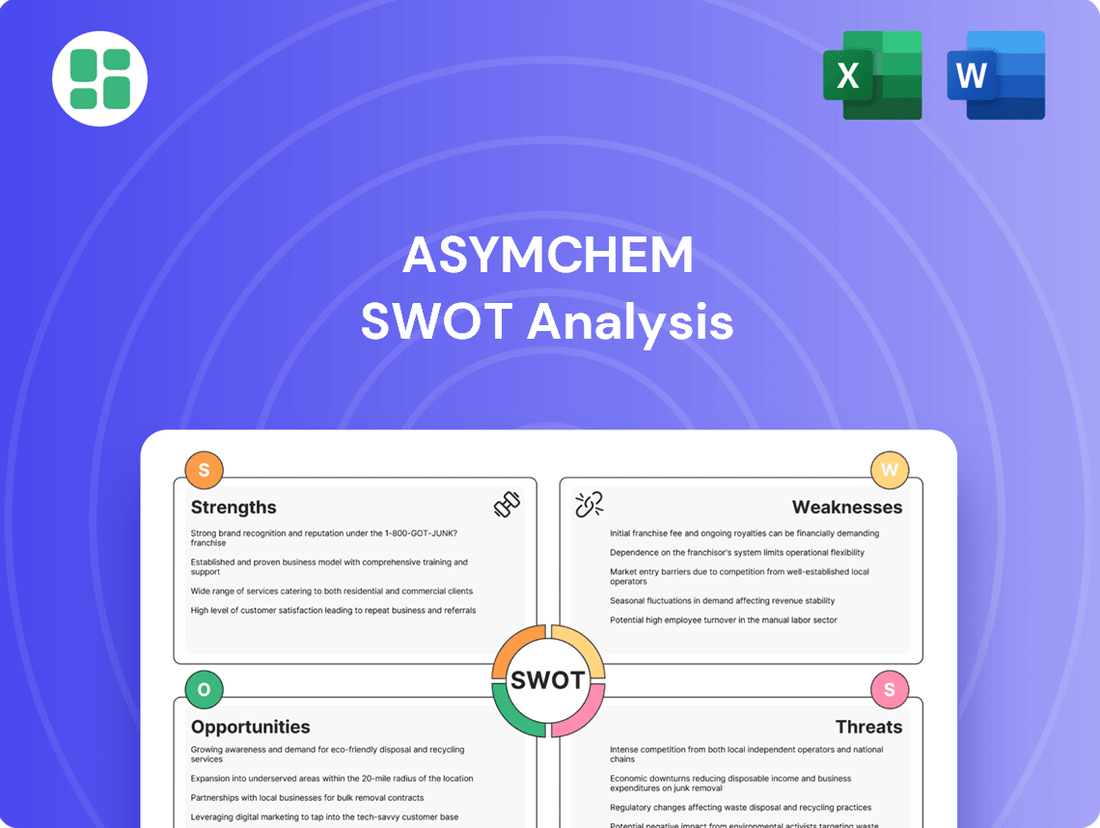

Asymchem SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

Asymchem's strong R&D capabilities and global reach are clear strengths, but understanding the full scope of their market position requires a deeper dive. Our comprehensive SWOT analysis reveals potential vulnerabilities and emerging opportunities that could significantly impact their trajectory.

Want the full story behind Asymchem's competitive advantages, potential threats, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Asymchem's integrated CDMO services are a significant strength, offering a full spectrum of support from early-stage research to large-scale commercial manufacturing. This end-to-end capability, covering both active pharmaceutical ingredients (APIs) and finished drug products, simplifies the complex drug development journey for clients.

This seamless integration across the drug lifecycle, from preclinical development through commercialization, is a key differentiator. For instance, Asymchem's revenue from its integrated services segment saw substantial growth, reflecting the market's demand for such comprehensive solutions. In 2023, Asymchem reported a notable increase in its integrated service offerings, with revenue from this segment contributing significantly to its overall financial performance, underscoring client trust and project pipeline expansion.

Asymchem stands out due to its dedication to advancing and implementing novel manufacturing techniques like flow chemistry, biocatalysis, and synthetic biology. This commitment is backed by significant R&D spending, evidenced by their extensive patent portfolio in these specialized areas.

This strategic investment in advanced technology enables Asymchem to deliver drug manufacturing solutions that are not only more efficient and cost-effective but also environmentally friendly. For instance, their utilization of flow chemistry can lead to a significant reduction in waste and energy consumption compared to traditional batch processing, a key differentiator in the competitive CDMO landscape.

Asymchem's global footprint is a significant strength, with R&D and manufacturing sites strategically located in China, the UK, and the US. The recent inauguration of a European site further solidifies this international presence. This expansive network allows Asymchem to effectively serve a global client base and adapt to diverse market needs.

The company's commitment to regulatory compliance is exceptional, evidenced by over 65 successful inspections from major bodies like the FDA, NMPA, TGA, and MFDS. This robust track record instills confidence in clients and ensures smooth operations across different jurisdictions, a critical factor in the pharmaceutical and biotech industries.

Strong Customer Relationships and Project Pipeline

Asymchem boasts a robust client base, actively engaged in numerous clinical and commercial projects. This deep engagement stems from the company's proven ability to tackle complex challenges with exceptional quality, even under demanding schedules, solidifying enduring client partnerships.

The company's substantial project pipeline is a key strength, featuring 27 projects currently in the New Drug Application (NDA) stage. This, coupled with an expanding backlog of commercial orders, provides a strong foundation for sustained future revenue growth.

- Active Client Base: A large number of ongoing clinical and commercial projects demonstrate strong client engagement.

- Problem-Solving Prowess: Asymchem's success in addressing difficult challenges under tight deadlines fosters loyalty.

- Future Revenue Drivers: 27 NDA-stage projects and a growing commercial order backlog indicate significant future revenue potential.

Expertise in Complex Chemistry and Emerging Modalities

Asymchem’s core strength lies in its profound expertise in intricate chemical synthesis, particularly with highly potent active pharmaceutical ingredients (HPAPIs). This capability is crucial for developing advanced cancer therapies and other specialized medicines.

The company is strategically advancing into cutting-edge therapeutic areas, notably peptide and oligonucleotide synthesis. Asymchem has already made significant strides by establishing automated production lines for peptides, demonstrating a commitment to innovation in these rapidly growing fields.

This specialization in complex modalities, including peptides and oligonucleotides, positions Asymchem to effectively capture the increasing market demand for these advanced drug types. For example, the global oligonucleotide therapeutics market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially, reaching an estimated $35.5 billion by 2030, according to various market research reports covering the 2024-2025 period.

- Deep Expertise: Mastery of complex chemical synthesis, including HPAPIs, peptides, and oligonucleotides.

- Emerging Modalities: Active expansion into peptide and oligonucleotide synthesis with automated production capabilities.

- Market Alignment: Strong positioning to meet the escalating demand for advanced and complex drug development.

Asymchem's integrated CDMO services offer a comprehensive, end-to-end solution for drug development and manufacturing, simplifying the process for clients. This seamless integration across the entire drug lifecycle, from early research to commercialization, is a significant competitive advantage. In 2023, revenue from integrated services showed robust growth, highlighting market demand and project pipeline expansion.

The company's commitment to advanced manufacturing technologies like flow chemistry and biocatalysis, backed by substantial R&D investment and a strong patent portfolio, enhances efficiency and sustainability. Their global operational footprint, with sites in China, the UK, and the US, supported by recent European expansion, allows for effective service to a worldwide clientele.

Asymchem demonstrates exceptional regulatory compliance, with a strong history of successful inspections from major health authorities, fostering client trust. Furthermore, their deep expertise in complex chemical synthesis, particularly with highly potent active pharmaceutical ingredients (HPAPIs), positions them well for specialized medicines. The company is also strategically expanding into high-growth areas like peptide and oligonucleotide synthesis, evidenced by established automated production lines for peptides.

The company's robust project pipeline, featuring 27 projects in the New Drug Application (NDA) stage and a growing backlog of commercial orders, provides a strong foundation for sustained future revenue growth. This, combined with their proven ability to handle complex challenges efficiently, underpins strong client relationships and project success.

| Strength Category | Specific Strength | Key Differentiator/Impact |

|---|---|---|

| Service Integration | End-to-end CDMO services (API & Finished Drug Product) | Simplifies drug development, enhances client trust and project pipeline. |

| Technological Advancement | Expertise in flow chemistry, biocatalysis, synthetic biology | Drives efficiency, cost-effectiveness, and environmental sustainability. |

| Global Presence & Compliance | Strategic global sites (China, UK, US, Europe) & 65+ successful regulatory inspections | Facilitates global client service and ensures market access. |

| Expertise & Market Focus | HPAPI synthesis, peptide & oligonucleotide development | Positions Asymchem to capture demand in advanced therapeutic areas. |

What is included in the product

Analyzes Asymchem’s competitive position through key internal and external factors, detailing its strengths in technology and market opportunities against potential weaknesses and threats.

Simplifies complex strategic analysis by offering a clear, actionable overview of Asymchem's market position and internal capabilities.

Weaknesses

Asymchem experienced a notable downturn in its financial results for the fiscal year ending December 31, 2024. Revenue saw a substantial decrease of 25.40%, and net profit attributable to shareholders plunged by 58.17% when compared to the prior year.

Although the small molecule Contract Development and Manufacturing Organization (CDMO) segment demonstrated growth when large, one-off orders were excluded, the broader financial decline points to significant hurdles in Asymchem's ability to generate consistent revenue and maintain profitability.

Asymchem's reliance on the domestic market presents a significant weakness, as evidenced by its slower-than-anticipated domestic revenue growth in 2024. This slowdown was largely a consequence of a downturn in China's biotech financing environment, highlighting the company's susceptibility to regional economic headwinds and funding volatility within its primary operating territory.

The contract development and manufacturing organization (CDMO) sector is incredibly crowded. Asymchem contends with a wide array of competitors, from highly specialized firms to large, comprehensive service providers. This intense competition can put pressure on pricing and make it harder to win new business.

Capital Intensive Operations and Capacity Ramp-Up Challenges

Asymchem's business model, like other Contract Development and Manufacturing Organizations (CDMOs), is inherently capital intensive. Significant investments are required for state-of-the-art facilities, advanced manufacturing equipment, and robust research and development capabilities. This ongoing need for capital can strain financial resources.

The company is actively expanding its capacity, especially in promising new areas. However, some of these newer segments are currently in a ramp-up phase. During this period, the initial costs associated with bringing new facilities online and achieving full operational efficiency can temporarily depress gross profit margins, impacting overall profitability in the short term.

Effectively managing these substantial capital expenditures and ensuring that newly built capacity is utilized optimally presents a continuous challenge. Asymchem's ability to scale efficiently while controlling costs is crucial for long-term financial health and competitive positioning in the CDMO market.

- Capital Investment: CDMO operations necessitate considerable upfront and ongoing capital for advanced manufacturing technologies and facilities.

- Capacity Ramp-Up Impact: Emerging business segments undergoing capacity expansion may experience initial pressure on gross profit margins due to ramp-up costs.

- Utilization Management: Optimizing the utilization of large-scale, capital-intensive assets is a key operational challenge for maintaining profitability.

Geopolitical and Regulatory Risks (e.g., BIOSECURE Act)

As a Chinese company with a significant global footprint, Asymchem faces inherent risks from geopolitical tensions and evolving regulatory landscapes. The proposed US BIOSECURE Act, while met with industry skepticism, serves as a clear indicator of potential policy shifts that could impact cross-border partnerships and supply chain integrity. This regulatory uncertainty directly affects Asymchem's overseas operations and future growth prospects.

The potential for such legislation to disrupt established business relationships and create barriers to market access presents a notable weakness. For instance, if the BIOSECURE Act were to significantly limit collaborations with US entities, it could directly impact Asymchem's ability to secure contracts and expand its market share in a key region. This highlights the critical need for robust risk mitigation strategies to navigate these complex international dynamics.

Furthermore, the company's reliance on global supply chains makes it vulnerable to trade disputes or sanctions that could arise from geopolitical friction. While Asymchem has demonstrated resilience, the ongoing volatility in international relations creates an environment of persistent uncertainty for its global business model.

- Geopolitical Exposure: Asymchem's Chinese headquarters and global operations place it at the intersection of international political dynamics, creating potential vulnerabilities.

- Regulatory Uncertainty: The BIOSECURE Act exemplifies the risk of new legislation impacting cross-border scientific and commercial collaborations, potentially disrupting Asymchem's business.

- Supply Chain Vulnerability: Global supply chains, essential for Asymchem's operations, are susceptible to disruptions stemming from geopolitical tensions and trade policy changes.

Asymchem's financial performance in 2024 showed a significant decline, with revenue dropping 25.40% and net profit falling 58.17%. This downturn, particularly the slower-than-expected domestic revenue growth, highlights a key weakness: over-reliance on the Chinese market, which is susceptible to local economic downturns like the biotech financing environment issues seen in 2024. The intense competition within the CDMO sector further pressures pricing and new business acquisition.

The capital-intensive nature of CDMO operations requires substantial ongoing investment in advanced facilities and equipment. While Asymchem is expanding capacity, new segments in their ramp-up phase can temporarily depress gross profit margins due to initial operational costs. Effectively managing these large capital expenditures and ensuring optimal utilization of new capacity remains a significant challenge for maintaining profitability and competitive standing.

Asymchem's global operations are exposed to geopolitical risks and evolving regulatory landscapes, exemplified by the potential impact of legislation like the US BIOSECURE Act. Such policy shifts could disrupt international partnerships and supply chain integrity, directly affecting overseas operations and market access. This regulatory uncertainty, coupled with the vulnerability of global supply chains to trade disputes, presents a notable weakness for the company's international business model.

| Weakness | Description | Impact |

| Market Concentration | Heavy reliance on the Chinese domestic market. | Susceptibility to regional economic headwinds and funding volatility. |

| Competitive Landscape | Operating in a crowded CDMO sector with numerous specialized and large competitors. | Pressure on pricing and challenges in securing new contracts. |

| Capital Intensity & Utilization | High capital requirements for facilities and equipment; challenges in optimizing capacity utilization. | Strain on financial resources and potential short-term margin depression during capacity ramp-up. |

| Geopolitical & Regulatory Risk | Exposure to international political tensions and evolving regulations (e.g., BIOSECURE Act). | Potential disruption to cross-border partnerships, supply chains, and market access. |

Full Version Awaits

Asymchem SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Asymchem SWOT analysis, ensuring you know exactly what you're getting. Unlock the complete, in-depth report after your purchase.

Opportunities

The global contract development and manufacturing organization (CDMO) market is booming, anticipated to reach approximately $250 billion by 2027, a significant increase from its 2022 valuation. This expansion is fueled by pharmaceutical and biotech firms strategically outsourcing research, development, and manufacturing to leverage cost savings, enhance scalability, and tap into specialized capabilities. Asymchem is well-positioned to capitalize on this robust trend, which is expected to persist and provide substantial growth opportunities throughout the next decade.

The market for cell and gene therapies, along with novel drug classes like GLP-1 receptor agonists and antibody-drug conjugates (ADCs), is experiencing significant growth, creating a substantial opportunity for Contract Development and Manufacturing Organizations (CDMOs). Asymchem is strategically positioned to capitalize on this trend through its continued investment in cutting-edge manufacturing technologies.

Specifically, Asymchem's commitment to advanced capabilities such as synthetic biology and automated peptide production lines directly addresses the increasing demand in these high-growth therapeutic areas. This proactive approach allows them to offer specialized services for complex modalities, potentially capturing a larger share of this expanding market.

Asymchem is strategically expanding its global footprint, with a new manufacturing facility in Europe and ambitions to enter additional international markets. This move is crucial for tapping into new customer bases and diversifying its operational risks.

Strategic partnerships and acquisitions are key to bolstering Asymchem's capabilities and market presence. For instance, its prior investment in Snapdragon Chemistry aimed to integrate advanced technologies, particularly relevant for penetrating markets like the US and Europe, even with past regulatory challenges.

Leveraging AI and Digital Transformation for Efficiency

The Contract Development and Manufacturing Organization (CDMO) sector is rapidly embracing artificial intelligence and digital tools to boost efficiency. This includes predictive maintenance, enhanced quality control, and building more resilient supply chains. Asymchem's commitment to this trend is evident in its STAR system for protein design and the ongoing integration of automation across its manufacturing processes. This strategic focus presents a significant opportunity to further streamline operations and achieve cost reductions through continued digital transformation.

By leveraging AI and digital solutions, Asymchem can unlock substantial operational efficiencies. For instance, AI-driven predictive maintenance can minimize downtime, a critical factor in the pharmaceutical manufacturing timeline. Furthermore, advanced digital quality control systems can ensure higher product consistency and reduce batch failures, directly impacting profitability. The company's existing investments in platforms like STAR position it well to capitalize on these advancements.

- AI-driven process optimization: Asymchem can further enhance its STAR system for more sophisticated predictive modeling in drug development and manufacturing.

- Automation in production: Expanding automation beyond current integrations can lead to significant reductions in labor costs and improved throughput.

- Digital supply chain resilience: Implementing advanced digital tracking and analytics can create a more agile and robust supply chain, mitigating risks.

- Data-driven decision making: Utilizing AI to analyze vast datasets from R&D and manufacturing can lead to faster, more informed strategic decisions.

Increased Focus on Green Chemistry and Sustainability

The global push towards environmentally sound practices presents a significant opportunity for Asymchem. There's a clear industry demand for sustainable manufacturing, and Asymchem's dedication to green chemistry, exemplified by its continuous flow and biocatalysis technologies, directly addresses this. This strategic alignment is crucial for attracting clients who prioritize environmental responsibility and for bolstering Asymchem's corporate image. For instance, by 2025, the global green chemistry market is projected to reach over $100 billion, highlighting the immense growth potential.

Asymchem's proactive stance on reducing its carbon footprint further solidifies its position in this evolving landscape. This commitment can translate into tangible benefits, such as enhanced brand reputation and a stronger appeal to a growing segment of environmentally conscious customers. In 2023, Asymchem reported a 15% reduction in waste generation across its key facilities, a testament to its sustainability efforts.

This focus on sustainability can open doors to new partnerships and business ventures. Companies are increasingly seeking CDMOs that can demonstrate a commitment to ESG (Environmental, Social, and Governance) principles. Asymchem's investments in greener processes are therefore not just about compliance, but about strategic differentiation and future-proofing its business model.

Asymchem is well-positioned to benefit from the expanding global CDMO market, projected to exceed $250 billion by 2027, by leveraging its advanced manufacturing capabilities in high-growth areas like cell and gene therapies and novel drug classes. The company's strategic global expansion, including a new European facility, aims to capture new customer bases and diversify operational risks, further enhancing its market reach.

Threats

Global economic uncertainty and a tightening biotech funding landscape present a significant threat to Asymchem. Many of its clients are early-stage biotech firms that rely heavily on external investment for their research and development pipelines.

A slowdown in venture capital and other forms of financing for drug development, which was evident in the biotech sector throughout 2024, directly translates to fewer new projects and potential delays for Asymchem. This can curb revenue growth and impact the company's ability to secure new, long-term contracts.

The contract development and manufacturing organization (CDMO) sector is intensely competitive, and Asymchem faces significant pressure from rivals also vying for market share. This environment, combined with a global push from governments and major pharmaceutical buyers to reduce healthcare costs, directly translates into pricing pressure for CDMO services. For instance, in 2024, the pharmaceutical industry continued its focus on supply chain optimization and cost containment, impacting pricing negotiations across the board.

Global supply chains remain a significant vulnerability, with ongoing geopolitical tensions and the lingering effects of past disruptions, such as the semiconductor shortage impacting various industries, continuing to pose risks. Asymchem's reliance on international sourcing for key raw materials and specialized equipment means it's not immune to these global pressures, which can lead to unexpected delays and increased operational expenses.

For instance, the ongoing conflict in Eastern Europe and trade disputes in Asia have demonstrated how quickly supply routes can be impacted, directly affecting the availability and cost of critical components. While Asymchem actively works to diversify its supplier base and build inventory, its exposure to these external factors could still affect its ability to meet project timelines and client delivery schedules in 2024 and 2025.

Rapid Technological Advancements and Need for Continuous Investment

The pharmaceutical and biotech sectors are defined by incredibly fast technological shifts. Asymchem faces the constant challenge of investing significant resources into research and development, as well as adopting new technologies, just to stay competitive. For instance, in 2023, the global pharmaceutical R&D spending was estimated to be over $240 billion, highlighting the intense investment required.

Failing to keep pace with these rapid advancements or to successfully integrate them into its operations could result in Asymchem becoming technologically outdated, thereby eroding its competitive advantage in the market. This necessitates a proactive approach to innovation and technology adoption.

- Technological Obsolescence: Risk of existing processes and capabilities becoming outdated.

- R&D Investment Strain: Continuous high expenditure required to maintain a competitive edge.

- Integration Challenges: Difficulty in effectively implementing and scaling new technologies.

- Competitive Disadvantage: Potential loss of market share if rivals adopt innovations faster.

Intellectual Property Risks and Data Security Concerns

As a Contract Development and Manufacturing Organization (CDMO), Asymchem's core business involves handling highly sensitive drug development information and proprietary manufacturing processes for a diverse client base. This inherently exposes the company to significant intellectual property (IP) risks and data security concerns. A breach or unauthorized disclosure of this confidential client data could result in severe reputational damage, substantial legal liabilities, and ultimately, a loss of valuable business relationships.

The company acknowledges this threat, as evidenced by its own stated service offerings that include IP protection for its clients, underscoring the critical nature of these risks in the pharmaceutical services sector. The global cybersecurity market, which directly relates to data security, was projected to reach over $270 billion by the end of 2024, highlighting the scale of investment and the pervasive nature of these threats across industries.

- Reputational Damage: Loss of client trust due to IP breaches can be irreversible.

- Legal Liabilities: Significant financial penalties and lawsuits can arise from IP infringement.

- Loss of Business: Clients may withdraw their projects if data security is compromised.

- Competitive Disadvantage: Unauthorized access to proprietary processes can benefit competitors.

The biotech funding environment remains a considerable threat, with early-stage clients heavily reliant on external investment. A slowdown in venture capital, observed throughout 2024, directly impacts Asymchem by reducing new projects and potentially delaying existing ones, which can curb revenue growth.

Intense competition within the CDMO sector, coupled with global efforts to lower healthcare costs, translates into significant pricing pressure. The pharmaceutical industry's continued focus on supply chain optimization and cost containment in 2024 means Asymchem faces tougher negotiations.

Global supply chain disruptions, exacerbated by geopolitical tensions, pose a risk to Asymchem's operations. Reliance on international sourcing for materials means unexpected delays and increased costs are possible, impacting delivery schedules.

Rapid technological shifts in pharma necessitate continuous, substantial R&D investment to maintain competitiveness. Failure to adopt new technologies quickly could lead to obsolescence and a loss of market advantage, a challenge underscored by the over $240 billion estimated global pharmaceutical R&D spending in 2023.

Intellectual property and data security are critical risks for Asymchem, given the sensitive client information handled. A breach could lead to severe reputational damage, legal liabilities, and loss of business, especially as the global cybersecurity market approached $270 billion by the end of 2024.

| Threat Category | Specific Risk | Impact on Asymchem | 2024/2025 Relevance |

| Economic & Funding | Biotech Funding Slowdown | Reduced project pipeline, slower revenue growth | VC funding constraints impacting early-stage clients |

| Competitive Landscape | Pricing Pressure | Lower profit margins, tougher contract negotiations | Pharma cost containment efforts |

| Operational | Supply Chain Disruptions | Project delays, increased operational costs | Geopolitical tensions affecting global logistics |

| Technological | Obsolescence & R&D Strain | Loss of competitive edge, increased investment burden | Rapid pace of innovation in pharmaceuticals |

| Security | IP & Data Breach | Reputational damage, legal liabilities, client loss | High value of sensitive client data and processes |

SWOT Analysis Data Sources

This Asymchem SWOT analysis is built upon a robust foundation of diverse data sources, including detailed financial reports, comprehensive market intelligence, and expert industry analysis. These credible inputs ensure a thorough and accurate assessment of the company's strategic position.