Atlassian Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlassian Bundle

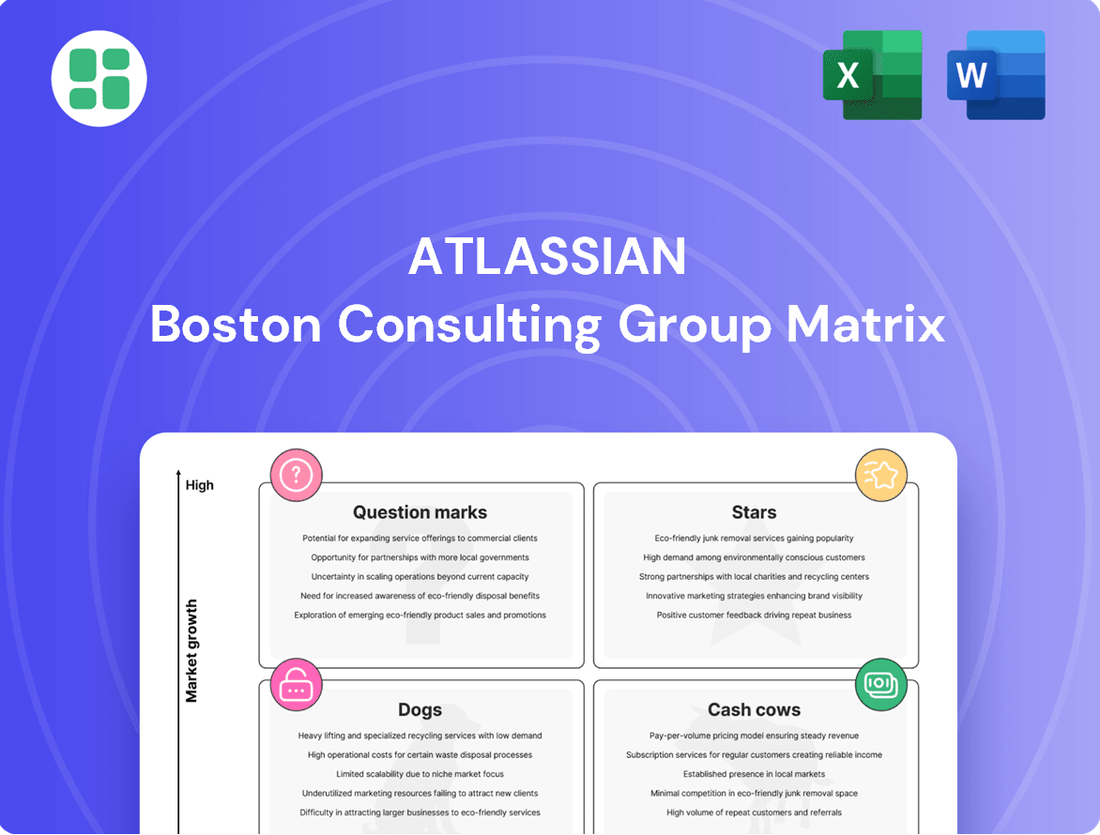

Curious about Atlassian's product portfolio performance? Our BCG Matrix preview highlights key areas, but the full report unlocks the strategic potential of each product. Discover which are Stars, Cash Cows, Dogs, or Question Marks, and gain actionable insights to optimize your investments.

Don't settle for a glimpse; dive into the complete Atlassian BCG Matrix to understand the strategic positioning of every product. Purchase the full version for detailed quadrant analysis, data-driven recommendations, and a clear roadmap for future growth and resource allocation.

Stars

Atlassian's Cloud Platform is a definitive Star in its BCG Matrix, fueled by impressive growth. Cloud revenue saw a substantial increase of 25-26% year-over-year in both Q3 and Q4 of Fiscal Year 2025, underscoring its strong market position.

This platform serves as the company's strategic core, attracting a steady stream of new customers and fostering deeper engagement with existing ones. Its inherent scalability and commitment to ongoing innovation are key drivers of this success, making it a highly attractive offering in the market.

The strategic shift and emphasis on cloud migration, especially following the server end-of-life, further cement Atlassian's leadership in this rapidly expanding sector. This focus ensures continued momentum for the Cloud Platform.

Jira Cloud Software is a clear Star in Atlassian's portfolio, holding a commanding position in project and issue tracking. Its growth is fueled by a significant shift of customers from on-premise versions to the cloud.

With ongoing improvements, including the integration of AI, and its essential function in agile and DevOps, Jira Cloud maintains a strong market share in the dynamic software development space. The product's revenue growth consistently matches or exceeds the company's overall growth rate.

Confluence Cloud is positioned as a Star in the BCG Matrix, recognized for its robust growth and strong market position within the knowledge management and team collaboration space. Its cloud-native architecture and extensive integration capabilities are fueling significant adoption, particularly as organizations embrace remote and hybrid work models.

The platform's increasing market penetration is evident in Atlassian's reporting, where Confluence Cloud has seen substantial user growth, contributing to the company's overall cloud revenue expansion. For instance, Atlassian reported strong performance for its collaboration tools in fiscal year 2024, with Confluence playing a key role in this momentum.

Rovo (AI Capabilities)

Rovo, Atlassian's AI-powered assistant, is a clear Star in their product portfolio. Its monthly active users surged to 2.3 million by the end of Q4 FY2025, marking a substantial 50% jump from the previous quarter.

This rapid user growth underscores Rovo's increasing integration and value within Atlassian's core offerings, including Jira, Confluence, and Bitbucket.

- Rovo's user base reached 2.3 million by the end of Q4 FY2025.

- This represents a 50% increase in monthly active users quarter-over-quarter.

- Rovo is strategically embedded across key Atlassian products to boost productivity.

Jira Service Management Cloud Premium & Enterprise

Jira Service Management Cloud Premium and Enterprise are positioned as Stars in the Atlassian BCG Matrix. Their sales have surged by over 50% year-over-year, underscoring robust demand for sophisticated IT and enterprise service management solutions.

This growth reflects a strategic expansion beyond core IT departments to encompass broader business functions, tapping into a competitive yet expanding market segment.

- Star Potential: Sales growth exceeding 50% year-over-year.

- Market Demand: Strong adoption for advanced IT and enterprise service management.

- Customer Focus: Targeting larger enterprises and higher-value cloud tiers.

- Market Position: High growth in a competitive, expanding market.

Atlassian's Cloud Platform is a definitive Star, experiencing robust growth with cloud revenue up 25-26% year-over-year in Q3 and Q4 FY2025. This platform is central to Atlassian's strategy, attracting new users and retaining existing ones through scalability and innovation. The company's focus on cloud migration following the server end-of-life further solidifies its leading position in this expanding market.

Jira Cloud Software is a prime Star, dominating the project and issue tracking market, driven by customer migration from on-premise solutions. Continuous enhancements, including AI integration, and its critical role in agile and DevOps practices ensure its strong market share. Jira Cloud's revenue growth consistently aligns with or surpasses the company's overall growth trajectory.

Confluence Cloud is a Star, showing strong growth and market leadership in knowledge management and collaboration. Its cloud-native design and integration capabilities are driving adoption, especially with the rise of hybrid work. Atlassian's FY2024 results highlighted significant user growth for Confluence Cloud, contributing to the company's cloud revenue expansion.

Rovo, Atlassian's AI assistant, is a clear Star, with monthly active users reaching 2.3 million by Q4 FY2025, a 50% increase from the prior quarter. This rapid growth signifies Rovo's increasing integration and value across Atlassian's core products like Jira, Confluence, and Bitbucket, enhancing user productivity.

Jira Service Management Cloud Premium and Enterprise are Stars, with sales increasing by over 50% year-over-year. This growth indicates strong demand for advanced IT and enterprise service management solutions, expanding beyond traditional IT to broader business functions in a competitive market.

| Product | BCG Category | Key Growth Drivers | FY2025 Performance Indicators | Strategic Importance |

|---|---|---|---|---|

| Atlassian Cloud Platform | Star | Cloud migration, scalability, innovation | 25-26% YoY Revenue Growth (Q3 & Q4 FY25) | Company's strategic core, customer engagement |

| Jira Cloud Software | Star | On-premise to cloud migration, AI integration, DevOps adoption | Revenue growth matching/exceeding company average | Market leader in project/issue tracking |

| Confluence Cloud | Star | Hybrid work adoption, integrations, user growth | Strong user growth contributing to cloud revenue | Key player in knowledge management/collaboration |

| Rovo | Star | AI capabilities, product integration, user adoption | 2.3M MAU (Q4 FY25), 50% QoQ user growth | Enhancing productivity across Atlassian suite |

| Jira Service Management Cloud Premium/Enterprise | Star | Demand for advanced ITSM, enterprise adoption | >50% YoY Sales Growth | Expansion into broader business functions |

What is included in the product

Strategic guidance on resource allocation, identifying which Atlassian products to invest in, hold, or divest based on market growth and share.

A clear BCG Matrix visualization that instantly highlights star products, relieving the pain of complex portfolio analysis.

Cash Cows

Jira Data Center is a prime example of a Cash Cow for Atlassian, specifically designed for large enterprises needing self-hosted, scalable solutions. Its revenue generation is robust and dependable, even with a more moderate growth trajectory compared to Atlassian's cloud products.

In fiscal year 2025, Jira Data Center is projected to see growth rates between 7% and 16.5%. This steady expansion, coupled with lower investment needs for acquiring new customers due to its established user base, translates into significant and consistent cash flow for Atlassian.

Confluence Data Center, much like Jira Data Center, operates as a Cash Cow within Atlassian's portfolio. It holds a significant market share by catering to enterprises that prefer on-premise or self-managed knowledge management solutions, ensuring a steady stream of revenue.

This segment benefits from a loyal and established customer base that continues to depend on its robust features for internal collaboration and documentation. The predictable income generated here is crucial for funding Atlassian's other growth-focused ventures.

While specific revenue figures for Confluence Data Center aren't broken out separately, Atlassian reported that its Data Center products collectively generated $1.2 billion in revenue for the fiscal year ending June 30, 2023, showcasing the overall strength of these mature offerings.

Bitbucket, with its robust code repository and continuous integration capabilities, firmly sits as a Cash Cow within Atlassian's portfolio. Its established presence and deep integration into developer workflows contribute to a stable revenue stream. In 2024, the continuous integration market saw Bitbucket holding a significant share, estimated around 19.06%, underscoring its strong market position.

While Atlassian continues to innovate with cloud migration and new features, Bitbucket's core functionality remains a reliable revenue generator. This is largely due to its widespread adoption by developers and teams who depend on its core services for their daily operations. Its deep integration within the broader Atlassian ecosystem further solidifies its value proposition and customer loyalty.

Trello

Trello, acquired by Atlassian in 2017, is firmly positioned as a Cash Cow within Atlassian's product portfolio. Its strong brand recognition and substantial user base in the project management space contribute to its stable revenue generation. In 2024, Trello maintained a significant presence, holding approximately 4.8% of the ERP software market share, a testament to its enduring appeal.

The platform's user-friendly Kanban-style boards remain a key differentiator, fostering consistent user engagement and retention. This allows Trello to generate predictable revenue streams with comparatively modest investment needs for growth, especially when contrasted with Atlassian's more innovative, high-growth products.

Trello's strategic integration into Atlassian's broader Teamwork Collection further solidifies its role as a reliable cash generator. This integration ensures its continued relevance and ability to contribute consistently to Atlassian's overall financial performance.

- Established Brand and User Base: Trello's acquisition in 2017 has allowed it to mature into a stable product with a loyal following.

- Market Position: Holding a 4.8% market share in the ERP software category in 2024 highlights its significant, albeit mature, market presence.

- Revenue Generation: Its consistent revenue is driven by its intuitive Kanban-style interface, requiring lower growth investments.

- Strategic Integration: Inclusion in the Teamwork Collection enhances its utility and maintains its cash-cow status.

Atlassian Marketplace (Established Apps)

The Atlassian Marketplace, specifically its established app ecosystem, functions as a significant Cash Cow for the company. This segment consistently generates substantial revenue through the sale and renewal of popular third-party applications, which are integral to the functionality of core Atlassian products like Jira and Confluence.

These mature, widely adopted apps contribute a reliable and high-margin income stream. For instance, in fiscal year 2023, Atlassian reported that its cloud products, which heavily leverage the marketplace, saw substantial growth, indicating the marketplace's vital role in its overall financial health. The marketplace ecosystem is estimated to be worth billions, with individual apps generating millions in annual recurring revenue.

- Established apps on the Atlassian Marketplace provide a steady, high-margin revenue stream.

- These apps enhance the value and stickiness of core Atlassian products like Jira and Confluence.

- The marketplace ecosystem is a significant contributor to Atlassian's overall financial performance.

- In FY23, Atlassian's cloud revenue, bolstered by marketplace integrations, showed robust growth.

Atlassian's Cash Cows represent mature products with established market positions that generate consistent, predictable revenue with relatively low investment needs. These offerings are vital for funding the company's growth initiatives in newer, more dynamic areas.

Jira Data Center and Confluence Data Center are prime examples, serving large enterprises with self-hosted solutions and benefiting from a loyal customer base. Bitbucket, with its strong developer adoption, and Trello, known for its user-friendly interface, also contribute significantly to this stable revenue generation.

The Atlassian Marketplace, featuring a robust ecosystem of third-party apps, acts as a substantial cash cow, enhancing core product value and driving recurring revenue.

| Product | BCG Category | Key Characteristic | FY24/FY25 Data Point |

|---|---|---|---|

| Jira Data Center | Cash Cow | Enterprise self-hosted solution | Projected 7%-16.5% growth (FY25) |

| Confluence Data Center | Cash Cow | On-premise knowledge management | Part of $1.2B Data Center revenue (FY23) |

| Bitbucket | Cash Cow | Developer workflow integration | ~19.06% market share (2024) |

| Trello | Cash Cow | User-friendly project management | ~4.8% ERP market share (2024) |

| Atlassian Marketplace | Cash Cow | Third-party app ecosystem | Billions in ecosystem value |

What You’re Viewing Is Included

Atlassian BCG Matrix

The Atlassian BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no hidden watermarks or placeholder content; you'll get a professional, analysis-ready report designed to provide clear strategic insights into Atlassian's product portfolio. The comprehensive data and visual representation of their products within the Stars, Cash Cows, Question Marks, and Dogs categories are all present and accurate in this preview. This ensures you can confidently assess its value and utility for your own strategic planning before committing to a purchase.

Dogs

Atlassian Server products are definitively Stars in the BCG Matrix, as Atlassian officially ceased support for them on February 15, 2024. This strategic decision eliminated new sales, security updates, and technical support, forcing remaining customers to migrate to Cloud or Data Center.

These products no longer contribute to future growth and represent a legacy segment that the company is actively moving away from, marking a significant shift in their product strategy.

Unsupported or obsolete integrations and plugins, particularly those tied to Atlassian's deprecated Server platform, are firmly in the Dog quadrant of the BCG Matrix. These components have no prospect for future growth and increasingly pose security risks due to a lack of updates. For instance, as of mid-2024, Atlassian's official support for Server products has ended, meaning any integrations relying on these versions are effectively obsolete.

Niche, Underperforming Legacy Acquisitions represent a potential drag on resources. These are acquisitions that haven't integrated smoothly or found their footing in the market, consuming investment without delivering substantial returns or strategic benefit. Identifying them requires deep internal analysis, but their presence can hinder growth in more promising areas.

Products with Declining User Tiers

Products with declining user tiers, often found in Atlassian's older, on-premises offerings, represent a challenge. These segments typically involve very small, stagnant customer bases that are not transitioning to more advanced cloud or Data Center versions. For example, some legacy Server products might see a gradual decrease in active users as businesses upgrade or consolidate their tools.

These remaining user segments can be resource-intensive, demanding support that outweighs their financial contribution. Atlassian's strategic focus is to incentivize these customers to migrate to higher-value cloud editions or Data Center, where they can access enhanced features and benefit from ongoing innovation. This migration is key to streamlining support and focusing development efforts on growth areas.

- Stagnant User Growth: Older product lines may exhibit flat or declining user numbers as newer, cloud-based alternatives gain traction.

- Migration Inertia: Small, entrenched customer segments may resist moving to cloud or Data Center due to perceived costs or complexity.

- Disproportionate Support Costs: Maintaining legacy systems for a small user base can strain support resources relative to revenue generated.

- Strategic Imperative: Atlassian aims to drive adoption of its cloud and Data Center offerings, encouraging users to move to platforms with greater scalability and feature sets.

Non-Strategic, Low-Usage Internal Tools

Non-strategic, low-usage internal tools at Atlassian, such as experimental projects that were never productized or have minimal external adoption, fall into this category. These tools, while potentially innovative at their inception, now consume valuable maintenance resources without generating external revenue or contributing to future growth.

Atlassian's strategic focus involves streamlining its product portfolio to concentrate on core offerings. This means that tools not aligned with current strategic priorities or demonstrating low external usage are candidates for divestment or discontinuation. For example, in 2023, Atlassian announced the sunsetting of several products to better focus its resources, highlighting a commitment to shedding non-core assets.

- Resource Drain: These tools represent an ongoing cost for maintenance and support, diverting funds from more strategically important projects.

- Lack of ROI: Without significant external adoption or a clear path to monetization, these internal tools offer little to no return on investment.

- Strategic Misalignment: They do not contribute to Atlassian's stated goals of expanding its cloud offerings or enhancing its core collaboration and development platforms.

- Opportunity Cost: The resources allocated to maintaining these tools could be better utilized in developing or improving products that drive revenue and market share.

Dogs in Atlassian's BCG Matrix represent products or integrations with low market share and low growth prospects, often characterized by declining user bases or obsolescence. These are typically legacy components that require resources but offer minimal return, such as unsupported plugins for discontinued Server products. Atlassian's strategy actively phases out these offerings to focus on growth areas.

Unsupported integrations and plugins for Atlassian's Server products, which officially ended support on February 15, 2024, are prime examples of Dogs. These components have no future growth potential and can pose security risks. Similarly, niche, underperforming legacy acquisitions that haven't integrated well consume resources without delivering strategic benefits.

Products with declining user tiers, particularly older on-premises versions that customers are not migrating from, also fall into the Dog category. These segments demand support disproportionate to their revenue contribution. Non-strategic, low-usage internal tools that are not productized or have minimal external adoption are also considered Dogs, as they drain maintenance resources without generating revenue.

Atlassian's strategic focus involves streamlining its portfolio, leading to the divestment or discontinuation of products that do not align with current goals or show low external usage. This shedding of non-core assets, as seen with product sunsets in 2023, is crucial for concentrating resources on high-growth cloud and Data Center offerings.

Question Marks

Loom, acquired by Atlassian for $975 million in October 2023, is currently positioned as a Question Mark in the BCG matrix. Its high growth potential is evident, with monthly active users (MAU) experiencing over 30% year-over-year growth.

While Loom boasts a strong and expanding user base in video messaging, its overall market share within the vast collaboration and communication sector is still solidifying as it integrates with Atlassian's existing product ecosystem. Atlassian is actively investing in Loom's expansion, incorporating it into new product bundles to broaden its market reach and adoption.

Jira Product Discovery fits the Question Mark category in the BCG Matrix. This relatively new Atlassian offering, designed for product managers, has quickly gained traction, boasting over 20,000 customers.

The market for product management and roadmap tools is experiencing significant growth, yet Jira Product Discovery's market share remains modest when measured against more established players. This presents both an opportunity and a challenge for Atlassian.

Atlassian is strategically investing in enhancing Jira Product Discovery’s premium features and deepening its integration within the Atlassian ecosystem. These efforts aim to accelerate customer adoption and bolster its market penetration in this competitive space.

Atlassian Focus, launched in January 2025, is positioned as a Question Mark within the BCG Matrix. This new enterprise strategy and planning solution targets the high-growth area of strategic portfolio management for large enterprises. Its early market penetration signifies potential but also inherent risk.

Atlassian is investing heavily in Atlassian Focus, integrating it with Jira Align and its broader Strategy Collection. This strategic alignment suggests a strong belief in its future growth potential, aiming to capture a significant share of the growing market for enterprise strategy tools, which is projected to see substantial expansion in the coming years.

Atlassian Talent

Atlassian Talent, a new workforce planning application, is positioned as a Question Mark within the BCG Matrix. This classification stems from its recent launch and high growth potential in the expanding human resources and talent management software market. Atlassian is strategically bundling this offering to accelerate its adoption, aiming to capture a significant share in a competitive landscape.

- Market Position: Question Mark

- Growth Potential: High

- Current Market Share: Low

- Strategic Objective: Drive rapid adoption through bundling.

Compass and Atlas

Compass and Atlas, born from Atlassian's Point A incubator, represent strategic moves into developer productivity and cross-team collaboration. These free offerings are designed to rapidly capture market share. Atlassian's 2024 fiscal year saw significant growth, with revenue reaching $4.37 billion, indicating a strong foundation to support new product launches.

The success of Compass and Atlas hinges on their ability to transition free users to paid models or integrate them into the broader Atlassian ecosystem. Atlassian's customer base exceeded 287,000 as of May 2024, providing a substantial pool for potential conversion.

- Developer Productivity: Compass aims to streamline developer workflows, a critical area for high-growth tech companies.

- Teamwork Repository: Atlas focuses on enhancing cross-team communication and knowledge sharing, vital for distributed and agile teams.

- Market Penetration Strategy: Offering these tools for free is a deliberate strategy to build a user base and gather feedback quickly.

- Monetization Potential: Long-term revenue will likely come from premium features or integration with Atlassian's existing paid products like Jira and Confluence.

Question Marks in Atlassian's portfolio, like Loom and Jira Product Discovery, represent products with high growth potential but currently low market share. Atlassian is actively investing in these areas, aiming to convert their potential into market dominance. This strategy involves integrating them into existing offerings and enhancing their features to drive adoption.

The company's overall revenue growth, reaching $4.37 billion in fiscal year 2024, provides a strong financial backing for these strategic investments. By nurturing these Question Marks, Atlassian seeks to expand its market reach and solidify its position in evolving software sectors.

| Product | Category | Growth Potential | Market Share | Atlassian's Strategy |

|---|---|---|---|---|

| Loom | Question Mark | High | Low | Integration, Bundling |

| Jira Product Discovery | Question Mark | High | Low | Feature Enhancement, Ecosystem Integration |

| Atlassian Focus | Question Mark | High | Low | Integration with Jira Align, Strategic Alignment |

| Atlassian Talent | Question Mark | High | Low | Bundling, Market Capture |

| Compass & Atlas | Question Mark | High | Low | Free Offering, User Base Expansion, Monetization Potential |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from internal sales figures, customer feedback, and market research reports to accurately assess product performance and market share.