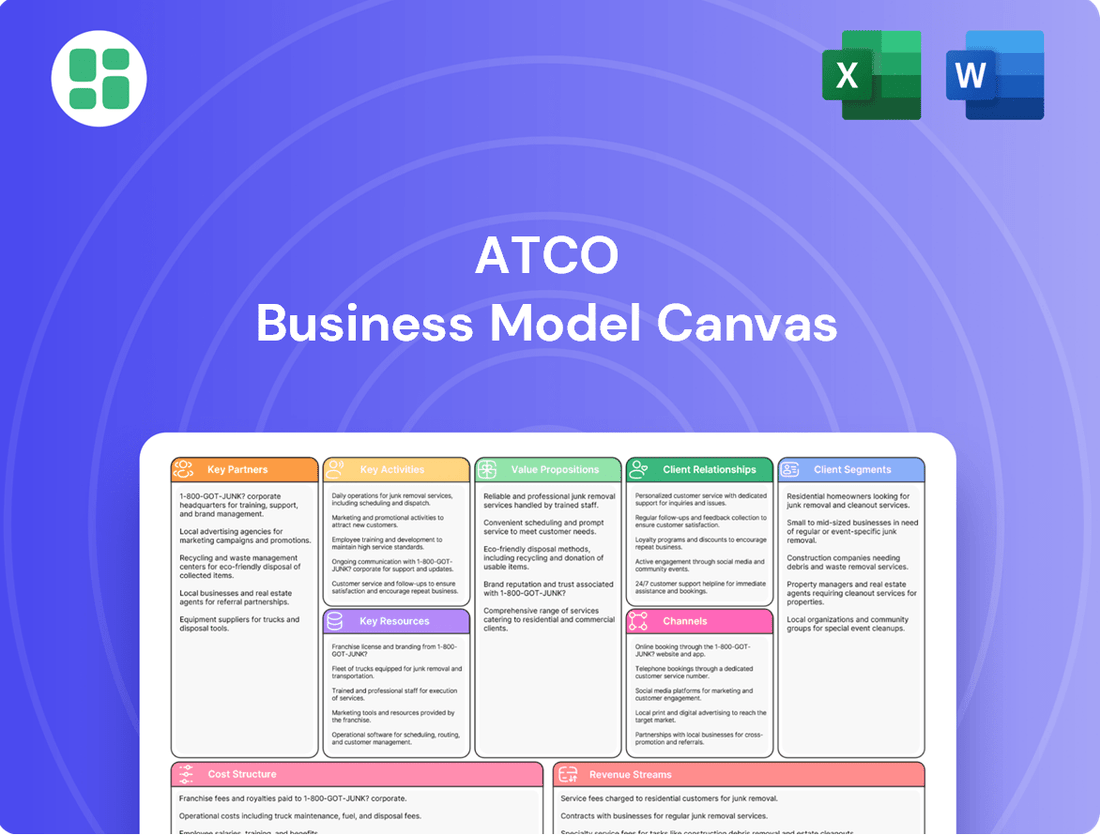

ATCO Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

Unlock the core components of ATCO's operational strategy with our Business Model Canvas. This snapshot reveals how ATCO connects with its customers and delivers value, offering a foundational understanding of its market approach. Discover the key elements that drive ATCO's success and gain inspiration for your own ventures.

Partnerships

ATCO’s extensive operations in regulated utility sectors across Canada and Australia necessitate robust partnerships with government and regulatory bodies. These include entities like the Alberta Utilities Commission (AUC) and Australia's Economic Regulation Authority (ERA). These collaborations are vital for navigating complex approval processes and establishing fair utility rates.

Maintaining strong relationships with these authorities is fundamental to ATCO's business stability and long-term growth. For instance, in 2023, ATCO Gas Australia was approved to invest approximately AUD 400 million in its gas distribution network, a process heavily influenced by regulatory oversight and engagement.

ATCO prioritizes collaborations with Indigenous groups, viewing them as essential for major infrastructure projects. For instance, the Yellowhead Mainline project saw ATCO actively seeking equity partnership arrangements with Indigenous communities.

These partnerships are designed to create substantial economic benefits and promote shared prosperity, ensuring development respects traditional territories. In 2024, ATCO reported delivering $123 million in net economic benefits directly to its Indigenous partners.

ATCO actively cultivates partnerships with technology and innovation leaders to accelerate its sustainable energy initiatives and boost operational effectiveness. For instance, their collaboration with Linde Canada is pivotal in advancing hydrogen production capabilities, a key component of their clean energy strategy. This focus on innovation is crucial as the global energy sector increasingly prioritizes decarbonization and efficiency improvements.

Joint Venture Partners

ATCO strategically engages in joint ventures to tackle significant infrastructure projects and penetrate new geographical areas. A prime example is their collaboration with Quanta Services Inc. to form LUMA Energy, which manages electricity transmission and distribution in Puerto Rico. This partnership is crucial for modernizing the island's energy grid.

Further demonstrating this strategy, ATCO partnered with Inuvialuit Frontec Services for defense contracts. These alliances are designed to pool complementary skills and assets, thereby enhancing the capability to successfully deliver intricate and demanding projects.

These key partnerships are vital for ATCO's growth and operational success. For instance, LUMA Energy secured approximately $1.6 billion in federal funding through the Puerto Rico Electric Power Authority (PREPA) Transformation Plan, highlighting the scale of projects undertaken through these ventures.

- Strategic Expansion: Joint ventures enable ATCO to enter new markets and undertake large-scale infrastructure developments.

- Risk Mitigation: Partnering shares the financial and operational risks associated with complex, high-value projects.

- Leveraging Expertise: Collaborations allow ATCO to access specialized knowledge and capabilities from partners like Quanta Services and Inuvialuit Frontec.

- Enhanced Project Execution: Shared resources and combined strengths improve the efficiency and effectiveness of project delivery.

Suppliers and Contractors

ATCO's extensive operations rely heavily on a strong network of suppliers and contractors. This is crucial for everything from building utility infrastructure to manufacturing modular homes. For instance, in 2024, ATCO Gas Australia continued its significant infrastructure upgrade programs, necessitating a steady supply of materials and specialized construction services from numerous partners.

These partnerships are fundamental for ensuring projects are completed on time and within budget, while also guaranteeing access to high-quality materials and expert skills across ATCO's global presence. Their ability to deliver specialized services is key to maintaining ATCO's operational effectiveness.

- Material Procurement: Sourcing essential components for energy infrastructure and modular construction.

- Specialized Services: Engaging contractors for complex engineering, construction, and installation tasks.

- Logistics and Transportation: Partnering for the efficient movement of materials and finished products globally.

- Maintenance and Repair: Collaborating with service providers to ensure ongoing operational reliability.

ATCO's success hinges on strategic alliances with technology providers and industry innovators to drive sustainable energy solutions and operational efficiency. Their collaboration with Linde Canada, for example, is instrumental in advancing hydrogen production, a critical area for their clean energy ambitions.

Furthermore, ATCO actively forms joint ventures to undertake large-scale infrastructure projects and expand into new markets, such as their partnership with Quanta Services Inc. to create LUMA Energy for Puerto Rico's energy grid modernization. These collaborations are vital for accessing specialized expertise and mitigating project risks.

ATCO also relies on a robust network of suppliers and contractors for essential materials and specialized services, ensuring timely and budget-conscious project completion across its diverse operations. In 2024, ATCO Gas Australia's infrastructure upgrades underscored the need for reliable partners in material procurement and specialized construction.

| Partnership Type | Example Partner | Strategic Importance | 2024 Impact/Data |

| Regulatory Bodies | Alberta Utilities Commission (AUC) | Navigating approvals, rate setting | Facilitated AUD 400M investment approval (ATCO Gas Australia) |

| Indigenous Communities | Various | Equity partnerships, economic benefits | Delivered $123M net economic benefits to Indigenous partners |

| Technology & Innovation | Linde Canada | Advancing hydrogen production | Key to clean energy strategy |

| Joint Ventures | Quanta Services Inc. (LUMA Energy) | Market expansion, large projects | LUMA Energy secured $1.6B in federal funding |

| Suppliers & Contractors | Various | Material procurement, specialized services | Essential for ATCO Gas Australia's infrastructure upgrades |

What is included in the product

A strategic blueprint for ATCO, detailing its core operations, customer focus, and revenue streams within the established Business Model Canvas framework.

The ATCO Business Model Canvas effectively addresses the pain of scattered strategic thinking by providing a structured, visual framework for understanding and communicating a business's core elements.

It alleviates the frustration of complex strategy documents by condensing all essential components into a single, easily digestible page.

Activities

ATCO's utility infrastructure development and operation is central to its business. This involves meticulously planning, building, and maintaining the vital electricity and natural gas transmission and distribution networks that power communities.

Significant investments are continuously made in modernizing and expanding these essential energy systems. For instance, major projects like the Yellowhead Mainline natural gas project and the Central East Transfer-Out (CETO) electricity transmission project highlight ATCO's commitment to ensuring the reliability and capacity of energy delivery for millions of customers.

ATCO's key activities involve the end-to-end design, manufacturing, and global delivery of a wide array of modular structures. This includes specialized solutions like workforce housing and rapid deployment camps for resource extraction projects, as well as commercial facilities and permanent modular buildings. Their operational scope extends to providing auxiliary buildings crucial for mining and other industrial operations.

The company's manufacturing process is geared towards efficiency and scalability, enabling them to serve diverse client needs across various sectors and geographies. This comprehensive approach ensures that ATCO can provide complete modular solutions, from initial concept to final on-site delivery and installation.

A significant recent development bolstering these capabilities is the acquisition of NRB Limited, a move that has demonstrably expanded ATCO's footprint and expertise within the modular building sector. This integration enhances their capacity to meet the growing demand for prefabricated and modular construction solutions worldwide.

ATCO is heavily invested in creating and implementing cleaner energy options. This involves pushing forward with hydrogen production, increasing their capacity for renewable energy sources like wind and solar, and researching energy storage innovations.

These efforts are crucial to ATCO's goal of reducing carbon emissions and ensuring a sustainable energy future. For example, in 2024, ATCO continued to advance its hydrogen projects, aiming to contribute to a lower-carbon economy.

Operational Support Services

ATCO Frontec delivers essential operational support services across government, defense, and commercial industries. These services are critical for clients who need reliable management of their facilities, complex logistics, and even emergency response capabilities.

The company's expertise extends to managing remote workforces and providing support during disaster relief efforts. This segment highlights ATCO's ability to handle demanding operational challenges, ensuring continuity and efficiency for its clients.

- Facilities Management: ATCO Frontec manages a wide array of facilities, ensuring they operate smoothly and efficiently.

- Logistics and Supply Chain: The company provides comprehensive logistics solutions, from transportation to inventory management.

- Disaster Response: ATCO Frontec offers critical support during emergency situations, including deployment of resources and personnel.

- Remote Workforce Support: Services include housing, catering, and essential services for personnel in remote locations.

Retail Energy and Home Services Provision

ATCO's retail energy and home services provision involves directly supplying electricity and natural gas to a broad customer base, encompassing both homes and businesses. This core activity is complemented by offering specialized home maintenance services and expert advice, all designed to enhance customer comfort and provide a sense of security.

This strategic focus on direct customer interaction allows ATCO to build strong relationships and diversify its service offerings beyond traditional energy supply. In 2024, ATCO Electric Alberta reported serving over 1.2 million customers, highlighting the scale of its retail operations.

- Direct Energy Sales: Supplying electricity and natural gas to residential and commercial clients.

- Home Services: Offering maintenance, repairs, and professional advice for home comfort and efficiency.

- Customer Engagement: Focusing on building relationships and providing value-added services.

- Service Diversification: Expanding beyond energy provision into broader home solutions.

ATCO's key activities revolve around the development, operation, and maintenance of utility infrastructure, including electricity and natural gas transmission and distribution. They also focus on designing, manufacturing, and delivering modular structures globally for various industries. Furthermore, ATCO provides essential operational support services through ATCO Frontec and directly supplies energy and home services to customers.

Recent data highlights ATCO's extensive reach and ongoing investments. In 2024, ATCO Electric Alberta served over 1.2 million customers, underscoring the scale of their retail operations. The company continues to invest in modernizing its energy systems, with significant projects like the Yellowhead Mainline and CETO transmission projects demonstrating their commitment to reliability and capacity expansion.

| Key Activity Area | Description | 2024 Data/Context |

|---|---|---|

| Utility Infrastructure | Development, operation, and maintenance of electricity and natural gas networks. | Serving millions of customers across vast transmission and distribution systems. |

| Modular Structures | Design, manufacturing, and global delivery of modular buildings and workforce housing. | Acquisition of NRB Limited expanded capabilities in the modular sector. |

| Operational Support (ATCO Frontec) | Facilities management, logistics, and disaster response services. | Supports government, defense, and commercial industries with critical operational needs. |

| Retail Energy & Home Services | Direct supply of electricity and natural gas, plus home maintenance services. | ATCO Electric Alberta served over 1.2 million customers in 2024. |

| Clean Energy Initiatives | Investing in hydrogen production, renewables, and energy storage. | Advancing hydrogen projects in 2024 to contribute to a lower-carbon economy. |

Full Document Unlocks After Purchase

Business Model Canvas

The ATCO Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This means you're seeing the exact structure, content, and formatting that will be delivered, ensuring no surprises. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas.

Resources

ATCO's extensive infrastructure network is a cornerstone of its business, featuring a vast array of physical assets like electricity transmission and distribution lines, and natural gas pipelines. This robust network spans across Canada and Australia, forming the essential backbone for delivering critical utility services.

These regulated assets are key to ATCO's financial stability, generating predictable and reliable cash flows. For instance, in 2024, ATCO Gas Australia reported significant capital investments aimed at maintaining and enhancing its gas distribution network, demonstrating a commitment to its long-term operational integrity and service capacity.

Continuous capital investments are crucial for modernizing and expanding this vital infrastructure. This proactive approach ensures ATCO can meet growing energy demands and adapt to evolving regulatory landscapes, solidifying its position as a dependable utility provider.

ATCO's key resources include its advanced manufacturing facilities for modular buildings and an extensive global rental fleet. This fleet, boasting over 25,000 modular units as of recent reports, is crucial for quickly supplying housing and commercial spaces across various sectors and regions. Strategic moves, such as the acquisition of NRB Limited, enhance ATCO's ability to deliver customized solutions rapidly.

ATCO's operations are powered by a global team of roughly 20,000 to 21,000 employees. This vast workforce includes a significant number of highly skilled professionals across critical areas like engineering, operations, logistics, construction, and customer service.

The specialized expertise these individuals bring is absolutely essential for ATCO to effectively manage its intricate infrastructure projects and deliver top-tier services. Their collective knowledge is a key driver for innovation within the company.

Financial Capital and Investment Capacity

ATCO possesses robust financial capital, enabling substantial investment capacity. This allows the company to undertake significant capital expenditure programs and pursue strategic growth opportunities.

The company has outlined an ambitious capital expenditure plan, projecting at least $6.1 billion for the period of 2025 through 2027. This substantial investment is largely earmarked for its regulated utility operations, ensuring infrastructure modernization and expansion.

This strong financial foundation is crucial for ATCO's long-term growth trajectory and operational stability. It underpins the company's ability to meet future energy demands and adapt to evolving market conditions.

- Financial Strength: ATCO's considerable financial resources are a key asset.

- Capital Expenditure: An expected capital expenditure of at least $6.1 billion is planned for 2025-2027.

- Investment Focus: The majority of these funds are allocated to regulated utilities.

- Growth and Stability: This financial backing supports sustained growth and operational resilience.

Proprietary Technology and Intellectual Property

ATCO's proprietary technology and intellectual property are foundational to its business model, particularly in its utility and energy solutions segments. Key technological assets include advanced metering infrastructure (AMI) vital for smart grid operations, enabling real-time data collection and enhanced grid management. In 2024, ATCO continued to invest in and deploy these smart grid technologies, aiming to improve service reliability and customer engagement.

Furthermore, ATCO possesses significant expertise in advanced distribution management systems, crucial for optimizing energy flow and responding effectively to grid disturbances. This technological edge allows for more efficient operations and a more resilient energy infrastructure. The company also holds specialized knowledge in cleaner energy technologies, such as hydrogen production and carbon capture, positioning it for future growth in the evolving energy landscape.

- Advanced Metering Infrastructure (AMI): Facilitates smart grid capabilities, real-time data, and improved operational efficiency.

- Advanced Distribution Management Systems: Enhances grid reliability and operational responsiveness.

- Cleaner Energy Technologies: Expertise in hydrogen production and carbon capture supports sustainability goals and future market opportunities.

- Intellectual Property: Patents and trade secrets related to these technologies protect ATCO's competitive advantage and innovation.

ATCO's intellectual property and technological capabilities are critical. This includes advanced metering infrastructure (AMI) for smart grids, which ATCO continued to deploy in 2024 to enhance reliability. Their expertise in advanced distribution management systems also optimizes energy flow and grid responsiveness. Furthermore, ATCO's knowledge in cleaner energy, like hydrogen production, positions them for future growth.

Value Propositions

ATCO’s value proposition centers on providing fundamental and reliable services, encompassing electricity, natural gas, water, and shelter. These utilities are critical for communities and industries globally, ensuring consistent access to essential infrastructure that supports daily life and economic operations. For instance, in 2023, ATCO Electric Alberta delivered approximately 17,500 gigawatt-hours of electricity to over 250,000 customers, highlighting their significant role in energy provision.

ATCO is actively driving the energy transition by channeling significant investments into cleaner fuels, renewable energy sources, and cutting-edge technologies. For instance, in 2024, the company continued its expansion of wind and solar power generation, aiming to bolster its renewable portfolio.

This dedication is exemplified by ATCO's pioneering work in hydrogen projects and the ongoing modernization of its utility grids, which includes the strategic deployment of smart meters. These initiatives are designed to enhance efficiency and reliability across its energy networks.

Ultimately, ATCO's commitment to sustainability and innovation translates into providing customers with energy solutions that are not only more dependable but also demonstrably better for the environment. This focus on greener energy aligns with growing consumer and regulatory demand for responsible energy practices.

ATCO excels in providing flexible and rapidly deployable solutions, a key value proposition for clients needing agile infrastructure. Their modular structures and operational support are highly customizable, ensuring immediate and tailored responses to complex logistical needs, especially for remote workforces or disaster relief efforts. For instance, in 2024, ATCO's rapid deployment services were critical in establishing temporary housing and essential services for communities impacted by severe weather events, showcasing their ability to deliver critical infrastructure swiftly.

Operational Efficiency and Cost Management

ATCO is deeply committed to streamlining its operations and actively managing costs across its diverse business segments. This dedication translates into tangible savings, which are then passed on to customers, ensuring affordability and enhanced value for utility users.

Key initiatives, such as the ongoing grid modernization efforts and sophisticated asset management strategies, are central to ATCO's pursuit of efficiency. These programs are designed not only to improve service reliability but also to contribute to competitive pricing structures.

- Grid Modernization: ATCO continues to invest in upgrading its utility infrastructure, aiming to reduce operational expenses and improve service delivery. For instance, through its various utility operations, ATCO has reported significant progress in integrating advanced technologies to enhance grid resilience and efficiency.

- Asset Management Optimization: The company employs rigorous asset management practices to maximize the lifespan and performance of its infrastructure, thereby minimizing costly replacements and maintenance.

- Cost Control Measures: ATCO consistently reviews and implements cost-saving measures throughout its organization, from procurement to administrative functions, to maintain a lean operational structure.

- Customer Affordability: The direct benefit of these efficiencies is reflected in ATCO's commitment to providing competitive and affordable rates to its customer base.

Long-Term Partnership and Community Benefit

ATCO cultivates long-term partnerships by deeply embedding itself within the communities it serves, extending far beyond mere utility provision. This commitment is evident in their substantial investments in local economies, aiming to foster sustainable growth and create lasting value.

A key aspect of this strategy involves actively fostering Indigenous partnerships, recognizing the importance of collaboration and shared prosperity. In 2024, ATCO continued its focus on these relationships, aiming to create mutually beneficial outcomes that respect cultural heritage and promote economic self-sufficiency for Indigenous communities.

Furthermore, ATCO actively contributes to social value initiatives, ensuring that its operations generate broader societal benefits. This includes supporting local programs and infrastructure development, reinforcing their role as a responsible corporate citizen dedicated to community well-being.

- Community Investment: ATCO's dedication to local economies is demonstrated through ongoing investments in infrastructure and services, aiming to enhance quality of life for residents.

- Indigenous Partnerships: The company prioritizes meaningful collaboration with Indigenous communities, focusing on economic development, employment opportunities, and shared ownership models.

- Social Value Creation: ATCO actively contributes to social well-being by supporting local initiatives, education, and environmental stewardship programs.

ATCO's value proposition is multifaceted, offering essential and reliable utility services like electricity, natural gas, and water, alongside critical shelter solutions. They are a key player in the energy transition, investing heavily in renewables and innovative technologies such as hydrogen, with a focus on modernizing grids and smart meter deployment for enhanced efficiency and sustainability. Furthermore, ATCO provides agile, customizable infrastructure solutions for rapid deployment, especially vital for remote or disaster-affected areas, while maintaining a strong commitment to cost management and community partnerships, including significant focus on Indigenous collaboration and social value creation.

| Value Proposition | Description | Key Initiatives/Data Points |

| Essential & Reliable Utilities | Providing consistent access to electricity, natural gas, water, and shelter. | ATCO Electric Alberta delivered ~17,500 GWh to over 250,000 customers in 2023. |

| Energy Transition & Innovation | Driving cleaner fuels, renewables, and grid modernization. | Continued expansion of wind and solar generation in 2024; pioneering hydrogen projects. |

| Agile & Rapid Deployment | Flexible, customizable infrastructure solutions for immediate needs. | Critical in establishing temporary housing and services for disaster-affected communities in 2024. |

| Operational Efficiency & Affordability | Streamlining operations and managing costs to ensure competitive pricing. | Grid modernization and asset management optimization contribute to cost control. |

| Long-Term Community Partnerships | Deep community embedding through investment and collaboration. | Prioritizing Indigenous partnerships and contributing to social value initiatives in 2024. |

Customer Relationships

For major industrial, commercial, and government clients, ATCO offers dedicated account management teams. These specialized groups focus on delivering a personalized experience, deeply understanding each client's unique requirements and navigating complex contract landscapes. This strategic, hands-on approach is designed to cultivate robust, enduring business partnerships.

ATCO actively engages with communities, especially regarding utility infrastructure and land development. In 2024, this commitment translated into numerous public information sessions and open houses across its operating regions, fostering transparency. For instance, their energy utility division held over 50 community consultations for new pipeline projects, ensuring local voices shaped development plans.

Building trust is paramount, and ATCO's investment in local initiatives, such as sponsoring community events and supporting educational programs, reinforces this. This proactive approach, demonstrated by their $5 million in community investments across Canada in 2024, is crucial for securing social license and ensuring the smooth execution of projects, ultimately benefiting both the company and the communities it serves.

ATCO prioritizes accessible customer service for its residential and small business clients through dedicated call centers and online portals. These channels are crucial for managing inquiries, billing, service requests, and critical emergency situations, ensuring prompt and dependable support.

In 2024, ATCO reported a significant volume of customer interactions across these service channels, demonstrating their commitment to responsive assistance. For instance, their call centers handled millions of inquiries, with a growing percentage resolved on the first contact, directly contributing to enhanced customer satisfaction metrics.

Digital Self-Service Platforms

ATCO's digital self-service platforms provide customers with convenient online portals to manage accounts, track energy usage, and access home services. These tools give users more control and flexibility. For instance, ATCO Gas’s online portal allows customers to view bills, make payments, and report outages, streamlining interactions.

- Enhanced Convenience: Digital tools significantly improve customer ease of use.

- Account Management: Customers can easily monitor and manage their utility accounts online.

- Consumption Tracking: Platforms offer insights into energy usage patterns.

- Service Access: Home services and support are readily available through digital channels.

Regulatory and Public Relations

ATCO prioritizes strong relationships with regulatory bodies and the public through proactive engagement and transparent communication. This includes diligently navigating evolving energy regulations, a critical aspect given the sector's dynamic nature, and ensuring strict adherence to compliance standards.

The company's commitment to safety, sustainability, and affordability is a cornerstone of its public relations strategy. For instance, in 2024, ATCO continued to invest in renewable energy projects, aiming to reduce its carbon footprint while maintaining competitive energy prices for consumers.

- Regulatory Compliance: ATCO actively monitors and adapts to regulatory changes, ensuring all operations meet or exceed industry standards.

- Public Trust: Through open communication about safety protocols and environmental initiatives, ATCO aims to foster and maintain public confidence.

- Advocacy Efforts: The company engages in advocacy to inform policy discussions, promoting a balanced approach to energy development and consumer protection.

ATCO cultivates diverse customer relationships, from dedicated account management for large clients to accessible digital and call center support for residential users. Their approach emphasizes community engagement, exemplified by over 50 public consultations in 2024 for new energy projects, and significant community investments totaling $5 million that year.

| Customer Segment | Relationship Type | Key Engagement Channels | 2024 Focus/Data Point |

|---|---|---|---|

| Major Industrial, Commercial, Government | Dedicated Account Management | Personalized service, contract navigation | Fostering robust, enduring partnerships |

| Residential & Small Business | Accessible Support | Call centers, online portals, digital self-service | Millions of inquiries handled, improved first-contact resolution |

| Communities | Proactive Engagement & Investment | Public information sessions, local sponsorships, educational programs | Over 50 community consultations, $5 million in community investments |

| Regulatory Bodies & Public | Transparent Communication & Compliance | Adherence to regulations, safety/sustainability initiatives | Continued investment in renewables, maintaining competitive prices |

Channels

ATCO's Direct Sales and Business Development channel is crucial for securing large-scale projects. They actively engage with major industrial, commercial, government, and defense clients. This involves dedicated sales teams and participation in competitive bid processes to win significant contracts for energy infrastructure, modular buildings, and operational support.

This direct approach is essential for handling the complexity and customization required for these high-value agreements. In 2024, ATCO's focus on these direct channels contributed to a robust pipeline of opportunities, particularly in the energy transition and critical infrastructure sectors, underscoring the importance of building strong relationships with key enterprise clients.

ATCO's physical utility networks are the core channels for delivering electricity and natural gas. These extensive transmission and distribution systems, comprising pipelines and power lines, directly connect services to over 1.2 million customers across Alberta as of 2024.

This robust physical infrastructure is the backbone of ATCO's operations, ensuring reliable energy delivery to homes, businesses, and industrial facilities. In 2023, ATCO Electric's capital investments in its electricity distribution system exceeded $500 million, focusing on modernization and expansion.

ATCO leverages online platforms and digital portals to serve its retail energy and home services customers. These digital touchpoints are crucial for enabling self-service options, allowing customers to manage their accounts, schedule appointments, and access a wealth of information and resources conveniently. In 2024, ATCO reported a significant increase in digital engagement, with over 70% of customer inquiries being handled through their online portal, demonstrating a clear preference for digital convenience among their user base.

Customer Service Centers and Call Lines

Customer service centers and dedicated phone lines are vital touchpoints for ATCO, facilitating customer inquiries, technical support, and emergency communications. These channels ensure customers have direct access to assistance for their utility and home service needs, providing essential support.

In 2024, ATCO continued to invest in its customer service infrastructure. For instance, ATCO Gas Alberta reported handling over 1.5 million customer interactions across various channels, including phone and online, in a typical year, highlighting the significant volume managed through these direct support lines.

- Direct Customer Support: Offers immediate assistance for inquiries and issues.

- Emergency Response: Crucial for timely reporting and management of utility emergencies.

- Accessibility: Provides a reliable communication method for all customer demographics.

- Information Dissemination: Facilitates the sharing of important service updates and safety information.

Strategic Partnerships and Joint Ventures

ATCO actively pursues strategic partnerships and joint ventures to broaden its operational footprint and offer specialized services in new markets. This approach allows ATCO to access expertise and capital, mitigating risks associated with new ventures.

A prime example is ATCO's involvement in LUMA Energy, a partnership managing Puerto Rico's electric transmission and distribution system. This venture, which began in 2020, represents a significant expansion beyond ATCO's traditional Canadian base, showcasing its ability to operate in diverse regulatory and geographical environments.

- LUMA Energy Partnership: ATCO’s stake in LUMA Energy demonstrates its commitment to international utility operations, managing a system serving over 1.4 million customers in Puerto Rico.

- Market Expansion: These collaborations are crucial for ATCO to enter new sectors and geographies, leveraging local knowledge and established networks.

- Risk Mitigation: Joint ventures allow ATCO to share the financial and operational burdens of large-scale projects, enhancing capital efficiency.

ATCO's channels are diverse, encompassing direct sales for large projects, physical utility networks for energy delivery, digital platforms for customer self-service, and customer service centers for direct support. Strategic partnerships further expand its reach and capabilities.

In 2024, ATCO's digital engagement saw over 70% of customer inquiries handled online, reflecting a strong shift towards digital convenience. Concurrently, ATCO Gas Alberta managed over 1.5 million customer interactions through various channels, underscoring the volume handled by direct support.

The LUMA Energy partnership, in which ATCO holds a stake, manages Puerto Rico's electric grid, serving over 1.4 million customers. This international venture highlights ATCO's strategy of market expansion through collaboration, mitigating risks while accessing new opportunities.

| Channel Type | Key Function | 2024/Recent Data Point | Strategic Importance |

|---|---|---|---|

| Direct Sales & Business Development | Securing large-scale projects, competitive bids | Focus on energy transition and critical infrastructure pipeline | Essential for high-value, complex agreements |

| Physical Utility Networks | Reliable energy delivery (electricity, natural gas) | Serving over 1.2 million customers in Alberta | Backbone of core operations, ensuring service continuity |

| Online Platforms & Digital Portals | Customer self-service, account management | Over 70% of customer inquiries handled online | Enhances customer convenience and operational efficiency |

| Customer Service Centers & Phone Lines | Inquiries, technical support, emergency communication | Managed over 1.5 million customer interactions (ATCO Gas Alberta) | Provides direct access to assistance and critical information |

| Strategic Partnerships & Joint Ventures | Market expansion, access to expertise and capital | LUMA Energy partnership managing Puerto Rico's grid | Mitigates risk and broadens operational footprint |

Customer Segments

This segment encompasses individual households and smaller commercial operations that depend on ATCO for their electricity and natural gas. These customers' primary concerns revolve around dependable, secure, and reasonably priced energy to meet their everyday requirements.

In 2024, ATCO continued to serve millions of residential and small business customers across its operating regions, emphasizing consistent service delivery and value. For instance, ATCO Electric Alberta's 2024 capital investment plan, totaling approximately $640 million, includes projects aimed at enhancing the reliability and safety of the grid for these essential customer groups.

Large industrial and commercial clients, including those in mining, oil and gas, and manufacturing, represent a key segment for ATCO. These businesses demand substantial and reliable energy supplies, often requiring customized modular structures for their extensive projects. For example, in 2024, the global mining sector alone was projected to invest billions in new infrastructure and operational upgrades, underscoring the scale of demand.

These clients typically have intricate and large-scale infrastructure requirements, necessitating comprehensive operational support services from ATCO. Their operations are critical, and any disruption can lead to significant financial losses, making ATCO's dependable service delivery paramount to their success.

ATCO's government and defense sector customers, including various levels of government and defense organizations, rely on ATCO Frontec for critical operational support services. These clients, such as national defense ministries and emergency management agencies, demand stringent security protocols and dependable logistical solutions for their operations.

In 2024, ATCO's commitment to this segment is evident in its provision of specialized modular housing and facilities. These are crucial for military bases, disaster relief efforts, and public sector infrastructure projects, underscoring the need for robust and adaptable solutions in challenging environments.

Developers and Construction Companies

Developers and construction companies are key clients for ATCO, leveraging its modular building solutions for diverse projects like housing, schools, and hospitals. They prioritize speed, cost savings, and efficiency in their construction processes, making ATCO's prefabricated units highly attractive. In 2024, the global modular construction market was projected to reach over $100 billion, highlighting the significant demand for these methods.

These businesses benefit from ATCO's ability to deliver high-quality structures quickly, reducing on-site labor and project timelines. This translates to faster revenue generation and lower overall project costs.

- Targeted Solutions: ATCO provides tailored modular units for residential, educational, and healthcare sectors.

- Efficiency Gains: Clients achieve faster project completion and reduced on-site labor costs.

- Cost-Effectiveness: Modular construction offers predictable pricing and minimizes waste, leading to significant savings.

- Market Growth: The increasing demand for rapid and sustainable building solutions fuels the adoption of modular construction.

Indigenous Communities and Partners

ATCO views Indigenous communities not just as stakeholders but as vital partners, especially in the realm of energy infrastructure. This collaboration is central to developing projects that benefit everyone involved, aiming for mutual growth and sustainability.

The company actively seeks to create shared economic opportunities through these partnerships. This includes employment, training, and business development initiatives designed to empower local economies and foster long-term prosperity within Indigenous communities.

A key aspect of ATCO's approach is ensuring the provision of essential services, such as reliable energy, to these communities. This commitment goes hand-in-hand with building and maintaining respectful, enduring relationships based on trust and mutual understanding.

- Shared Economic Opportunities: ATCO's 2024 initiatives include direct employment targets for Indigenous individuals on major projects, aiming for a significant percentage increase over previous years.

- Capacity Building: Investments in skills training and development programs are tailored to Indigenous participants, enhancing their employability and entrepreneurial capabilities.

- Respectful Relationships: Formalized partnership agreements and ongoing consultation processes are in place to ensure community voices are heard and respected in project planning and execution.

- Service Provision: Efforts are underway to expand access to clean and reliable energy solutions in remote Indigenous communities, addressing critical infrastructure gaps.

ATCO serves a diverse customer base, from individual households to large industrial clients, each with unique energy and infrastructure needs. The company also partners with government entities, developers, and Indigenous communities, demonstrating a broad reach and a commitment to tailored solutions.

In 2024, ATCO's customer segments highlight its role as a critical infrastructure provider across multiple sectors. The company's strategic focus on reliability, customized solutions, and community partnerships underscores its adaptability in meeting varied market demands.

Key customer segments include residential and small commercial users prioritizing dependable and affordable energy, and large industrial clients requiring substantial, reliable power for operations like mining and manufacturing.

Additionally, government and defense sectors depend on ATCO Frontec for secure logistical support, while developers leverage modular solutions for faster, cost-effective construction projects.

| Customer Segment | Key Needs | 2024 Focus/Data Point |

|---|---|---|

| Residential & Small Commercial | Reliable, affordable energy | Millions served; $640M investment in grid reliability (ATCO Electric Alberta) |

| Large Industrial & Commercial | Substantial, reliable energy; customized infrastructure | Serving mining, oil & gas; global mining investment in billions for infrastructure |

| Government & Defense | Secure, dependable operational support; modular facilities | Provision of specialized modular housing for defense and emergency relief |

| Developers & Construction | Speed, cost savings, efficiency via modular solutions | Modular construction market projected over $100B globally in 2024 |

| Indigenous Communities | Shared economic opportunities, reliable energy, respectful partnerships | Employment targets for Indigenous individuals on major projects; skills training |

Cost Structure

ATCO dedicates a substantial portion of its expenses to capital expenditures for developing, maintaining, and enhancing its extensive energy infrastructure. This includes critical assets like pipelines, transmission lines, and power generation facilities.

For the period of 2025 to 2027, ATCO has projected capital investments amounting to at least $6.1 billion specifically for its regulated utility operations.

ATCO's cost structure heavily features operational and maintenance expenses for its diverse utility networks and modular building assets. These ongoing costs are essential for keeping everything running smoothly, from power grids to construction sites.

Key components include the procurement of energy, which fluctuates with market prices, and the necessary repairs and upkeep for all physical assets. Field service activities, involving technicians and equipment, also contribute significantly to these operational outlays.

For instance, in 2024, ATCO's utility segment likely saw substantial spending on maintaining its extensive natural gas and electricity distribution systems, ensuring reliability for millions of customers. Similarly, its modular building division would incur costs for site preparation, assembly, and ongoing support for its deployed units.

ATCO's personnel and labor costs are a significant component of its overall cost structure, reflecting its global workforce of roughly 20,000 to 21,000 employees. These expenses encompass salaries, wages, comprehensive benefits packages, and ongoing training initiatives crucial for maintaining a highly skilled workforce.

Regulatory and Compliance Costs

Operating in sectors like utilities and energy, ATCO faces substantial regulatory and compliance costs. These expenses are crucial for adhering to stringent safety, environmental, and operational standards mandated by various government bodies. For instance, in 2024, ATCO's capital expenditures included significant investments in maintaining and upgrading infrastructure to meet evolving regulatory requirements, such as those related to pipeline safety and emissions control.

These costs are not merely operational but are fundamental to ATCO's license to operate. They encompass legal fees, the management of complex regulatory applications, and ongoing monitoring and reporting. Failure to comply can result in severe penalties, operational disruptions, and reputational damage, making these expenditures a non-negotiable aspect of the business model.

- Ongoing investment in safety and environmental compliance technologies.

- Costs associated with obtaining and maintaining operating permits and licenses.

- Expenditures on legal counsel and expert consultation for regulatory matters.

- Resources dedicated to internal compliance audits and reporting to regulatory agencies.

Acquisition and Investment-Related Costs

ATCO's cost structure includes significant expenses related to strategic acquisitions and corporate investments. For instance, the acquisition of NRB Limited represents a substantial outlay, encompassing due diligence, integration planning, and the financing costs associated with securing the deal. These investments are crucial for ATCO's ongoing strategy of diversifying its business portfolio and expanding its market reach.

These acquisition-related costs are not one-time events but often involve ongoing integration expenses as new entities are brought into the ATCO fold. Financing costs, whether through debt or equity, also add to the overall expenditure. For example, in 2024, ATCO continued to manage the financial implications of its strategic growth initiatives, which directly impact its cost base.

- Strategic Acquisitions: Costs like the purchase price and integration efforts for entities such as NRB Limited.

- Due Diligence: Expenses incurred in thoroughly vetting potential acquisition targets.

- Integration Expenses: Costs associated with merging acquired businesses into ATCO's existing operations.

- Financing Costs: Interest payments or equity dilution related to funding new investments and acquisitions.

ATCO's cost structure is dominated by significant capital expenditures for infrastructure development and maintenance, alongside substantial operational and maintenance expenses for its utility and modular building segments. Personnel costs, driven by a global workforce, and regulatory compliance expenditures are also key financial outlays. Strategic acquisitions and their integration further contribute to the overall cost base.

| Cost Category | Description | Example/Data Point (2024/2025-2027) |

|---|---|---|

| Capital Expenditures | Infrastructure development, maintenance, and upgrades (pipelines, transmission lines, power generation). | Projected $6.1 billion for regulated utility operations (2025-2027). Significant investments in 2024 for pipeline safety and emissions control upgrades. |

| Operational & Maintenance | Keeping utility networks and modular buildings running; energy procurement; repairs; field services. | Ongoing costs for natural gas and electricity distribution systems; site preparation and assembly for modular units. |

| Personnel Costs | Salaries, wages, benefits, and training for a global workforce. | Covers approximately 20,000-21,000 employees. |

| Regulatory & Compliance | Adhering to safety, environmental, and operational standards; legal fees; permits. | Expenditures on legal counsel and internal compliance audits. |

| Strategic Acquisitions | Purchase price, due diligence, and integration of acquired businesses. | Costs associated with the acquisition of NRB Limited and ongoing integration expenses. |

Revenue Streams

ATCO's primary revenue comes from regulated electricity and natural gas distribution and transmission services. Prices and profit margins for these essential services are set and overseen by regulatory bodies, ensuring a stable and predictable income. This regulated structure is a cornerstone of ATCO's financial stability.

ATCO generates revenue through the sale and rental of modular buildings. This includes both temporary and permanent structures designed for diverse sectors like workforce housing, commercial, and industrial needs. The demand for these buildings is closely tied to project timelines within the resource and construction industries.

In 2024, ATCO's modular solutions segment experienced robust demand, particularly from infrastructure projects and the ongoing need for remote workforce accommodation. This segment is a significant contributor to ATCO's overall financial performance, reflecting the company's strategic positioning in essential service delivery.

ATCO's Operational Support and Contract Services generate income through long-term agreements for facility management, logistics, and operational support, primarily serving government, defense, and commercial sectors. These contracts typically involve a mix of recurring fees and payments tied to specific projects, providing a stable and diversified revenue base outside of their core utility operations.

In 2023, ATCO's Structures & Logistics segment, which encompasses these services, reported revenue of $2.3 billion. This segment's performance is bolstered by its ability to secure multi-year contracts, demonstrating the reliability and recurring nature of these revenue streams.

Retail Energy Sales

ATCO generates revenue through the direct sale of electricity and natural gas to a broad base of residential and commercial customers. This is particularly relevant in competitive retail markets where ATCO actively engages with end-consumers.

The success of this revenue stream is closely tied to fluctuating energy prices, ATCO's effectiveness in acquiring new customers, and its ability to retain existing ones through reliable service and competitive offerings. This direct engagement allows ATCO to expand its market reach significantly.

- Energy Sales: Revenue derived from selling electricity and natural gas directly to end-users.

- Customer Base: Serves both residential and commercial sectors, diversifying its customer portfolio.

- Market Influence: Performance is sensitive to energy market price volatility and customer acquisition/retention rates.

Energy Infrastructure Development and Other Investments

ATCO earns revenue from its investments in non-regulated energy infrastructure projects. This includes earnings from renewable energy generation, such as solar and wind farms, as well as natural gas storage facilities. These ventures are strategically chosen to align with market demand for cleaner energy and reliable energy storage solutions.

The company also generates income from other strategic investments, exemplified by its stake in Neltume Ports, which focuses on logistics and port operations. This diversification into non-regulated sectors aims to foster growth and capture opportunities beyond its traditional utility operations.

- Renewable Energy Generation: Revenue from solar and wind projects, capitalizing on the growing demand for sustainable power.

- Natural Gas Storage: Earnings derived from the operation and utilization of natural gas storage infrastructure, crucial for energy market stability.

- Strategic Ventures: Income from diversified investments like Neltume Ports, contributing to broader market access and growth opportunities.

ATCO's revenue streams are diverse, encompassing regulated utilities, modular building solutions, and operational support services. The company's core business in electricity and natural gas distribution and transmission provides a stable, regulated income, while its modular buildings cater to project-driven demand. Operational support contracts offer recurring revenue from facility management and logistics.

| Revenue Stream | Description | Key Factors |

| Regulated Utilities | Electricity and natural gas distribution and transmission. | Regulatory oversight, stable demand. |

| Modular Buildings | Sale and rental of temporary and permanent structures. | Project timelines, resource and construction industry activity. |

| Operational Support | Facility management, logistics, and operational support. | Long-term contracts, government and commercial sector needs. |

| Energy Sales | Direct sale of electricity and natural gas to end-users. | Energy price volatility, customer acquisition and retention. |

| Non-Regulated Investments | Renewable energy, natural gas storage, port operations. | Market demand for clean energy, strategic partnerships. |

Business Model Canvas Data Sources

The ATCO Business Model Canvas is informed by a blend of internal financial reports, customer feedback surveys, and operational performance metrics. This multifaceted approach ensures a comprehensive understanding of ATCO's current strategic landscape.