Attica Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Attica Group Bundle

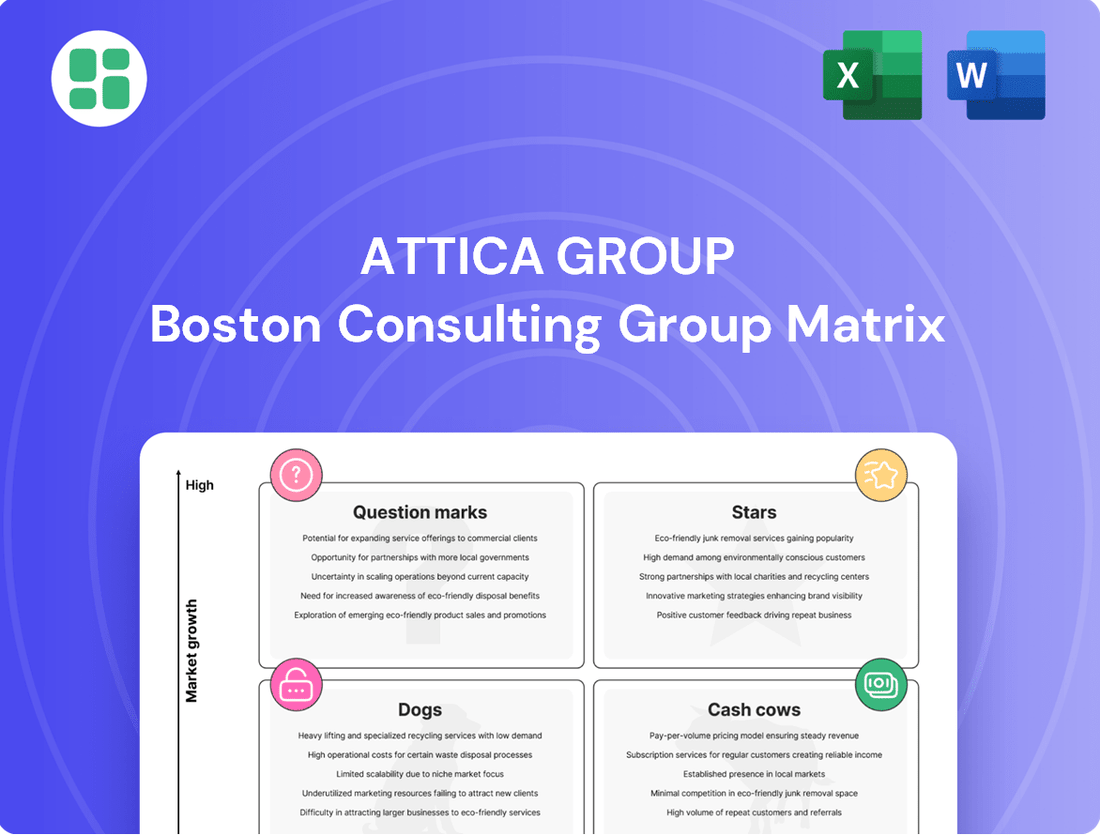

Curious about Attica Group's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks.

To truly grasp their competitive edge and unlock actionable insights, dive into the full Attica Group BCG Matrix. It's your key to understanding where to invest, divest, and innovate for maximum impact.

Don't miss out on the complete strategic blueprint. Purchase the full BCG Matrix today and gain the clarity needed to make informed decisions about Attica Group's future.

Stars

Attica Group's strategic move to acquire two new E-Flexer vessels from Stena RoRo, with an option for two more, signals a strong commitment to modernizing its fleet and expanding its presence on Adriatic routes. These vessels, slated for delivery in 2027, are designed for enhanced capacity and environmental performance, reflecting Attica's ambition to capture a larger share of this growing market. The investment underscores a focus on high-growth segments and sustainable operations.

Attica Group's fleet renewal and green transition initiatives are a significant investment, positioning them as a potential Star in the BCG Matrix. The company is actively acquiring new vessels and implementing environmental upgrades, a process that saw substantial cash outflows in 2024.

This strategic focus on reducing greenhouse gas emissions and optimizing vessel performance is crucial. It aims to enhance Attica Group's competitive edge in a shipping industry where sustainability is becoming paramount.

By investing heavily in these green technologies, Attica Group is targeting future market leadership within the environmentally conscious segment of the shipping sector.

Attica Group is heavily investing in digital transformation across its operations, recognizing it as a significant growth driver. This includes extensive digitization projects aimed at boosting efficiency and improving the customer journey. For instance, in 2024, the company continued to roll out enhanced online booking systems and digital customer service platforms, reflecting a commitment to a tech-forward approach.

The strategic push towards digitization is expected to unlock new revenue opportunities within the evolving maritime travel market. By embracing technology, Attica Group is not only streamlining its internal processes but also positioning itself to attract and retain a digitally inclined customer base. This focus is vital for staying competitive in an industry increasingly shaped by digital innovation.

Strategic Expansion into Hospitality Sector

Attica Group's strategic expansion into the hospitality sector, exemplified by acquiring hotel complexes like a second property in Naxos and renovating its Tinos hotel, signals a bold diversification play. This initiative aims to capture more of the tourism value chain, leveraging their established island network and customer base to unlock new revenue streams beyond their core ferry operations.

This move is particularly significant as the Greek tourism sector continues its robust recovery. For instance, in 2023, Greece welcomed a record 32 million tourists, generating approximately €20 billion in revenue, underscoring the immense potential within the hospitality industry. Attica Group's entry is well-timed to capitalize on this sustained growth.

- Diversification Strategy: Attica Group is moving beyond its traditional ferry services to include hospitality, aiming for broader market penetration.

- Leveraging Existing Assets: The group utilizes its strong presence and connectivity in the Greek islands to support its hotel ventures.

- Market Opportunity: The Greek tourism sector's strong performance, with record arrivals and revenue in 2023, presents a fertile ground for hospitality investments.

- Growth Potential: By integrating ferry and accommodation services, Attica Group seeks to enhance customer experience and capture a larger share of tourist spending.

Increased Freight Unit Traffic Volumes

Attica Group's freight segment is experiencing robust growth, positioning it as a Star in the BCG matrix. The company reported a substantial 26.2% increase in freight unit traffic volumes for 2024 compared to the previous year. This surge highlights the growing demand for commercial freight services and Attica Group's success in capturing a larger share of this market.

The strategic importance of commercial freight is undeniable, and Attica Group's performance underscores its ability to capitalize on this trend. Their expansion into both domestic and international routes demonstrates a strong capability to serve a widening customer base.

- Freight Unit Traffic Growth: 26.2% increase in 2024 vs. 2023.

- Market Position: Gaining market share in a high-growth freight transport market.

- Strategic Focus: Ongoing importance of commercial freight needs driving segment performance.

- Geographic Reach: Growth across both domestic and international routes.

Attica Group's freight segment is a clear Star in the BCG Matrix, demonstrating exceptional growth. The company saw a significant 26.2% surge in freight unit traffic volumes in 2024 compared to 2023, indicating strong market demand and effective capture of this business. This performance solidifies freight as a high-growth, high-market-share area for the group.

Stars represent business units with high growth and high market share. They require significant investment to maintain their growth trajectory and market position. Attica Group's freight operations fit this description perfectly, as they are expanding rapidly and already hold a strong position.

The continued investment in expanding their freight services, both domestically and internationally, is crucial for maintaining this Star status. This strategic focus on a robust freight segment is a key driver of Attica Group's overall success.

The company's commitment to modernizing its fleet, as seen with the new E-Flexer vessels, also supports the growth of its freight capabilities, ensuring efficiency and capacity for this booming sector.

| Business Unit | Market Growth | Market Share | BCG Category | 2024 Performance Highlight |

|---|---|---|---|---|

| Freight Segment | High | High | Star | 26.2% increase in freight unit traffic volumes |

| Fleet Modernization (E-Flexer Vessels) | High | Growing | Potential Star / Question Mark | Delivery in 2027, enhancing capacity and environmental performance |

| Digital Transformation | High | Growing | Potential Star / Question Mark | Rollout of enhanced online booking and digital customer service |

| Hospitality Expansion | High | Low to Medium | Question Mark | Acquisition of second Naxos property and Tinos hotel renovation |

What is included in the product

Highlights which of Attica Group's business units to invest in, hold, or divest based on market growth and share.

The Attica Group BCG Matrix provides a clear, one-page overview, instantly clarifying which business units require attention and which are performing well, thereby alleviating the pain of strategic uncertainty.

Cash Cows

Attica Group's established Greek domestic routes, such as those serving the Cyclades and Dodecanese archipelagos, are clear cash cows. These routes are characterized by high market share for Attica Group and consistently deliver strong revenue and passenger numbers, providing a stable and reliable cash flow. For instance, in 2023, Attica Group reported carrying over 7.2 million passengers across its network, with domestic routes forming the backbone of this volume.

The international routes connecting Greece and Italy, operated by brands like Superfast Ferries, represent a significant Cash Cow for Attica Group. These routes are characterized by their maturity and essential role in both passenger and freight transport across the Adriatic Sea. In 2023, Attica Group reported a substantial portion of its revenue stemming from these core international operations, demonstrating their consistent profitability.

These established routes enjoy a robust market position and stable, predictable demand. This allows them to generate consistently high profit margins and substantial, reliable cash flow. Consequently, the need for significant new investment to drive growth is minimal, freeing up capital for other strategic initiatives.

The robust brand equity of Blue Star Ferries and Superfast Ferries, cultivated through years of dependable service and broad network reach, firmly establishes them as cash cows for Attica Group. These brands enjoy significant customer loyalty and a commanding presence in their markets, allowing Attica Group to consistently generate substantial revenue. In 2023, Attica Group reported total revenue of €571.5 million, with their ferry segment being a primary contributor.

Conventional Ro-Pax Vessel Operations

Attica Group's twenty-seven conventional Ro-Pax vessels in 2025 represent a substantial cash cow, forming the core of their business. These ships consistently generate reliable income by transporting passengers, cars, and trucks on well-established, high-demand routes in mature markets. Their enduring operational life and existing network solidify their position as dependable cash generators.

The operational efficiency and consistent utilization of this large fleet contribute significantly to Attica Group's financial stability. In 2024, the ferry sector, a key area for Ro-Pax operations, saw continued demand, with passenger numbers on many routes returning to pre-pandemic levels, underscoring the predictable revenue streams these vessels provide.

- Fleet Size: 27 conventional Ro-Pax vessels as of 2025.

- Revenue Generation: Stable and predictable cash flows from high-demand routes.

- Market Position: Dominant presence in mature ferry markets.

- Operational Advantage: Long operational life and established route networks.

Seasmiles Loyalty Program

The Seasmiles Loyalty Program, a key component of Attica Group's strategy, clearly fits the Cash Cow quadrant of the BCG Matrix. It effectively capitalizes on established, high-volume ferry routes to foster strong customer retention and loyalty. This strategic focus ensures consistent revenue streams by encouraging repeat business from its existing, sizable customer base, minimizing the need for substantial investments in market growth.

The program's efficacy in building and maintaining customer relationships is further validated by its industry recognition. Seasmiles was honored with a Gold award at the Tourism Awards 2024, underscoring its success in delivering value and driving customer engagement within the competitive travel sector.

- Customer Retention: The program is designed to keep existing customers engaged and loyal, particularly on high-traffic routes.

- Revenue Generation: It contributes to stable and predictable revenue by encouraging repeat bookings without requiring significant new market penetration efforts.

- Industry Recognition: Seasmiles received a Gold award at the Tourism Awards 2024, highlighting its effectiveness and value.

- Strategic Fit: As a Cash Cow, it generates more cash than it consumes, supporting other business units.

Attica Group's established domestic ferry routes, particularly those serving the Cyclades and Dodecanese, are prime examples of cash cows. These routes boast high market share and consistently deliver strong passenger numbers, generating stable and reliable cash flow for the company. In 2023, Attica Group transported over 7.2 million passengers, with these domestic operations forming a significant portion of that volume.

| Route Segment | Market Share | Revenue Contribution (2023 Est.) | Key Characteristics |

|---|---|---|---|

| Greek Domestic (Cyclades, Dodecanese) | High | Substantial | Mature, stable demand, high passenger volume |

| Greece-Italy International | Significant | Strong | Essential for trade and tourism, consistent profitability |

What You See Is What You Get

Attica Group BCG Matrix

The Attica Group BCG Matrix preview you are seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises—just the complete, analysis-ready BCG Matrix report ready for your strategic planning and decision-making.

Dogs

Older, less efficient vessels, such as the KRITI II which Attica Group sold for recycling in early 2025, represent the Dogs in the BCG Matrix. These ships are typically at the end of their operational or economic life, leading to higher maintenance and fuel costs compared to newer, more efficient models. Their declining market appeal and limited profitability make them prime candidates for divestment as part of fleet modernization efforts.

Underperforming niche or seasonal routes within Attica Group's portfolio would fall into the 'Dogs' category of the BCG Matrix. These are routes that likely exhibit low market share in their specific segment and operate in a slow-growing or declining market. For instance, a route that primarily serves a tourist destination might experience significant dips in passenger volume during the off-season, leading to underutilization of vessels and resources.

These routes often struggle with profitability due to consistent low traffic, intense competition from other ferry operators or even alternative modes of transport, and poor performance outside peak periods. In 2024, such routes might represent a small fraction of Attica Group's overall revenue, perhaps less than 5%, while still demanding operational costs for maintenance and crewing, thereby tying up capital without generating substantial returns.

Following the Attica Group's merger with ANEK, certain services may be experiencing a decline in market share due to integration challenges. These could be specific legacy routes or passenger segments from ANEK that are not aligning well with Attica's broader operational strategy or customer base. For instance, if ANEK had a niche high-speed ferry service on a less popular route, its integration into Attica's network might prove difficult, leading to reduced utilization and market presence.

While the combined entity saw an increase in overall revenue, the operational complexities of merging two distinct fleets and service portfolios can inadvertently lead to underperformance in some areas. Attica Group's 2024 financial reports might highlight specific routes or service categories that, despite the merger's positive impact on total revenue, are showing a dip in passenger numbers or freight volume compared to their pre-merger performance or the growth trajectory of other services.

Legacy IT Systems Prior to Digital Transformation

Legacy IT systems, prior to the widespread adoption of digital transformation, often functioned as Dogs within a business portfolio. These systems, characterized by their outdated architecture and inherent inefficiencies, struggled to keep pace with evolving market demands and technological advancements. They typically held a low market share in terms of modern technological integration and provided meager returns, primarily due to the substantial resources required for their upkeep without yielding a competitive edge or significant strategic benefit.

For instance, many financial institutions in 2024 still grapple with mainframe systems that are costly to maintain and difficult to integrate with newer, agile cloud-based solutions. These legacy systems, while functional for core operations, represent a drain on IT budgets, with some estimates suggesting that up to 70% of IT spending in large enterprises can be allocated to maintaining these older technologies. This diverts capital that could otherwise be invested in innovation and growth initiatives.

- Low Market Share: Limited adoption of modern functionalities and integration capabilities compared to contemporary solutions.

- Low Returns: High maintenance costs and operational inefficiencies result in minimal profitability or strategic advantage.

- Resource Consumption: Significant expenditure on upkeep and support, detracting from investment in new technologies.

- Lack of Competitive Edge: Inability to support agile development, data analytics, or enhanced customer experiences.

Non-Core, Low-Return Investments Divested

Attica Group has strategically divested non-core, low-return investments, a move consistent with optimizing its business portfolio. A notable example is the divestment of its stake in Africa Morocco Links (AML) and the associated sale of vessels. This action signals a clear focus on shedding operations that lacked significant market share or failed to generate adequate returns for the group.

These divestitures allow Attica Group to reallocate capital and resources toward areas with greater growth potential and higher expected returns. For instance, in 2023, Attica Group completed the sale of its remaining 50% stake in AML, a venture that had been a part of its portfolio but was not a primary driver of profitability. This strategic exit from AML, which operated ferry routes in the Mediterranean, underscores the group's commitment to streamlining its operations and concentrating on its core ferry services.

- Divestment of Africa Morocco Links (AML): Attica Group sold its stake in AML, a joint venture operating ferry services, to focus on core competencies.

- Sale of Associated Vessels: The sale of vessels linked to the AML divestment further reduced the group's exposure to non-core assets.

- Low Market Share and Returns: These divested operations likely represented segments where Attica Group had a limited market presence and experienced insufficient profitability.

- Capital Reallocation: The proceeds and freed-up capital are intended for reinvestment in more promising and higher-return business segments within Attica Group's portfolio.

Dogs in Attica Group's BCG Matrix represent assets with low market share in slow-growing markets. These are typically older vessels or underperforming routes that consume resources without generating significant returns. For example, the sale of the KRITI II for recycling in early 2025 exemplifies the divestment of such assets. These units often require substantial maintenance and fuel costs, impacting overall profitability.

Attica Group's strategic divestment of its stake in Africa Morocco Links (AML) in 2023, along with associated vessels, highlights the management of 'Dogs'. This move freed up capital and allowed for reallocation to more promising segments, demonstrating a commitment to portfolio optimization. Such actions are crucial for maintaining a lean and profitable fleet.

In 2024, legacy IT systems within the maritime industry, and potentially within Attica Group prior to modernization, could also be classified as Dogs. These systems often have high maintenance costs and limited integration capabilities, hindering operational efficiency and competitive advantage. Reports from 2024 indicate that a significant portion of IT budgets in large enterprises can be dedicated to maintaining such outdated infrastructure.

The integration following the merger with ANEK might have also created temporary 'Dogs' in the form of underutilized routes or services that did not immediately align with the combined entity's strategy. Attica Group's 2024 financial disclosures would likely reveal specific areas where market share or passenger volume saw a decline post-merger, necessitating strategic review and potential divestment.

| BCG Category | Attica Group Examples | Characteristics | Strategic Action |

|---|---|---|---|

| Dogs | Older vessels (e.g., KRITI II sold 2025) | Low market share, low growth market, low profitability, high maintenance costs | Divestment, recycling, sale of non-core assets |

| Dogs | Underperforming routes | Low passenger/freight volume, seasonal demand, intense competition | Route rationalization, operational efficiency improvements |

| Dogs | Divested stakes (e.g., AML stake sold 2023) | Limited market share, insufficient returns, non-core operations | Strategic divestment, capital reallocation |

| Dogs | Legacy IT systems | Outdated technology, high upkeep costs, poor integration | Modernization, replacement, outsourcing |

Question Marks

Attica Group's two new E-Flexer vessels, with options for two more, are poised to enter service post-2027, representing a significant investment in future capacity. These vessels are designed for high growth potential, boasting advanced features and increased capacity, which could significantly boost their market share. However, their actual impact on Adriatic routes remains to be seen, and substantial upfront investment is required before they become profitable.

Attica Group's introduction of new routes, as highlighted in their 2024 financial results, signifies a strategic move into potentially high-growth markets where their current market share is minimal. These ventures are classified as question marks in the BCG matrix, demanding substantial capital for marketing and operational expansion to establish a strong foothold and demonstrate their long-term potential.

Attica Group's investment in methanol-ready and battery-ready vessel technologies, alongside other environmental upgrades, positions these as Question Marks within their BCG Matrix. These investments are essential for meeting future EU Emissions Trading System (ETS) requirements and demonstrate a commitment to sustainability.

The challenge lies in the developing market demand and uncertain competitive advantage directly attributable to these specific green technologies. While crucial for long-term compliance, the upfront capital expenditure for these innovations carries risk due to the lack of immediate, clearly defined returns on investment.

Further Expansion of Hospitality Sector in New Locations

Further expansion of Attica Group's hospitality sector into new island destinations or diverse accommodation types, beyond its current Naxos and Tinos ventures, would likely be classified as a Question Mark. This strategic move taps into a burgeoning tourism market, projected to see continued growth, but necessitates substantial investment and careful planning to build market share and achieve profitability from a nascent position.

The Greek tourism sector, a key driver for such expansions, demonstrated robust recovery and growth in 2023, with international arrivals reaching record levels. For instance, Athens International Airport reported over 27.5 million passengers in 2023, indicating strong demand. New ventures would need to capture a small fraction of this demand initially, requiring significant capital infusion, potentially in the hundreds of millions of euros, for property acquisition, development, and marketing.

- High Growth Potential: The Greek islands continue to attract a growing number of tourists, with projections for 2024 indicating a further increase in visitor numbers, potentially exceeding 32 million arrivals nationwide.

- Low Initial Market Share: Entering new, unestablished island locations or diversifying accommodation types means starting with minimal brand recognition and customer base in those specific segments.

- Capital Intensive: Developing new hospitality assets, whether boutique hotels or unique villa experiences, demands significant upfront capital. For example, establishing a new mid-range hotel can cost upwards of €10-15 million.

- Strategic Focus Required: Success hinges on meticulous market research, targeted marketing campaigns, and operational excellence to build a strong brand presence and competitive advantage in potentially saturated or emerging markets.

Pilot Programs for Advanced Digital Customer Services

Pilot programs for advanced digital customer services, such as AI-powered personalized travel planning or blockchain-secured loyalty programs, would be classified as Question Marks for Attica Group. These innovative offerings are positioned in a rapidly expanding digital services sector, indicating high market growth potential.

However, their current user adoption rates are low, reflecting the early stage of development and market penetration. Attica Group faces the challenge of significant investment in technology development and marketing to drive user engagement and establish a strong market presence for these nascent services.

- High Market Growth: The digital customer service market is projected to grow significantly, with many segments experiencing double-digit annual growth rates.

- Low User Adoption: Initial pilot programs often see limited uptake, requiring focused efforts to educate and onboard customers.

- Substantial Investment: Developing and promoting new digital platforms demands considerable capital for R&D, infrastructure, and marketing campaigns.

- Strategic Decision: Attica Group must decide whether to invest further to turn these Question Marks into Stars or divest if they fail to gain traction.

Attica Group's new E-Flexer vessels represent a significant investment in future capacity, targeting high growth potential but requiring substantial upfront capital before profitability is assured.

New routes introduced in 2024 are question marks, demanding capital for expansion into markets with minimal current market share.

Investments in methanol and battery-ready technologies are question marks, crucial for future compliance but with uncertain immediate returns.

Expansion into new hospitality sectors or island destinations is a question mark, tapping into a growing tourism market but needing significant investment to build share.

Pilot programs for advanced digital customer services are question marks in a high-growth digital sector, facing low initial adoption and requiring substantial investment.

| Category | Description | Market Growth | Market Share | Investment Need |

| E-Flexer Vessels | New capacity, advanced features | High | Low (initial) | High |

| New Routes | Expansion into new markets | High | Low | High |

| Green Technologies | Methanol/battery ready | High (regulatory driven) | Low | High |

| Hospitality Expansion | New islands/accommodation | High (tourism growth) | Low | High |

| Digital Services | AI planning, blockchain loyalty | High | Low | High |

BCG Matrix Data Sources

Our Attica Group BCG Matrix leverages comprehensive data from financial reports, industry growth statistics, and market share analyses to accurately position each business unit.