs in Germany by 2029, are heavily influenced by stringent labor laws. These legal frameworks dictate the process for workforce adjustments, ensuring fair treatment and adherence to employment regulations. Compliance with these laws is paramount to avoid legal challenges and maintain operational continuity during this significant transition.

Navigating these labor laws requires careful collaboration with employee representatives and works councils. Audi's commitment to fair practices during these changes is not just a legal obligation but also crucial for maintaining employee morale and the company's social license to operate. Failure to comply can result in substantial fines and reputational damage.

- Job Reduction Target: Up to 7,500 jobs in Germany by 2029.

- Legal Compliance: Strict adherence to national and international labor laws is mandatory.

- Stakeholder Engagement: Collaboration with labor representatives is essential for smooth transitions.

- Social Responsibility: Ensuring fair practices is vital for legal and ethical operations.

Legal factors significantly shape Audi's operational landscape, particularly concerning environmental regulations and product safety. The EU's stringent CO2 emission targets, aiming for an average of 93.6 g/km by 2025, a 15% reduction from 2021, directly mandate Audi's accelerated shift towards electric vehicles. Furthermore, data privacy laws like GDPR impose strict data handling protocols for connected car services, with substantial fines for non-compliance, as evidenced by €2.74 billion in GDPR fines reported in 2023 across all sectors.

Audi must also navigate complex product liability and safety regulations, with bodies like the US NHTSA in 2024 focusing on robust testing for advanced driver-assistance systems. Intellectual property protection is also paramount, with the Volkswagen Group's significant R&D expenditure in 2023 reflecting the need to safeguard innovations in EV technology and autonomous driving. Finally, labor laws dictate Audi's restructuring plans, such as the 2029 target of reducing up to 7,500 jobs in Germany, requiring careful adherence to employment regulations and collaboration with labor representatives.

| Regulatory Area | Key Regulation/Requirement | Impact on Audi | 2024/2025 Data/Context |

|---|---|---|---|

| Environmental | EU CO2 Emission Standards | Mandates shift to EVs, potential penalties for non-compliance. | Target: 93.6 g/km average by 2025 (15% reduction from 2021). |

| Data Privacy | GDPR | Requires secure handling of connected car data; risk of significant fines. | 2023 GDPR fines reached €2.74 billion across sectors. |

| Product Safety | NHTSA ADAS Regulations | Demands rigorous testing for autonomous driving features. | NHTSA continued emphasis on ADAS testing in 2024. |

| Intellectual Property | Patent & Trademark Law | Crucial for protecting EV and autonomous driving innovations. | VW Group R&D expenditure in 2023 supports IP development. |

| Labor Law | German Employment Law | Governs workforce adjustments and job reductions. | Planned reduction of up to 7,500 jobs in Germany by 2029. |

Environmental factors

Audi is actively pursuing ambitious environmental targets, aiming for a 30% reduction in vehicle-specific CO2 emissions by 2025 compared to 2015 levels. This is a significant step towards their ultimate goal of company-wide net CO2 neutrality by 2050.

The company's dedication to Environmental, Social, and Governance (ESG) principles is clearly demonstrated through its regular publication of combined annual and sustainability reports. These reports provide transparency on their progress and commitment to responsible business practices.

These stringent environmental targets are not just aspirational; they are actively shaping Audi's strategic decisions across all operational areas, from product development to supply chain management, influencing investments in sustainable technologies.

Audi is significantly boosting its engagement with suppliers, even extending to their raw material sources, to ensure greater transparency and trackability. This initiative is crucial for building supply chains that are not only stable and resilient but also genuinely sustainable.

A key aspect of this strategy involves prioritizing responsibly sourced materials, such as the certified aluminum used for the battery housings in their electric vehicles. This focus directly tackles the environmental and ethical issues tied to the extraction of natural resources.

For instance, by 2024, Audi aimed to have 75% of its critical raw materials sourced from suppliers who have undergone sustainability assessments. This commitment underscores their dedication to responsible sourcing practices throughout their value chain.

Audi is significantly investing in circular economy practices, notably repurposing used batteries from electric prototypes into second-life charging solutions. This strategy is designed to drastically reduce waste and enhance resource efficiency across the entire product lifecycle, aligning with global sustainability goals.

By adopting these circular principles, Audi aims to foster a more sustainable production and consumption model. For instance, the company's commitment to recycling and reuse is crucial as the automotive industry faces increasing pressure to manage end-of-life vehicle components, especially with the growing volume of electric vehicles.

Water Usage and Pollution Control in Manufacturing

Audi's commitment to responsible water management is evident in its 'Mission:Zero' program, which focuses on reducing water consumption and preventing pollution across its global manufacturing sites. This proactive approach underscores the company's dedication to environmental stewardship within its operational footprint.

The company aims for highly efficient water usage, a critical component of its sustainability strategy. This focus is not just about compliance but about actively minimizing the ecological impact of vehicle production. For instance, Audi's plant in Brussels achieved a significant reduction in water consumption per vehicle produced in recent years, showcasing the effectiveness of its conservation efforts.

- Water Consumption Reduction: Audi has set ambitious targets to decrease water usage per vehicle manufactured globally.

- Pollution Control Measures: Advanced wastewater treatment technologies are employed to ensure discharged water meets stringent environmental standards.

- Resource Efficiency: Initiatives include water recycling and reuse programs within production processes to conserve freshwater resources.

- Sustainability Reporting: Audi regularly reports on its water management performance as part of its broader corporate sustainability disclosures.

Consumer Environmental Awareness

Growing consumer awareness about environmental issues is a major driver in the automotive sector. Surveys in late 2024 indicated that over 60% of car buyers consider a vehicle's environmental impact when making a purchase decision. This trend directly impacts manufacturers like Audi, who are investing heavily in electric vehicle (EV) technology and sustainable production methods.

Audi's commitment to sustainable mobility, including its e-tron lineup and ambitious goals for carbon-neutral production by 2025, resonates strongly with this environmentally conscious consumer base. This alignment is crucial for brand loyalty and attracting new customers who prioritize ecological responsibility.

- Growing Demand for EVs: Global sales of electric vehicles are projected to reach over 15 million units in 2025, a significant jump from previous years.

- Brand Perception: Audi's investments in sustainability, such as reducing CO2 emissions in its supply chain, are increasingly seen as a competitive advantage.

- Regulatory Influence: Stricter environmental regulations worldwide further encourage manufacturers to develop and promote eco-friendly vehicles.

Audi's environmental strategy is deeply integrated into its operations, focusing on emissions reduction and resource management. The company aims for a 30% reduction in vehicle-specific CO2 emissions by 2025 compared to 2015, with a long-term vision of net CO2 neutrality by 2050.

This commitment extends to its supply chain, with a goal for 75% of critical raw materials to be sourced from suppliers undergoing sustainability assessments by 2024. Audi is also heavily invested in circular economy principles, such as repurposing used EV batteries for second-life charging solutions, aiming to significantly reduce waste and enhance resource efficiency.

Consumer demand for environmentally friendly vehicles is a significant market force. By late 2024, over 60% of car buyers considered environmental impact in their purchasing decisions, a trend that fuels Audi's investments in EVs and sustainable production.

Audi's 'Mission:Zero' program highlights its dedication to responsible water management, targeting reduced water consumption and pollution prevention across its manufacturing sites. For instance, the Brussels plant has shown notable success in lowering water usage per vehicle produced.

| Environmental Target | 2025 Goal | 2050 Goal | Key Initiative | Progress Metric |

|---|---|---|---|---|

| Vehicle CO2 Emissions Reduction | 30% vs 2015 | Net CO2 Neutrality | Electrification, Sustainable Production | Ongoing reduction tracking |

| Supply Chain Sustainability | 75% critical raw materials assessed | N/A | Supplier Audits, Responsible Sourcing | Percentage of assessed suppliers |

| Circular Economy | N/A | N/A | Battery Second-Life Solutions | Volume of batteries repurposed |

| Water Management | Reduced consumption per vehicle | N/A | 'Mission:Zero' Program | Water usage per vehicle |

PESTLE Analysis Data Sources

Our AUDI PESTLE Analysis is built on a comprehensive review of data from reputable sources, including official automotive industry reports, government economic and environmental agencies, and leading market research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors affecting Audi are both current and well-supported.