Asymchem Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

Asymchem navigates a landscape shaped by intense competition, significant supplier power, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to grasp their market position.

The complete report reveals the real forces shaping Asymchem’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Asymchem's reliance on specialized raw materials and reagents for drug development means supplier bargaining power can be significant. If these inputs are proprietary or scarce, Asymchem faces limited alternatives, potentially driving up costs. For instance, in 2024, the global pharmaceutical raw material market experienced price volatility due to supply chain disruptions and increased demand for specific active pharmaceutical ingredients (APIs).

Suppliers of highly specialized manufacturing equipment, analytical instruments, and advanced technology platforms, such as those for continuous flow or biocatalysis, wield considerable bargaining power. These critical assets often represent substantial capital investments and require specialized maintenance, creating significant switching costs and complexity for Asymchem.

For instance, the pharmaceutical manufacturing equipment market is highly concentrated, with a few key players dominating advanced technologies. Acquiring and integrating new, specialized equipment can take months, impacting production timelines and costs. Asymchem's own investments in proprietary technologies, like its STAR system, are strategic moves to reduce its reliance on these external technology providers.

The pharmaceutical and biotechnology contract development and manufacturing organization (CDMO) sector, where Asymchem operates, is heavily reliant on a highly skilled workforce. This includes specialized roles such as R&D scientists, process engineers, and quality control experts. A significant scarcity of this specialized talent can directly translate into increased bargaining power for employees, subsequently driving up labor costs and creating recruitment hurdles for companies like Asymchem.

Regulatory Compliance and Quality System Providers

Suppliers offering regulatory compliance and quality system solutions wield significant bargaining power over companies like Asymchem. These providers specialize in critical areas such as current Good Manufacturing Practices (cGMP), and compliance with agencies like the FDA, NMPA, TGA, and MFDS. Their certified software and expert services are essential for maintaining a strong regulatory track record, making them indispensable partners.

The reliance on these specialized suppliers for maintaining Asymchem's adherence to stringent global pharmaceutical standards directly translates into their strong bargaining position. Without these expert-backed systems and ongoing support, Asymchem would face significant risks in market access and operational integrity. This dependence highlights the suppliers' ability to influence pricing and contract terms.

- High Switching Costs: Implementing and validating new regulatory compliance software or quality management systems can be time-consuming and expensive, creating high switching costs for Asymchem.

- Specialized Expertise: These suppliers possess unique knowledge and certifications that are not easily replicated, giving them a competitive edge and leverage.

- Intellectual Property Protection: Providers of intellectual property management solutions are critical for safeguarding Asymchem's innovations, further solidifying their importance and bargaining power.

Logistics and Supply Chain Service Providers

For a global Contract Development and Manufacturing Organization (CDMO) like Asymchem, the bargaining power of logistics and supply chain service providers is significant. These providers are essential for Asymchem's operations, ensuring the timely and compliant sourcing of raw materials and the delivery of finished pharmaceutical products worldwide. The complexity of pharmaceutical logistics, including specialized handling for temperature-sensitive materials, adds to the leverage these suppliers hold.

The increasing emphasis on supply chain resilience, particularly in light of recent global disruptions, further amplifies the power of specialized logistics providers. Companies like Asymchem rely heavily on their expertise in navigating international regulations, managing customs, and ensuring the integrity of their supply chain. For instance, the global cold chain logistics market was valued at approximately $16.7 billion in 2023 and is projected to grow substantially, indicating high demand and potential supplier influence.

- Criticality of Services: Specialized logistics, including cold chain and secure transport, are non-negotiable for pharmaceutical manufacturing, giving providers considerable leverage.

- Supplier Concentration: A limited number of highly specialized logistics providers capable of meeting stringent pharmaceutical standards can lead to concentrated supplier power.

- Geopolitical Impact: Ongoing geopolitical tensions and the drive for supply chain diversification can increase reliance on and the bargaining power of established, resilient logistics partners.

- Regulatory Compliance: The need for strict adherence to international pharmaceutical regulations (e.g., Good Distribution Practices) means CDMOs must work with providers who demonstrate impeccable compliance, enhancing supplier influence.

Suppliers of specialized raw materials and reagents, particularly for novel drug development, hold significant bargaining power due to potential scarcity and proprietary nature. In 2024, the pharmaceutical raw material market saw price increases driven by supply chain issues and demand for specific APIs, impacting companies like Asymchem.

Providers of advanced manufacturing equipment and technology, such as those for continuous flow processes, also exert strong influence. These critical assets involve high capital investment and specialized maintenance, creating substantial switching costs for Asymchem and limiting its alternatives.

The bargaining power of suppliers is amplified by Asymchem's reliance on specialized talent in areas like R&D and process engineering. A shortage of skilled professionals in the CDMO sector can drive up labor costs and complicate recruitment, giving employees and their representative agencies more leverage.

Suppliers of regulatory compliance and quality system solutions are indispensable, possessing unique expertise in cGMP and FDA standards. Their services are critical for market access and operational integrity, enabling them to dictate terms and pricing due to high switching costs and specialized knowledge.

Logistics and supply chain providers, especially those specializing in cold chain and compliant global distribution, wield considerable power. The complexity and regulatory demands of pharmaceutical logistics, coupled with the need for resilience, enhance the leverage of established providers, as seen in the growing cold chain market.

What is included in the product

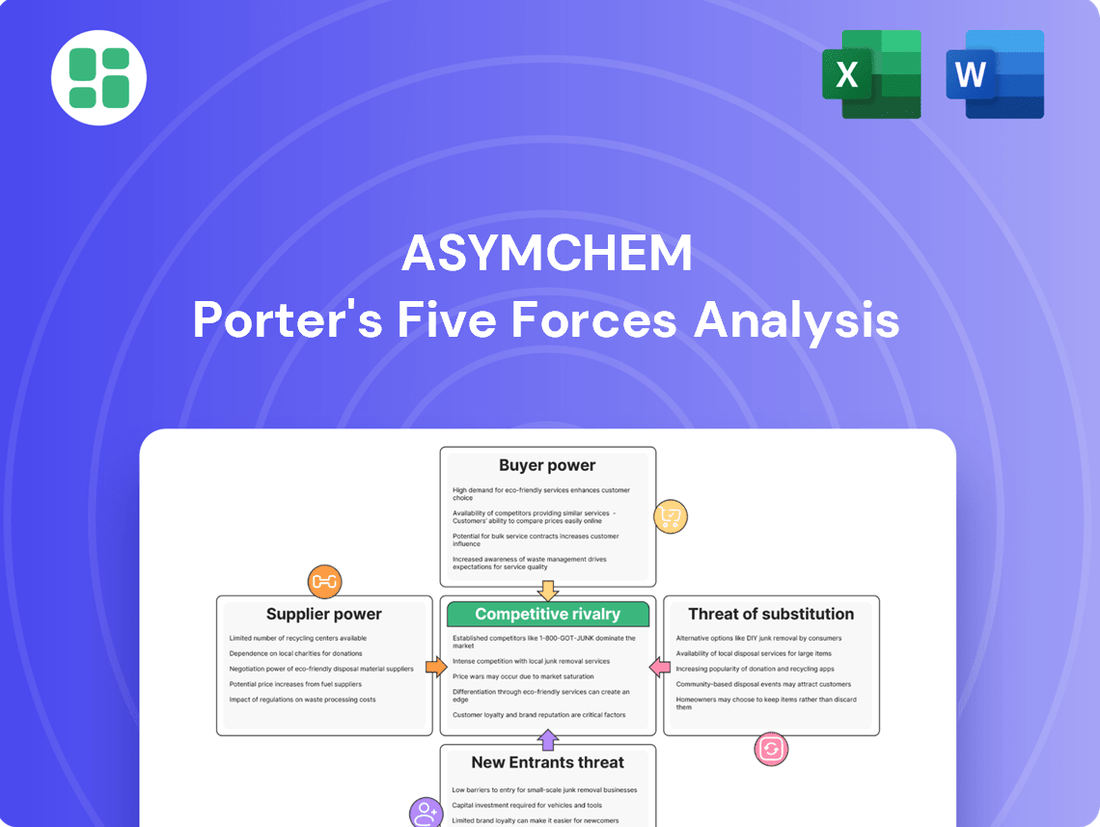

Asymchem's Porter's Five Forces Analysis dissects the competitive intensity within the pharmaceutical CDMO sector, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the overall competitive rivalry.

Instantly visualize competitive intensity with a dynamic, interactive Porter's Five Forces model, allowing for rapid assessment of Asymchem's strategic landscape.

Customers Bargaining Power

Large pharmaceutical and biotechnology companies represent a significant customer base for Asymchem. These major players often possess substantial bargaining power, driven by their considerable order volumes and the availability of multiple Contract Development and Manufacturing Organization (CDMO) options. This leverage allows them to negotiate for competitive pricing, favorable contract terms, and robust regulatory compliance support, directly influencing Asymchem's operational costs and profitability.

Emerging biotech and small to mid-sized pharma companies often have limited manufacturing capacity and financial resources, making them heavily reliant on Contract Development and Manufacturing Organizations (CDMOs). While they need cost-effective and adaptable solutions, their dependence can be a double-edged sword. These smaller players are actively seeking CDMOs that can provide comprehensive, integrated services, from early-stage development through to commercial scale manufacturing.

Asymchem's strength lies in its ability to offer these end-to-end solutions. This integration significantly reduces the switching costs for these clients, as they don't need to manage multiple vendors. In 2023, the global CDMO market was valued at approximately $22.5 billion, with continued growth projected, indicating a strong demand for reliable partners. By providing a seamless experience, Asymchem can foster deeper customer loyalty among these vital emerging players.

For highly complex or specialized projects, such as antibody-drug conjugates (ADCs) or gene therapies, the pool of qualified contract development and manufacturing organizations (CDMOs) is often limited. This scarcity directly reduces the bargaining power of customers, as they have fewer viable alternatives for their unique manufacturing needs. Asymchem's demonstrated expertise in these niche areas, including its advanced capabilities in peptide drug production utilizing automation and continuous flow technologies, significantly bolsters its negotiating position with clients seeking specialized services.

Switching Costs for Customers

Switching costs for customers in the Contract Development and Manufacturing Organization (CDMO) sector, particularly for companies like Asymchem, are often substantial. These costs encompass not only monetary outlays but also the significant time and resource investments required for technology transfer, re-validation of processes, and the inherent risk of project delays. For instance, a pharmaceutical company midway through clinical trials or at the commercial manufacturing stage would face considerable disruption and expense if they were to switch CDMO partners. This complexity fosters customer stickiness, enhancing Asymchem's bargaining power once a relationship is established and the project is deeply integrated into their operations.

The financial implications of switching CDMOs can be particularly daunting. Consider the cost of re-validating analytical methods, retraining personnel, and potentially redesigning manufacturing processes to meet the new CDMO's capabilities. These are not trivial expenses. In 2023, the global CDMO market was valued at approximately $200 billion, with a significant portion of this value tied to long-term contracts where switching would be prohibitively expensive for clients. Asymchem, by demonstrating robust quality control and efficient process integration, can leverage these high switching costs to its advantage.

- High Tech Transfer Costs: Transferring complex drug substance manufacturing processes can take 6-12 months and cost hundreds of thousands to millions of dollars.

- Re-validation Expenses: Regulatory bodies require extensive re-validation of manufacturing processes and analytical methods, adding significant time and cost.

- Project Delay Risks: Switching CDMOs can introduce unforeseen delays in critical drug development timelines, impacting market entry and revenue generation.

- Intellectual Property Protection: Ensuring seamless and secure transfer of intellectual property is paramount and adds another layer of complexity and cost.

Demand for End-to-End Services

Customers are increasingly seeking contract development and manufacturing organizations (CDMOs) that can handle their entire drug development pipeline, from early-stage research and development all the way through to commercial-scale manufacturing. This demand for end-to-end services simplifies the process for pharmaceutical and biotechnology companies, reducing the complexity of managing multiple suppliers and ensuring a smoother, more efficient path to market.

Asymchem's strategic focus on providing an integrated service model, encompassing both drug substance and drug product development, directly addresses this customer preference. By offering a comprehensive suite of services under one roof, Asymchem significantly reduces the burden on its clients, who no longer need to coordinate with separate entities for different stages of production. This integrated approach not only enhances Asymchem's value proposition but also strengthens its bargaining power by becoming a more indispensable partner.

- Integrated Service Demand: Pharmaceutical clients increasingly favor CDMOs offering end-to-end solutions, from early R&D to commercial manufacturing.

- Asymchem's Advantage: Asymchem's model covers both drug substance and drug product development, simplifying the supply chain for its customers.

- Reduced Vendor Management: By consolidating services, Asymchem lowers the need for clients to manage multiple vendors, increasing efficiency.

- Enhanced Value Proposition: This integrated offering makes Asymchem a more attractive and valuable partner, strengthening customer loyalty.

The bargaining power of customers in the CDMO market, particularly for large pharmaceutical firms, is significant due to their substantial order volumes and the availability of numerous alternative suppliers. This leverage allows them to negotiate favorable pricing and contract terms, directly impacting Asymchem's profitability. However, for specialized projects, the limited number of qualified CDMOs reduces customer leverage, benefiting Asymchem.

Switching costs for CDMO clients are high, involving complex technology transfers, re-validation processes, and potential project delays. These substantial costs, estimated in the hundreds of thousands to millions of dollars for process transfers alone, create customer stickiness. Asymchem's integrated service model, offering end-to-end solutions from R&D to commercial manufacturing, further reduces a client's need to manage multiple vendors, thereby strengthening Asymchem's position.

| Customer Segment | Bargaining Power Factors | Impact on Asymchem |

|---|---|---|

| Large Pharma/Biotech | High order volumes, multiple CDMO options | Price pressure, demand for favorable terms |

| Emerging Biotech/Small Pharma | Need for cost-effective, integrated solutions | Reliance on CDMOs for capacity and expertise |

| Specialized Project Clients | Limited pool of qualified CDMOs | Reduced negotiation leverage for clients, stronger position for Asymchem |

Same Document Delivered

Asymchem Porter's Five Forces Analysis

This preview showcases the complete Asymchem Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the pharmaceutical CDMO industry. You're looking at the actual document, which includes detailed insights into buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry. The document you see here is exactly what you’ll be able to download after payment, providing you with a professionally formatted and actionable strategic tool.

Rivalry Among Competitors

The Contract Development and Manufacturing Organization (CDMO) market is characterized by its fragmentation, featuring a wide array of companies from niche specialists to comprehensive service providers. Despite this, a significant consolidation trend is underway, driven by mergers and acquisitions.

Currently, the top five CDMOs collectively hold approximately 15% of the global market share. This indicates substantial room for growth and integration, as larger CDMOs actively pursue expansion of their service offerings and global footprint, thereby heightening competitive pressures.

Competitive rivalry in the pharmaceutical contract development and manufacturing organization (CDMO) space is intense, with companies like Asymchem differentiating themselves through advanced technological capabilities. This includes a focus on areas such as continuous manufacturing, biocatalysis, and the application of sophisticated data analytics to optimize processes. For instance, Asymchem has been a proponent of continuous flow chemistry, a technology that offers advantages in efficiency and safety over traditional batch manufacturing.

Furthermore, specialized expertise in handling complex drug modalities is a key differentiator. Asymchem's proficiency in areas like highly potent active pharmaceutical ingredients (HPAPIs) and peptide synthesis allows them to cater to niche but high-value segments of the market. Their commitment to research and development, evident in their ongoing investments in novel technologies, is paramount for sustaining this competitive advantage and staying ahead in a rapidly evolving industry.

Competitive rivalry is intensified by the need for Contract Development and Manufacturing Organizations (CDMOs) to possess a robust global presence and adeptly manage varied regulatory requirements. Asymchem's strategic expansion into Europe, notably through its acquisition of a facility in the UK from Pfizer, underscores this competitive driver, aiming to bolster its reach in crucial markets and strengthen its overall market position.

Pricing Pressures and Cost Efficiency

Customers, especially major pharmaceutical firms, frequently apply pressure on pricing, forcing Contract Development and Manufacturing Organizations (CDMOs) like Asymchem to offer competitive rates. This dynamic necessitates a careful balance between delivering high-quality services and maintaining cost-effectiveness to stay ahead in the market.

Asymchem actively addresses this by emphasizing its commitment to smarter, greener, and more cost-effective manufacturing processes. This strategic focus is crucial for retaining clients and attracting new business in a price-sensitive industry.

- Pricing Pressure: Large pharmaceutical clients often leverage their scale to negotiate lower prices, impacting CDMO margins.

- Cost Efficiency Imperative: CDMOs must continuously optimize their operations to reduce costs without compromising quality or regulatory compliance.

- Asymchem's Strategy: The company's investment in advanced technologies and process optimization aims to achieve both cost savings and improved manufacturing efficiency, a key differentiator.

Strategic Partnerships and Client Relationships

Long-term strategic partnerships and a proven track record with clients are vital competitive advantages for Contract Development and Manufacturing Organizations (CDMOs) like Asymchem. These relationships foster trust and loyalty, making it harder for competitors to poach clients. For instance, Asymchem's enduring collaborations with major pharmaceutical players are a testament to their reliability.

CDMOs that excel at building trust, demonstrating flexibility, and ensuring seamless collaboration are better positioned to secure and retain contracts. This is particularly true when working with emerging biotechs and mid-sized pharmaceutical companies that often rely heavily on their CDMO partners for development and manufacturing expertise. Asymchem's ability to adapt to evolving client needs and project complexities is a key differentiator.

- Client Retention: Strong relationships reduce client churn, a critical factor in the predictable revenue streams of CDMOs.

- Trust and Reliability: A history of successful project delivery builds confidence, leading to repeat business and referrals.

- Emerging Biotech Focus: CDMOs that cater to the specific needs of smaller, innovative companies often build deep, long-lasting partnerships.

- Flexibility: The capacity to adapt to changing project scopes and timelines is highly valued by clients navigating complex drug development pathways.

Competitive rivalry within the CDMO sector is fierce, with companies like Asymchem differentiating through advanced technologies such as continuous manufacturing and biocatalysis. The market is consolidating, with the top five CDMOs holding about 15% of the global share, leaving ample room for expansion and increased competition as larger players grow their service offerings and global reach.

Asymchem's strategic expansion, including its UK facility acquisition, and its focus on specialized areas like HPAPIs and peptide synthesis, highlight key competitive strategies. These efforts are crucial for navigating pricing pressures from large pharmaceutical clients and maintaining cost-effectiveness while delivering high-quality services.

Long-term client partnerships built on trust and flexibility are vital. Asymchem's enduring collaborations with major pharmaceutical firms demonstrate the importance of reliability and adaptability in securing repeat business, especially with emerging biotechs.

| Key Competitive Differentiators | Asymchem's Approach | Market Impact |

|---|---|---|

| Technological Advancement | Continuous flow chemistry, biocatalysis, data analytics | Improved efficiency, safety, and cost-effectiveness |

| Specialized Expertise | HPAPIs, peptide synthesis | Access to high-value niche markets |

| Global Presence & Regulatory Acumen | UK facility acquisition | Enhanced market access and compliance capabilities |

| Client Relationships | Long-term partnerships, flexibility | Client retention, trust, and loyalty |

SSubstitutes Threaten

The primary substitute for Contract Development and Manufacturing Organization (CDMO) services is the in-house development and manufacturing capabilities of pharmaceutical and biotechnology companies themselves. This direct approach bypasses external providers entirely.

However, establishing and maintaining these in-house operations demands significant capital outlays for state-of-the-art facilities, specialized equipment, and a highly skilled workforce. For instance, building a new cGMP-compliant manufacturing facility can easily cost hundreds of millions of dollars, a barrier many firms, particularly emerging biotechs, cannot overcome.

This substantial investment requirement makes in-house manufacturing a less attractive or even unattainable option for a considerable portion of the industry. Consequently, the threat of this substitute is somewhat mitigated by the high entry costs, allowing CDMOs to retain a strong market position.

While not direct replacements for Asymchem's advanced capabilities, the presence of generic Contract Development and Manufacturing Organization (CDMO) services for less complex manufacturing tasks can act as a substitute. These services might appeal to clients with simpler drug substance needs or those prioritizing cost over specialized expertise.

Asymchem counters this threat by emphasizing its commitment to innovation, particularly in complex chemistry and advanced manufacturing technologies. This focus allows them to offer high-quality, integrated solutions across a broad spectrum of therapeutic areas, differentiating them from commoditized offerings.

For instance, in 2024, the global CDMO market continued its growth trajectory, with specialized services for biologics and complex small molecules commanding premium pricing. Asymchem's strategic investment in areas like continuous manufacturing and advanced analytical services positions them to capture value in these high-demand segments, thereby mitigating the impact of simpler, lower-margin substitutes.

New technologies that bypass traditional chemical synthesis or biologics production pose a threat of substitution for Contract Development and Manufacturing Organizations (CDMOs). For instance, advancements in cell-free protein synthesis or entirely novel therapeutic modalities could reduce reliance on conventional manufacturing processes.

However, Asymchem is proactively mitigating this threat by heavily investing in cutting-edge technologies. In 2024, the company continued its focus on integrating AI for protein design and exploring continuous flow chemistry. These investments aim to keep Asymchem at the vanguard of pharmaceutical manufacturing innovation, ensuring its services remain relevant and competitive against emerging alternatives.

Shifts in Drug Modalities

A significant shift in dominant drug modalities, such as a rapid move from small molecules to cell and gene therapies, poses a threat by potentially altering the demand for specific Contract Development and Manufacturing Organization (CDMO) services. While Asymchem has strategically expanded its capabilities to include biologics and advanced drug delivery systems, a swift and disruptive technological change in therapeutic approaches could necessitate substantial further adaptation and investment to maintain its competitive edge.

For instance, the growing prominence of cell and gene therapies requires specialized manufacturing processes and infrastructure, distinct from traditional small molecule production. Asymchem's reported revenue from biologics, while growing, still represents a portion of its overall business. A dramatic acceleration in this shift could strain resources and require agile capital allocation to meet evolving client needs. The market for cell and gene therapy manufacturing alone is projected to reach tens of billions of dollars in the coming years, highlighting the scale of potential disruption if a CDMO is not adequately prepared.

- Demand Fluctuation: A substantial pivot towards new drug types, like mRNA vaccines or advanced biologics, could decrease demand for traditional small molecule synthesis services, impacting Asymchem's core business areas.

- Investment Requirements: Adapting to novel modalities often demands significant upfront investment in new technologies, specialized equipment, and highly skilled personnel, potentially straining financial resources if not managed proactively.

- Competitive Landscape: Companies that are quicker to develop expertise and capacity in emerging therapeutic areas may gain a competitive advantage, potentially drawing market share away from less adaptable CDMOs.

- Regulatory Hurdles: New drug modalities frequently come with evolving regulatory pathways, requiring CDMOs to navigate complex compliance landscapes, adding another layer of complexity and potential delay.

Regionalization of Supply Chains

The increasing trend towards regionalizing supply chains, driven by geopolitical considerations, presents a significant threat of substitutes for global Contract Development and Manufacturing Organizations (CDMOs) like Asymchem. Legislation such as the BIOSECURE Act, for instance, is prompting pharmaceutical firms to explore domestic manufacturing partners, potentially diverting business from established international players. This shift necessitates a proactive approach to geographic diversification.

Asymchem's strategic global expansion, including its facility in the United Kingdom, directly addresses this emerging threat. By establishing a presence in key regions, Asymchem can offer localized solutions that align with the growing demand for regionalized pharmaceutical manufacturing. This diversification mitigates the risk of losing market share to domestic CDMOs that may emerge as preferred alternatives due to these geopolitical pressures.

- Geopolitical Drivers: Legislation like the BIOSECURE Act encourages a move towards domestic pharmaceutical manufacturing.

- Regionalization Preference: Pharmaceutical companies are increasingly prioritizing suppliers within their own geographic regions.

- Asymchem's Mitigation: Global expansion, including the UK facility, diversifies Asymchem's operational footprint.

- Addressing the Threat: This geographic diversification helps Asymchem cater to regional demands and counter the threat of domestic substitutes.

The threat of substitutes for Asymchem's services is multifaceted, encompassing in-house capabilities, less specialized CDMOs, and entirely new manufacturing technologies.

While high capital costs deter many from in-house production, advancements in novel therapeutic modalities and shifts towards regionalized supply chains present more dynamic substitution risks that Asymchem actively addresses through strategic investments and global expansion.

For instance, the burgeoning cell and gene therapy market, projected to reach tens of billions of dollars, demands specialized infrastructure that could bypass traditional CDMO services if not adequately met.

Asymchem's 2024 focus on advanced manufacturing technologies and strategic geographic presence, such as its UK facility, are key initiatives to counter these evolving substitution threats by offering integrated, cutting-edge solutions and localized support.

| Threat Category | Nature of Substitute | Asymchem's Mitigation Strategy | 2024 Market Context/Data Point |

|---|---|---|---|

| In-house Manufacturing | Internal R&D and production capabilities | High capital cost barrier for clients | New cGMP facility costs can exceed hundreds of millions USD. |

| Less Specialized CDMOs | Commoditized manufacturing services for simpler needs | Focus on innovation, complex chemistry, and integrated solutions | Global CDMO market growth driven by specialized services (e.g., biologics). |

| Emerging Technologies | Novel modalities (e.g., cell-free synthesis) bypassing traditional processes | Investment in AI for protein design, continuous flow chemistry | Asymchem's continued focus on cutting-edge R&D. |

| Therapeutic Modality Shifts | Rapid adoption of new drug types (e.g., cell & gene therapy) | Expansion into biologics and advanced drug delivery systems | Cell & gene therapy manufacturing market projected in tens of billions USD. |

| Supply Chain Regionalization | Geopolitical drivers favoring domestic production | Global expansion (e.g., UK facility) for localized solutions | Legislation like the BIOSECURE Act influencing sourcing decisions. |

Entrants Threaten

Entering the Contract Development and Manufacturing Organization (CDMO) market, especially for companies offering a full spectrum of services like Asymchem, demands substantial capital. We're talking about significant investments in cutting-edge manufacturing plants, advanced research and development laboratories, and sophisticated equipment. For instance, establishing a new, compliant biologics manufacturing facility can easily run into hundreds of millions of dollars. This high financial barrier effectively discourages many potential new players from even attempting to enter the space.

The pharmaceutical sector presents a formidable barrier to new entrants due to extensive regulatory requirements. Companies must adhere to current Good Manufacturing Practices (cGMP) and secure approvals from bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, the average time to gain FDA approval for a new drug can span several years, involving significant investment in clinical trials and documentation.

The development and manufacturing of intricate pharmaceutical products demand a high level of scientific knowledge, specialized technical abilities, and seasoned leadership. This need for deep expertise acts as a significant hurdle for potential new entrants. For instance, companies like Moderna, which pioneered mRNA vaccine technology, invested heavily in attracting top-tier scientists and engineers, a costly and time-consuming endeavor.

Established Client Relationships and Trust

Established client relationships and trust represent a significant barrier for new entrants in the Contract Development and Manufacturing Organization (CDMO) space, particularly for companies like Asymchem. Existing CDMOs have cultivated deep, long-standing partnerships with pharmaceutical and biotechnology firms, built on years of proven reliability and successful project execution. For instance, a new CDMO entering the market would face the considerable challenge of replicating this level of trust, which often takes many years and substantial investment to achieve.

Securing significant contracts in this highly competitive sector requires not only technical expertise but also a demonstrated track record of quality and regulatory compliance. New players would need to invest heavily in building credibility and proving their operational capabilities to attract major clients away from established, trusted providers. This process is lengthy and resource-intensive, making it difficult for newcomers to gain immediate traction.

- Long-Term Partnerships: Established CDMOs have decades-long relationships with major pharmaceutical companies, fostering loyalty and repeat business.

- Credibility and Reliability: New entrants must demonstrate a robust history of successful project delivery and adherence to stringent quality standards to gain client confidence.

- High Switching Costs: Pharmaceutical companies often face significant costs and risks associated with changing CDMOs, preferring to maintain existing, reliable partnerships.

- Market Penetration Difficulty: The established trust and operational excellence of incumbent CDMOs create a high hurdle for new companies seeking to secure substantial market share.

Intellectual Property Protection and Technology Ownership

The threat of new entrants in the CDMO space, particularly concerning intellectual property (IP), is significantly influenced by the need for robust protection mechanisms. New companies must prove they can safeguard highly sensitive client innovations, a crucial element for building trust. Asymchem, for instance, strengthens its position with a substantial patent portfolio, demonstrating its commitment to IP security and creating a higher barrier for newcomers.

New entrants face considerable challenges in establishing the necessary infrastructure and reputation for IP protection. This includes implementing advanced cybersecurity measures and demonstrating a proven track record of confidentiality. Without this, attracting and retaining clients who entrust them with groundbreaking research and development becomes nearly impossible.

- IP Protection as a Trust Factor: CDMOs handle proprietary processes, making robust IP protection a critical determinant of client trust and a significant barrier for new entrants.

- Asymchem's Patent Strength: Asymchem's extensive patent portfolio serves as a tangible asset, reinforcing its ability to safeguard intellectual property and deter potential competitors.

- Technological Safeguards: New CDMOs must invest heavily in advanced technological safeguards and demonstrate a strong commitment to data security to compete effectively.

The threat of new entrants into the CDMO market, where Asymchem operates, is considerably low due to immense capital requirements for facilities and technology. For instance, establishing a state-of-the-art biologics manufacturing site can cost upwards of $500 million, a prohibitive sum for most newcomers. This high initial investment, coupled with stringent regulatory hurdles like FDA compliance, creates a formidable barrier.

The need for specialized scientific expertise and a proven track record further limits new entrants. Asymchem, for example, boasts a team of highly skilled scientists and a history of successful project delivery, making it difficult for less experienced companies to compete. Additionally, the long-term relationships and trust established by incumbent CDMOs mean that new players must invest heavily in building credibility and demonstrating reliability to win over clients.

Intellectual property protection is another significant deterrent. Newcomers must prove their capability to safeguard sensitive client data and innovations, a challenge Asymchem addresses through its robust patent portfolio. The high switching costs for pharmaceutical clients also reinforce the dominance of established players, making market penetration extremely difficult for emerging CDMOs.

Porter's Five Forces Analysis Data Sources

Our Asymchem Porter's Five Forces analysis is built upon a robust foundation of data, including Asymchem's annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and pharmaceutical trade publications to capture a comprehensive view of the competitive landscape.