AtriCure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

AtriCure navigates a complex landscape shaped by intense rivalry, significant buyer power from hospitals, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder.

The complete report reveals the real forces shaping AtriCure’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

AtriCure's reliance on highly specialized components for its advanced medical devices, like ablation systems, places significant power in the hands of its suppliers. The unique nature of these inputs often means a limited pool of qualified manufacturers, giving them leverage.

This dependency means that if a critical component has only one or two suppliers, AtriCure could face production delays or increased costs if those suppliers decide to raise prices or experience disruptions. For instance, in the medical device industry, lead times for specialized electronic components can extend for months, impacting manufacturing schedules.

Suppliers providing proprietary technologies, such as specialized sensor components or unique biomaterials, wield considerable bargaining power. AtriCure's cutting-edge medical devices, including its Isolator® Synergy™ Ablation System and AtriClip® Left Atrial Appendage Exclusion System, are reliant on these advanced inputs.

The intellectual property rights associated with these proprietary technologies can significantly restrict AtriCure's flexibility to transition to alternative suppliers. Such a shift could necessitate substantial redesign efforts for its products or even lead to costly intellectual property disputes, thereby reinforcing the suppliers' leverage.

Suppliers in the medical device sector face significant hurdles due to strict regulatory compliance, such as FDA regulations and ISO certifications. This complexity acts as a barrier to entry, empowering established suppliers who already meet these demanding standards. For AtriCure, this means a reliance on these compliant vendors, strengthening their bargaining position.

Switching Costs for AtriCure

Switching suppliers for AtriCure's specialized medical devices presents significant hurdles. The process often involves substantial expenses related to re-validation and re-certification of components and manufacturing processes. For instance, in 2024, the medical device industry saw increased scrutiny on supply chain integrity, meaning any change could trigger lengthy and costly regulatory review periods, potentially impacting AtriCure's product timelines and market access.

These high switching costs are directly linked to the intricate nature of the components AtriCure utilizes. Should a change be necessary, AtriCure might need to re-engineer its products, undertake extensive new testing protocols, and secure fresh regulatory approvals. This complexity inherently strengthens the bargaining power of existing suppliers, as the cost and time associated with finding and integrating a new one are considerable deterrents.

- Re-validation and Re-certification: Essential steps that require significant time and financial investment.

- Product Re-engineering: Necessary if new components do not seamlessly integrate with existing designs.

- New Testing and Regulatory Approvals: Critical to ensure safety and efficacy, adding to the overall cost and timeline.

- Impact on Product Development: Delays in these processes can push back product launches and revenue generation.

Supplier Concentration in Niche Markets

In specific segments of the medical device supply chain, particularly those for cardiac ablation and arrhythmia treatment, supplier concentration can be quite high. This means that a limited number of companies often supply the majority of specialized components or raw materials needed by manufacturers like AtriCure.

When AtriCure relies on these concentrated markets, suppliers gain significant leverage. This leverage translates into considerable pricing power, as there are few viable alternatives for AtriCure to source these critical, often proprietary, materials or sub-assemblies. For instance, if a unique biocompatible polymer or a specialized electrode component is only produced by one or two firms, those suppliers can dictate terms and pricing.

- High Supplier Concentration: Niche medical device markets often have few dominant suppliers.

- Pricing Power: This concentration allows suppliers to exert significant influence over pricing.

- Specialized Components: The impact is amplified for unique materials or sub-assemblies essential for cardiac ablation devices.

- Limited Alternatives: For AtriCure, sourcing from such markets restricts its ability to negotiate favorable terms.

The bargaining power of suppliers for AtriCure is significant due to the specialized nature of components and the high barriers to entry in the medical device sector. Suppliers of proprietary technologies and those meeting stringent regulatory standards hold considerable sway, as switching costs for AtriCure are substantial, involving re-validation, re-engineering, and new regulatory approvals.

In 2024, the medical device industry continued to emphasize supply chain resilience and regulatory compliance, further solidifying the position of established, compliant suppliers. This environment means AtriCure faces limited options for critical inputs, potentially leading to increased costs and production lead times if suppliers leverage their advantageous position.

Supplier concentration in niche markets, such as those for cardiac ablation components, amplifies this power, allowing a few firms to dictate terms. AtriCure's reliance on these specialized, often unique, materials or sub-assemblies means suppliers can exert considerable pricing power, as viable alternatives are scarce.

| Factor | Impact on AtriCure | Evidence/Example |

|---|---|---|

| Supplier Specialization | High | Reliance on proprietary components for advanced ablation and LAA exclusion systems. |

| Barriers to Entry (Regulatory) | High | Strict FDA and ISO certifications required for medical device components. |

| Switching Costs | High | Costs include re-validation, re-engineering, and new regulatory approvals. |

| Supplier Concentration | High in Niche Markets | Limited number of suppliers for unique biocompatible polymers or specialized electrode components. |

What is included in the product

This analysis details AtriCure's competitive environment by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cardiac ablation market.

Instantly analyze competitive pressures and identify strategic opportunities to relieve market pain points.

Customers Bargaining Power

AtriCure's primary customers, including hospitals, electrophysiology labs, and large healthcare systems, wield considerable bargaining power. These consolidated entities often procure medical devices in substantial volumes, enabling them to negotiate more favorable pricing and contract terms. Their collective purchasing decisions can significantly influence AtriCure's revenue streams and overall market penetration.

The bargaining power of customers, primarily healthcare providers, is significantly influenced by the availability of alternative treatments for atrial fibrillation. These alternatives include established pharmacological interventions, a growing array of ablation technologies from competitors, and even non-invasive therapeutic approaches.

The increasing number of treatment options, particularly the emergence of newer, potentially safer ablation techniques like pulsed-field ablation, empowers healthcare providers to critically assess efficacy, safety profiles, and cost-effectiveness. This competitive landscape allows them to negotiate more favorable terms with AtriCure.

Healthcare providers are acutely aware of reimbursement policies, making them sensitive to the overall cost of procedures. For instance, in 2024, the Centers for Medicare & Medicaid Services (CMS) continued to emphasize value-based care initiatives, which often tie reimbursement to patient outcomes and cost-efficiency. This environment encourages providers to scrutinize the cost-effectiveness of all medical devices.

Any shifts in insurance reimbursement rates or broader pressures to curb healthcare spending directly influence providers' willingness to pay. This can lead them to actively seek out less expensive alternatives to AtriCure's products or to push for significant price reductions during contract negotiations, thereby increasing their bargaining power.

Clinical Evidence and Outcomes Data

Cardiac surgeons and electrophysiologists are increasingly influential in their purchasing decisions, heavily leaning on solid clinical evidence and demonstrated patient outcomes. This trend means products showcasing superior published data, higher success rates, or a lower incidence of complications gain significant traction, granting these customers the leverage to insist on proven technologies. AtriCure's ongoing investment in clinical research and the generation of compelling evidence is therefore paramount for retaining their loyalty.

For instance, in 2024, the demand for devices with peer-reviewed data supporting efficacy in complex ablation procedures continued to rise. Studies published in leading cardiology journals often directly impact adoption rates, with physicians actively seeking out technologies that have demonstrated statistically significant improvements in patient outcomes. This focus on evidence empowers customers to negotiate terms more effectively.

- Clinical Data as a Differentiator: Physicians prioritize devices with published data on efficacy and safety.

- Outcomes Drive Purchasing: Products demonstrating better patient results command higher preference.

- Evidence-Based Negotiation: Strong clinical evidence gives customers bargaining power for pricing and terms.

- AtriCure's Research Focus: Continued investment in clinical studies is vital for maintaining market position.

Physician Preference and Training

Physician preference significantly influences purchasing decisions within hospitals, often overriding institutional procurement strategies. This preference is largely shaped by a physician's training and hands-on experience with specific medical devices. For instance, if a substantial cohort of cardiac surgeons is extensively trained on and consistently prefers a competitor's ablation system, it directly diminishes AtriCure's potential market share for its own products.

This physician-driven demand can force AtriCure to allocate greater resources towards developing and implementing comprehensive training programs to onboard new users or convert existing ones. Such investments can increase operational costs and potentially reduce profit margins, thereby amplifying the bargaining power of these physician groups.

- Physician Training Impact: A significant portion of physicians may have received extensive training on competing ablation technologies, making them less inclined to adopt new systems.

- Switching Costs for Physicians: The time and effort required for physicians to learn and become proficient with a new device can be a deterrent, increasing their leverage.

- Market Share Influence: If a competitor has secured the loyalty of a large number of key opinion leaders in cardiac surgery, it can create a substantial barrier for AtriCure's market penetration.

The bargaining power of AtriCure's customers, primarily hospitals and large healthcare systems, is amplified by the availability of alternative atrial fibrillation treatments. In 2024, the market saw continued growth in competitive ablation technologies, alongside established pharmacological options. This diverse landscape allows healthcare providers to negotiate more aggressively on pricing and contract terms, directly impacting AtriCure's revenue potential.

Healthcare providers are highly sensitive to cost-effectiveness, especially given reimbursement policies. For example, 2024 saw continued emphasis on value-based care by CMS, encouraging scrutiny of device costs. This pressure incentivizes providers to seek out less expensive alternatives or demand significant price reductions from AtriCure.

Physician preference, driven by training and clinical evidence, significantly influences purchasing. In 2024, demand for devices with robust, peer-reviewed data on efficacy in complex procedures remained high. Physicians leveraging this evidence gain leverage in negotiations, making AtriCure's investment in clinical research crucial.

| Factor | Impact on AtriCure | Customer Leverage |

|---|---|---|

| Availability of Alternatives | Increased competition for market share | Ability to negotiate on price and terms |

| Reimbursement Policies (2024) | Pressure to demonstrate cost-effectiveness | Demand for lower-priced devices |

| Physician Preference & Evidence | Need for strong clinical data | Leverage to insist on proven technologies |

Preview Before You Purchase

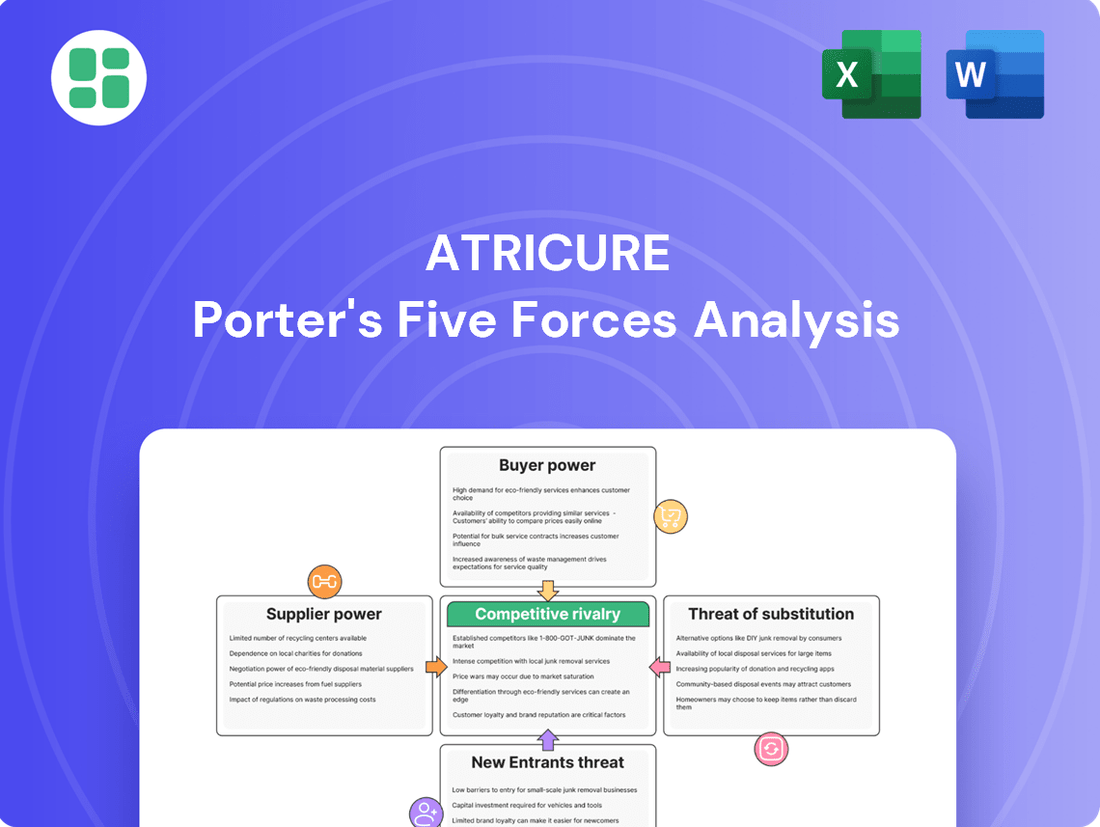

AtriCure Porter's Five Forces Analysis

This preview showcases the complete AtriCure Porter's Five Forces analysis, detailing competitive rivalry, buyer and supplier power, threat of new entrants, and the threat of substitutes. What you see here is the exact, professionally formatted document you'll receive immediately after purchase, ready for immediate use and strategic planning.

Rivalry Among Competitors

The atrial fibrillation treatment market is indeed a hotbed of activity, with robust growth projections. For instance, the global AFib market was valued at approximately $5.5 billion in 2023 and is anticipated to reach over $12 billion by 2030, showcasing a compound annual growth rate of around 12%. This expansion, fueled by an aging demographic and a rising incidence of AFib, tends to temper direct price wars as companies can grow by capturing new demand rather than solely by stealing existing customers.

However, this attractive growth trajectory also acts as a magnet for new entrants and encourages significant investment in research and development. Companies are pouring capital into innovative solutions, from advanced ablation technologies to novel pharmacological treatments. This environment fosters a dynamic landscape where innovation, rather than just price, becomes a key competitive differentiator, pushing the boundaries of what's possible in AFib management.

AtriCure competes in a crowded market dominated by major global medical device manufacturers such as Medtronic, Boston Scientific, Johnson & Johnson, and Abbott Laboratories. These established giants leverage significant research and development investments, vast distribution channels, and well-known brand names to their advantage.

In this dynamic environment, AtriCure holds the second position among 64 active competitors, underscoring the intense rivalry and the need for continuous innovation and market penetration.

The competitive landscape in cardiac ablation is intensely shaped by rapid technological advancements. The introduction of Pulsed Field Ablation (PFA) systems, for instance, presents a significant shift, promising enhanced safety and efficacy compared to established thermal methods. AtriCure is actively participating in this innovation by investing in PFA technology.

Companies are in a constant race to differentiate their offerings through novel features, superior patient outcomes, and increasingly less invasive procedures. This drive for differentiation is crucial for capturing market share and maintaining a competitive edge in an evolving field.

Product Portfolio Breadth and Depth

Competitive rivalry in the Atrial Fibrillation (Afib) market is intense, driven by companies offering extensive product portfolios. These competitors provide a wide array of Afib treatment options, including various ablation technologies, left atrial appendage (LAA) management devices, and diagnostic tools. This broad approach means AtriCure, with its specialization in surgical and minimally invasive ablation systems and LAA management, faces direct competition from firms offering both similar and complementary solutions.

The need for continuous portfolio development is paramount for AtriCure to maintain its competitive edge. For instance, in 2024, the global cardiac ablation market was valued at approximately $6.5 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030. This growth highlights the significant investment and innovation occurring across the sector, compelling players like AtriCure to expand their offerings to capture market share.

- Broad Portfolios: Competitors offer comprehensive Afib treatment solutions, including diverse ablation technologies and LAA management devices.

- Complementary Solutions: Companies often provide a mix of surgical, minimally invasive, and device-based treatments, creating a competitive landscape for AtriCure.

- Market Growth: The expanding cardiac ablation market, estimated to reach over $12 billion by 2030, necessitates ongoing product innovation and portfolio expansion.

Intense R&D and Clinical Trial Investments

Competitive rivalry in the cardiac ablation market is intensified by substantial investments in research and development and clinical trials. Companies pour resources into these areas to secure regulatory approvals and prove their technologies are more effective. This ongoing pursuit of innovation means the landscape is constantly shifting as firms aim to capture greater market share.

AtriCure, for instance, has been actively engaged in clinical trials for its various ablation systems. For example, the company's MOAB system for left atrial appendage closure has been a focus of its clinical development efforts. Demonstrating positive outcomes in these trials is paramount for AtriCure to maintain its competitive standing and expand its product's reach.

- AtriCure's investment in R&D and clinical trials is crucial for gaining regulatory approvals and showcasing superior efficacy.

- Companies are actively seeking new applications for their technologies and improving existing ones to increase market share.

- AtriCure's ongoing clinical studies and new product introductions are vital for sustaining its competitive advantage.

The competitive landscape for AtriCure is characterized by intense rivalry from large, established medical device manufacturers and a growing number of specialized competitors. This dynamic is fueled by significant R&D investments and the rapid introduction of new technologies like Pulsed Field Ablation (PFA). AtriCure, holding the second position among 64 competitors in cardiac ablation, must continually innovate and expand its product portfolio to maintain its market standing.

| Competitor | Market Position (Cardiac Ablation) | Key Offerings |

| Medtronic | Leading | Broad range of ablation technologies, pacemakers, LAA closure devices |

| Boston Scientific | Leading | Electrophysiology catheters, PFA systems, LAA closure devices |

| Johnson & Johnson | Major Player | Surgical ablation systems, electrophysiology diagnostics |

| Abbott Laboratories | Major Player | Cardiac rhythm management, PFA systems, LAA closure devices |

| AtriCure | Second Position | Surgical and minimally invasive ablation systems, LAA management devices |

SSubstitutes Threaten

Pharmacological treatments, such as antiarrhythmic drugs and anticoagulants, pose a notable threat of substitution to AtriCure's device-based interventions for atrial fibrillation (AFib). While these medications may not always offer the same long-term rhythm control efficacy as procedures, especially for persistent AFib, their less invasive nature makes them a common first-line approach or a suitable option for patients who cannot undergo surgical or interventional treatments.

The market for AFib drugs is expanding, reflecting their continued use and adoption. For instance, the global anticoagulant market alone was valued at approximately $30 billion in 2023 and is projected to see continued growth. This indicates a substantial and persistent alternative for managing AFib, directly impacting the demand for more invasive device solutions.

The threat of substitutes within the ablation market is significant, with various energy sources and techniques competing. AtriCure's focus on radiofrequency and cryoablation for surgical and hybrid procedures faces competition from emerging technologies.

Pulsed Field Ablation (PFA) stands out as a key substitute, offering potentially safer and faster alternatives for catheter ablation procedures. PFA has already secured FDA approval, indicating its growing acceptance and rapid adoption by competitors in the market.

Lifestyle modifications like diet, exercise, and stress management offer a non-invasive way for some patients to manage atrial fibrillation (Afib) or reduce its underlying risk factors. While these changes don't directly replace AtriCure's surgical solutions, they can potentially delay or lessen the need for interventional procedures. For instance, studies have shown that significant weight loss can lead to sinus rhythm restoration in a substantial percentage of obese Afib patients.

Watchful Waiting and Symptom Management

The threat of substitutes for AtriCure's ablation devices is present, particularly from less invasive or non-procedural alternatives. Some patients, especially those with asymptomatic or well-managed atrial fibrillation (Afib), might choose a 'watchful waiting' strategy or focus on managing symptoms with medication rather than undergoing an ablation procedure. This passive approach directly impacts AtriCure's accessible market by reducing the number of patients seeking curative interventions.

This substitution threat is amplified by the fact that many Afib patients may not experience debilitating symptoms, making the perceived need for a definitive procedure less urgent. For instance, a significant portion of individuals diagnosed with Afib might be asymptomatic or have mild symptoms that are manageable with pharmacotherapy, representing a segment less likely to opt for AtriCure's solutions.

- Watchful Waiting: Patients with mild or no symptoms may delay or forgo ablation, opting for monitoring.

- Symptom Management: Reliance on medication to control Afib symptoms reduces the demand for procedural intervention.

- Reduced Addressable Market: These patient choices directly shrink the pool of individuals likely to purchase AtriCure's devices.

- Passive Substitution: The absence of a procedure serves as a substitute for AtriCure's active treatment solutions.

Evolving Percutaneous LAA Closure Devices

Percutaneous Left Atrial Appendage (LAA) closure devices are emerging as a significant threat of substitutes for AtriCure's surgical LAA exclusion devices. These catheter-based alternatives offer a less invasive approach to stroke prevention in patients with atrial fibrillation. The market for these percutaneous devices is experiencing substantial growth, with projections indicating continued expansion as technology advances and physician adoption increases.

The appeal of percutaneous LAA closure lies in its potential to reach a wider patient demographic, including those who may not be ideal candidates for open-heart surgery. This accessibility could also attract different medical specialties, further fragmenting AtriCure's traditional market. For instance, in 2024, the global LAA closure market was valued at an estimated $2.5 billion and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030.

- Growing Market Share: Percutaneous devices are capturing an increasing share of the LAA closure market.

- Minimally Invasive Appeal: The less invasive nature of percutaneous procedures attracts a broader patient base.

- Technological Advancements: Ongoing innovation in percutaneous device technology enhances efficacy and safety.

- Potential for New Entrants: The expanding market may encourage new companies to develop competing percutaneous solutions.

Pharmacological treatments, particularly anticoagulants and antiarrhythmic drugs, represent a significant substitute threat to AtriCure's device-based AFib solutions. Their less invasive nature makes them a common initial treatment, and the global anticoagulant market was valued at approximately $30 billion in 2023, highlighting its substantial presence.

Emerging ablation technologies, such as Pulsed Field Ablation (PFA), offer potentially safer and faster alternatives to AtriCure's current offerings, with PFA already gaining FDA approval and market traction.

Lifestyle modifications and a "watchful waiting" approach for asymptomatic or mildly symptomatic AFib patients also act as substitutes, reducing the immediate need for AtriCure's invasive procedures and shrinking the addressable market.

Percutaneous Left Atrial Appendage (LAA) closure devices are a growing substitute for AtriCure's surgical LAA exclusion. The LAA closure market was estimated at $2.5 billion in 2024 and is projected to grow at over 15% CAGR through 2030, driven by their minimally invasive appeal and technological advancements.

Entrants Threaten

Entering the complex cardiac therapy medical device market, like AtriCure's, demands immense upfront capital. Companies need to fund extensive research and development, rigorous clinical trials, and specialized manufacturing facilities. For example, bringing a new cardiovascular device to market can easily cost tens of millions, if not hundreds of millions, of dollars, making it a significant hurdle for potential new competitors.

The medical device industry, including companies like AtriCure, faces significant hurdles due to stringent regulatory approval processes. Agencies such as the U.S. Food and Drug Administration (FDA) and international counterparts mandate extensive testing and documentation before new devices can reach the market. This rigorous oversight, including pre-market approvals (PMAs), is a substantial barrier for potential new entrants, requiring considerable investment in time and resources. For instance, the average time to obtain FDA approval for a Class III medical device, the highest risk category, can extend to several years, with associated costs often running into millions of dollars.

AtriCure's robust patent portfolio presents a significant barrier to entry. For instance, their patents on minimally invasive ablation technologies and left atrial appendage (LAA) closure devices create a strong defensive moat. Newcomers would face substantial legal and financial hurdles to navigate these existing intellectual property rights, potentially requiring expensive licensing agreements or lengthy, costly development of non-infringing technologies.

Established Clinical Relationships and Brand Loyalty

AtriCure benefits from deeply entrenched relationships with cardiac surgeons and electrophysiologists worldwide. Its flagship products, such as the AtriClip, have garnered significant recognition and trust within the medical community.

New competitors must overcome substantial hurdles in challenging this established brand loyalty. Convincing healthcare professionals to switch from proven AtriCure devices to novel, unproven technologies demands extensive marketing investment and dedicated clinical education initiatives. For example, in 2023, AtriCure reported revenue of $354.6 million, demonstrating the market traction of its established product lines.

- Established Brand Recognition: AtriCure's AtriClip is a well-known and trusted device among cardiac surgeons.

- Strong Physician Relationships: The company has cultivated deep ties with key medical professionals in the cardiac field.

- High Switching Costs: Adopting new technology requires significant training and validation, making surgeons hesitant to switch from familiar, effective solutions.

Access to Distribution Channels and Expertise

Building a robust sales and distribution network to reach specialized cardiac centers globally presents a substantial hurdle for new companies looking to enter the market. AtriCure leverages its existing, well-established network and extensive expertise in supporting complex cardiac procedures. New entrants would need to invest heavily, either through expensive acquisitions of established players or by undertaking a costly and time-consuming process of hiring specialized personnel and developing their own infrastructure.

Consider the significant capital investment required. For instance, establishing a direct sales force with the necessary clinical expertise can cost millions annually. New entrants might find it more feasible to partner with existing distributors, but this often means sacrificing a significant portion of their profit margins and relinquishing control over customer relationships.

- Distribution Network Costs: Establishing a direct sales force with specialized clinical support can cost upwards of $5 million annually per region.

- Expertise Replication: Hiring and training personnel with the deep understanding of cardiac procedures and device implantation required by AtriCure is a multi-year, high-cost endeavor.

- Partnership Trade-offs: Relying on third-party distributors can reduce profit margins by 20-30% and limit direct engagement with key opinion leaders in cardiac surgery.

The threat of new entrants into AtriCure's market is generally low due to significant barriers. These include the immense capital required for R&D and regulatory approval, which can run into tens or hundreds of millions of dollars for cardiac devices. AtriCure's strong patent portfolio and established physician relationships further deter new competitors by creating high switching costs and legal hurdles.

Building a global sales and distribution network is another major obstacle. Replicating AtriCure's expertise and market penetration would demand substantial investment, potentially costing millions annually for a direct sales force or sacrificing profits through distributor partnerships.

| Barrier to Entry | Estimated Cost/Timeframe | Impact on New Entrants |

|---|---|---|

| Capital Investment (R&D, Trials) | $50M - $200M+ | Very High |

| Regulatory Approval (FDA PMA) | 2-7 Years | Very High |

| Patent Landscape Navigation | Significant Legal Fees | High |

| Sales & Distribution Network | $5M+ Annually per Region | Very High |

| Physician Relationships & Brand Loyalty | Multi-year Effort | High |

Porter's Five Forces Analysis Data Sources

Our AtriCure Porter's Five Forces analysis is built upon a foundation of robust data, including SEC filings, investor reports, and industry-specific market research from firms like MedTech Analytics. We also incorporate insights from competitor press releases and trade publications to accurately assess industry dynamics.