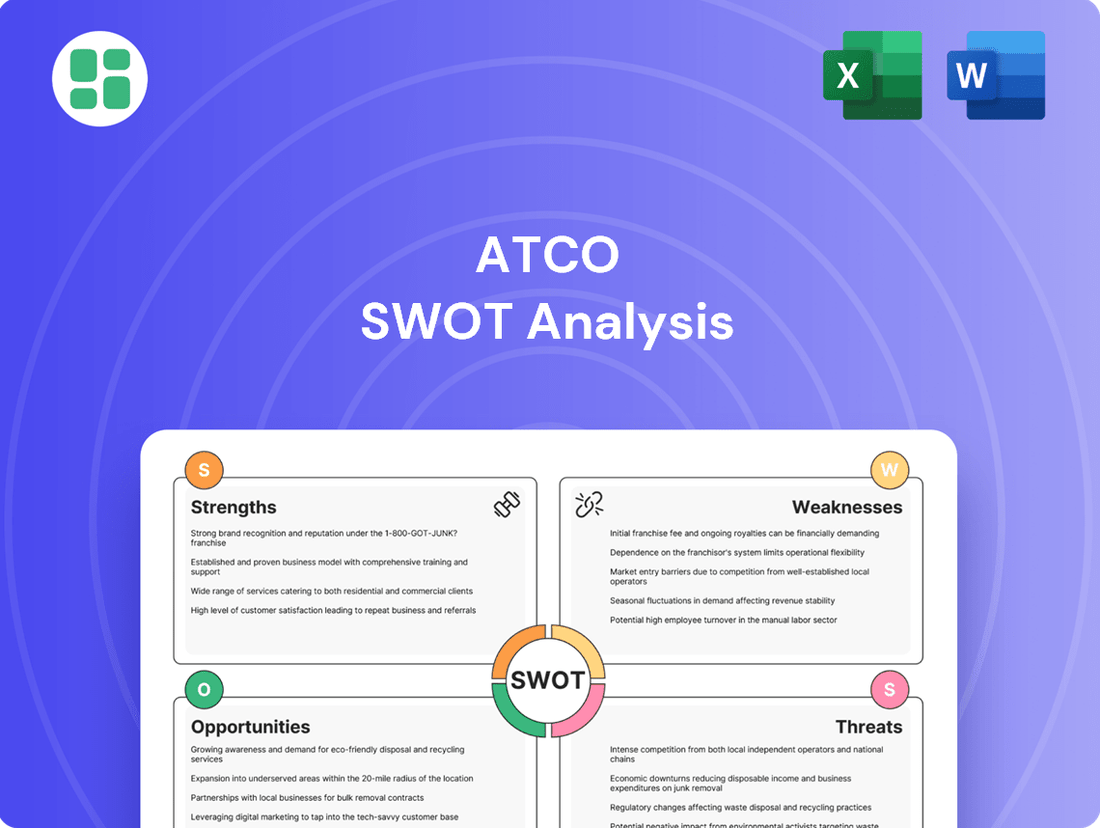

ATCO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

ATCO's strengths lie in its diversified energy portfolio and strong regulatory relationships, but its opportunities are tempered by the evolving energy landscape. Understanding these dynamics is crucial for informed decision-making.

Want the full story behind ATCO's market position, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning.

Strengths

ATCO's strength lies in its diversified global operations, spanning essential sectors like utilities, energy infrastructure, and structures & logistics. This broad portfolio, with approximately $27 billion in assets and a workforce of around 21,000 employees worldwide, creates a resilient business model. It's less vulnerable to economic shocks in any one industry, ensuring a more stable revenue stream.

ATCO demonstrated robust financial performance, reporting adjusted earnings of $481 million in 2024. This upward trend continued into 2025, with the company achieving $160 million in adjusted earnings during the first quarter.

The company's commitment to growth is evident in its substantial capital investment plans. ATCO anticipates investing a minimum of $6.1 billion between 2025 and 2027, with a significant portion allocated to its regulated utility operations, signaling a strategic focus on long-term infrastructure development and expansion.

ATCO's dedication to sustainability and the energy transition is a significant strength. Their 2024 Sustainability Report showcases tangible progress in areas like grid modernization and hydrogen initiatives, alongside notable reductions in greenhouse gas emissions.

The company has set an ambitious goal to own, develop, or manage 1,000 megawatts of renewable energy by 2030. This commitment is already reflected in their current portfolio, where renewable generation capacity has climbed to 64% of their total power generation.

Geographic Diversification and Expanding Presence

ATCO's geographic diversification, with core operations in Canada and Australia, significantly reduces exposure to any single regional downturn. This spread across different economies acts as a natural hedge against localized economic or regulatory challenges.

The company's international expansion, including recent ventures into Chile and the growth of its Australian manufacturing facilities, further broadens its market reach. This strategic expansion allows ATCO to tap into new growth opportunities and leverage global operational efficiencies.

- Diverse Market Exposure: Primary operations in Canada and Australia, with expanding international presence.

- Risk Mitigation: Geographic spread helps buffer against regional economic or regulatory risks.

- Global Best Practices: Opportunity to implement and benefit from international operational standards.

- Growth Opportunities: Expansion into new markets like Chile and enhanced Australian manufacturing capabilities.

Essential Services and Regulated Assets

ATCO's foundational strength lies in its provision of essential services, including electricity, natural gas, and water. These regulated utilities offer a remarkably stable and predictable revenue stream, insulated from the volatility often seen in other market sectors.

The company's strategic focus on capital expenditures within these regulated utilities underpins a robust and reliable earnings base. This consistent investment translates into predictable returns, a key advantage for long-term financial planning and investor confidence.

- Stable Revenue: Regulated utilities provide a consistent income, crucial for financial stability.

- Predictable Returns: Investments in regulated assets yield reliable and forecastable profits.

- Essential Services: Demand for electricity, gas, and water remains high regardless of economic conditions.

ATCO's diversified global operations across utilities, energy infrastructure, and structures & logistics create a resilient business model. With approximately $27 billion in assets and 21,000 employees, this broad portfolio mitigates risks associated with single industry downturns, ensuring more stable revenue streams.

Financially, ATCO reported adjusted earnings of $481 million in 2024, with $160 million achieved in Q1 2025, showcasing a positive financial trajectory. The company plans to invest at least $6.1 billion between 2025 and 2027, primarily in regulated utility operations, highlighting a strategic commitment to long-term infrastructure growth.

ATCO's commitment to sustainability is a key strength, with progress in grid modernization and hydrogen initiatives, alongside greenhouse gas emission reductions. The company aims to have 1,000 megawatts of renewable energy by 2030, and currently, 64% of its power generation is from renewable sources.

| Metric | 2024 | Q1 2025 | 2025-2027 Outlook |

|---|---|---|---|

| Adjusted Earnings | $481 million | $160 million | N/A |

| Capital Investment | N/A | N/A | Minimum $6.1 billion |

| Renewable Energy Target | N/A | N/A | 1,000 MW by 2030 |

What is included in the product

Delivers a strategic overview of ATCO’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis into actionable insights for immediate problem-solving.

Weaknesses

As a utility and infrastructure company, ATCO's operations are deeply intertwined with regulatory frameworks. Changes in these regulations, such as the reset of allowable Return on Equity (ROE) for Alberta Utilities from 9.28% in 2024 to 8.97% for 2025, directly affect its financial performance and investment capacity.

Unfavorable regulatory decisions or prolonged approval processes for new infrastructure projects represent a significant weakness. These delays can hinder ATCO's ability to execute its growth strategies and impact its projected profitability, creating uncertainty in its business outlook.

ATCO's operations, particularly in utilities and energy infrastructure, are inherently capital intensive. This means significant upfront investment is needed to build and maintain essential services. For example, ATCO has projected a minimum capital expenditure of $6.1 billion between 2025 and 2027, underscoring this reality.

This high level of spending can translate into substantial debt, making the company sensitive to changes in interest rates. While a rising rate environment poses a challenge, a potential decrease in interest rates could offer a favorable financial tailwind for ATCO's future investments and debt management.

ATCO's significant operational footprint in Canada and Australia, while a strength in those markets, also presents a key weakness. This geographic concentration means the company is particularly susceptible to economic slowdowns, regulatory changes, or environmental events specific to these two countries. For example, shifts in Australian energy policy or fluctuations in the Canadian economy could disproportionately affect ATCO's overall performance.

Competition in Non-Regulated Segments

ATCO's non-regulated businesses, particularly structures & logistics and retail energy, contend with a diverse array of competitors. This intense rivalry can put pressure on pricing and profitability, potentially limiting market share gains. For instance, in the structures segment, numerous regional and national providers offer similar modular building solutions.

The company's strategy to expand its market presence necessitates ongoing investment and organic growth initiatives, such as building new manufacturing facilities. This proactive approach is a direct response to the competitive landscape, underscoring the need to stay ahead and capture market opportunities. In 2024, ATCO's Structures & Logistics division reported revenue growth, demonstrating its efforts to navigate this competitive environment.

- Intense Rivalry: ATCO faces significant competition in its non-regulated sectors from numerous players, impacting market share and margins.

- Strategic Investments: The company's need for continuous growth, evidenced by investments in new manufacturing facilities, highlights the competitive pressures it navigates.

- Market Dynamics: Competitors in areas like modular buildings and retail energy solutions can dilute ATCO's market position if differentiation is not maintained.

Vulnerability to Commodity Price Volatility

While ATCO's regulated utilities provide a stable revenue base, its energy infrastructure and retail energy segments are susceptible to fluctuations in natural gas and electricity prices. This volatility can affect earnings, particularly within its natural gas storage operations, even though current market conditions are generally supportive.

For instance, a significant downturn in natural gas prices, which can occur due to oversupply or reduced demand, directly impacts the profitability of ATCO's storage and transportation services. The company's financial reports for 2023 and early 2024 indicate that while overall performance was strong, specific segments tied to commodity markets experienced more pronounced swings.

- Exposure to Natural Gas Price Swings: ATCO's profitability in its energy infrastructure segment is directly linked to the price of natural gas, creating a vulnerability to market downturns.

- Impact on Retail Energy: The retail energy division faces similar risks, as fluctuating wholesale electricity and gas prices can compress margins if not effectively hedged.

- Natural Gas Storage Sensitivity: The natural gas storage business is particularly sensitive to price differentials and demand, meaning lower commodity prices can reduce revenue opportunities.

ATCO's significant capital expenditure requirements, projected at $6.1 billion between 2025-2027 for essential services, create a substantial debt burden, making it vulnerable to interest rate fluctuations. This financial leverage means that rising interest rates could significantly increase financing costs and impact profitability.

The company's geographic concentration in Canada and Australia exposes it to country-specific economic downturns, regulatory shifts, or environmental events, which could disproportionately affect its overall performance. For instance, changes in Australian energy policy could directly impact ATCO's operations there.

ATCO faces intense competition in its non-regulated sectors like structures and logistics, where numerous regional and national providers offer similar solutions, potentially limiting market share and pressuring margins. The need for continuous strategic investments, such as new manufacturing facilities, highlights these competitive pressures.

The company's profitability is also susceptible to volatility in natural gas and electricity prices, particularly impacting its energy infrastructure and retail energy segments. For example, downturns in natural gas prices can directly reduce revenue from storage and transportation services.

Same Document Delivered

ATCO SWOT Analysis

This is the actual ATCO SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full ATCO SWOT report you'll get. Purchase unlocks the entire in-depth version.

This is a real excerpt from the complete ATCO SWOT analysis. Once purchased, you’ll receive the full, editable version.

Opportunities

The global push for decarbonization is a major tailwind for ATCO, particularly its strategic focus on hydrogen and renewable energy. The company's commitment to owning 1,000 MW of renewable energy by 2030 positions it well to capitalize on this trend.

Australia's energy landscape exemplifies this opportunity, with substantial investments flowing into clean energy and battery storage solutions. ATCO's involvement in such markets, for instance through its Australian utility operations, directly aligns with these burgeoning clean energy demands.

ATCO is well-positioned to capitalize on the ongoing infrastructure modernization trend, particularly in the development of smart grids. Continued investment in upgrading existing power grids with smart meters and advanced technologies to improve reliability and efficiency presents a significant opportunity for growth. For example, in 2023, ATCO Electric Alberta invested approximately $300 million in capital projects focused on system enhancements and modernization.

The global push towards an energy transition, emphasizing renewable energy integration and electrification, necessitates substantial upgrades to existing energy infrastructure. This creates a sustained, long-term capital expenditure cycle for utilities like ATCO, as they adapt their systems to accommodate new energy sources and demand patterns. Utilities are increasingly deploying advanced distribution automation systems to manage distributed energy resources and enhance grid flexibility.

ATCO Structures is actively broadening its reach, evidenced by its new manufacturing facility in Australia and a robust pipeline of global contracts in regions like Chile and the United States. This strategic expansion points to significant opportunities for further international market penetration and increased demand for its modular construction and support services.

Strategic Partnerships and Acquisitions

ATCO can significantly bolster its growth by forging strategic partnerships and pursuing targeted acquisitions. These moves are crucial for expanding its asset base, diversifying its operational footprint, and crucially, upgrading its technological capabilities. The acquisition of Suncor's renewable energy assets in late 2023, which added 1,500 megawatts of wind power capacity, serves as a prime example of how these strategies can rapidly enhance ATCO's market position and renewable energy portfolio.

These strategic maneuvers offer several key advantages:

- Asset Expansion: Acquiring established infrastructure or renewable energy projects allows ATCO to quickly scale its operations.

- Diversification: Partnerships and acquisitions can open doors to new markets or energy sectors, reducing reliance on existing operations.

- Technological Advancement: Integrating new technologies through acquisitions or collaborations can improve efficiency and introduce innovative solutions.

- Market Synergies: Strategic alliances can create powerful market synergies, combining complementary strengths for mutual benefit.

Digitalization and Operational Efficiencies

ATCO can significantly boost its performance by embracing digitalization. Implementing advanced digital tools across its operations, from energy generation to infrastructure management, promises to streamline processes, cut costs, and elevate the quality of services provided to customers. This aligns perfectly with ATCO's ongoing commitment to operational efficiency, a strategy already reflected in its financial results.

For instance, ATCO's cash flow from operating activities saw a notable increase, demonstrating the positive impact of efficiency-focused initiatives. Digitalization offers a powerful avenue to amplify these gains. Consider these specific opportunities:

- Enhanced Grid Management: Deploying smart grid technologies can optimize energy distribution, reduce outages, and improve load balancing, leading to significant cost savings and better service reliability.

- Predictive Maintenance: Utilizing AI and IoT sensors for equipment monitoring allows for proactive maintenance, preventing costly breakdowns and minimizing downtime across ATCO's diverse asset base.

- Customer Experience Improvement: Digital platforms can offer customers more self-service options, personalized communication, and faster issue resolution, fostering greater satisfaction and loyalty.

The global demand for cleaner energy sources presents a significant growth avenue for ATCO, especially with its focus on hydrogen and renewable energy projects. By aiming to own 1,000 MW of renewable capacity by 2030, ATCO is strategically positioned to benefit from this transition. For instance, Australia's energy market is seeing substantial investment in clean energy and storage, aligning perfectly with ATCO's utility operations there.

Threats

The energy sector's competitive landscape is intensifying, marked by new players and innovative business models, especially within the burgeoning renewable energy market. ATCO's strategic investments in renewables, while promising, face the challenge of robust competition that could potentially impact its profit margins and hold on market share in this rapidly expanding segment.

Changes in government policies, stricter environmental regulations, or unfavorable regulatory decisions, such as those impacting allowable rates of return or tariffs, pose ongoing threats to regulated utility earnings. For instance, proposed gas price hikes in Australia faced significant scrutiny in 2024, highlighting the sensitivity of utility operations to political and regulatory shifts.

These shifts can directly affect ATCO's profitability by altering revenue streams or increasing operational costs. For example, a tightening of emissions standards, a common trend in 2024 and projected into 2025, could necessitate substantial capital investments in cleaner technologies, impacting the company's financial performance and requiring careful management of regulatory compliance.

Economic slowdowns in ATCO's key operating regions, particularly Canada and Australia, pose a significant threat by potentially dampening demand for its diverse services. This could translate into fewer new projects and reduced revenue streams.

Persistent inflation, a notable concern in 2024 and projected into 2025, directly impacts ATCO's bottom line. Rising costs for labor, materials, and energy increase operational expenses and the overall cost of undertaking new projects, thereby squeezing profit margins.

For instance, while specific ATCO figures for 2024 are still emerging, broader Canadian inflation reached 3.9% year-over-year in March 2024, and Australia's inflation was 3.6% in the first quarter of 2024, both impacting input costs for infrastructure and energy projects.

Climate Change and Extreme Weather Events

As a critical infrastructure operator, ATCO faces significant threats from climate change and the escalating frequency and intensity of extreme weather. Wildfires, for instance, pose a direct risk to ATCO's extensive network of pipelines and utility assets, potentially leading to costly repairs and prolonged service disruptions. In 2023, Canada experienced its most severe wildfire season on record, with over 18 million hectares burned, highlighting the tangible impact such events can have on infrastructure reliability and operational continuity.

The financial implications of these climate-related risks are substantial. Increased capital expenditures for asset hardening and resilience measures, coupled with potential insurance premium hikes or uninsurable losses, could impact ATCO's profitability and cash flow. For example, the estimated economic cost of natural disasters in Canada in 2023 alone surpassed $5 billion, underscoring the growing financial burden associated with climate change impacts on essential services.

- Asset Damage: Extreme weather events can physically damage ATCO's infrastructure, requiring immediate and expensive repairs.

- Operational Disruption: Service interruptions due to weather events can lead to lost revenue and reputational damage.

- Increased Capital Costs: Investments in climate resilience and adaptation measures will likely rise to mitigate future risks.

- Insurance and Liability: Rising claims and potential changes in insurance availability could increase ATCO's operating expenses.

Technological Disruption and Cybersecurity Risks

The energy sector is experiencing rapid technological shifts, with advancements in distributed generation, battery storage, and smart grid technologies potentially challenging ATCO's established utility models. For instance, the increasing adoption of rooftop solar and microgrids could reduce reliance on traditional utility services. ATCO's significant investment in digital infrastructure, while enabling efficiency, also exposes it to growing cybersecurity risks. A successful cyberattack could disrupt critical operations, compromise sensitive customer data, and severely damage its reputation, as seen in the increasing frequency and sophistication of attacks on critical infrastructure globally.

Cybersecurity threats are a significant concern for utilities. In 2023, the U.S. Department of Energy reported that the energy sector experienced a substantial increase in cyber incidents. ATCO, like its peers, must continuously invest in robust cybersecurity measures to protect its vast network and customer information. Failure to do so could lead to significant financial losses and operational downtime, impacting service delivery and public trust.

The pace of technological change presents both opportunities and threats. ATCO needs to adapt to evolving energy landscapes, which include:

- Emerging renewable energy integration challenges.

- The need for advanced grid modernization investments.

- The constant threat of sophisticated cyberattacks targeting operational technology (OT) and information technology (IT) systems.

Intensifying competition in the energy sector, particularly from new entrants in renewables, could erode ATCO's market share and profit margins. Regulatory shifts, such as unfavorable rate decisions or stricter environmental mandates, pose ongoing threats to earnings, as seen with gas price scrutiny in Australia in 2024. Economic downturns in Canada and Australia could reduce demand for ATCO's services, impacting revenue streams.

Persistent inflation in 2024 and 2025, with Canada's inflation at 3.9% and Australia's at 3.6% in early 2024, increases operational costs and project expenses. Climate change risks, exemplified by Canada's record wildfire season in 2023, threaten ATCO's infrastructure, leading to costly repairs and service disruptions, with natural disaster costs in Canada exceeding $5 billion in 2023.

Rapid technological advancements, like distributed generation, could disrupt traditional utility models, while sophisticated cyberattacks pose significant operational and data security risks, with a notable increase in energy sector cyber incidents reported in 2023.

| Threat Category | Specific Risk | Impact | Example Data/Trend |

| Competition | New entrants in renewables | Market share erosion, margin pressure | Growth in renewable energy investments globally |

| Regulatory | Unfavorable policy changes | Reduced revenue, increased costs | Gas price hike scrutiny in Australia (2024) |

| Economic | Slowdowns in key markets | Lower demand, reduced project revenue | Inflation rates: Canada 3.9%, Australia 3.6% (Q1 2024) |

| Climate Change | Extreme weather events | Asset damage, operational disruption | Canada's 2023 wildfire season (18M+ hectares burned) |

| Cybersecurity | Sophisticated cyberattacks | Operational disruption, data breaches | Increased cyber incidents in US energy sector (2023) |

SWOT Analysis Data Sources

This ATCO SWOT analysis is built upon a robust foundation of data, including ATCO's official financial statements, comprehensive market research reports, and insights from industry experts to ensure a well-rounded and accurate assessment.