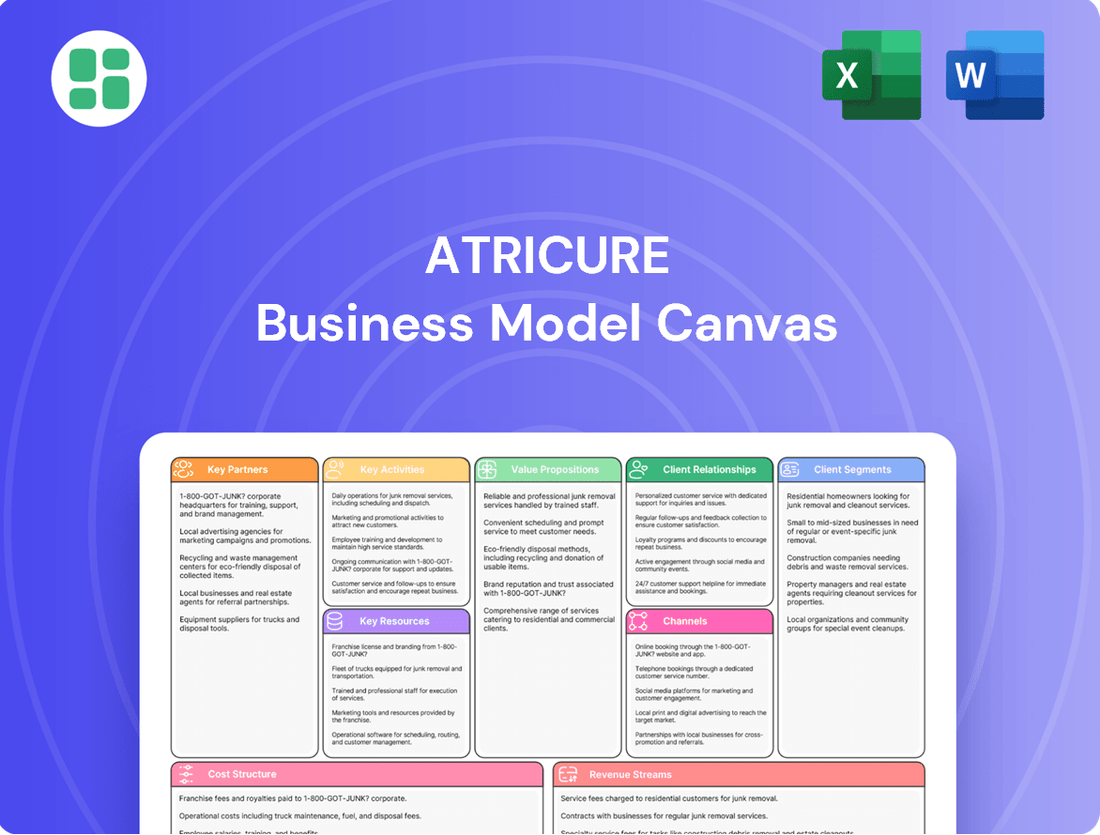

AtriCure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AtriCure Bundle

Unlock the strategic blueprint of AtriCure's innovative approach to cardiac surgery. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear view of their market dominance. Download the full canvas to gain actionable insights for your own business strategy.

Partnerships

AtriCure strategically partners with leading hospital systems and specialized cardiac centers. These partnerships are crucial as these institutions are the primary adopters of AtriCure's innovative medical devices. For instance, in 2023, AtriCure reported significant growth driven by strong adoption within its key hospital networks, reflecting the success of these collaborations.

These alliances typically involve multi-year supply agreements, ensuring a steady demand for AtriCure's products. Furthermore, they foster collaborative efforts to develop and implement novel treatment protocols, integrating AtriCure's technology directly into the hospital's existing clinical pathways. This integration is key to driving consistent product utilization and solidifying market penetration.

AtriCure relies on medical device distributors to expand its global footprint and ensure efficient delivery of its specialized cardiac devices. These partners are crucial for managing logistics, providing sales support, and leveraging local market knowledge, particularly in areas where AtriCure lacks a direct sales force.

This strategic collaboration grants AtriCure enhanced market access and optimizes its supply chain operations. For instance, in 2023, AtriCure reported net sales of $355.9 million, a significant portion of which was likely facilitated by its distributor network in reaching healthcare providers worldwide.

AtriCure actively collaborates with prominent research institutions and universities. These partnerships are vital for advancing their innovative therapies and building robust clinical evidence. For instance, collaborations support crucial clinical trials, like the LeAAPS trial, which are instrumental in generating data for scientific publications.

These academic alliances are fundamental to validating the safety and effectiveness of AtriCure's medical devices. By contributing to peer-reviewed literature, these partnerships enhance the company's credibility and play a significant role in elevating the standard of care for patients.

Key Component and Technology Suppliers

AtriCure depends on specialized suppliers for crucial components and cutting-edge technologies that are fundamental to producing its innovative medical devices. These collaborations are key to ensuring the high quality and dependable supply of materials needed for their ablation systems and surgical tools.

Strong relationships with these suppliers are paramount for maintaining efficient production and fostering ongoing innovation in their product lines. For example, AtriCure's revenue in 2023 reached $357.3 million, highlighting the scale of operations that rely on these critical partnerships.

- Component Quality: Suppliers provide specialized materials and components that meet AtriCure's stringent quality standards for medical devices.

- Technological Advancement: Partnerships with technology suppliers enable AtriCure to integrate the latest advancements into its product development.

- Supply Chain Reliability: Ensuring a consistent and reliable supply of these specialized inputs is vital for uninterrupted manufacturing and meeting market demand.

- Cost Management: Effective supplier agreements can also contribute to managing the cost of goods sold, impacting overall profitability.

Professional Medical Associations

AtriCure's engagement with professional medical associations, such as the American Heart Association and the Society of Thoracic Surgeons, is crucial. These collaborations ensure AtriCure remains informed about evolving clinical guidelines and the specific needs of cardiac surgeons and electrophysiologists. For instance, participation in these forums allows for direct feedback on product development and market trends within the cardiovascular field.

These partnerships also function as vital channels for advancing medical education and training. By supporting or participating in association-led initiatives, AtriCure can effectively promote the adoption of its innovative cardiac ablation and surgical solutions. This educational outreach is key to expanding the use of their technologies among target medical professionals.

- Clinical Guideline Alignment: Associations provide up-to-date information on best practices, helping AtriCure align its product development with current medical standards.

- Physician Needs Assessment: Direct engagement offers insights into the challenges and requirements faced by cardiac surgeons and electrophysiologists in their daily practice.

- Emerging Trend Identification: Partnerships facilitate early awareness of new research, technologies, and patient care approaches in cardiac medicine.

- Education and Training Platforms: Associations offer avenues for AtriCure to conduct symposia, workshops, and provide educational materials to enhance the skills of medical practitioners.

AtriCure's key partnerships are foundational to its business model, enabling market penetration and innovation. These include collaborations with leading hospital systems and specialized cardiac centers, which act as primary adopters of their devices. Distributors are also vital for global reach and efficient logistics. Furthermore, partnerships with research institutions and suppliers are critical for product advancement and quality.

| Partnership Type | Role in Business Model | Example/Impact |

|---|---|---|

| Hospital Systems & Cardiac Centers | Primary Adoption & Integration | Drove significant growth in 2023 through strong adoption. |

| Medical Device Distributors | Global Footprint & Sales Support | Facilitated 2023 net sales of $355.9 million. |

| Research Institutions & Universities | Clinical Validation & Innovation | Support crucial trials like the LeAAPS trial for data generation. |

| Specialized Suppliers | Component Quality & Supply Chain | Ensured reliable inputs for 2023 revenues of $357.3 million. |

| Professional Medical Associations | Market Insights & Education | Aligns product development with evolving clinical guidelines. |

What is included in the product

A detailed breakdown of AtriCure's strategy, this Business Model Canvas outlines their focus on cardiac ablation solutions for atrial fibrillation and other cardiac conditions.

It highlights their value proposition of improving patient outcomes and reducing healthcare costs, targeting cardiologists and cardiac surgeons through direct sales and partnerships.

AtriCure's Business Model Canvas offers a clear, actionable framework for understanding and addressing the critical challenges in cardiac surgery.

It provides a structured approach to identifying and solving the pain points faced by surgeons and patients in treating atrial fibrillation and other cardiac conditions.

Activities

AtriCure's commitment to research and development is central to its business. In 2023, the company reported R&D expenses of $75.6 million, a significant investment aimed at advancing its portfolio of cardiac ablation and left atrial appendage (LAA) management solutions. This focus ensures a pipeline of innovative medical devices designed to address unmet clinical needs in treating atrial fibrillation and other cardiac arrhythmias.

Key R&D efforts include the development of next-generation ablation systems, aiming for enhanced efficacy and patient outcomes. Furthermore, AtriCure is actively innovating its AtriClip LAA management devices, a cornerstone of its product offering, and exploring advancements in post-operative pain management technologies, such as its cryoSPHERE probes. These ongoing developments are crucial for maintaining a competitive edge and expanding treatment options for patients.

AtriCure’s manufacturing and quality control are paramount, focusing on the precise production of its innovative medical devices. This includes their cardiac ablation systems, surgical access tools, and crucial disposable components. The company’s commitment to rigorous quality control ensures that every product meets stringent regulatory standards, directly impacting patient safety and the effectiveness of treatments.

In 2024, AtriCure continued to emphasize its manufacturing excellence. For instance, their Q1 2024 earnings report highlighted continued investment in production capabilities to meet growing demand for their minimally invasive cardiac surgical solutions. This focus on high-quality, reliable manufacturing is a cornerstone of their strategy to deliver advanced therapies to patients worldwide.

AtriCure's key activities revolve around actively promoting and selling its specialized medical devices to healthcare professionals and institutions across the globe. This is primarily achieved through a dedicated, highly trained sales force and established distribution networks.

The company invests significantly in developing robust marketing strategies, participating in crucial medical conferences, and conducting hands-on product demonstrations. These efforts are designed to drive product adoption and deepen market penetration for their innovative cardiac surgical solutions.

In 2024, AtriCure reported net sales of $349.6 million, a substantial increase compared to previous years, underscoring the effectiveness of their sales and marketing initiatives in reaching a wider customer base and expanding market share.

Clinical Trials and Regulatory Affairs

AtriCure's key activities heavily involve conducting clinical trials to prove the efficacy and safety of its innovative cardiac ablation devices. For instance, the LeAAPS trial was pivotal in demonstrating the benefits of their system for patients undergoing left atrial appendage closure. This focus on generating strong clinical evidence is paramount for market acceptance and reimbursement.

Managing regulatory affairs is equally crucial. This includes navigating the complex submission processes for approvals from agencies like the U.S. Food and Drug Administration (FDA). Obtaining CE Mark certification for European markets and other international regulatory clearances are also vital steps to ensure global access to their life-saving technologies.

- Clinical Trials: Generating robust data, like that from the LeAAPS trial, to support device safety and effectiveness.

- Regulatory Submissions: Successfully navigating FDA approval processes for U.S. market access.

- International Certifications: Securing approvals such as the CE Mark to expand global market reach.

Professional Training and Education

AtriCure places significant emphasis on professional training and education, offering comprehensive programs designed for cardiac surgeons and electrophysiologists. These initiatives focus on the correct and effective utilization of AtriCure's sophisticated medical devices, including their ablation systems and surgical tools. By ensuring healthcare professionals are highly proficient, AtriCure aims to enhance patient outcomes and drive wider acceptance of their innovative therapies.

The company's commitment to education is a critical component of its business model, directly impacting device adoption and clinical success. For instance, in 2023, AtriCure reported investing in its commercial infrastructure, which includes robust training and support for physicians. This investment is crucial for complex procedures where surgeon expertise is paramount.

- Device Proficiency: Training ensures surgeons master AtriCure's ablation technologies.

- Improved Outcomes: Educated professionals lead to better patient results.

- Market Adoption: Effective training accelerates the uptake of new therapies.

- Clinical Support: Ongoing education reinforces best practices and new advancements.

AtriCure's key activities are centered on the research, development, manufacturing, and commercialization of innovative medical devices for the treatment of cardiac arrhythmias. This includes their cardiac ablation systems and left atrial appendage (LAA) management solutions, such as the AtriClip device. The company also focuses on generating strong clinical evidence and navigating complex regulatory pathways to ensure global market access and physician adoption. For example, in 2023, AtriCure's R&D expenses were $75.6 million, reflecting a commitment to innovation.

The company actively engages in sales and marketing efforts, supported by a dedicated sales force and participation in key medical conferences. In 2024, AtriCure reported net sales of $349.6 million, demonstrating the success of these commercial strategies. Furthermore, AtriCure invests heavily in physician training and education to ensure the effective use of its advanced technologies, which is crucial for improving patient outcomes.

AtriCure's operational focus includes rigorous manufacturing and quality control to ensure the safety and efficacy of its products. This is complemented by ongoing clinical trials, such as the LeAAPS trial, to validate device performance and support market acceptance. Navigating regulatory affairs, including FDA approvals and international certifications like the CE Mark, is also a critical activity enabling worldwide product availability.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Research & Development | Developing next-generation cardiac ablation and LAA management devices. | $75.6 million in R&D expenses (2023) |

| Sales & Marketing | Promoting and selling medical devices through a specialized sales force and medical conferences. | $349.6 million in net sales (2024) |

| Clinical Trials & Regulatory Affairs | Generating clinical evidence and securing global regulatory approvals. | Pivotal role of trials like LeAAPS; FDA approvals and CE Mark certifications. |

| Manufacturing & Quality Control | Producing high-quality, precise medical devices meeting stringent standards. | Continued investment in production capabilities (2024). |

| Physician Training & Education | Ensuring healthcare professionals are proficient in using AtriCure's devices. | Investment in commercial infrastructure including physician training (2023). |

Full Version Awaits

Business Model Canvas

The AtriCure Business Model Canvas preview you are viewing is precisely the document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the actual, comprehensive Business Model Canvas that will be delivered to you, fully editable and ready for your strategic planning.

Resources

AtriCure's robust intellectual property, particularly its patents and proprietary technologies, is a cornerstone of its business model. This IP encompasses unique ablation techniques and sophisticated device designs that set its offerings apart. For instance, the Isolator Synergy Ablation System and the AtriClip Left Atrial Appendage Exclusion System are protected by this valuable intellectual property.

This strong patent portfolio provides AtriCure with a significant competitive edge by safeguarding its innovations. In 2023, AtriCure reported $350.3 million in net sales, underscoring the market's acceptance of its differentiated technologies. The company's commitment to research and development, evidenced by its ongoing patent filings, is crucial for maintaining this market position.

AtriCure's specialized manufacturing and R&D facilities are the engine behind its innovative medical devices. These aren't just buildings; they are hubs of precision engineering and scientific advancement, crucial for bringing complex surgical and ablation technologies to life.

The company's investment in these areas is significant. For instance, their expanded global headquarters, a key physical asset, underscores their commitment to scaling production and fostering continuous innovation. This infrastructure is vital for meeting the growing demand for their life-saving technologies.

AtriCure's skilled human capital, including its R&D, clinical, and sales teams, represents a critical resource. These highly specialized professionals are the engine behind product innovation and market penetration.

The company's engineering and scientific talent is key to developing advanced surgical solutions. In 2023, AtriCure continued to invest in its R&D pipeline, aiming to bring novel therapies to patients, underscoring the value of this expertise.

Clinical teams manage intricate trials and navigate regulatory hurdles, ensuring product safety and efficacy. Sales professionals build vital relationships with healthcare providers, driving adoption of AtriCure's life-saving devices. This human capital is fundamental to the company's value proposition and growth strategy.

Regulatory Approvals and Certifications

Regulatory approvals are a cornerstone of AtriCure's business. Securing FDA clearances for key devices, such as the Isolator Synergy Ablation System and the AtriClip, is paramount. These certifications are not just permissions; they are essential validations that allow AtriCure to legally bring its life-saving technologies to market, building crucial trust with healthcare providers and patients alike within the stringent medical device sector.

These approvals are critical for market access and brand credibility. For instance, the FDA clearance for the AtriClip Ligation System, a significant product for AtriCure, underscores the company's commitment to quality and safety. This enables AtriCure to operate within the highly regulated healthcare landscape, ensuring compliance and fostering confidence in their innovative solutions.

AtriCure's ability to obtain and maintain these regulatory milestones directly impacts its revenue streams and market penetration. In 2024, the continued success and expansion of their product lines, supported by ongoing regulatory compliance, are vital for sustained growth. The company's proactive approach to regulatory affairs ensures they can navigate the complex global healthcare environment effectively.

- FDA Clearances: Essential for legal marketing and sales of devices like the Isolator Synergy Ablation System.

- Market Access: Certifications enable entry into diverse geographical markets.

- Trust and Credibility: Regulatory compliance builds confidence among healthcare professionals and patients.

- Compliance: Adherence to strict industry standards is a fundamental operational requirement.

Clinical Data and Evidence

AtriCure's extensive clinical data, exemplified by the LeAAPS study, is a critical asset. This evidence underpins the effectiveness and safety of their ablation solutions, directly impacting clinical practice and reimbursement decisions. For instance, data from trials continues to inform physician adoption and market penetration.

This robust evidence base is crucial for market acceptance, providing healthcare providers and payers with the confidence needed to embrace AtriCure's technologies. The company's commitment to generating and disseminating high-quality clinical evidence is a cornerstone of its value proposition.

- Clinical Trial Data: Evidence from studies like LeAAPS supports product efficacy and safety claims.

- Guideline Influence: Data helps shape clinical practice guidelines, enhancing product adoption.

- Market Acceptance: Compelling evidence drives acceptance among healthcare providers and payers, facilitating reimbursement.

AtriCure's key resources are its strong intellectual property, specialized manufacturing and R&D facilities, skilled human capital, and crucial regulatory approvals. These elements collectively enable the company to develop, produce, and market its innovative medical devices, driving its market position and growth.

The company's intellectual property, including numerous patents, protects its unique ablation technologies and device designs, such as the Isolator Synergy Ablation System and the AtriClip. This IP is fundamental to its competitive advantage and market differentiation.

AtriCure's manufacturing and R&D facilities are vital for precision engineering and scientific advancement, supporting the creation of complex surgical and ablation technologies. Investment in these areas, like their expanded global headquarters, is key to scaling production and fostering innovation.

The expertise of AtriCure's R&D, clinical, and sales teams is indispensable for product innovation, clinical trials, regulatory navigation, and market penetration. This human capital directly fuels the company's value proposition and expansion strategies.

Regulatory approvals, such as FDA clearances for its flagship products, are critical for market access, credibility, and revenue generation. These certifications validate product safety and efficacy, enabling AtriCure to operate effectively within the highly regulated healthcare industry.

AtriCure's clinical data, including evidence from studies like LeAAPS, is a significant asset that substantiates the effectiveness and safety of its solutions. This data is instrumental in influencing clinical practice, driving physician adoption, and securing favorable reimbursement from payers.

| Key Resource | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Intellectual Property | Patents and proprietary technologies for ablation and device design. | Competitive edge, market differentiation. | Net sales of $350.3 million, reflecting market acceptance of differentiated technologies. |

| Manufacturing & R&D Facilities | Specialized centers for precision engineering and scientific advancement. | Enables complex product development and scaled production. | Ongoing investment in expanded global headquarters for scaling production and innovation. |

| Human Capital | Skilled R&D, clinical, and sales teams. | Drives product innovation, clinical trials, regulatory navigation, and market penetration. | Continued investment in R&D pipeline to bring novel therapies to patients. |

| Regulatory Approvals | FDA clearances and other certifications. | Essential for market access, credibility, and revenue generation. | Continued success and expansion of product lines in 2024 supported by ongoing regulatory compliance. |

| Clinical Data | Evidence from trials demonstrating product efficacy and safety. | Influences clinical practice, drives adoption, and supports reimbursement. | Data continues to inform physician adoption and market penetration of ablation solutions. |

Value Propositions

AtriCure's innovative medical devices offer durable solutions for complex arrhythmias like persistent and long-standing persistent Afib. These technologies are engineered to tackle the root causes of these challenging heart conditions, significantly enhancing patient quality of life.

By reducing symptoms and mitigating serious complications such as stroke, AtriCure's solutions aim to provide lasting relief for individuals suffering from debilitating cardiac arrhythmias. This focus on addressing underlying issues differentiates their approach in the medical device market.

AtriCure offers groundbreaking surgical solutions that cater to both traditional open-heart procedures and less invasive approaches. This focus on minimally invasive techniques translates into significant benefits for patients, including potentially shorter hospital stays and quicker recovery periods.

The company's innovative product portfolio, such as the Hybrid AF Therapy, is engineered for exceptional precision in cardiac tissue modification. These advanced ablation tools are crucial for improving procedural outcomes and enhancing patient well-being, underscoring AtriCure's commitment to effective surgical interventions.

AtriCure provides a complete suite of tools for managing cardiac conditions, encompassing ablation systems like the Isolator Synergy Ablation System and cryoICE cryoSPHERE probes. This integrated approach simplifies complex procedures for surgeons and electrophysiologists.

Beyond ablation, AtriCure offers essential surgical access tools and innovative left atrial appendage (LAA) management devices, such as the widely adopted AtriClip System. This broad portfolio enables healthcare providers to tackle a range of cardiac arrhythmias and associated issues effectively.

In 2023, AtriCure reported net product revenue of $367.3 million, with their ablation and surgical products forming a significant portion of this. The company's commitment to a comprehensive offering directly supports improved patient outcomes in cardiac care.

Enhanced Precision and Procedural Efficiency for Clinicians

AtriCure's ablation systems and visualization tools are designed to give cardiac surgeons and electrophysiologists a higher degree of accuracy and smoother workflows. These technologies enable the creation of very specific lesions, leading to better control during procedures. This enhanced precision can translate into improved patient outcomes and potentially shorter surgery times for clinicians.

The efficiency gains are significant. By streamlining the procedural steps, AtriCure's offerings help healthcare providers achieve more consistent results. For example, in 2024, AtriCure reported that its advanced ablation technologies contributed to a reduction in procedure variability for many of its customers, a key factor in optimizing healthcare delivery.

- Precision Lesion Creation: Minimizes off-target tissue damage.

- Procedural Efficiency: Reduces overall procedure time.

- Improved Control: Empowers clinicians with greater confidence.

- Outcome Optimization: Contributes to better patient results.

Reduction of Post-Operative Pain

AtriCure's commitment extends beyond cardiac ablation to patient comfort. Their cryoSPHERE MAX probes, cleared for temporary nerve ablation, directly target post-operative pain, offering a significant improvement in patient recovery.

This innovation provides a tangible benefit by reducing the need for extensive opioid use, a common challenge in post-surgical care. For instance, in 2024, the focus on multimodal pain management strategies in thoracic surgery has intensified, making solutions like AtriCure's particularly relevant.

- Enhanced Patient Comfort: Directly addresses and mitigates post-operative discomfort.

- Reduced Opioid Dependence: Offers an alternative to traditional pain management, lowering risks associated with opioids.

- Holistic Care Approach: Integrates pain management into the overall patient recovery strategy for cardiac and thoracic procedures.

AtriCure provides durable solutions for complex arrhythmias, focusing on persistent and long-standing persistent Afib. Their technologies aim to address the root causes of these challenging heart conditions, significantly improving patient quality of life by reducing symptoms and mitigating serious complications like stroke.

The company offers groundbreaking surgical solutions for both traditional open-heart and less invasive procedures, leading to benefits such as shorter hospital stays and quicker recovery periods. AtriCure's advanced ablation tools, like the Isolator Synergy Ablation System, are engineered for precision in cardiac tissue modification, enhancing procedural outcomes and patient well-being.

Beyond ablation, AtriCure supplies essential surgical access tools and left atrial appendage (LAA) management devices, including the widely adopted AtriClip System. This comprehensive portfolio empowers healthcare providers to effectively manage a range of cardiac arrhythmias and related issues. In 2023, AtriCure reported net product revenue of $367.3 million, with their ablation and surgical products being key contributors.

AtriCure's cryoSPHERE MAX probes offer enhanced patient comfort by targeting post-operative pain, reducing the reliance on opioids. This aligns with the growing emphasis on multimodal pain management strategies in thoracic surgery, a trend that gained significant traction in 2024.

| Value Proposition | Description | Key Benefit | Supporting Data/Fact |

|---|---|---|---|

| Durable Arrhythmia Solutions | Addresses root causes of persistent Afib | Improved patient quality of life, reduced stroke risk | Focus on long-standing persistent Afib |

| Minimally Invasive Techniques | Enables less invasive surgical approaches | Shorter hospital stays, quicker recovery | Part of their comprehensive surgical offerings |

| Precision Ablation Technology | Engineered for precise cardiac tissue modification | Enhanced procedural outcomes, better patient well-being | Utilizes advanced ablation tools like Isolator Synergy |

| Comprehensive Cardiac Portfolio | Includes LAA management and access tools | Effective management of various cardiac conditions | AtriClip System widely adopted; 2023 net product revenue $367.3M |

| Post-Operative Pain Management | CryoSPHERE MAX probes for nerve ablation | Reduced opioid dependence, enhanced patient comfort | Relevant to 2024 focus on multimodal pain management |

Customer Relationships

AtriCure cultivates robust customer relationships through its dedicated clinical and technical support. This commitment ensures healthcare professionals are proficient with their complex medical devices, leading to higher adoption rates and satisfaction.

This support encompasses crucial elements like on-site assistance, comprehensive product training, and readily available technical service. For instance, in 2024, AtriCure continued to invest in its support infrastructure, aiming to reduce device-related complications and enhance patient outcomes.

AtriCure cultivates deep connections with medical professionals through extensive education and training. These programs are crucial for ensuring surgeons and electrophysiologists can effectively utilize AtriCure's innovative cardiac ablation and surgical solutions. By offering hands-on workshops and fostering peer learning, AtriCure equips clinicians with the expertise to achieve optimal patient outcomes.

AtriCure focuses on building enduring partnerships with hospitals and cardiac centers, transforming transactional sales into deep collaborations. This approach is crucial for understanding and addressing the complex needs of cardiac care providers.

By working closely with these institutions, AtriCure actively engages in improving clinical outcomes and integrating therapies. This collaborative model ensures their solutions are not just adopted but are optimally utilized, fostering sustained product use and deeper market penetration.

For instance, AtriCure's commitment to clinical data sharing and ongoing support helps partners achieve better patient results, a key driver for loyalty. This strategic alignment is vital in the competitive medical device market, where long-term relationships often translate to predictable revenue streams and market leadership.

Direct Sales Force Engagement

AtriCure's direct sales force is crucial for building strong customer relationships by engaging directly with key decision-makers and medical professionals in hospitals and clinics. This hands-on approach allows for a deep understanding of specific customer needs and facilitates the delivery of tailored solutions. For instance, in 2023, AtriCure reported that its direct sales force was instrumental in driving revenue growth, highlighting the effectiveness of this personalized engagement model.

This direct interaction is not just about initial sales; it's about fostering long-term partnerships. By providing personalized support and understanding the evolving requirements of healthcare providers, AtriCure secures recurring business and builds significant trust. This is particularly vital in the specialized medical device market where clinical expertise and ongoing support are paramount.

- Direct Engagement: AtriCure's sales team regularly interacts with hospital and clinic staff.

- Needs Understanding: This allows for a granular grasp of customer requirements and challenges.

- Personalized Solutions: Tailored offerings are developed based on direct feedback.

- Trust Building: Consistent, informed interaction fosters essential long-term relationships for repeat business.

Post-Market Surveillance and Feedback Integration

AtriCure actively engages in post-market surveillance, a crucial element in maintaining strong customer relationships. This involves meticulously tracking product performance and user experiences after they reach the market.

The company places significant emphasis on collecting feedback directly from clinicians. This direct line of communication ensures that AtriCure understands the real-world application and challenges faced by healthcare professionals using their devices.

This continuous feedback loop is instrumental in driving product improvements. By integrating clinician insights, AtriCure can refine existing products and develop new solutions that better meet evolving clinical needs and enhance user satisfaction. For instance, in 2023, AtriCure reported that over 90% of surveyed clinicians found their post-market feedback process valuable for product enhancement.

- Post-Market Surveillance: Ongoing monitoring of device performance and safety in clinical settings.

- Clinician Feedback: Direct collection of user input on product usability and effectiveness.

- Product Evolution: Utilizing feedback to inform design changes and future product development.

- Customer Satisfaction: Demonstrating commitment to user needs through responsive product improvement.

AtriCure fosters strong customer relationships through a multi-faceted approach centered on education, direct engagement, and continuous support. This strategy is vital for ensuring the effective use of their advanced cardiac devices and building lasting partnerships with healthcare institutions.

The company's direct sales force plays a pivotal role, engaging directly with clinicians to understand specific needs and provide tailored solutions, as evidenced by their contribution to revenue growth in 2023. Furthermore, AtriCure's commitment to post-market surveillance and clinician feedback, with over 90% of surveyed clinicians finding the process valuable in 2023, drives product improvement and enhances customer satisfaction.

AtriCure’s customer relationships are built on a foundation of comprehensive support, including extensive training and technical assistance. This ensures healthcare professionals can confidently utilize their innovative ablation and surgical solutions, ultimately leading to improved patient outcomes and sustained product adoption.

| Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force Engagement | Personalized interaction with clinicians and decision-makers. | Instrumental in driving revenue growth in 2023. |

| Clinical & Technical Support | On-site assistance, product training, and technical service. | Crucial for effective device utilization and satisfaction. |

| Post-Market Surveillance & Feedback | Monitoring product performance and collecting clinician input. | Over 90% of surveyed clinicians found the process valuable in 2023 for product enhancement. |

| Partnership Building | Collaborating with hospitals and cardiac centers on clinical outcomes. | Fosters sustained product use and market penetration. |

Channels

AtriCure’s direct sales force is the cornerstone of its go-to-market strategy, focused on building deep relationships with cardiac surgeons, electrophysiologists, and hospital administrators. This hands-on approach facilitates detailed product demonstrations and crucial technical education for their innovative cardiac ablation and surgical devices.

This direct engagement enables AtriCure to effectively communicate the clinical and economic benefits of its solutions. In 2024, the company continued to invest in expanding its sales team, recognizing that personalized interaction is key to securing adoption in the highly specialized field of cardiac surgery.

AtriCure leverages a network of medical device distributors and agents to extend its global reach, particularly in markets where establishing a direct sales force is challenging. These partnerships are crucial for navigating local regulatory landscapes and distribution complexities.

In 2023, AtriCure reported that its international revenue, which heavily relies on these third-party channels, continued to grow, demonstrating the effectiveness of this strategy in accessing new customer bases and expanding market penetration beyond its direct operational areas.

These distributors and agents handle essential functions such as local inventory management, customer service, and specialized sales support, ensuring that AtriCure’s innovative cardiac surgical solutions are accessible to healthcare providers worldwide.

AtriCure actively participates in major medical conferences, including the prestigious J.P. Morgan Healthcare Conference, a key venue for industry insights and investor relations. These events are crucial for showcasing their innovative solutions in cardiac surgery and fostering connections within the medical community.

The company also hosts specialized workshops. These hands-on sessions allow medical professionals to gain practical experience with AtriCure's devices, thereby driving product adoption and reinforcing scientific understanding. For instance, in 2023, AtriCure reported that its revenue increased by 18.6% to $326.3 million, reflecting strong market reception, partly fueled by these educational channels.

Online Presence and Professional Portals

AtriCure’s corporate website and investor relations portal are key digital hubs. They offer easy access to financial reports, news, product details, and educational content for medical professionals, investors, and patients alike.

These online presences are vital for transparent communication and stakeholder engagement. For instance, in 2024, the company actively updated its investor relations section with quarterly earnings calls and SEC filings, ensuring timely information dissemination.

- Corporate Website: A central point for product innovation, clinical data, and corporate news.

- Investor Relations Portal: Provides financial statements, presentations, and webcast archives.

- Accessibility: Designed to cater to a diverse audience, from healthcare providers to individual investors.

- Information Dissemination: Facilitates the flow of critical company updates and strategic initiatives.

Clinical Publications and Peer-Reviewed Journals

AtriCure leverages clinical publications and peer-reviewed journals as a crucial channel to disseminate its research and trial results. This strategy validates the efficacy and safety of their innovative cardiac ablation solutions, directly influencing how physicians approach treatment for atrial fibrillation and other cardiac conditions. By presenting robust data, AtriCure builds trust and encourages the adoption of its technologies within the medical community.

The company's commitment to evidence-based medicine is reflected in its consistent publication record. For instance, in 2024, AtriCure continued to support and publish data from its pivotal trials, contributing to a growing body of literature that underscores the benefits of their minimally invasive surgical techniques. This academic rigor is essential for establishing new standards of care.

- Evidence Dissemination: Peer-reviewed publications are key to sharing AtriCure's clinical trial outcomes, demonstrating the real-world effectiveness of their ablation systems.

- Credibility and Adoption: The scientific validation provided by journals enhances AtriCure's credibility, driving wider adoption among healthcare providers.

- Influencing Practice: Published research directly informs clinical guidelines and best practices, positioning AtriCure's technologies as preferred treatment options.

- 2024 Focus: Continued publication of data from ongoing studies reinforces the long-term value and clinical impact of AtriCure's solutions.

AtriCure's channel strategy is multifaceted, blending direct engagement with strategic partnerships to reach cardiac specialists and hospitals globally. This approach ensures their innovative cardiac ablation and surgical devices are understood and adopted by the medical community.

The company's direct sales force is crucial for building relationships and providing technical education, while distributors and agents extend their reach into international markets. This hybrid model, supported by participation in key medical conferences and digital platforms, effectively disseminates clinical data and fosters adoption.

Evidence-based dissemination through clinical publications further bolsters AtriCure's credibility, influencing treatment standards. In 2023, AtriCure’s international revenue growth highlighted the success of its distributor network in expanding market penetration.

Customer Segments

Cardiac surgeons are AtriCure's core customer segment. These specialists perform complex procedures, both open-heart and minimally invasive, to address conditions like atrial fibrillation and structural heart issues. They rely on AtriCure's innovative ablation systems and specialized surgical tools to effectively modify cardiac tissue and manage the left atrial appendage, a key area of focus for stroke prevention.

Electrophysiologists, or EPs, are crucial users of AtriCure's innovative cardiac ablation devices. These specialists focus on the heart's electrical system, treating conditions like atrial fibrillation and other arrhythmias. In 2024, the demand for advanced ablation solutions continues to grow as EPs seek to improve patient care and procedural efficacy.

EPs utilize AtriCure's portfolio, especially for complex hybrid procedures that combine surgical and catheter-based approaches. They also employ specific ablation techniques designed to precisely target and eliminate abnormal electrical pathways in the heart. The effectiveness of these devices directly impacts patient outcomes, making EPs a vital segment for AtriCure's success in the electrophysiology market.

Hospitals and cardiac centers are key clients for AtriCure, acquiring its medical devices for surgical procedures and electrophysiology treatments. These institutions prioritize advanced technology to improve patient care and surgical success rates in cardiac interventions.

In 2024, AtriCure's focus on these large healthcare networks is evident in its sales strategies, aiming to integrate its solutions into the standard of care for complex cardiac surgeries. The company's commitment to innovation directly addresses the needs of these centers for cutting-edge treatments.

Healthcare Administrators and Procurement Teams

Healthcare administrators and procurement teams are pivotal in adopting new medical devices. Their focus is on ensuring technologies like AtriCure's solutions offer demonstrable clinical value and improve patient outcomes, while also fitting within budget constraints. These decision-makers evaluate the overall economic impact, considering factors beyond the initial purchase price.

AtriCure understands that these stakeholders require evidence of cost-effectiveness and operational efficiency. For instance, by reducing readmissions or length of hospital stays, AtriCure's minimally invasive cardiac ablation systems can contribute to significant savings for hospitals. In 2023, AtriCure reported net sales of $347.9 million, reflecting the market's adoption of their innovative technologies.

- Cost-Effectiveness: Demonstrating a positive return on investment through improved patient outcomes and reduced hospital resource utilization.

- Operational Efficiency: Streamlining surgical procedures and potentially reducing patient recovery times.

- Clinical Value: Providing physicians with tools that enhance treatment efficacy and patient safety in cardiac procedures.

- Budgetary Alignment: Offering solutions that align with the financial planning and procurement processes of healthcare institutions.

Patients with Atrial Fibrillation and Other Arrhythmias

Patients experiencing atrial fibrillation (AFib) and other cardiac arrhythmias are the primary beneficiaries of AtriCure's innovative solutions. While they may not directly purchase the devices, their improved quality of life and reduced risk of stroke are the ultimate drivers of demand. AtriCure's commitment to addressing the unmet needs of these patients, such as preventing blood clots associated with AFib, directly resonates with this crucial segment.

The impact on patients is substantial, with AFib affecting an estimated 3 million people in the US alone, and this number projected to rise. AtriCure's technologies aim to mitigate serious complications like stroke, which is a significant concern for AFib patients. For instance, left atrial appendage (LAA) closure devices offer an alternative to anticoagulants for stroke risk reduction in these individuals.

- Beneficiaries of Improved Outcomes: Patients with AFib and related conditions directly benefit from AtriCure's therapies, experiencing enhanced health and reduced risks.

- Demand Influencers: Patient advocacy and the desire for better treatment options significantly influence physician and hospital adoption of AtriCure's products.

- Quality of Life Enhancement: AtriCure's focus on treating conditions like AFib and post-operative pain directly addresses patients' needs for a higher quality of life and symptom relief.

AtriCure's customer segments are diverse, encompassing the medical professionals who directly utilize their devices and the institutions that procure them. Cardiac surgeons and electrophysiologists are primary users, relying on AtriCure's innovative ablation systems for complex cardiac procedures. Hospitals and cardiac centers are key clients, seeking advanced technology to improve patient care.

Healthcare administrators and procurement teams play a vital role in the adoption process, evaluating the cost-effectiveness and clinical value of AtriCure's solutions. Patients with conditions like atrial fibrillation are the ultimate beneficiaries, experiencing improved quality of life and reduced health risks. In 2023, AtriCure's net sales reached $347.9 million, indicating strong market adoption.

| Customer Segment | Key Needs/Interests | 2024 Focus/Trends |

| Cardiac Surgeons | Effective ablation tools, minimally invasive options | Continued innovation in open and minimally invasive techniques |

| Electrophysiologists (EPs) | Advanced ablation devices, improved procedural efficacy | Growth in complex hybrid procedures and sophisticated ablation solutions |

| Hospitals & Cardiac Centers | Advanced technology, improved patient outcomes, cost-effectiveness | Integration of solutions into standard of care, value-based purchasing |

| Administrators & Procurement | ROI, operational efficiency, clinical validation, budget alignment | Demonstrating economic benefits and long-term value |

| Patients (AFib, Arrhythmias) | Stroke risk reduction, improved quality of life, symptom relief | Focus on LAA closure and therapies addressing unmet patient needs |

Cost Structure

AtriCure dedicates a substantial part of its financial resources to Research and Development (R&D). This investment fuels the creation of novel medical devices and the crucial clinical trials needed to validate them.

These R&D costs encompass salaries for scientific staff, the upkeep of laboratory equipment, and the rigorous testing and regulatory hurdles inherent in bringing new medical products to market.

For the fiscal year 2023, AtriCure reported R&D expenses of $74.1 million, representing a notable increase from $63.1 million in 2022, underscoring their commitment to innovation.

Manufacturing and production costs are a significant component for AtriCure, covering everything from the acquisition of raw materials and specialized components to the direct labor involved in assembly. For instance, in 2023, AtriCure reported cost of revenue, which includes these manufacturing expenses, to be $168.6 million. This figure reflects the substantial investment needed to maintain the high-quality standards essential for complex medical devices.

The complexity of AtriCure's cardiac ablation and surgical devices necessitates advanced manufacturing processes and rigorous quality control. This translates into considerable investment in state-of-the-art facilities, specialized equipment, and highly skilled labor. The overhead associated with these operations, including depreciation and facility maintenance, also contributes to the overall manufacturing and production cost structure.

AtriCure dedicates significant resources to its sales, marketing, and distribution efforts. These considerable costs are essential for driving market penetration and ensuring widespread product adoption. In 2023, the company reported $171.4 million in selling, general, and administrative expenses, a substantial portion of which is allocated to these critical functions.

Maintaining a global sales force, participating in key medical conferences, and engaging in targeted advertising are all vital components of AtriCure's strategy. Furthermore, effectively managing distribution channels ensures that their innovative medical devices reach healthcare providers efficiently. These investments are directly linked to increasing revenue and solidifying their market position.

Clinical and Regulatory Compliance Costs

AtriCure faces significant expenses for clinical trials and ongoing regulatory adherence. These costs are essential for product development and market access, ensuring patient safety and efficacy. For instance, in 2023, the company reported research and development expenses of $105.6 million, a substantial portion of which is allocated to clinical studies and regulatory submissions.

Maintaining compliance with global healthcare standards, such as those set by the FDA in the United States and obtaining CE Marks for European markets, requires continuous investment. These efforts are critical for bringing innovative cardiac ablation solutions to patients and keeping them available.

- Clinical Trial Expenses: Costs associated with designing, executing, and analyzing clinical studies to demonstrate product safety and effectiveness.

- Regulatory Submission Fees: Payments made to regulatory bodies for the review and approval of new medical devices and procedures.

- Post-Market Surveillance: Expenses incurred for monitoring product performance and patient outcomes after market release to ensure continued compliance.

- Quality System Maintenance: Costs related to maintaining robust quality management systems that meet stringent regulatory requirements.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses at AtriCure encompass the essential overhead costs that keep the company running smoothly. This includes executive compensation, salaries for administrative personnel, legal and accounting services, and the IT infrastructure that supports all operations. These costs are fundamental to the day-to-day management and strategic decision-making for the entire organization.

In 2023, AtriCure reported G&A expenses of $68.9 million, representing a significant portion of their overall operating costs. This figure highlights the investment required to maintain a robust corporate structure capable of supporting innovation and growth in the medical device sector. For instance, the company's commitment to compliance and corporate governance, often managed within G&A, is crucial for navigating the regulatory landscape of the healthcare industry.

- Executive Salaries: Compensation for top leadership driving AtriCure's vision.

- Administrative Staff: Support personnel handling essential business functions.

- Legal & Professional Fees: Costs associated with legal counsel, audits, and consulting.

- IT Infrastructure: Investment in technology systems for operational efficiency.

AtriCure's cost structure is heavily influenced by its commitment to innovation and market expansion. Key expenses include substantial investments in research and development, manufacturing and production, sales and marketing, clinical trials, and general administration. These elements are critical for developing and distributing their advanced cardiac surgical devices.

| Cost Category | 2023 Expenses (Millions USD) | 2022 Expenses (Millions USD) |

| Research & Development | $105.6 | $74.1 |

| Cost of Revenue (Manufacturing) | $168.6 | $142.7 |

| Selling, General & Administrative | $171.4 | $155.1 |

Revenue Streams

AtriCure's core revenue generation is through the sale of its advanced ablation systems and associated devices. These products, like the Isolator Synergy Ablation System and cryoICE cryoSPHERE probes, are crucial for cardiac tissue ablation and pain management procedures.

In 2023, AtriCure reported net sales of $395.7 million, with a significant portion attributed to these system and device sales. The company's focus on innovative solutions in the electrophysiology and surgical ablation markets drives this primary revenue stream.

AtriCure's revenue streams are significantly bolstered by the sale of its Left Atrial Appendage (LAA) management devices. A prime example is the AtriClip Left Atrial Appendage Exclusion System, a product line that has seen substantial market adoption and contributes meaningfully to the company's financial results.

In 2023, AtriCure reported total revenue of $334.8 million, with their LAA management segment playing a crucial role. This segment's success underscores the demand for innovative solutions in managing atrial fibrillation-related risks.

AtriCure's business model thrives on a consistent flow of income generated from disposable components and consumables. These are essential parts of their medical systems that hospitals and clinics need to replace regularly.

This recurring revenue is crucial because it provides a predictable income stream, supplementing the initial sales of their capital equipment. For example, in 2023, AtriCure reported net sales of $337.8 million, with a significant portion attributed to these recurring purchases, demonstrating the model's effectiveness.

International Sales and Market Expansion

AtriCure is seeing a significant uptick in revenue from its international operations, demonstrating successful market penetration across various regions for its entire product portfolio. This global reach is becoming an increasingly vital component of the company's overall financial performance.

The company's strategic focus on expanding into new geographic territories and driving product adoption abroad directly fuels its revenue growth. For instance, in the first quarter of 2024, AtriCure reported that its international revenue increased by 25.2% year-over-year, reaching $22.5 million. This expansion highlights the growing demand for its innovative cardiac solutions on a global scale.

- International Revenue Growth: AtriCure's international sales are a key growth driver, with a 25.2% year-over-year increase in Q1 2024.

- Geographic Expansion: The company is actively expanding its presence in new international markets, contributing to diversified revenue streams.

- Product Franchise Adoption: Growth is observed across all product franchises in international markets, indicating broad acceptance of AtriCure's offerings.

- Contribution to Overall Revenue: International sales represent an increasingly significant portion of AtriCure's total revenue, underscoring its global market strategy.

Service and Maintenance Contracts

AtriCure likely generates revenue through service and maintenance contracts for its sophisticated medical devices. These agreements are crucial for ensuring the ongoing functionality and extending the lifespan of the equipment installed within healthcare facilities.

While not always highlighted as a primary revenue driver in public disclosures, service contracts are a standard practice for medical technology companies. For instance, in 2024, the medical device industry saw continued emphasis on post-sale support, with many companies offering tiered service plans to hospitals.

- Service Contracts: Offering ongoing support and upkeep for installed medical devices.

- Maintenance Agreements: Ensuring devices function optimally and reliably over time.

- Extended Warranties: Providing peace of mind and predictable costs for healthcare providers.

- Technical Support: Access to expert assistance for troubleshooting and operational queries.

AtriCure's revenue streams are primarily driven by the sale of its innovative cardiac ablation systems and Left Atrial Appendage (LAA) management devices, such as the Isolator Synergy and AtriClip systems. These core product sales are complemented by recurring revenue from disposable components and consumables essential for the ongoing use of their equipment. The company is also experiencing robust growth in its international markets, with a notable 25.2% year-over-year increase in international revenue reported for Q1 2024, indicating broad global adoption of its cardiac solutions. Additionally, AtriCure likely generates revenue through service and maintenance contracts, ensuring the continued optimal performance of its sophisticated medical devices for healthcare providers.

| Revenue Stream | Description | 2023 Data (if applicable) | Q1 2024 Data (if applicable) |

|---|---|---|---|

| Systems & Device Sales | Sale of ablation systems and LAA management devices. | Net sales of $395.7 million (total company) | N/A |

| Recurring Revenue (Disposables) | Sales of disposable components and consumables. | Significant portion of $337.8 million net sales | N/A |

| International Operations | Revenue generated from sales outside the US. | N/A | $22.5 million (25.2% YoY growth) |

| Service & Maintenance Contracts | Revenue from ongoing support for medical devices. | Industry trend in 2024 | N/A |

Business Model Canvas Data Sources

The AtriCure Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and competitive analysis. These sources ensure each component, from value propositions to cost structures, is informed by accurate and relevant industry insights.