APA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

APA's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants. Understanding these dynamics is crucial for navigating the energy sector.

The complete report reveals the real forces shaping APA’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

APA Corporation's operations are significantly impacted by suppliers of specialized equipment and services, particularly in areas like advanced drilling and seismic imaging. The oil and gas sector demands highly technical solutions, and the limited number of providers for these critical inputs grants them considerable bargaining power. This can translate into higher costs for APA, as seen in the 2024 capital expenditure budgets where specialized drilling services represented a substantial portion of project expenses.

APA Corporation's reliance on a highly specialized workforce, including geoscientists, engineers, and experienced field operators, underscores the bargaining power of skilled labor. A documented shortage of geoscientists, for instance, can drive up labor costs and empower these professionals, directly impacting APA's operational expenses and project execution timelines.

The drilling and oilfield services market has experienced significant consolidation. Major upstream customers, like those APA Corporation deals with, have engaged in large-scale mergers. This trend can lead to fewer, but larger, service providers. For APA, this means potentially facing a more concentrated supplier base.

While consolidation might bring efficiencies, it can also limit APA's choices for essential services. This reduced competition among suppliers could empower the remaining large service companies, giving them more leverage in negotiating pricing and contract terms with APA. For instance, in 2023, the oilfield services sector saw several notable mergers and acquisitions, signaling this ongoing consolidation trend.

Technological Advancements and Proprietary Knowledge

Suppliers who possess unique technological advantages or hold patents for advanced exploration and production methods can significantly influence the bargaining power within the industry. APA Corporation's need to integrate these innovations to maintain a competitive edge and boost operational efficiency means these suppliers can dictate terms, potentially leading to increased costs or stringent contractual obligations.

The continuous investment by these suppliers in cutting-edge technology further solidifies their value proposition, making their specialized knowledge and proprietary processes indispensable. For instance, advancements in seismic imaging or drilling efficiency, often protected by patents, can create dependencies for companies like APA. In 2024, the energy sector saw significant R&D spending, with major players investing billions to develop and adopt new technologies, underscoring the importance of these innovations.

- Proprietary Technology: Suppliers with patented drilling fluids or advanced geological survey software hold considerable leverage.

- Efficiency Gains: Innovations that reduce well completion times or improve recovery rates are highly sought after, increasing supplier power.

- R&D Investment: Companies investing heavily in developing next-generation exploration tools in 2024 are likely to see enhanced supplier bargaining power.

- Cost Implications: Access to these proprietary technologies may come with premium pricing or licensing fees for APA.

Geopolitical and Regulatory Influence on Supply Chains

Geopolitical shifts and evolving regulations significantly shape supply chain dynamics for oil and gas equipment. For instance, trade disputes or sanctions can restrict the flow of critical components, thereby increasing the bargaining power of suppliers in unaffected regions. APA Corporation, with its diverse operational footprint across the US, Egypt, and the UK, faces this reality directly; disruptions in any of these key markets can heighten reliance on alternative, potentially more expensive, suppliers.

The impact of these geopolitical and regulatory factors is tangible. In 2024, several nations implemented new environmental regulations affecting the extraction and transportation of oil and gas, leading to increased compliance costs for operators and a corresponding uplift in demand for specialized, compliant equipment. This scenario inherently strengthens the position of suppliers who can readily meet these new standards, allowing them to command higher prices and dictate terms.

- Geopolitical Instability: Trade wars or regional conflicts can disrupt established supply routes, forcing companies to seek alternative, often costlier, sources.

- Regulatory Compliance: New environmental or safety standards can favor suppliers with advanced, compliant technologies, enhancing their pricing power.

- Supplier Leverage: For companies like APA Corporation with international operations, supply chain vulnerabilities in one region can amplify the bargaining power of suppliers in more stable geopolitical and regulatory environments.

Suppliers of specialized equipment and services hold significant bargaining power over APA Corporation due to the highly technical nature of the oil and gas industry. This power is amplified by market consolidation, proprietary technologies, and geopolitical factors affecting supply chains. For instance, the 2024 capital expenditure budgets highlighted substantial costs associated with specialized drilling services, reflecting supplier leverage.

| Factor | Impact on APA Corporation | Example Data (2024/2023) |

|---|---|---|

| Supplier Concentration | Reduced choice, potential for higher prices | Oilfield services sector saw notable M&A activity in 2023. |

| Proprietary Technology | Dependency on innovation, potential for premium pricing | Energy sector R&D spending in 2024 reached billions for new technologies. |

| Geopolitical/Regulatory Shifts | Supply chain vulnerability, increased reliance on alternative suppliers | New environmental regulations in 2024 increased demand for compliant equipment. |

What is included in the product

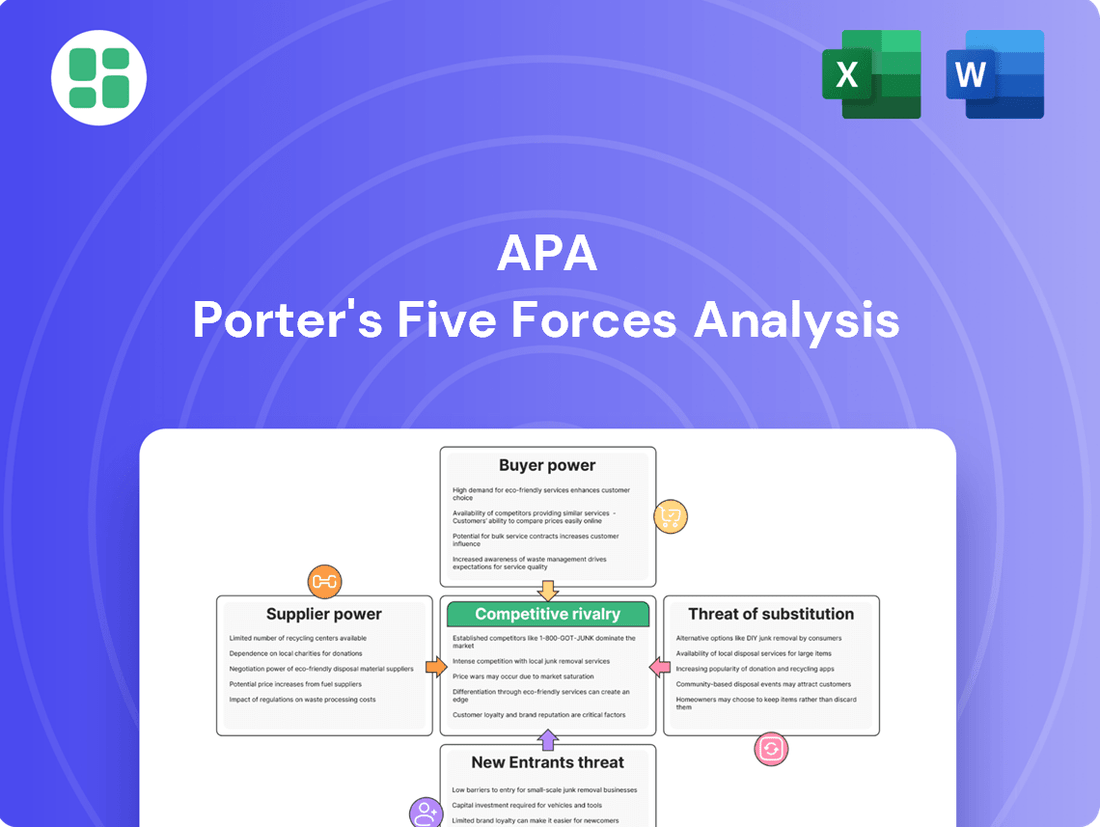

Analyzes the five competitive forces impacting APA's industry, including rivalry, new entrants, buyer power, supplier power, and substitutes, to inform strategic decision-making.

Instantly identify and address competitive threats with a visual breakdown of each force, streamlining strategic planning.

Customers Bargaining Power

The bargaining power of customers in the energy sector, particularly for companies like APA Corporation, is significantly shaped by global commodity pricing. Since oil and natural gas prices are largely dictated by worldwide supply and demand, individual producers have minimal influence over these benchmarks. This means the broad market, acting as the collective customer, wields substantial power because price fluctuations directly impact APA's financial performance.

In 2024, global oil demand growth has indeed shown signs of moderation, while supply remains a dynamic factor influenced by various geopolitical and economic events. For instance, the International Energy Agency (IEA) projected in early 2024 that global oil demand growth would slow to around 1.2 million barrels per day for the year, down from stronger growth in previous periods. This shift in demand-supply balance inherently strengthens the customer's position by creating a more price-sensitive environment.

APA Corporation's customer base is quite broad, encompassing major refiners, utility providers, and energy trading firms. This wide reach means that no single customer typically holds excessive sway over APA's operations.

While individual customers might not wield immense power due to the standardized nature of crude oil and natural gas, their collective purchasing power is substantial. For instance, in 2024, global oil demand was projected to reach 103.2 million barrels per day, highlighting the significant volume these large buyers represent.

The purchasing decisions of these large entities collectively impact market prices and APA's sales volumes, demonstrating a significant, albeit distributed, bargaining power within the energy sector.

The mix of long-term supply contracts and spot market sales significantly impacts customer bargaining power for APA. While long-term agreements provide price predictability, they can limit APA's ability to benefit from market upswings. Conversely, engaging in spot market transactions exposes APA to immediate price fluctuations and shifts in customer demand.

For instance, in the natural gas sector, APA has employed basis swap agreements to mitigate price risk associated with certain capacity. This strategy aims to balance the benefits of stable pricing with the need to manage exposure to volatile market conditions, thereby influencing the leverage customers hold.

Downstream Integration of Customers

When APA Corporation's customers are large, integrated energy companies, their bargaining power increases significantly. These customers often possess their own exploration and production (E&P) capabilities or substantial refining and distribution networks. This integration allows them to reduce their dependence on external suppliers, including APA, by opting for internal production or prioritizing their existing supply chains, thereby enhancing their leverage.

For instance, a major integrated oil company might have the capacity to meet a portion of its demand through its own upstream operations. This internal capacity acts as a credible threat, allowing them to negotiate more favorable terms with suppliers like APA. In 2024, major integrated energy companies continued to invest heavily in their upstream segments, aiming for greater self-sufficiency and cost control.

- Customer Integration: Large customers with their own E&P or refining capabilities reduce reliance on external suppliers like APA.

- Internal Production Threat: The ability to produce internally or prioritize their own supply chains strengthens customer negotiation power.

- Market Dynamics in 2024: Integrated energy firms focused on upstream investments, increasing their potential for self-sufficiency and leverage against suppliers.

Regulatory and Environmental Policies Impacting Demand

Evolving environmental regulations and policies promoting renewable energy and decarbonization efforts can significantly shift demand away from traditional fossil fuels over the long term. For instance, the European Union's Fit for 55 package aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly impacting the demand for oil and gas.

This growing preference for cleaner energy sources among end-users and governments can reduce the overall demand for oil and gas, thereby increasing customer power as they actively seek and adopt viable alternatives. By 2023, global renewable energy capacity additions reached a record high, further signaling this shift.

Renewables are increasingly displacing fossil fuel demand in various sectors, though fossil fuels still account for a substantial portion of global energy consumption. In 2023, renewable energy sources provided approximately 30% of global electricity generation, a figure that is expected to rise.

- Regulatory Push: Policies like carbon pricing and emissions standards incentivize a move towards cleaner alternatives.

- Consumer Preference: Growing awareness of climate change drives demand for sustainable products and services.

- Technological Advancements: Innovations in renewable energy technologies are making them more cost-competitive.

- Market Share Shift: Renewables captured over 80% of the global power capacity additions in 2023.

The bargaining power of customers in the energy sector is substantial, driven by global commodity pricing and the collective volume of major buyers. While individual customers may have limited sway, their combined purchasing power significantly influences market prices and supplier sales volumes. This dynamic is amplified when customers are large, integrated energy companies capable of internal production or prioritizing their own supply chains, thereby increasing their leverage.

In 2024, the energy market continues to be shaped by moderating global oil demand growth and dynamic supply conditions, which inherently strengthens the customer's position by fostering a more price-sensitive environment. Furthermore, evolving environmental regulations and the increasing adoption of renewable energy sources are gradually shifting demand away from traditional fossil fuels, further empowering customers seeking cleaner alternatives.

The energy sector's customer base, including major refiners and utility providers, wields considerable power due to the sheer volume they represent. For instance, global oil demand was projected to reach approximately 103.2 million barrels per day in 2024, underscoring the significant collective purchasing power of these entities. This collective strength allows them to negotiate terms that reflect market conditions and their substantial commitment.

APA Corporation's strategy of employing basis swap agreements in the natural gas sector, for example, demonstrates an effort to balance stable pricing with exposure management. This approach directly addresses the customer's inherent power by seeking to mitigate the impact of volatile market conditions on contract terms and pricing, thereby influencing the negotiation leverage.

| Factor | Impact on Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Global Commodity Pricing | High; prices set by worldwide supply/demand | Moderating demand growth, dynamic supply |

| Customer Concentration | Low for APA (broad base) | No single customer dominates |

| Collective Purchasing Volume | High; significant market influence | Projected 103.2 million bpd oil demand |

| Customer Integration | High for integrated companies | Focus on upstream investment for self-sufficiency |

| Shift to Renewables | Increasing; driven by policy and preference | Renewables captured >80% of global capacity additions in 2023 |

What You See Is What You Get

APA Porter's Five Forces Analysis

The preview you see is the exact APA Porter's Five Forces Analysis document you will receive immediately after purchase, offering a comprehensive examination of industry competitiveness. This detailed report, meticulously formatted according to APA guidelines, provides actionable insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You're looking at the actual document, ensuring no surprises or placeholders, ready for your immediate download and use.

Rivalry Among Competitors

The global oil and natural gas sector is highly fragmented, with APA Corporation facing competition from a wide array of International Oil Companies (IOCs), National Oil Companies (NOCs), and numerous independent exploration and production (E&P) firms. This diverse competitive landscape necessitates a constant focus on operational efficiency and cost management.

Regional markets, such as the Permian Basin in the United States, exemplify this intense rivalry, marked by significant merger and acquisition (M&A) activity and ongoing consolidation among upstream participants. APA's competitive strategy must therefore account for these dynamic regional pressures and the drive for scale.

The oil and gas sector is characterized by intense competitive rivalry, largely driven by the commodity nature of its products. Since oil and natural gas are largely undifferentiated, price becomes the primary battlefield for companies like APA. This means that the ability to produce at a lower cost is a significant advantage.

Price volatility is a constant factor. Global supply and demand dynamics, coupled with geopolitical events, can cause sharp swings in commodity prices. For instance, while oil prices saw some stability in early 2024, the market remains susceptible to disruptions. This volatility forces companies to adopt aggressive pricing strategies, which can directly impact APA's profit margins and influence crucial investment decisions regarding exploration and production.

The oil and gas sector is inherently capital-intensive, meaning companies face significant upfront investments in exploration, drilling, and infrastructure. These high fixed costs create a strong incentive to operate at high production levels to amortize expenses over a larger output. For instance, APA Corporation's 2025 capital expenditure program reflects this ongoing need for investment in its assets.

This drive for high utilization can lead to increased supply within the market. When companies are pressured to keep production high, it naturally intensifies competition as they battle to secure market share and ensure their substantial investments are generating revenue. This dynamic can put downward pressure on prices.

Access to Reserves and Exploration Success

Competitive rivalry in the upstream oil and gas sector is intensely driven by the ability to secure and successfully exploit hydrocarbon reserves. Companies are locked in a perpetual competition for access to promising exploration blocks and the subsequent success in discovering and developing these resources. This pursuit directly impacts a company's production capacity and future growth prospects.

APA Corporation's strategic positioning reflects this dynamic. Their operational focus spans key regions such as the Permian Basin, Egypt, and emerging exploration frontiers like Suriname. This diversified approach aims to capture potential discoveries and bolster their reserve base. The acquisition of Callon Petroleum in 2024, for instance, significantly bolstered APA's footprint and reserve holdings within the Permian, a highly contested and valuable shale play.

- Reserve Acquisition and Exploration Success: The core of competitive rivalry lies in securing access to proven and potential hydrocarbon reserves. Companies that excel in exploration, appraisal, and development gain a significant edge.

- Strategic Land Acquisition: Competition for prime acreage, particularly in prolific basins like the Permian, is fierce. Successful bidders gain exclusive rights to explore and produce, creating a barrier for rivals.

- Technological Advancement in Exploration: Companies investing in and effectively deploying advanced seismic imaging and drilling technologies increase their chances of exploration success, thereby outmaneuvering less technologically adept competitors.

- APA's Strategic Moves: APA Corporation's 2024 acquisition of Callon Petroleum for approximately $2.1 billion underscored the importance of consolidating acreage in high-value areas like the Permian to enhance competitive standing.

Strategic Mergers and Acquisitions (M&A)

Mergers and acquisitions are a powerful tool for companies to gain an edge, consolidate resources, and expand their market presence. This activity directly impacts the intensity of competition among existing players.

APA Corporation’s acquisition of Callon Petroleum in 2024 for approximately $4.5 billion exemplifies this strategy. This move was designed to bolster APA's footprint in the Permian Basin, a key oil-producing region, and unlock significant cost savings through operational efficiencies. Such consolidations can lead to a more concentrated market, potentially increasing the bargaining power of larger, merged entities.

- Strategic Consolidation: M&A activity aims to combine assets, achieve economies of scale, and improve overall portfolio strength.

- Permian Basin Focus: APA Corporation's 2024 acquisition of Callon Petroleum highlights the strategic importance of consolidating positions in resource-rich areas like the Permian Basin.

- Synergy Realization: The primary driver behind many M&A deals is the expectation of cost synergies and enhanced operational efficiency post-integration.

- Competitive Landscape Shift: These consolidations can fundamentally alter the competitive dynamics, often leading to fewer, larger, and more efficient rivals.

Competitive rivalry in the oil and gas sector is fierce, driven by the commodity nature of products and the pursuit of reserves. Companies like APA Corporation must focus on cost efficiency and technological advancement to maintain an edge. The intense competition for prime acreage, particularly in regions like the Permian Basin, necessitates strategic land acquisition and exploration success.

Mergers and acquisitions are a key strategy to enhance competitive standing, as demonstrated by APA's 2024 acquisition of Callon Petroleum for approximately $4.5 billion. This consolidation aims to achieve economies of scale and operational efficiencies, ultimately reshaping the competitive landscape.

The ability to secure and exploit hydrocarbon reserves is central to rivalry, with exploration success and technological deployment being critical differentiators. APA's diversified operational footprint across regions like the Permian, Egypt, and Suriname reflects this strategy.

Price volatility, influenced by global supply, demand, and geopolitical factors, further intensifies competition. Companies must adopt aggressive pricing strategies to manage profit margins amidst these fluctuations, impacting investment decisions.

| Competitor Type | Examples | Impact on APA |

|---|---|---|

| International Oil Companies (IOCs) | ExxonMobil, Chevron | High operational scale, significant capital for exploration and technology. |

| National Oil Companies (NOCs) | Saudi Aramco, Petrobras | Access to vast reserves, often government-backed, influencing global supply. |

| Independent E&P Firms | ConocoPhillips, EOG Resources | Agile in specific plays, strong focus on cost-efficiency and technological innovation. |

| APA's 2024 Acquisition Target | Callon Petroleum | Strengthened Permian presence, potential for synergies, increased scale. |

SSubstitutes Threaten

The most substantial threat of substitution for traditional energy sources stems from the rapid expansion of renewables like solar, wind, and hydropower. These alternatives are increasingly cost-effective, thanks to technological progress, favorable government incentives, and heightened environmental awareness, leading to their growing market penetration.

In 2024, renewable energy saw remarkable growth, with projections indicating they will surpass coal as a primary power source by 2025. This shift underscores the intensifying competitive pressure from cleaner, more sustainable energy alternatives.

The increasing popularity of electric vehicles (EVs) directly challenges traditional gasoline-powered cars, thereby impacting demand for oil. By 2024, global EV sales are projected to surpass 15 million units, a significant jump from previous years, indicating a growing segment of consumers opting out of fossil fuel consumption for transportation.

Improvements in energy efficiency across industries, from manufacturing to building design, further diminish the need for fossil fuels. For instance, advancements in LED lighting alone have drastically cut electricity consumption in commercial spaces, reducing the overall demand for energy generated from traditional sources.

Falling battery costs are a key enabler for EV adoption, making them more competitive with internal combustion engine vehicles. This cost reduction, coupled with government incentives, is accelerating the shift away from oil, especially in developed markets where consumer awareness and infrastructure are more advanced.

The global push for decarbonization, amplified by policies and regulations, significantly increases the threat of substitutes for traditional energy sources like oil and gas. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, directly encouraging a move towards renewables and electric vehicles.

Government incentives, such as tax credits for solar panel installations and subsidies for electric vehicle purchases, further tilt the playing field, making alternative energy more economically viable. Carbon pricing mechanisms, like the EU Emissions Trading System, which saw an average price of €80 per tonne of CO2 in 2023, directly penalize fossil fuel use, thereby increasing the attractiveness of substitutes.

Despite these strong policy headwinds, fossil fuels still represented approximately 81% of global primary energy consumption in 2023, indicating that while the threat is growing, the transition is not immediate. This persistent reliance means that while substitutes are gaining traction, the complete displacement of fossil fuels remains a long-term challenge.

Development of Alternative Fuels and Technologies

The development of alternative fuels and technologies presents a significant threat of substitutes to the traditional oil and gas industry. Beyond solar and wind, emerging options like green hydrogen and advanced biofuels are gaining traction, offering lower-carbon alternatives for transportation and industrial processes. For instance, global investment in clean hydrogen production is projected to reach hundreds of billions of dollars by 2030, indicating a serious shift in energy infrastructure.

Technologies such as carbon capture, utilization, and storage (CCUS) also act as a substitute by mitigating the environmental impact of fossil fuels, potentially extending their lifecycle but also reducing the need for entirely new fossil fuel extraction. In 2024, CCUS projects are seeing increased activity, with several major oil and gas companies announcing new investments and partnerships in this area, aiming to decarbonize their operations and products.

These advancements collectively reduce the demand for conventional oil and gas, forcing established players to adapt. Many oil and gas firms are strategically investing in these low-carbon solutions, recognizing the long-term substitution threat and aiming to diversify their portfolios for a future energy landscape. For example, by mid-2025, several supermajors are expected to have significant portions of their capital expenditure allocated to renewable energy and low-carbon technologies.

The accelerating pace of innovation in alternative energy means that the threat of substitution is not static.

Consumer and Investor Pressure for Sustainable Energy

The increasing consumer and investor demand for sustainable energy acts as a significant threat of substitutes for traditional energy sources. Growing environmental awareness is directly influencing purchasing decisions, leading consumers to favor renewable energy options. For instance, by the end of 2023, global renewable energy capacity additions reached a record high, surpassing 500 gigawatts (GW) for the first time, according to the International Energy Agency (IEA).

Investor pressure is also a critical factor. Many institutional investors are divesting from fossil fuels and prioritizing companies with strong environmental, social, and governance (ESG) performance. This shift in capital allocation makes it harder for non-renewable energy companies to secure funding for new projects. A significant number of major corporations, including many in the energy sector, have publicly committed to net-zero emissions targets by 2050, signaling a clear move away from carbon-intensive operations.

- Growing Consumer Preference: Consumers are increasingly choosing energy providers and products that align with sustainability values, directly impacting demand for conventional energy.

- Investor Divestment: A substantial flow of investment capital is moving from fossil fuels to renewable energy projects, limiting growth opportunities for traditional energy companies.

- Corporate Net-Zero Commitments: Over 4,000 companies globally have set net-zero targets, creating a powerful market signal for a transition to cleaner energy sources.

- Policy and Regulatory Support: Government incentives and regulations favoring renewable energy further enhance the attractiveness and viability of substitute energy solutions.

The threat of substitutes for traditional energy sources is intensifying due to advancements in renewable technologies and shifting consumer preferences. These alternatives are becoming more cost-competitive and environmentally appealing, directly challenging the market share of fossil fuels.

Electric vehicles (EVs) represent a significant substitute for gasoline-powered cars, with global sales projected to exceed 15 million units in 2024. This trend, coupled with falling battery costs, accelerates the move away from oil dependency.

Emerging energy solutions like green hydrogen and advanced biofuels are also gaining traction, offering lower-carbon alternatives for various industrial and transportation needs. Global investment in clean hydrogen production is expected to reach substantial figures by 2030, signaling a major shift in energy infrastructure.

The increasing demand for sustainable energy, driven by both consumers and investors, further amplifies the threat of substitutes. By the end of 2023, global renewable energy capacity additions reached a record high, surpassing 500 GW, demonstrating a clear market shift.

| Substitute Area | Key Developments | 2024 Impact/Projection |

|---|---|---|

| Renewable Energy (Solar, Wind) | Cost reductions, technological advancements, government incentives | Projected to surpass coal as a primary power source by 2025; significant capacity additions in 2023 |

| Electric Vehicles (EVs) | Falling battery costs, government subsidies, growing consumer acceptance | Global sales projected to exceed 15 million units; direct challenge to gasoline-powered vehicles |

| Alternative Fuels (Hydrogen, Biofuels) | Growing investment, development of new production methods | Hundreds of billions in projected investment for clean hydrogen by 2030 |

| Energy Efficiency | Advancements in technologies like LED lighting, improved building design | Drastic reduction in electricity consumption in commercial spaces |

Entrants Threaten

The oil and gas industry, where companies like APA Corporation operate, demands substantial upfront capital. This includes the costs associated with exploration, drilling, and establishing the necessary infrastructure to bring resources to market. For instance, APA's projected upstream capital budget for 2025 is set between $2.5 billion and $2.6 billion, illustrating the scale of investment required.

These high capital requirements serve as a significant barrier to entry, effectively deterring many potential new competitors from entering the market and challenging established firms. The sheer financial commitment needed to even begin operations makes it difficult for smaller or less-resourced entities to compete effectively with established players.

The oil and gas sector, including companies like APA, faces formidable regulatory barriers. Navigating complex permitting, environmental impact assessments, and stringent operational standards requires substantial expertise and capital, effectively deterring new entrants. For instance, in 2024, the average time to obtain permits for new oil and gas projects in many developed nations exceeded 18 months, with compliance costs often running into millions of dollars, disproportionately impacting smaller, less-resourced companies.

Existing oil and gas giants possess deep-rooted access to proven reserves and command extensive networks of pipelines, processing facilities, and export terminals. This established infrastructure represents a significant competitive moat.

Newcomers grapple with the formidable challenge of acquiring competitive acreage and securing drilling rights. The sheer cost and complexity of building out the necessary transportation and processing infrastructure create a substantial barrier.

For instance, in 2024, the capital expenditure required for a new offshore oil platform can easily exceed $1 billion, a figure that dwarfs the initial investment for many new ventures in less capital-intensive industries.

Technological Complexity and Proprietary Knowledge

The exploration and production (E&P) sector is characterized by significant technological complexity. New entrants face a substantial barrier due to the need for advanced seismic imaging, drilling techniques, and reservoir management systems. For instance, the development of advanced hydraulic fracturing and horizontal drilling technologies, crucial for unlocking unconventional reserves, required billions in investment and years of refinement by established players.

Acquiring or developing the necessary proprietary knowledge and intellectual property is a major hurdle. Companies like APA Corporation have spent decades building expertise in geological analysis and operational efficiency, creating a knowledge moat. This accumulated know-how is not easily replicated, making it difficult for new companies to match the technological capabilities of incumbents without substantial upfront investment and a long learning curve.

- High R&D Investment: The E&P sector sees significant R&D spending, with major oil and gas companies investing billions annually to improve extraction efficiency and discover new reserves.

- Proprietary Technology: Leading firms possess patented technologies for seismic data processing, drilling optimization, and enhanced oil recovery, which are difficult and expensive for newcomers to license or develop.

- Operational Expertise: Decades of experience in managing complex projects, navigating regulatory environments, and mitigating operational risks provide established companies with a competitive edge that new entrants lack.

Brand Recognition and Scale Economies

Established players like APA Corporation leverage significant brand recognition and deep-rooted relationships with suppliers and customers. This allows them to secure favorable terms and maintain a loyal customer base, which are difficult for newcomers to replicate quickly.

Economies of scale are a major barrier. APA's operational size enables cost efficiencies in purchasing, production, and marketing that new entrants simply cannot match without substantial upfront investment. For instance, in 2024, the energy sector continued to see large capital expenditures, with major players like APA investing billions in infrastructure and exploration, creating a high cost of entry.

The industry's trend towards consolidation further exacerbates this threat. Mergers and acquisitions mean fewer, larger entities dominate the market, increasing the capital and time required for any new competitor to gain a foothold. This consolidation means potential new entrants face even more entrenched incumbents.

- Brand Loyalty: APA's established reputation fosters customer trust and repeat business.

- Economies of Scale: Larger operational volumes lead to lower per-unit costs.

- Supplier Relationships: Long-term partnerships ensure reliable supply chains and better pricing.

- Capital Intensity: The high cost of infrastructure and technology deters smaller, new entrants.

The threat of new entrants in the oil and gas industry, where APA Corporation operates, is significantly mitigated by several robust barriers. These include the immense capital required for exploration, drilling, and infrastructure, as exemplified by APA's projected 2025 upstream capital budget of $2.5 billion to $2.6 billion. Furthermore, stringent regulatory environments, demanding extensive permitting and compliance, add layers of difficulty and cost for any potential new player.

The established players, including APA, benefit from deep-rooted access to proven reserves and extensive infrastructure networks, a significant competitive moat that newcomers struggle to overcome. Acquiring competitive acreage and developing the necessary transportation and processing facilities represent substantial financial and logistical hurdles, with offshore platform costs alone easily exceeding $1 billion in 2024.

Technological complexity and the need for proprietary knowledge also act as strong deterrents. Companies like APA have invested heavily over decades to refine advanced seismic imaging, drilling techniques, and reservoir management, creating a knowledge moat that is difficult and expensive for new entrants to replicate.

Economies of scale, brand recognition, and established supplier relationships further solidify the position of incumbents. The ongoing trend of industry consolidation also means that potential new entrants face an increasingly concentrated market with deeply entrenched competitors.

| Barrier | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for exploration, drilling, and infrastructure. | APA's 2025 projected upstream capital budget: $2.5B - $2.6B. |

| Regulatory Hurdles | Complex permitting, environmental assessments, and operational standards. | Average permit acquisition time for new oil & gas projects in 2024 exceeded 18 months in many developed nations. |

| Infrastructure Access | Established networks of pipelines, processing facilities, and export terminals. | Cost of a new offshore oil platform in 2024: easily over $1 billion. |

| Technological Expertise | Need for advanced seismic imaging, drilling, and reservoir management. | Billions invested by established players in refining hydraulic fracturing and horizontal drilling. |

| Economies of Scale | Cost efficiencies from larger operational volumes. | Major players like APA investing billions in infrastructure and exploration in 2024. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive understanding of competitive pressures.