Asymchem PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

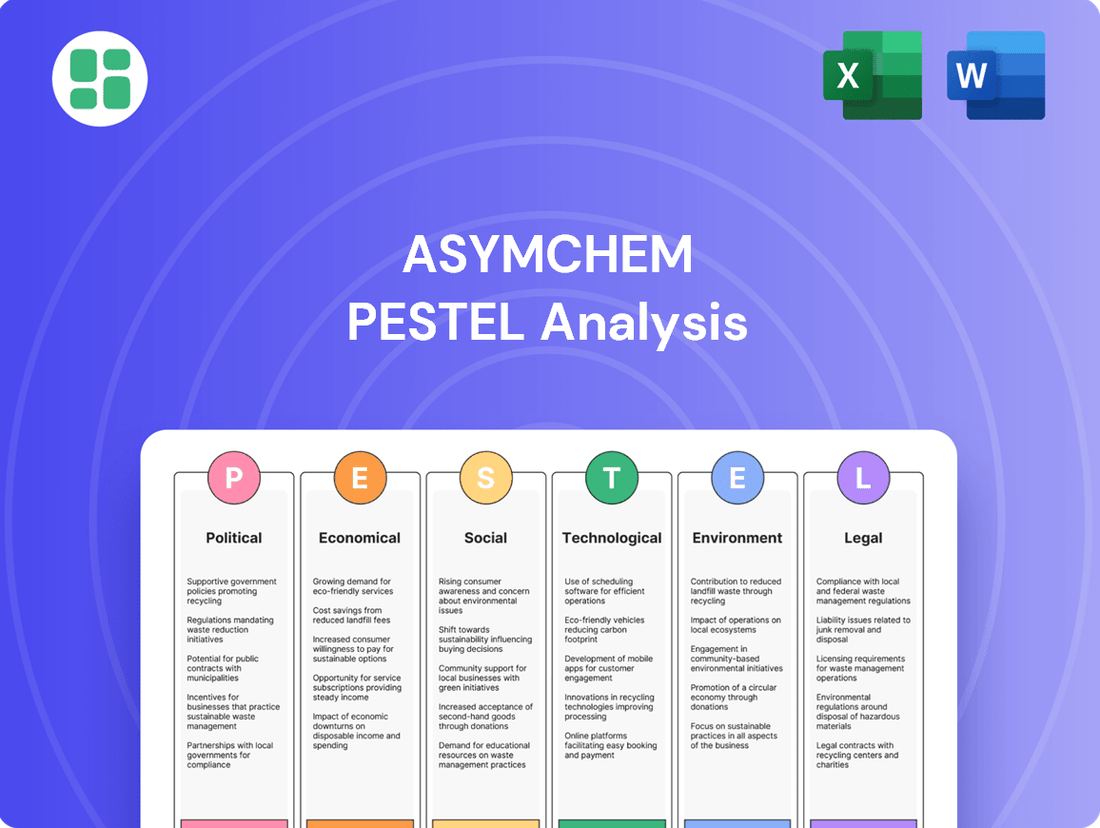

Unlock Asymchem's strategic landscape with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that are shaping its operations and future growth. This in-depth report provides actionable intelligence for investors and strategists. Download the full version now to gain a critical competitive edge.

Political factors

Government healthcare policies significantly shape the landscape for contract development and manufacturing organizations (CDMOs) like Asymchem. For instance, in 2024, many governments globally are focused on controlling healthcare costs, which can translate into pressure on drug pricing. This might lead pharmaceutical companies to seek more cost-effective development and manufacturing solutions from CDMOs.

Furthermore, government incentives for research and development in areas like oncology or rare diseases can directly boost demand for specialized CDMO services. In the US, the Inflation Reduction Act of 2022, which allows Medicare to negotiate drug prices, is a prime example of a policy that could influence client spending on drug development and manufacturing in the coming years, potentially impacting Asymchem's service demand.

Conversely, stringent regulations on drug manufacturing quality or increased taxes on pharmaceutical profits could create headwinds. Asymchem's ability to navigate these evolving policy environments, particularly regarding drug pricing and R&D support, will be crucial for its growth trajectory through 2025.

The stability of regulatory bodies like the FDA, EMA, and NMPA is paramount for Contract Development and Manufacturing Organizations (CDMOs) such as Asymchem. Predictable regulations streamline drug development and manufacturing, reducing project timelines and costs for both Asymchem and its pharmaceutical clients.

In 2024, the pharmaceutical industry continues to navigate evolving regulatory expectations. For instance, the FDA's increased focus on supply chain integrity and advanced manufacturing technologies, such as continuous manufacturing, presents both opportunities and challenges for CDMOs. Asymchem’s investment in these areas in 2023, aiming to meet these advanced standards, positions them to benefit from a stable regulatory environment, but significant shifts could impact their operational efficiency and client project timelines.

Geopolitical shifts and evolving trade policies, including tariffs, significantly impact the global supply chains essential for CDMOs like Asymchem. For instance, the US-China trade tensions have led to increased scrutiny and potential disruptions in sourcing raw materials and distributing finished products, directly affecting operational costs and market access. Asymchem's ability to manage these trade dynamics, including navigating import/export regulations and potential retaliatory tariffs, is crucial for maintaining cost-effectiveness and client relationships in 2024 and beyond.

Intellectual Property Protection

The strength and enforcement of intellectual property (IP) laws are critical for pharmaceutical companies, Asymchem's clients, to invest in research and development. Robust IP protection safeguards their innovations, encouraging them to entrust sensitive drug substance and product development to CDMOs like Asymchem. For instance, in 2024, global pharmaceutical R&D spending was projected to exceed $250 billion, a figure heavily reliant on secure IP.

Weak IP regimes in certain jurisdictions can deter clients from outsourcing vital development work, impacting Asymchem's business pipeline. Asymchem operates globally, and differing IP enforcement levels across regions, such as the US, Europe, and China, directly influence client confidence and project viability. A 2024 report indicated that countries with stronger IP protections saw, on average, 15% higher foreign direct investment in their life sciences sectors.

- Global IP Landscape: Asymchem must navigate varying IP protection strengths across key markets, impacting client decisions on outsourcing.

- R&D Investment Incentive: Strong IP laws encourage clients to invest heavily in novel drug development, benefiting CDMOs.

- Risk Mitigation: Weak IP enforcement poses a significant risk, potentially deterring clients from sharing proprietary information and processes.

Biosecurity and Pandemic Preparedness Initiatives

Heightened global biosecurity concerns and government-led pandemic preparedness initiatives are increasingly shaping the pharmaceutical and biotechnology landscapes. These efforts directly impact contract development and manufacturing organizations (CDMOs) like Asymchem.

Increased public funding for vaccine and therapeutic development, coupled with strategic stockpiling by governments, presents significant growth opportunities. For instance, the US government's Project NextGen, launched in 2023 with an initial $500 million investment, aims to accelerate the development of next-generation COVID-19 vaccines and therapeutics, potentially benefiting CDMOs involved in manufacturing these critical supplies. This surge in demand for rapid manufacturing scale-up and emergency response capabilities can translate into substantial new contracts for companies like Asymchem.

Furthermore, these initiatives underscore the strategic imperative for robust domestic manufacturing capabilities. Asymchem's existing footprint and capacity for rapid scale-up position it favorably to capitalize on this trend, supporting national health security objectives and securing long-term partnerships.

- Increased Government Funding: Global governments are channeling billions into biosecurity and pandemic preparedness, as seen with initiatives like the US Project NextGen.

- CDMO Opportunity: This funding creates demand for CDMOs capable of rapid manufacturing scale-up for vaccines and therapeutics.

- Strategic Importance of Domestic Manufacturing: The focus on biosecurity highlights the value of onshore production capabilities for national health security.

- Asymchem's Position: Asymchem's established manufacturing capacity and expertise are well-suited to meet these evolving demands.

Government policies on drug pricing and R&D incentives directly influence demand for CDMO services. For example, cost-containment measures in 2024 may push pharma companies to seek more efficient manufacturing partners like Asymchem.

Regulatory stability from bodies like the FDA and EMA is crucial for predictable project timelines and costs. Asymchem's investments in advanced manufacturing in 2023 position it to meet evolving FDA expectations on supply chain integrity.

Geopolitical shifts and trade policies impact global supply chains, affecting Asymchem's sourcing and distribution costs. Navigating US-China trade tensions remains a key challenge for operational efficiency.

Intellectual property (IP) protection is vital, as strong IP regimes encourage significant R&D investment, projected to exceed $250 billion globally in 2024, benefiting CDMOs like Asymchem.

What is included in the product

This Asymchem PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, making complex external factors easily digestible for strategic discussions.

Economic factors

Global biopharmaceutical R&D spending is a critical economic driver for Contract Development and Manufacturing Organizations (CDMOs) like Asymchem. In 2024, projections indicated continued robust investment, with the global pharmaceutical R&D market expected to reach over $240 billion, a significant increase from previous years.

This high level of investment directly translates into demand for specialized CDMO services, as companies increasingly outsource complex development and manufacturing processes. However, economic headwinds, such as inflation and potential recessions, could lead some firms to re-evaluate R&D budgets, potentially dampening project pipelines for CDMOs.

Conversely, a healthy economic climate with strong venture capital funding and government incentives for innovation fuels the biopharmaceutical sector's growth. For instance, the U.S. government's continued support for biomedical research, including initiatives announced in 2024, bolsters the overall R&D environment, benefiting companies like Asymchem.

Rising inflation presents a significant challenge for Asymchem, directly impacting its operational expenses. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with inflation figures hovering around 3.1% in early 2024, a slight uptick from previous months, indicating persistent price pressures across various sectors. This surge in inflation translates to higher costs for essential inputs like raw materials, energy, and skilled labor, all critical for Asymchem's drug substance and product manufacturing processes.

Managing these escalating costs is paramount for Asymchem to sustain its profitability and offer competitive pricing for its contract development and manufacturing organization (CDMO) services. The company must implement strategies to mitigate the impact of these rising expenses, potentially through long-term supplier contracts or optimizing energy consumption. Furthermore, inflationary pressures can worsen existing supply chain disruptions, potentially delaying project timelines and impacting overall operational efficiency.

The biotech and pharmaceutical sectors rely heavily on robust capital access. In 2024, venture capital funding for life sciences remained a critical driver, though it saw some recalibration compared to peak years. For instance, while specific figures for Q4 2024 are still emerging, the overall trend for the year indicated continued, albeit more selective, investment in promising early-stage and mid-stage companies.

Asymchem, as a contract development and manufacturing organization (CDMO), directly benefits from a healthy investment climate in life sciences. A strong flow of venture capital and public market investments into biotech and pharma translates into more clients seeking Asymchem's services for drug development and manufacturing. For example, the success of IPOs and follow-on offerings by biotech firms in 2024 directly impacts the pipeline of potential projects for CDMOs like Asymchem.

Conversely, a downturn in capital availability can create headwinds. If funding for drug development projects dries up, clients may delay or cancel crucial manufacturing contracts, impacting Asymchem's revenue and project pipeline. This was a concern in early 2024 as interest rate hikes and economic uncertainty led some investors to become more cautious with capital deployment in the sector.

Currency Exchange Rate Fluctuations

As a global Contract Development and Manufacturing Organization (CDMO), Asymchem's operations are significantly influenced by currency exchange rate fluctuations. Dealing with international clients and suppliers means that the value of transactions can change considerably based on currency movements. For instance, a strengthening US Dollar against, say, the Euro could make Asymchem's services more expensive for European clients, potentially impacting demand.

These shifts directly affect Asymchem's financial performance. The cost of raw materials or specialized equipment imported from countries with a stronger currency can rise, squeezing profit margins. Conversely, revenue generated from contracts denominated in weaker currencies might translate into less value when converted back to Asymchem's reporting currency. For example, if Asymchem has significant contracts in China and the Yuan weakens against the Dollar, the reported revenue from those contracts would decrease.

To manage this inherent risk, Asymchem likely employs various hedging strategies. These can include forward contracts or currency options to lock in exchange rates for future transactions, thereby providing greater predictability in costs and revenues. The company's ability to effectively manage currency volatility is crucial for maintaining stable financial results in a globalized market.

- Impact on Revenue: A weaker local currency for international clients can lead to lower revenue for Asymchem when converted to its reporting currency.

- Cost of Goods Sold: Fluctuations can increase the cost of imported raw materials and equipment, impacting profitability.

- Hedging Strategies: Asymchem likely utilizes financial instruments to mitigate currency risks, aiming for predictable financial outcomes.

- Competitive Pricing: Exchange rates can affect the competitiveness of Asymchem's pricing in different international markets.

Competition in the CDMO Market

The contract development and manufacturing organization (CDMO) market is intensely competitive, featuring a multitude of companies actively seeking client agreements. This dynamic landscape directly impacts Asymchem by creating significant pricing pressures and fostering market consolidation. The potential rise of new, cost-effective competitors further challenges established players.

In 2024, the global CDMO market was valued at approximately $210 billion, with projections indicating continued growth. However, this expansion is accompanied by heightened competition, forcing companies like Asymchem to focus on unique selling propositions. Differentiation through specialized technological expertise, stringent quality control, and comprehensive, end-to-end service offerings are vital for maintaining and growing market share.

- Intensifying Competition: The CDMO sector is crowded, with many firms competing for contracts, leading to potential margin compression.

- Pricing Pressures: Increased competition often results in downward pressure on pricing, impacting profitability for all market participants.

- Emergence of New Entrants: Low-cost competitors, particularly from emerging markets, are entering the space, adding another layer of competitive challenge.

- Strategic Differentiation: Asymchem must emphasize its unique capabilities, such as advanced biologics manufacturing or specialized small molecule synthesis, to stand out.

Global biopharmaceutical R&D spending remains a key economic driver for CDMOs like Asymchem. Projections for 2024 indicated continued robust investment, with the global pharmaceutical R&D market expected to exceed $240 billion, fueling demand for specialized services. However, economic uncertainties such as inflation and potential recessions could lead to budget re-evaluations by clients, impacting project pipelines.

Rising inflation directly impacts Asymchem's operational costs, with U.S. CPI hovering around 3.1% in early 2024, increasing expenses for raw materials, energy, and labor. Managing these costs is crucial for maintaining profitability and competitive pricing. Furthermore, inflation can exacerbate supply chain disruptions, potentially delaying projects.

Access to capital is vital for the biotech and pharma sectors. While venture capital funding for life sciences in 2024 saw some recalibration, it remained a critical driver, with continued, albeit more selective, investment in promising companies. Asymchem benefits from this healthy investment climate, as it translates into more clients seeking its development and manufacturing services.

Currency exchange rate fluctuations significantly influence Asymchem's global operations. A strengthening U.S. Dollar can make its services more expensive for European clients, while revenue from contracts in weaker currencies may translate to less value. For instance, a weaker Yuan against the Dollar could decrease reported revenue from Chinese contracts.

| Economic Factor | Impact on Asymchem | 2024 Data/Trend |

| R&D Spending | Drives demand for CDMO services | Global pharma R&D market projected >$240 billion |

| Inflation | Increases operational costs (materials, energy, labor) | U.S. CPI ~3.1% in early 2024 |

| Capital Availability | Influences client investment in drug development | VC funding for life sciences remained critical, though more selective |

| Currency Exchange Rates | Affects revenue and cost of imported goods | USD strength can impact European client pricing; Yuan weakness affects China revenue |

Same Document Delivered

Asymchem PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Asymchem PESTLE analysis covers all critical external factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to the detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences on Asymchem.

The content and structure shown in the preview is the same document you’ll download after payment. This PESTLE analysis provides actionable insights for strategic planning and risk assessment related to Asymchem.

Sociological factors

The world's population is getting older. By 2050, the United Nations projects that one in six people globally will be over 65, up from one in 11 in 2015. This demographic shift directly correlates with a rise in chronic diseases, such as cardiovascular conditions, diabetes, and cancer, which are more prevalent in older age groups. This trend fuels a continuous demand for pharmaceutical treatments and, consequently, for the drug development and manufacturing services that companies like Asymchem provide.

Asymchem, as a Contract Development and Manufacturing Organization (CDMO), is well-positioned to capitalize on this expanding market. The sustained need for new and existing therapies to manage age-related illnesses creates a larger pool of potential clients and projects. For instance, the global chronic disease management market was valued at over $1.5 trillion in 2023 and is projected to grow significantly, offering a substantial opportunity for CDMOs supporting these vital drug pipelines.

Growing health awareness is a significant driver for the pharmaceutical industry. In 2024, global healthcare spending is projected to reach over $11.5 trillion, reflecting a societal emphasis on wellness and disease management. This heightened public focus directly translates into increased demand for innovative treatments and therapies.

As patients become more informed and empowered, their expectations for effective and cutting-edge medical solutions are rising. This trend is particularly evident in areas like oncology and rare diseases, where patient advocacy groups actively campaign for new drug development. For instance, the number of clinical trials for novel cancer therapies continues to expand year-over-year.

This societal shift compels biopharmaceutical companies to significantly invest in research and development for novel therapies. Consequently, there's a burgeoning demand for specialized Contract Development and Manufacturing Organizations (CDMOs) like Asymchem, capable of supporting the complex development and manufacturing processes required for these advanced treatments.

Global lifestyle shifts, including changes in diet and activity, are driving a rise in chronic conditions like diabetes and heart disease. For instance, the World Health Organization reported in 2023 that non-communicable diseases, largely driven by lifestyle, account for 74% of all deaths globally. This trend necessitates pharmaceutical companies, and by extension CDMOs like Asymchem, to focus on developing treatments for these prevalent conditions, impacting their R&D and manufacturing priorities.

Urbanization and sedentary lifestyles are contributing to an increase in metabolic disorders and certain cancers. By 2050, it's projected that 68% of the world's population will live in urban areas, a significant increase from 56% in 2021, according to UN data. This demographic shift creates a growing market for pharmaceuticals addressing these lifestyle-related diseases, requiring CDMOs to have flexible manufacturing capabilities for a wider range of therapeutic agents.

The emergence of new infectious diseases, such as COVID-19, has underscored the need for rapid vaccine and therapeutic development. In 2024, global health spending is expected to exceed $10 trillion, with a significant portion allocated to infectious disease preparedness and response. This volatile landscape presents both challenges and opportunities for CDMOs to pivot and support novel drug discovery and large-scale production for emerging health threats.

Public Perception of Pharmaceutical Industry

Public trust in the pharmaceutical sector significantly shapes policy and market dynamics. For instance, a 2024 Gallup poll indicated that while trust in science remains relatively high, trust in specific pharmaceutical companies can fluctuate based on news regarding drug pricing and research ethics. Negative sentiment, such as concerns over high drug costs, can translate into greater regulatory oversight and public pressure, impacting the entire industry, including Contract Development and Manufacturing Organizations (CDMOs) like Asymchem.

CDMOs, though not directly consumer-facing, are indirectly affected by the overall public perception of the pharmaceutical industry. A positive industry image, often fostered by breakthroughs in medicine and innovation, encourages investment and attracts skilled professionals. Conversely, widespread distrust can create headwinds, making it harder for companies across the pharmaceutical value chain to operate smoothly. In 2024, reports showed increased legislative interest in drug pricing controls, a direct response to public concern, which could indirectly affect the cost pressures faced by CDMOs.

- Public Trust Fluctuations: A 2024 Gallup survey highlighted that while trust in science generally remains robust, public confidence in individual pharmaceutical companies can vary significantly based on media coverage of pricing and ethical conduct.

- Impact of Negative Perceptions: Concerns over high drug prices and alleged unethical practices can lead to heightened regulatory scrutiny and increased public pressure, potentially influencing policy decisions that affect the entire pharmaceutical ecosystem.

- CDMOs' Indirect Benefit: Asymchem, as a CDMO, benefits from a generally positive industry perception that supports innovation and investment, even though they are not directly involved in drug pricing decisions.

- Talent Acquisition and Investment: A strong public image for the pharmaceutical industry can attract top talent and encourage investment, which indirectly supports CDMOs by ensuring a healthy pipeline of projects and skilled workforce.

Workforce Demographics and Talent Availability

The availability of a skilled workforce in science, engineering, and manufacturing is paramount for Asymchem's success. Educational trends and growing interest in STEM fields, particularly in regions where Asymchem operates, are positive indicators for talent acquisition. For instance, in 2023, China saw a significant increase in STEM graduates, with over 10 million students completing STEM-related degrees, a trend that is projected to continue into 2024 and 2025.

Demographic shifts in the labor pool, however, present both opportunities and challenges. An aging workforce in some developed nations might create a gap, while younger demographics in emerging economies offer a potential talent pipeline. Asymchem's ability to attract and retain specialized professionals, such as process chemists and bioengineers, will be crucial, as a shortage in these areas could drive up labor costs and potentially hinder operational expansion.

Key considerations for Asymchem include:

- Talent Pool Growth: Monitoring the growth rate of STEM graduates globally and in key operational regions.

- Skill Specialization: Assessing the availability of highly specialized talent in areas like synthetic chemistry and biopharmaceutical manufacturing.

- Labor Cost Trends: Analyzing wage inflation for skilled scientific and manufacturing roles.

- Retention Strategies: Implementing competitive compensation and development programs to retain key personnel.

Societal trends significantly influence the pharmaceutical landscape, directly impacting CDMOs like Asymchem. An aging global population, projected to see one in six people over 65 by 2050, drives demand for treatments for chronic diseases, a market valued at over $1.5 trillion in 2023. Increased health awareness, reflected in over $11.5 trillion in global healthcare spending anticipated for 2024, further fuels the need for innovative therapies. Lifestyle changes, contributing to a 74% global mortality rate from non-communicable diseases in 2023, also necessitate a focus on treatments for these conditions.

Public trust in the pharmaceutical industry plays a crucial role, with concerns over drug pricing potentially leading to increased regulatory scrutiny. For instance, legislative interest in drug pricing controls surged in 2024 due to public sentiment. This can indirectly affect CDMOs through cost pressures. Conversely, a positive industry image fosters investment and attracts talent, vital for companies like Asymchem.

The availability of a skilled workforce is critical, with regions like China producing over 10 million STEM graduates in 2023, a trend expected to continue. Asymchem must focus on attracting and retaining specialized talent, such as process chemists, to manage potential labor cost increases and support operational growth.

Technological factors

Technological progress is dramatically speeding up how we find and create new medicines. Think about artificial intelligence helping to sift through vast amounts of data to pinpoint potential drug candidates, or advanced gene sequencing that unlocks new therapeutic pathways. These breakthroughs are making drug discovery quicker and more efficient than ever before.

Companies like Asymchem, which help other pharmaceutical firms develop drugs, need to embrace these new technologies. They must invest in areas like AI, genomics, and high-throughput screening to keep up with clients working on more complex drugs, including biologics. For example, the global AI in drug discovery market was valued at approximately $1.1 billion in 2023 and is projected to grow significantly, highlighting the need for CDMOs to integrate these capabilities.

To remain competitive, contract development and manufacturing organizations (CDMOs) must continuously update their expertise and infrastructure. This means not only adopting new tools but also fostering the skills needed to leverage them effectively, enabling them to offer integrated solutions for the next generation of pharmaceuticals.

Technological innovations like continuous manufacturing and advanced process control are revolutionizing pharmaceutical production, boosting efficiency and quality. Asymchem can harness these advancements, including automation and single-use technologies, to offer clients faster timelines and cost reductions, securing a competitive advantage.

The pharmaceutical industry's investment in advanced manufacturing technologies is substantial, with the global market for pharmaceutical manufacturing equipment projected to reach over $100 billion by 2025. While Asymchem can leverage these trends, the significant capital outlay and specialized expertise required for adoption present a notable challenge.

Asymchem benefits from the manufacturing sector's embrace of digitalization and big data analytics, aligning with Industry 4.0. This allows for optimized processes and predictive maintenance, crucial for efficiency. For instance, by 2024, the global advanced manufacturing market, which includes these technologies, was projected to reach over $400 billion, highlighting the significant investment and adoption in this area.

Leveraging these tools enhances operational transparency and data-driven decision-making, enabling Asymchem to offer more efficient services across the entire drug development lifecycle. The company can improve its supply chain management and client support through better insights. Data security remains paramount, especially with the increased volume of sensitive information handled.

Bioprocessing Technologies Evolution

The bioprocessing landscape is rapidly evolving, with continuous advancements in cell line development, bioreactor design, purification methods, and gene/cell therapy platforms shaping the future of biologics manufacturing. Asymchem, with its focus on drug substance capabilities, must stay at the forefront of these technological shifts to effectively serve the burgeoning biologics market and support clients developing novel therapeutic modalities.

This necessitates substantial investment in research and development, alongside significant capital expenditure to upgrade and maintain state-of-the-art bioprocessing technologies. For instance, the global biopharmaceutical contract manufacturing market was valued at approximately USD 20.3 billion in 2023 and is projected to grow substantially, underscoring the need for continuous technological enhancement.

- Cell Line Development: Innovations in CRISPR-Cas9 and other gene-editing tools are accelerating the creation of high-yield, stable cell lines for biologics production.

- Bioreactor Technology: Advancements include single-use bioreactors, perfusion systems, and intensified cell culture processes, leading to higher productivity and flexibility.

- Purification Techniques: Novel chromatography resins, membrane filtration technologies, and continuous processing methods are improving efficiency and purity of biologics.

- Gene/Cell Therapy Platforms: The development of robust viral vector manufacturing platforms and cell expansion technologies is crucial for the rapidly growing gene and cell therapy sectors.

Emergence of Novel Therapeutic Modalities

The pharmaceutical landscape is rapidly evolving with the emergence of complex therapeutic modalities. These include gene therapies, cell therapies, mRNA vaccines, and antibody-drug conjugates (ADCs). This shift necessitates highly specialized development and manufacturing capabilities, moving beyond traditional small molecule production.

Asymchem's strategic advantage lies in its capacity to adapt its existing platforms and cultivate new expertise to handle these novel therapies. This adaptability is paramount for securing partnerships with companies at the forefront of biopharmaceutical innovation and for maintaining its leadership position as a Contract Development and Manufacturing Organization (CDMO).

Successfully navigating this technological frontier often requires substantial capital investment. This includes building new, state-of-the-art facilities equipped for advanced biologics manufacturing and investing in specialized training programs for its workforce. For instance, the global cell and gene therapy market alone was projected to reach over $20 billion in 2024, highlighting the significant growth opportunities and the associated infrastructure demands.

- Growing Demand for Advanced Therapies: The market for cell and gene therapies is experiencing exponential growth, with an increasing number of clinical trials progressing to late stages.

- Manufacturing Complexity: Novel modalities like mRNA vaccines and ADCs require intricate manufacturing processes, including specialized containment, purification, and conjugation techniques.

- Investment in Specialized Infrastructure: CDMOs like Asymchem must invest heavily in advanced manufacturing technologies and facilities to meet the stringent quality and regulatory requirements for these complex products.

- Talent Acquisition and Development: A skilled workforce with expertise in biologics, viral vectors, and complex molecule synthesis is critical for successful development and manufacturing.

Technological advancements are accelerating drug discovery and development, with AI and genomics becoming integral. Asymchem must integrate these, as the AI in drug discovery market reached approximately $1.1 billion in 2023, with significant projected growth.

Continuous manufacturing and advanced process controls, including automation and single-use technologies, are boosting pharmaceutical production efficiency. Asymchem can leverage these to offer faster timelines and cost reductions, aligning with the global pharmaceutical manufacturing equipment market projected to exceed $100 billion by 2025.

Digitalization and big data analytics, part of Industry 4.0, enhance operational transparency and predictive maintenance. Asymchem benefits from this trend, as the global advanced manufacturing market was projected to exceed $400 billion by 2024.

The bioprocessing landscape is rapidly evolving with new platforms for biologics and gene/cell therapies. Asymchem's focus on drug substance capabilities requires staying ahead in these areas, especially as the biopharmaceutical contract manufacturing market was valued at approximately USD 20.3 billion in 2023.

Legal factors

Asymchem operates within a highly regulated pharmaceutical landscape, demanding strict adherence to global standards like FDA's current Good Manufacturing Practices (cGMP) and EMA guidelines. Failure to comply, as seen with past instances of manufacturing violations at other firms leading to product recalls and significant financial penalties, can result in severe consequences for Asymchem, including production stoppages and damage to its reputation among clients.

The company must continuously adapt to evolving regulatory frameworks, such as the International Council for Harmonisation (ICH) guidelines, to maintain its operational licenses and the trust of its pharmaceutical partners. For example, updates to impurity control standards or data integrity requirements necessitate ongoing investment in quality systems and personnel training.

Protecting client intellectual property (IP) is a cornerstone for Contract Development and Manufacturing Organizations (CDMOs) like Asymchem. Robust legal frameworks and stringent internal controls are essential for managing confidential information, patents, and trade secrets, ensuring client trust and data security.

Compliance with licensing agreements and vigilance against infringing on third-party IP are critical to preventing costly legal disputes and upholding Asymchem's reputation as a reliable partner. This necessitates meticulous contract negotiation and ongoing management.

Asymchem's handling of sensitive client data, including proprietary drug development information and potentially patient data from clinical trials, places it under the purview of stringent data privacy regulations like the EU's General Data Protection Regulation (GDPR) and the U.S.'s Health Insurance Portability and Accountability Act (HIPAA). Failure to comply can lead to substantial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Environmental, Health, and Safety (EHS) Regulations

Asymchem operates within a highly regulated pharmaceutical manufacturing sector, making Environmental, Health, and Safety (EHS) regulations a critical factor. The handling of potent active pharmaceutical ingredients (APIs) and the generation of chemical waste necessitate stringent compliance with local and international EHS laws. For instance, in 2024, the US Environmental Protection Agency (EPA) continued to enforce regulations like the Resource Conservation and Recovery Act (RCRA) for hazardous waste management, impacting Asymchem's waste disposal practices.

Adherence to these rules is not merely a matter of corporate responsibility but a fundamental operational requirement. Asymchem must meticulously manage air emissions, wastewater discharge, and workplace safety protocols to prevent accidents and environmental contamination. Failure to comply can lead to severe financial penalties, such as the significant fines levied by regulatory bodies for environmental violations, and can even result in temporary or permanent operational suspensions, as seen in past instances within the chemical industry.

Key EHS compliance areas for Asymchem include:

- Hazardous Material Handling: Strict protocols for storing, transporting, and using hazardous chemicals, including compliance with Globally Harmonized System (GHS) labeling standards.

- Waste Management: Proper classification, treatment, and disposal of chemical and biological waste, adhering to regulations like the Basel Convention for transboundary movement of hazardous wastes.

- Air and Water Emissions: Meeting permissible limits for pollutants released into the atmosphere and water bodies, often requiring advanced filtration and treatment technologies.

- Occupational Safety: Implementing robust safety training, personal protective equipment (PPE) mandates, and risk assessment procedures to safeguard employees, aligning with standards from organizations like OSHA.

Labor Laws and Employment Regulations

Asymchem, like any global employer, must navigate a complex web of labor laws and employment regulations. These cover everything from minimum wage requirements and safe working conditions to anti-discrimination statutes and mandates for employee benefits. For instance, in China, where Asymchem has significant operations, the Labor Contract Law dictates terms of employment, dispute resolution, and termination procedures, with recent amendments in 2023 focusing on strengthening worker protections and clarifying platform economy employment. Failure to comply can lead to substantial fines and reputational damage.

Adherence to these legal frameworks is not merely about avoiding penalties; it's fundamental to building a stable and productive workforce. In 2024, the pharmaceutical and biotech sectors continue to face scrutiny regarding fair labor practices, especially concerning the demanding nature of R&D and manufacturing. Asymchem's commitment to compliance helps foster a positive work environment, which is critical for attracting and retaining the highly skilled scientists and technicians essential for its growth in a competitive global market. This includes staying abreast of evolving international labor standards, such as those promoted by the International Labour Organization (ILO), particularly as the company expands its footprint.

- Compliance with China's Labor Contract Law: Ensures fair employment practices and dispute resolution mechanisms.

- Adherence to International Labor Standards: Aligns operations with global best practices for worker welfare.

- Attracting and Retaining Talent: Demonstrates commitment to a positive work environment, crucial in the competitive biotech talent market.

- Risk Mitigation: Avoids legal challenges and associated financial penalties by adhering to wage, working condition, and discrimination laws.

Asymchem's legal environment is shaped by stringent pharmaceutical regulations, intellectual property protection, and data privacy laws like GDPR and HIPAA, with non-compliance leading to significant financial penalties and operational disruptions.

The company must also adhere to Environmental, Health, and Safety (EHS) laws, managing hazardous materials and emissions to avoid fines and operational suspensions, as underscored by ongoing EPA enforcement in 2024.

Labor laws, including China's Labor Contract Law, are critical for maintaining a stable workforce and attracting talent, with adherence to international standards like those from the ILO ensuring fair practices.

Environmental factors

Pharmaceutical manufacturing, including Asymchem's operations, inherently generates diverse waste streams such as chemical, biological, and hazardous materials. Effective waste management and stringent pollution control are paramount for regulatory compliance and ecological responsibility. For instance, in 2023, the global pharmaceutical waste management market was valued at approximately USD 12.5 billion, highlighting the significant investment in this sector.

Asymchem's commitment to minimizing its environmental impact necessitates robust strategies, including investments in advanced treatment technologies and sustainable disposal methods. These efforts are crucial for mitigating environmental liabilities and ensuring adherence to evolving global environmental standards, which are becoming increasingly rigorous.

Asymchem's manufacturing operations are inherently energy-intensive, a characteristic common in the pharmaceutical and chemical sectors. This high energy demand directly translates into a significant carbon footprint. For instance, in 2023, the global chemical industry's energy consumption accounted for approximately 10% of total global energy use, with a substantial portion of this attributed to manufacturing processes.

The company is under mounting pressure from regulators, investors, and customers to actively reduce its environmental impact. This includes decreasing energy consumption and lowering its carbon emissions. A key strategy involves integrating sustainable practices, such as transitioning to renewable energy sources for its facilities and enhancing the energy efficiency of its production lines. For example, many companies in the sector are setting targets to achieve net-zero emissions by 2050, with interim goals for emissions reduction.

By embracing these sustainable initiatives, Asymchem not only aligns with international climate objectives, like those outlined in the Paris Agreement, but also stands to benefit from potential cost savings through reduced energy expenditure. Furthermore, a demonstrable commitment to environmental stewardship can significantly bolster its corporate reputation and attract environmentally conscious investors and partners.

Water is absolutely essential for pharmaceutical companies like Asymchem, playing a key role in everything from production processes and equipment cleaning to cooling systems. Efficient management of this vital resource is paramount, especially with growing concerns about water scarcity.

Asymchem needs to focus on treating its wastewater effectively before releasing it to meet strict environmental regulations and mitigate its impact on local water sources. For instance, China, where Asymchem has significant operations, faces considerable water stress in many regions, making responsible water management a critical factor.

Adopting water recycling technologies and implementing robust conservation measures can significantly lower Asymchem's operational expenses and reduce its overall environmental footprint, aligning with sustainability goals and potentially improving its public image.

Supply Chain Environmental Impact

Asymchem's environmental impact is significantly influenced by its supply chain, encompassing everything from where raw materials originate to how products are transported and packaged. The company is increasingly focused on understanding and reducing the environmental footprint generated by its suppliers and logistics providers to enhance its overall sustainability efforts.

This commitment translates into actively partnering with suppliers who meet stringent environmental standards and actively seeking out more eco-friendly procurement choices. For instance, in 2024, Asymchem continued its initiatives to reduce Scope 3 emissions, which largely stem from its supply chain activities. While specific figures for 2025 are still emerging, the industry trend shows a growing emphasis on supplier environmental performance as a key metric.

- Supplier Audits: Asymchem conducts environmental performance audits on key suppliers to ensure compliance with sustainability goals.

- Green Logistics: The company is exploring and implementing greener transportation methods, such as optimizing shipping routes and considering lower-emission carriers.

- Sustainable Packaging: Efforts are underway to reduce packaging waste and utilize more recyclable or biodegradable materials throughout the supply chain.

Climate Change Adaptation and Resilience

Asymchem's manufacturing sites and supply networks face risks from climate change impacts like severe weather, natural disasters, and resource shortages. For example, the increasing frequency of extreme heat events in key manufacturing regions could affect production efficiency and require significant investment in cooling infrastructure.

Building resilience into operations and supply chains is vital for Asymchem's continued operation and long-term success. This involves proactive measures to mitigate potential disruptions.

- Risk Assessment: Implementing comprehensive vulnerability assessments for all facilities and key suppliers to identify specific climate-related threats.

- Contingency Planning: Developing robust business continuity plans that include alternative sourcing strategies and emergency response protocols for climate-induced events.

- Infrastructure Investment: Allocating capital for climate-resilient infrastructure upgrades, such as reinforced buildings and diversified water sources, to withstand extreme weather.

- Supply Chain Diversification: Reducing reliance on single geographic regions prone to climate instability by expanding the supplier base across different climate zones.

Asymchem's environmental strategy heavily relies on managing waste and pollution, a critical aspect given the nature of pharmaceutical manufacturing. The global pharmaceutical waste management market reached approximately USD 12.5 billion in 2023, underscoring the significant financial and operational focus on this area. Asymchem's commitment to advanced treatment technologies and sustainable disposal methods is essential for regulatory compliance and minimizing ecological impact.

Energy consumption is another key environmental factor, with pharmaceutical manufacturing being energy-intensive. The chemical industry, a close parallel, consumed about 10% of global energy in 2023. Asymchem faces pressure to reduce its carbon footprint, driving initiatives like transitioning to renewable energy and improving energy efficiency, with many industry players targeting net-zero emissions by 2050.

Water management is crucial for Asymchem's operations, especially considering water scarcity concerns. Effective wastewater treatment is vital to meet stringent regulations, particularly in regions like China which face water stress. Implementing water recycling and conservation measures can lead to cost savings and a reduced environmental footprint.

The company's supply chain also presents environmental challenges and opportunities, with a growing focus on Scope 3 emissions. Asymchem actively partners with environmentally conscious suppliers and explores greener logistics and packaging solutions to enhance overall sustainability.

| Environmental Factor | Industry Trend/Data (2023-2025) | Asymchem's Focus/Action |

|---|---|---|

| Waste Management | Global market valued at USD 12.5 billion (2023) | Investment in advanced treatment and sustainable disposal |

| Energy Consumption & Carbon Footprint | Chemical industry used ~10% of global energy (2023) | Transition to renewables, energy efficiency improvements |

| Water Usage & Wastewater Treatment | Increasing focus on water scarcity and treatment efficacy | Wastewater treatment, water recycling, conservation measures |

| Supply Chain Emissions (Scope 3) | Growing emphasis on supplier environmental performance | Supplier audits, green logistics, sustainable packaging initiatives |

PESTLE Analysis Data Sources

Our Asymchem PESTLE Analysis is built on a robust foundation of data from leading financial institutions, government regulatory bodies, and reputable industry analysis firms. We synthesize information on global economic trends, environmental policies, technological advancements, and legal frameworks to provide comprehensive insights.