APA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

Curious about the American Psychological Association's strategic landscape? Our comprehensive SWOT analysis delves into its core strengths, potential weaknesses, exciting opportunities, and pressing threats. Understand how APA navigates the evolving world of psychology and its impact on research, practice, and public policy.

Want the full story behind the APA's market position and future trajectory? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning, advocacy, and informed decision-making within the psychological community.

Strengths

APA Corporation's disciplined capital allocation strategy is a key strength, focusing on long-term shareholder value creation. This approach prioritizes investments that generate robust free cash flow. For instance, in the first quarter of 2024, APA reported strong free cash flow generation, enabling continued shareholder returns.

The company's commitment to returning capital to shareholders is evident through its consistent dividend payments and active share repurchase programs. This consistent capital return policy builds investor confidence and provides a reliable income stream, even during periods of market volatility. APA's proactive management of its capital ensures it can effectively reward its investors.

APA's Permian Basin position is a significant strength, with the region being a cornerstone of its production strategy. The company has demonstrated a commitment to enhancing operational efficiency here, targeting a 20% decrease in lease operating expenses per barrel of oil equivalent.

The acquisition of Callon Petroleum in 2024 is a prime example of APA's strategic approach to bolstering its Permian assets. This move is expected to lower breakeven oil prices and improve overall margins, further solidifying its competitive standing in this vital U.S. shale play.

APA Corporation's dedication to sustainability is a significant strength, evidenced by its 2025 Sustainability Progress Report. The company surpassed its target by reducing annualized carbon dioxide equivalent emissions by over 1 million tonnes from 2021 to 2024.

Further bolstering its environmental credentials, APA has drastically cut freshwater consumption through effective produced water recycling. This commitment is complemented by achieving the lowest Total Recordable Incident Rate in its history, underscoring a robust safety culture and proactive environmental management.

Diversified Asset Base and Exploration Portfolio

APA Corporation's strength lies in its strategically diversified asset base, spanning the prolific Permian Basin in the United States, established operations in Egypt, and promising development in Suriname. This geographic diversification significantly reduces the company's exposure to the risks inherent in any single market or regulatory environment.

The company's commitment to exploration fuels its future growth. Recent discoveries in Egypt, coupled with ongoing appraisal activities in Suriname, are crucial for replenishing APA's long-term drilling inventory and ensuring production stability. For instance, APA reported significant exploration success in Egypt during 2023, contributing to its reserve replacement efforts.

- Geographic Diversification: Operations in the US (Permian), Egypt, and Suriname mitigate regional risk.

- Exploration Success: Recent discoveries in Egypt and appraisal in Suriname bolster future production.

- Long-Term Inventory: Continued investment in exploration secures a robust drilling inventory.

Leveraging Technological Advancements for Optimization

The company is well-positioned to integrate cutting-edge technologies like AI-driven analytics and automation, which are rapidly transforming the oil and gas sector. These advancements are crucial for improving exploration precision and optimizing drilling processes. For instance, advancements in seismic data processing using AI have shown potential to reduce exploration costs by up to 20% in some projects.

By embracing digital transformation, the company can significantly enhance the real-time monitoring of its operations, leading to greater efficiency and reduced downtime. Automation in drilling operations, for example, has been reported to increase drilling speed by as much as 15% while improving safety metrics.

The implementation of these digital tools directly translates to boosted productivity and safer working environments. Decision-making capabilities are also sharpened through data-driven insights, allowing for more agile responses to market dynamics and operational challenges across its global footprint.

- AI in Exploration: Potential to reduce exploration costs by up to 20%.

- Drilling Automation: Can increase drilling speed by 15% and enhance safety.

- Real-time Monitoring: Improves operational efficiency and minimizes downtime.

- Digital Transformation: Boosts overall productivity and decision-making.

APA Corporation's disciplined capital allocation is a core strength, prioritizing long-term shareholder value. This focus on generating robust free cash flow was evident in Q1 2024, enabling continued shareholder returns through dividends and share repurchases, fostering investor confidence.

The company's strategic acquisition of Callon Petroleum in 2024 significantly bolsters its Permian Basin position. This move is expected to lower breakeven oil prices and improve margins, reinforcing APA's competitive edge in this key U.S. shale play, with a target to reduce lease operating expenses per barrel by 20%.

APA's commitment to sustainability is a demonstrable strength, having surpassed its 2025 target by reducing annualized CO2e emissions by over 1 million tonnes between 2021 and 2024. Furthermore, the company has significantly cut freshwater consumption via produced water recycling and achieved its lowest Total Recordable Incident Rate, highlighting a strong safety and environmental culture.

APA Corporation benefits from a strategically diversified asset base, with operations spanning the Permian Basin, Egypt, and Suriname. This geographic spread mitigates risks associated with any single market. Recent exploration successes in Egypt and ongoing appraisal activities in Suriname are vital for replenishing its long-term drilling inventory and ensuring production stability.

The company is actively integrating advanced technologies like AI-driven analytics and automation to enhance exploration precision and optimize drilling. These digital transformations are projected to boost productivity, improve safety, and sharpen decision-making capabilities in response to market dynamics.

| Strength Category | Specific Initiative/Asset | Key Metric/Impact | Year/Period |

|---|---|---|---|

| Capital Allocation | Disciplined Capital Allocation | Strong Free Cash Flow Generation | Q1 2024 |

| Asset Portfolio | Permian Basin Position / Callon Acquisition | Target 20% reduction in lease operating expenses per barrel | 2024 |

| Sustainability | CO2e Emission Reduction | Reduced annualized emissions by >1 million tonnes | 2021-2024 |

| Geographic Diversification | Permian, Egypt, Suriname Operations | Mitigates regional risk | Ongoing |

| Technology Integration | AI in Exploration | Potential to reduce exploration costs by up to 20% | Projected |

What is included in the product

Analyzes APA’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic analysis into an actionable, easy-to-understand format.

Weaknesses

APA Corporation's core business in oil and natural gas exploration and production inherently ties its financial health to the unpredictable swings in global hydrocarbon prices. For instance, in the first quarter of 2024, APA reported that a $10 per barrel change in oil prices could impact its adjusted EBITDA by approximately $200 million, underscoring this sensitivity.

This exposure means that geopolitical tensions, shifts in global economic activity, and changes in supply and demand dynamics, all factors outside of APA's direct control, can significantly affect its revenues and profitability. For example, the Brent crude oil price averaged around $83 per barrel in Q1 2024, but experienced volatility throughout the quarter, directly influencing APA's realized prices.

Operating in regions like Egypt presents APA Corporation with potential geopolitical instabilities and evolving regulatory landscapes. These factors can introduce uncertainty and potentially disrupt operations or affect financial performance.

APA's strategic decision to exit the UK North Sea by 2029, citing "uneconomic" regulations and higher energy taxes, underscores its sensitivity to adverse governmental policies. This move, announced in early 2024, demonstrates how fiscal changes in specific jurisdictions can directly impact the economic viability of existing projects and future investment decisions.

The oil and gas sector, including companies like APA, is inherently capital intensive. This means significant upfront investments are always needed for exploration, development, and production activities to maintain and grow reserves. For instance, APA's 2024 capital expenditure guidance was around $1.7 to $1.9 billion, highlighting the scale of these necessary investments.

Environmental Impact and Energy Transition Pressures

APA's reliance on fossil fuels places it directly in the crosshairs of global climate change concerns and the accelerating shift towards renewable energy. This core business model faces mounting pressure from various stakeholders, including environmentally conscious investors and governments pushing for decarbonization.

The company's operations inherently contribute to greenhouse gas emissions, attracting scrutiny from environmental groups, investors focused on Environmental, Social, and Governance (ESG) criteria, and regulatory bodies. For instance, the International Energy Agency (IEA) reported in late 2024 that global energy-related CO2 emissions reached a new peak, highlighting the ongoing challenge for fossil fuel producers.

This persistent environmental pressure translates into tangible risks for APA, potentially manifesting as more stringent environmental regulations, increased operational costs for compliance, and difficulties in accessing capital from lenders prioritizing sustainability. Furthermore, maintaining a social license to operate in an increasingly climate-aware world presents an ongoing hurdle.

- Increased Regulatory Scrutiny: Anticipate stricter emissions standards and carbon pricing mechanisms impacting profitability.

- Investor ESG Mandates: Growing investor demand for sustainable portfolios may limit capital availability and increase the cost of financing.

- Operational Challenges: Potential for disruptions due to climate-related events or policy changes affecting fossil fuel extraction and distribution.

- Reputational Risk: Negative public perception and advocacy campaigns can impact brand value and market access.

Potential for Decline in Legacy Assets

APA Corporation, while holding robust positions in key regions like the Permian Basin, faces the inherent challenge of natural production declines in its mature fields. This necessitates continuous and substantial investment to counteract these reductions and maintain output levels.

Without consistent success in exploration activities and the efficient development of newly discovered resources, APA could struggle to sustain or increase its overall production volumes. This dynamic requires ongoing capital allocation and sophisticated reservoir management to preserve the value and productivity of its existing asset base.

- Production Decline: Mature fields naturally experience declining production rates, requiring ongoing investment to offset.

- Exploration Risk: Future production growth depends on successful exploration, which carries inherent risks and costs.

- Capital Intensity: Sustaining production and growing reserves demands significant and consistent capital expenditure.

- Reservoir Management: Effective management of existing reservoirs is crucial to maximize recovery and mitigate decline.

APA Corporation's significant reliance on oil and gas prices makes it vulnerable to market volatility. For example, in Q1 2024, a $10/barrel fluctuation in oil prices could impact APA's adjusted EBITDA by approximately $200 million, highlighting this sensitivity.

The company's operations in geopolitically sensitive regions, such as Egypt, introduce risks related to political instability and regulatory changes. These external factors can directly influence operational continuity and financial outcomes.

APA's business model is inherently capital intensive, requiring substantial and ongoing investment in exploration, development, and production. For instance, APA's 2024 capital expenditure guidance was between $1.7 to $1.9 billion, underscoring this need.

The company faces increasing pressure from environmental concerns and the global energy transition. This can lead to stricter regulations, higher compliance costs, and potential challenges in accessing capital from ESG-focused investors.

| Weakness | Description | Impact Example (Q1 2024 Data) |

|---|---|---|

| Price Volatility Exposure | Financial performance is directly tied to fluctuating global hydrocarbon prices. | $10/barrel oil price change impacts adjusted EBITDA by ~$200 million. |

| Geopolitical & Regulatory Risk | Operations in regions like Egypt face potential instability and evolving regulations. | Unpredictable policy shifts can disrupt operations and financial performance. |

| High Capital Intensity | Sustaining and growing production requires significant, continuous capital investment. | 2024 capital expenditure guidance: $1.7 - $1.9 billion. |

| Environmental & Transition Risks | Fossil fuel focus faces scrutiny from climate concerns and the shift to renewables. | Increased regulatory costs and potential limitations on capital access due to ESG mandates. |

What You See Is What You Get

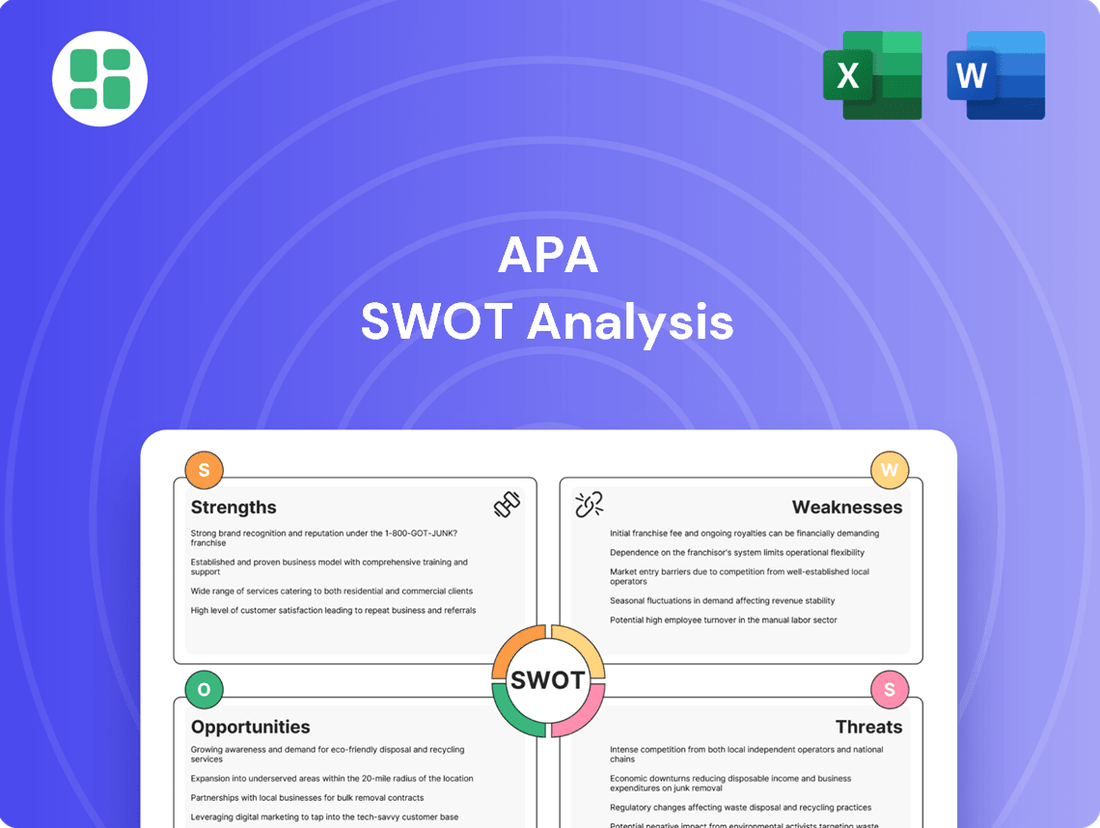

APA SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual SWOT analysis file, ensuring transparency and quality. Once purchased, the complete, detailed report will be yours to download.

Opportunities

Global energy demand is on an upward trajectory, with projections indicating continued growth through 2025. This surge is largely fueled by economic expansion and rising populations in developing nations. For instance, the International Energy Agency (IEA) forecast in late 2023 that global energy demand would rise by 2.5% in 2024, driven by a strong economic rebound in emerging markets.

This sustained demand presents a substantial market opportunity for APA Corporation. The company can capitalize on this by effectively utilizing its existing production infrastructure and actively seeking new ventures to satisfy the world's growing energy requirements.

Technological leaps in the oil and gas industry, particularly in areas like AI, machine learning, and advanced drilling, present significant opportunities for APA. These advancements enable more precise exploration, streamlined drilling, and ultimately, higher recovery rates from existing reserves, boosting overall efficiency.

APA can leverage these innovations to reduce operational costs and improve safety protocols. For instance, the adoption of predictive maintenance powered by AI can prevent costly equipment failures, a critical factor in maintaining profitability in the volatile energy market. This focus on efficiency directly translates to enhanced competitiveness.

The integration of robotics in hazardous environments, such as offshore platforms, minimizes human risk and increases operational uptime. Furthermore, enhanced oil recovery (EOR) techniques, often driven by sophisticated data analytics, allow APA to maximize output from mature fields, a key strategy for sustained growth.

The ongoing consolidation within the energy sector, including asset sales, offers APA significant opportunities to strategically acquire or divest assets, thereby optimizing its portfolio. APA's successful integration of Callon Petroleum's assets in 2024, which added approximately 112,000 net acres and 300 million barrels of oil equivalent (boe) of proved reserves, showcases this capability.

Further targeted acquisitions could bolster APA's high-quality resource inventory, increase its operational scale in key regions like the Permian Basin, or diversify its asset base. Simultaneously, divesting non-core assets allows for improved capital efficiency and a reduction in overall debt, strengthening the company's financial position.

Growth in Natural Gas Markets and LNG Exports

The global demand for natural gas is on the rise, fueled by its cleaner environmental profile compared to other fossil fuels and the significant expansion of liquefied natural gas (LNG) export capabilities. APA Corporation is well-positioned to benefit from this trend, particularly through its gas-focused drilling operations in Egypt and its substantial natural gas reserves within its Permian Basin assets.

This strategic focus allows APA to tap into a growing international market for natural gas. For instance, in 2023, global LNG demand reached new highs, with projections indicating continued growth through 2024 and beyond as countries seek to diversify energy sources. APA's ability to expand its gas production and leverage access to export infrastructure, such as the recent expansions announced by some US LNG terminals, could significantly boost its revenue streams and diversify its market reach.

Key opportunities include:

- Capitalizing on increasing global LNG demand: As countries prioritize cleaner energy, natural gas is becoming a key transition fuel.

- Leveraging Egyptian gas production: APA's operations in Egypt provide a stable platform to supply growing regional gas needs.

- Expanding Permian Basin gas output: The Permian region continues to be a major source of natural gas, offering significant production growth potential for APA.

- Enhancing export infrastructure access: Securing or expanding access to LNG export facilities can unlock higher international pricing and broader market access for APA's gas production.

Investment in Carbon Management Technologies

The increasing global focus on sustainability presents a prime opportunity for investment in carbon management technologies. As environmental regulations continue to tighten, particularly around emissions, companies like APA can strategically invest in solutions such as carbon capture, utilization, and storage (CCUS) and advanced methane emission reduction. This proactive approach not only addresses regulatory pressures but also positions APA to capitalize on emerging markets and enhance its long-term value proposition.

Investing in these technologies offers a dual benefit of risk mitigation and new revenue streams. For instance, the global CCUS market is projected to grow significantly, with estimates suggesting it could reach hundreds of billions of dollars by 2030. APA’s strategic deployment of such technologies could reduce its operational carbon footprint, thereby lowering potential carbon taxes or penalties, while simultaneously creating opportunities for carbon credit generation and new service offerings.

- Growing Market Demand: The global carbon capture market alone is expected to reach approximately $17.2 billion by 2027, indicating substantial growth potential for companies investing in these solutions.

- Regulatory Tailwinds: Governments worldwide are implementing stricter environmental policies and offering incentives for decarbonization, making investments in carbon management technologies increasingly attractive and financially viable.

- Enhanced Investor Appeal: A strong commitment to environmental, social, and governance (ESG) principles, demonstrated through investments in green technologies, can significantly improve APA's standing with investors and access to capital.

- Operational Efficiency: Advanced methane reduction technologies can lead to operational cost savings through reduced gas loss, directly impacting the company's bottom line while improving environmental performance.

APA's strategic acquisitions, like the 2024 integration of Callon Petroleum, significantly expand its resource base and operational scale, particularly in the Permian Basin. This move added substantial proved reserves and acreage, enhancing APA's competitive position. Continued disciplined M&A activity offers further opportunities to optimize its portfolio and strengthen its financial standing through strategic asset management.

The company is well-positioned to benefit from the increasing global demand for natural gas, especially with its strong production capabilities in Egypt and the Permian. Leveraging expanded access to LNG export infrastructure can unlock higher international prices and broaden market reach for its gas output. This diversification strategy is crucial in a dynamic energy landscape.

Investing in carbon management technologies like CCUS and methane reduction presents a significant opportunity for APA to mitigate environmental risks and tap into new revenue streams. The growing market for these solutions, supported by regulatory tailwinds and increasing investor focus on ESG, can enhance APA's long-term value and operational efficiency.

Threats

APA faces significant risks from persistent commodity price volatility, particularly in oil and gas markets. Geopolitical tensions and economic slowdowns can trigger sharp price swings, directly impacting APA's revenue. For instance, the International Energy Agency (IEA) projected in late 2024 that while demand growth was expected to continue into 2025, the pace of that growth could be outstripped by new supply coming online, potentially creating oversupply and downward price pressure.

A sustained downturn in oil and gas prices could severely curtail APA's profitability and cash flow. This directly affects its capacity to finance crucial exploration and development projects, essential for long-term growth. The company's financial health is intrinsically linked to the stability of commodity markets, making price volatility a critical threat to its operational and strategic objectives through 2025.

The accelerating global shift towards renewable energy sources, driven by climate change concerns, presents a significant long-term threat to traditional fossil fuel demand. Stricter environmental regulations and the implementation of carbon pricing mechanisms, such as those seen in the European Union's Emissions Trading System (ETS), are likely to increase operating costs for companies like APA. For instance, the EU ETS saw carbon prices average around €65 per tonne in 2023, a figure projected to rise, directly impacting the economic viability of fossil fuel projects and increasing the risk of stranded assets.

Geopolitical instability, particularly in regions like Egypt where APA Corporation operates, presents a significant threat. For instance, ongoing regional conflicts can disrupt critical supply chains and transit routes, impacting the company's ability to move its products efficiently. This instability also increases operational costs due to heightened security needs and can lead to unpredictable fluctuations in global energy prices, directly affecting APA's revenue streams.

Intensifying Competition and Industry Consolidation

The oil and gas sector remains intensely competitive, with major international oil companies (IOCs), national oil companies (NOCs), and independent exploration and production (E&P) firms all vying for prime exploration rights and market share. APA Corporation faces this dynamic landscape, where securing new prospects requires outmaneuvering a multitude of established players.

Industry consolidation is a significant threat, as larger entities merge to achieve greater economies of scale and operational efficiencies. For instance, the ExxonMobil and Pioneer Natural Resources deal, valued at approximately $60 billion and expected to close in mid-2024, exemplifies this trend. Such mergers can create formidable competitors, potentially impacting APA's ability to acquire attractive acreage or maintain its competitive standing.

- Intensifying Competition: Numerous global and national oil companies, alongside independent E&P firms, actively compete for exploration and development opportunities.

- Industry Consolidation: Recent large-scale mergers, like ExxonMobil's acquisition of Pioneer Natural Resources for ~$60 billion, are creating larger, more efficient competitors.

- Impact on APA: This consolidation could make it more challenging for APA to secure new prospects and maintain its competitive edge in the market.

Increasing Public and Investor Scrutiny on ESG Performance

Energy companies face intensifying scrutiny regarding their Environmental, Social, and Governance (ESG) performance from investors, regulators, and the public. For instance, in 2024, many major oil and gas firms saw increased shareholder resolutions demanding more aggressive climate action plans. Failure to align with evolving ESG standards risks significant reputational harm, potentially limiting access to capital from the growing pool of ESG-mandated investment funds. This pressure is amplified by analyses, such as those published in late 2024, highlighting a considerable divergence between the industry's stated transition pathways and the emissions reductions required by established climate science.

APA Corporation faces the threat of increased competition from larger, consolidated entities within the oil and gas sector. Major mergers, such as the approximately $60 billion ExxonMobil and Pioneer Natural Resources deal expected to finalize in mid-2024, create more formidable rivals. This trend could make it harder for APA to secure desirable exploration acreage and maintain its market position through 2025.

SWOT Analysis Data Sources

This APA SWOT analysis is built upon a robust foundation of data, drawing from official financial disclosures, comprehensive market intelligence, and expert industry evaluations to provide a thoroughly informed strategic perspective.