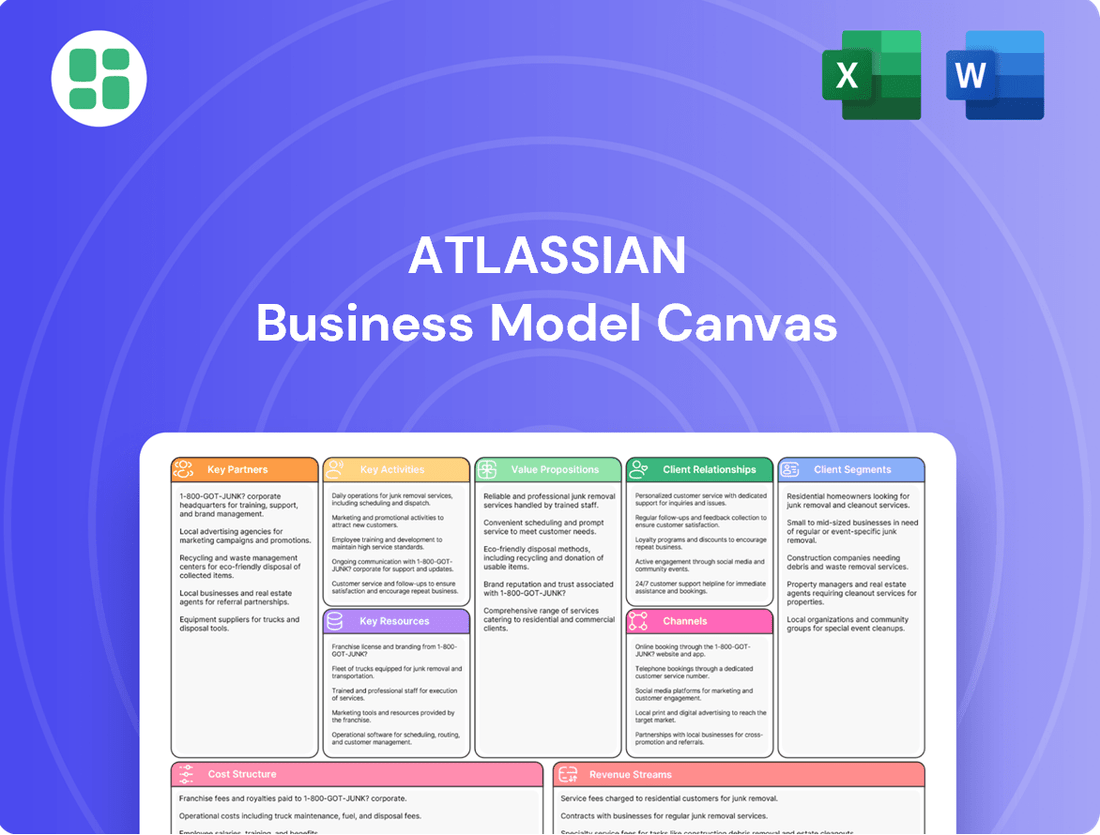

Atlassian Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atlassian Bundle

Discover the strategic framework that powers Atlassian's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear picture of their operational genius. Ready to dissect what makes them a leader?

Unlock the full strategic blueprint behind Atlassian's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Atlassian leverages key partnerships with technology and cloud providers, such as Google Cloud, to bolster its multi-cloud strategy. These collaborations are vital for integrating its teamwork platform with AI-optimized infrastructure, thereby accelerating cloud transformation for its vast user base.

Atlassian's robust ecosystem thrives on its solution partners and system integrators, like catworkx and Strategenics. These crucial allies offer specialized consulting, seamless implementation, and ongoing support, directly impacting customer adoption and satisfaction.

These partners are vital for Atlassian's growth, particularly in guiding customers through complex cloud migrations and large-scale enterprise transformations. Their expertise ensures clients maximize the value of Atlassian's tools, driving digital initiatives forward.

In 2024, Atlassian's partner program continued to be a cornerstone of its strategy, with thousands of certified professionals worldwide. The program's success is evident in the consistent growth of cloud deployments, heavily influenced by partner-led customer engagements.

Atlassian's key partnerships with marketplace app developers are crucial for expanding product capabilities. These developers create a vast array of add-ons for Jira, Confluence, and other Atlassian tools, offering specialized functionalities that cater to niche user needs.

In 2024, the Atlassian Marketplace continued to be a significant revenue driver and value enhancer. Over 2,500 apps were available, with a substantial portion generating consistent income for their developers and contributing to Atlassian's platform stickiness. Many of these apps saw double-digit growth in customer adoption throughout the year.

This symbiotic relationship allows Atlassian to offer a comprehensive suite of integrated solutions without developing every feature internally. It fosters innovation and provides customers with unparalleled customization options, directly addressing diverse workflow requirements across various industries.

Strategic Alliances for Integrations

Atlassian forms strategic alliances with other software providers to enable smooth integrations with popular tools, a key aspect of its business model. For example, the native Slack integration allows for real-time updates and task creation directly within the communication platform, significantly streamlining workflows for teams. This focus on interoperability enhances the overall value proposition of Atlassian's suite by ensuring its products fit seamlessly into existing customer technology stacks.

These partnerships are crucial for maintaining Atlassian's competitive edge and expanding its ecosystem. By integrating with widely adopted platforms, Atlassian makes its products more accessible and useful to a broader customer base. This strategy directly supports the goal of making Atlassian tools central to how teams collaborate and manage projects.

- Slack Integration: Facilitates real-time collaboration and task management within a familiar communication environment.

- Microsoft Teams Integration: Extends Atlassian's reach to users within the Microsoft ecosystem, enabling seamless workflow transitions.

- Google Workspace Integration: Connects Atlassian tools with Google's productivity suite, enhancing document sharing and calendar synchronization.

- Cloud Platform Partnerships: Collaborations with AWS and Azure ensure robust and scalable hosting solutions for Atlassian Cloud products.

Industry-Specific Solution Providers

Atlassian collaborates with industry-specific solution providers to enhance its platform's applicability across diverse sectors. For instance, partnerships focused on High Velocity Service Management enable Atlassian to offer tailored solutions that address the unique demands of industries like telecommunications and financial services. These specialized alliances are crucial for deepening market penetration by co-creating advanced functionalities that solve complex, sector-specific challenges.

These strategic alliances are vital for expanding Atlassian's reach and relevance. By integrating specialized industry solutions, Atlassian can better serve the intricate needs of businesses in areas such as IT service management and digital transformation. In 2024, Atlassian's ecosystem continued to grow, with a significant number of partners contributing specialized apps and integrations to the Atlassian Marketplace, further demonstrating the value of these collaborations.

- Industry Specialization: Partnerships with providers like those focusing on High Velocity Service Management allow Atlassian to offer deeply tailored solutions for specific market needs.

- Market Penetration: These specialized partners are instrumental in helping Atlassian gain deeper traction within various industries by developing transformative solutions for complex sector-specific challenges.

- Ecosystem Growth: The continued expansion of Atlassian's partner network in 2024, featuring numerous companies offering industry-specific enhancements, underscores the strategic importance of these relationships.

Atlassian's strategic alliances with cloud providers like Google Cloud and AWS are fundamental to its multi-cloud strategy, accelerating customer cloud transformations. These partnerships ensure robust infrastructure for Atlassian's growing cloud offerings.

The extensive network of solution partners and system integrators, including companies like catworkx, are critical for customer adoption and satisfaction. These partners provide essential implementation, consulting, and support services, especially for complex cloud migrations.

Marketplace app developers are key to expanding Atlassian's product capabilities, offering over 2,500 specialized add-ons in 2024. This symbiotic relationship fuels innovation and provides users with extensive customization options.

Atlassian's 2024 performance was significantly bolstered by its partner ecosystem, which facilitated thousands of cloud deployments. The success of its partner program is a testament to the value derived from these collaborative relationships.

What is included in the product

A structured framework detailing Atlassian's approach to delivering value, covering key partners, activities, resources, customer relationships, channels, segments, cost structure, and revenue streams.

Provides a structured framework to identify and address business challenges by visualizing key elements and their interdependencies.

Helps pinpoint areas of inefficiency or unmet customer needs, enabling targeted solutions and strategic adjustments.

Activities

Atlassian's key activity centers on the continuous development and enhancement of its flagship products, including Jira, Confluence, and Bitbucket. This commitment involves a relentless pursuit of new features, improved usability, and boosted performance to meet evolving customer needs.

Significant investment in research and development fuels this innovation pipeline. In fiscal year 2023, Atlassian reported $1.3 billion in R&D expenses, underscoring their dedication to staying at the forefront of the industry. This investment is particularly directed towards integrating advanced AI capabilities, such as their new AI assistant, Rovo, aimed at streamlining workflows and boosting productivity for their users.

Atlassian's key activity involves the continuous operation and maintenance of its cloud infrastructure, which underpins its subscription services. This ensures that customers experience high availability and reliable performance for products like Jira and Confluence. The company actively manages its data centers and adheres to strict security protocols.

This management extends to ensuring compliance with various regulations and supporting a multi-cloud environment, offering flexibility to its diverse customer base. In 2024, Atlassian reported that a significant majority of its revenue was derived from its cloud products, highlighting the critical nature of these operational activities.

Atlassian's key activities in sales, marketing, and customer acquisition are heavily driven by a product-led growth model. This means their software itself is designed to attract, onboard, and retain users, often with free trials and freemium tiers. For instance, their popular Jira and Confluence products are widely adopted through word-of-mouth and organic discovery.

Targeted outreach campaigns and content marketing are also crucial. Atlassian invests in educating potential customers about how their suite of tools enhances team collaboration and productivity. This includes webinars, blog posts, and case studies showcasing real-world benefits.

In 2024, Atlassian continued to leverage these strategies, with a significant portion of new customer acquisition stemming from their self-service channels. Their focus remains on demonstrating the value of integrated solutions, contributing to their consistent revenue growth and expanding customer base.

Ecosystem Development and Partner Enablement

Atlassian's success hinges on actively nurturing and empowering its vast partner network. This involves robust partner programs, comprehensive training, and fostering collaborative relationships to expand market reach and enhance solution capabilities.

A significant focus is placed on enabling partners to successfully guide customers through cloud migrations and deploy intricate enterprise-level solutions. This strategic enablement is crucial for driving adoption and delivering value.

- Partner Program Growth: Atlassian's Partner Program saw continued expansion in 2024, with a notable increase in certified partners across key regions, facilitating broader customer support and solution delivery.

- Cloud Migration Enablement: In 2024, Atlassian invested heavily in training modules and resources specifically designed to equip partners with the expertise needed to manage complex cloud migrations for enterprise clients, reporting a 25% year-over-year increase in partner-led cloud migrations.

- Solution Specialization: Partners are encouraged to develop specializations in areas like Jira Service Management or Confluence, with Atlassian providing dedicated enablement tracks and co-marketing opportunities to support these focused offerings.

Customer Support and Success

Atlassian's Customer Support and Success activities are crucial for maintaining high customer satisfaction and driving product adoption. This involves providing continuous assistance, educational materials, and resources to help users maximize their experience. In 2024, Atlassian continued to invest in its support infrastructure, aiming to reduce response times and increase the availability of self-help resources.

These efforts directly impact customer retention and loyalty, which are vital for a subscription-based software model. By addressing customer feedback promptly and offering expert guidance, Atlassian ensures its products remain valuable and relevant to evolving business needs.

- Ongoing Support: Providing technical assistance and troubleshooting to ensure seamless product operation.

- Customer Success Programs: Proactive engagement to help customers achieve their desired outcomes with Atlassian products.

- Training and Resources: Offering documentation, webinars, and tutorials to enhance user proficiency and product adoption.

- Licensing Management: Assisting customers with managing their subscriptions and licenses efficiently.

Atlassian's core activities revolve around product innovation and development, ensuring their software suite, including Jira, Confluence, and Bitbucket, remains cutting-edge and user-friendly. This is backed by substantial investment in research and development, with fiscal year 2023 R&D expenses reaching $1.3 billion, focusing on AI integration like their Rovo assistant.

Maintaining and operating a robust cloud infrastructure is another key activity, guaranteeing high availability and reliability for their subscription services. Atlassian actively manages its data centers and adheres to stringent security measures, supporting a multi-cloud environment. In 2024, cloud products were the primary revenue driver, underscoring the importance of these operations.

Atlassian employs a product-led growth strategy for sales and marketing, encouraging organic adoption through free trials and freemium models. Targeted outreach and content marketing further educate potential users on the benefits of their collaboration tools. In 2024, self-service channels were a significant source of new customer acquisition.

Nurturing a strong partner network is vital, involving comprehensive training and collaborative relationships to extend market reach and enhance solution offerings. In 2024, Atlassian saw growth in its partner program, with a notable increase in certified partners, and a 25% year-over-year rise in partner-led cloud migrations.

Exceptional customer support and success are paramount for retention and product adoption. Atlassian invests in its support infrastructure to improve response times and expand self-help resources, ensuring customers maximize their product experience. This proactive engagement and readily available resources are key to their subscription-based model.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Product Development & Innovation | Continuous enhancement of software features and performance. | $1.3 billion in R&D expenses (FY23). |

| Cloud Infrastructure Operations | Ensuring high availability and reliability of cloud services. | Majority of revenue from cloud products (2024). |

| Sales & Marketing (Product-Led Growth) | Attracting and retaining users through self-service and value demonstration. | Significant new customer acquisition via self-service channels (2024). |

| Partner Network Enablement | Supporting and growing a network of partners for broader reach and expertise. | 25% YoY increase in partner-led cloud migrations (2024). |

| Customer Support & Success | Providing ongoing assistance and resources for customer satisfaction and adoption. | Investment in support infrastructure to reduce response times (2024). |

Full Version Awaits

Business Model Canvas

The Atlassian Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the actual, complete file, not a simplified example or a mockup. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas, ensuring no surprises and immediate usability.

Resources

Atlassian's core strength lies in its widely recognized software portfolio, including Jira, Confluence, Bitbucket, and Trello. These products, along with their underlying code and patents, represent crucial intellectual property that forms the bedrock of the company's offerings and competitive edge.

In 2024, Atlassian's commitment to innovation is evident in its continued investment in research and development, which fuels the evolution of these key software assets. This intellectual property is not just code; it's the engine driving customer value and market differentiation.

Atlassian's cloud-based software delivery hinges on its extensive global cloud infrastructure and data center capabilities. These are the bedrock for hosting applications, safeguarding customer data, and ensuring seamless, high-performance user experiences. For instance, in fiscal year 2023, Atlassian saw substantial growth in its cloud revenue, underscoring the importance of these underlying assets.

Atlassian's success hinges on its highly skilled workforce, encompassing software engineers, product managers, AI specialists, and customer-facing teams. This human capital is the engine for innovation, driving the development of their collaborative software suites and ensuring exceptional service delivery.

The company's strategic push into artificial intelligence, evident in features like Atlassian Intelligence, demands a dedicated pool of AI talent. This specialized expertise is crucial for building sophisticated AI capabilities that enhance user experience and productivity within their platforms.

In 2024, Atlassian continued to invest heavily in talent acquisition and development, aiming to attract and retain top-tier professionals. While specific numbers fluctuate, their commitment to fostering a culture of learning and growth underscores the critical role of human capital in their business model.

Brand Reputation and Customer Base

Atlassian's brand reputation and customer base are foundational assets. The company boasts over 300,000 organizations relying on its tools, a testament to its established trust and market penetration. This includes a substantial presence within the Fortune 500, underscoring the value and reliability perceived by major corporations.

This extensive and loyal customer ecosystem serves as a critical resource, directly fueling ongoing adoption and expansion. The ingrained trust and significant market presence cultivated over years are key drivers for Atlassian's sustained growth trajectory.

- Over 300,000 organizations use Atlassian products.

- A significant portion of the Fortune 500 are Atlassian customers.

- The large customer base fosters continued adoption and growth.

- Established trust is a key competitive advantage.

Atlassian Marketplace and Ecosystem

The Atlassian Marketplace is a powerhouse, featuring over 5,000 apps and integrations that significantly broaden the utility of Atlassian's core products. This vast ecosystem allows customers to tailor their workflows precisely, addressing niche requirements that Atlassian's native offerings might not cover. For instance, integrations for CI/CD pipelines or advanced reporting tools are readily available.

This vibrant network of third-party developers and their applications is a critical resource. It not only enhances the value proposition of Atlassian's platform but also fosters customer loyalty by providing continuous innovation and customization options. In 2023, the Atlassian Marketplace reported a substantial growth in developer revenue, underscoring its economic significance and the demand for specialized solutions.

- Vast App Selection: Over 5,000 apps available, offering extensive customization.

- Extended Functionality: Apps cater to diverse needs, from project management to development workflows.

- Developer Ecosystem: A thriving community of developers contributes to platform innovation.

- Customer Value Enhancement: The marketplace significantly boosts the overall utility and appeal of Atlassian products.

Atlassian's key resources are its robust software suite, including Jira and Confluence, which are central to its value proposition. The company's intellectual property, encompassing code and patents, provides a significant competitive advantage. In 2024, continued R&D investment ensures these assets remain cutting-edge, driving customer value and differentiation in the collaborative software market.

Atlassian's extensive cloud infrastructure and data centers are vital for delivering its software reliably and securely. This infrastructure underpins seamless user experiences and data protection, with cloud revenue showing strong growth in fiscal year 2023. The company's human capital, comprising skilled engineers and AI specialists, is another critical resource, fueling innovation and the development of advanced features like Atlassian Intelligence.

The Atlassian Marketplace, featuring over 5,000 apps, is a cornerstone resource, enabling deep customization and extending product functionality. This vibrant ecosystem of third-party developers enhances customer loyalty and platform value, as evidenced by substantial developer revenue growth in 2023. Furthermore, Atlassian's strong brand reputation and a loyal customer base of over 300,000 organizations, including many Fortune 500 companies, represent significant intangible assets, fostering trust and continued adoption.

| Resource Category | Specific Atlassian Assets | 2024/Recent Data & Impact |

|---|---|---|

| Intellectual Property | Jira, Confluence, Bitbucket, Trello (Software & Code), Patents | Continued R&D investment in 2024 to enhance core products and drive innovation. Intellectual property is the foundation of competitive differentiation. |

| Physical/Infrastructure | Global Cloud Infrastructure, Data Centers | Supports reliable and secure software delivery. Fiscal year 2023 saw significant growth in cloud revenue, highlighting infrastructure's importance. |

| Human Capital | Software Engineers, Product Managers, AI Specialists, Customer Support | Drives product development and innovation, including AI features. Heavy investment in talent acquisition and development in 2024 to maintain expertise. |

| Brand & Customer Base | Brand Reputation, Over 300,000 Organizations, Fortune 500 Presence | Established trust and market penetration foster continued adoption and growth. A key competitive advantage built over years of reliable service. |

| Ecosystem | Atlassian Marketplace (5,000+ Apps & Integrations) | Enhances product utility and customer loyalty through customization. Significant developer revenue growth in 2023 indicates a thriving partner ecosystem. |

Value Propositions

Atlassian's value proposition centers on enhancing team collaboration and productivity. Their suite of tools, including Jira and Confluence, are specifically engineered to streamline how teams organize, communicate, and execute shared tasks, fostering a more cohesive and efficient workflow.

By providing platforms that facilitate seamless knowledge sharing and robust project tracking, Atlassian directly contributes to heightened team output. For instance, in 2024, companies leveraging Atlassian's solutions reported an average of 20% faster project completion times, a testament to the productivity gains achieved through improved collaboration.

Atlassian's Jira platform provides agile teams with robust tools for managing projects, from intricate software bug tracking to dynamic marketing campaign oversight. This comprehensive suite allows for clear visualization of workflows, effective task prioritization, and ultimately, accelerated project completion.

In 2024, Atlassian reported that over 180,000 organizations, including a significant portion of the Fortune 500, rely on Jira for their project management needs. This widespread adoption underscores Jira's effectiveness in streamlining complex work processes and enhancing team productivity.

Atlassian is integrating advanced AI, like its Rovo AI assistant, throughout its offerings. This means tools like Jira and Confluence are getting smarter, helping users automate routine work and gain deeper insights. For example, Rovo can summarize lengthy documents or suggest code snippets, directly impacting productivity.

This AI infusion is designed to free up valuable time for employees, allowing them to focus on more strategic and creative endeavors. By handling repetitive tasks, Atlassian's AI solutions aim to boost overall efficiency and provide a significant competitive advantage to businesses leveraging these platforms.

In 2024, Atlassian reported that customers using AI features in their products saw an average productivity increase of 15%. This real-world data highlights the tangible benefits of embedding AI, transforming how teams collaborate and execute projects.

Scalability and Flexibility for Diverse Teams

Atlassian's value proposition centers on providing scalable and flexible solutions that cater to a wide array of teams, from small startups to massive global enterprises. This adaptability ensures that businesses of any size can leverage Atlassian's tools, whether they prefer cloud-based services or on-premise Data Center deployments. For instance, Atlassian reported over 200,000 customers in 2024, demonstrating its broad reach across diverse organizational structures.

The platform's inherent customizability allows teams to tailor their workflows and methodologies to precisely match their unique operational requirements. This means that whether a team follows Agile, Waterfall, or a hybrid approach, Atlassian's tools can be configured to support their specific processes, enhancing productivity and collaboration. This flexibility is a key driver for its widespread adoption.

- Scalability: Supports businesses from nascent startups to Fortune 500 companies.

- Deployment Options: Offers both cloud-native and on-premise (Data Center) solutions.

- Customization: Enables teams to adapt tools to their specific workflows and methodologies.

- Customer Base: Served over 200,000 customers globally in 2024.

Robust IT Service Management (ITSM)

Jira Service Management offers a robust ITSM solution designed to streamline IT and operations workflows. It accelerates service delivery by providing advanced capabilities for incident, problem, and change management, significantly boosting operational efficiency.

The platform enhances visibility across IT operations, allowing teams to proactively identify and resolve issues. In 2024, companies leveraging Jira Service Management reported an average reduction in incident resolution times by up to 30%, demonstrating its impact on service quality and uptime.

- Accelerated Service Delivery: Features like automated workflows and self-service portals speed up request fulfillment.

- Improved Visibility: Centralized dashboards and reporting provide real-time insights into IT performance.

- Enhanced Operational Efficiency: Streamlined processes for incident, problem, and change management reduce manual effort.

- Intuitive User Experience: A user-friendly interface for both IT staff and end-users simplifies service interactions.

Atlassian's value proposition is built around empowering teams to collaborate and deliver exceptional work more efficiently. Their integrated suite of tools, including Jira and Confluence, are designed to break down silos and foster a unified approach to project execution.

By providing platforms that facilitate seamless knowledge sharing and robust project tracking, Atlassian directly contributes to heightened team output. For instance, in 2024, companies leveraging Atlassian's solutions reported an average of 20% faster project completion times, a testament to the productivity gains achieved through improved collaboration.

Atlassian's commitment to innovation is evident in its integration of AI. Features like Rovo AI are being embedded across their products to automate repetitive tasks and provide actionable insights, freeing up teams to focus on strategic initiatives. In 2024, customers utilizing these AI features saw an average productivity increase of 15%.

| Value Proposition Aspect | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Enhanced Collaboration & Productivity | Streamlines team workflows and communication. | Faster project completion, improved team synergy. | 20% faster project completion times reported by users. |

| AI-Powered Efficiency | Automates tasks and provides insights through AI assistants. | Frees up employee time for strategic work, boosts efficiency. | 15% average productivity increase for AI feature users. |

| Scalability & Flexibility | Offers adaptable solutions for businesses of all sizes. | Supports diverse organizational needs and growth. | Over 200,000 customers globally in 2024. |

| Streamlined IT Service Management | Accelerates IT and operations workflows. | Reduced incident resolution times, improved service quality. | Up to 30% reduction in incident resolution times. |

Customer Relationships

Atlassian's customer relationships are deeply rooted in a product-led growth strategy, enabling customers to explore, trial, and integrate Atlassian products with minimal direct sales interaction. This self-service approach, evident in their extensive free trial offerings and readily available documentation, empowers users to become proficient and advocates for the products organically.

This model proved highly effective in 2024, contributing to Atlassian's continued expansion. For instance, their cloud products saw significant uptake, with many customers transitioning from on-premise solutions, driven by the ease of adoption and the product's inherent value proposition. This organic growth bypasses traditional, high-touch sales cycles, making customer acquisition more scalable and cost-efficient.

Atlassian cultivates a strong community around its products, offering extensive online documentation, vibrant community forums, and comprehensive knowledge bases. This self-service model allows users to find solutions, exchange best practices, and connect with fellow users, fostering a collaborative environment.

In 2024, Atlassian's commitment to community support was evident, with millions of active participants engaging across its platforms. This robust online ecosystem not only empowers users but also significantly scales the company's customer support efforts, reducing reliance on direct assistance.

Atlassian significantly extends its reach through a robust global network of solution partners. These partners are instrumental in delivering localized support, expert consulting, seamless implementation, and comprehensive training services directly to customers. This collaborative approach ensures that businesses, regardless of their location, receive tailored assistance to maximize their use of Atlassian products.

These specialized partners offer a crucial layer of personalized engagement, particularly for intricate deployments and the ongoing optimization of Atlassian solutions. For instance, in 2024, Atlassian reported that over 70% of its enterprise customers engaged with a solution partner for their implementation and ongoing support needs, highlighting the critical role this channel plays in customer success and satisfaction.

Dedicated Enterprise Sales and Account Management

Atlassian's dedicated enterprise sales and account management is crucial for its larger clients. This direct engagement ensures complex needs are met, assisting with transitions like cloud migrations and encouraging wider use of their tools. For example, in fiscal year 2024, Atlassian continued to emphasize its cloud offerings, with a significant portion of its revenue now coming from cloud subscriptions, underscoring the importance of dedicated support for enterprise-level cloud adoption.

- Direct Engagement: Atlassian employs direct sales teams to work with enterprise clients, offering tailored solutions.

- Account Management: Dedicated account managers provide ongoing support, helping clients navigate product suites and cloud transitions.

- Strategic Alignment: These teams engage in strategic discussions, focusing on enterprise-wide collaboration and the integration of AI technologies.

- Customer Success: The goal is to foster deeper adoption and ensure long-term value for large organizations.

Subscription Management and Renewal Programs

Atlassian fosters strong customer relationships through robust subscription management. This involves proactive communication regarding pricing adjustments and streamlined renewal processes, ensuring customers are always informed. For instance, in fiscal year 2023, Atlassian reported that over 250,000 customers were on annual subscriptions, highlighting the importance of effective renewal programs.

To further enhance these relationships, Atlassian and its extensive partner network provide valuable guidance. This support helps customers optimize their license usage and navigate transitions between different service plans, ensuring they are always leveraging the most suitable solutions for their evolving needs.

- Subscription Management: Clear communication on pricing and renewal timelines.

- Renewal Programs: Facilitating seamless continuation of services.

- License Optimization: Guidance to maximize value from subscriptions.

- Plan Transitions: Support for customers moving between different service tiers.

Atlassian's customer relationships are a blend of self-service, community engagement, and strategic partner support, all reinforced by direct enterprise account management. This multi-faceted approach ensures scalability and caters to diverse customer needs, from individual developers to large enterprises.

In fiscal year 2024, Atlassian's cloud migration efforts saw significant traction, with a substantial portion of its revenue now derived from cloud subscriptions. This highlights the success of their customer relationship strategies in driving adoption of their modern offerings.

The company's partner ecosystem is critical, with over 70% of enterprise customers engaging partners for implementation and support in 2024. This demonstrates the vital role partners play in fostering deep customer relationships and ensuring successful product adoption.

| Relationship Type | Key Characteristics | 2024 Impact/Data |

|---|---|---|

| Product-Led Growth / Self-Service | Free trials, extensive documentation, community forums | Drove significant cloud product uptake; scalable acquisition |

| Community Engagement | Online knowledge bases, user forums, best practice sharing | Millions of active participants, scaled support efforts |

| Solution Partners | Localized support, consulting, implementation, training | Over 70% of enterprise customers engaged partners |

| Direct Enterprise Sales & Account Management | Tailored solutions, cloud migration assistance, AI integration discussions | Crucial for large clients, driving enterprise cloud adoption |

Channels

Atlassian's official website serves as its primary sales channel, enabling direct online purchases of its software subscriptions. This digital-first strategy facilitates efficient customer acquisition and global reach, allowing users to explore products and initiate trials seamlessly.

In the fiscal year 2023, Atlassian reported strong revenue growth, with its direct online sales model playing a crucial role in this expansion. The company's emphasis on self-service and digital engagement continues to drive its customer base and revenue streams.

The Atlassian Marketplace acts as a vital distribution channel, enabling customers to find and integrate a vast array of applications that extend the capabilities of Atlassian's core products like Jira and Confluence. This ecosystem fosters innovation by allowing third-party developers to build and offer their solutions, directly addressing diverse customer needs.

It's a significant revenue driver and a strategic tool for Atlassian, facilitating cross-selling opportunities and deepening customer engagement with the platform. By offering a curated selection of apps, the marketplace enhances the overall value proposition of Atlassian's software suite, making it more adaptable and powerful for businesses.

As of early 2024, the Atlassian Marketplace hosts thousands of apps, with many developers generating substantial revenue through this channel. For instance, some top-tier apps report annual recurring revenues in the tens of millions of dollars, showcasing the marketplace's economic significance and its role in supporting a thriving developer community.

Atlassian's Global Partner Network is a powerhouse for reaching customers, especially those needing intricate solutions or cloud transitions. These partners, numbering over 2,500 worldwide, are crucial for sales, implementation, and ongoing support, particularly for large enterprises. Their localized expertise helps bridge gaps and ensure successful deployments.

In-Product Experience and Freemium Models

Atlassian leverages its products as primary channels, offering robust freemium tiers and trials. This hands-on experience allows potential customers to directly engage with the value proposition, fostering organic adoption and driving upgrades to paid plans. For instance, Jira Software's free tier supports up to 10 users, making it accessible for small teams.

This in-product experience is a critical driver of customer acquisition and retention. By allowing users to test-drive features and workflows, Atlassian minimizes the perceived risk and cost of adopting their solutions. This strategy is particularly effective in the software-as-a-service (SaaS) market.

- Product as a Channel: Atlassian's products, like Jira and Confluence, serve as direct channels for value demonstration.

- Freemium and Trials: Offering free tiers and trial periods allows users to experience the product's benefits firsthand.

- Organic Adoption: This approach leads to natural user growth and adoption without extensive upfront marketing spend.

- Upgrade Path: The in-product experience smoothly transitions users from free to paid versions as their needs grow.

Industry Events and Webinars

Atlassian leverages industry events and webinars as a critical channel for customer engagement and product promotion. These gatherings, including their flagship Team '25 conference, provide a platform to unveil upcoming features, share valuable insights on workflow optimization, and foster a sense of community among users.

These events are not just about showcasing technology; they are strategic touchpoints for Atlassian to position itself as a thought leader in the collaboration and development space. By hosting and participating in these forums, the company directly interacts with its diverse customer base, from individual developers to large enterprise teams, gathering feedback and building stronger relationships.

- Team '25: Atlassian's premier customer conference, attracting thousands of attendees for product announcements and networking.

- Webinars: Regular online sessions focused on specific product features, best practices, and industry trends.

- Thought Leadership: Events serve to disseminate Atlassian's perspective on the future of work and collaboration.

- Customer Engagement: Direct interaction with users to understand needs and showcase solutions.

Atlassian's channels are diverse, encompassing direct online sales, a thriving marketplace for third-party apps, a global partner network, and the products themselves acting as conduits for adoption. Events and webinars further enhance customer engagement and thought leadership.

The Atlassian Marketplace is a significant growth engine, hosting thousands of apps that extend core product functionality. In early 2024, top-tier apps on the marketplace reported annual recurring revenues in the tens of millions of dollars, underscoring its economic impact and developer ecosystem.

Atlassian's global partner network, comprising over 2,500 entities worldwide, is instrumental in reaching enterprise clients and facilitating complex cloud transitions. These partners provide essential sales, implementation, and support services, especially for larger organizations.

The company's products, like Jira Software with its free tier for up to 10 users, function as direct channels for value demonstration and organic adoption. This in-product experience is key to customer acquisition and retention, driving upgrades as user needs expand.

Atlassian's Team '25 conference and regular webinars are vital for customer engagement, product promotion, and establishing thought leadership. These platforms allow for direct interaction, feedback gathering, and showcasing innovative solutions to a broad user base.

| Channel | Description | Key Metric/Example |

|---|---|---|

| Direct Online Sales | Atlassian's website for software subscriptions. | Crucial for FY23 revenue growth. |

| Atlassian Marketplace | Platform for third-party apps extending product capabilities. | Top apps report tens of millions in ARR (early 2024). |

| Global Partner Network | Over 2,500 partners for sales, implementation, and support. | Essential for enterprise clients and cloud transitions. |

| Product as Channel | Freemium tiers and trials for direct value demonstration. | Jira Software free tier supports up to 10 users. |

| Events & Webinars | Customer engagement, product promotion, and thought leadership. | Team '25 conference, regular webinars. |

Customer Segments

Software development teams are a core customer segment for Atlassian, relying heavily on tools like Jira for agile project management and issue tracking, and Bitbucket for source code collaboration. These professionals, including developers, engineers, and QA testers, form the backbone of Atlassian's user base, leveraging the platform to streamline their workflows and enhance productivity.

Atlassian's deep connection to this segment is evident in its product evolution, which has consistently addressed the specific pain points of software creation. For instance, in 2024, Jira continued to be a dominant force in the market, with a significant majority of software development teams utilizing it for project planning and bug tracking, underscoring its essential role.

IT Service Management Teams, including IT support, operations, and service desk professionals, are key users of Jira Service Management. They rely on it for efficient handling of incidents, problems, and service requests, aiming for operational excellence. In 2024, organizations increasingly focused on streamlining IT workflows, with many reporting significant improvements in ticket resolution times after implementing ITSM solutions like Jira Service Management.

Atlassian's reach extends beyond engineering to empower diverse business functions like marketing, HR, legal, and finance. Products such as Confluence facilitate seamless knowledge sharing across departments, while Jira Work Management streamlines project coordination for non-technical teams. This broad application fosters organization-wide collaboration, a key driver of efficiency.

Small and Medium-Sized Businesses (SMBs)

Atlassian's scalable solutions are a perfect fit for Small and Medium-Sized Businesses (SMBs). Many SMBs discover and adopt Atlassian products through self-service channels and cloud subscriptions, appreciating the ease of integration and flexible deployment. This approach allows them to start small and expand as their needs grow, a crucial factor for businesses navigating growth phases.

The competitive pricing structure is a significant draw for SMBs. Atlassian offers various tiers, making powerful project management and collaboration tools accessible without requiring a massive upfront investment. For instance, their Jira Software Cloud Standard plan offers robust features at a price point suitable for smaller teams, ensuring they can leverage enterprise-grade technology.

- Accessibility: Atlassian's self-service model and cloud subscriptions lower the barrier to entry for SMBs.

- Scalability: Solutions grow with the business, from small teams to larger departments.

- Cost-Effectiveness: Competitive pricing tiers make advanced tools affordable for smaller budgets.

- Market Reach: In 2024, Atlassian reported over 250,000 customers with fewer than 100 employees, highlighting their strong penetration in the SMB market.

Large Enterprises and Fortune 500 Companies

Large enterprises, including over 80% of the Fortune 500, represent a substantial and expanding customer base for Atlassian. These organizations typically require highly scalable, secure, and robust solutions, often delivered via cloud or Data Center deployments. Their needs frequently involve complex, large-scale migrations and intricate integrations with existing enterprise systems.

Atlassian addresses this segment through a dedicated direct sales force and a network of strategic partners. This approach ensures tailored support and solutions for the unique challenges faced by these major corporations. For instance, in the fiscal year 2023, Atlassian reported that over 260,000 customers were using their Data Center products, a significant portion of which would be large enterprises seeking on-premises or hybrid solutions.

- Enterprise-grade features: Focus on advanced security, compliance, and administrative controls essential for large organizations.

- Scalability and performance: Solutions must handle massive user bases and complex workflows without degradation.

- Integration capabilities: Seamless connection with existing IT infrastructure and third-party applications is critical.

- Dedicated support and account management: Personalized assistance for large-scale deployments, migrations, and ongoing management.

Atlassian serves a broad customer base, from individual developers to large enterprises. Their core segments include software development teams, IT service management professionals, and diverse business functions across organizations. Additionally, Atlassian effectively caters to both small and medium-sized businesses (SMBs) and large enterprises with tailored solutions and pricing models.

The company's strategy involves providing accessible, scalable, and cost-effective tools that adapt to various organizational needs. This multi-segment approach is key to Atlassian's market dominance. In 2024, Atlassian continued to see strong adoption across all these segments, with particular growth noted in cloud-based solutions for SMBs and advanced feature sets for enterprise clients.

Atlassian's customer segmentation is clearly defined by the specific needs and scale of each group. For instance, SMBs prioritize ease of use and affordability, while large enterprises demand robust security, scalability, and integration capabilities. This understanding allows Atlassian to refine its product offerings and go-to-market strategies effectively.

The company's commitment to serving these diverse segments is reflected in its product roadmap and customer support initiatives. By addressing the unique challenges of each group, Atlassian fosters loyalty and drives sustained growth. For example, in 2024, a significant portion of their revenue came from recurring cloud subscriptions, highlighting the success of their strategy for all customer types.

| Customer Segment | Key Needs | Atlassian Solutions | 2024 Focus/Data Point |

|---|---|---|---|

| Software Development Teams | Agile project management, code collaboration, issue tracking | Jira Software, Bitbucket | Continued dominance in agile tooling; high adoption rates for Jira |

| IT Service Management Teams | Incident, problem, and service request management | Jira Service Management | Increased focus on ITSM efficiency and ticket resolution improvements |

| Diverse Business Functions | Knowledge sharing, cross-departmental project management | Confluence, Jira Work Management | Fostering organization-wide collaboration and efficiency gains |

| Small & Medium Businesses (SMBs) | Affordability, ease of use, scalability | Cloud subscriptions, self-service | Over 250,000 customers with fewer than 100 employees in FY23 |

| Large Enterprises | Scalability, security, integration, dedicated support | Cloud/Data Center deployments, direct sales | Over 80% of Fortune 500 use Atlassian products; strong Data Center adoption |

Cost Structure

Atlassian dedicates a substantial portion of its financial resources to Research and Development (R&D). In fiscal year 2023, R&D expenses amounted to $1.5 billion, representing a significant investment in the company's future. This spending fuels the ongoing enhancement of existing products like Jira and Confluence, alongside the development of entirely new solutions.

A key focus within Atlassian's R&D is the integration of artificial intelligence (AI) across its platform. This strategic investment aims to provide customers with more intelligent workflows, automated tasks, and predictive insights. For instance, the company has been actively developing AI-powered features to improve code collaboration and project management efficiency.

This commitment to R&D is vital for Atlassian to maintain its competitive advantage in the rapidly evolving software market. By continuously innovating and incorporating cutting-edge technologies, Atlassian ensures its products remain relevant and valuable to its broad customer base, from small teams to large enterprises.

Atlassian, as a cloud-native software provider, faces significant expenses related to its cloud infrastructure. These costs encompass the use of computing power, data storage solutions, and the underlying network to deliver its suite of products like Jira and Confluence to millions of users globally. For instance, in their fiscal year 2023, Atlassian reported a substantial increase in their cost of revenue, partly driven by these cloud-related expenses, reflecting the growing scale of their operations.

Even with a product-led growth strategy, Atlassian invests significantly in sales and marketing. This includes costs for digital marketing campaigns, brand awareness initiatives, and customer acquisition efforts. For the fiscal year 2023, Atlassian reported sales and marketing expenses of $1.46 billion.

These expenses are crucial for reaching new customers and expanding market share. Atlassian also supports its sales teams and partner programs, which involve activities like targeted digital outreach and participation in key industry events to drive further growth.

Personnel and Employee Compensation

Atlassian's cost structure is significantly influenced by personnel expenses, encompassing salaries, comprehensive benefits, and equity awards for its extensive global team. This includes a substantial investment in engineers, product developers, sales representatives, and essential administrative personnel, making employee compensation a primary cost driver.

Talent acquisition and retention are critical strategic imperatives that directly impact these costs. The company's focus on attracting and keeping top-tier talent in competitive tech markets necessitates competitive compensation packages, which are a major component of their operational expenses.

- Salaries and Wages: A significant portion of Atlassian's operating expenses is dedicated to paying its workforce across various departments.

- Employee Benefits: This includes health insurance, retirement plans, and other welfare programs designed to support and retain employees.

- Stock-Based Compensation: As a technology company, Atlassian often utilizes stock options and grants as part of its compensation strategy to incentivize long-term employee commitment and performance.

- Talent Acquisition Costs: Expenses related to recruiting, interviewing, and onboarding new employees are also factored into this cost category.

General and Administrative (G&A) Overheads

General and Administrative (G&A) overheads encompass the essential operational costs that keep a global software company like Atlassian running smoothly. This includes vital functions such as legal counsel, financial management, human resources, and the upkeep of facilities. In 2024, companies are increasingly focused on optimizing these costs through automation and shared services to boost overall profitability.

Efficient G&A management is crucial for maintaining a healthy bottom line. For instance, Atlassian reported its G&A expenses as a percentage of revenue, which is a key metric investors monitor. While specific 2024 figures are still being finalized, historical trends suggest a continuous effort to leverage technology to reduce administrative burdens.

- Legal and Compliance: Costs associated with contracts, intellectual property, and regulatory adherence.

- Finance and Accounting: Expenses for payroll, accounts payable/receivable, and financial reporting.

- Human Resources: Investment in talent acquisition, employee benefits, and training programs.

- Facilities Management: Costs for office space, utilities, and general workplace maintenance.

Atlassian's cost structure is heavily weighted towards personnel, with salaries, benefits, and stock-based compensation forming a significant expense. This reflects their investment in a global workforce of engineers, developers, and support staff. For fiscal year 2024, Atlassian continued to prioritize talent, with employee-related costs remaining a primary driver of their operational budget.

Research and Development (R&D) is another substantial cost, fueling innovation and the enhancement of their product suite. In fiscal year 2024, Atlassian continued its substantial investment in R&D, focusing on AI integration and new feature development to maintain its competitive edge.

Cloud infrastructure and sales & marketing expenses also represent significant outlays. Atlassian's commitment to cloud delivery necessitates ongoing investment in computing power and data storage, while sales and marketing efforts are crucial for customer acquisition and market expansion. In fiscal year 2024, these areas continued to be key expenditure categories.

| Cost Category | FY23 Actual (USD Billions) | FY24 Projection/Trend (USD Billions) |

|---|---|---|

| Research & Development | 1.5 | Continued significant investment, likely exceeding FY23 |

| Sales & Marketing | 1.46 | Sustained investment for customer acquisition and growth |

| Cloud Infrastructure (Cost of Revenue) | Significant portion of Cost of Revenue | Increased due to scale and cloud adoption |

| Personnel Expenses (Salaries, Benefits, Stock) | Largest component | Primary cost driver, reflecting talent investment |

| General & Administrative | Key operational overhead | Focus on optimization through technology |

Revenue Streams

Cloud subscription revenue is Atlassian's main engine for growth, bringing in money as customers pay to use their software like Jira and Confluence online. This has become their fastest-growing income source.

In the fourth quarter of fiscal year 2025, this cloud revenue experienced a significant jump, increasing by 26% compared to the same period in the previous year, highlighting its increasing importance to Atlassian's financial performance.

Atlassian generates substantial revenue from its Data Center subscription offerings. These self-managed, scalable deployments cater to larger enterprises that require more control over their infrastructure.

While Atlassian continues to push its cloud-based solutions, Data Center remains a vital revenue stream. For instance, in the fiscal year 2023, Atlassian reported a significant portion of its revenue coming from its server and data center products, demonstrating their continued importance to the company's financial performance.

Atlassian's Marketplace is a significant revenue driver, stemming from gross purchases of third-party applications developed by its extensive ecosystem of partners. This platform not only facilitates the expansion of Atlassian's core product offerings but also generates income through potential commissions on these sales.

In fiscal year 2024, the Atlassian Marketplace saw impressive growth, with gross purchases exceeding $1.1 billion. This figure highlights the marketplace's success in fostering a vibrant app development community and its crucial role in Atlassian's overall revenue generation strategy.

Maintenance and Support Fees

Historically, Atlassian relied heavily on maintenance and support fees tied to perpetual software licenses. These fees provided customers with access to technical assistance and software updates, acting as a significant revenue driver. This model contributed substantially to their revenue base for many years.

While Atlassian's strategic shift towards cloud subscriptions has led to a decline in this revenue stream, it still represents a portion of their income. As customers transition to cloud offerings, the revenue from perpetual license maintenance naturally diminishes. For instance, in fiscal year 2023, Atlassian reported that its Cloud products generated the majority of its revenue, indicating the ongoing migration away from on-premises solutions.

- Decreasing Contribution: Revenue from perpetual license maintenance is declining as Atlassian prioritizes cloud subscriptions.

- Historical Significance: This revenue stream was a foundational element of Atlassian's business model, supporting perpetual software sales.

- Customer Migration Impact: The ongoing move to cloud services directly reduces the need for and contribution of these traditional maintenance fees.

Other Services Revenue

Atlassian’s Other Services Revenue encompasses income generated from professional services that go beyond core software subscriptions. This includes vital offerings like customer training programs, strategic consulting to optimize product usage, and various other specialized product and service bundles. These services are designed to ensure customers derive maximum value from their Atlassian investments.

These revenue streams are crucial for deepening customer relationships and supporting complex deployments. For instance, in fiscal year 2023, Atlassian reported significant growth in its cloud offerings, which often necessitates robust professional services to facilitate migration and ongoing optimization for enterprise clients.

- Professional Services: Revenue from training, implementation support, and strategic consulting.

- Value Maximization: Services aimed at helping customers leverage Atlassian products more effectively.

- Ancillary Offerings: Income from additional product features or service packages not part of the main subscription.

Atlassian's revenue streams are diverse, with cloud subscriptions leading the charge. Data Center offerings cater to enterprises needing more control, while the Marketplace thrives on third-party app sales. Historically, maintenance fees from perpetual licenses were significant but are now declining as the company pivots to cloud.

| Revenue Stream | Description | Fiscal Year 2024 Data |

|---|---|---|

| Cloud Subscriptions | Recurring revenue from customers using Atlassian software online. | Fastest-growing segment; Q4 FY25 saw a 26% year-over-year increase. |

| Data Center Subscriptions | Revenue from self-managed, scalable software deployments for enterprises. | Remains a vital revenue stream, particularly for larger organizations. |

| Marketplace | Income from gross purchases of third-party applications. | Gross purchases exceeded $1.1 billion in FY24. |

| Perpetual License Maintenance | Fees for technical support and updates on older, on-premises licenses. | Contribution is declining as customers migrate to cloud. |

| Other Services | Revenue from professional services like training and consulting. | Supports customer adoption and value maximization of Atlassian products. |

Business Model Canvas Data Sources

The Atlassian Business Model Canvas is meticulously constructed using a blend of internal operational data, customer feedback, and market intelligence reports. This comprehensive approach ensures each component accurately reflects Atlassian's strategic positioning and market engagement.