AtriCure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

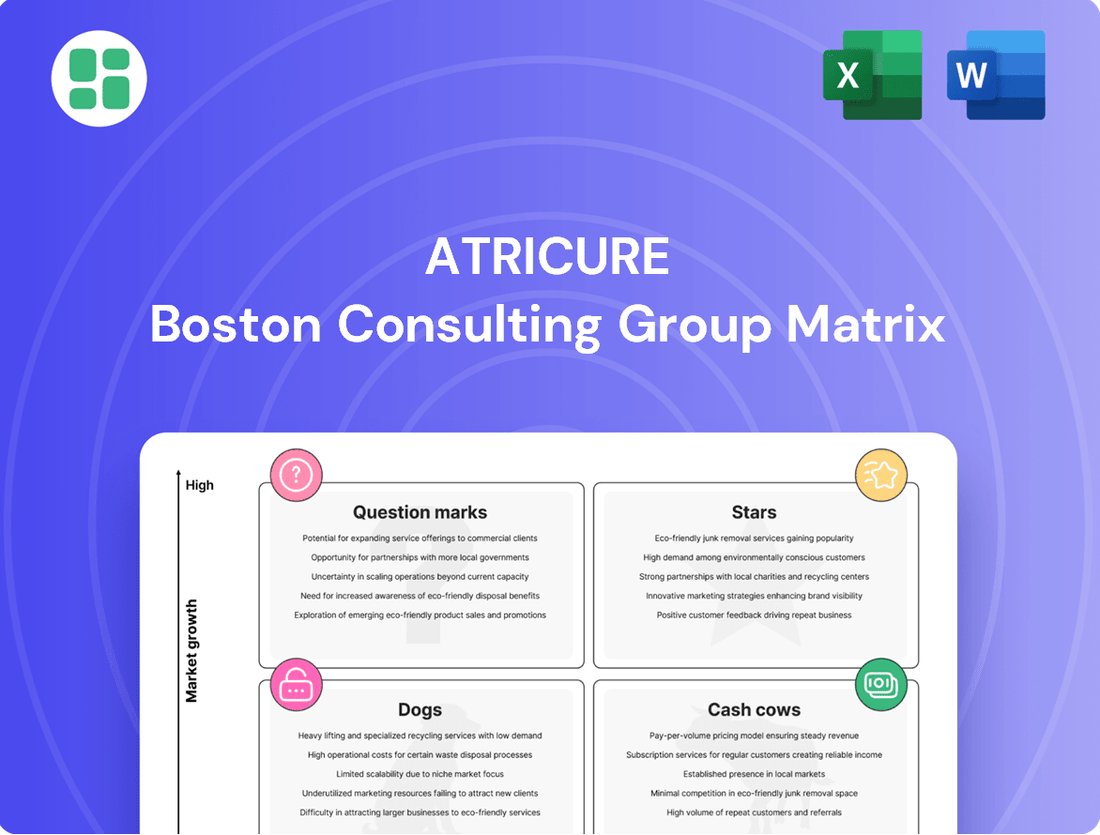

Curious about AtriCure's product portfolio performance? This preview offers a glimpse into their strategic positioning within the BCG Matrix, highlighting potential Stars, Cash Cows, Dogs, or Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix for a comprehensive breakdown and actionable strategic insights.

Stars

AtriCure's AtriClip platform, especially the AtriClip FLEX·Mini™ device, is a strong performer. Worldwide appendage management revenue saw a significant jump, growing over 20% in Q2 2025. This product line is a global leader, being the most frequently sold Left Atrial Appendage (LAA) management device available.

This success is fueled by its operation within the booming minimally invasive cardiac surgery market. The completion of the extensive LeAAPS clinical trial, which enrolled 6,500 patients, underscores its dominant market position and hints at future growth through expanded uses in stroke prevention.

The cryoSPHERE MAX™ and cryoSPHERE+ probes are pivotal for AtriCure's expansion, especially in post-operative pain management. These devices are driving significant growth, reflecting their strong market penetration and increasing demand.

In the second quarter of 2025, AtriCure saw U.S. pain management sales surge by an impressive 41.1%. This substantial increase underscores the effectiveness and adoption of their cryoablation technology in addressing patient needs.

These innovative probes are designed for faster freeze times, which directly translates to improved procedural efficiency and better patient outcomes. This technological advantage positions AtriCure as a leader in the burgeoning pain management market.

The EnCompass® Clamp is a significant contributor to AtriCure's revenue, particularly in the open ablation market. Its success is evident in its role driving U.S. revenue growth during Q4 2024 and Q1 2025.

This innovative product is not just performing domestically; it's also making strides in expanding its global reach. AtriCure's strategic focus on this segment, supported by products like the EnCompass® Clamp, positions them well within the growing cardiac ablation market.

The EnCompass® Clamp holds a commanding market share within its specific niche. This strong position allows AtriCure to effectively leverage the overall increase in demand for cardiac ablation procedures, further solidifying its market presence.

Overall AtriCure Portfolio in AFib and LAA Management

AtriCure's comprehensive portfolio for atrial fibrillation (Afib) and left atrial appendage (LAA) management is a clear Star within the AtriCure BCG Matrix. This segment is poised for significant expansion, with the global Afib devices market expected to grow at a compound annual growth rate of 11.5% to 13.97% between 2025 and 2034.

The company's strong financial performance reinforces this position. In Q2 2025, AtriCure achieved an impressive 17.1% year-over-year revenue increase, demonstrating robust demand for its integrated Afib and LAA solutions. This growth trajectory highlights AtriCure's leadership in a rapidly expanding and lucrative market.

- Market Growth: Global Afib devices market projected CAGR of 11.5% to 13.97% (2025-2034).

- Revenue Performance: Q2 2025 year-over-year revenue growth of 17.1%.

- Strategic Positioning: Market leadership driven by innovation and expansion in Afib and LAA management.

Innovative Surgical Solutions for Cardiac Arrhythmias

AtriCure's position as a Star in the BCG Matrix is solidified by its relentless innovation in cardiac arrhythmia solutions. The company consistently introduces new products and expands its existing franchises, demonstrating a clear strategy for market leadership. This commitment translates into revenue growth significantly outpacing competitors in a rapidly evolving sector.

AtriCure's innovation pipeline is a key driver of its Star status. For instance, the company's focus on minimally invasive ablation technologies, such as its flagship systems for atrial fibrillation and ventricular tachycardia, allows it to capture substantial market share. In 2024, AtriCure reported strong revenue growth, exceeding industry averages, a testament to the market's adoption of its advanced solutions.

- Product Innovation: Continued development and launch of next-generation ablation devices.

- Market Expansion: Growing adoption of minimally invasive techniques for complex arrhythmias.

- Revenue Growth: Outperforming competitors with double-digit revenue increases in key segments.

- Strategic Partnerships: Collaborations to enhance clinical adoption and expand geographical reach.

AtriCure's integrated solutions for atrial fibrillation (Afib) and left atrial appendage (LAA) management are clearly positioned as Stars in the BCG Matrix. This segment is experiencing robust growth, with the global Afib devices market projected to expand at a significant compound annual growth rate. AtriCure's Q2 2025 performance, showing a 17.1% year-over-year revenue increase, directly reflects the strong market demand for its innovative offerings in this area.

| Segment | BCG Category | Key Drivers | 2025 Market Growth (CAGR) | Q2 2025 Revenue Growth (YoY) |

| Afib & LAA Management | Star | Minimally invasive cardiac surgery, clinical trial data (LeAAPS), expanding indications | 11.5% - 13.97% (2025-2034) | 17.1% |

What is included in the product

The AtriCure BCG Matrix analyzes their product portfolio's market share and growth, guiding strategic decisions.

Streamlined workflow for efficient pain management, reducing patient discomfort.

Cash Cows

The Isolator Synergy Ablation System is a cornerstone for AtriCure, holding the distinction of being the first medical device cleared by the FDA for treating persistent atrial fibrillation. This established product is a prime example of a cash cow within AtriCure's portfolio, contributing stable and substantial revenue streams.

While the overall cardiac ablation market is expanding, the Synergy system represents a mature product with a well-entrenched market position. Its long history of FDA approval and widespread adoption indicates a dominant market share in a segment that reliably generates consistent cash flow for the company.

AtriCure's established open ablation product lines serve as significant cash cows, underpinning the company's financial stability. These products, integral to traditional open-heart surgeries, generate a consistent revenue stream thanks to their established effectiveness and seamless integration into surgical practices.

Despite the rise of minimally invasive techniques, open ablation continues to be a vital and frequently employed surgical method. This sustained demand ensures a reliable source of cash flow for AtriCure, even as the company innovates in other areas.

AtriCure's mature surgical access and visualization tools are foundational to cardiac surgery, both open and minimally invasive. These indispensable instruments likely hold a strong, stable market share, generating consistent, high-margin revenue for the company. Their established presence and critical role in numerous procedures firmly position them as cash cows within AtriCure's portfolio.

Legacy AtriClip Device Generations

The earlier generations of AtriCure's AtriClip Left Atrial Appendage Exclusion System are likely functioning as cash cows within the company's portfolio. Despite the emergence of newer, high-growth models, these established devices continue to hold a significant market share, being the most widely sold LAA management devices globally.

These mature products generate consistent and predictable cash flow, requiring less investment in marketing and development compared to their newer counterparts. Their widespread adoption and the familiarity physicians have with them contribute to their stable revenue generation. For instance, in 2024, AtriCure reported continued strong performance in its LAA management segment, with established products forming the backbone of this success.

- Established Market Dominance: Older AtriClip generations are the most widely adopted LAA management devices worldwide, ensuring a steady revenue stream.

- Predictable Cash Flow: These mature products generate substantial and reliable cash flow with relatively low reinvestment needs.

- Reduced Marketing Costs: As established products, they benefit from existing physician familiarity, lowering the need for extensive promotional spending.

- Foundation for Growth: The cash generated by these older models helps fund the research and development of newer, high-growth AtriClip innovations.

Profitable Core Business Operations

AtriCure's established business, while still navigating net losses, demonstrates robust cash generation capabilities. The company's adjusted EBITDA has shown significant improvement, with projections indicating positive adjusted EBITDA for the full year 2025. This suggests that its core operations are increasingly self-sustaining and capable of funding expansion initiatives.

The company's high gross margin, consistently around 74.5%, is a key indicator of its cash-generating prowess. This healthy margin on its established product lines means that a substantial portion of revenue directly contributes to covering operational costs and generating surplus cash.

- Core Operations Profitability: AtriCure's core business is moving towards positive adjusted EBITDA, projected for 2025.

- Strong Gross Margins: A gross margin of approximately 74.5% highlights the cash-generating efficiency of established product lines.

- Cash Generation for Investment: Improved EBITDA signifies the ability of mature operations to fund growth areas.

AtriCure's established open ablation product lines and earlier generations of the AtriClip LAA exclusion system are prime examples of cash cows. These mature products, benefiting from widespread adoption and physician familiarity, generate consistent and predictable revenue streams with minimal reinvestment needs. Their strong market position ensures a stable cash flow that supports the company's ongoing innovation and growth initiatives.

| Product Category | BCG Category | Key Characteristics | Financial Contribution |

| Synergy Ablation System | Cash Cow | First FDA-cleared device for persistent AFib, mature product, established market position | Stable and substantial revenue streams |

| Open Ablation Products | Cash Cow | Integral to traditional open-heart surgeries, vital and frequently employed | Consistent revenue stream, underpinning financial stability |

| Earlier AtriClip Generations | Cash Cow | Most widely sold LAA management devices globally, significant market share | Consistent and predictable cash flow, reduced marketing costs |

Delivered as Shown

AtriCure BCG Matrix

The AtriCure BCG Matrix preview you are viewing is the identical, fully finalized document you will receive upon purchase. This means no watermarks, no demo content, and no missing sections—just the complete, professionally formatted strategic analysis ready for immediate use in your business planning or presentations.

Dogs

AtriCure's U.S. Hybrid AF therapy franchise is facing significant headwinds, with the company anticipating ongoing pressure and modest sequential declines through the remainder of 2025. This segment is losing ground as competitors increasingly embrace Pulsed Field Ablation (PFA) catheter technology, signaling a shift in the market towards newer, potentially more effective treatments.

The company's candid acknowledgment of this pressure points to a product line with a diminishing market share and uncertain future prospects. This situation firmly places the U.S. Hybrid AF franchise within the 'Dog' quadrant of the BCG Matrix, characterized by low growth and low market share.

AtriCure's older minimally invasive ablation devices are positioned as question marks within the BCG matrix. The company reported a decline in its U.S. minimally invasive devices segment in Q4 2024, indicating these products are facing increased competition and market share erosion.

This segment likely represents products with low market share and low growth prospects, as newer, more advanced, or cost-effective alternatives emerge from competitors. AtriCure's strategy would involve careful consideration of whether to divest these underperforming assets or invest in innovation to revitalize them.

Within AtriCure's portfolio, underperforming niche products represent items with a small slice of their specific market and don't bring in much money. These might be kept to offer a full range of solutions, but they aren't driving growth. For instance, if a niche product only captured 0.5% of its market segment in 2024, it would likely fall into this category.

Products Facing Intense Price Competition

In the dynamic medical device sector, AtriCure likely encounters products facing significant price competition. These are often offerings with limited proprietary technology or in mature markets where numerous competitors exist. Intense price pressure can erode profitability and market standing if these products cannot differentiate themselves through superior clinical outcomes or value-added services.

While specific product lines aren't detailed in public financial reports as "Dogs," any AtriCure product primarily competing on price in a crowded sub-segment of the cardiovascular or thoracic surgery market would fit this category. For instance, if AtriCure offers a standard surgical clamp or a less innovative closure device, it might face pressure from lower-cost alternatives. The company's 2024 performance, particularly in segments with established competitors, would reveal which products are most susceptible to this pricing pressure.

AtriCure's strategy to mitigate this would involve focusing on innovation for its higher-growth products and potentially optimizing manufacturing costs for those facing price wars. The company's ability to maintain or grow market share in 2024 despite these pressures would be a key indicator of its competitive positioning.

- Price Sensitivity: Products with fewer unique features are more vulnerable to price-based competition.

- Margin Erosion: Intense price wars can significantly reduce profit margins on affected products.

- Market Share Risk: Failure to compete on value can lead to a decline in market share for less differentiated offerings.

- Strategic Response: AtriCure likely focuses on innovation and cost management to counter pricing pressures.

Non-Core or Divested Business Units

Non-core or divested business units, often referred to as Dogs in the BCG Matrix, represent segments that consume significant resources but yield minimal returns. While specific divestitures for AtriCure weren't detailed in recent reports, companies frequently identify these units when they no longer align with the overarching strategic vision or growth objectives. These could be older product lines or services that have become less competitive, draining capital that could be better allocated to more promising ventures.

These units are prime candidates for strategic review, potentially leading to divestment, discontinuation, or a significant restructuring to improve performance. For instance, a company might divest a legacy medical device line that requires substantial R&D investment but has plateaued in market share and profitability. Such a move allows for a sharper focus on core, high-growth areas, optimizing resource allocation and enhancing overall financial health.

- Identification: Non-core units are typically characterized by low market share and low growth, often requiring significant investment for minimal return.

- Strategic Implications: Divesting these units frees up capital and management attention for more strategic and profitable business lines.

- Financial Impact: Historically, companies that streamline operations by divesting underperforming assets have seen improved profitability and shareholder value.

- Example Scenario: A company might sell off a division that manufactures older, less efficient equipment, redirecting funds towards the development of advanced, next-generation medical technologies.

AtriCure's U.S. Hybrid AF therapy franchise, facing increasing competition from Pulsed Field Ablation (PFA) technology, is a prime example of a 'Dog' in the BCG Matrix. This segment is experiencing modest sequential declines, indicating low market share and limited growth prospects for 2025.

Similarly, AtriCure's older minimally invasive ablation devices are also categorized as 'Dogs.' The company reported a decline in this segment during Q4 2024, suggesting these products are losing ground due to market shifts and competitive pressures.

Products that are price-sensitive or operate in mature markets with numerous competitors also fall into the 'Dog' category. These offerings may struggle to differentiate themselves, leading to margin erosion and a risk of market share decline if not managed strategically.

Non-core business units that consume resources with minimal returns are also 'Dogs.' Divesting these underperforming assets, which may include legacy product lines, allows AtriCure to reallocate capital and management focus to more promising, high-growth areas.

| BCG Category | AtriCure Segment Example | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | U.S. Hybrid AF Therapy | Low | Low | Divest, discontinue, or revitalize |

| Dogs | Older Minimally Invasive Ablation Devices | Low | Low | Divest, discontinue, or revitalize |

| Dogs | Price-Sensitive Niche Products | Low | Low | Focus on cost management or niche differentiation |

| Dogs | Non-Core/Legacy Business Units | Low | Low | Divest to free up resources |

Question Marks

AtriCure is heavily investing in its Pulsed Field Ablation (PFA) platform, a cutting-edge technology poised for significant growth in the cardiac ablation market. This emerging segment is experiencing rapid expansion, with projections indicating continued strong upward trends through 2025 and beyond.

Despite the promising market outlook, AtriCure's PFA products are still in the development phase. Consequently, they currently hold a minimal market share within this nascent area, classifying them as a 'Question Mark' on the BCG matrix. This necessitates substantial capital allocation to nurture their potential and move them towards becoming a future market leader.

The cryoXT probe by AtriCure is positioned as a 'Question Mark' in the BCG matrix, targeting the nascent market of pain management for extremity amputations. This new therapy area signifies an opportunity for AtriCure to establish a foothold, but current adoption rates are low, reflecting a minimal market share.

AtriCure is gearing up to introduce a next-generation EnCompass Clamp, with an anticipated launch window of 2026-2027. This upcoming product fits the 'Question Mark' category in the BCG matrix because, despite the current EnCompass clamp's solid performance, this new iteration is still in development.

The market for this type of medical device is expanding, which is a positive indicator. However, the ultimate success and market share of the next-generation EnCompass Clamp remain uncertain. Factors like ongoing research and development investment and a smooth market introduction will be critical to its future standing.

New International Market Penetration Initiatives

New international market penetration initiatives for AtriCure, particularly in emerging economies or regions with lower adoption rates of their cardiac surgical solutions, represent potential Stars in the BCG matrix. While AtriCure reported a 26% increase in international revenue in 2023, reaching $138.7 million, these new ventures carry substantial upfront costs and competitive risks.

These markets, while offering significant untapped demand, demand considerable investment in sales infrastructure, physician training, and regulatory approvals. For instance, expanding into Southeast Asia or parts of Latin America, where cardiac surgery penetration is still developing, could unlock substantial long-term growth, but the path to profitability is often longer and more uncertain.

- High Growth Potential: Emerging markets often exhibit faster economic growth and increasing healthcare spending, creating fertile ground for innovative medical devices.

- Significant Investment Required: Establishing a presence in new international markets necessitates investment in distribution networks, marketing, and local regulatory compliance.

- Competitive Landscape: These markets may already have established local or global competitors, requiring a differentiated strategy to gain market share.

- Uncertainty of Success: Market acceptance, reimbursement policies, and the effectiveness of entry strategies can significantly impact the success of new international ventures.

Emerging Technologies in Cardiac Rhythm Management

AtriCure's forward-looking research into emerging technologies within cardiac rhythm management, such as advanced AI-driven diagnostic tools or novel implantable sensors, represents a significant investment in potential future growth areas. These ventures, while currently in nascent stages with minimal market penetration, embody the high-risk, high-reward profile characteristic of question marks in the BCG matrix. For instance, the company's reported commitment to R&D, which has historically seen significant allocation, suggests a pipeline that extends beyond established product lines.

Exploring these cutting-edge technologies positions AtriCure to potentially disrupt the cardiac rhythm management landscape. Success in these early-stage projects could lead to substantial market share gains in the long term, even as current revenue contributions remain negligible. This strategic exploration is crucial for maintaining a competitive edge in a rapidly evolving medical technology sector.

- AI-Powered Diagnostic Platforms: Development of predictive algorithms to identify patients at risk of arrhythmias.

- Next-Generation Implantable Sensors: Research into continuous monitoring devices for subtle rhythm changes.

- Minimally Invasive Ablation Technologies: Exploration of new energy sources or delivery systems for more precise lesion creation.

- Personalized Therapy Devices: Investigating adaptive devices that tailor treatment based on real-time patient data.

AtriCure's Pulsed Field Ablation (PFA) platform is a prime example of a 'Question Mark' due to its substantial investment and nascent market position. While the PFA market is projected for strong growth, AtriCure's current share is minimal, requiring significant capital to foster its development and potential market leadership.

The cryoXT probe for pain management in extremity amputations also falls into the 'Question Mark' category. This new therapy area presents an opportunity for AtriCure to gain a foothold, but low current adoption rates mean its market share is presently insignificant.

AtriCure's upcoming EnCompass Clamp, slated for a 2026-2027 launch, is another 'Question Mark'. Despite the existing clamp's performance, this next-generation version is still in development, with its future market share contingent on successful R&D and market introduction.

New international market penetration initiatives, particularly in emerging economies, represent potential 'Stars' but are currently 'Question Marks' due to high upfront costs and competitive risks. AtriCure's 2023 international revenue saw a 26% increase to $138.7 million, highlighting the potential, yet these ventures demand considerable investment in infrastructure and training, with uncertain timelines to profitability.

| Product/Initiative | BCG Category | Market Growth | Market Share | Strategic Focus |

| Pulsed Field Ablation (PFA) Platform | Question Mark | High | Low | Significant R&D investment, market development |

| cryoXT probe (Pain Management) | Question Mark | Emerging | Minimal | New market entry, adoption building |

| Next-Generation EnCompass Clamp | Question Mark | Growing | Uncertain (pre-launch) | Product development, market introduction |

| International Market Penetration | Potential Star (currently Question Mark) | High (emerging markets) | Low (new ventures) | Infrastructure investment, regulatory navigation |

BCG Matrix Data Sources

Our AtriCure BCG Matrix is built on comprehensive market intelligence, integrating financial reports, clinical trial data, and industry expert analyses to provide strategic insights.