Attica Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Attica Group's strengths lie in its established brand and extensive ferry network, while its opportunities include expanding into new routes and modernizing its fleet. However, the company faces challenges from intense competition and fluctuating fuel prices, and its weaknesses include reliance on specific markets.

Want the full story behind Attica Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Attica Group commands a leading position in the Eastern Mediterranean passenger shipping sector, a crucial competitive edge. Its portfolio boasts highly recognized brands like Superfast Ferries, Blue Star Ferries, and Hellenic Seaways, ensuring extensive network coverage and frequent service.

The strategic integration with ANEK Lines in 2023 significantly bolstered Attica Group's market standing. This merger positioned the company as one of the largest global passenger shipping operators by passenger capacity, handling approximately 3.5 million passengers annually across its routes.

Attica Group boasts a modern and diverse fleet, featuring conventional Ro-Pax, high-speed ferries, and Ro-Ro carriers. This variety allows them to serve a broad customer base, from passengers and private vehicles to commercial freight. As of the first half of 2024, Attica Group continued its strategic investment in fleet renewal, with a focus on greener vessels to improve environmental performance and operational efficiency.

Attica Group boasts an extensive network, connecting mainland Greece with a multitude of islands and extending its reach to international destinations, particularly across the Adriatic Sea. This broad operational scope is a significant strength, facilitating essential maritime transportation for both leisure travelers and commercial cargo. For instance, in 2023, Attica Group operated over 70 routes, underscoring its commitment to comprehensive coverage.

This robust route coverage provides vital connectivity, especially for Greece's numerous islands, ensuring consistent access for residents and tourists alike. The company's presence across diverse geographical areas, including the Adriatic, also mitigates risks associated with over-dependence on any single market, as evidenced by their 2023 passenger numbers which saw growth across multiple segments.

Financial Stability and Investment Capacity

Attica Group exhibits remarkable financial stability, bolstered by record revenues in 2024, a significant portion of which is attributed to the successful integration of ANEK. This strong financial footing, characterized by a robust capital structure and ample liquidity, positions the company favorably for substantial investments.

The group's financial health directly translates into a significant investment capacity, allowing for strategic outlays in critical areas such as fleet modernization, the ongoing green transition, and digitalization initiatives. This capacity is further evidenced by its commitment to large-scale development programs.

For instance, Attica Group has earmarked approximately €700 million for fleet development, a clear testament to its financial strength and forward-looking investment strategy. This financial prowess enables the company to pursue ambitious growth and sustainability goals.

- Record Revenues in 2024, boosted by ANEK merger.

- Strong Capital Structure and Liquidity, enabling strategic investments.

- Significant Investment Capacity for fleet renewal, green transition, and digitalization.

- Planned €700 Million Investment in fleet development highlights financial strength.

Commitment to Sustainability and ESG

Attica Group's commitment to sustainability is a significant strength, underscored by its 2024-2026 Corporate Responsibility and Sustainability Strategy. This plan prioritizes environmental stewardship, social accountability, and robust governance practices.

The company is making substantial investments in future-proofing its fleet, including methanol-ready and battery-ready vessels. This strategic move is designed to significantly cut greenhouse gas emissions, keeping Attica Group ahead of increasingly stringent EU environmental regulations.

This forward-thinking approach to environmental, social, and governance (ESG) factors not only guarantees regulatory adherence but also bolsters the company's brand image. It also attracts investors and customers who increasingly value sustainable operations, a trend expected to intensify through 2025.

- Strategic Fleet Modernization: Investment in methanol and battery-ready vessels for emission reduction.

- Regulatory Compliance: Proactive alignment with evolving EU environmental standards.

- Enhanced Stakeholder Appeal: Improved reputation among environmentally conscious investors and customers.

Attica Group's market leadership in the Eastern Mediterranean passenger shipping sector is a core strength, amplified by its well-recognized brands and extensive route network. The strategic merger with ANEK Lines in 2023 solidified its position as a major global player, handling approximately 3.5 million passengers annually.

The company's modern, diverse fleet, encompassing Ro-Pax, high-speed ferries, and Ro-Ro carriers, caters to a wide range of customers and cargo needs. Furthermore, Attica Group's financial stability, demonstrated by record revenues in 2024 and a robust capital structure, provides significant capacity for strategic investments, including a planned €700 million for fleet development and green initiatives.

Attica Group’s commitment to sustainability is a key advantage, with investments in methanol and battery-ready vessels demonstrating a proactive approach to emission reduction and regulatory compliance. This focus on ESG factors enhances its brand image and appeal to environmentally conscious stakeholders.

| Metric | 2023 Data | 2024 Outlook/Activity |

|---|---|---|

| Passenger Capacity Handled (Annual) | ~3.5 million | Continued growth expected |

| Fleet Development Investment | Ongoing renewal | Planned €700 million |

| Route Network | Over 70 routes | Expansion and optimization |

| Revenue Performance | Strong | Record revenues in 2024 |

What is included in the product

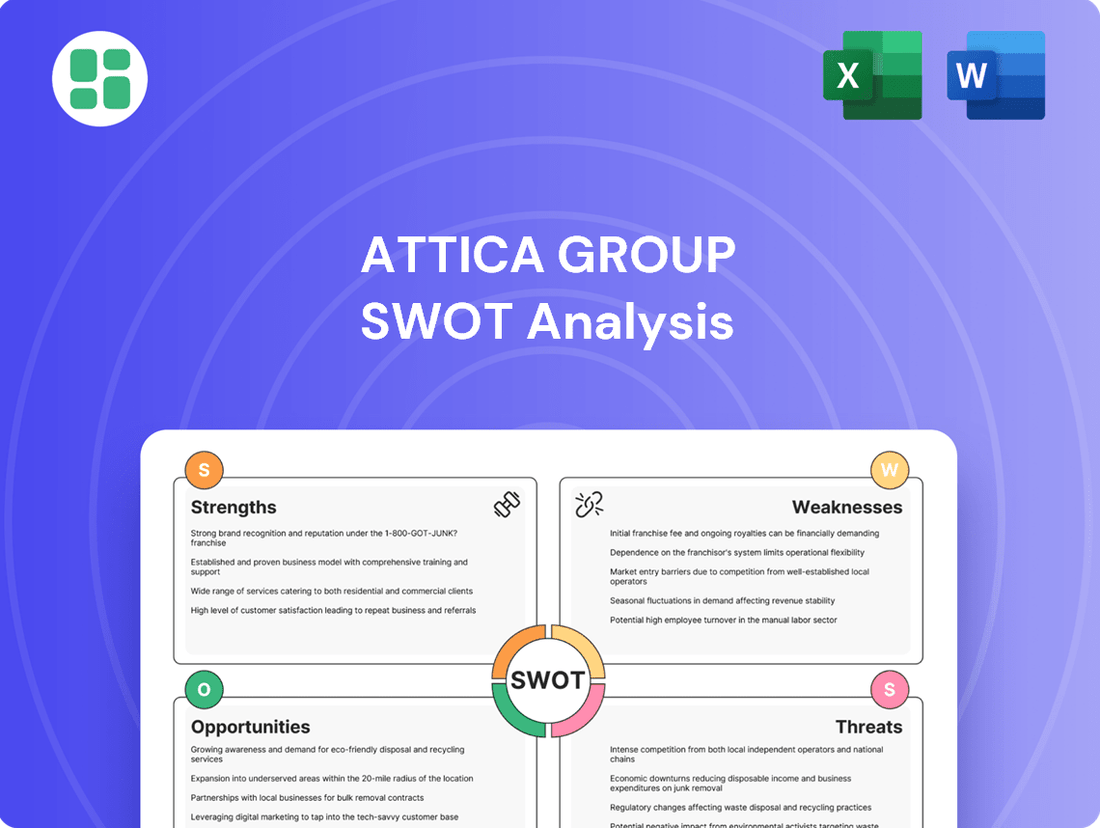

Delivers a strategic overview of Attica Group’s internal and external business factors, mapping its strengths, weaknesses, opportunities, and threats.

Uncovers critical competitive advantages and potential threats for proactive risk mitigation.

Weaknesses

Attica Group faces significant headwinds from high operating costs inherent in the shipping sector. Fuel expenses, a major variable cost for ferries, are particularly susceptible to market volatility. For instance, in 2024, bunker fuel prices saw fluctuations impacting profitability, with average prices for high-sulfur fuel oil hovering around $600-$700 per metric ton, depending on the region and time of year.

Beyond fuel, the company must contend with substantial costs for spare parts, routine maintenance, and crew wages. These expenditures are not only fixed but can also escalate due to inflation and global supply chain issues. In 2024, the cost of marine lubricants and specialized engine parts saw an estimated 5-10% increase compared to the previous year, further squeezing margins.

These elevated fixed and variable costs create a challenging environment for Attica Group, particularly when demand softens. A downturn in passenger or freight volumes directly amplifies the impact of these high operating expenses, potentially leading to reduced profitability or even losses if not managed effectively through operational efficiencies and strategic pricing.

Attica Group faces a significant weakness due to the pronounced seasonality of the ferry industry. Peak demand, driven by summer tourism, typically occurs from July through September, creating concentrated revenue periods. Conversely, the period from November to February experiences substantially lower traffic. This uneven demand pattern results in fluctuating revenue streams and can lead to the underutilization of their substantial fleet capacity during the off-peak months, impacting overall profitability and operational efficiency.

Attica Group operates in the Eastern Mediterranean, a region prone to geopolitical tensions and economic volatility. These factors can directly affect travel and trade volumes, impacting the company's core business. For instance, the ongoing Red Sea shipping crisis, while not directly impacting Attica's routes, has demonstrated how broader market disruptions can increase operational risks and costs across the industry, with knock-on effects on supply chains and freight rates.

Economic uncertainty within Greece and the wider European market also poses a significant weakness. Reduced disposable income and consumer confidence can lead to a decrease in discretionary travel, directly impacting passenger numbers and revenue for ferry services. As of early 2024, inflation in the Eurozone remained a concern, potentially dampening consumer spending on non-essential services like leisure travel.

Exposure to Stringent Environmental Regulations

Attica Group faces significant operational challenges due to increasingly strict environmental regulations, particularly from the European Union. The designation of the Mediterranean Sea as a Sulphur Emission Control Area (SECA) effective May 1, 2025, necessitates the adoption of more costly low-sulfur fuels. This, coupled with the EU Emissions Trading System (EU ETS) for carbon emissions, will substantially increase operating expenses. While Attica Group is actively investing in greener technologies to meet these mandates, the financial outlay and inherent uncertainties in these transitions represent a considerable weakness.

- Increased Fuel Costs: Transitioning to low-sulfur fuels due to the Mediterranean SECA from May 1, 2025, will directly impact operational expenditures.

- Carbon Emission Compliance: Adherence to the EU ETS for carbon emissions adds another layer of cost and complexity to operations.

- Investment in Green Technology: While strategic, the substantial costs and potential uncertainties associated with adopting new green technologies present a financial strain.

- Potential for Cost Pass-Through: The need to recover these increased costs may lead to higher ticket prices, potentially affecting passenger demand.

Dependency on Tourism Trends

Attica Group's significant reliance on passenger ferry services, especially for its Greek island routes, exposes it to the volatility of tourism trends. A downturn in tourist arrivals or a preference shift away from island travel, potentially driven by elevated ferry ticket costs, directly curtails passenger numbers and revenue streams. For instance, preliminary data from early 2025 suggests a noticeable deceleration in passenger traffic, underscoring this inherent weakness.

This dependency means that external factors impacting the travel industry, such as economic downturns affecting discretionary spending or unforeseen global events, can disproportionately affect Attica Group's financial performance. The company's revenue, while diversified by freight operations, remains intrinsically linked to the health and attractiveness of the Greek island tourism market.

- Tourism Reliance: Attica Group's core business is heavily tied to passenger ferry operations, particularly for routes serving Greek islands.

- Vulnerability to Travel Shifts: Declines in tourist arrivals or changes in travel preferences, such as opting for mainland destinations over islands due to cost, directly impact passenger volume and revenue.

- Early 2025 Slowdown: Emerging data from the beginning of 2025 indicates a softening in passenger traffic, highlighting the immediate impact of these trends on the company.

Attica Group's profitability is significantly challenged by the high and volatile costs associated with operating a large ferry fleet. Fuel expenses, a major component, are subject to global price fluctuations; for example, bunker fuel prices in 2024 averaged between $600-$700 per metric ton, impacting margins. Additionally, the company faces substantial, often escalating, costs for maintenance, spare parts, and crew wages, which are further pressured by inflation and supply chain disruptions, with marine lubricants and parts seeing an estimated 5-10% increase in 2024.

The ferry sector's inherent seasonality creates a pronounced weakness for Attica Group, with revenue heavily concentrated in the peak summer months (July-September). Off-peak periods, particularly November to February, experience significantly lower demand, leading to underutilization of assets and impacting overall operational efficiency and profitability.

Strict environmental regulations, especially the Mediterranean SECA designation from May 1, 2025, and the EU ETS, necessitate costly transitions to low-sulfur fuels and carbon emission compliance. These mandates will substantially increase operating expenses, and while investments in green technology are strategic, the financial outlay and associated uncertainties represent a notable weakness.

Attica Group's heavy reliance on passenger ferry services, particularly for its popular Greek island routes, makes it vulnerable to shifts in tourism trends and discretionary spending. Early 2025 data suggests a slowdown in passenger traffic, highlighting the direct impact of economic conditions and potential cost sensitivity on demand for these services.

Same Document Delivered

Attica Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats for the Attica Group, providing a comprehensive overview for strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Attica Group's market position and future potential.

Opportunities

The global travel industry is witnessing a significant shift towards sustainability, with consumers increasingly prioritizing eco-friendly options. This trend presents a substantial opportunity for Attica Group. In 2024, for instance, reports indicated a double-digit percentage increase in bookings for certified eco-tours and accommodations across Europe, highlighting this growing market segment.

Attica Group's strategic investments in modernizing its fleet, including the development of methanol-ready and battery-ready vessels, directly addresses this demand. By embracing greener technologies, the company is positioning itself to be a preferred choice for environmentally conscious travelers and businesses seeking sustainable logistics solutions.

Effectively communicating these sustainability initiatives can significantly bolster Attica Group's brand reputation. This enhanced image can attract a growing base of eco-conscious passengers and freight clients, potentially leading to increased market share and customer loyalty in the competitive ferry and shipping sector.

Attica Group can capitalize on opportunities to broaden its operational footprint by introducing new ferry routes, utilizing its established market presence and contemporary fleet. This strategic expansion could tap into underserved or emerging travel corridors, boosting passenger and freight volumes.

Diversifying into adjacent industries, such as acquiring or developing hospitality assets like hotels, presents a significant avenue for growth. This integration would not only create additional revenue streams but also enrich the customer journey by offering a more comprehensive travel and leisure experience, as seen with other integrated tourism operators.

By pursuing these expansion and diversification strategies, Attica Group can reduce its dependence on the cyclical nature of the maritime transport sector, thereby strengthening its overall financial resilience and market position. For instance, a successful foray into hospitality could offset potential downturns in ferry ticket sales, as experienced by some travel conglomerates in recent years.

Attica Group's strategic focus on technological advancements and digitalization offers significant opportunities. By adopting advanced digital solutions, the company can optimize its operations, leading to improved efficiency and a better customer experience. For instance, in 2024, the maritime industry saw a surge in digital transformation initiatives aimed at enhancing customer interaction and operational fluidity.

Investments in digitalization can streamline key processes like booking, onboarding, and freight logistics. This streamlining not only leads to substantial cost savings but also boosts customer satisfaction by providing a smoother, more efficient service. Attica Group's commitment to digital innovation is crucial for staying competitive in the evolving travel and logistics sectors.

Beyond just propulsion, embracing broader maritime technology innovation presents a competitive edge. This includes areas like smart vessel management systems and data analytics platforms, which can provide real-time insights for better decision-making. By leveraging these technologies, Attica Group can enhance its service offerings and operational performance in the 2024-2025 period.

Increased Freight Transport Demand

The demand for commercial freight transport, especially within the Eastern Mediterranean, shows consistent growth and is notably less affected by seasonal fluctuations compared to passenger services. This steady increase presents a significant opportunity for Attica Group. For instance, in 2024, freight volumes in the region are projected to see a steady upward trend, building on the 5.5% increase observed in 2023 for key shipping lanes.

Attica Group can leverage this by enhancing the utilization of its Ro-Ro and Ro-Pax vessels for cargo transport. This strategic focus could involve expanding its dedicated freight services and integrated logistics solutions. The company's ability to tap into this growing market offers a reliable revenue stream, effectively counterbalancing the inherent seasonality of its passenger ferry operations.

Key advantages include:

- Diversification of Revenue: Reducing reliance on passenger traffic by capturing a larger share of the freight market.

- Optimized Asset Utilization: Maximizing the use of existing Ro-Ro and Ro-Pax fleets for cargo, improving overall operational efficiency.

- Market Expansion: Building a stronger presence in the logistics sector, potentially through strategic partnerships or service enhancements.

- Stable Income Stream: Benefiting from a less volatile demand pattern compared to passenger transport, contributing to more predictable financial performance.

Strategic Partnerships and Acquisitions

Attica Group can further consolidate its market position and enhance operational efficiency through strategic mergers and acquisitions, mirroring the successful integration of ANEK. This approach not only reduces competitive pressures but also unlocks significant economies of scale. For instance, by expanding its fleet or acquiring complementary ferry routes, Attica Group could see its market share in the Aegean Sea, which stood at approximately 70% of passenger traffic in early 2024, further solidify.

Collaborations with entities outside the direct ferry sector, such as major tourism operators or integrated logistics providers, present a substantial opportunity. These partnerships can foster synergistic benefits, leading to expanded market reach and the development of bundled travel and transport solutions. Such alliances could tap into the growing demand for seamless travel experiences, potentially increasing passenger volumes by an estimated 5-10% in targeted segments.

Exploring partnerships focused on green technology development offers a pathway to de-risk investments in sustainability initiatives. By sharing the costs and expertise associated with adopting new, environmentally friendly technologies, such as advanced hull coatings or alternative fuel systems, Attica Group can accelerate its transition towards greener operations. This collaborative approach is crucial as environmental regulations tighten and consumer preference for sustainable travel grows, with a projected 15% increase in demand for eco-friendly maritime transport by 2025.

- Consolidate Market Share: Continued M&A activity, following the ANEK integration, could further strengthen Attica Group's dominant position in the Greek ferry market.

- Expand Market Reach: Strategic alliances with tourism and logistics firms can create new revenue streams and enhance customer offerings.

- De-risk Green Investments: Partnerships for developing and implementing sustainable technologies can mitigate financial exposure in a rapidly evolving environmental landscape.

Attica Group can leverage the increasing global demand for sustainable travel by highlighting its investments in eco-friendly fleet modernization. The company's methanol-ready and battery-ready vessels directly align with consumer preferences, and effective communication of these efforts can significantly enhance brand reputation and attract environmentally conscious customers, a trend that saw double-digit growth in eco-tours in Europe during 2024.

Expanding its operational footprint through new ferry routes can tap into underserved markets, boosting both passenger and freight volumes. Furthermore, diversification into hospitality assets offers additional revenue streams and a more integrated customer experience, as demonstrated by successful models in the tourism sector.

The consistent growth in commercial freight transport within the Eastern Mediterranean, projected to continue its upward trend in 2024 following a 5.5% increase in key shipping lanes in 2023, presents a stable income opportunity. Attica Group can enhance its Ro-Ro and Ro-Pax fleet utilization for cargo, building a stronger presence in the logistics sector and counterbalancing the seasonality of passenger services.

Strategic mergers and acquisitions, such as the integration of ANEK, can further consolidate market share, potentially increasing its already dominant position in the Aegean Sea passenger traffic, which was around 70% in early 2024. Collaborations with tourism and logistics firms can create synergistic benefits, expanding market reach and developing bundled travel solutions, which could boost passenger volumes by an estimated 5-10% in targeted segments.

Threats

Attica Group faces significant pressure from its competitors in the Greek ferry market, which is dominated by a few key players like Seajets and Minoan Lines. This oligopolistic structure often results in aggressive pricing strategies.

The ongoing competition can trigger price wars, directly impacting Attica Group's ticket revenue and overall profitability. This is particularly evident with recent reports in early 2025 indicating that ferry operators are reducing fares to attract passengers amidst a general decline in travel demand.

Fluctuating global fuel prices remain a substantial threat to Attica Group's operating margins, as bunker fuel represents a significant portion of its operational expenses. For instance, in 2023, the average price of High Sulphur Fuel Oil (HSFO) saw considerable volatility, impacting shipping companies directly.

The increasing stringency of environmental regulations, including the EU Emissions Trading System (ETS) and the implementation of SECA zones, will continue to escalate compliance costs. These additional expenses are challenging to fully pass on to consumers through ticket prices without potentially dampening demand for ferry services.

Economic instability and high inflation in Greece and key source markets pose a significant threat to Attica Group. This can lead to reduced consumer spending, directly impacting travel and tourism demand.

The consequence is a potential decline in passenger volumes and revenue for ferry services. For instance, a slowdown in Greek ferry passenger traffic observed in early 2025, linked to high prices and economic strain, highlights this vulnerability.

Geopolitical Risks and Regional Instability

The Eastern Mediterranean, Attica Group's operational heartland, remains a hotbed for geopolitical tensions, particularly given its proximity to the Middle East. These ongoing conflicts and potential crises pose a significant threat by disrupting crucial shipping lanes and escalating security concerns across the region.

Such instability directly impacts Attica Group by increasing operational costs due to heightened security measures and potentially deterring tourism, a key revenue driver for ferry services. For instance, the ongoing conflict in the Middle East, which saw oil prices spike in early 2024, can indirectly affect fuel costs and consumer spending on travel.

The unpredictable nature of these geopolitical events significantly undermines the reliability of maritime operations and can lead to a substantial reduction in demand for ferry and shipping services. Attica Group's financial performance is therefore vulnerable to the ripple effects of regional instability, impacting everything from ticket sales to freight volumes.

- Disruption of Shipping Lanes: Conflicts in the Eastern Mediterranean can lead to rerouting or temporary closure of vital maritime routes, increasing transit times and operational expenses.

- Increased Security Costs: Heightened geopolitical risks necessitate greater investment in security measures for vessels and ports, adding to operating expenditures.

- Reduced Tourism Demand: Regional instability often leads to a decline in tourist arrivals, directly impacting passenger ferry volumes, a significant segment for Attica Group.

- Supply Chain Volatility: Geopolitical events can cause disruptions in global supply chains, affecting the cost and availability of goods transported by sea, potentially impacting freight revenue.

Aging Fleet and High Capital Expenditure Needs

Attica Group faces the persistent threat of an aging fleet, necessitating significant and ongoing capital expenditure. This includes substantial investments in newbuilds and retrofitting existing vessels to comply with increasingly stringent environmental regulations, a trend that will only intensify through 2025 and beyond.

These large-scale investment programs, while crucial for maintaining competitiveness and achieving sustainability goals, can place considerable strain on the company's financial resources. Consequently, this often leads to increased debt levels, impacting financial flexibility.

A key challenge for Attica Group, and the broader maritime industry, remains the difficulty in securing adequate financing for the green transition. This is particularly relevant as the demand for environmentally friendly shipping solutions grows, requiring significant upfront capital.

- Fleet Modernization Costs: Attica Group's ongoing fleet renewal program, essential for meeting environmental standards and operational efficiency, requires substantial capital outlay. For instance, the delivery of new, eco-friendly vessels in 2024 and 2025 represents a significant financial commitment.

- Environmental Compliance: Meeting upcoming regulations, such as those related to emissions and ballast water treatment, necessitates costly upgrades or replacements of older vessels. This is a continuous threat as standards evolve.

- Financing the Green Transition: Accessing affordable and sufficient financing for the substantial investments needed for decarbonization and fleet upgrades presents a significant hurdle. The industry's reliance on debt financing for these transitions can increase financial risk.

Intense competition within the Greek ferry market, notably from players like Seajets and Minoan Lines, can lead to aggressive pricing and "price wars," directly impacting Attica Group's revenue. This was evident in early 2025 with reports of fare reductions to counter declining travel demand, squeezing profit margins.

Fluctuating global fuel prices remain a significant threat, as bunker fuel constitutes a large part of operational costs, with notable volatility observed in 2023 impacting shipping firms. Furthermore, escalating environmental regulations, such as the EU Emissions Trading System, will increase compliance costs, which are difficult to fully pass on to passengers without deterring demand.

Geopolitical instability in the Eastern Mediterranean, Attica Group's primary operational area, poses risks of disrupted shipping lanes and increased security expenses, potentially deterring tourism and impacting freight. Economic instability and high inflation in Greece and key markets also threaten demand due to reduced consumer spending, as seen in a slowdown of Greek ferry passenger traffic in early 2025.

Attica Group faces substantial capital expenditure requirements for fleet modernization and compliance with evolving environmental standards, potentially increasing debt. Securing financing for this green transition is a challenge, given the significant upfront investment needed for eco-friendly solutions.

| Threat Category | Specific Threat | Impact on Attica Group | Example/Data Point (2024/2025) |

|---|---|---|---|

| Competition | Aggressive Pricing by Competitors | Reduced ticket revenue and profitability | Reports of fare reductions in early 2025 to boost passenger numbers amid travel slowdown. |

| Operational Costs | Fuel Price Volatility | Erosion of operating margins | Continued volatility in High Sulphur Fuel Oil (HSFO) prices impacting shipping expenses. |

| Regulatory Compliance | Stringent Environmental Regulations (e.g., EU ETS) | Increased compliance costs, difficult to pass on | Escalating costs for emissions control and retrofitting vessels to meet new standards. |

| Market Demand | Economic Instability & Inflation | Decreased consumer spending on travel, lower passenger volumes | Observed slowdown in Greek ferry passenger traffic in early 2025 due to economic pressures. |

| Geopolitical Risk | Regional Instability (Eastern Mediterranean) | Disrupted shipping lanes, increased security costs, reduced tourism | Heightened security measures and potential deterrent to tourism in regions affected by ongoing conflicts. |

| Fleet Management | Fleet Modernization & Green Transition Costs | High capital expenditure, increased debt levels | Significant investment in new eco-friendly vessels delivered in 2024/2025, requiring substantial financing. |

SWOT Analysis Data Sources

This Attica Group SWOT analysis is built upon a foundation of robust data, including the company's official financial reports, comprehensive market research, and insights from industry experts. These sources ensure a thorough understanding of the company's operational landscape and strategic positioning.