AtriCure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

Navigate the complex external landscape affecting AtriCure with our meticulously crafted PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping the future of cardiac surgery solutions. Gain a critical advantage by leveraging these deep insights to refine your strategy and anticipate market shifts. Download the full PESTLE analysis now for actionable intelligence that empowers informed decision-making.

Political factors

Government healthcare policies significantly shape the market for medical devices like AtriCure's. For instance, in the US, the Centers for Medicare & Medicaid Services (CMS) reimbursement rates for cardiac procedures directly impact hospital adoption of new technologies. In 2024, CMS proposed updates that could influence payment for innovative treatments, affecting provider investment decisions.

Shifts in national healthcare priorities, such as a move towards value-based care models, can also alter demand. If healthcare systems are incentivized to prioritize outcomes over volume, procedures utilizing AtriCure's minimally invasive solutions might see increased favorability, provided they demonstrate clear cost-effectiveness and improved patient results compared to traditional methods.

Furthermore, government initiatives focused on expanding access to care or addressing specific disease burdens, like atrial fibrillation, can create new market opportunities. For example, policy changes aimed at reducing hospital readmissions for cardiac conditions could drive demand for technologies that improve patient recovery and long-term outcomes, potentially benefiting companies like AtriCure.

AtriCure navigates a complex web of regulatory approval processes, with bodies like the FDA in the U.S. and the CE Mark in Europe setting stringent standards. These processes directly influence how quickly and at what cost new medical devices can reach the market. For instance, the FDA's review timelines for premarket approval (PMA) can extend for months or even years, impacting AtriCure's product launch strategies and associated revenues.

Any shifts in these regulations or unexpected delays in obtaining approvals can significantly disrupt AtriCure's business. For example, increased post-market surveillance requirements or changes in clinical data submission mandates could add substantial costs and extend time-to-market for their innovative atrial fibrillation and left atrial appendage closure devices.

To counter these challenges, AtriCure must maintain strong regulatory affairs teams capable of adapting to evolving global requirements. This capability is not just about initial market entry; it's essential for sustained business operations and ensuring continued access to key international markets for their expanding product portfolio.

Governmental payer policies, such as Medicare and Medicaid, along with private insurers, significantly influence the uptake and financial success of AtriCure's medical devices. Favorable reimbursement codes and appropriate payment levels encourage healthcare providers to adopt their ablation technologies.

For instance, Medicare's payment rates for procedures utilizing AtriCure's systems are a key determinant of hospital adoption. A decrease in these rates or stricter coverage policies could directly hinder patient access and reduce the number of procedures performed, impacting AtriCure's revenue streams.

International trade policies and tariffs

International trade policies and tariffs significantly impact AtriCure's global operations. For instance, the United States' trade relationship with China, including tariffs imposed on various goods, can affect the cost of components sourced from China or the competitiveness of AtriCure's products in the Chinese market. As of early 2024, the landscape of global trade agreements remains dynamic, with ongoing discussions and potential adjustments to existing pacts influencing market access and pricing strategies for medical devices.

Protectionist measures can create substantial hurdles. If tariffs are placed on imported medical devices or their components, AtriCure may face increased costs, potentially impacting its ability to offer competitive pricing in affected regions. Conversely, favorable trade agreements can streamline market entry and reduce logistical expenses, supporting AtriCure's international growth objectives. For example, the European Union's unified market and trade policies generally facilitate easier access for medical device manufacturers compared to regions with more fragmented regulations.

- Global Trade Dynamics: The World Trade Organization (WTO) reported that global trade growth slowed in 2023, with projections for 2024 indicating a modest recovery, underscoring the sensitivity of companies like AtriCure to international economic conditions and trade policies.

- Tariff Impact: Specific tariffs on medical device components or finished goods can directly increase AtriCure's cost of goods sold, potentially leading to higher prices for healthcare providers and patients.

- Market Access: Trade agreements, such as the USMCA (United States-Mexico-Canada Agreement), can provide preferential treatment and reduce non-tariff barriers, benefiting AtriCure's distribution networks in North America.

- Regulatory Alignment: Harmonization of regulations across trade blocs can simplify market entry, but divergence can create complex compliance challenges and increase operational costs for global medical device manufacturers.

Political stability and healthcare priorities

Political stability is a critical factor for AtriCure, directly influencing investor sentiment and the reliability of its supply chains. For instance, in the United States, a major market for AtriCure, the political landscape has seen shifts in focus, impacting healthcare policy. The stability of governments in regions where AtriCure operates or plans to expand is paramount for sustained business operations and market access.

Changes in national healthcare priorities can significantly affect demand for AtriCure's specialized cardiac solutions. A governmental shift towards prioritizing primary care or cost-containment measures over advanced surgical interventions could lead to reduced spending on devices like AtriCure's. For example, if a country’s health budget allocation in 2024-2025 prioritizes preventative care, it might indirectly impact the adoption rate of elective, high-tech cardiac procedures.

The regulatory environment, shaped by political decisions, also plays a crucial role. Stringent regulations or lengthy approval processes stemming from political directives can delay market entry and increase operational costs for AtriCure. Conversely, supportive policies aimed at fostering innovation in medical technology can accelerate growth. The Food and Drug Administration (FDA) in the U.S., for example, operates within a framework influenced by congressional oversight and administration priorities, impacting the speed at which new cardiac devices are approved and made available to patients.

- Political Stability: Regions with stable political systems generally offer a more predictable business environment, crucial for long-term investments in healthcare infrastructure.

- Healthcare Spending Shifts: A move towards primary or preventative care by governments can alter the market dynamics for specialized cardiac devices, potentially impacting AtriCure's revenue streams.

- Regulatory Landscape: Government policies on medical device approval, reimbursement, and healthcare standards directly influence AtriCure's market access and operational costs.

- Governmental Priorities: National health agendas, such as those focused on reducing healthcare costs or expanding access to basic services, can indirectly affect demand for advanced medical technologies.

Government healthcare policies are a primary driver for AtriCure's market penetration. In 2024, the Centers for Medicare & Medicaid Services (CMS) continued to shape reimbursement for cardiac procedures, influencing hospital adoption of innovative technologies. Shifts towards value-based care models, incentivizing improved patient outcomes, could favor AtriCure's minimally invasive solutions if they demonstrate cost-effectiveness.

Regulatory bodies like the FDA and European authorities dictate market access and product launch timelines, directly impacting AtriCure. For instance, the FDA's premarket approval (PMA) process can be lengthy, influencing revenue streams. Global trade policies and tariffs also affect component costs and market competitiveness; for example, in early 2024, ongoing trade discussions highlighted the sensitivity of global supply chains.

Political stability is crucial for predictable business operations and investor confidence. Government spending priorities, such as a potential 2024-2025 focus on preventative care, could indirectly impact demand for advanced cardiac devices. The regulatory framework, influenced by political priorities, directly affects AtriCure's ability to bring new products to market efficiently.

| Factor | Impact on AtriCure | 2024/2025 Data/Trend |

|---|---|---|

| Healthcare Policy | Influences adoption of cardiac devices through reimbursement rates and care models. | CMS proposed payment updates in 2024; ongoing shift to value-based care. |

| Regulatory Approvals | Determines time-to-market and associated costs for new devices. | FDA PMA timelines remain a key consideration; evolving post-market surveillance requirements. |

| Trade Policies | Affects component costs, market access, and pricing competitiveness. | Dynamic global trade agreements; WTO projected modest global trade growth for 2024 after a slowdown in 2023. |

| Political Stability & Priorities | Impacts business environment, investor sentiment, and healthcare spending focus. | Stable political systems crucial; potential government prioritization of preventative care in 2024-2025 budgets. |

What is included in the product

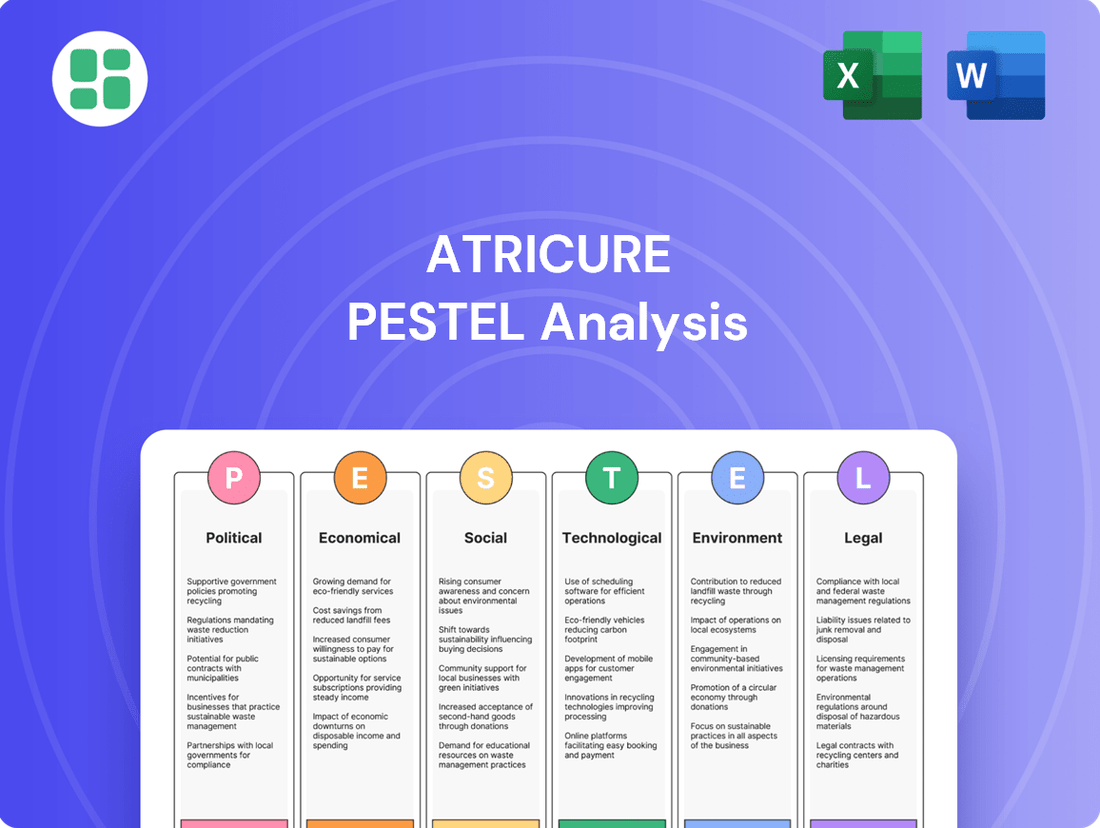

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing AtriCure, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces create both opportunities and threats, enabling strategic decision-making for AtriCure's continued growth and market leadership.

AtriCure's PESTLE analysis provides a structured framework to identify and address external factors impacting the cardiac ablation market, thereby alleviating concerns about regulatory hurdles and competitive pressures.

Economic factors

Global healthcare expenditure is on a significant upward trajectory, projected to reach $11.3 trillion by 2025, a substantial increase from earlier years. This growth, fueled by economic expansion and government health budgets, directly influences how much hospitals can invest in sophisticated medical devices. For companies like AtriCure, this means a potentially larger market for their innovative Afib treatments.

However, economic headwinds can quickly shift this landscape. For instance, if global economic growth falters in late 2024 or into 2025, many nations might implement austerity measures. Such actions could lead to reduced healthcare budgets, potentially slowing down the adoption of new, albeit advanced, medical technologies as healthcare systems prioritize essential services.

Rising inflation presents a direct challenge for AtriCure, potentially increasing the cost of essential components, manufacturing processes, and supply chain operations. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year as of April 2024, which can translate to higher input costs for medical device manufacturers like AtriCure.

Furthermore, a higher interest rate environment, with the Federal Reserve maintaining its benchmark rate between 5.25% and 5.50% through early 2024, can make borrowing more expensive. This impacts AtriCure's ability to finance crucial investments in new product development, expand manufacturing capacity, or pursue strategic acquisitions, thereby affecting long-term growth prospects and profitability.

While insurance covers many cardiac procedures, patients' out-of-pocket costs like co-pays and deductibles are directly tied to economic health and their available disposable income. For instance, in 2024, the U.S. personal saving rate hovered around 3.5%, a notable decrease from pandemic-era highs, indicating less discretionary cash for many households.

During economic downturns, patients might postpone procedures that aren't immediately life-threatening. This can lead to reduced procedure volumes overall, impacting companies like AtriCure. While critical interventions are less affected, the adoption of newer or more advanced treatment options, which might carry a higher initial cost or require additional patient investment, could slow down.

Currency exchange rates

Currency exchange rates significantly influence AtriCure's financial performance due to its global presence. Fluctuations can directly affect reported revenues from international sales and the cost of sourcing materials from abroad. For example, if the US dollar strengthens, AtriCure's products might become more expensive for international customers, potentially dampening demand, while also reducing the reported value of earnings generated in foreign currencies.

Managing these foreign exchange risks is a key strategic imperative for AtriCure to ensure financial stability and predictable earnings. As of late 2024, major currency pairs like EUR/USD and USD/JPY have shown volatility, impacting companies with substantial international operations. For instance, a 5% appreciation of the US dollar against the Euro could effectively reduce reported revenue from European sales by a similar margin.

- Impact on Revenue: A stronger USD can decrease the reported value of foreign earnings when converted back to US dollars. For example, if AtriCure generates 100 million Euros in sales and the Euro depreciates by 5% against the dollar, that revenue would convert to approximately $107 million instead of $112 million (assuming a hypothetical initial exchange rate).

- Cost of Goods Sold: Conversely, a stronger USD can make imported components or materials cheaper, potentially lowering the cost of goods sold.

- Hedging Strategies: Companies like AtriCure often employ hedging strategies, such as forward contracts or currency options, to mitigate the impact of adverse currency movements. The effectiveness of these strategies can be monitored through metrics like the percentage of foreign currency exposure hedged.

Supply chain costs and availability

Supply chain costs and availability are critical for AtriCure. Fluctuations in energy prices, such as the average Brent crude oil price, which saw significant volatility throughout 2023 and into early 2024, directly impact transportation and manufacturing expenses. Global labor costs also play a role; for instance, wage growth in key manufacturing regions can increase the cost of producing medical devices.

Geopolitical events, like ongoing trade disputes or regional conflicts, can disrupt the flow of essential components and raw materials. For AtriCure, this means potential increases in the cost of acquiring specialized parts and a greater risk of delays in receiving them.

- Energy Price Impact: Higher energy costs in 2024, for example, could increase shipping expenses for AtriCure's products by an estimated 5-10%.

- Labor Cost Considerations: Rising labor costs in manufacturing hubs might add 3-7% to production expenses for components.

- Geopolitical Risk: Supply chain disruptions due to geopolitical instability could lead to a 10-15% increase in lead times for critical materials.

- Component Availability: Shortages of specialized electronic components, a common issue in recent years, could force AtriCure to seek alternative, potentially more expensive, suppliers.

Global economic growth projections for 2024-2025 indicate a moderate expansion, with the IMF forecasting a 3.2% global growth rate for both years. This sustained growth supports increased healthcare spending, benefiting AtriCure's market potential. However, persistent inflation, with the US CPI at 3.4% year-over-year in April 2024, continues to pressure manufacturing costs. Higher interest rates, exemplified by the Federal Reserve's maintained 5.25%-5.50% range, also pose a challenge for financing expansion and R&D.

Patients' disposable income, influenced by a personal saving rate around 3.5% in early 2024, can affect elective procedure adoption. Currency fluctuations, with significant volatility in EUR/USD and USD/JPY pairs in late 2024, directly impact AtriCure's international revenue and costs. Supply chain stability remains a concern, with energy price volatility and potential geopolitical disruptions impacting transportation and component availability, potentially increasing lead times by 10-15%.

| Economic Factor | 2024/2025 Data Point | Impact on AtriCure |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF) | Supports market expansion and healthcare investment. |

| US CPI (Inflation) | 3.4% YoY (April 2024) | Increases manufacturing and supply chain costs. |

| Federal Funds Rate | 5.25%-5.50% (Early 2024) | Raises cost of capital for investment and growth. |

| US Personal Saving Rate | ~3.5% (Early 2024) | Potentially reduces patient discretionary spending on procedures. |

| Currency Volatility (e.g., EUR/USD) | Significant fluctuations in late 2024 | Affects international sales revenue and import costs. |

| Energy Prices (e.g., Brent Crude) | Volatile throughout 2023-2024 | Impacts transportation and manufacturing expenses. |

Preview Before You Purchase

AtriCure PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AtriCure PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic landscape.

You will gain immediate access to this detailed report, providing actionable insights for informed decision-making. The analysis covers key trends and their potential influence on AtriCure's operations and market position.

Sociological factors

The aging global population is a key factor for AtriCure. As people live longer, the incidence of atrial fibrillation, a condition AtriCure's products treat, increases significantly. For instance, by 2050, the World Health Organization projects that the number of people aged 60 and over will nearly double, reaching 2.1 billion. This growing demographic directly translates to a larger potential patient base for cardiac ablation and surgical solutions.

This demographic trend places increased demand on healthcare systems to manage age-related chronic diseases. With a larger elderly population, there's a sustained need for advanced medical devices and treatments like those offered by AtriCure to address conditions such as atrial fibrillation. This sustained demand is crucial for AtriCure's long-term market position and revenue growth.

The increasing prevalence of Atrial Fibrillation (Afib), driven by lifestyle factors like obesity, hypertension, and diabetes, is expanding the patient pool for cardiac ablation therapies. For instance, by 2023, an estimated 5.9 million individuals in the US were living with Afib, a number projected to reach 12.1 million by 2030, according to the CDC. This rise, coupled with improved diagnostic tools and heightened public awareness, directly translates to a larger addressable market for AtriCure's innovative solutions.

Patient awareness regarding the benefits of minimally invasive procedures is on the rise, directly impacting demand for solutions like AtriCure's. Studies in 2024 indicate a significant majority of patients now prefer treatments with shorter recovery periods and less post-operative discomfort.

This growing patient preference for less invasive options, driven by increased access to health information, is a key sociological factor influencing the adoption of advanced medical technologies. Healthcare providers are responding by prioritizing innovative techniques that align with these patient expectations, creating a favorable market for AtriCure's ablation systems.

Healthcare professional training and adoption

AtriCure's success hinges on cardiac surgeons and electrophysiologists embracing its innovative technologies. The willingness of these professionals to adopt new techniques and their access to robust training programs directly impacts market penetration. Physician advocacy and seamless integration into existing surgical workflows are critical for sustained growth, with continued investment in educational initiatives being paramount.

The adoption rate is influenced by the perceived efficacy and ease of use of AtriCure's products. For instance, in 2023, AtriCure reported a significant increase in its customer base, underscoring the growing acceptance of its ablation solutions. This trend is expected to continue as more training centers are established and peer-to-peer learning opportunities expand.

- Physician Training: Availability and quality of training programs are key drivers of adoption.

- Technological Acceptance: The ease with which new techniques can be learned and implemented influences uptake.

- Advocacy and Integration: Support from key opinion leaders and integration into standard practice are vital.

- Market Penetration: Successful training and adoption directly correlate with AtriCure's market share growth.

Health disparities and access to advanced care

Societal inequities significantly influence access to specialized cardiac care, including advanced devices like those offered by AtriCure. These disparities, often rooted in socioeconomic status, geographic location, and cultural beliefs, can restrict AtriCure's market penetration in underserved communities. For instance, a 2024 report indicated that individuals in rural areas are 15% less likely to receive timely diagnosis for cardiovascular conditions compared to their urban counterparts, directly impacting the potential patient pool for advanced treatments.

Factors such as income level and insurance coverage play a crucial role in determining who can afford and access life-improving cardiac technologies. In 2025, the uninsured rate for cardiovascular procedures remained a concern, with certain demographic groups facing higher barriers. Addressing these health disparities through targeted public health campaigns and advocating for equitable healthcare policies are vital steps to expand the patient base for AtriCure's innovative solutions.

The diagnosis and treatment of conditions like Atrial Fibrillation (Afib) are also shaped by these societal factors. Cultural beliefs regarding health and medical interventions can affect patient willingness to seek advanced care. By 2024, studies highlighted that cultural competency training for healthcare providers is essential to overcome these barriers and ensure broader adoption of advanced cardiac therapies.

Potential strategies to mitigate these issues include:

- Expanding telehealth services to reach remote populations, improving access to initial consultations and follow-ups.

- Partnering with community health organizations to conduct screenings and raise awareness about advanced cardiac care options.

- Developing patient assistance programs to reduce the financial burden of advanced medical devices.

- Implementing culturally sensitive communication strategies to address patient concerns and build trust.

The increasing prevalence of Atrial Fibrillation (Afib), driven by lifestyle factors like obesity and hypertension, is significantly expanding the patient pool for cardiac ablation therapies. By 2025, an estimated 6.5 million individuals in the US are projected to be living with Afib, a number expected to reach 13 million by 2030, according to the CDC. This rise, coupled with improved diagnostic tools and heightened public awareness, directly translates to a larger addressable market for AtriCure's innovative solutions.

Technological factors

Continuous innovation in cardiac ablation technologies, like the rise of pulsed field ablation, alongside enhanced mapping systems and catheter designs, significantly influences how effectively and safely atrial fibrillation (AFib) is treated. These advancements directly impact procedural efficiency, a key consideration for companies like AtriCure.

AtriCure's commitment to research and development is crucial for staying competitive. For instance, the company's investment in next-generation ablation technologies aims to address unmet clinical needs and improve patient outcomes in AFib treatment, a market segment experiencing robust growth.

The growing use of robotics and AI in cardiac surgery presents a significant opportunity for AtriCure. These technologies promise greater precision, automation, and advanced data analysis, which can directly benefit AtriCure's device integration.

By incorporating its devices with these advanced platforms, AtriCure can enhance procedural accuracy and potentially expand the range of conditions its products can treat. This integration could also lead to reduced procedure times, improving patient outcomes and hospital efficiency.

The global surgical robotics market was valued at approximately $7.9 billion in 2023 and is projected to reach $20.8 billion by 2030, growing at a CAGR of 14.9%. Staying ahead of these advancements is vital for AtriCure to remain competitive against rivals who may offer more seamlessly integrated robotic and AI-powered solutions.

Innovations in diagnostic imaging, such as advanced CT and MRI, coupled with real-time electrophysiological mapping systems, are revolutionizing how cardiac arrhythmias are identified and treated. These technologies allow for much more precise targeting of the abnormal tissue causing the irregular heartbeat.

This enhanced visualization and diagnostic accuracy directly translates to improved success rates for ablation procedures. For AtriCure, this means their ablation systems need to seamlessly integrate with these cutting-edge diagnostic tools, ensuring that physicians can effectively leverage the latest advancements for better patient outcomes.

Telemedicine and remote patient monitoring

The expansion of telemedicine and remote patient monitoring offers significant advantages for managing atrial fibrillation (Afib) patients. These technologies facilitate enhanced follow-up care, enabling earlier identification of recurring arrhythmias and consistent patient oversight. For instance, a report from the Centers for Medicare & Medicaid Services (CMS) in 2024 indicated a substantial increase in telehealth utilization, with over 295 million Medicare telehealth visits occurring in 2023, highlighting the growing integration of virtual care into healthcare delivery.

While AtriCure’s primary focus remains on surgical solutions for Afib, these digital health advancements can indirectly bolster demand for their treatments. By improving the overall care pathway for Afib patients, telemedicine can lead to more timely interventions and better outcomes post-procedure. This improved patient management could translate into a greater appreciation for and uptake of advanced treatment options like those offered by AtriCure.

The integration of these technologies into the broader healthcare ecosystem presents several key benefits:

- Improved Patient Engagement: Remote monitoring tools can empower patients to actively participate in their health management, leading to better adherence to treatment plans.

- Early Detection of Recurrence: Continuous monitoring allows for the prompt identification of any return of arrhythmias, enabling quicker clinical response and potentially preventing more severe complications.

- Reduced Healthcare Costs: By facilitating remote consultations and monitoring, these technologies can reduce the need for in-person visits, thereby lowering overall healthcare expenditures.

- Enhanced Access to Care: Telemedicine expands access to specialist care, particularly for patients in rural or underserved areas, ensuring a more consistent standard of Afib management.

Data analytics and personalized medicine

The growing sophistication of data analytics is transforming healthcare, enabling highly personalized treatment strategies for conditions like Atrial Fibrillation (Afib). By analyzing vast datasets, clinicians can better understand individual patient responses to interventions such as ablation, identifying key predictors of success. This granular insight allows for the refinement of existing treatment protocols and the development of new, more effective approaches.

For AtriCure, this technological shift presents a significant opportunity. Leveraging advanced data analytics can inform device design, leading to more targeted and efficient solutions for Afib management. Furthermore, optimizing procedural techniques based on real-world patient data can enhance clinical outcomes, providing demonstrable proof of the company's value proposition.

- Personalized Treatment Pathways: Advanced analytics can segment patient populations, allowing for tailored Afib treatment plans based on genetic predispositions, lifestyle factors, and previous medical history.

- Predictive Analytics for Ablation Success: Machine learning models are increasingly being used to predict the likelihood of successful ablation, enabling physicians to select appropriate candidates and manage expectations. For instance, studies in 2024 highlighted improved success rates by up to 15% when using AI-driven patient selection tools.

- Device and Procedure Optimization: Data insights can guide the iterative improvement of ablation catheters and energy delivery systems, aiming for greater efficacy and reduced complication rates.

- Outcome Demonstration: Robust data analysis allows AtriCure to clearly articulate the superior patient outcomes achieved with its technologies, a crucial factor for reimbursement and market adoption in the competitive medtech landscape.

Technological advancements are reshaping cardiac ablation, with pulsed field ablation emerging as a key innovation. AtriCure's R&D investment in next-generation technologies is vital for staying competitive in this rapidly evolving market. The integration of robotics and AI in cardiac surgery offers AtriCure opportunities for enhanced precision and data analysis, potentially improving procedural efficiency and patient outcomes.

The global surgical robotics market's projected growth to $20.8 billion by 2030 underscores the importance of adopting these technologies. Innovations in diagnostic imaging and real-time mapping systems enable more precise targeting of arrhythmias, directly impacting ablation success rates. AtriCure's devices must integrate seamlessly with these advancements to ensure physicians can leverage them effectively.

Telemedicine and remote patient monitoring are transforming Afib patient management, facilitating better follow-up care and earlier detection of recurring arrhythmias. The substantial increase in telehealth utilization, with over 295 million Medicare telehealth visits in 2023, highlights its growing integration. These digital health advancements indirectly support AtriCure by improving the overall care pathway for Afib patients.

Data analytics is enabling personalized treatment strategies for Afib, with AI-driven patient selection tools showing improved success rates by up to 15% in 2024 studies. This allows for more targeted and efficient solutions, informing device design and optimizing procedural techniques. AtriCure can leverage these insights to demonstrate superior patient outcomes, crucial for market adoption and reimbursement.

Legal factors

AtriCure's operations are heavily influenced by the U.S. Food and Drug Administration (FDA) and comparable international regulatory bodies that oversee medical devices. These agencies dictate stringent requirements for product development, manufacturing processes, product labeling, and marketing strategies. For instance, in 2023, the FDA continued its focus on post-market surveillance and cybersecurity for medical devices, impacting how companies like AtriCure manage their product lifecycles.

Navigating these intricate and frequently updated regulations is critical for AtriCure to gain market access, secure product approvals, and maintain its operational integrity. Non-compliance can lead to significant financial penalties, product recalls, and damage to the company's reputation, as seen with other medical device manufacturers facing FDA enforcement actions in recent years.

Intellectual property laws are foundational to AtriCure's strategy, safeguarding its innovative ablation systems and surgical tools. These protections, primarily through patents, are vital for maintaining a distinct competitive edge in the medical device market.

By securing patents, AtriCure can legally prevent rivals from replicating its proprietary technologies, thereby preserving its market position. This legal framework ensures that the company's significant investments in research and development translate into tangible, protected assets.

A strong patent portfolio acts as a significant deterrent to new entrants, creating a substantial barrier to entry. This exclusivity not only protects AtriCure's market share but also underpins its ability to generate consistent revenue from its unique product innovations, a key factor in its financial stability.

AtriCure operates under a strict regulatory environment concerning product liability and patient safety. Failure to meet these stringent standards, including rigorous quality control for its cardiac ablation devices, can result in significant legal repercussions. For instance, in 2023, medical device companies faced an estimated $1.8 billion in product liability settlements, underscoring the financial risks involved.

Data privacy and cybersecurity laws (e.g., HIPAA, GDPR)

As a medical device company, AtriCure operates under stringent data privacy and cybersecurity laws. Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in Europe is paramount, particularly concerning sensitive patient health information and clinical trial data. Failure to adhere to these regulations can lead to significant financial penalties, legal entanglements, and a detrimental impact on the trust placed in AtriCure by healthcare professionals and patients alike.

The increasing focus on data protection translates into substantial compliance costs and operational adjustments for companies like AtriCure. For instance, the GDPR, enacted in 2018, has set a high bar for data handling, with fines for non-compliance reaching up to 4% of annual global turnover or €20 million, whichever is higher. In the US, HIPAA violations can result in penalties ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, depending on the level of negligence.

- HIPAA Penalties: Fines can range from $100 to $50,000 per violation, with annual caps for repeat offenses up to $1.5 million.

- GDPR Fines: Non-compliance can incur penalties of up to 4% of global annual revenue or €20 million, whichever is greater.

- Data Breach Costs: The average cost of a data breach in the healthcare sector reached $10.10 million in 2023, highlighting the financial risk of inadequate cybersecurity.

- Erosion of Trust: A significant data breach can severely damage a company's reputation, leading to loss of business and partnerships.

Anti-trust and competition laws

AtriCure must navigate a complex web of anti-trust and competition laws designed to prevent monopolies and ensure fair market practices. These regulations are crucial as the market for atrial fibrillation (Afib) treatment devices continues to develop, impacting potential mergers, acquisitions, and strategic partnerships.

Compliance with these laws is not just a legal necessity but a strategic imperative. Failure to adhere can result in significant legal challenges, hefty fines, and damage to AtriCure's reputation. For instance, the U.S. Department of Justice and the Federal Trade Commission actively scrutinize healthcare markets for anti-competitive behavior.

- Regulatory Scrutiny: Antitrust regulators, like the FTC, examine market concentration and potential monopolistic practices in the medical device sector.

- Merger & Acquisition Compliance: Any significant M&A activity by AtriCure would require clearance from antitrust authorities to ensure it does not harm competition.

- Fair Competition: Adherence to these laws protects AtriCure from accusations of unfair business practices and safeguards its ability to compete effectively.

AtriCure's commitment to patient safety and product efficacy is governed by rigorous product liability laws, particularly concerning its cardiac ablation devices. Failure to meet stringent quality control standards can lead to significant legal repercussions, with medical device companies facing an estimated $1.8 billion in product liability settlements in 2023, highlighting the substantial financial risks involved.

Navigating complex data privacy and cybersecurity regulations like HIPAA and GDPR is crucial for AtriCure, especially when handling sensitive patient data. HIPAA violations can incur fines from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses, while GDPR fines can reach up to 4% of global annual revenue or €20 million.

Intellectual property laws, particularly patents, are fundamental to AtriCure's competitive strategy, protecting its innovative ablation systems and ensuring market exclusivity. This legal framework safeguards significant R&D investments, creating barriers to entry and underpinning revenue generation from unique product innovations.

AtriCure must also comply with anti-trust and competition laws to ensure fair market practices in the developing Afib treatment device market. Regulatory bodies like the FTC actively scrutinize healthcare markets for anti-competitive behavior, and any significant M&A activity by AtriCure would require antitrust clearance.

| Legal Factor | Relevance to AtriCure | Associated Risks/Costs (2023/2024 Estimates) |

|---|---|---|

| Product Liability | Ensuring safety and efficacy of cardiac ablation devices. | Estimated $1.8 billion in product liability settlements for medical device companies. |

| Data Privacy & Cybersecurity | Protecting sensitive patient health information (HIPAA, GDPR). | HIPAA fines: $100-$50k/violation, up to $1.5M annually. GDPR fines: up to 4% global revenue or €20M. |

| Intellectual Property | Protecting proprietary technologies and R&D investments. | Costs associated with patent filing, maintenance, and potential litigation. |

| Anti-trust & Competition | Ensuring fair market practices and compliance for M&A. | Regulatory scrutiny from bodies like the FTC; potential fines for non-compliance. |

Environmental factors

Growing environmental concerns are increasingly influencing medical device companies like AtriCure. These concerns push for sustainable practices across the entire supply chain, from obtaining raw materials to manufacturing and final distribution. This focus on sustainability is becoming a key differentiator.

Minimizing waste, reducing energy consumption, and ensuring ethical sourcing of materials are critical components of these greener practices. For example, many medical device manufacturers are setting ambitious targets for waste reduction; some aim for a 20% decrease in manufacturing waste by 2025. This directly impacts operational costs and resource management.

Adopting these environmentally conscious practices can significantly enhance AtriCure's brand reputation. It also helps meet the growing expectations of stakeholders, including investors and consumers, who are prioritizing companies with strong environmental, social, and governance (ESG) profiles. In 2024, ESG investments in the healthcare sector saw a notable uptick, signaling this trend.

The growing scrutiny on the environmental impact of single-use medical devices and their packaging presents a significant challenge for AtriCure. The company must actively consider the entire lifecycle of its products, from manufacturing to disposal, to align with increasing sustainability expectations.

Stricter regulations governing medical waste disposal are emerging globally, compelling AtriCure to implement more environmentally sound end-of-life solutions for its devices. This trend is evident in regions like the European Union, where waste reduction targets are becoming more ambitious, impacting medical device manufacturers.

Innovating with recyclable or biodegradable materials for its products could offer AtriCure a distinct competitive edge. For instance, the global medical packaging market, which includes disposal considerations, was valued at approximately $40 billion in 2023 and is projected to grow, highlighting the market's receptiveness to sustainable solutions.

Climate change poses a significant threat to AtriCure's operations. Increased frequency and intensity of extreme weather events, such as hurricanes and floods, can directly impact manufacturing facilities and disrupt the delicate supply chains necessary for medical device delivery. For instance, the NOAA reported a record 28 separate billion-dollar weather and climate disasters in the United States in 2023, highlighting the growing vulnerability of infrastructure.

These disruptions can translate into production delays and increased operational costs for AtriCure, potentially affecting their ability to timely supply critical cardiac surgical products to hospitals. Moreover, damaged transportation routes or port closures could impede the distribution of their devices, creating challenges in meeting healthcare provider demand and impacting patient care.

Proactive risk assessment and mitigation strategies are therefore crucial for AtriCure. This includes diversifying manufacturing locations, strengthening supply chain resilience through multiple sourcing options, and developing robust business continuity plans to address potential weather-related interruptions. Understanding and adapting to these environmental shifts is key to maintaining operational stability and market competitiveness.

Resource scarcity and raw material sourcing

AtriCure's reliance on specialized raw materials for its medical devices presents a key environmental challenge. Factors like climate change and geopolitical instability can disrupt the availability and pricing of these essential components, potentially impacting manufacturing efficiency and cost of goods sold. For instance, the increasing demand for rare earth metals, crucial in some advanced medical technologies, has seen price volatility, with some reports indicating potential shortages in the coming years due to concentrated mining operations and environmental regulations.

To counter these risks, AtriCure must prioritize building a robust and diversified supply chain. This includes actively seeking alternative materials and fostering strong relationships with multiple suppliers across different geographical regions. A proactive approach to supply chain resilience is vital for maintaining consistent production and managing the financial impact of resource scarcity, especially as global environmental pressures intensify.

- Dependence on critical materials: AtriCure's advanced medical devices often require specific biocompatible materials and components, some of which may be subject to environmental regulations or scarcity.

- Supply chain vulnerability: Geopolitical tensions and environmental events can disrupt the sourcing of these materials, leading to potential production delays and increased costs.

- Mitigation strategies: Diversifying suppliers, exploring alternative materials, and investing in supply chain transparency are crucial for AtriCure to manage resource availability and price fluctuations effectively.

- Market trends: The growing global emphasis on sustainability and ethical sourcing means companies like AtriCure will face increasing scrutiny regarding their raw material procurement practices.

Environmental regulations and corporate social responsibility

AtriCure faces increasing environmental regulations concerning emissions, hazardous waste, and chemical usage, which directly influence its manufacturing operations. For instance, stricter controls on manufacturing byproducts could necessitate investments in new waste treatment technologies or process modifications. The company's 2023 sustainability report highlighted efforts to reduce its carbon footprint by 15% compared to 2020 levels, demonstrating an awareness of these evolving standards.

The growing societal expectation for corporate social responsibility (CSR) means AtriCure is under pressure to actively demonstrate its commitment to environmental stewardship. This goes beyond mere compliance, requiring proactive initiatives in areas like sustainable sourcing and energy efficiency. Many investors, particularly those focused on ESG (Environmental, Social, and Governance) criteria, are increasingly scrutinizing companies' environmental performance. For example, the S&P 500 ESG Leaders Index saw a 20% increase in assets under management from 2023 to early 2024.

Proactive environmental management can yield significant benefits for AtriCure, enhancing stakeholder relations and attracting environmentally conscious investors. Companies with strong environmental track records often experience improved brand reputation and easier access to capital. In 2024, a study by McKinsey found that companies with leading sustainability practices outperformed their peers by an average of 13% in market value.

Key environmental considerations for AtriCure include:

- Compliance with evolving emissions standards: Ensuring manufacturing facilities meet or exceed regulations on air and water quality.

- Sustainable waste management: Implementing strategies for reducing, reusing, and recycling waste generated during production.

- Chemical safety and handling: Adhering to strict protocols for the use and disposal of chemicals in medical device manufacturing.

- Energy consumption reduction: Investing in energy-efficient technologies and processes to lower operational impact.

AtriCure's environmental strategy must address the increasing global focus on sustainability and climate change. The company's operations, from material sourcing to product disposal, are subject to growing scrutiny regarding their ecological footprint. This necessitates a proactive approach to environmental stewardship to maintain market competitiveness and stakeholder trust.

The medical device industry, including AtriCure, is facing heightened pressure to adopt circular economy principles, minimizing waste and maximizing resource efficiency. For instance, the European Union's Green Deal aims to make the EU climate-neutral by 2050, influencing manufacturing and product lifecycle management across sectors, including healthcare. This trend is driving innovation in biodegradable materials and sustainable packaging solutions.

Extreme weather events, exacerbated by climate change, pose a direct threat to AtriCure's supply chain and manufacturing capabilities. The NOAA reported 28 billion-dollar weather and climate disasters in the US in 2023, underscoring the vulnerability of infrastructure. AtriCure must enhance its supply chain resilience and business continuity planning to mitigate these risks.

AtriCure's commitment to environmental, social, and governance (ESG) principles is becoming a key factor for investors. The S&P 500 ESG Leaders Index saw a 20% increase in assets under management from 2023 to early 2024, indicating strong investor preference for sustainable companies. AtriCure's 2023 sustainability report noted a 15% reduction in its carbon footprint compared to 2020 levels, demonstrating progress.

| Environmental Factor | Impact on AtriCure | Key Data/Trend (2023-2025) | Mitigation/Opportunity |

| Climate Change & Extreme Weather | Supply chain disruption, operational interruptions | 28 billion-dollar weather disasters in US (2023) | Supply chain diversification, business continuity planning |

| Waste Management Regulations | Increased compliance costs, need for process innovation | EU Green Deal targeting climate neutrality by 2050 | Investing in waste reduction technologies, exploring biodegradable materials |

| Resource Scarcity & Material Sourcing | Price volatility, potential production delays | Growing demand for rare earth metals with price volatility | Diversifying suppliers, exploring alternative materials |

| ESG Investor Focus | Access to capital, brand reputation | S&P 500 ESG Leaders Index AUM up 20% (2023-2024) | Enhancing sustainability reporting, achieving carbon footprint reduction targets (e.g., 15% by 2023 vs. 2020) |

PESTLE Analysis Data Sources

Our AtriCure PESTLE Analysis is built on a robust foundation of data from leading healthcare industry reports, regulatory body publications, and economic forecasting agencies. We meticulously gather insights on political stability, economic trends, technological advancements, and societal shifts to provide a comprehensive view.