Attica Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

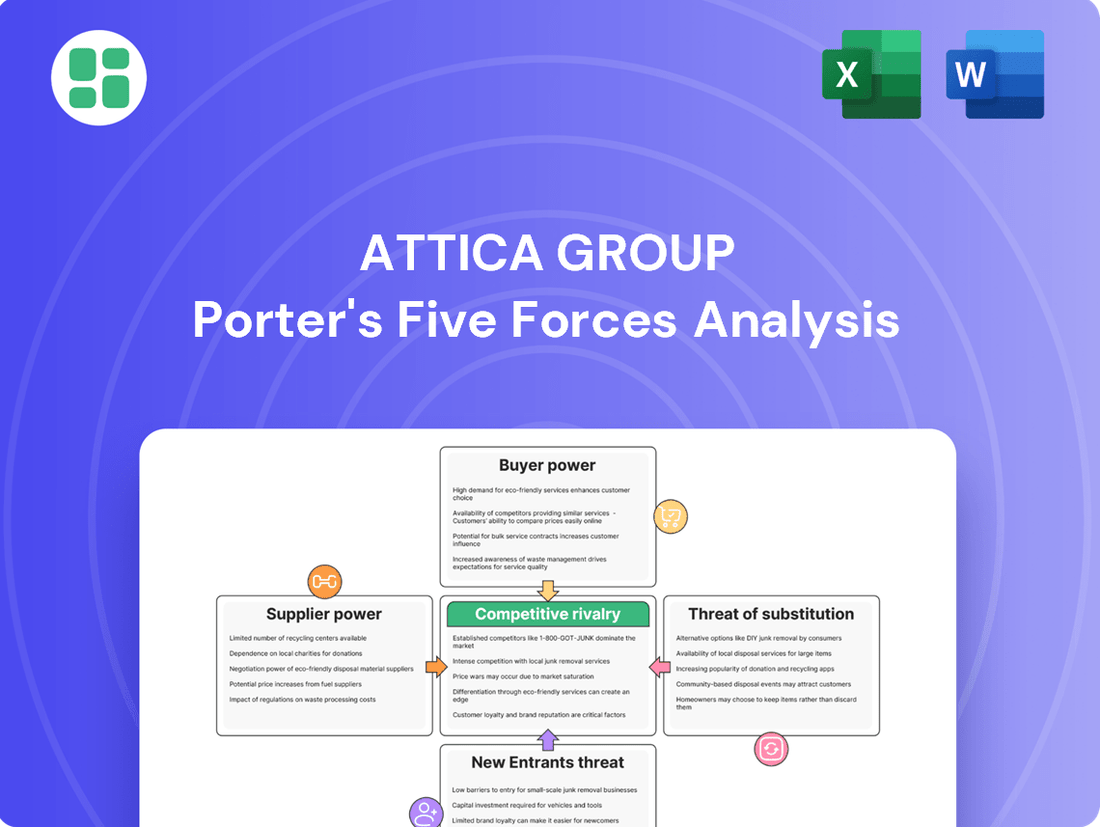

Attica Group operates in a dynamic industry shaped by several key competitive forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Attica Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Attica Group faces substantial bargaining power from marine fuel suppliers, largely driven by the unpredictable nature of global oil prices and the escalating expenses linked to new environmental mandates. The implementation of the European Union Emissions Trading System (EU ETS) on January 1, 2024, requires the acquisition of emission allowances, directly impacting the company's operational expenditures. This regulatory shift, coupled with the 'FuelEU Maritime' initiative's push for lower-sulfur fuels, which are inherently pricier, grants fuel providers considerable leverage over shipping operators.

Shipyards and maritime technology providers wield significant influence over Attica Group due to the company's ongoing fleet renewal and modernization efforts. Attica Group's substantial investment of around EUR 1 billion in upgrading its fleet and commissioning new methanol-ready vessels highlights a strong dependence on specialized shipbuilding expertise.

The extended timelines for vessel construction and the considerable expenses involved in switching between major maintenance providers amplify the bargaining power of these suppliers. This reliance on a limited number of highly specialized entities creates a situation where Attica Group faces considerable supplier leverage.

The bargaining power of suppliers in the maritime sector is significantly influenced by the availability and cost of skilled labor. Attica Group, like other ferry operators, relies on qualified crew and onshore staff, whose compensation directly impacts operating expenses. Industry associations have highlighted rising wage costs as a key driver of increased expenses for ferry companies, indicating that specialized maritime labor can indeed command higher wages, thereby affecting Attica Group's bottom line.

Spare Parts and Equipment

Suppliers of critical spare parts and specialized equipment for vessel operation and maintenance hold significant bargaining power. The Association of Passenger Shipping Companies (SEEN) has highlighted increasing spare part costs as a contributor to higher ferry ticket prices, directly impacting operational expenses for companies like Attica Group. This suggests that the specialized nature or limited supply of certain components can translate into elevated procurement costs.

The bargaining power of these suppliers is further amplified by the critical nature of their products for ensuring vessel uptime and safety. A lack of readily available alternatives for essential spare parts or specialized machinery can force Attica Group to accept supplier-dictated terms and pricing. For instance, in 2024, reports indicated a global shortage in marine engine components, leading to extended lead times and price hikes for critical parts, a situation that directly affects the cost structure of ferry operators.

- Criticality of Parts: Essential components for vessel operation and maintenance are often supplied by a limited number of specialized manufacturers.

- Price Sensitivity: Rising spare part costs, as noted by SEEN, directly influence Attica Group's overall operating expenses and ticket pricing strategies.

- Limited Alternatives: The specialized nature of some equipment means few, if any, substitute suppliers exist, strengthening the power of the incumbent.

- Supply Chain Disruptions: Global supply chain issues, such as those experienced in 2024 with marine engine components, can exacerbate supplier power through increased demand and reduced availability.

Port Services and Infrastructure

Port services and infrastructure, while essential for ferry operators like Attica Group, can exhibit supplier power. Specialized services such as docking, pilotage, and cargo handling are often provided by a limited number of entities, giving them leverage over pricing and availability.

Historically, port authorities have wielded significant influence over ferry operators concerning operational expenses. For instance, a recent government initiative in Greece mandated a 50% reduction in port fees. This measure underscores the substantial bargaining power previously held by port authorities, which necessitated governmental intervention to alleviate financial burdens on ferry companies.

- Specialized Services: Ports offer critical services like docking and cargo handling, often with few alternatives.

- Historical Leverage: Port authorities have traditionally commanded significant control over operational costs for ferry operators.

- Government Intervention: A 50% cut in Greek port fees in 2024 demonstrates the extent of this past supplier power and the need for relief.

Attica Group faces considerable supplier power from maritime fuel providers, influenced by volatile global oil prices and increasing environmental regulations. The EU Emissions Trading System (ETS) introduced in January 2024, alongside the FuelEU Maritime initiative, necessitates higher-cost, lower-sulfur fuels, granting suppliers significant leverage.

Shipyards and technology providers also hold strong bargaining power due to Attica Group's substantial investments in fleet modernization, including new methanol-ready vessels. The lengthy construction times and high costs associated with switching shipyards or maintenance providers further solidify this supplier influence.

The bargaining power of suppliers for critical spare parts and specialized equipment is significant for Attica Group. As noted by the Association of Passenger Shipping Companies (SEEN), rising spare part costs directly impact ferry operators' expenses. Global shortages in marine engine components in 2024, for example, led to price hikes and extended lead times, reinforcing supplier leverage.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Attica Group |

|---|---|---|

| Marine Fuel Suppliers | Volatile oil prices, EU ETS (2024), FuelEU Maritime | Increased operating costs, limited negotiation room on fuel prices. |

| Shipyards & Technology Providers | Fleet renewal, specialized expertise, long lead times | High capital expenditure, dependence on specific builders for new vessels. |

| Spare Parts & Equipment Suppliers | Criticality of parts, limited alternatives, supply chain disruptions (2024) | Elevated maintenance costs, potential operational delays if parts are unavailable. |

What is included in the product

Analyzes the competitive intensity within the ferry industry, evaluating the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and Attica Group's strategic positioning.

Quickly identify and mitigate competitive threats with a clear, actionable summary of Attica Group's Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Attica Group's passengers demonstrate considerable price sensitivity, particularly for leisure travel. Ferry ticket prices in Greece have seen substantial increases, with some routes experiencing hikes of up to 60% since 2019, leading to public outcry and government attention.

This strong reaction to rising costs highlights a clear demand for affordable ferry services. While individual passengers may not have direct bargaining power, their collective sensitivity to price shifts significantly influences demand and the company's pricing strategies.

For residents of Greek islands, the bargaining power of customers is significantly constrained by the lack of viable alternatives to ferry services. These services are often the only practical way to transport both people and essential goods to and from the mainland, effectively making them a public utility. This reliance limits the ability of islanders to demand lower prices or better terms, as switching options are virtually non-existent for critical travel and supply chains.

Commercial freight customers, like trucking companies, hold considerable bargaining power due to their focus on operational efficiency and managing logistics expenses. Attica Group has observed growth in freight unit volumes, yet these clients continuously prioritize competitive pricing and dependable service, influencing Attica's pricing strategies.

The substantial revenue generated from transporting freight, encompassing both private vehicles and commercial trucks, underscores the importance of retaining these customers. For instance, in 2024, Attica Group's ferry segment, which includes freight, continued to be a vital contributor to its overall financial performance, highlighting the leverage these clients possess.

Governmental and Regulatory Oversight

The bargaining power of customers is significantly influenced by governmental and regulatory bodies. For instance, entities like the Greek Shipping Ministry and the Hellenic Competition Commission actively monitor the ferry market. Their interventions, aimed at preventing abusive market behavior and unreasonable price hikes, effectively consolidate customer power. This regulatory oversight compels ferry operators, including Attica Group, to carefully consider their pricing strategies, as any perceived unfairness can lead to official scrutiny and potential penalties.

These regulatory pressures translate into a tangible limitation on pricing flexibility for Attica Group. The threat of investigations into 'unreasonable price changes' means that the company cannot unilaterally implement drastic fare increases without risking regulatory action. This dynamic ensures that customer interests are indirectly championed by these official bodies, adding a layer of collective bargaining power that influences Attica Group's financial decisions regarding ticket prices.

- Regulatory bodies like the Greek Shipping Ministry and Hellenic Competition Commission act on behalf of customers.

- These entities can intervene to prevent 'abusive market behavior' and 'unreasonable price changes'.

- This regulatory pressure effectively represents collective customer power, influencing Attica Group's fare structures.

Impact of Tourism Trends

While Greece saw a record 32 million tourist arrivals in 2023, a significant portion of these visitors opted for air travel for inter-island journeys. This shift indicates that a segment of the tourist market values speed and convenience, potentially reducing their reliance on ferry services. This preference grants these customers a degree of bargaining power as they can choose alternative transportation methods.

This trend means Attica Group needs to remain agile, constantly evaluating and adapting its services to meet the evolving preferences of travelers. Understanding that not all tourists prioritize the ferry experience is crucial for maintaining market share and customer loyalty.

- Record Tourism in 2023: Greece welcomed approximately 32 million tourists, a new all-time high.

- Shift to Air Travel: A notable portion of inter-island travel occurred via domestic flights, bypassing traditional ferry routes.

- Customer Preference for Speed: This indicates a segment of tourists prioritizes faster transit times, influencing their travel choices.

- Attica Group's Adaptation: The company must continuously innovate its offerings to appeal to diverse tourist needs and travel preferences.

The bargaining power of customers for Attica Group is multifaceted, influenced by price sensitivity, lack of alternatives for some segments, and the leverage held by commercial clients. While island residents have limited options, tourists and freight customers can exert more pressure through price consciousness and the availability of substitutes. Regulatory oversight further amplifies customer power by limiting pricing flexibility.

The increasing reliance on air travel for inter-island journeys by a segment of tourists, as seen with the record 32 million arrivals in Greece in 2023, directly impacts Attica Group. This preference for speed and convenience grants these travelers more bargaining power, as they can opt for alternative transportation, forcing Attica to remain competitive and adaptable in its service offerings.

Commercial freight customers, crucial for Attica Group's revenue, wield significant bargaining power. Their focus on logistics costs and dependable service means they actively seek competitive pricing. The continued growth in freight volumes in 2024 underscores the importance of retaining these clients, giving them leverage in negotiations.

| Customer Segment | Bargaining Power | Key Influencing Factors |

| Island Residents | Low | Lack of viable transport alternatives, essential service reliance |

| Leisure Tourists | Moderate to High | Price sensitivity, availability of air travel alternatives |

| Commercial Freight | High | Focus on operational efficiency, competitive pricing, service dependability |

Preview the Actual Deliverable

Attica Group Porter's Five Forces Analysis

This preview showcases the complete Attica Group Porter's Five Forces Analysis, offering a deep dive into competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing comprehensive insights into Attica Group's competitive landscape.

Rivalry Among Competitors

The Greek ferry market is an oligopoly, with Attica Group, Seajets, and Grimaldi Group (via Minoan Lines) being the dominant forces. Attica Group, particularly after its integration with ANEK, commands a substantial portion of the market, evident in its fleet size, passenger capacity, and vehicle capacity, making it a key player in this concentrated landscape.

This concentration naturally fuels aggressive competition among these few major operators. They vie fiercely for market share and to maximize profitability, engaging in strategic pricing and service offerings to attract and retain customers in this high-stakes environment.

Even with an oligopolistic market structure, Attica Group faces significant price competition. This can lead to public and governmental scrutiny, particularly concerning potential fare increases. For instance, the Hellenic Competition Commission launched an inquiry in 2024 into the coastal shipping sector, citing concerns over evolving ferry ticket prices and the sector's concentrated nature.

Competitive rivalry in the ferry sector extends beyond mere price wars, with Attica Group and Minoan Lines focusing on fleet modernization and service differentiation. Both companies are making significant investments in new, eco-friendly vessels and upgrading onboard amenities to enhance customer satisfaction and operational efficiency.

For instance, Attica Group's investment in new vessels, like the Hellenic Spirit, aims to improve fuel efficiency and passenger comfort. Minoan Lines is also upgrading its fleet, contributing to a market where service quality and sustainability are becoming key differentiators rather than just cost.

Route Coverage and Network Dominance

Attica Group's extensive route coverage, linking mainland Greece to numerous islands and international ports through its prominent brands like Blue Star Ferries and Hellenic Seaways, presents a formidable competitive advantage. This network dominance is a key factor in its market position.

Rival ferry operators are actively working to expand their own route offerings and increase sailing frequencies. This strategic move is designed to directly challenge Attica Group's established network and capture market share on popular and profitable routes, thereby intensifying rivalry.

- Network Reach: Attica Group's brands collectively served approximately 60 destinations as of early 2024, highlighting their broad network coverage.

- Fleet Expansion: Competitors are investing in new vessels and acquiring existing ones to bolster their capacity and extend their operational reach, directly confronting Attica's network strength.

- Route Competition: Key routes, particularly those connecting major islands to the mainland, see heightened competition with rivals matching or even exceeding sailing frequencies during peak seasons.

Strategic Mergers and Acquisitions

The recent merger of Attica Group with ANEK Lines in early 2024 is a prime example of how strategic mergers and acquisitions are actively reshaping the competitive landscape in the ferry industry. This consolidation aims to bolster the combined entity's market share and mitigate intense rivalry.

This significant move, which saw Attica Group acquire ANEK Lines, is designed to create a more dominant player. The goal is to leverage operational synergies, improve cost efficiencies, and ultimately present a stronger front against existing competitors and potential new entrants.

- Market Consolidation: The Attica Group-ANEK Lines merger signifies a trend towards fewer, larger players in the ferry market, reducing the number of direct competitors.

- Synergy Realization: Expected synergies from the merger include optimized route planning, shared vessel utilization, and streamlined administrative functions, aiming to improve profitability.

- Competitive Pressure: This strategic acquisition is a direct response to high competitive pressure, seeking to enhance pricing power and service offerings for the consolidated group.

- Industry Landscape: The merger is anticipated to alter the competitive dynamics, potentially leading to a more concentrated market structure in the Aegean Sea routes.

The competitive rivalry within the Greek ferry market is intense, primarily driven by a few dominant players like Attica Group, Seajets, and Grimaldi Group. Attica Group, especially after its 2024 integration with ANEK Lines, holds a significant market share, engaging in strategic pricing and service enhancements to capture customers.

This rivalry is characterized by aggressive competition on popular routes, with companies often matching or exceeding sailing frequencies. The Hellenic Competition Commission's 2024 inquiry into coastal shipping highlights concerns over ticket prices and market concentration, underscoring the high stakes involved.

Beyond price, differentiation through fleet modernization and service quality is crucial. Attica Group's investment in new, eco-friendly vessels like the Hellenic Spirit, alongside competitors' similar upgrades, signals a shift towards sustainability and enhanced passenger experience as key competitive tools.

The competitive landscape is further shaped by market consolidation, exemplified by Attica Group's acquisition of ANEK Lines in early 2024. This move aims to leverage synergies, improve cost efficiencies, and strengthen the combined entity's position against rivals.

| Competitor | Key Brands | Estimated Market Share (Early 2024) | Fleet Size (Approx.) | Key Competitive Actions |

|---|---|---|---|---|

| Attica Group | Blue Star Ferries, Hellenic Seaways | 35-40% (post-ANEK merger) | 20+ vessels | Fleet modernization, route expansion, synergy realization from ANEK merger |

| Seajets | Seajets | 25-30% | 15+ vessels | Aggressive route deployment, high-speed ferry focus |

| Grimaldi Group (Minoan Lines) | Minoan Lines | 15-20% | 10+ vessels | Fleet upgrades, international route focus, service quality improvements |

SSubstitutes Threaten

For longer distances, especially connecting mainland Greece to its islands or for travelers prioritizing speed, air travel acts as a potent substitute for ferry services. While ferries excel at transporting vehicles and cargo, flights offer unparalleled convenience and time savings for passengers.

The significant rebound in Greek tourism in 2023, with a substantial number of visitors utilizing air travel for inter-island transit, underscores the competitive pressure from this substitute. This trend indicates a clear preference for air travel among certain traveler segments, impacting ferry demand.

On the Greek mainland, road transport, including private cars, buses, and trains, can indeed offer a substitute for ferry services on specific coastal routes where robust infrastructure like bridges or tunnels is available. However, for the crucial island connections that form the backbone of Attica Group's operations, direct land-based alternatives are virtually non-existent. This fundamental lack of viable land substitutes for island travel significantly diminishes the threat of substitution for Attica Group's core ferry services.

The development of hydroplane services in Greece, while slow, represents a developing threat of substitution for certain passenger groups desiring quicker inter-island transit. Currently, this threat is limited, but future advancements in smaller, high-speed vessels or hydroplanes could offer a faster, though likely pricier, alternative on specific routes, potentially affecting Attica Group's faster ferry services.

Cruise Ships and Leisure Boating

For travelers prioritizing unique experiences over simple transit, cruise ships and private leisure boating represent significant indirect substitutes. These alternatives offer a distinct vacation style, potentially siphoning off customers who might otherwise opt for ferry services for island exploration. For instance, the global cruise industry, valued at approximately $15.5 billion in 2023, continues to expand, attracting a broad demographic.

Attica Group's strategic positioning, emphasizing dependable transportation for both holidaymakers and vital commercial cargo, serves as a key differentiator. This dual focus helps mitigate the impact of leisure-focused substitutes. In 2024, Attica Group reported a substantial increase in passenger numbers, particularly on its popular Greek island routes, underscoring its resilience against these leisure alternatives.

- Cruise Industry Growth: The global cruise market is projected to grow, offering a leisure-focused alternative to ferry travel.

- Leisure Boating Appeal: Private boat rentals and ownership provide a personalized travel experience that can divert potential ferry passengers.

- Attica Group's Differentiation: The company's emphasis on reliable transport for both passengers and freight distinguishes it from purely leisure-oriented substitutes.

- 2024 Performance: Attica Group's robust passenger figures in 2024 highlight its ability to maintain market share despite these competitive pressures.

Perceived Value and Customer Experience

The threat of substitutes for Attica Group's ferry services is significantly shaped by the perceived value and the overall customer experience. When customers feel they are getting a good deal and enjoy their journey, they are less likely to look elsewhere. For instance, in 2024, ferry ticket prices in Greece, particularly on popular routes, can be a point of comparison for travelers. If these prices are perceived as high relative to other European travel options or even alternative domestic transport, customers might opt for different modes of travel or postpone their trips.

Attica Group must therefore focus on enhancing service quality to bolster the perceived value of its offerings. This includes everything from onboard amenities and customer service to the efficiency of the boarding process. A superior experience can justify ticket prices and build loyalty, making substitutes less appealing. For example, in 2023, reports indicated a general increase in travel costs across Europe, making price sensitivity a key factor for many consumers.

- Perceived Value: Customers weigh the benefits of ferry travel against its cost.

- Customer Experience: Service quality, comfort, and convenience are critical differentiators.

- Price Sensitivity: High ticket prices, especially when compared to alternatives or other regions, can drive customers away. In 2024, average ferry ticket prices on key Greek routes might be scrutinized against budget airline fares or even the cost of driving, depending on the destination and number of passengers.

- Mitigation Strategies: Attica Group can counter this threat by investing in service improvements and offering competitive pricing structures.

While direct land substitutes for island travel are scarce, air travel remains a significant threat, particularly for passengers prioritizing speed over vehicle transport. The rebound in Greek tourism in 2023 saw a notable increase in air travel for inter-island transit, indicating a segment of travelers who prefer flights. Hydroplane services, though nascent, also pose a developing, albeit limited, threat for faster inter-island journeys.

| Substitute Type | Key Characteristics | Impact on Attica Group |

|---|---|---|

| Air Travel | Faster transit, passenger-focused | High for passengers prioritizing speed; limited for cargo |

| Land Transport | Viable on mainland routes with infrastructure | Minimal for island connections; relevant for mainland coastal routes |

| Hydroplanes | Potentially faster inter-island transit | Developing threat for specific passenger segments |

Entrants Threaten

The passenger shipping industry, particularly for large Ro-Pax vessels, presents a formidable barrier to entry due to the immense capital required to acquire and maintain a modern fleet. Attica Group's significant EUR 1 billion fleet upgrade program for new vessels highlights this substantial financial hurdle.

Prospective new entrants would need to secure vast financial resources to purchase or construct ships, develop essential port infrastructure, and manage ongoing operational expenses, thereby making market entry exceptionally difficult.

The maritime shipping industry, including ferry operations like Attica Group, is heavily regulated. New entrants must immediately contend with complex maritime safety, operational, and environmental standards. This creates a significant barrier, as meeting these requirements demands substantial capital investment and specialized knowledge from the outset.

Recent EU directives, such as the Emissions Trading System (ETS) and FuelEU Maritime, impose new costs and operational complexities related to low-sulfur fuels and emissions reduction. For instance, the EU ETS, implemented in 2024 for maritime transport, places a carbon price on emissions, directly impacting operational expenses. These evolving environmental mandates mean new companies must factor in significant compliance costs and technological upgrades, making market entry more challenging.

Attica Group benefits from strong brand loyalty across its Superfast Ferries, Blue Star Ferries, and Hellenic Seaways brands, making it difficult for new entrants to gain traction. This loyalty is built on years of reliable service and customer trust.

The company's extensive, established network of routes and associated infrastructure creates significant network effects, a formidable barrier for newcomers. Replicating this comprehensive coverage and operational efficiency would require substantial investment and time.

New entrants would face immense challenges in matching Attica Group's brand recognition and the trust it has cultivated, essential for securing passenger and freight volumes. For instance, in 2023, Attica Group's passenger numbers reached approximately 7 million, a testament to its established market presence.

Oligopolistic Market Dominance

The Greek ferry market is a prime example of an oligopoly, with Attica Group, Seajets, and Minoan Lines holding a dominant position. This concentration means that these few players control a significant portion of the market's capacity, making it challenging for newcomers to enter and compete. For instance, in 2024, these three companies collectively operated a substantial fleet, accounting for the majority of routes and passenger volume across the Aegean.

The existing market structure presents a considerable barrier to entry for new entrants. Incumbent companies like Attica Group benefit from significant economies of scale in operations, maintenance, and marketing, which new, smaller entities struggle to match. Their established brand recognition and customer loyalty further solidify their advantage, making it difficult for a new ferry company to attract a comparable market share.

- Dominant Players: Attica Group, Seajets, and Minoan Lines control the majority of the Greek ferry market.

- Economies of Scale: Incumbents leverage cost advantages in operations and marketing.

- Market Share: New entrants face the challenge of overcoming established brand loyalty and capacity.

- 2024 Data: Analysis of fleet size and route coverage in 2024 highlights the entrenched nature of the oligopoly.

Access to Routes and Port Slots

Securing access to profitable ferry routes and desirable port slots presents a substantial hurdle for potential new entrants. Established companies, such as Attica Group, often leverage long-standing relationships with port authorities, granting them preferential access to critical departure and arrival times, particularly during peak travel seasons. For instance, in 2024, major European ports reported high occupancy rates, making it difficult for new operators to secure prime slots without significant prior negotiation or investment.

Newcomers may struggle to obtain the necessary permits and operational slots required to compete effectively. These regulatory and infrastructure-based barriers can significantly delay or even prevent market entry. The complexity of securing these resources means that even with a strong business plan, a new ferry operator could face substantial operational disadvantages compared to incumbents.

- Limited Port Slot Availability: Many popular ports, especially those with high passenger and cargo traffic, operate at near-full capacity, making it challenging for new entrants to secure berths.

- Established Operator Relationships: Incumbents like Attica Group have built decades-long partnerships with port authorities, often leading to prioritized scheduling and access.

- Regulatory Hurdles: Obtaining operating licenses and route permits can be a lengthy and complex process, requiring substantial legal and administrative resources.

- Peak Season Congestion: During summer months and holidays, competition for available port slots intensifies, further disadvantaging new companies with less established networks.

The threat of new entrants in the passenger shipping industry, particularly for companies like Attica Group, is significantly low. The immense capital investment required for fleet acquisition and modernization, coupled with stringent regulatory compliance, creates substantial barriers. For example, Attica Group's ongoing EUR 1 billion fleet upgrade program underscores the financial commitment needed to operate in this sector.

Furthermore, the established market structure, characterized by an oligopoly dominated by players like Attica Group, Seajets, and Minoan Lines, limits opportunities for newcomers. These incumbents benefit from economies of scale, strong brand loyalty, and preferential access to critical port infrastructure and routes, as evidenced by the 7 million passengers Attica Group served in 2023.

| Barrier Type | Description | Impact on New Entrants | Example (Attica Group) |

|---|---|---|---|

| Capital Requirements | High cost of acquiring and maintaining modern vessels. | Extremely high; requires significant financing. | EUR 1 billion fleet upgrade program. |

| Regulation & Compliance | Adherence to strict safety, environmental, and operational standards. | High; demands expertise and investment. | Compliance with EU ETS and FuelEU Maritime from 2024. |

| Market Concentration | Dominance of a few key players in the Greek ferry market. | High; difficult to gain market share. | Attica Group, Seajets, Minoan Lines control majority of routes. |

| Brand Loyalty & Network Effects | Established customer trust and extensive route networks. | High; challenging to replicate customer base and operational efficiency. | 7 million passengers served in 2023; established route coverage. |

| Port Access & Slots | Securing desirable port departure/arrival times. | High; incumbents often have preferential access. | Competition for prime slots during peak seasons. |

Porter's Five Forces Analysis Data Sources

Our Attica Group Porter's Five Forces analysis is built upon a foundation of credible data, including the company's annual reports, financial statements, and investor relations materials. We also incorporate insights from industry-specific publications and market research reports to provide a comprehensive understanding of the competitive landscape.