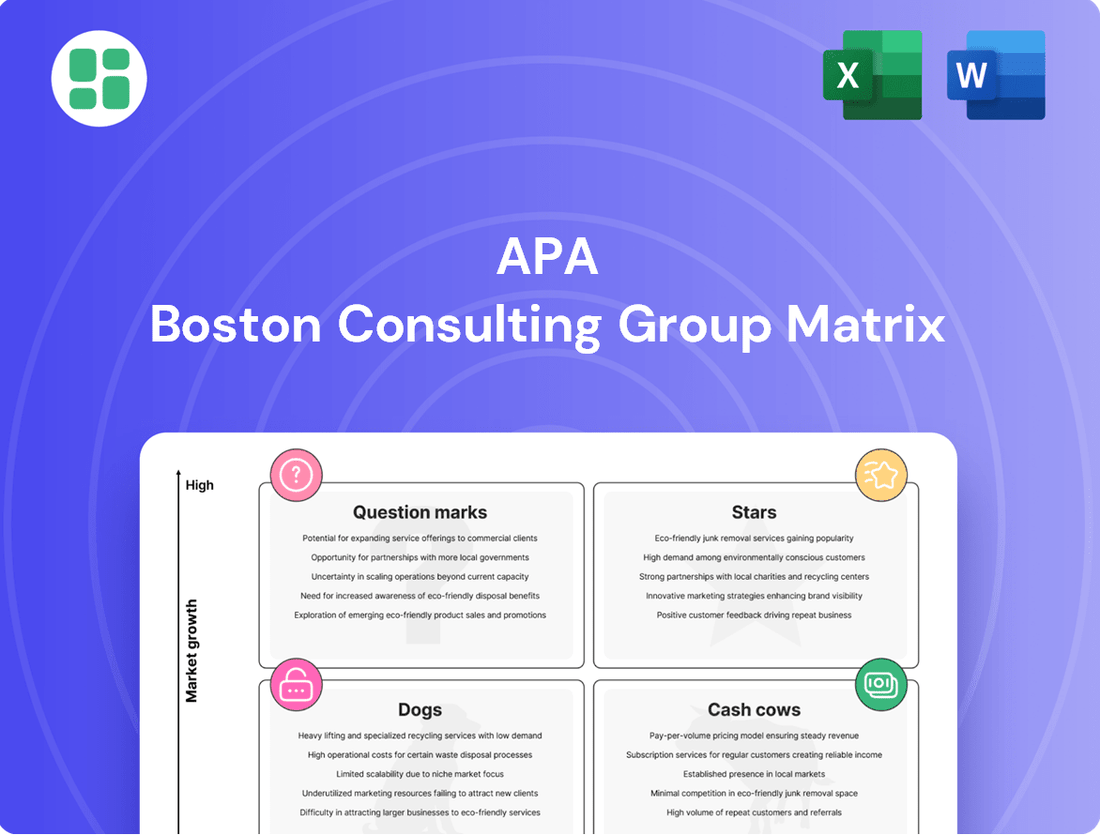

APA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APA Bundle

Unlock the strategic power of the BCG Matrix to understand your product portfolio's performance. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, guiding crucial investment decisions. Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

APA Corporation's acquisition of Callon Petroleum Company significantly bolstered its Permian Basin footprint, especially within the Delaware Basin. This strategic expansion enhances APA's portfolio of attractive, short-cycle development projects, aiming for improved margins and returns in this vital U.S. shale region.

The integration of Callon's assets is projected to boost APA's total Permian production by an estimated 7% in 2025. This growth solidifies APA's position in the Permian, a region experiencing continued strategic importance for energy production.

APA's Egyptian gas appraisal and development programs are showing significant promise, driving an increase in gas-focused drilling activities. This intensified drilling is a direct response to a new gas price agreement in Egypt, which has made gas-focused investment economically comparable to oil drilling.

This favorable pricing environment is expected to fuel substantial growth in Egypt's natural gas production volumes. For APA, this translates into an enhanced market position in a region experiencing escalating demand for natural gas.

APA is showcasing impressive capital efficiency in its Permian Basin drilling activities. The company has managed to lower its rig count substantially, yet it's targeting stable oil production volumes. This operational feat is largely thanks to significant enhancements in drilling speed and effectiveness, evidenced by increased drilled feet per day across both the Midland and Delaware Basins.

These performance improvements directly translate into a more optimized cost structure for APA. By drilling more efficiently, the company can improve its asset performance, which is crucial for boosting profitability on each barrel of oil produced in the highly competitive Permian market.

Future Contribution from Suriname's GranMorgu Project

The GranMorgu Phase 1 project in Suriname Block 58, a partnership with TotalEnergies, has achieved its Final Investment Decision (FID). This marks a significant step towards unlocking substantial future production for APA Corporation.

While 2025 will not see any drilling activities, capital is being deployed for essential long-lead items. This strategic allocation demonstrates a clear commitment to the project's long-term development and future operational readiness.

GranMorgu is positioned as a high-growth potential area, slated to become a new major production hub for APA. It is anticipated to significantly bolster the company's production profile starting from 2028.

- Project Status: GranMorgu Phase 1 (Suriname Block 58) has reached Final Investment Decision (FID).

- 2025 Outlook: No drilling planned, but capital allocated for long-lead items.

- Future Contribution: Expected to establish a new major production hub.

- Production Impact: Significant contribution to APA's production profile from 2028 onwards.

Alaska Exploration Success

APA's strategic focus on exploration, particularly in Alaska, positions it for future growth. The company's Q1 2025 announcement of the Sockeye-2 discovery well in the Brookian play is a significant development. This success, marked by superior rock quality compared to nearby wells, suggests substantial untapped potential in the region.

- Alaska Exploration Focus: APA has directed significant capital towards exploration efforts in Alaska.

- Sockeye-2 Discovery: A second discovery well, Sockeye-2, was announced in Q1 2025.

- Brookian Play Success: The discovery in the Brookian play exhibits improved rock quality over offset analogs.

- Future Potential: This success enhances APA's long-term resource base and market position through new production areas.

Stars, representing high-growth, high-market-share ventures, are crucial for a company's future. In APA's portfolio, the GranMorgu project in Suriname, slated for significant production increases from 2028, embodies this star characteristic. Similarly, the promising exploration results in Alaska, like the Sockeye-2 discovery, highlight potential future stars that require continued investment to maintain their growth trajectory.

| Project/Region | Market Share | Growth Rate | Strategic Importance |

|---|---|---|---|

| GranMorgu (Suriname) | Emerging | High (from 2028) | New major production hub |

| Alaska Exploration (Brookian Play) | Emerging | High Potential | Long-term resource base expansion |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

Clear visualization of business unit potential and resource needs.

Cash Cows

APA's core Permian Basin oil production acts as a classic cash cow. This established region, representing a significant portion of APA's adjusted production, consistently generates substantial free cash flow.

In 2024, APA continued to prioritize optimizing these mature Permian assets. The focus remains on extracting consistent returns and maximizing free cash flow generation, rather than pursuing aggressive expansion in this highly productive market segment.

APA's established Egyptian oil operations are a prime example of a Cash Cow within the BCG framework. These mature fields, with a long history of production, consistently generate substantial cash flow for the company. In 2024, despite a projected modest gross production decline, adjusted volumes were anticipated to see a slight year-over-year increase, a testament to the effectiveness of operational efficiencies and water injection programs.

APA Corporation stands out for its consistent ability to generate robust free cash flow. This indicates a strong operational performance where cash inflows significantly outpace cash outflows, a hallmark of a healthy business.

In 2024, APA reported an impressive $841 million in free cash flow. This substantial cash generation is a direct result of its dominant position in key markets, allowing the company to effectively reinvest in growth opportunities and reward its investors.

The company strategically deploys this strong cash flow to reduce its debt burden, fund future capital expenditures, and crucially, return value to shareholders via dividends and share repurchase programs. This financial flexibility is a key characteristic of a Cash Cow.

Disciplined Capital Allocation

APA's approach to capital allocation for its Cash Cows emphasizes maximizing returns from established, high-performing assets. This strategy is designed to generate consistent cash flow by focusing on operational efficiency and cost optimization rather than aggressive expansion in mature regions.

For 2024, APA's upstream capital budget of approximately $1.7 billion highlights this disciplined approach. A significant portion is directed towards optimizing existing operations, particularly in the Permian Basin and Egypt, to ensure sustained profitability and efficient resource extraction.

- Permian Basin Focus: Continued investment in the Permian aims to enhance production efficiency and reduce lifting costs, thereby boosting the cash flow generated by these assets.

- Egypt Optimization: Efforts in Egypt are centered on maximizing output from existing fields and exploring incremental growth opportunities with minimal capital outlay.

- Mature Asset Management: The strategy deliberately limits new capital expenditures in mature areas to avoid diluting returns and to preserve the strong cash-generating capacity of these Cash Cows.

- Shareholder Returns: The resulting strong cash flow from these optimized assets is then available for shareholder distributions, debt reduction, or reinvestment in other business segments.

Cost Reduction Initiatives

APA is actively implementing significant cost reduction initiatives across its operations, targeting $350 million in sustainable annual savings by the end of 2027.

These efforts, including streamlining business practices and improving operating efficiency, are aimed at enhancing profit margins from existing high market share assets.

The realized savings contribute directly to increased cash flow from its core operations, reinforcing the Cash Cow status of these business segments.

- Targeted Savings: $350 million in annual savings by end of 2027.

- Strategic Focus: Streamlining operations and improving efficiency.

- Impact: Enhanced profit margins and increased cash flow from core assets.

APA's established oil production in the Permian Basin and Egypt are prime examples of its Cash Cows. These mature, high-volume assets consistently generate substantial free cash flow, a key indicator of their strong market position and operational efficiency.

In 2024, APA's strategic focus remained on optimizing these core assets, prioritizing consistent returns over aggressive expansion. The company generated $841 million in free cash flow, a testament to the profitability of these mature operations.

This strong cash generation allows APA to strategically reduce debt, fund necessary capital expenditures, and importantly, return value to shareholders through dividends and buybacks, reinforcing the stability and maturity of these business segments.

| Asset Category | 2024 Free Cash Flow (Millions USD) | Key Strategy |

|---|---|---|

| Permian Basin | N/A (Part of overall FCF) | Optimization, Cost Reduction |

| Egypt | N/A (Part of overall FCF) | Operational Efficiency, Water Injection |

| Overall APA FCF | $841 | Shareholder Returns, Debt Reduction |

Preview = Final Product

APA BCG Matrix

The APA BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive upon completing your purchase. This means you get the fully formatted, analysis-ready content without any watermarks or placeholder text, ensuring immediate usability for your strategic planning needs.

Dogs

APA Corporation's UK North Sea operations are classified as a Dog in the BCG Matrix. The company plans to cease all production by December 31, 2029, significantly earlier than the assets' economic lifespan. This strategic exit is a direct response to an increasingly challenging regulatory environment.

The primary drivers for this decision are unfavorable regulations, specifically tax increases and the costly requirements for new emissions control investments. These factors have rendered the UK North Sea operations unprofitable for APA Corporation. This highlights a critical challenge for companies operating in mature, highly regulated offshore basins.

Reflecting the diminished value and future prospects of these assets, APA Corporation recorded a significant $571 million impairment charge in the third quarter of 2024. This substantial write-down underscores the financial strain and the company's assessment that continued investment is not viable. The impairment signals a clear recognition of the assets' declining economic contribution.

APA Corporation has strategically divested its New Mexico Permian assets for $608 million, signifying a complete exit from this region. These assets, though productive, were classified as non-core and were not prioritized for capital allocation within APA's broader strategic framework. This move aligns with shedding assets that exhibit lower market share or growth potential, thereby optimizing the company's overall performance and capital efficiency.

APA Corporation's divestment of non-core East Texas and Midland Basin royalty properties in 2024 for over $700 million highlights a strategic move within its BCG Matrix analysis. These assets, primarily in the Austin Chalk and Eagle Ford, were characterized by low, non-operated production, signaling they likely fell into the 'Dog' category due to their limited contribution to overall company performance and growth potential.

The sale of these underperforming assets directly addresses the 'Dog' quadrant's characteristics: low market share and low growth. By shedding these properties, APA aimed to optimize its portfolio, freeing up capital and reducing near-term borrowings, which is a common strategy for 'Dogs' to improve financial health.

Underperforming Legacy Assets

Underperforming legacy assets, often referred to as Dogs in the APA BCG Matrix context, represent a crucial area for strategic evaluation. These are typically older producing properties that, while still operational, offer minimal growth prospects and low returns on investment.

These assets often require consistent operational expenditure to maintain, yet their contribution to overall revenue or market share is negligible. For instance, a legacy oil field producing a few hundred barrels per day with high water cut might fall into this category, absorbing resources without significant upside. APA, like many energy companies, continuously assesses these types of assets for potential divestiture or a strategy of minimal investment to preserve capital.

- Low Growth Potential: These assets are unlikely to see significant increases in production or profitability due to their maturity and declining reserves.

- High Operational Expenditure Relative to Returns: The cost to operate and maintain these properties often outweighs the revenue they generate, leading to low or negative profit margins.

- Minimal Market Share: Within their specific geographic or product segments, these legacy assets typically hold a very small market share, limiting their strategic importance.

- Strategic Consideration: Companies like APA evaluate these assets for divestiture to free up capital and management focus for more promising growth areas.

Assets with High Asset Retirement Obligations (AROs)

Certain mature assets, especially those nearing the end of their operational life, can come with substantial asset retirement obligations (AROs). These are the costs associated with decommissioning and restoring a site after its productive use.

While not a direct indicator of low market share, a high ARO on an asset with declining production can effectively turn it into a cash trap. This situation is exemplified by some assets in the UK North Sea, where future liabilities significantly impact current profitability.

These types of assets might only just break even or could even become cash consumers when the future costs of their retirement are factored in. For instance, in 2024, some oil and gas fields with significant decommissioning liabilities struggled to generate positive free cash flow after accounting for these future obligations.

- High AROs are often found in industries like oil and gas, mining, and utilities.

- Decommissioning costs can include dismantling structures, removing hazardous materials, and environmental remediation.

- The timing of ARO recognition and funding is crucial for accurate financial reporting and strategic planning.

- In 2024, regulatory changes in several regions increased the stringency of ARO requirements, impacting companies with older infrastructure.

Dogs in the BCG Matrix represent business units or products with low market share and low growth potential. APA Corporation's divestment of non-core East Texas and Midland Basin royalty properties in 2024 for over $700 million exemplifies this. These assets, characterized by limited contribution and growth, were strategically shed to optimize the portfolio and improve capital efficiency.

The UK North Sea operations, also classified as a Dog, faced a similar fate due to an unfavorable regulatory environment, including tax increases and costly emissions control investments. This led to a significant $571 million impairment charge in Q3 2024, highlighting the economic unviability of continuing operations.

These underperforming assets often incur high operational expenditures relative to their returns and require continuous assessment for divestiture. The presence of substantial asset retirement obligations (AROs) can further diminish their profitability, as seen with some UK North Sea assets where future liabilities impact current cash flow.

APA Corporation's strategy to exit these low-performing segments underscores the importance of managing the 'Dog' quadrant effectively by divesting or minimizing investment to reallocate resources to more promising areas.

| Asset Segment | BCG Classification | 2024 Financial Impact | Strategic Action |

|---|---|---|---|

| UK North Sea Operations | Dog | $571 million impairment charge | Cease production by December 31, 2029 due to regulatory challenges |

| East Texas & Midland Basin Royalties | Dog | Divested for over $700 million | Portfolio optimization, capital reallocation |

| New Mexico Permian Assets | Non-Core (likely Dog characteristics) | Divested for $608 million | Focus on core operations, capital efficiency |

Question Marks

Early-stage exploration ventures, like APA's planned $100 million investment in 2025 for activities including the Sockeye-2 discovery in Alaska, are characterized by their high-growth potential but currently minimal market share. These are classic 'question marks' in the BCG matrix, demanding substantial initial investment with no guarantee of commercial success.

The inherent risk is significant; while a breakthrough discovery could dramatically reshape APA's future production, a failure means the capital invested becomes stranded. For instance, the average success rate for wildcat exploration wells globally hovers around 10-20%, underscoring the speculative nature of these investments.

Unconventional gas plays like Alpine High grapple with significant hurdles stemming from volatile pricing, notably at Waha hubs. These areas boast considerable reserves and production capacity, indicating a strong growth market for natural gas.

However, the unpredictable nature and often depressed realized prices for gas from these plays can severely impact their economic feasibility. This volatility directly affects their capacity to deliver stable returns and expand market presence.

For instance, in early 2024, Waha natural gas prices experienced significant swings, sometimes dipping below $1.00 per MMBtu, a stark contrast to periods of much higher pricing. This price instability makes long-term financial planning and investment decisions particularly challenging for operators in these unconventional basins.

Emerging technologies for emissions reduction, such as direct air capture and green hydrogen production, are crucial for deep decarbonization. While these hold immense potential, their current commercial viability and widespread adoption by oil and gas firms remain limited. For instance, the global carbon capture, utilization, and storage (CCUS) market, projected to reach $50 billion by 2030, still faces significant cost hurdles for many companies.

New Geographic Market Entry Opportunities

APA Corporation might explore entirely new geographic markets for exploration and production, positioning these as potential question marks within the BCG framework. These ventures would demand substantial initial capital outlay and face considerable geological and regulatory hurdles, starting with a minimal market presence.

The allure of these new territories lies in their high-growth potential, should exploration prove successful. However, the inherent uncertainty means that significant investment could yield little return, making them classic question marks requiring careful risk assessment.

- Exploration in frontier basins: APA could investigate opportunities in regions like the Eastern Mediterranean or parts of West Africa, where exploration success rates can be volatile but discoveries can be substantial. For example, the average exploration success rate in frontier basins can range from 10% to 30%, with significant upfront costs for seismic surveys and initial drilling.

- Unconventional resource plays: Entering new geographic areas with established unconventional resource potential, such as certain shale plays outside North America, presents a similar risk-reward profile. These require specialized technology and infrastructure, with initial development costs potentially exceeding $1 billion for a significant project.

- Partnerships for market entry: Collaborating with local companies in emerging markets can mitigate some of the regulatory and geological risks. Such partnerships might involve a shared investment of $500 million to $2 billion for initial exploration blocks.

Pilot Projects for Enhanced Oil Recovery (EOR)

Investing in pilot projects for Enhanced Oil Recovery (EOR) aligns with the question mark category of the BCG matrix, signifying high potential growth but uncertain commercial success. These initiatives, such as advanced water injection techniques, aim to unlock additional reserves from mature fields. For instance, in 2024, the global EOR market was valued at approximately $35 billion, with significant investment flowing into pilot programs to test novel methods.

The inherent uncertainty in the efficacy and economic viability of new EOR techniques at the pilot stage places them in this high-risk, high-reward quadrant. While successful pilots can lead to substantial incremental production, the transition to full-scale implementation often faces technical and financial hurdles.

- Pilot EOR projects represent potential high growth due to their ability to access previously unrecoverable oil.

- The commercial success of these advanced EOR methods is often unproven at the pilot stage, creating uncertainty.

- Investments in EOR pilots are crucial for technological advancement but carry inherent risks.

- In 2024, EOR projects were a focus for mature fields, with a significant portion of the $35 billion global market dedicated to testing new recovery techniques.

Question Marks in the BCG matrix represent business units or products with low market share in high-growth markets. These are often new ventures or emerging technologies that require significant investment to gain traction. Their future is uncertain: they could become stars with substantial growth, or they could fail, consuming resources without generating returns.

For companies like APA Corporation, question marks are often found in early-stage exploration projects in frontier regions or in the development of novel technologies like advanced carbon capture. The success of these ventures hinges on significant capital infusion and the ability to navigate technological and market uncertainties. For instance, APA's $100 million planned investment in 2025 for Alaskan exploration, including Sockeye-2, exemplifies this category, holding high potential but facing inherent exploration risks.

The key challenge with question marks is determining which ones to invest in and which to divest from. A successful transition from a question mark to a star can be highly lucrative, but the risk of failure is substantial. For example, while the global EOR market was around $35 billion in 2024, many pilot EOR projects remain question marks due to unproven efficacy and economic viability.

Navigating these question marks requires careful strategic analysis, often involving partnerships to share risk and capital. For example, entering new markets with exploration potential might involve joint ventures costing $500 million to $2 billion for initial exploration blocks, aiming to mitigate the 10-30% success rate typical in frontier basins.

| Business Area | Market Growth | Market Share | Investment Need | Potential Outcome |

| Frontier Exploration (e.g., Alaska) | High | Low | High | Star or Dog |

| Emerging EOR Technologies | High | Low | Medium to High | Star or Dog |

| New Geographic Market Entry | High | Low | High | Star or Dog |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.