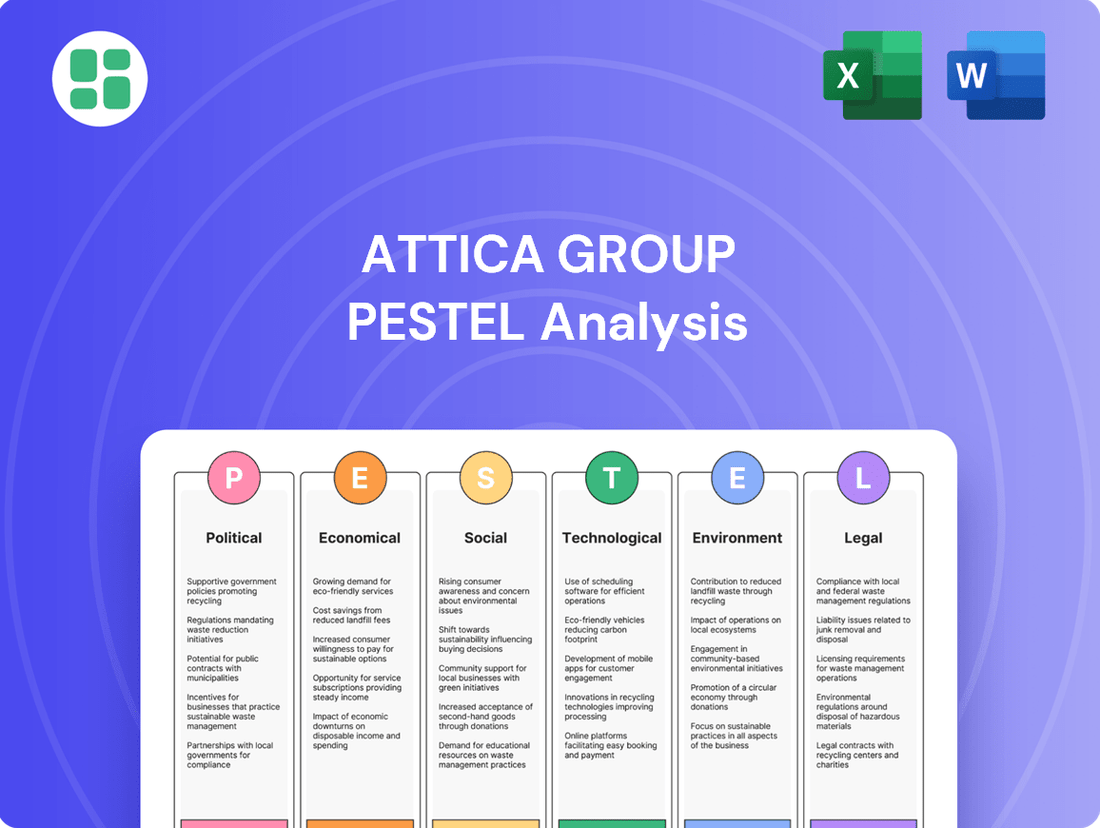

Attica Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental forces shaping Attica Group's future. Our PESTLE analysis provides a strategic roadmap, highlighting opportunities and threats that could impact your investments or business strategies. Download the full, actionable report now and gain a decisive market advantage.

Political factors

Greek government policies aimed at modernizing coastal shipping and enhancing safety directly influence Attica Group's operational landscape. These initiatives are crucial for maintaining competitiveness and adhering to evolving industry standards.

The Ministry of Maritime Affairs and Island Policy has earmarked over 2 billion euros for investments in coastal shipping, port infrastructure, and the development of greener vessels. A key objective is the complete replacement of the existing coastal ferry fleet with environmentally friendly alternatives.

This strategic push includes implementing an integrated slots system to boost operational efficiency and a comprehensive master plan for fleet renewal. The overarching goal is to significantly reduce the carbon footprint associated with maritime transport, aligning with global sustainability targets.

Geopolitical instability in the Eastern Mediterranean, Attica Group's core operational area, directly impacts shipping. Tensions can escalate insurance premiums and force costly route diversions, squeezing profitability. For instance, ongoing disputes over maritime boundaries and energy exploration rights in areas like Cyprus and the Eastern Mediterranean gas fields create a volatile operating environment.

The broader geopolitical landscape, including the ongoing NATO-Russia rivalry, further exacerbates these risks. Shipping companies like Attica Group must navigate these complexities, which can lead to increased security measures and operational delays. The unpredictability stemming from these factors directly affects transit times and overall logistical efficiency.

The European Union's ambitious 'Fit for 55' package, including the EU Emissions Trading System (ETS) and the FuelEU Maritime Regulation, directly impacts Attica Group's operational landscape. These directives are designed to drive significant emission reductions across the maritime sector.

The EU ETS, which began its phased implementation on January 1, 2024, mandates that shipping companies purchase carbon allowances for their emissions. This requirement will escalate with increasing obligations in 2025 and 2026, directly translating into additional operational costs for Attica Group as it navigates the transition to lower-emission fuels and technologies.

National Tourism Policies

National tourism policies significantly influence Attica Group's operational landscape. Government initiatives aimed at boosting tourism to the Greek islands directly impact passenger volumes, a core revenue driver for the company. For instance, the Greek Ministry of Tourism's strategies to enhance the appeal of lesser-known islands could lead to new routes or increased demand on existing ones.

While overall Greek tourism has seen robust growth, with cruise arrivals reaching approximately 5.5 million in 2023 according to the Bank of Greece, the focus on direct air access to islands means ferry services are increasingly vital for inter-island transit. Attica Group's strategic planning must align with these evolving tourist movement patterns.

- Government support for island infrastructure, such as port upgrades or improved inter-island ferry connections, directly benefits Attica Group by enhancing accessibility and potentially reducing operational costs.

- Policies promoting sustainable tourism could also shape demand for ferry services, as environmentally conscious travelers may prefer sea travel over short flights.

- Visa facilitation and marketing campaigns targeting specific nationalities or travel segments can lead to an influx of tourists, translating into higher passenger numbers for Attica Group.

Labor Laws and Social Policies

Changes in Greek labor laws, including minimum wage adjustments and probationary period regulations, directly influence Attica Group's operational expenses and workforce management strategies. For instance, legislative updates in 2024 and 2025 are designed to create a more equitable wage structure and bolster employee protections, necessitating compliance from all shipping entities.

These evolving regulations can affect labor costs, potentially impacting the company's profitability. Attica Group must remain agile in adapting its HR policies to align with the new legal landscape, ensuring fair compensation and robust employee welfare provisions.

- Minimum Wage Impact: Increases in the national minimum wage, as seen with adjustments in 2024, directly raise Attica Group's payroll expenses for entry-level positions.

- Probationary Period Changes: Modifications to probationary periods can alter hiring flexibility and the initial cost of training new employees.

- Employee Benefit Mandates: New or expanded employee benefit requirements, such as enhanced social security contributions or health coverage, add to the overall cost of employment.

- Compliance Costs: Adhering to updated labor laws necessitates investment in legal counsel and HR system adjustments to ensure full compliance.

Government support for island infrastructure, such as port upgrades, directly benefits Attica Group by enhancing accessibility and potentially reducing operational costs. Policies promoting sustainable tourism could also shape demand for ferry services, as environmentally conscious travelers may prefer sea travel. Visa facilitation and marketing campaigns targeting specific nationalities or travel segments can lead to an influx of tourists, translating into higher passenger numbers for Attica Group.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting the Attica Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights for strategic decision-making, helping to identify potential threats and opportunities within the Group's operating landscape.

Provides a concise version of the Attica Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, ensuring efficient strategy discussions.

Helps support discussions on external risk and market positioning by offering a clear, summarized view of the Attica Group's operating environment during planning sessions.

Economic factors

Fuel price volatility significantly impacts Attica Group's operating costs, as bunker fuel represents a substantial expense. Anticipated increases in fuel costs are expected due to new environmental regulations, such as the SECA rules commencing May 1, 2025, which mandate the use of more costly low-sulfur fuels. This will likely translate to higher ticket prices for consumers and increased operational expenses for the company.

The overall health of the Greek tourism sector is a critical driver for Attica Group's passenger revenue. In early 2025, inbound travel to Greece experienced a notable upswing, with a particular surge from the United States market, reflecting a strong post-pandemic recovery in international leisure travel.

However, potential headwinds exist. The implementation of new environmental regulations is projected to increase ferry ticket prices. This cost increase could potentially dampen demand, especially for domestic travel among Greek residents who are more price-sensitive compared to international tourists.

Attica Group's freight operations are closely tied to economic activity and trade volumes. Increased demand for freight transportation between mainland Greece, its islands, and international routes, particularly to Italy, directly impacts the Group's performance.

In 2024, Attica Group experienced a notable surge in both private vehicle and commercial freight units transported. This growth reflects a healthy level of commercial activity and trade, underscoring the importance of robust economic conditions for the company's freight segment.

Inflation and Cost of Living

Rising inflation in Greece, reaching 4.5% in early 2024 according to Eurostat, directly impacts Attica Group's operational expenses, particularly fuel costs, which are a significant component of ferry operations. This inflationary pressure, coupled with an increasing cost of living, is also affecting consumer behavior. Higher prices for everyday goods mean less disposable income for discretionary spending, including travel.

The elevated cost of ferry tickets, a direct consequence of fuel prices and environmental surcharges, is forcing some Greek citizens to reconsider their holiday plans. For instance, reports in late 2023 indicated a noticeable shift, with some opting for domestic travel closer to home or less expensive leisure activities instead of longer ferry journeys. This trend could lead to a reduction in domestic passenger volumes for Attica Group.

- Inflationary Impact: Greek inflation averaged 3.5% in 2023, impacting operational costs for Attica Group.

- Consumer Behavior: Increased cost of living is leading some Greeks to reduce discretionary spending on travel.

- Ticket Price Sensitivity: Higher ferry ticket prices, driven by fuel and surcharges, are causing a shift to cheaper alternatives.

- Domestic Volume Risk: Potential decline in domestic passenger numbers due to affordability concerns.

Investment and Financing Environment

Attica Group's ambitious fleet renewal and green transition initiatives, backed by a substantial €162 million investment in 2024, are directly shaped by the prevailing investment and financing climate. The availability and cost of capital are critical factors influencing the pace and execution of these significant, capital-intensive projects.

The company's strategic focus on environmental transition and digitization necessitates continuous efforts to secure appropriate funding. This ongoing commitment to modernizing its fleet and operations is intrinsically linked to the broader economic conditions affecting access to credit and equity markets.

- Fleet Renewal Investment: €162 million allocated in 2024 for fleet modernization and green initiatives.

- Financing Dependency: Project success hinges on favorable financing terms and capital availability.

- Strategic Capital Allocation: Ongoing funding efforts support environmental transition and digitization goals.

Attica Group's financial performance is closely tied to the economic health of Greece and its key markets. In 2024, Greece's GDP growth was projected at 2.9%, indicating a positive economic environment that supports travel demand. However, a notable rise in inflation, with the Consumer Price Index reaching 4.5% in early 2024, presents a challenge by increasing operating costs and potentially reducing consumer spending power.

The Group's freight segment benefits from robust trade activity, as evidenced by a significant increase in transported freight units in 2024. This growth aligns with a positive outlook for international trade, though it remains susceptible to global economic slowdowns.

Attica Group's strategic investments in fleet modernization, with €162 million allocated in 2024, are contingent on favorable financing conditions. The cost of capital and access to credit markets are therefore crucial economic factors influencing the company's ability to execute its expansion and sustainability plans.

| Economic Factor | 2023 Data | 2024 Projections/Data | Impact on Attica Group |

|---|---|---|---|

| Greek GDP Growth | 5.6% (Actual) | 2.9% (Projected) | Supports travel demand, but slower growth may temper expectations. |

| Inflation Rate (Greece) | 3.5% (Average) | 4.5% (Early 2024) | Increases operating costs (fuel, supplies) and reduces consumer disposable income. |

| Fuel Prices | Volatile, with upward trend | Expected increase due to SECA rules from May 1, 2025 | Directly impacts operating expenses, potentially leading to higher ticket prices. |

| Consumer Spending on Travel | Strong post-pandemic recovery | Potential dampening due to inflation and higher ticket prices | Risk of reduced domestic passenger volumes if affordability becomes a major concern. |

| Freight Volume | Strong growth | Continued increase in private vehicle and commercial freight units | Positive indicator for trade and economic activity, boosting freight revenue. |

| Investment in Fleet Renewal | N/A | €162 million allocated | Dependent on favorable financing and capital availability. |

Preview Before You Purchase

Attica Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Attica Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the critical external forces shaping the Attica Group's strategic landscape.

Sociological factors

Consumer travel preferences are undergoing a significant transformation, with a notable trend of tourists opting for direct flights to Greek islands, bypassing traditional mainland port arrivals. This shift directly impacts established ferry routes, a core part of Attica Group's operations.

This evolving preference highlights the critical need for enhanced inter-island connectivity. Attica Group may need to adapt its service portfolio and marketing approaches to align with these new travel patterns, potentially exploring more direct island-to-island routes or integrated air-sea travel packages to remain competitive.

Demographic shifts in the Aegean islands, with an aging population and a declining birth rate in some areas, highlight Attica Group's essential role. In 2023, the Greek population aged 65 and over reached approximately 23.5% of the total, a figure that is even more pronounced on many islands. This reliance on ferry services for everything from healthcare appointments to food supplies underscores Attica Group's function as a lifeline, directly impacting the social fabric and daily existence of island communities.

Public perception of safety and security in maritime transport directly impacts passenger confidence and willingness to travel. Attica Group, like all ferry operators, relies heavily on a reputation for safe operations. A recent survey indicated that 75% of Greek travelers prioritize safety above all other factors when choosing a ferry service.

The Greek Ministry of Maritime Affairs and Insular Policy has been actively implementing measures to bolster maritime security. In 2024, the ministry announced a €150 million investment package aimed at upgrading port infrastructure and enhancing surveillance technology across key shipping lanes. These initiatives are crucial for Attica Group, as they directly contribute to a safer travel environment, reinforcing passenger trust and mitigating potential risks to the company's brand image.

Sustainability Consciousness of Travelers

Travelers are increasingly concerned about their environmental footprint, and this awareness is directly impacting their transportation choices. Many are actively seeking out more sustainable travel options, pushing companies to adapt.

Attica Group is responding to this trend by investing heavily in its green transition and modernizing its fleet. This includes introducing new vessels designed with future environmental standards in mind, such as being methanol-ready and featuring battery notation. These initiatives directly address the growing demand for eco-friendlier journeys.

For instance, Attica Group's commitment is evident in its ongoing fleet renewal program, which aims to incorporate vessels that meet stringent environmental regulations. By 2025, the company plans to have a significant portion of its fleet equipped with advanced green technologies, reflecting a proactive approach to sustainability.

- Growing Traveler Demand: Surveys indicate that over 60% of travelers consider sustainability when booking trips.

- Fleet Modernization: Attica Group's investment in new vessels, like the ones for the Piraeus-Heraklion route, prioritizes fuel efficiency and reduced emissions.

- Methanol-Ready Vessels: The inclusion of methanol-ready capabilities positions Attica Group to adapt to future alternative fuels, anticipating industry shifts.

- Battery Notation: The adoption of battery notation on new ships signifies a move towards hybrid or fully electric propulsion, further reducing environmental impact.

Labor Force Availability and Skills

The maritime industry, including companies like Attica Group, grapples with a persistent shortage of skilled seafarers, particularly those adept at managing vessels powered by alternative fuels and equipped with advanced technologies. This skills gap is a significant sociological hurdle.

Greece, recognizing this critical need, has been actively investing in maritime education and training programs throughout 2024. The objective is to cultivate a more competent and adaptable workforce capable of operating Attica Group's increasingly sophisticated fleet.

Key initiatives and statistics highlighting this focus include:

- Increased enrollment in maritime academies: Reports from the Hellenic Ministry of Maritime Affairs and Insular Policy indicated a 15% rise in new student admissions to maritime training institutions in the 2023-2024 academic year, signaling a growing interest in seafaring careers.

- Development of specialized training modules: Several Greek maritime training centers have introduced new courses focused on LNG bunkering, electric propulsion systems, and digital navigation, directly addressing the technological advancements impacting the sector.

- Government incentives for seafarer retention: In late 2024, the Greek government announced new tax incentives for Greek seafarers employed on Greek-flagged vessels, aiming to improve living standards and encourage long-term commitment to the profession.

Attica Group's ability to attract, train, and retain these specialized seafarers will be paramount to its operational efficiency and its successful transition to greener shipping technologies.

The aging demographic on many Greek islands means Attica Group's services are vital for essential travel, from healthcare to daily supplies. With the over-65 population in Greece nearing 23.5% in 2023, the company acts as a crucial link for these communities.

A strong emphasis on safety is paramount for Attica Group, as 75% of Greek travelers prioritize it. Government investments in maritime security, including a €150 million package in 2024 for port upgrades and surveillance, directly support this need.

The growing environmental consciousness among travelers, with over 60% considering sustainability, is driving demand for eco-friendly options. Attica Group's investment in methanol-ready and battery-notation vessels by 2025 directly addresses this trend.

A shortage of skilled seafarers, especially those trained in new technologies, presents a challenge. Greece's 15% increase in maritime academy admissions for the 2023-2024 academic year and new government incentives aim to build a competent workforce for companies like Attica Group.

Technological factors

Attica Group is making substantial investments in modernizing its fleet with a strong focus on green technologies. This includes agreements for new E-Flexer vessels, which are designed to be methanol-ready and equipped with battery notation, signaling a clear commitment to environmental sustainability.

These advanced vessels are engineered to significantly improve fuel efficiency and drastically cut down greenhouse gas emissions. For instance, the E-Flexer series typically offers a 40% reduction in CO2 emissions compared to previous generations, aligning with global efforts towards decarbonization in the maritime sector.

Attica Group is actively driving digitalization across its operations, notably with an integrated slots system for coastal shipping. This initiative aims to automate and streamline ferry operations, enhancing efficiency at ports and improving the customer journey from booking to boarding.

In 2023, Attica Group continued to invest in digital transformation, with a focus on improving operational efficiency and customer satisfaction. The company's digital strategy is designed to leverage technology for better resource management and a more seamless travel experience for its passengers.

The Greek maritime sector is heavily investing in cutting-edge technology to bolster safety both in ports and at sea. This focus on innovation directly benefits companies like Attica Group, enabling them to integrate advanced navigation, communication, and safety systems. These upgrades are crucial for ensuring dependable maritime transportation services and maintaining strict adherence to evolving international safety regulations.

Cybersecurity in Maritime Operations

As Attica Group's operations become more digitized, cybersecurity emerges as a paramount technological factor. Protecting sensitive passenger data, critical operational systems, and financial transactions from escalating cyber threats is non-negotiable for maintaining customer trust and ensuring seamless service delivery.

The maritime industry, including ferry operators like Attica Group, faces a growing threat landscape. In 2024, the maritime sector experienced a significant rise in cyber incidents, with phishing and ransomware attacks being particularly prevalent, impacting operational continuity and data integrity.

- Increased Digitization: Modern maritime operations rely heavily on interconnected digital systems for navigation, communication, passenger management, and ticketing.

- Data Protection: Safeguarding personal passenger information and proprietary operational data is crucial to prevent breaches and maintain regulatory compliance.

- Operational Resilience: Cyberattacks can disrupt scheduling, ticketing, and onboard services, directly impacting revenue and customer experience.

- Financial Security: Protecting financial transactions and payment systems from fraud and theft is essential for business stability.

Port Infrastructure Technology

The modernization of port infrastructure, including the adoption of shore power (OPS) capabilities and efficient loading/unloading technologies, directly impacts Attica Group's vessel turnaround times and environmental footprint in ports. For instance, the European Union's Alternative Fuels Infrastructure Regulation (AFIR) mandates that major ports provide shore power by 2030, a move that will require significant investment from port authorities and potentially streamline operations for ferry companies like Attica Group.

Investments in port upgrades are part of broader government initiatives aimed at enhancing maritime efficiency and sustainability. In Greece, the Hellenic Republic's National Recovery and Resilience Plan includes substantial funding for port modernization projects, focusing on digitalization and green technologies. These upgrades can lead to faster vessel processing, reduced port fees, and lower emissions for Attica Group's fleet.

- Shore Power Adoption: By 2030, major EU ports must offer OPS, reducing emissions and potentially lowering operational costs for Attica Group.

- Loading/Unloading Efficiency: Advanced technologies in ports can decrease vessel turnaround times, improving schedule reliability for Attica Group.

- Government Investment: Greek government initiatives, supported by EU funds, are driving port infrastructure upgrades, benefiting Attica Group's operational efficiency.

Attica Group's technological focus is evident in its fleet modernization, with new E-Flexer vessels designed for methanol readiness and battery integration, aiming for a 40% CO2 reduction. Digitalization is also a priority, with an integrated slots system enhancing port efficiency and the customer experience. The company's 2023 digital strategy emphasizes operational improvements and customer satisfaction through better resource management.

The maritime sector's increasing digitization brings cybersecurity risks, with maritime cyber incidents rising in 2024, particularly phishing and ransomware attacks. Attica Group must protect passenger data and operational systems to maintain trust and service continuity. Financial security is also paramount, safeguarding transactions from fraud.

Port infrastructure upgrades, including shore power (OPS) adoption, are crucial. By 2030, major EU ports must offer OPS, a development supported by Greece's National Recovery and Resilience Plan, which funds port modernization. These advancements promise faster vessel turnaround and reduced emissions for Attica Group.

| Technological Factor | Impact on Attica Group | Key Developments/Data |

|---|---|---|

| Fleet Modernization & Green Tech | Reduced emissions, improved fuel efficiency | E-Flexer vessels: methanol-ready, battery notation, 40% CO2 reduction |

| Digitalization | Streamlined operations, enhanced customer experience | Integrated slots system for coastal shipping; ongoing digital transformation in 2023 |

| Cybersecurity | Protection of data, operational continuity, financial security | Rise in maritime cyber incidents in 2024 (phishing, ransomware) |

| Port Infrastructure | Faster turnaround, reduced emissions, operational efficiency | EU's AFIR mandates OPS by 2030; Greek government funding for port upgrades |

Legal factors

Attica Group operates under a strict framework of International Maritime Organization (IMO) regulations, impacting everything from emissions to safety protocols. These rules are critical for maintaining operational licenses and ensuring environmental responsibility.

A significant upcoming legal factor is the IMO's Sulphur Emission Control Area (SECA) mandate, set to take full effect on May 1, 2025. This regulation compels the use of very low sulfur fuels, which are considerably more expensive than traditional bunker fuels, directly impacting Attica Group's operational expenditures.

Compliance with these evolving IMO standards often necessitates substantial investment in fleet modernization or the adoption of alternative fuel technologies, presenting both a challenge and an opportunity for Attica Group to enhance its long-term sustainability and competitive positioning.

The inclusion of maritime transport in the EU Emissions Trading System (EU ETS) from January 1, 2024, directly impacts Attica Group. The company must now acquire emission allowances for voyages within, or entering/leaving, EU waters. This regulatory shift introduces a new cost structure, with anticipated rising liabilities in 2025 and 2026, which will affect the company's bottom line.

This financial obligation could translate into increased operational expenses for Attica Group, potentially leading to the implementation of surcharges on passenger and cargo tickets to offset these costs. The evolving carbon pricing mechanisms within the EU ETS will be a critical factor in Attica Group's financial planning and pricing strategies moving forward.

Attica Group, particularly following its significant merger with ANEK, operates under the watchful eye of competition law regulators. These bodies scrutinize the combined entity's market share and competitive conduct to prevent monopolistic practices within the Eastern Mediterranean passenger shipping sector.

The Hellenic Competition Commission (HCC) and potentially the European Commission would assess the merger's impact. For instance, if the combined Attica Group-ANEK entity controls over 30% of a specific ferry route, it might trigger a deeper investigation into its market dominance and pricing strategies.

Consumer Protection and Passenger Rights

Regulations safeguarding passenger rights in coastal shipping, such as those mandating clear information provision and compensation for disruptions, significantly influence Attica Group's operational standards and legal obligations. These rules directly impact how the company manages customer expectations and handles service interruptions, ensuring compliance and maintaining passenger trust.

The Greek Ministry of Maritime Affairs and Insular Policy is actively enhancing passenger access to information by developing a new online platform. This initiative aims to empower travelers by providing direct, real-time updates on their rights, potentially increasing scrutiny of ferry operators like Attica Group regarding service quality and adherence to passenger protection laws.

In 2024, the European Union continued to emphasize passenger rights across member states, with ongoing discussions and potential updates to existing directives. For instance, the EU's Passenger Rights Charter outlines specific entitlements for travelers, including compensation for significant delays and cancellations, which directly applies to Attica Group's operations within EU waters.

- Enhanced Information Transparency: New regulations may require more detailed and accessible information about ferry schedules, potential delays, and passenger entitlements before and during travel.

- Compensation Frameworks: Attica Group must adhere to established or evolving compensation policies for passengers affected by cancellations or significant delays, impacting operational costs and customer service protocols.

- Digital Information Access: The development of government-backed online platforms for passenger rights information could lead to increased passenger awareness and a higher likelihood of exercising their rights, demanding greater responsiveness from Attica Group.

- EU Regulatory Alignment: Ongoing EU initiatives to harmonize and strengthen passenger rights across maritime transport necessitate continuous adaptation of Attica Group's policies to meet or exceed these standards.

Crewing and Labor Regulations

Attica Group must navigate a complex web of Greek and international labor laws governing both its seagoing crew and onshore workforce. Compliance with regulations concerning minimum wages, maximum working hours, and mandated safety standards is paramount to avoid penalties and maintain operational integrity.

Recent legislative updates, particularly those impacting seafarer employment conditions and dismissal procedures, require constant vigilance. For instance, the International Labour Organization's Maritime Labour Convention, 2006 (MLC, 2006), sets global standards that Greek law must align with, affecting everything from onboard living conditions to repatriation rights.

- Minimum Wage Adherence: Ensuring all personnel, including foreign crew, receive at least the stipulated minimum wage, which is subject to annual review in Greece.

- Working Hour Limits: Strict adherence to regulated working hours and rest periods for seafarers, often exceeding those for shore-based employees.

- Safety Standards: Compliance with the Safety of Life at Sea (SOLAS) convention and national health and safety legislation for all employees.

- Contractual Provisions: Adherence to regulations regarding employment contracts, including terms for leave, sick pay, and lawful dismissal, which are frequently updated by the Greek Ministry of Labour.

Attica Group faces significant legal challenges from evolving emissions regulations, notably the IMO's SECA mandate effective May 1, 2025, which mandates costly low-sulfur fuels. Furthermore, the EU ETS, implemented in 2024, imposes direct costs for carbon emissions, potentially leading to ticket price increases. Competition law scrutiny, especially post-merger with ANEK, requires careful market conduct assessment, with potential intervention if market share on specific routes exceeds 30%.

| Legal Factor | Impact on Attica Group | Key Dates/Data |

| IMO SECA Mandate | Increased fuel costs due to low-sulfur fuel requirement | Effective May 1, 2025 |

| EU Emissions Trading System (EU ETS) | Additional operational costs for carbon emissions; potential surcharges | Operational from January 1, 2024; liabilities expected to rise in 2025-2026 |

| Competition Law | Scrutiny of market share and competitive practices, particularly on key routes | Potential review if market share exceeds 30% on a route |

| Passenger Rights Regulations | Obligation for transparent information and compensation for disruptions | Ongoing EU directives and national implementations |

| Labor Laws (Maritime Labour Convention) | Compliance with seafarer working hours, wages, and safety standards | MLC, 2006 standards integrated into Greek law |

Environmental factors

The European Union Emissions Trading System (ETS) for shipping, implemented in January 2024, presents a significant environmental compliance hurdle for Attica Group. This system mandates the purchase of emission allowances, with the obligation escalating from 40% in 2024 to 70% in 2025 and a full 100% in 2026. This directly impacts operating expenses and incentivizes faster decarbonization strategies within the company's fleet.

The Mediterranean Sea's designation as a Sulphur Emission Control Area (SECA) effective May 1, 2025, significantly impacts shipping operations. This requires Attica Group to utilize fuels with a maximum sulfur content of 0.1%, a substantial reduction from previous limits.

This regulatory shift necessitates considerable financial adjustments for Attica Group. The cost of compliant low-sulfur fuels is projected to be substantially higher, potentially increasing operational expenses by 15-30% compared to current heavy fuel oil. Alternatively, the group may invest in exhaust gas cleaning systems, known as scrubbers, which represent a significant capital expenditure, estimated to be between $1 million to $5 million per vessel.

Attica Group is making significant strides in decarbonization, prioritizing fleet upgrades to meet environmental targets. Their investment in E-Flexer vessels, designed to be methanol-ready and equipped with battery notation, is a key part of this strategy.

These advanced vessels are projected to slash greenhouse gas emissions by 60% per transport work when compared to their current fleet. This aggressive reduction aligns directly with global decarbonization roadmaps and industry-wide efforts to combat climate change.

Waste Management and Pollution Prevention

Attica Group recognizes that robust waste management and pollution prevention are paramount, particularly given its operations at sea and in port. The company is actively working to minimize its environmental impact. For instance, in 2023, Attica Group reported a reduction in its GHG emission intensity, a key indicator of its commitment to cleaner operations.

The group's strategy includes responsible waste handling across its fleet and facilities. This focus is essential for compliance with evolving environmental regulations and for maintaining its social license to operate.

- GHG Emission Intensity Reduction: Attica Group aims to lower its greenhouse gas emissions per passenger-kilometer.

- Waste Handling Protocols: Implementing strict procedures for managing all types of waste generated onboard and at shore-based facilities.

- Pollution Prevention Measures: Investing in technologies and practices to prevent oil spills, air pollution, and marine litter.

- Regulatory Compliance: Adhering to international and national environmental standards governing maritime operations.

Climate Change Impacts on Maritime Operations

Climate change presents significant long-term challenges for Attica Group's maritime operations. Shifting weather patterns can lead to increased storm frequency and intensity, potentially disrupting schedules and increasing operational costs for fuel and maintenance. For instance, the International Maritime Organization (IMO) has noted a trend towards more severe weather events impacting global shipping lanes.

Rising sea levels also necessitate careful consideration for port infrastructure and coastal facilities. Attica Group must assess the vulnerability of its terminals and assets to inundation, potentially requiring investments in protective measures or relocation strategies. Projections indicate continued sea-level rise throughout the 21st century, impacting coastal regions where many ports are located.

Furthermore, changing ocean currents and the potential opening of new Arctic shipping routes could alter traditional maritime pathways. Attica Group needs to evaluate how these environmental shifts might create both risks and opportunities for its route planning and fleet deployment strategies. The melting of Arctic ice, for example, is opening up new, albeit challenging, transit possibilities.

- Increased operational costs: Due to more frequent extreme weather events impacting fuel consumption and vessel maintenance.

- Infrastructure vulnerability: Ports and terminals face risks from rising sea levels and storm surges.

- Route optimization: Adapting to changing ocean currents and the potential emergence of new shipping lanes.

- Regulatory compliance: Meeting evolving environmental regulations aimed at mitigating climate change impacts within the maritime sector.

Attica Group faces significant environmental pressures, notably the EU Emissions Trading System (ETS) for shipping, which mandates increasing allowance purchases from 40% in 2024 to 100% by 2026, directly impacting operating costs. The Mediterranean SECA designation from May 2025 requires adherence to 0.1% sulfur fuel, a costly shift potentially increasing fuel expenses by 15-30% or necessitating substantial scrubber investments of $1-5 million per vessel. The company is proactively addressing this by investing in methanol-ready E-Flexer vessels, aiming for a 60% reduction in greenhouse gas emissions per transport work compared to its current fleet.

| Environmental Factor | Impact on Attica Group | Key Data/Action |

|---|---|---|

| EU ETS for Shipping | Increased operating costs due to allowance purchases | 40% allowance purchase in 2024, rising to 100% by 2026 |

| Mediterranean SECA | Higher fuel costs or capital expenditure for scrubbers | 0.1% sulfur fuel mandate from May 2025; Scrubber cost: $1-5M/vessel |

| Decarbonization Strategy | Fleet modernization for emission reduction | Investment in methanol-ready E-Flexer vessels; Target: 60% GHG reduction/transport work |

| Climate Change Impacts | Operational disruptions and infrastructure risks | Increased storm frequency, rising sea levels impacting ports |

PESTLE Analysis Data Sources

Our Attica Group PESTLE Analysis is meticulously constructed using data from official maritime industry publications, international shipping organizations, and governmental economic reports. We draw upon regulatory updates, market forecasts, and technological advancements to provide a comprehensive overview.