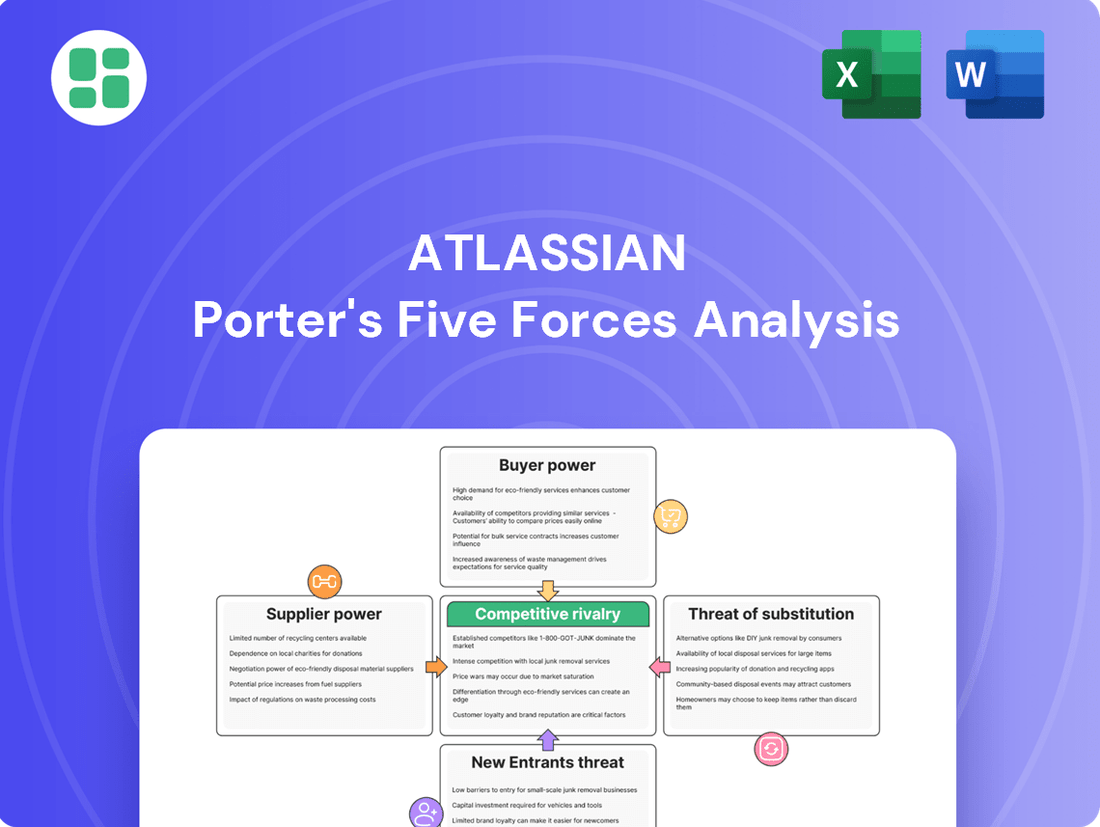

Atlassian Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlassian Bundle

Atlassian navigates a dynamic software landscape, facing intense rivalry from established players and agile newcomers alike. Understanding the bargaining power of their buyers and the constant threat of substitute solutions is crucial for their continued success.

The complete report reveals the real forces shaping Atlassian’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Atlassian's reliance on major cloud infrastructure providers like Google Cloud for hosting its extensive product suite, including Jira and Confluence, grants these providers a degree of bargaining power. This is particularly evident given the August 2025 partnership announcement with Google Cloud, underscoring a significant dependency on their core services.

While Atlassian's adoption of a multi-cloud strategy and its considerable scale likely temper the suppliers' leverage, the fundamental need for robust and reliable cloud infrastructure means these providers hold a crucial position. The cost and complexity of migrating such a large-scale operation would also contribute to supplier stickiness.

The availability of skilled software developers, AI/ML engineers, and product managers directly influences Atlassian's operational expenses and its capacity for innovation. A persistent global talent shortage in the technology sector, as highlighted by various industry analyses, can amplify the bargaining power of employees. This often translates into upward pressure on wages and increased recruitment expenditures for companies like Atlassian.

Atlassian's success in attracting and retaining top-tier talent is therefore paramount for its ongoing product evolution and maintaining a competitive advantage in the market. For instance, in 2024, the demand for specialized AI and machine learning talent saw a significant surge, with some reports indicating salary increases of 15-20% for experienced professionals in these fields compared to the previous year.

Third-party app developers for Atlassian's marketplace hold some bargaining power, particularly those with highly specialized or popular integrations that are crucial for customer workflows. The marketplace itself is a significant revenue driver, with gross purchases exceeding $1.1 billion in fiscal year 2024, highlighting the value these developers bring. Atlassian's strategic investments through Atlassian Ventures aim to cultivate these relationships, potentially mitigating some of this power by fostering a broader, more collaborative ecosystem.

Open-Source Software and Libraries

Atlassian's reliance on open-source software and libraries, common in the tech industry, presents a nuanced aspect of supplier bargaining power. While these components often lower initial development costs, shifts in their licensing or the emergence of critical security flaws can impose unexpected expenses and require substantial engineering resources to adapt. For instance, a major open-source project experiencing a significant vulnerability could necessitate Atlassian to either invest heavily in patching or migrate to alternative, potentially less mature, solutions.

The dependency management of these external components is an ongoing operational challenge. In 2024, the open-source ecosystem continued to evolve rapidly, with many foundational libraries seeing active development and occasional license changes. Atlassian, like its peers, must constantly monitor these dependencies to mitigate risks associated with obsolescence, security breaches, or unfavorable licensing adjustments that could impact their product roadmap and operational costs.

- Dependency Management: Atlassian actively manages its use of open-source components, a crucial task given the dynamic nature of the open-source landscape.

- Cost Reduction vs. Risk: While open-source software reduces direct licensing fees, it introduces risks related to security, maintenance, and potential licensing changes.

- Operational Impact: Vulnerabilities or licensing shifts in widely adopted open-source projects can necessitate costly development efforts and technology stack modifications for Atlassian.

- Ecosystem Evolution: The continuous evolution of open-source projects in 2024 means Atlassian must remain vigilant in assessing and updating its dependencies to ensure product stability and security.

Hardware and Network Equipment Providers

Atlassian depends on hardware and network equipment providers for its Data Center solutions and internal IT infrastructure. While the move towards cloud services lessens direct hardware purchases for customer-facing operations, the necessity for strong, secure internal systems and Data Center setups maintains a degree of reliance on these suppliers. For instance, in 2024, global semiconductor shortages continued to impact lead times and costs for critical networking components, potentially affecting Atlassian's infrastructure upgrade timelines and expenses.

The bargaining power of these suppliers is influenced by factors such as the concentration of providers, the availability of substitute products, and the importance of Atlassian's business to them. A limited number of specialized hardware providers can exert significant influence, particularly for custom or high-performance equipment. For example, specialized network interface card manufacturers often hold considerable sway due to the niche nature of their products.

- Supplier Concentration: The market for advanced networking hardware is often dominated by a few key players, such as Cisco and Arista Networks, giving them leverage.

- Switching Costs: Migrating to different hardware architectures can involve substantial costs and integration challenges, increasing Atlassian's dependence on current suppliers.

- Impact of Disruptions: In 2023, supply chain issues for certain advanced processors, critical for high-speed networking, saw price increases of up to 15% for some components, highlighting supplier leverage.

Atlassian's reliance on cloud infrastructure providers like Google Cloud and Amazon Web Services grants these suppliers significant bargaining power. This is amplified by the increasing complexity and scale of Atlassian's operations, making switching providers a costly and time-consuming endeavor. The August 2025 expanded partnership with Google Cloud further solidifies this dependency.

The bargaining power of third-party app developers for Atlassian's marketplace is also noteworthy, especially for those offering critical or highly adopted integrations. With over $1.1 billion in gross purchases on the marketplace in fiscal year 2024, these developers represent a valuable component of Atlassian's ecosystem, influencing customer retention and product stickiness.

Open-source software suppliers, while offering cost benefits, can exert influence through licensing changes or security vulnerabilities, forcing Atlassian to invest in adaptation or migration. The rapid evolution of the open-source landscape in 2024 necessitates constant vigilance in dependency management to mitigate these risks.

Hardware and network equipment providers for Atlassian's Data Center solutions also hold leverage, particularly those supplying specialized components. Supply chain disruptions in 2023, impacting semiconductor availability and prices, demonstrated how concentrated supplier markets can significantly affect operational timelines and costs.

| Supplier Type | Key Dependencies | Bargaining Power Factors | 2024/2025 Relevance |

|---|---|---|---|

| Cloud Infrastructure | Google Cloud, AWS | Scale of operations, switching costs, strategic partnerships | Expanded Google Cloud partnership (Aug 2025) |

| Marketplace Apps | Popular/specialized integrations | Customer workflow criticality, marketplace revenue contribution | $1.1B+ gross purchases (FY2024) |

| Open-Source Software | Libraries, frameworks | Licensing changes, security vulnerabilities, maintenance costs | Rapid ecosystem evolution |

| Hardware/Network Equipment | Data Center, IT infrastructure | Supplier concentration, specialization, supply chain stability | Semiconductor shortages impact (2023) |

What is included in the product

Analyzes the competitive intensity within the software collaboration and development tools market, focusing on Atlassian's unique position and strategic advantages.

Instantly identify and address competitive threats with a pre-built framework for strategic analysis.

Streamline complex market assessments by visualizing competitive intensity and potential disruptions.

Customers Bargaining Power

Atlassian's integrated suite of products, including Jira, Confluence, and Bitbucket, fosters high switching costs for its customer base. This integration means that moving to a competitor requires not just a change in software, but a significant overhaul of established workflows and data migration processes.

For large enterprises, the complexity of their existing setups amplifies these costs. The effort involved in migrating data, reconfiguring integrations, and retraining staff on new platforms can be substantial. This deep integration creates a strong lock-in effect, making it challenging for customers to simply switch providers.

In 2024, Atlassian reported over 250,000 customers, with a significant portion being large organizations. The very nature of these long-term, deeply embedded relationships means that the perceived cost and disruption of switching are often prohibitive, thereby reducing the bargaining power of these customers.

Atlassian's extensive customer reach, encompassing over 300,000 organizations worldwide, significantly tempers the bargaining power of individual customers. This diverse base includes a substantial portion of the Fortune 500, with 80% of these large enterprises utilizing Atlassian products.

While Atlassian has seen growth in high-spending enterprise clients, with an increasing number of customers spending over $1 million annually, the sheer volume of smaller clients prevents any single entity or small group from wielding undue influence. This widespread adoption across various business sizes and sectors dilutes the collective bargaining power of the customer base.

Atlassian's subscription model, while offering predictable recurring revenue, also grants customers the power to leave if they are unhappy. This inherent flexibility means customer satisfaction is paramount to retaining their business.

However, Atlassian has demonstrated remarkable resilience in this area. Their impressive cloud net revenue retention rate of 120% as of Q2 2024 strongly suggests that customers are not only renewing their subscriptions but are also expanding their usage, indicating high satisfaction and a reduced propensity to churn.

Product Differentiation and Ecosystem Value

Atlassian's products stand out due to their seamless integration, comprehensive features, and a thriving Marketplace. This deep interconnectivity and the vast array of add-ons create a sticky ecosystem that is difficult for customers to replicate with alternative solutions.

The company's commitment to innovation, exemplified by the recent launch of Atlassian Intelligence and Rovo, an AI agent, further solidifies this differentiation. These advancements offer unique productivity and collaboration benefits, making it challenging for customers to switch to less integrated or less intelligent offerings without significant disruption.

- Product Integration: Atlassian's suite, including Jira, Confluence, and Trello, offers deep integration, creating a unified workflow.

- Marketplace Ecosystem: Over 4,000 apps on the Atlassian Marketplace extend product functionality, increasing switching costs.

- AI Enhancements: Atlassian Intelligence and Rovo provide advanced AI capabilities, boosting productivity and offering unique value propositions.

- Reduced Price Sensitivity: The strong differentiation and ecosystem value limit customers' ability to bargain solely on price.

Pricing Changes and Value Perception

Atlassian's recent price adjustments for its Data Center and Cloud offerings in 2025, with increases varying by product and user count, directly influence customer bargaining power. For instance, certain Data Center tiers saw a 15% rise, while Cloud enterprise plans experienced a 10% uplift.

However, Atlassian counters potential customer pushback by emphasizing significant product enhancements. These include advanced AI capabilities integrated into Jira Service Management and Confluence, alongside notable improvements in cloud infrastructure scalability and security protocols, aiming to bolster the perceived value proposition.

- Price Adjustments: Atlassian's 2025 price hikes, impacting both Data Center and Cloud products, directly affect customer cost considerations.

- Value Justification: The company links these increases to substantial upgrades, such as AI integration and enhanced cloud security, to reinforce value.

- Customer Perception: The ultimate bargaining power of customers hinges on their assessment of whether the enhanced features and services justify the increased costs.

Atlassian's extensive customer base, exceeding 300,000 organizations globally, including 80% of the Fortune 500, significantly dilutes the bargaining power of individual customers. The company's strong product integration, exemplified by Jira and Confluence, creates high switching costs, making it difficult for clients to migrate to alternative solutions. Furthermore, Atlassian's thriving Marketplace, featuring over 4,000 apps, enhances product functionality and further locks in customers.

| Metric | Value (as of Q2 2024/2025) | Impact on Customer Bargaining Power |

| Total Customers | > 300,000 | Lowers individual customer influence due to scale. |

| Fortune 500 Penetration | 80% | Indicates high reliance among large enterprises, potentially increasing collective leverage, but Atlassian's scale mitigates this. |

| Cloud Net Revenue Retention | 120% | Suggests high customer satisfaction and expansion, reducing the likelihood of customers seeking alternatives or bargaining aggressively on price. |

| Marketplace Apps | > 4,000 | Increases switching costs and ecosystem dependency, limiting bargaining power. |

Same Document Delivered

Atlassian Porter's Five Forces Analysis

This preview showcases the precise Atlassian Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of competitive forces within the software industry. You'll gain immediate access to this fully formatted and professionally written document, enabling you to understand Atlassian's strategic positioning without any placeholders or surprises. This is the exact, ready-to-use analysis that will be yours upon completing your purchase.

Rivalry Among Competitors

Atlassian operates in highly competitive arenas, facing formidable rivals in software development, service management, and work management. Microsoft, with offerings like Azure DevOps and Microsoft Teams, presents a significant challenge, as does ServiceNow in the IT Service Management (ITSM) space. Companies like GitHub and GitLab, alongside project management specialists such as Asana, ClickUp, and Smartsheet, further intensify the competitive landscape, ensuring continuous pressure on Atlassian's market share and innovation.

Atlassian sharpens its competitive edge by building a robust ecosystem and leveraging advanced AI. Their integrated suite, featuring products like Jira and Confluence, works seamlessly together, offering a cohesive experience for teams. This integration is a significant differentiator, making it challenging for rivals to offer a comparable, end-to-end solution.

The company's commitment to AI, exemplified by Atlassian Intelligence and Rovo, further solidifies its position. By harnessing over two decades of workflow data through its Teamwork Graph, Atlassian aims to deliver AI-powered insights and automation that are difficult to match. In 2024, Atlassian reported that its cloud products saw strong growth, with revenue from cloud increasing by 27% year-over-year, highlighting the success of their ecosystem strategy.

Atlassian's strategic pivot towards the enterprise segment intensifies rivalry with established software giants. By aiming to serve larger organizations, Atlassian directly confronts vendors with deep-rooted enterprise relationships and extensive product suites tailored for corporate needs.

While Atlassian boasts an impressive 80% penetration within Fortune 500 companies, these large accounts currently constitute only about 10% of its overall revenue. This highlights a substantial growth opportunity but also signals fierce competition for these lucrative, high-value deals against seasoned enterprise players.

Cloud Migration and Data Center Strategy

Atlassian's strategic shift to the cloud, including the discontinuation of its Server products, intensifies rivalry by pushing customers towards its cloud-based solutions. This move aims to capture a larger share of the growing cloud market, where competitors like Microsoft Azure and Amazon Web Services (AWS) are already dominant players. The success of this transition hinges on Atlassian's ability to offer a compelling enterprise-grade cloud experience that rivals existing offerings.

While Atlassian's cloud revenue saw a significant increase, with cloud subscriptions contributing over 60% of its total revenue by the end of fiscal year 2023, the company still supports Data Center deployments. This dual approach means navigating customer migration preferences while facing intense competition from other SaaS providers and even internal IT departments managing their own infrastructure. The pressure is on to demonstrate superior value and reliability in its cloud offerings to retain and attract customers.

- Cloud Transition Impact: Atlassian's decision to end support for its Server products in February 2024 is a significant competitive maneuver, forcing customers to migrate to Cloud or Data Center.

- Market Dynamics: Competitors offering robust cloud solutions and compelling pricing models create a challenging environment as Atlassian transitions its user base.

- Enterprise Cloud Advantage: Atlassian's ability to deliver enterprise-grade cloud services with high uptime, security, and scalability is a key differentiator against rivals.

- Data Center Role: Despite the cloud push, Atlassian continues to offer Data Center, acknowledging a segment of customers who may be slower to migrate, thus managing a hybrid competitive landscape.

Product Specific Competition

Within specific product categories, Atlassian faces intense competition. Jira, its flagship product for issue tracking and project management, contends with powerful alternatives such as Asana, Microsoft's Azure DevOps, and GitHub Issues. Similarly, Confluence, the team collaboration and wiki tool, finds itself challenged by platforms like Notion, Google Docs, and SharePoint. Bitbucket, Atlassian's code repository and collaboration tool, directly competes with established players like GitHub and GitLab.

This fragmented competitive landscape, featuring both specialized tools and comprehensive suites, necessitates continuous innovation from Atlassian. The company must focus on integrating its offerings and enhancing features to retain its market position. For instance, in 2023, the project management software market alone was valued at approximately $6.8 billion, with significant growth projected, indicating the high stakes involved in capturing and holding market share against these diverse competitors.

- Jira's rivals include Asana, Azure DevOps, and GitHub Issues.

- Confluence competes with Notion, Google Docs, and SharePoint.

- Bitbucket's primary competitors are GitHub and GitLab.

- Atlassian must innovate and integrate to counter both niche and broad-suite competitors.

Atlassian faces intense competition across its product lines from both specialized tools and broad software suites. Key rivals like Microsoft, ServiceNow, GitHub, GitLab, Asana, ClickUp, and Smartsheet exert constant pressure on market share and innovation.

The company's strategic shift to cloud offerings, including the discontinuation of Server products in February 2024, intensifies rivalry with dominant cloud providers. Atlassian's success hinges on offering compelling enterprise-grade cloud services that rival existing solutions, especially as cloud subscriptions represented over 60% of its revenue by the end of fiscal year 2023.

Atlassian's focus on enterprise clients, despite an 80% Fortune 500 penetration, means competing fiercely for these high-value accounts against established enterprise software vendors, as these large deals currently account for only about 10% of its revenue.

| Atlassian Product | Key Competitors | Market Segment |

|---|---|---|

| Jira | Asana, Microsoft Azure DevOps, GitHub Issues | Issue Tracking & Project Management |

| Confluence | Notion, Google Docs, SharePoint | Team Collaboration & Wiki |

| Bitbucket | GitHub, GitLab | Code Repository & Collaboration |

SSubstitutes Threaten

General-purpose collaboration tools like Microsoft Teams, Google Workspace, and Slack present a significant threat of substitution for certain Atlassian functionalities, especially those offered by Confluence. These platforms provide widespread accessibility and seamless integration into existing business workflows, making them attractive alternatives for basic document sharing and team communication.

While these substitutes may not replicate the deep, specialized features Atlassian offers for software development and project management, their broad appeal and often lower cost can lure users away for less complex collaboration needs. For instance, Google Workspace saw its active user base grow to over 3 billion, highlighting its extensive reach and potential to absorb collaboration tasks.

The increasing prevalence of low-code and no-code platforms presents a significant threat of substitutes for traditional software development and project management tools, including those offered by Atlassian. These platforms democratize application development, allowing business users to create solutions without extensive coding knowledge. For instance, Gartner predicted that by the end of 2024, the low-code development market would reach $26.9 billion, a substantial increase from previous years, highlighting the growing adoption and capability of these alternatives.

Manual processes and traditional methods like spreadsheets or basic email communication serve as a significant threat of substitutes for Atlassian's software. For smaller teams or less complex projects, these simpler, often cheaper, alternatives can be appealing. For instance, a small startup might manage tasks using shared spreadsheets and email threads instead of adopting a full project management suite.

While these manual approaches offer a low barrier to entry, their limitations become apparent as teams grow or project demands increase. In 2024, many businesses reported that inefficient manual processes were a major drain on productivity. Studies indicate that companies relying heavily on manual data entry and management can experience error rates up to 5% higher than those using automated systems, directly impacting project timelines and budgets.

Atlassian's core value proposition is to streamline workflows and enhance collaboration, directly addressing the inefficiencies inherent in these substitute methods. By offering integrated platforms for project tracking, code collaboration, and issue resolution, Atlassian aims to demonstrate a clear return on investment compared to the hidden costs of manual operations, especially as organizations scale.

In-House Developed Solutions

Large enterprises with substantial IT budgets might opt to build their own internal systems for project management and issue tracking. These custom-built solutions, though resource-intensive, offer unparalleled alignment with unique business processes, presenting a significant alternative to commercially available software like Atlassian's offerings. For instance, a major financial institution might invest millions in developing a proprietary platform to meet stringent regulatory and security requirements, bypassing standard market solutions.

Atlassian addresses this threat by continuously enhancing the customization and integration capabilities of its product suite. Features like Jira's extensive marketplace of add-ons and Confluence's robust API allow organizations to tailor the platforms to their specific workflows, thereby reducing the perceived need for entirely in-house developed alternatives. This strategy aims to provide the flexibility of custom solutions with the benefits of a supported, evolving product ecosystem.

- Customization Potential: Enterprises may develop bespoke solutions to perfectly match unique operational needs, a capability that off-the-shelf software struggles to replicate entirely.

- Resource Investment: Building in-house systems requires significant upfront investment in development, maintenance, and IT personnel, often exceeding the cost of subscribing to established platforms.

- Atlassian's Counter: Atlassian mitigates this by offering highly configurable products and a rich ecosystem of integrations, aiming to provide tailored solutions without the burden of full in-house development.

Open-Source Alternatives

The threat of open-source alternatives is a significant factor for Atlassian. Numerous free and open-source project management, version control, and collaboration tools are readily available. These can directly substitute for Atlassian's offerings, especially for budget-conscious businesses or those who prefer a self-managed, customizable software environment.

While these alternatives might demand more technical know-how for setup and ongoing management, they eliminate licensing costs. For instance, projects like GitLab (which offers a robust open-source Community Edition) provide version control and CI/CD capabilities that compete with Atlassian's Bitbucket. Similarly, tools like Taiga or OpenProject offer project management features that can be an alternative to Jira.

- Cost Savings: Open-source solutions eliminate the recurring subscription fees associated with Atlassian products, which can be substantial for larger teams.

- Flexibility and Customization: Organizations can modify and extend open-source tools to perfectly fit their unique workflows and technical requirements.

- Community Support: Many open-source projects benefit from active developer communities that contribute to development, bug fixes, and provide support through forums.

- Control Over Data and Infrastructure: Self-hosting open-source tools allows businesses to maintain complete control over their data and infrastructure, which is crucial for security-conscious entities.

General collaboration tools like Microsoft Teams and Google Workspace offer a compelling substitute for Atlassian's Confluence, especially for less specialized needs. Their widespread adoption and integration into existing business ecosystems make them an easy choice for many teams. Google Workspace alone boasts over 3 billion active users, demonstrating its vast reach and potential to absorb basic collaboration tasks.

Entrants Threaten

The enterprise software market, particularly for mission-critical tools like those Atlassian provides, presents substantial barriers to new competitors. Significant upfront investment in research and development is essential, alongside the considerable effort required to cultivate a trustworthy brand reputation. Furthermore, establishing a comprehensive sales and support network, along with obtaining crucial certifications and compliance for large enterprise clients, demands extensive resources and time, making it difficult for newcomers to challenge established players.

Atlassian benefits from powerful network effects, meaning its products become more valuable as more users and teams join, and its Marketplace expands. This creates a significant barrier for newcomers who find it challenging to replicate Atlassian's established ecosystem and the deep integrations that foster customer loyalty.

Developing and scaling enterprise software like Atlassian's offerings demands significant capital. Think tens to hundreds of millions for R&D, sales, and marketing. For instance, in 2023, the global cloud computing market, which underpins much of this software, was valued at over $600 billion, highlighting the scale of investment required.

Attracting and retaining skilled software engineers, especially those with AI expertise, presents another formidable barrier. The demand for such talent is immense, with average software engineer salaries in major tech hubs often exceeding $150,000 annually. New entrants must compete with established players for this scarce and expensive resource.

Brand Recognition and Customer Trust

Atlassian's formidable brand recognition, cultivated over two decades, presents a significant barrier to new entrants. This trust is deeply embedded within its core user base of software developers, project managers, and IT professionals, who rely on Atlassian's products for mission-critical operations and sensitive data management.

New competitors must invest heavily to replicate the credibility and assurance that Atlassian offers. For instance, Atlassian's consistent uptime and robust security protocols, often highlighted in their customer success stories, are hard-won attributes that new players struggle to establish quickly. This established reputation means potential new entrants face a steep uphill battle in convincing customers to switch from a trusted, long-standing provider.

- Established Trust: Atlassian's two-decade history fosters deep user trust, particularly for handling sensitive corporate data.

- Credibility Challenge: New entrants must build comparable reliability and security credentials, a lengthy and costly process.

- User Loyalty: Existing customers are often hesitant to migrate from proven solutions that integrate seamlessly into their workflows.

Regulatory and Compliance Hurdles

For enterprise clients, especially in government or heavily regulated sectors, software vendors must adhere to rigorous security and compliance mandates like SOC 2, ISO/IEC 27001, and FedRAMP. The effort and expense involved in securing these certifications create a substantial obstacle for newcomers lacking established compliance structures.

Atlassian's progress towards FedRAMP authorization, specifically its 'In Process' status, offers a distinct competitive edge. This demonstrates a commitment to meeting the high standards required by government agencies, a significant deterrent for potential new competitors who would need to invest heavily to achieve similar compliance levels.

- Regulatory Compliance Costs: New entrants face substantial costs and time investments to achieve certifications like SOC 2 and FedRAMP, essential for enterprise and government contracts.

- Atlassian's Compliance Advantage: Atlassian's 'In Process' FedRAMP status provides a significant barrier to entry, signaling a readiness for government sector business that new competitors would struggle to match quickly.

- Industry-Specific Standards: Meeting diverse and evolving regulatory requirements across different industries demands ongoing resources and expertise, further complicating market entry.

The threat of new entrants in the enterprise software market, particularly for Atlassian's specialized tools, remains relatively low due to substantial barriers. These include the immense capital required for research, development, and building a trusted brand, alongside the complex web of integrations and network effects Atlassian has cultivated.

Newcomers must also navigate significant regulatory compliance hurdles, such as achieving certifications like SOC 2 and FedRAMP, which demand considerable investment and time. Atlassian's existing relationships and established reputation further solidify its position, making it challenging for new players to gain traction and market share.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High R&D, sales, and marketing investment needed. Global cloud market over $600 billion in 2023. | Significant financial hurdle for startups. |

| Brand Reputation & Trust | Atlassian's 20-year history builds deep user trust for critical operations. | New entrants struggle to establish comparable credibility and reliability. |

| Network Effects | Products become more valuable with more users and integrations. | Challenging for newcomers to replicate Atlassian's established ecosystem and user loyalty. |

| Regulatory Compliance | Mandatory certifications (SOC 2, FedRAMP) are costly and time-consuming. | Substantial obstacle, especially for government contracts, where Atlassian holds an 'In Process' FedRAMP status. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including company annual reports, investor presentations, and industry-specific trade publications. We also leverage market research reports and publicly available financial statements to capture a comprehensive view of competitive dynamics.