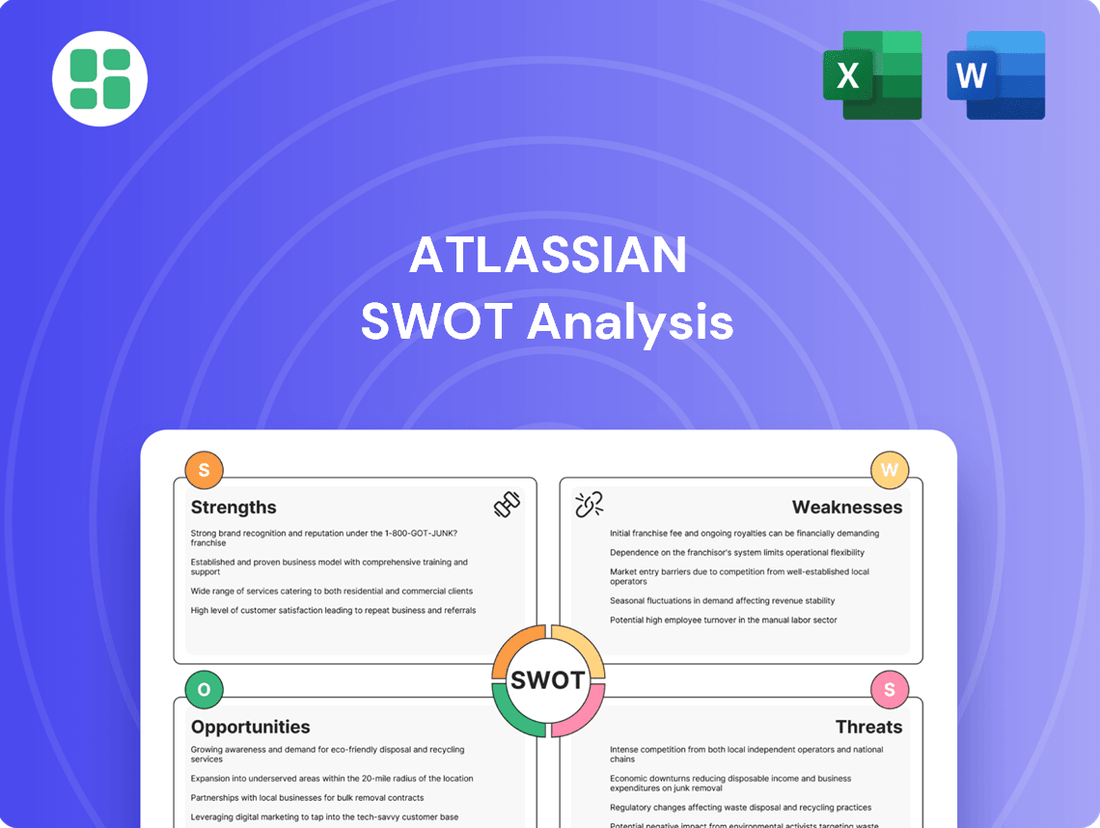

Atlassian SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlassian Bundle

Atlassian's robust product suite and strong brand loyalty are undeniable strengths, but understanding the nuances of their competitive landscape and potential market shifts is crucial for strategic advantage. Our comprehensive SWOT analysis dives deep into these factors, providing actionable insights beyond this initial overview.

Want the full story behind Atlassian's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Atlassian's extensive product portfolio is a significant strength, featuring flagship tools like Jira for issue tracking and project management, Confluence for collaborative documentation, and Bitbucket for code hosting. This comprehensive suite addresses a wide range of customer needs within software development and IT operations.

The deep integration between these products creates a powerful, cohesive ecosystem. This interconnectedness allows teams to streamline workflows, from planning and development to deployment and collaboration, enhancing overall productivity and efficiency for users.

This robust ecosystem is utilized by a vast customer base, exceeding 300,000 organizations worldwide. Notably, over 80% of Fortune 500 companies rely on Atlassian's solutions, underscoring the platform's scalability and enterprise-grade capabilities.

Atlassian's cloud strategy is proving to be a major strength, with cloud revenue surging 26% year-over-year in the fourth quarter of fiscal year 2025. This robust growth underscores the company's successful transition, as cloud now represents a substantial 67% of total GAAP revenue.

The company's commitment to cloud is further evidenced by the expansion of its cloud offerings, including specialized solutions like Government Cloud and Isolated Cloud. These new services are facilitating customer migration and catering to diverse needs, solidifying Atlassian's position in the evolving market.

Atlassian's strategic investment in artificial intelligence is a significant strength, with the Rovo AI assistant now integrated into key products like Jira, Confluence, and Bitbucket. This focus on AI enhances user experience and product functionality.

By Q4 FY2025, Rovo had achieved 2.3 million monthly active users, a clear indicator of successful AI adoption and the company's commitment to innovation. This positions Atlassian as a leader in human-AI collaboration within the software development space.

Resilient Subscription-Based Business Model

Atlassian's subscription-based business model is a significant strength, providing a stable and predictable revenue foundation. This recurring revenue allows for consistent financial planning and investment in product development.

The company's commitment to this model is evident in its financial performance. For instance, Atlassian announced a robust 23% year-over-year increase in subscription revenue for Q4 FY2025. This growth highlights strong customer adoption and retention, validating the appeal and effectiveness of their subscription offerings.

- Predictable Revenue: Subscription model ensures consistent income.

- Customer Loyalty: Recurring revenue indicates strong customer engagement.

- Financial Stability: Provides a reliable base for future investments and growth.

- Q4 FY2025 Performance: Subscription revenue grew by 23% year-over-year.

Strong Financial Performance and Free Cash Flow Generation

Atlassian demonstrated exceptional financial strength in fiscal year 2025, reporting a total revenue of $5.2 billion. This represents a significant 20% year-over-year growth compared to FY2024, highlighting strong market demand for its products.

The company's ability to generate substantial free cash flow, exceeding $1.4 billion in FY2025, underscores its operational efficiency and robust business model. This cash generation is crucial for reinvestment and shareholder returns.

Further solidifying its financial prowess, Atlassian achieved a non-GAAP operating margin of 24% in the fourth quarter of FY2025. This expansion indicates effective cost management and a healthy profitability trajectory.

- Robust Revenue Growth: $5.2 billion in total revenue for FY2025, a 20% increase from FY2024.

- Strong Cash Generation: Over $1.4 billion in free cash flow generated in FY2025.

- Expanding Profitability: Non-GAAP operating margin reached 24% in Q4 FY2025.

Atlassian's extensive product ecosystem, including Jira and Confluence, provides a comprehensive solution for software development and IT operations, fostering deep integration and a seamless user experience.

This integrated suite is trusted by over 300,000 organizations, with more than 80% of Fortune 500 companies utilizing their tools, demonstrating significant scalability and enterprise adoption.

The company's successful cloud transition is a key strength, with cloud revenue growing 26% year-over-year in Q4 FY2025, now representing 67% of total GAAP revenue.

Atlassian's strategic AI integration, with Rovo AI reaching 2.3 million monthly active users by Q4 FY2025, enhances product functionality and user experience.

| Metric | FY2025 (Q4) | Year-over-Year Growth |

|---|---|---|

| Total Revenue | $5.2 Billion | 20% |

| Cloud Revenue | 67% of Total GAAP Revenue | 26% |

| Free Cash Flow | Over $1.4 Billion | N/A |

| Non-GAAP Operating Margin | 24% | Expansion |

| Subscription Revenue | N/A | 23% |

| Rovo AI Active Users | 2.3 Million | N/A |

What is included in the product

Analyzes Atlassian's internal capabilities and external market dynamics to identify key strategic advantages and potential challenges.

Simplifies complex strategic thinking by presenting Atlassian's SWOT in a clear, actionable format.

Weaknesses

Atlassian’s persistent GAAP net losses, despite robust revenue and non-GAAP profits, present a notable weakness. For Q4 FY2025, the company reported a GAAP net loss of $23.9 million, and for the full fiscal year 2025, this loss widened to $256.7 million. This ongoing divergence highlights significant investments in R&D and marketing that, while fueling growth, are impacting the bottom line on a GAAP basis.

Atlassian's significant revenue generation heavily depends on its core products like Jira and Confluence, which accounted for a substantial majority of its revenue in recent fiscal periods. This concentration, while a testament to their strength, creates a vulnerability. A significant shift in customer preference away from these established tools, or the emergence of a superior competitor, could disproportionately impact Atlassian's financial performance.

While Atlassian has seen strong cloud migration momentum, some large enterprises, particularly those with strict regulatory needs or mandates for on-premises data, still encounter substantial hurdles. This can impede or halt the migration process for a valuable customer segment, even with Atlassian's ongoing improvements to cloud compliance features.

Concerns Regarding Stock Valuation

Concerns regarding Atlassian's stock valuation persist, with some analyses suggesting a potential for overvaluation. For instance, as of August 2025, the company's Price-to-Book ratio stood at a notable 36.72x. This elevated metric indicates that the market may be pricing in significant future growth, potentially placing the stock at a premium.

While Atlassian has a track record of robust growth, this high valuation could represent a risk, particularly within the intensely competitive software industry. Investors should carefully consider whether the current stock price adequately reflects the company's intrinsic value and future prospects.

- Elevated Price-to-Book Ratio: Atlassian's Price-to-Book ratio reached 36.72x in August 2025, signaling a high market valuation.

- Premium Valuation Risk: This premium valuation could be a concern for investors, especially in a competitive market.

- Growth vs. Valuation: While growth is strong, the valuation metric prompts a discussion about whether the stock is trading above its fundamental worth.

Impact of Co-CEO Transition

The transition of co-founder Scott Farquhar stepping down as co-CEO in August 2024, while Mike Cannon-Brookes remains CEO, introduces a potential weakness. This leadership shift, even with a strong existing team, could create temporary ambiguity regarding strategic focus or investor confidence. For instance, while Atlassian has a robust management structure, significant leadership changes can sometimes impact market sentiment in the short term.

Such transitions can necessitate a recalibration of internal processes and external communication. While Atlassian's market capitalization stood at approximately $45 billion in early 2024, demonstrating considerable investor trust, any perceived instability could affect this valuation. The company's ability to clearly articulate its ongoing strategy will be crucial in mitigating this weakness.

- Leadership Transition: Scott Farquhar's departure as co-CEO in August 2024 marks a significant leadership change.

- Potential Uncertainty: While Mike Cannon-Brookes continues as CEO, leadership transitions can introduce short-term strategic or market perception uncertainties.

- Market Perception: Investor confidence, reflected in Atlassian's market capitalization of around $45 billion in early 2024, could be temporarily impacted by perceived leadership shifts.

Atlassian's reliance on a few core products like Jira and Confluence presents a significant weakness. This concentration means that any substantial shift in customer preference away from these established tools, or the emergence of a disruptive competitor, could disproportionately impact the company's financial performance. For example, if a new, more efficient project management tool gains widespread adoption, Atlassian's revenue streams could be significantly threatened.

The company's ongoing GAAP net losses, despite strong revenue and non-GAAP profits, are a notable concern. For Q4 FY2025, Atlassian reported a GAAP net loss of $23.9 million, and for the full fiscal year 2025, this loss expanded to $256.7 million. This divergence suggests that substantial investments in research and development, as well as marketing, are impacting the reported bottom line, even as the business grows.

While Atlassian has made strides in its cloud offerings, some large enterprises still face considerable challenges migrating due to strict regulatory requirements or mandates for on-premises data. This can limit the company's ability to capture a valuable customer segment, even with ongoing improvements to cloud compliance features.

Atlassian's stock valuation, with a Price-to-Book ratio of 36.72x as of August 2025, suggests a potentially elevated market assessment. This premium valuation could pose a risk, especially in the highly competitive software industry, raising questions about whether the current stock price fully reflects the company's intrinsic value and future growth prospects.

| Weakness | Description | Financial/Market Data |

| Product Concentration | Heavy reliance on Jira and Confluence | These products form the substantial majority of revenue. |

| GAAP Net Losses | Persistent net losses on a GAAP basis | Q4 FY2025: -$23.9M GAAP Net Loss; FY2025: -$256.7M GAAP Net Loss. |

| Cloud Migration Hurdles | Challenges for some enterprises migrating to cloud | Regulatory and on-premises data requirements are key barriers. |

| Elevated Valuation | High market valuation of the stock | Price-to-Book ratio of 36.72x (August 2025). |

Preview the Actual Deliverable

Atlassian SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

Atlassian has a significant runway for growth by targeting the enterprise sector, which represents a $67 billion serviceable addressable market globally. The company is actively shifting its strategy to become a top-tier enterprise solutions provider, aiming to serve the complex needs of larger organizations.

This strategic pivot is crucial, as Atlassian sees a $14 billion opportunity within its existing customer base alone, indicating a strong potential for upselling and expanding its footprint in larger accounts.

Atlassian's deep integration of AI, exemplified by its Rovo AI assistant, represents a prime opportunity. This AI focus, enhanced by partnerships with Google Cloud's Vertex AI and Gemini models, is poised to unlock substantial productivity gains for users.

This technological advancement can foster entirely new workflows and user experiences within Atlassian's suite of products. The potential for AI-driven features to become increasingly valuable creates clear pathways for new monetization strategies as adoption grows.

Strategic collaborations, like the one with Google Cloud, are key for Atlassian. This partnership bolsters their multi-cloud approach, expands their presence via cloud marketplaces, and allows them to integrate cutting-edge external technologies.

The Atlassian Marketplace is a significant growth engine, with over $1.1 billion in gross purchases recorded in fiscal year 2024. This highlights the immense value and potential driven by their expanding ecosystem of partners and applications.

Continued Cloud Migration of Data Center Customers

The ongoing shift of Data Center customers to Atlassian's Cloud and Data Center products presents a prime opportunity for consistent revenue expansion and platform integration. Atlassian is heavily investing in its cloud infrastructure, adding robust enterprise features to smooth this transition.

This strategic move targets Atlassian's considerable on-premise customer base, aiming to onboard them onto their modernized cloud solutions. By the end of fiscal year 2024, Atlassian reported that over 17,000 customers had migrated from Data Center to Cloud, demonstrating significant traction.

- Increased Cloud Adoption: Atlassian's focus on enhancing cloud capabilities directly addresses customer needs for scalability and advanced features, driving migration.

- Revenue Growth: Converting on-premise users to subscription-based cloud services is a key driver for predictable and growing revenue streams.

- Platform Consolidation: Encouraging migration simplifies Atlassian's product portfolio and customer support, leading to greater operational efficiency.

- Enterprise Feature Development: Continued investment in enterprise-grade security, compliance, and performance for the cloud platform is crucial for attracting and retaining larger organizations.

Diversification Through New Product Development

Atlassian's commitment to innovation fuels diversification through new product development. Recent additions like Jira Product Discovery, Compass, and Loom demonstrate this, alongside specialized solutions such as the Talent workforce planning app. These launches are designed to tap into emerging market needs and generate fresh revenue.

The strategic 'Strategy Collection,' encompassing Focus, Talent, and Jira Align, is a key initiative allowing Atlassian to penetrate new market segments. This expansion beyond core offerings like Jira and Confluence opens up significant opportunities for cross-selling and upselling, thereby broadening its customer base and revenue sources.

- Product Expansion: Atlassian introduced Jira Product Discovery, Compass, Loom, and a Talent workforce planning app in the 2024 fiscal year.

- Market Penetration: The 'Strategy Collection' (Focus, Talent, Jira Align) targets new market segments, enhancing Atlassian's reach.

- Revenue Growth: These new products are designed to create additional, diversified revenue streams, reducing reliance on existing core products.

Atlassian is capitalizing on the substantial enterprise market, estimated at $67 billion globally, by enhancing its cloud offerings and targeting larger organizations. This strategic shift is supported by a $14 billion opportunity within its existing customer base for upselling and expansion.

The integration of AI, particularly through its Rovo AI assistant and partnerships with Google Cloud's Vertex AI and Gemini models, presents a significant opportunity to boost user productivity and create new monetization avenues. The Atlassian Marketplace is also a key growth driver, with over $1.1 billion in gross purchases in fiscal year 2024, demonstrating the strength of its partner ecosystem.

| Opportunity Area | Description | Data Point |

|---|---|---|

| Enterprise Market Expansion | Targeting larger organizations with tailored solutions. | $67 billion global serviceable addressable market. |

| AI Integration | Leveraging AI for enhanced productivity and new features. | Partnerships with Google Cloud's Vertex AI and Gemini. |

| Marketplace Growth | Expanding the ecosystem of apps and integrations. | $1.1 billion in gross purchases (FY24). |

| Cloud Migration | Transitioning Data Center customers to cloud solutions. | Over 17,000 customers migrated (FY24). |

| Product Diversification | Developing new products to tap into emerging needs. | Launched Jira Product Discovery, Compass, Loom, Talent app. |

Threats

Atlassian contends with significant rivalry from tech giants like Microsoft, offering Microsoft Teams and Azure DevOps, and Google with its Google Workspace. These established players command substantial market share and possess vast financial resources for ongoing product enhancement and advancements in artificial intelligence.

For instance, Microsoft's continued investment in its collaboration and development tools, coupled with its extensive enterprise customer base, presents a direct challenge. Similarly, Google's integration of AI into its Workspace suite offers a compelling alternative for productivity and collaboration, potentially drawing users away from Atlassian's offerings. These competitive pressures can affect Atlassian's ability to maintain its market standing and influence its pricing strategies.

A significant economic slowdown or a sharp cutback in corporate technology budgets poses a direct threat to Atlassian. As businesses tighten their belts, they may scale back on software subscriptions, impacting Atlassian's recurring revenue model. For instance, during periods of economic uncertainty, companies often scrutinize software expenses, potentially delaying upgrades or reducing user licenses for tools like Jira and Confluence.

While Atlassian has historically demonstrated resilience, a prolonged recession could still lead to a deceleration in new customer acquisition. Furthermore, existing clients might slow their expansion plans or even reduce their spending on additional features and services. This vulnerability is amplified by the fact that many of Atlassian's products are mission-critical for development and collaboration, but discretionary spending can still be curtailed in tough economic times.

As a significant player in the software industry, Atlassian, which manages crucial project and collaboration data for numerous businesses, is an attractive target for cyberattacks. The company's reliance on cloud infrastructure and the sensitive nature of the information it holds make it particularly vulnerable to security breaches.

The year 2024 has seen a notable increase in reported cybersecurity incidents across the tech sector, highlighting the ongoing threat landscape. A data breach for Atlassian could lead to the compromise of sensitive customer information, severely damaging its hard-earned reputation and potentially resulting in substantial financial penalties and legal challenges.

Lingering Cloud Compliance and Data Residency Challenges

Despite advancements in cloud compliance, certain organizations, especially those in heavily regulated sectors or with stringent data residency mandates, might still perceive Atlassian Cloud’s capabilities as inadequate. This could impede broader enterprise adoption, potentially pushing these clients towards competing platforms that offer more tailored solutions for their specific needs.

For instance, in 2024, a significant percentage of companies in finance and healthcare continued to express concerns about cloud data sovereignty, with some studies indicating over 40% of these sectors prioritize on-premises or hybrid solutions due to regulatory pressures. Atlassian's ability to fully address these niche but critical requirements remains a potential threat, as it could limit its market penetration in these high-value segments.

- Regulatory Hurdles: Industries like finance and healthcare often face strict regulations (e.g., GDPR, HIPAA) that dictate data handling and location, posing a challenge for universal cloud adoption.

- Data Sovereignty Concerns: Companies with a strong emphasis on data residency may be hesitant to move sensitive information to the cloud if they cannot guarantee it remains within specific geographical boundaries.

- Market Segmentation: This threat specifically targets a segment of the enterprise market that requires highly specialized compliance features, potentially driving them to seek alternatives.

Perception of Vendor Lock-in and Integration Complexity

Atlassian's robust ecosystem, while a key strength, can also foster a perception of vendor lock-in. The deep integration of its products and extensive customization options, coupled with numerous third-party app connections, can make it difficult and expensive for businesses to migrate away from Atlassian platforms. This complexity might deter potential new customers who prioritize platform flexibility and easier switching capabilities.

The challenge of extensive customization and integration with third-party applications, while beneficial for existing users, can present a significant hurdle for new prospects. Organizations seeking more open or adaptable solutions might view Atlassian's tightly integrated environment as a barrier. For instance, in Q4 FY24, Atlassian reported a 12% year-over-year increase in revenue, indicating strong customer retention, but the complexity of switching remains a point of discussion in market analysis.

- Perceived Vendor Lock-in: Deep integration and customization create a perception that switching away from Atlassian is difficult and costly.

- Integration Complexity: The sheer number of third-party app integrations can make migration to alternative platforms daunting for businesses.

- Deterrent for New Customers: Organizations prioritizing flexibility and ease of switching may be hesitant to adopt Atlassian due to these integration complexities.

- Impact on Market Share: While Atlassian maintains strong customer loyalty, the perception of lock-in could limit its appeal to a segment of the market seeking more open ecosystems.

Intense competition from tech giants like Microsoft and Google poses a significant threat, as they leverage vast resources and AI advancements to enhance their collaboration and development tools. Economic downturns also present a risk, potentially leading businesses to cut back on software subscriptions, impacting Atlassian's recurring revenue. Furthermore, Atlassian's role in managing critical business data makes it a prime target for cyberattacks, with data breaches carrying severe reputational and financial consequences.

SWOT Analysis Data Sources

This Atlassian SWOT analysis is built upon a foundation of credible data, drawing from publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.