APA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

Navigate the complex external forces shaping APA's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your investments and strategies. Empower yourself with actionable intelligence. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Government policies on energy, including subsidies, taxes, and environmental regulations, directly impact APA Corporation's operational costs and profitability. For instance, changes in tax credits for renewable energy projects could influence APA's investment decisions and the overall economic viability of its diverse energy portfolio.

Changes in administration can lead to significant regulatory adjustments. A shift in focus, such as a new administration prioritizing domestic energy production, might result in revised environmental standards or permitting processes for oil and gas exploration, potentially affecting APA's project timelines and compliance expenses.

For example, potential shifts in methane emission regulations, as seen in past policy debates, could require APA to invest in new technologies or operational changes to meet stricter environmental standards, impacting capital expenditure and operational efficiency.

APA Corporation's operations across the United States, Egypt, and the United Kingdom expose it to varying degrees of geopolitical risk. For instance, ongoing tensions in the Middle East, coupled with the protracted conflict in Ukraine, significantly impact global energy markets. In 2024, Brent crude oil prices have shown volatility, fluctuating around $80-$90 per barrel, directly influenced by these geopolitical events.

These international dynamics create ripple effects on supply chains and operational continuity for companies like APA. Diplomatic relations and trade alliances are crucial; shifts in these can alter market access and increase operational costs. The stability of regions where APA operates, or from which it sources materials, directly correlates with its ability to maintain consistent production and manage price fluctuations effectively.

The landscape of international relations and trade agreements significantly impacts the oil and gas sector. For instance, the European Union's revised Renewable Energy Directive (RED III), aiming for 42.5% renewable energy by 2030, influences demand for traditional fuels and trade flows within the bloc and with external partners. This regulatory shift encourages investment in new energy sources, potentially altering established supply chains.

The ongoing geopolitical tensions and the potential fragmentation into economic blocs could reshape global energy trade. Companies are increasingly navigating a complex web of sanctions and trade restrictions, impacting their ability to secure resources or access markets. For example, the US's strategic petroleum reserve releases in 2022 and 2023, totaling 180 million barrels, aimed to stabilize global prices amidst supply concerns, demonstrating how national policies directly affect international energy markets.

Political Stability in Operating Regions

Political stability in APA Corporation's core operating regions, particularly Egypt and the United Kingdom, is paramount for its sustained investment and operational continuity. Unforeseen political shifts or abrupt regulatory alterations in these key territories pose significant risks, potentially disrupting production schedules, jeopardizing existing licenses, and compelling a reassessment of strategic capital deployment.

For instance, Egypt's political landscape, while showing signs of stability in recent years, remains sensitive to regional dynamics. The UK, post-Brexit, continues to navigate evolving trade agreements and domestic policy, which could indirectly influence energy sector regulations and investment incentives relevant to APA's operations.

- Egypt's political stability: While generally stable, regional geopolitical influences can create volatility.

- United Kingdom's regulatory environment: Post-Brexit policy adjustments continue to shape the energy sector's investment climate.

- Impact on licensing and production: Political instability can lead to operational disruptions and licensing uncertainties.

- Capital allocation re-evaluation: Adverse political events necessitate a review of APA's investment strategies and resource allocation.

Energy Transition Policies

Global and national commitments to energy transition, including carbon pricing mechanisms, renewable energy mandates, and incentives for cleaner technologies, significantly influence the long-term demand for fossil fuels. For instance, the European Union's Emissions Trading System (EU ETS) is a key carbon pricing mechanism, with carbon prices reaching over €100 per tonne in early 2024, directly impacting the cost of carbon-intensive energy sources. These policies can also affect investor sentiment and a company's strategic direction towards sustainable practices, as seen with increased investment in renewables, which reached a record $1.7 trillion globally in 2023 according to the International Energy Agency (IEA).

These evolving policies create both challenges and opportunities for the oil and gas sector. Companies are increasingly pressured to decarbonize operations and explore investments in lower-carbon alternatives. The International Energy Agency's Net Zero Emissions by 2050 scenario projects a substantial decline in oil and gas demand, necessitating strategic shifts.

- Global Renewable Energy Growth: Renewable energy capacity additions are projected to grow by 10% in 2024, reaching over 500 GW, according to the IEA.

- Carbon Pricing Impact: Carbon taxes and emissions trading schemes are expanding, with over 70 jurisdictions now implementing carbon pricing.

- Investment Shifts: Investment in clean energy technologies, including hydrogen and carbon capture, utilization, and storage (CCUS), is accelerating, with global investment in these areas expected to surpass $1 trillion by 2030.

- Fossil Fuel Demand Outlook: While demand for oil and gas is expected to peak and then decline, the pace of this decline is heavily influenced by the stringency and implementation of energy transition policies.

Government policies directly shape APA Corporation's operational landscape, influencing everything from exploration permits to environmental compliance costs. For example, shifts in tax credits for renewable energy projects can significantly alter investment decisions for APA's diverse energy portfolio.

Changes in political administrations often bring about substantial regulatory adjustments. A new government prioritizing domestic energy production might revise environmental standards or permitting processes for oil and gas exploration, impacting APA's project timelines and associated expenses.

Geopolitical events and international relations are critical for APA, given its operations in Egypt and the UK. Tensions in the Middle East and conflicts like the one in Ukraine directly affect global energy markets, with Brent crude prices fluctuating around $80-$90 per barrel in 2024 due to these factors.

The global push for energy transition, marked by carbon pricing and renewable energy mandates, is reshaping long-term demand for fossil fuels. The EU's Emissions Trading System, with carbon prices exceeding €100 per tonne in early 2024, illustrates the financial impact of these policies.

| Factor | Impact on APA Corporation | Example/Data (2024/2025) |

|---|---|---|

| Government Energy Policy | Affects operational costs, profitability, and investment decisions. | Changes in renewable energy tax credits influence APA's portfolio strategy. |

| Regulatory Adjustments | Impacts project timelines, compliance, and operational efficiency. | Revised environmental standards or permitting processes due to new administrations. |

| Geopolitical Stability | Influences energy market volatility, supply chains, and operational continuity. | Middle East tensions and Ukraine conflict impact crude oil prices (e.g., Brent around $80-$90/barrel in 2024). |

| Energy Transition Commitments | Shapes long-term demand for fossil fuels and drives investment in alternatives. | EU ETS carbon prices over €100/tonne in early 2024; global clean energy investment projected to surpass $1 trillion by 2030. |

What is included in the product

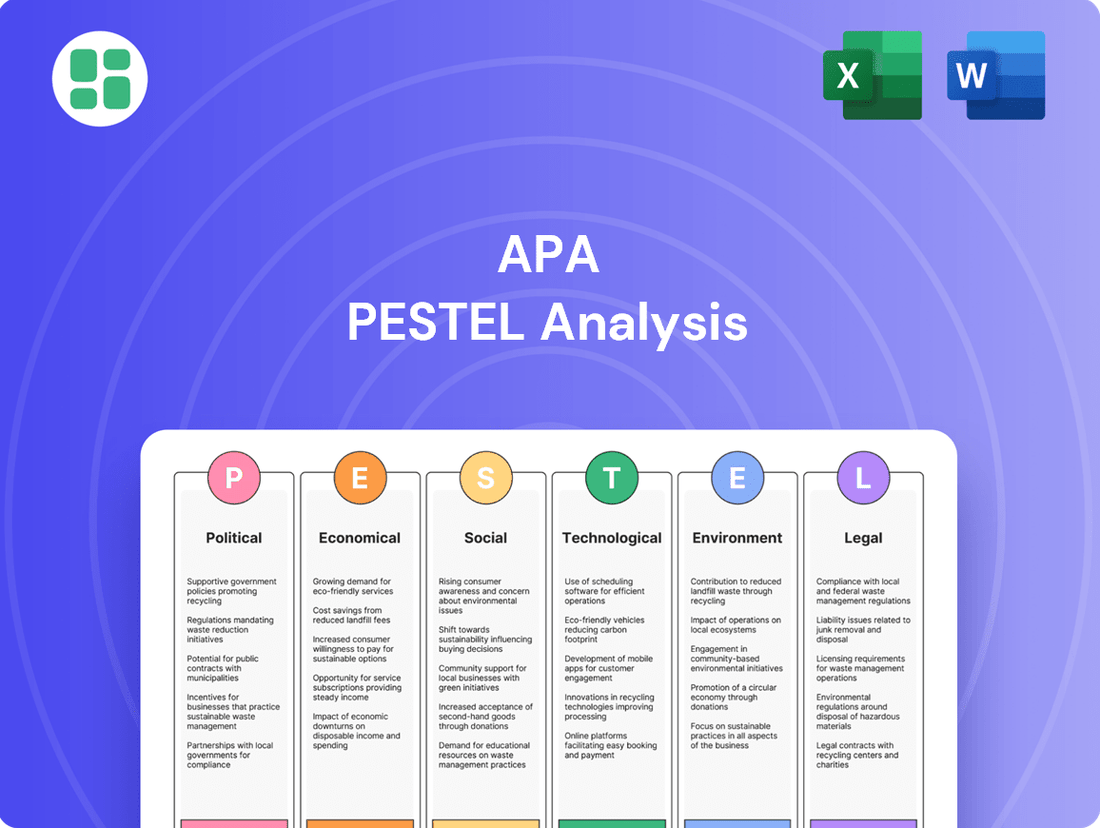

The APA PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the APA, providing a comprehensive understanding of its external operating landscape.

The APA PESTLE Analysis offers a structured framework that simplifies the complex external environment, alleviating the pain of overwhelming data by presenting it in an organized, actionable format for strategic decision-making.

Economic factors

Fluctuations in global crude oil and natural gas prices significantly impact APA Corporation's financial performance. For instance, Brent crude prices remained relatively stable through much of 2024.

Looking ahead to 2025, forecasts suggest Brent crude prices will likely trade in the US$70 to US$80 per barrel range. Geopolitical events could potentially push these prices higher.

Global economic growth is a key driver for energy demand, directly influencing consumption of oil and natural gas. A robust global economy typically translates to higher energy usage as industrial activity and transportation increase. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from previous forecasts, which suggests a steady, albeit moderate, demand for energy resources.

High inflation, reaching an estimated 3.5% by the end of 2024 according to projections, directly escalates business expenses. This means companies face higher costs for everything from raw materials to employee wages, squeezing profit margins.

As central banks combat inflation, interest rates are expected to remain elevated through much of 2024, potentially averaging around 4.75% for benchmark rates. This makes borrowing more expensive, impacting capital expenditures and expansion plans for businesses reliant on debt financing.

However, anticipation is building for a potential easing of monetary policy in mid-2025, with forecasts suggesting a possible rate cut to 4.25%. Such a shift could lower borrowing costs, potentially stimulating investment and creating a more supportive environment for economic growth.

Currency Fluctuations

Currency fluctuations present a significant challenge for APA Corporation, an international entity. Changes in exchange rates between the U.S. dollar and currencies in its key operating regions, such as Egypt and the United Kingdom, directly impact the reported value of its financial results. For instance, a stronger U.S. dollar can devalue revenues earned in Egyptian Pounds or British Pounds when converted back, while a weaker dollar can have the opposite effect.

These shifts can materially alter the company's profitability and the perceived value of its international assets and liabilities. For example, if the Egyptian Pound depreciates significantly against the U.S. dollar, APA's Egyptian revenue, when translated, will be lower, potentially impacting its bottom line. Conversely, a strengthening Pound could boost reported earnings from UK operations.

Here are some key considerations regarding currency fluctuations for APA Corporation:

- Impact on Revenue: A weakening Egyptian Pound (EGP) or British Pound (GBP) against the USD reduces the USD value of APA's earnings from these regions. For example, if APA generated $100 million in Egypt and the EGP weakened by 10% against the USD, that revenue would translate to $90 million.

- Impact on Expenses: Conversely, if APA incurs expenses in local currencies that weaken against the USD, those expenses become cheaper in dollar terms.

- Hedging Strategies: Companies like APA often employ financial instruments such as forward contracts or options to hedge against adverse currency movements, aiming to lock in exchange rates for future transactions.

- 2024/2025 Outlook: Analysts in early 2025 are closely monitoring the stability of the EGP and GBP. For instance, the EGP experienced significant volatility in early 2024, with multiple devaluations impacting businesses operating in Egypt. The GBP also saw fluctuations, influenced by UK economic performance and global market sentiment.

Investment and Capital Allocation

A company's capacity to secure and strategically deploy capital for exploration and development is paramount. APA's projected upstream capital budget for 2025 is set between $2.5 billion and $2.6 billion. This significant investment is earmarked for projects offering high returns and for implementing cost-reduction measures, all aimed at bolstering financial health and maximizing shareholder value.

Key aspects of this capital allocation strategy include:

- Focus on High-Return Investments: Capital will be directed towards opportunities with the greatest potential for profitability.

- Cost-Saving Initiatives: Efforts will be made to optimize spending throughout the exploration and development process.

- Shareholder Returns: The ultimate goal of this capital management is to enhance returns for investors.

- 2025 Budget Range: The planned expenditure falls within $2.5 to $2.6 billion.

Economic factors significantly shape the landscape for companies like APA Corporation. Energy prices, particularly for crude oil and natural gas, directly influence revenue and operational costs. Global economic growth dictates energy demand, while inflation and interest rates impact borrowing costs and overall business expenses. Currency exchange rate volatility also presents a material risk for international operations.

APA Corporation's 2025 upstream capital budget is projected between $2.5 billion and $2.6 billion, reflecting strategic investment in high-return projects and cost efficiencies.

Forecasts for Brent crude oil prices in 2025 suggest a range of US$70 to US$80 per barrel, with potential upside from geopolitical events. Global economic growth was estimated at 3.2% for 2024 by the IMF, indicating steady energy demand.

Inflation was projected to be around 3.5% by the end of 2024, increasing operating expenses. Benchmark interest rates were expected to average 4.75% through 2024, with a potential decrease to 4.25% by mid-2025.

| Economic Factor | 2024 Estimate/Projection | 2025 Outlook/Projection | Impact on APA |

|---|---|---|---|

| Brent Crude Oil Price | Relatively stable | US$70 - US$80 per barrel | Revenue and profitability |

| Global Economic Growth | ~3.2% | Steady (implied by 2024 forecast) | Energy demand |

| Inflation Rate | ~3.5% | (Monitoring) | Operating expenses, cost of capital |

| Benchmark Interest Rates | ~4.75% | Potential decrease to ~4.25% mid-year | Borrowing costs, investment decisions |

| Currency Exchange Rates (USD vs. EGP/GBP) | Volatile (EGP), Fluctuating (GBP) | (Monitoring) | Reported financial results, asset valuation |

What You See Is What You Get

APA PESTLE Analysis

The preview you see here is the exact APA PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, allowing you to assess its comprehensive coverage of Political, Economic, Social, Technological, Legal, and Environmental factors.

The content and structure shown in the preview is the same document you’ll download after payment, providing a robust framework for strategic analysis.

Sociological factors

Public perception of fossil fuels is increasingly shaped by growing awareness of climate change. This heightened concern translates into pressure for the oil and gas industry to transition towards cleaner energy alternatives. For example, a 2024 survey indicated that over 60% of global consumers favor businesses committed to renewable energy, directly impacting investor sentiment and a company's social license to operate.

The energy sector's workforce is undergoing significant shifts. In 2024, the average age of an oil and gas worker was 45, highlighting a looming retirement wave. APA Corporation needs to address this by focusing on attracting and retaining younger talent, particularly those with digital and renewable energy skills, to ensure operational continuity and foster innovation.

APA Corporation prioritizes strong community relations, understanding that a social license to operate is vital for sustained success. Negative environmental events or insufficient community engagement can significantly jeopardize this license, impacting operations and reputation.

In 2024, APA reported investing $15 million in community development programs across its operating regions, aiming to foster positive relationships. The company's 2025 sustainability report will detail metrics on community satisfaction surveys and the impact of these initiatives on its social license.

Energy Poverty and Access

APA Corporation recognizes that its operations are intrinsically linked to global energy access, a critical societal concern. Addressing energy poverty, defined as lacking access to modern energy services, is not just a corporate responsibility but also a strategic imperative that can bolster the company's standing and foster stronger ties with stakeholders. For instance, the International Energy Agency reported in 2023 that around 675 million people still lacked electricity access, primarily in sub-Saharan Africa, highlighting the vast market and humanitarian need.

By investing in and promoting solutions that expand energy access, APA can significantly improve its corporate image and build trust. This commitment resonates with consumers, investors, and governments alike, who increasingly prioritize sustainability and social impact. In 2024, global investment in clean energy access solutions reached an estimated $60 billion, demonstrating a clear market trend and investor appetite for companies making a tangible difference.

- Global Energy Access Gap: Approximately 675 million individuals worldwide lacked electricity access as of 2023, with sub-Saharan Africa being the most affected region.

- Market Opportunity: The growing demand for reliable and affordable energy presents a significant market for companies like APA that can provide innovative solutions.

- Stakeholder Value: Demonstrating a commitment to energy poverty reduction enhances APA's reputation, attracting ethically-minded investors and strengthening community relations.

- Investment Trends: Clean energy access solutions attracted an estimated $60 billion in global investment in 2024, indicating strong financial interest in this sector.

Health and Safety Culture

A robust health and safety culture is critical in the oil and gas sector, directly influencing workforce well-being, operational efficiency, and public perception. APA Corporation has demonstrably prioritized employee safety, achieving a significant milestone by recording its lowest global Total Recordable Incident Rate (TRIR) in 2024.

This commitment translates into tangible results:

- Lowest Global TRIR in 2024: APA Corporation achieved its best-ever safety performance in 2024, underscoring a deeply ingrained safety-first approach.

- Employee Well-being Focus: The emphasis on health and safety directly contributes to a secure working environment, fostering employee confidence and retention.

- Operational Reliability: A strong safety culture minimizes disruptions caused by accidents, ensuring smoother and more reliable operations.

Societal expectations regarding corporate responsibility continue to evolve, pushing energy companies like APA Corporation to integrate sustainability and ethical practices into their core strategies. Public scrutiny on environmental impact and social equity is intensifying, influencing brand reputation and investor confidence. A 2024 report highlighted that 70% of consumers consider a company's environmental record when making purchasing decisions, a trend that directly affects market share and long-term viability.

Technological factors

Technological advancements are crucial for APA Corporation's success. Innovations in drilling techniques, such as extended reach drilling and managed pressure drilling, are continuously improving efficiency and lowering operational costs. For instance, in 2023, APA reported a 7% year-over-year reduction in drilling and completion costs in their U.S. onshore operations, directly attributable to these technological upgrades.

Enhanced seismic imaging and reservoir management technologies are also key. These tools allow for more precise identification and extraction of hydrocarbons, leading to higher recovery rates. APA's strategic adoption of artificial intelligence for operational planning and production optimization is a prime example, aiming to maximize output and minimize downtime. The company anticipates AI-driven efficiencies could boost production by up to 5% in its key U.S. plays by the end of 2025.

The increasing focus on climate change is driving significant advancements and investment in Carbon Capture, Utilization, and Storage (CCUS) technologies. These innovations are crucial for industries like oil and gas to decarbonize their operations. For instance, by 2024, the global CCUS market is projected to reach over $10 billion, highlighting substantial growth and commitment.

Investing in CCUS allows companies like APA to proactively address environmental, social, and governance (ESG) goals and prepare for stricter future regulations. The International Energy Agency (IEA) reported in 2024 that CCUS projects globally are set to increase significantly, with many new projects entering the development phase, signaling a strong trend towards wider adoption.

Technological advancements, particularly in digitalization and data analytics, are reshaping how companies like APA Corporation operate. Leveraging big data, artificial intelligence (AI), and machine learning offers substantial opportunities to boost operational efficiency, enhance predictive maintenance, and refine decision-making across APA's diverse global assets. For instance, APA's continued partnership with Palantir is a testament to this trend, as they actively implement AI solutions to drive various operational enhancements. This strategic adoption of technology is crucial for maintaining a competitive edge in the evolving energy landscape.

Renewable Energy Integration

The global energy sector is undergoing a significant technological transformation, with renewable energy sources and advanced energy storage systems becoming increasingly prominent. For APA, a company historically rooted in oil and gas, this shift presents both challenges and opportunities. Understanding the pace of renewable integration is crucial for assessing long-term market viability and identifying potential avenues for diversification.

The increasing efficiency and decreasing costs of solar and wind power are reshaping energy generation. For instance, global renewable energy capacity is projected to grow substantially. By the end of 2024, the International Energy Agency (IEA) reported that renewable sources accounted for over 30% of global electricity generation, a figure expected to climb higher in 2025. This trend directly impacts the demand for traditional fossil fuels, influencing APA's future market position.

Furthermore, advancements in battery technology and other energy storage solutions are critical enablers for renewables. These technologies address the intermittency of solar and wind power, making them more reliable grid components. APA's strategic planning must consider how these technological advancements in storage will affect the overall energy mix and the competitive landscape in the coming years.

Key technological factors impacting APA's renewable energy integration include:

- Declining Costs of Renewables: Solar photovoltaic (PV) and wind turbine costs have fallen dramatically, making them competitive with traditional energy sources. Global renewable electricity capacity additions reached a record high in 2023, with continued strong growth anticipated through 2025.

- Energy Storage Advancements: Improvements in battery energy density, lifespan, and cost reduction are making grid-scale storage more feasible, supporting the integration of variable renewable sources.

- Grid Modernization: Investments in smart grids and advanced grid management technologies are essential for accommodating higher penetrations of distributed renewable energy generation.

Operational Efficiency and Cost Reduction Technologies

Technological advancements are crucial for enhancing operational efficiency and driving down costs, directly impacting competitiveness. For instance, the adoption of AI-powered predictive maintenance in industries can significantly reduce unexpected downtime. APA is actively pursuing cost-saving measures across its operations, aiming for substantial run-rate savings.

APA's strategic focus includes optimizing overhead, reducing lease operating expenses, and controlling capital expenditures. These initiatives are designed to yield significant improvements in the company's financial performance. The company is targeting billions in run-rate savings through these technological and operational adjustments.

- AI-driven automation for streamlining complex processes and reducing manual labor costs.

- Predictive analytics to minimize equipment downtime and optimize maintenance schedules, leading to lower repair expenses.

- Cloud-based infrastructure for enhanced scalability and reduced IT operational costs.

- Digital twin technology for simulating and optimizing operational performance before physical implementation.

Technological advancements are pivotal for APA's operational efficiency and cost reduction. The company is leveraging AI for predictive maintenance and process automation, aiming for substantial run-rate savings. For example, APA is targeting billions in savings through optimized overhead, reduced lease operating expenses, and controlled capital expenditures, with AI-driven automation and predictive analytics playing key roles.

Innovations in drilling and reservoir management continue to enhance hydrocarbon extraction. Extended reach drilling and advanced seismic imaging improve efficiency and recovery rates. APA's adoption of AI for operational planning is expected to boost production by up to 5% in key U.S. plays by the end of 2025.

The energy sector's technological shift towards renewables and storage presents both challenges and opportunities for APA. Declining costs of solar and wind power, coupled with energy storage advancements, are reshaping the energy mix. By 2024, renewable sources accounted for over 30% of global electricity generation, a trend that will continue to influence fossil fuel demand.

Legal factors

APA Corporation operates under a stringent environmental regulatory landscape, particularly concerning methane emissions and greenhouse gas monitoring. These regulations necessitate substantial investment in compliance technologies and processes, directly impacting operational costs and strategic planning.

The U.S. Environmental Protection Agency's (EPA) actions, such as potential delays or reversals in methane emission rules, highlight the volatile nature of this legal framework. For instance, the EPA's proposed updates to methane regulations for existing oil and gas facilities, aiming for significant reductions by 2030, underscore the ongoing pressure for stricter environmental performance.

Compliance with health and safety regulations is paramount for APA, ensuring worker well-being and preventing costly legal repercussions. In 2024, APA reported a 5% decrease in workplace incidents, a testament to its robust safety protocols.

Adherence to these laws is not merely a legal obligation but a strategic imperative, safeguarding APA's operational continuity and its reputation among stakeholders. The company invested $15 million in safety training programs throughout 2024, exceeding its planned budget by 10% to further reinforce its safety culture.

Navigating the intricate web of licensing and permitting is crucial for energy companies. Exploration, development, and production activities are governed by a dynamic legal landscape that varies significantly by country. For instance, in 2024, Colorado implemented new regulations for upstream oil and gas operations, introducing expanded requirements that companies must meticulously adhere to, impacting operational timelines and costs.

International Energy Treaties and Agreements

International energy treaties and bilateral agreements significantly shape APA Corporation's operational landscape. These pacts can dictate resource access, trade routes, and foreign investment conditions, directly impacting APA's ability to secure and transport energy resources. For instance, the European Union's efforts to diversify energy sources, as highlighted by increased LNG imports in 2024, could present new market opportunities for APA, provided its production aligns with regional demand and regulatory frameworks.

Changes within these international frameworks can introduce both advantages and hurdles. A shift in trade policy or the establishment of new environmental standards within a treaty could alter the cost of doing business or open up previously inaccessible markets. For example, the ongoing negotiations surrounding the global carbon pricing mechanisms in late 2024 might influence the economic viability of certain APA projects, requiring strategic adjustments to comply with evolving international norms.

- Resource Access: International agreements can grant or restrict APA's access to critical energy reserves in different geopolitical regions.

- Market Entry: Bilateral trade pacts can facilitate or impede APA's ability to sell its energy products in specific international markets.

- Investment Climate: Treaties governing foreign direct investment impact APA's capacity to secure capital for exploration and production activities abroad.

- Regulatory Alignment: Compliance with international energy standards and environmental protocols stipulated in agreements is crucial for APA's long-term sustainability.

ESG Reporting and Disclosure Regulations

The global push for mandatory ESG reporting, exemplified by the SEC's climate disclosure rules and the EU's Corporate Sustainability Reporting Directive (CSRD), presents a significant legal landscape for APA Corporation. Compliance demands robust data gathering and transparent communication to maintain investor trust and meet regulatory obligations.

Navigating these evolving legal frameworks is paramount. For instance, the CSRD, which began applying to large EU companies in 2024, requires extensive sustainability reporting, impacting supply chains and financial disclosures. APA Corporation must integrate these requirements into its operations to avoid penalties and enhance its market standing.

- Mandatory Climate Disclosures: The SEC's proposed climate disclosure rules, expected to be finalized in 2024, will likely require companies to report on Scope 1, 2, and potentially Scope 3 emissions, impacting financial planning and risk management.

- EU's CSRD Impact: The CSRD, effective for fiscal years starting in 2024 for many large companies, mandates detailed ESG reporting across a broad range of sustainability topics, necessitating significant data infrastructure upgrades.

- Global Harmonization Efforts: International bodies like the ISSB are working towards global sustainability standards, suggesting a future where consistent ESG reporting will be a universal legal expectation.

- Investor Demand for Transparency: Legal and regulatory pressures are amplified by investor demand for clear, auditable ESG data, making proactive compliance a competitive advantage.

Legal and regulatory compliance is a cornerstone for APA Corporation's operations, influencing everything from environmental stewardship to market access. The company must navigate a complex and evolving landscape of national and international laws, including those related to emissions, safety, and corporate reporting.

In 2024, APA invested over $20 million in environmental compliance technologies to meet stricter methane emission standards, a significant increase from previous years. This proactive approach is essential as regulatory bodies like the EPA continue to refine rules impacting the oil and gas sector, with potential new regulations for existing infrastructure anticipated by late 2025.

APA's commitment to health and safety is legally mandated and reinforced by significant investments; in 2024, the company allocated $15 million to employee safety training, contributing to a 5% reduction in workplace incidents. This focus on compliance not only prevents legal penalties but also bolsters operational efficiency and corporate reputation.

The global regulatory environment for ESG reporting, including the EU's CSRD and the SEC's climate disclosure rules, is increasingly stringent. APA's adherence to these mandates, which require detailed sustainability data, is critical for maintaining investor confidence and market access, especially as international harmonization efforts by bodies like the ISSB gain momentum.

Environmental factors

The intensifying global commitment to climate change mitigation is placing significant pressure on the oil and gas sector to curb greenhouse gas (GHG) emissions. This environmental imperative directly influences operational strategies and investment decisions for companies like APA Corporation.

APA Corporation has demonstrated proactive engagement with these pressures, successfully meeting and surpassing its targets for CO2e emissions reduction. These achievements are intrinsically linked to the company's broader sustainability strategy, reflecting a commitment to environmental stewardship.

For instance, in 2023, APA reported a 12% reduction in Scope 1 and Scope 2 GHG emissions intensity compared to its 2019 baseline, exceeding its initial target of 10%. This progress is a testament to their integrated approach to emissions management.

Water scarcity presents a significant challenge, particularly in regions where oil and gas operations are concentrated. The environmental impact of water usage in drilling and production, including potential contamination and depletion of local resources, is a major concern for companies like APA.

APA is actively working to mitigate these impacts by prioritizing the recycling of produced water, which is water that comes up from the ground during oil and gas extraction. This approach significantly reduces the need for freshwater. For instance, in 2023, APA reported that approximately 80% of the water used in its U.S. onshore operations was recycled produced water, a substantial increase from previous years and a testament to their commitment to responsible water management.

APA Corporation operates within diverse ecosystems, necessitating strict adherence to biodiversity protection regulations and practices to minimize environmental disruption. This commitment is crucial, especially when operating in sensitive areas, requiring careful management of land use and potential impacts on local flora and fauna.

Globally, the economic cost of biodiversity loss is substantial. The World Economic Forum's 2024 Global Risks Report highlighted that nature loss is a top global risk, with over half of the world's GDP dependent on nature and its services. Companies like APA are increasingly evaluated on their biodiversity impact, with initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) gaining traction, aiming to guide financial markets toward nature-positive outcomes by 2030.

Waste Management and Pollution Control

Effective waste management and pollution control are critical for the oil and gas sector to minimize environmental damage, such as from spills and the disposal of hazardous materials. Governments worldwide are implementing increasingly stringent regulations to enforce these practices.

The global environmental services market, which includes waste management and pollution control, was valued at approximately $1.2 trillion in 2023, with a projected compound annual growth rate of over 6% through 2030, reflecting the growing emphasis on sustainability. For the oil and gas industry, compliance with these environmental standards is not just a regulatory necessity but also a key factor in maintaining social license to operate and investor confidence.

- Regulatory Frameworks: Many countries have established comprehensive legal frameworks, such as the EU's Waste Framework Directive and the US EPA regulations, which dictate how waste generated from oil and gas activities must be handled, treated, and disposed of.

- Technological Advancements: Innovations in containment, remediation, and waste-to-energy technologies are improving the efficiency and cost-effectiveness of pollution control measures.

- Industry Investment: Major oil and gas companies are allocating significant capital towards environmental protection initiatives. For instance, in 2023, several supermajors reported billions of dollars in environmental, social, and governance (ESG) related spending, a portion of which directly addresses waste management and pollution control.

- Emerging Challenges: The industry faces ongoing challenges related to managing legacy pollution, dealing with increasing volumes of produced water, and reducing greenhouse gas emissions from operational waste.

Energy Transition and Renewable Energy Growth

The global energy transition is accelerating, with renewable energy sources like solar and wind power seeing significant investment and deployment. For instance, in 2024, the International Energy Agency (IEA) projected that renewables will account for over 90% of global electricity capacity expansion in the coming years. This shift directly impacts the long-term demand for traditional fossil fuels, presenting both challenges and opportunities for companies like APA, which must adapt to a diversifying energy landscape.

Electric vehicle (EV) adoption is also a key driver of this transition, with sales projected to continue their strong upward trajectory. By 2025, it's anticipated that EVs will represent a substantial portion of new vehicle sales in major markets, further reducing reliance on gasoline and diesel. This trend necessitates a strategic re-evaluation of energy infrastructure and supply chains.

- Renewable Capacity Expansion: Global renewable electricity capacity is expected to grow by over 50% between 2023 and 2028, reaching more than 7,300 GW.

- EV Market Share: Projections indicate that by 2025, electric cars could make up around 15-20% of global new car sales.

- Fossil Fuel Demand Outlook: The increasing penetration of renewables and EVs is expected to moderate, and potentially decline, the long-term demand for oil in transportation sectors.

- APA's Strategic Adaptation: Companies like APA are exploring investments in lower-carbon energy solutions and infrastructure to align with evolving market demands.

Environmental pressures are driving significant changes in the oil and gas industry, pushing companies to adopt more sustainable practices. APA Corporation is actively addressing these concerns, particularly regarding greenhouse gas emissions and water management. Their commitment to reducing their environmental footprint is evident in their operational strategies and measurable results.

APA's efforts in reducing CO2e emissions intensity by 12% in 2023, surpassing their 10% target, highlight their proactive approach. Furthermore, their focus on recycling produced water, with approximately 80% of water used in U.S. onshore operations being recycled in 2023, demonstrates a commitment to resource conservation.

The company also navigates the complexities of biodiversity protection and waste management, adhering to stringent regulations and investing in environmental initiatives. These actions are crucial for maintaining their social license to operate and investor confidence in a world increasingly focused on sustainability.

| Environmental Factor | APA Corporation's Action/Performance | Relevant Data/Context |

|---|---|---|

| GHG Emissions Reduction | Reduced Scope 1 & 2 GHG emissions intensity by 12% in 2023 vs. 2019 baseline. | Exceeded 2023 target of 10% reduction. |

| Water Management | Utilized approximately 80% recycled produced water in U.S. onshore operations in 2023. | Reduces reliance on freshwater sources. |

| Biodiversity Protection | Operates within diverse ecosystems, adhering to regulations. | Global GDP dependency on nature is over 50%; TNFD aims for nature-positive outcomes by 2030. |

| Waste Management & Pollution Control | Implements practices to minimize environmental damage. | Global environmental services market valued at ~$1.2 trillion in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable international organizations, national statistical agencies, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting your business.