ATCO PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ATCO Bundle

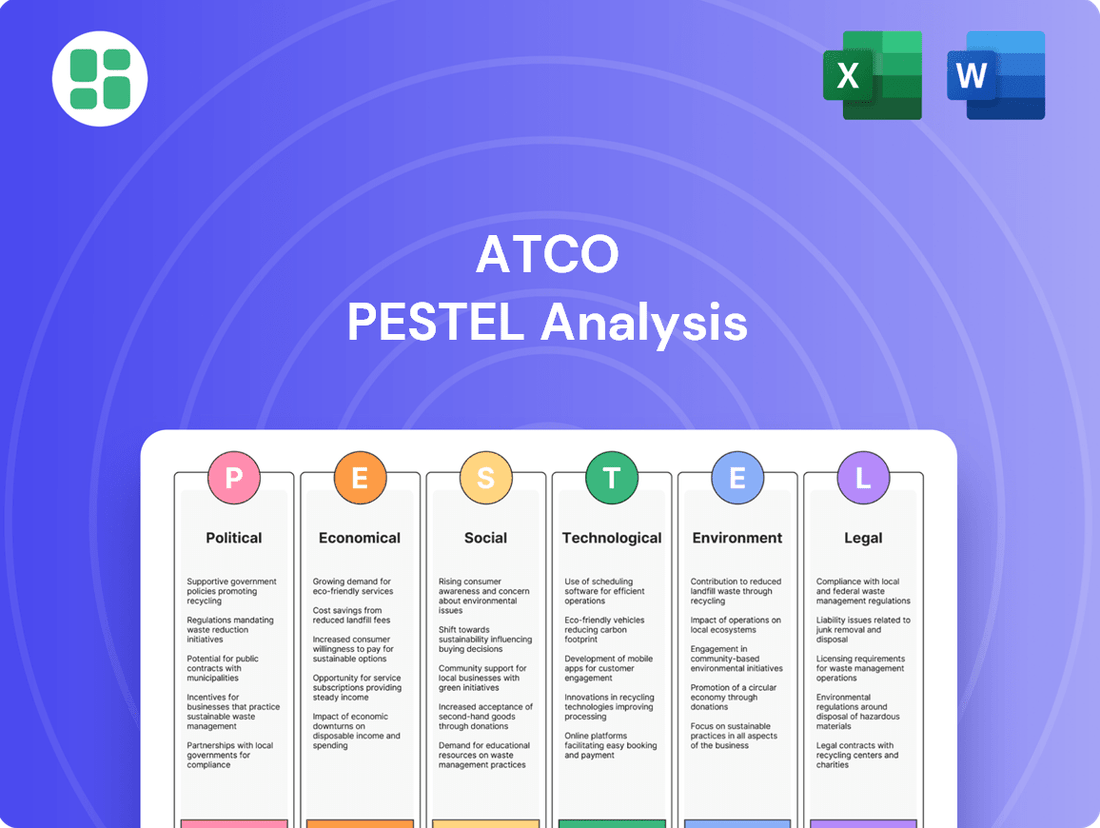

Unlock the strategic forces shaping ATCO's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, technological advancements, environmental regulations, and social trends are creating both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your own strategies and anticipate market movements. Purchase the full PESTLE analysis now for a deeper dive into ATCO's external landscape.

Political factors

Government energy policies in Canada and Australia are critical for ATCO. For instance, Canada's federal government has set ambitious targets for emissions reductions, impacting the fossil fuel infrastructure ATCO operates. Australia's National Energy Guarantee, though evolving, aims to balance reliability, affordability, and emissions reduction, directly shaping ATCO's utility investments.

Shifts in political priorities can create both opportunities and challenges. A move towards greater energy independence might spur investment in domestic natural gas infrastructure, a segment ATCO is involved in. Conversely, stricter environmental regulations, such as increased carbon pricing mechanisms, could elevate operating costs or necessitate significant capital expenditure for ATCO's energy businesses.

Political stability is a cornerstone for ATCO's long-term planning. In 2024, Canada's energy sector continues to navigate evolving federal and provincial policies, while Australia's energy transition faces ongoing political debate. ATCO's ability to adapt to these dynamic political landscapes in regions like Alberta and Western Australia will be key to its sustained growth and investment certainty.

ATCO's expanding global footprint makes it keenly aware of international trade relations. Changes in these agreements, like the potential for new tariffs or trade blocs, can directly impact the cost of materials and the accessibility of markets for ATCO's diverse operations, which span energy, utilities, and infrastructure. For instance, disruptions in global supply chains, as seen with various trade disputes in recent years, could increase the cost of essential components for ATCO's projects.

Geopolitical shifts and the imposition of new trade barriers present significant challenges. These can affect not only the cost of goods but also the ease with which ATCO can move its services and capital across borders, impacting the feasibility of its international development pipeline. The company’s strategic planning in 2024 and 2025 will likely involve navigating these complexities, potentially diversifying sourcing and market access to mitigate risks.

Maintaining robust diplomatic relationships is crucial for ATCO's international growth. Positive bilateral ties between Canada, Australia, and other key operating regions can facilitate smoother cross-border operations and open doors for new ventures. For example, favorable trade agreements can reduce the cost of capital for large infrastructure projects, enhancing their financial viability.

In Canada, the federal government's commitment to reconciliation, as evidenced by the Truth and Reconciliation Commission's Calls to Action, significantly impacts infrastructure development. ATCO's projects, particularly in energy and utilities, require robust engagement with Indigenous groups, often involving co-ownership or benefit-sharing agreements. For instance, the Indigenous Clean Energy (ICE) network reports growing Indigenous investment in renewable energy projects across Canada, highlighting the increasing need for collaborative models.

Similarly, in Australia, the Native Title Act 1993 and subsequent legislation mandate consultation with Traditional Owners for projects impacting native title rights. ATCO's operations in Western Australia, for example, must adhere to these frameworks, which can involve complex land use agreements and cultural heritage protection protocols. The economic participation of Indigenous communities in resource and infrastructure projects is a growing political priority, influencing project viability and social license.

Public-Private Partnerships and Infrastructure Spending

Government initiatives focused on infrastructure development, often through public-private partnerships (PPPs), present significant opportunities for ATCO. For instance, Canada's federal budget in 2024 proposed substantial investments in clean energy and infrastructure, potentially benefiting ATCO's utilities segment. Increased government spending on essential services like water, natural gas, and electricity infrastructure drives demand for ATCO's expertise and assets.

Conversely, austerity measures or shifts in government investment priorities could reduce potential project pipelines. For example, if provincial governments facing fiscal challenges scale back infrastructure projects, it could impact ATCO's project development in those regions. The success of PPPs often hinges on stable regulatory frameworks and predictable revenue streams, which are influenced by political stability and government commitment.

- Federal Infrastructure Bank (Canada) Investment: As of early 2025, the Canada Infrastructure Bank has committed billions to large-scale projects, many of which align with ATCO's utility and energy transition services.

- Provincial Infrastructure Plans: Several Canadian provinces, like Alberta, have outlined multi-year infrastructure spending plans, with significant allocations to energy grid modernization and renewable energy integration, creating direct opportunities for ATCO.

- Impact of Fiscal Policy: Changes in government debt levels or inflation targets can lead to adjustments in public spending, potentially affecting the pace and scale of infrastructure projects available to companies like ATCO.

Energy Security and Reliability Mandates

Governments are increasingly focused on energy security and reliability, a trend amplified by extreme weather and geopolitical tensions. For ATCO, this translates into a critical role in maintaining essential services. For instance, Canada's federal government, through initiatives like the Pan-Canadian Framework on Clean Growth and Climate Change, emphasizes grid modernization and resilience, directly influencing ATCO's infrastructure investments.

Mandates for grid resilience and diversification require ATCO to allocate capital towards strengthening its networks and exploring a broader energy mix. In 2023, ATCO reported significant capital expenditures aimed at infrastructure upgrades and modernization, underscoring its commitment to meeting these evolving regulatory demands. These policies also present avenues for ATCO to innovate, developing and deploying solutions that bolster system reliability and preparedness for unforeseen events.

- Grid Modernization Investments: ATCO's capital program for 2024-2028 includes substantial investments in upgrading its electricity and natural gas infrastructure to enhance resilience and reliability.

- Renewable Energy Integration: Government policies encouraging renewable energy sources necessitate ATCO's adaptation and integration of these technologies into its existing grid, impacting operational strategies.

- Emergency Preparedness: Regulatory bodies are imposing stricter requirements for emergency preparedness and response plans, compelling ATCO to continuously refine its protocols and resource allocation for disaster mitigation.

Government energy policies in Canada and Australia directly shape ATCO's operational landscape. Canada's federal commitment to emissions reduction targets, for example, influences ATCO's fossil fuel infrastructure, while Australia's evolving National Energy Guarantee impacts its utility investments. Political stability is crucial, with 2024 and 2025 seeing continued policy debates in both nations regarding energy transition and infrastructure development, affecting ATCO's investment certainty.

Geopolitical shifts and trade relations are also significant political factors for ATCO. Changes in international trade agreements or the imposition of tariffs can affect the cost of materials and market access for ATCO's global operations. Navigating these complexities in 2024 and 2025 will require strategic planning to mitigate risks associated with cross-border operations and supply chains.

Indigenous relations are increasingly central to political considerations for ATCO's projects. In Canada, reconciliation efforts and the Calls to Action necessitate robust engagement with Indigenous groups, often leading to co-ownership or benefit-sharing agreements for infrastructure development. Australia's Native Title Act also mandates consultation with Traditional Owners, impacting land use agreements and cultural heritage protocols for projects in regions like Western Australia.

Government infrastructure spending, often through public-private partnerships, presents key opportunities for ATCO. Canada's 2024 budget, for instance, signaled significant investment in clean energy and infrastructure, potentially benefiting ATCO's utility segment. However, shifts in government fiscal policy or austerity measures could impact the pipeline of available projects, underscoring the importance of stable regulatory frameworks.

| Political Factor | Description | Impact on ATCO | Data Point/Example (2024/2025 Focus) |

| Energy Policy & Regulation | Government mandates and targets for energy production, emissions, and grid reliability. | Influences investment in specific energy sources and infrastructure upgrades. | Canada's 2030 emissions reduction target of 40-45% below 2005 levels (federal government) impacts ATCO's fossil fuel asset strategy. |

| Infrastructure Investment | Government spending and support for public infrastructure projects. | Creates opportunities for ATCO's utility and energy services through project pipelines. | Canada Infrastructure Bank's multi-billion dollar commitments to clean growth projects in 2024-2025 align with ATCO's service offerings. |

| Indigenous Relations & Policy | Legal frameworks and government initiatives for Indigenous consultation and participation in projects. | Requires ATCO to engage in co-ownership or benefit-sharing agreements, influencing project timelines and social license. | Growing trend of Indigenous-led clean energy projects in Canada, as reported by Indigenous Clean Energy (ICE), necessitates collaborative models for ATCO. |

| Trade & Geopolitics | International trade agreements, tariffs, and geopolitical stability. | Affects the cost of materials, market access, and cross-border operations for ATCO's international ventures. | Potential for new trade tariffs in 2024-2025 could increase the cost of specialized equipment for ATCO's infrastructure projects. |

What is included in the product

This ATCO PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the organization across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to empower strategic decision-making and identify potential threats and opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

ATCO's diverse operations are significantly influenced by global and regional economic growth trends. For instance, a robust global economy in 2024 and projected for 2025 typically translates to higher industrial output and increased consumer spending, directly boosting demand for ATCO's energy and infrastructure services.

Conversely, the specter of recession looms, with the IMF forecasting global growth to moderate in 2025. Economic slowdowns can depress energy consumption and potentially strain customer affordability, impacting ATCO's revenue streams through reduced demand and potentially lower commodity prices.

ATCO, as a capital-intensive entity heavily invested in infrastructure, faces significant exposure to interest rate fluctuations. For instance, the Bank of Canada's overnight rate, a key benchmark, saw increases throughout 2022 and 2023, impacting borrowing costs. Higher interest rates directly translate to increased capital costs for ATCO's new projects and the refinancing of its substantial debt portfolio, potentially squeezing profit margins and affecting the economic viability of future growth initiatives.

ATCO's significant involvement in natural gas and other energy commodities, especially within its energy infrastructure and retail energy divisions, exposes its profitability to price fluctuations. For instance, in 2024, natural gas prices have shown considerable swings, impacting the cost of ATCO's operations and the attractiveness of its energy offerings.

These price swings directly influence ATCO's operational expenses and the competitive positioning of its energy solutions. The financial health of its energy-related assets is also closely tied to these market dynamics, requiring careful monitoring.

Given this exposure, ATCO's ability to manage commodity risks effectively is paramount for maintaining financial stability and predictable performance. Robust hedging strategies and market analysis are crucial to mitigate the effects of price volatility.

Inflationary Pressures and Supply Chain Costs

Inflationary pressures are a significant concern for ATCO, directly impacting its diverse operations. Rising costs for labor, raw materials, and equipment can escalate expenses across its utilities, energy infrastructure, and structures & logistics segments. For instance, the Consumer Price Index (CPI) in Canada, where ATCO primarily operates, saw a notable increase, contributing to higher input costs throughout 2024. This trend is expected to continue, albeit at a potentially moderating pace into 2025, necessitating careful financial management.

Supply chain disruptions further exacerbate these challenges. Increased costs for essential components, from specialized materials for energy projects to parts for infrastructure development, can lead to project delays and budget overruns. Global supply chain volatility, influenced by geopolitical events and demand fluctuations, means ATCO must remain agile in its procurement strategies. For example, the cost of steel, a key material in many infrastructure projects, experienced significant price swings in late 2023 and early 2024, directly affecting construction budgets.

To navigate these headwinds, ATCO is focused on several key strategies. These include optimizing procurement processes to secure favorable pricing and ensure timely delivery of critical supplies. Robust cost control measures are being implemented across all business units to mitigate the impact of rising expenses. Furthermore, where applicable, ATCO leverages its regulated rate structures to seek adjustments that reflect increased operating costs, ensuring the financial sustainability of its utility services. The company's ability to adapt its operational and financial strategies in response to these economic factors will be crucial for maintaining profitability and project execution in the coming years.

- Inflationary Impact: Canadian CPI averaged 3.9% in 2023, impacting ATCO's input costs. Projections for 2024 suggest continued, though potentially slower, inflation.

- Supply Chain Volatility: Fluctuations in commodity prices, such as steel, directly affect ATCO's project budgets and timelines.

- Mitigation Strategies: ATCO employs efficient procurement, stringent cost controls, and seeks regulated rate adjustments to manage rising operational expenses.

Foreign Exchange Rate Movements

ATCO's operations span Canada and Australia, making it susceptible to foreign exchange rate volatility. Fluctuations between the Canadian Dollar (CAD) and the Australian Dollar (AUD), or other relevant currencies, directly influence how ATCO's international earnings and assets are reported in its primary currency. For instance, a stronger CAD relative to the AUD would reduce the reported value of Australian-based profits and assets.

These currency shifts can materially impact ATCO's reported financial performance and the perceived value of its overseas investments. For example, if the CAD strengthens significantly against the AUD, ATCO's reported net income from its Australian operations could appear lower, even if the underlying business performance remains stable. This dynamic necessitates careful currency risk management strategies.

- CAD/AUD Performance: As of early 2024, the CAD has shown some volatility against the AUD, with periods of both appreciation and depreciation influencing cross-border financial reporting for companies like ATCO.

- Impact on Translation: A substantial depreciation of the AUD against the CAD, for example, would lead to a lower reported value of ATCO's Australian assets and earnings when translated into CAD.

- Investment Attractiveness: Unfavorable exchange rate movements can diminish the attractiveness of new international investments or the repatriation of profits from existing foreign subsidiaries.

ATCO's financial performance is intrinsically linked to global economic growth, which is projected to see a moderation in 2025 after a period of expansion in 2024. This economic backdrop directly influences demand for ATCO's energy and infrastructure services, with slower growth potentially dampening consumption and commodity prices.

Interest rate environments significantly impact ATCO's capital-intensive projects. For instance, the Bank of Canada's policy rate, which saw increases through 2022-2023, directly affects ATCO's borrowing costs for new developments and debt refinancing, potentially squeezing profit margins.

Inflationary pressures, evidenced by Canada's CPI which averaged 3.9% in 2023, continue to drive up ATCO's operational expenses for labor and materials, necessitating strategies like cost controls and seeking regulated rate adjustments to maintain financial stability.

Foreign exchange rates, particularly between the Canadian and Australian dollars, introduce volatility into ATCO's reported international earnings. A strengthening CAD against the AUD, for example, would decrease the reported value of profits from ATCO's Australian operations.

Same Document Delivered

ATCO PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ATCO PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing valuable strategic insights.

Sociological factors

Customers are increasingly prioritizing sustainability, with a significant portion of consumers willing to pay more for eco-friendly products and services. For instance, a 2024 survey indicated that over 60% of consumers consider a company's environmental impact when making purchasing decisions. This societal shift directly influences ATCO's customer base, who are actively seeking energy and infrastructure providers committed to environmental stewardship.

This growing demand translates into a clear preference for clean energy sources and greater operational transparency. ATCO is responding by expanding its investments in renewable energy projects, such as solar and wind farms, and enhancing energy efficiency initiatives. By 2025, ATCO aims to have 30% of its energy portfolio derived from renewable sources, a substantial increase from its 2020 baseline.

ATCO's large infrastructure projects, such as its gas and electricity distribution networks, rely heavily on community acceptance. In 2024, ATCO continued to invest in community development programs across its service territories, contributing over $5 million to local initiatives aimed at improving education and environmental sustainability. This proactive engagement is crucial for maintaining a social license to operate, as demonstrated by the successful, on-time completion of several key pipeline upgrades in Alberta, which benefited from strong local stakeholder support.

ATCO faces evolving workforce demographics, with an aging population in some established energy sectors contrasting with the demand for new skills in renewable energy and digital technologies. For instance, the Canadian workforce, like many developed nations, is experiencing an aging trend, with a significant portion of skilled tradespeople nearing retirement age, creating potential knowledge gaps.

Attracting and retaining a skilled workforce, especially in specialized technical roles crucial for grid modernization and renewable energy projects, is paramount for ATCO's operational efficiency and innovation. A 2024 report highlighted a growing shortage of qualified electricians and technicians across Canada's energy sector, impacting project timelines.

To address these challenges, ATCO's strategic imperative includes robust investment in training programs, comprehensive talent development pathways, and proactive diversity and inclusion initiatives. This approach is vital for building a resilient workforce capable of meeting the future demands of a transforming energy landscape.

Public Perception of Utilities and Energy Companies

Public perception of utility and energy companies like ATCO is shifting, with growing emphasis on climate action, energy costs, and corporate accountability. A 2024 survey indicated that 65% of Canadians are concerned about the environmental impact of energy production. ATCO's ability to maintain a positive brand image hinges on transparent communication regarding its dedication to dependable service, environmental responsibility, and community support.

Negative public sentiment can translate into heightened regulatory oversight and opposition to new infrastructure developments. For instance, in 2023, public opposition contributed to delays in several renewable energy projects across North America. ATCO's proactive engagement with stakeholders and clear articulation of its sustainability initiatives are therefore crucial for navigating this evolving landscape.

- Public Concern: 65% of Canadians expressed concern about the environmental impact of energy production in a 2024 survey.

- Reputation Management: ATCO's brand reputation is vital, requiring active communication on reliability, environmental stewardship, and community welfare.

- Regulatory Impact: Negative public perception can lead to increased regulatory scrutiny and resistance to new projects.

Urbanization and Infrastructure Demand

Urbanization continues to be a significant driver for ATCO, particularly in its core markets of Canada and Australia. As more people move into cities, the demand for reliable electricity, natural gas, and water infrastructure naturally increases. This trend is not slowing down; for instance, Canada's population grew by 3.2% in 2023, reaching over 40 million, with a substantial portion of this growth concentrated in urban areas.

This sustained population influx into urban centers directly translates into a need for ATCO to invest in expanding and upgrading its existing utility networks. Furthermore, the development of new residential and commercial buildings in these growing cities creates consistent opportunities for ATCO's diverse business segments. The company's ability to provide essential utility services positions it well to capitalize on these ongoing demographic shifts.

- Urban Population Growth: Continued migration to cities in Canada and Australia fuels demand for ATCO's core services.

- Infrastructure Investment: Population increases necessitate upgrades and expansions to existing utility networks.

- New Development Opportunities: Growth in residential and commercial construction provides a steady pipeline of projects for ATCO.

- Service Demand: The need for reliable electricity, natural gas, and water is directly tied to urban population density.

Societal expectations are increasingly focused on environmental responsibility and ethical business practices, directly impacting ATCO's operations and brand perception. A 2024 survey revealed that 65% of Canadians are concerned about the environmental impact of energy production, highlighting a critical area for ATCO's public engagement. This societal shift necessitates transparent communication regarding ATCO's commitment to sustainability, reliable service, and community well-being to maintain a positive reputation and avoid potential regulatory scrutiny or project opposition.

The demographic landscape presents both challenges and opportunities for ATCO's workforce. An aging workforce in traditional energy sectors contrasts with the demand for new skills in renewables and digital technologies. For instance, a 2024 report indicated a growing shortage of qualified electricians and technicians across Canada's energy sector, potentially impacting project timelines and requiring ATCO to invest heavily in training and talent development to ensure a skilled workforce for future demands.

Urbanization trends continue to drive demand for ATCO's core services, with Canada's population exceeding 40 million in 2023 and a significant portion concentrating in urban areas. This sustained population influx necessitates ongoing investment in expanding and upgrading ATCO's utility networks, creating consistent opportunities for new residential and commercial development projects. ATCO's ability to provide essential utility services positions it favorably to capitalize on these ongoing demographic shifts.

| Sociological Factor | Description | ATCO Relevance | Data Point (2023/2024) |

|---|---|---|---|

| Environmental Awareness | Growing public concern over climate change and sustainability. | Influences customer preferences and regulatory landscape. | 65% of Canadians concerned about energy production's environmental impact (2024 survey). |

| Workforce Demographics | Aging workforce in traditional sectors versus demand for new skills. | Impacts talent acquisition, retention, and operational efficiency. | Shortage of qualified electricians and technicians reported across Canada's energy sector (2024). |

| Urbanization | Increasing population density in urban centers. | Drives demand for utility infrastructure and creates development opportunities. | Canada's population grew 3.2% in 2023, with growth concentrated in urban areas. |

| Community Relations | Importance of local acceptance for infrastructure projects. | Crucial for maintaining social license to operate and project success. | ATCO invested over $5 million in local community development programs (2024). |

Technological factors

Rapid technological advancements in solar, wind, and battery storage are fundamentally reshaping the energy sector, directly influencing ATCO's established utility and energy infrastructure operations. These innovations present significant avenues for ATCO to broaden its energy offerings, incorporate more green energy into its distribution networks, and pioneer novel sustainable solutions for its clientele.

For instance, global solar photovoltaic (PV) capacity is projected to reach over 2,000 GW by the end of 2024, a substantial increase from previous years, while wind power continues its expansion. Battery storage costs have also fallen dramatically, with lithium-ion battery pack prices decreasing by over 90% in the last decade, making grid-scale storage increasingly viable. ATCO's ability to adapt and integrate these evolving technologies is paramount for maintaining its competitive edge and ensuring long-term resilience in the energy market.

The ongoing development and deployment of smart grid technologies, such as advanced metering infrastructure (AMI) and real-time data analytics, are significantly boosting the efficiency and reliability of energy networks. This digitalization allows ATCO to better manage its assets, respond more effectively to outages, and provide customers with more flexible service options.

By investing in these digital advancements, ATCO is modernizing its utility operations, which is crucial for meeting evolving energy demands and ensuring network resilience. For instance, smart grid investments are projected to improve grid efficiency by an estimated 5-10% in the coming years.

Innovations in energy storage, like large-scale battery systems and hydrogen storage, are becoming crucial for smoothly integrating renewable energy sources such as solar and wind, which can be unpredictable. These advancements also bolster grid stability, ensuring a more reliable power supply. For ATCO, embracing these technologies means better grid reliability, more effective management of peak energy demand, and the potential to introduce novel energy services to customers.

ATCO's strategic focus on energy storage is supported by significant industry trends. For instance, the global energy storage market was valued at approximately $225 billion in 2023 and is projected to grow substantially, with some forecasts suggesting it could reach over $600 billion by 2030. Continued investment in research and development, alongside pilot projects in energy storage, will be essential for ATCO to capitalize on these evolving technological capabilities and maintain a competitive edge in the energy sector.

Cybersecurity and Data Protection Technologies

As ATCO's operations become more digitized, the importance of cybersecurity and data protection technologies cannot be overstated. Protecting critical infrastructure from sophisticated cyber threats is essential, especially as smart grid technologies and digital platforms are increasingly adopted. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment in this area.

ATCO's commitment to investing in advanced cybersecurity solutions, including real-time threat detection and robust data encryption, is crucial. This not only safeguards operational integrity but also protects sensitive customer information. A 2024 report indicated that the average cost of a data breach in the energy sector could exceed $5 million, underscoring the financial implications of inadequate security.

Furthermore, ATCO must navigate and comply with a complex and evolving landscape of data protection regulations. These regulations, such as GDPR and similar frameworks globally, mandate stringent data handling practices. Failure to comply can result in substantial fines and reputational damage, making adherence a critical technological and operational factor.

- Cybersecurity Investment: The global cybersecurity market is expected to surpass $300 billion in 2024, reflecting the scale of investment required.

- Data Breach Costs: The average cost of a data breach in the energy sector is estimated to be over $5 million, emphasizing the financial risk.

- Regulatory Compliance: Adherence to evolving data protection laws like GDPR is paramount to avoid penalties and maintain trust.

Modular Construction and Logistics Innovation

ATCO's Structures & Logistics segment is leveraging technological advancements in modular construction and logistics to boost efficiency and speed. Innovations in materials science and design software, coupled with optimized supply chain management, are enabling faster, more cost-effective project delivery. For instance, the company's use of advanced prefabrication techniques in 2024 has reportedly reduced on-site construction times by up to 30% compared to traditional methods, directly impacting project timelines and client satisfaction.

These technological integrations are not only about speed but also about sustainability and cost savings. By minimizing waste through controlled factory environments and optimizing transportation routes via sophisticated logistics software, ATCO is enhancing its competitive edge. The company's investment in digital twins and BIM (Building Information Modeling) in late 2024 allows for greater precision in design and execution, further reducing material waste and rework, which can contribute to significant cost reductions, potentially in the range of 10-15% on large-scale projects.

- Modular Construction Efficiency: ATCO's adoption of advanced prefabrication in 2024 led to an estimated 30% reduction in on-site construction times.

- Logistics Optimization: Sophisticated supply chain management software is improving delivery routes and reducing transportation costs.

- Digital Integration: Investments in BIM and digital twins enhance design precision, aiming for 10-15% reduction in material waste and rework.

Technological factors significantly impact ATCO's operations, particularly in the energy sector. The rapid advancement of renewable energy technologies like solar and wind power, coupled with decreasing battery storage costs—lithium-ion battery pack prices have fallen over 90% in the last decade—necessitates ATCO's integration of these green solutions to maintain competitiveness. Smart grid technologies are also enhancing operational efficiency and reliability, with smart grid investments projected to improve grid efficiency by 5-10%.

The digital transformation of ATCO's infrastructure, including the adoption of smart meters and real-time data analytics, boosts network efficiency and customer service flexibility. This digitalization is crucial for managing evolving energy demands. Furthermore, innovations in energy storage, such as large-scale batteries and hydrogen, are vital for integrating intermittent renewables and ensuring grid stability, with the global energy storage market projected to grow substantially from approximately $225 billion in 2023.

Cybersecurity is a critical technological consideration as ATCO's operations become more digitized, especially with smart grid adoption. The global cybersecurity market was expected to exceed $300 billion in 2024, highlighting the scale of investment needed to protect against threats. The average cost of a data breach in the energy sector can exceed $5 million, underscoring the financial risks of inadequate security measures.

In its Structures & Logistics segment, ATCO leverages modular construction and logistics technologies for efficiency. Advanced prefabrication techniques, used by the company in 2024, reportedly reduced on-site construction times by up to 30%. Investments in digital twins and Building Information Modeling (BIM) are also enhancing design precision, aiming to reduce material waste and rework by 10-15% on large projects.

| Technological Area | Key Advancements/Trends | Impact on ATCO | Relevant Data (2024/2025) |

| Renewable Energy & Storage | Solar PV, Wind Power, Battery Storage | Integration of green energy, expanded offerings, grid stability | Solar PV capacity > 2,000 GW (end of 2024); Battery costs down >90% (last decade); Energy storage market ~$225 billion (2023) |

| Smart Grid & Digitalization | Advanced Metering Infrastructure (AMI), Data Analytics | Improved grid efficiency, reliability, customer service flexibility | Projected 5-10% grid efficiency improvement; Cybersecurity market >$300 billion (2024) |

| Energy Storage Innovations | Large-scale batteries, Hydrogen storage | Enhanced renewable integration, grid reliability, new service potential | Energy storage market growth projected to exceed $600 billion by 2030 |

| Modular Construction & Logistics | Prefabrication, BIM, Digital Twins | Faster project delivery, cost savings, reduced waste | 30% reduction in on-site construction times (2024); 10-15% reduction in waste/rework potential |

Legal factors

ATCO operates under a robust regulatory framework, particularly in its utilities and energy infrastructure sectors. These operations are governed by strict rules concerning tariffs, service standards, safety protocols, and environmental impact. For instance, in 2023, ATCO Electric Alberta's general rate application process, overseen by the Alberta Utilities Commission, determined the revenue it could collect from customers, directly influencing its financial performance.

Modifications to these regulatory structures, such as shifts in how rates are set or the introduction of new compliance mandates, can significantly affect ATCO's earnings, profit margins, and strategic agility. Navigating the intricate legal and regulatory environments in key markets like Canada and Australia presents a fundamental operational challenge for the company.

ATCO operates under increasingly stringent environmental laws, particularly concerning carbon emissions and pollution control. For instance, by the end of 2023, Canada, where ATCO has significant operations, saw federal carbon pricing reach $65 per tonne of CO2 equivalent, with plans to increase it further. This directly impacts ATCO's energy generation and distribution, requiring substantial investment in compliance and cleaner technologies to avoid penalties.

The evolving landscape of climate change legislation, including potential carbon taxes and renewable energy mandates, forces ATCO to continually adapt its business strategy. For example, many jurisdictions are setting ambitious targets for renewable energy integration into the grid. Failure to meet these targets or non-compliance with emission standards can lead to substantial financial penalties and severe reputational damage, impacting investor confidence and market access.

ATCO operates under stringent health, safety, and labor laws across its diverse operational regions, impacting everything from construction sites to office environments. These regulations mandate specific workplace safety standards and protocols, worker compensation schemes, and guidelines for collective bargaining and employment equity. For instance, in Canada, provincial occupational health and safety acts, such as Alberta's, set rigorous requirements for hazard identification and control, with non-compliance potentially leading to significant fines and operational shutdowns.

Adherence to these legal frameworks is paramount for ATCO to foster a secure and fair working environment, thereby mitigating risks of accidents, employee grievances, and costly legal challenges. In 2023, workplace injury rates across Canada's energy sector, a key area for ATCO, saw continued focus from regulators, underscoring the importance of robust safety management systems. Failure to comply can result in substantial penalties, impacting financial performance and corporate reputation.

Competition Law and Market Concentration Regulations

ATCO, as a global entity, navigates a complex web of competition laws aimed at fostering fair markets and preventing monopolistic practices. These regulations are particularly relevant to its diverse operations, ensuring that its market activities, including potential mergers and acquisitions, are scrutinized by relevant authorities. For instance, in 2024, the European Commission continued its robust enforcement of competition rules, investigating several sectors where market concentration could potentially harm consumers and innovation. Failure to comply can lead to significant penalties and hinder market access.

The company must remain vigilant regarding market concentration thresholds, as exceeding these could trigger investigations. In 2024, many jurisdictions, including the United States with its updated merger guidelines, intensified their focus on deals that could substantially lessen competition. ATCO's strategic planning must therefore incorporate a thorough understanding of these evolving antitrust landscapes to safeguard its business operations and maintain a competitive edge across its various segments.

- Antitrust Scrutiny: ATCO's mergers and acquisitions are subject to review by competition authorities worldwide, ensuring fair market practices.

- Market Concentration: Exceeding defined market concentration levels can trigger investigations, impacting ATCO's strategic moves.

- Regulatory Compliance: Adherence to competition laws is vital to avoid penalties and maintain access to diverse markets.

- Global Enforcement: In 2024, regulatory bodies like the European Commission and the US Department of Justice actively enforced competition rules, setting precedents for global corporations.

Land Use and Property Rights Legislation

ATCO's extensive infrastructure development, encompassing pipelines, transmission lines, and new facilities, necessitates meticulous adherence to land use and property rights legislation. This involves navigating complex regulations around land acquisition, easements, and zoning laws across various jurisdictions. For instance, in 2024, ATCO continued to manage numerous land access agreements and permits crucial for its ongoing projects, reflecting the constant need for legal compliance in its operational footprint.

The company's ability to develop and maintain its assets hinges on its capacity to comply with property rights legislation, including understanding and respecting expropriation procedures where necessary. This legal framework ensures fair compensation and due process for landowners impacted by infrastructure projects. In 2024, ATCO's land acquisition activities were guided by these established legal principles, aiming for efficient project execution while upholding landowner rights.

Furthermore, ATCO must critically address Indigenous land claims and rights, a significant legal and ethical consideration in its project planning and execution. This involves consultation, engagement, and adherence to agreements that recognize and protect Indigenous interests. By proactively managing these relationships and legal obligations, ATCO aims to foster sustainable development and build trust with Indigenous communities, a key factor in project approvals and long-term success.

- Land Use Compliance: ATCO's 2024 operations involved securing hundreds of land use permits for pipeline maintenance and new construction, underscoring the volume of regulatory engagement.

- Property Rights Navigation: The company's legal teams actively managed property acquisition and easement agreements, with a notable focus on streamlining processes in Western Canada.

- Indigenous Relations: In 2024, ATCO reported ongoing consultations with over 50 First Nations and Métis communities regarding current and future projects, highlighting the importance of these legal and social frameworks.

ATCO is subject to a complex web of legal and regulatory requirements across its utility and energy operations. These laws dictate everything from tariff setting and service standards to stringent safety protocols and environmental impact assessments. For example, in 2023, ATCO Electric Alberta's revenue was determined through a general rate application process by the Alberta Utilities Commission, directly impacting its financial performance.

Changes in these regulations, such as new compliance mandates or shifts in rate-setting mechanisms, can significantly alter ATCO's earnings and strategic flexibility. Navigating these intricate legal landscapes in key markets like Canada and Australia remains a core operational challenge for the company.

Environmental factors

Global and national mandates to combat climate change are placing substantial environmental pressures on ATCO, especially regarding its carbon footprint. For instance, Canada has committed to reducing greenhouse gas emissions by 40-45% below 2005 levels by 2030, a target that directly impacts energy companies like ATCO.

These increasing emissions reduction targets necessitate significant investments from ATCO in decarbonization technologies, a shift towards cleaner energy sources, and improved energy efficiency throughout its operations. This strategic pivot influences capital allocation and operational methodologies, as seen in ATCO's ongoing investments in renewable energy projects.

Water resources are increasingly strained globally, directly impacting industries like ATCO's, which rely on water for operations, including industrial solutions and energy generation. For instance, in 2024, regions where ATCO operates, like parts of Alberta, Canada, experienced below-average snowpack, signaling potential water stress for the upcoming seasons.

Stricter environmental regulations concerning water usage, discharge quality, and conservation efforts are a growing concern. Many jurisdictions are implementing tiered pricing for water consumption and imposing penalties for non-compliance with discharge limits, which could affect ATCO's operational costs and require capital investment in treatment technologies.

ATCO's proactive approach to water management, focusing on recycling, efficient sourcing, and investing in water-saving technologies, is crucial. By 2025, companies demonstrating robust water stewardship are expected to see improved investor sentiment and reduced operational risks, particularly as water scarcity becomes a more prominent factor in supply chain resilience and corporate social responsibility evaluations.

ATCO's extensive infrastructure development, particularly in energy and utilities, can significantly affect local ecosystems and the biodiversity within them. For instance, the construction of new transmission lines or pipelines may require clearing land, potentially impacting habitats and species.

Environmental regulations are increasingly stringent, mandating thorough environmental impact assessments and requiring companies like ATCO to implement robust mitigation strategies and land rehabilitation plans. These measures aim to minimize the ecological footprint of projects. For example, in 2023, ATCO reported investing over $150 million in environmental stewardship initiatives across its operations, which includes habitat restoration efforts.

Prioritizing biodiversity protection and effective land rehabilitation is not just about regulatory compliance; it's a critical component of responsible corporate citizenship. Successful rehabilitation projects, such as the reclamation of former industrial sites, enhance ATCO's reputation and are essential for obtaining permits for future growth, ensuring long-term operational sustainability.

Waste Management and Pollution Control

ATCO's operations necessitate robust waste management and pollution control strategies. In 2024, for instance, the company's commitment to environmental stewardship means adhering to stringent regulations on hazardous waste disposal and emissions. This includes managing byproducts from its energy generation and infrastructure development activities.

Compliance with environmental laws is paramount. ATCO must ensure its wastewater treatment processes meet or exceed standards set by regulatory bodies, a critical aspect given the scale of its industrial and construction projects. For example, in 2024, significant investments were directed towards upgrading filtration systems at several key facilities to reduce pollutant discharge.

Proactive investment in pollution prevention technologies is key to ATCO's sustainability. By implementing advanced emission control systems and waste reduction initiatives, ATCO not only safeguards the environment but also mitigates risks associated with non-compliance. This approach aligns with growing stakeholder expectations for corporate environmental responsibility.

- Regulatory Compliance: ATCO faces increasing scrutiny on emissions and waste disposal, with fines for non-compliance potentially reaching millions.

- Operational Impact: Effective waste management can reduce operational costs through resource recovery and lower disposal fees.

- Technological Investment: Companies in the energy and infrastructure sectors are allocating substantial capital, often in the billions annually across the industry, towards cleaner technologies and pollution abatement.

Extreme Weather Events and Climate Resilience

The escalating frequency and intensity of extreme weather events, directly linked to climate change, present substantial operational and financial risks for ATCO's extensive infrastructure. For instance, in 2023, Canada experienced a record-breaking wildfire season, with over 6,500 fires burning more than 17 million hectares, impacting regions where ATCO operates and potentially threatening its assets.

These events, including severe floods, intense wildfires, and powerful storms, can cause direct physical damage to critical utility networks, leading to service disruptions for customers. ATCO's commitment to reliability necessitates significant investment in climate-resilient infrastructure upgrades and the continuous development of robust emergency response protocols to mitigate these impacts.

- Infrastructure Hardening: ATCO is investing in hardening its natural gas and electricity distribution systems against extreme weather, such as burying more power lines in high-risk areas.

- Climate Adaptation Strategies: The company is actively developing and implementing strategies to adapt its operations, including enhanced vegetation management to reduce wildfire risk around its facilities.

- Emergency Preparedness: ATCO maintains comprehensive emergency response plans, regularly tested and updated, to ensure swift restoration of services following weather-related incidents.

- Regulatory Compliance: ATCO must navigate evolving environmental regulations and reporting requirements related to climate change and resilience, influencing capital expenditure and operational planning through 2025 and beyond.

ATCO's environmental obligations are increasingly shaped by global and national climate action goals, such as Canada's 2030 emissions reduction target, which directly impacts its energy operations. The company is responding by investing in decarbonization technologies and cleaner energy sources, as evidenced by its renewable energy project expansions.

Water scarcity is a growing concern, with regions like Alberta experiencing lower snowpack in 2024, potentially affecting ATCO's water-dependent operations. Stricter regulations on water usage and discharge quality are also increasing, necessitating investments in water treatment and conservation technologies.

ATCO's infrastructure development requires careful management of its ecological impact, including land clearing for transmission lines and pipelines. The company is investing in environmental stewardship, with over $150 million allocated in 2023 for initiatives like habitat restoration, to meet stringent environmental assessments and land rehabilitation requirements.

Extreme weather events, amplified by climate change, pose significant risks to ATCO's infrastructure, as demonstrated by Canada's severe wildfire season in 2023. The company is investing in climate-resilient infrastructure and robust emergency response plans to mitigate damage and ensure service reliability.

PESTLE Analysis Data Sources

Our ATCO PESTLE Analysis is meticulously constructed using a blend of publicly available government data, reputable industry-specific reports, and insights from leading economic and technological forecasting agencies. This ensures a comprehensive and accurate understanding of the macro-environmental factors impacting ATCO.