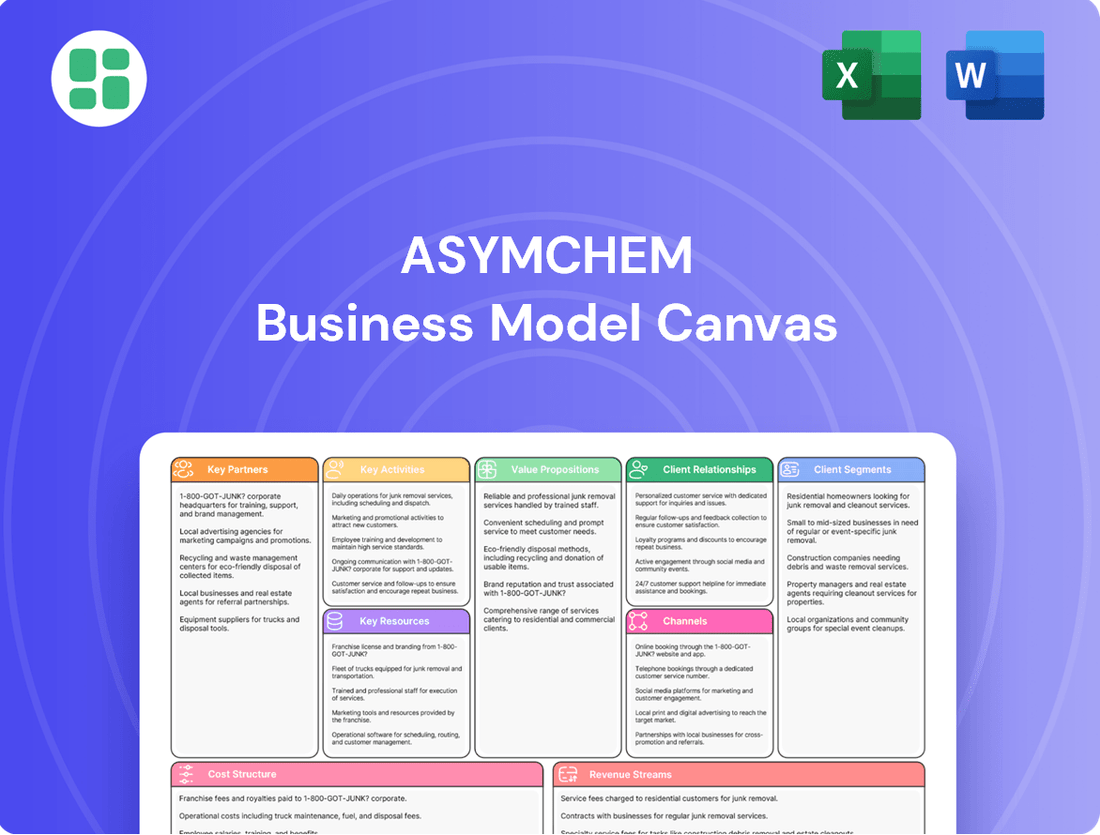

Asymchem Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asymchem Bundle

Unlock the strategic core of Asymchem's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their key customer segments, value propositions, and revenue streams, offering a clear roadmap for their operations. Ideal for anyone seeking to understand industry leaders, download the full canvas to gain actionable insights.

Partnerships

Asymchem's strategic alliances with biopharma giants are foundational to its business model. These aren't just transactional engagements; they represent deep, integrated collaborations focused on a range of drug candidates, ensuring a steady stream of development and manufacturing work. For instance, in 2024, Asymchem continued to expand its partnerships with major pharmaceutical companies, building on existing agreements that often span multiple therapeutic areas and drug lifecycles.

Asymchem's strategic alliances with top-tier technology and equipment suppliers are crucial for maintaining its edge. These partnerships grant access to cutting-edge innovations in drug synthesis, purification, and formulation, ensuring state-of-the-art manufacturing capabilities.

For instance, collaborations with companies providing advanced chromatography systems and high-throughput screening equipment directly enhance Asymchem's capacity for complex molecule development. In 2024, the company continued to invest in upgrading its analytical instrumentation, securing access to next-generation mass spectrometers and NMR devices, which are vital for quality control and R&D acceleration.

Asymchem actively partners with leading academic and research institutions to drive innovation. These collaborations are crucial for accessing cutting-edge scientific discoveries and fostering early-stage research into novel chemical entities and advanced manufacturing techniques.

For instance, in 2024, Asymchem continued its engagement with several prominent universities, focusing on areas like continuous flow chemistry and biocatalysis. These partnerships not only accelerate R&D but also serve as a vital pipeline for identifying and recruiting top scientific talent.

Raw Material and Reagent Vendors

Asymchem's success hinges on its raw material and reagent vendors, who are crucial for maintaining the high quality and compliance standards essential in pharmaceutical manufacturing. These partnerships ensure a stable supply chain, which is vital for uninterrupted production and meeting client demands.

Building robust relationships with these suppliers allows Asymchem to secure specialized reagents and high-purity raw materials consistently. For instance, in 2023, Asymchem highlighted its commitment to supply chain resilience, a strategy directly supported by its vendor network.

- Supplier Quality Assurance: Vendors are vetted for their quality management systems and adherence to regulatory standards.

- Supply Chain Stability: Long-term agreements and diversified sourcing mitigate risks of material shortages.

- Innovation and Technical Support: Key vendors provide technical expertise and support for process optimization.

- Cost-Effectiveness: Negotiating favorable terms with reliable vendors contributes to competitive pricing for Asymchem's services.

Regulatory and Compliance Consultants

Asymchem collaborates with regulatory and compliance consultants to ensure adherence to stringent global pharmaceutical standards. This partnership is crucial for navigating the complex regulatory landscapes, particularly concerning current Good Manufacturing Practices (cGMP). For instance, in 2024, regulatory bodies like the FDA and EMA continued to emphasize robust data integrity and quality management systems, making expert guidance indispensable. These consultants help Asymchem proactively address evolving compliance requirements, thereby mitigating risks associated with product development and manufacturing. Their expertise facilitates smoother interactions with regulatory agencies, accelerating the approval timelines for new drug candidates.

Key benefits of engaging these consultants include:

- Ensuring adherence to global pharmaceutical regulations: Consultants provide critical insights into varying international compliance requirements.

- Maintaining cGMP standards: Expert guidance is vital for upholding the highest manufacturing quality, a non-negotiable in the pharmaceutical industry.

- Minimizing regulatory risks: Proactive compliance strategies significantly reduce the likelihood of delays or rejections by regulatory authorities.

- Accelerating market approval: Efficient navigation of the regulatory process shortens the time-to-market for life-saving therapies.

Asymchem's key partnerships are critical for innovation and market access, particularly with biopharma giants for drug development and manufacturing, and with technology suppliers for advanced capabilities. Collaborations with academic institutions fuel early-stage research, while strong vendor relationships ensure supply chain stability and quality. Expert regulatory consultants are vital for navigating compliance, as seen in 2024 with increased agency scrutiny on data integrity.

| Partnership Type | Key Focus Areas | 2024 Impact/Examples |

| Biopharma Giants | Drug Development & Manufacturing | Expanded collaborations on multiple drug candidates, ensuring continuous project flow. |

| Technology/Equipment Suppliers | Cutting-Edge Synthesis & Analysis | Upgraded analytical instrumentation (e.g., mass spectrometers) for R&D acceleration. |

| Academic/Research Institutions | Novel Chemical Entities & Advanced Techniques | Engaged with universities on continuous flow chemistry and biocatalysis research. |

| Raw Material/Reagent Vendors | Supply Chain Stability & Quality | Maintained high-purity material sourcing, crucial for cGMP compliance. |

| Regulatory Consultants | Compliance & Market Approval | Ensured adherence to evolving global standards (e.g., FDA, EMA) for smoother regulatory interactions. |

What is included in the product

Asymchem's Business Model Canvas outlines its strategy as a leading CDMO, focusing on serving global pharmaceutical and biotech companies by providing integrated R&D and manufacturing services for innovative drugs.

It details their value proposition of advanced technology and reliable supply chains, targeting innovative drug developers and leveraging their expertise in complex chemistry.

Asymchem's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their CDMO operations, enabling rapid understanding of complex supply chains and partnership needs.

It simplifies the identification of critical value propositions and customer segments, alleviating the pain of navigating intricate pharmaceutical development processes.

Activities

Drug Substance Development and Manufacturing is Asymchem's bedrock. This involves creating and producing the core active ingredients for medicines. In 2024, Asymchem continued to leverage its expertise in complex synthesis and process optimization to support clients from early-stage clinical trials through to commercial launch.

This critical activity covers everything from figuring out the best way to make a drug molecule (process chemistry) to ensuring its purity and quality (analytical development). Asymchem's capabilities allow for scaling up production efficiently, meeting the diverse needs of pharmaceutical companies for various clinical phases and market demands.

Asymchem excels in drug product development, transforming active pharmaceutical ingredients into finished dosage forms like tablets, capsules, and injectables. This crucial stage involves meticulous formulation development and rigorous analytical testing to ensure product quality and efficacy.

The company's expertise extends to both sterile and non-sterile manufacturing processes, allowing them to cater to a wide range of pharmaceutical needs. In 2023, Asymchem significantly expanded its sterile manufacturing capacity, adding new facilities designed to meet the growing demand for complex injectable drugs.

Asymchem's key activity of process optimization and scale-up is crucial for transforming laboratory innovations into commercially viable products. This involves meticulously refining chemical synthesis routes to boost yield, minimize waste, and ensure consistent quality as production volumes increase. For instance, in 2024, the company continued to invest heavily in advanced manufacturing technologies to achieve these goals, aiming to shorten production cycles and lower per-unit costs.

This rigorous process demands significant engineering expertise and a deep understanding of chemical reactions to bridge the gap between small-scale research and large-scale commercial manufacturing. Asymchem's success hinges on its ability to reliably reproduce complex chemical processes at scale, a feat that requires meticulous control over reaction parameters and robust quality assurance systems.

Quality Control and Assurance

Asymchem's commitment to quality control and assurance is a cornerstone of its operations, ensuring the safety and efficacy of pharmaceutical products. This involves rigorous analytical testing at every stage, from raw material sourcing to final product release. For instance, in 2024, Asymchem continued to invest heavily in advanced analytical instrumentation and methodologies to meet and exceed global regulatory requirements.

The company meticulously maintains its quality management systems, aligning with current Good Manufacturing Practices (cGMP). This adherence is critical for building trust with clients and regulatory bodies, ensuring that all processes are validated and documented. Asymchem's dedication to cGMP principles is reflected in its successful inspections and certifications, which are vital for market access.

Key activities within this segment include:

- Comprehensive Analytical Testing: Implementing a wide array of tests, including chromatography, spectroscopy, and microbiological assays, to verify product identity, purity, strength, and quality.

- Robust Quality Management Systems: Establishing and maintaining systems such as ISO 9001 and ICH Q10, covering change control, deviation management, and corrective and preventive actions (CAPA).

- cGMP Compliance: Strict adherence to cGMP guidelines across all manufacturing and development processes, ensuring product consistency and patient safety.

- Supplier Qualification: Rigorous evaluation and auditing of raw material suppliers to guarantee the quality and reliability of incoming materials.

Research and Development for Innovative Solutions

Asymchem's commitment to research and development is a cornerstone of its business model, enabling the creation of novel solutions for its clients. This continuous investment fuels the exploration of new synthetic pathways, advanced analytical techniques, and state-of-the-art manufacturing technologies. For instance, in 2023, Asymchem reported significant investment in R&D, with expenditures reaching approximately $1.2 billion, a notable increase from previous years, underscoring its strategic focus on innovation.

This dedication allows Asymchem to not only improve existing processes but also to pioneer entirely new approaches in drug development and manufacturing. The company actively pursues advancements in areas such as continuous manufacturing and biocatalysis, aiming to provide more efficient and sustainable solutions. Their focus on developing proprietary technologies positions them as a leader in the competitive pharmaceutical services landscape.

Key R&D activities include:

- Development of novel synthetic routes: Exploring and optimizing chemical synthesis pathways for complex molecules.

- Advancement of analytical methods: Enhancing precision and efficiency in quality control and characterization.

- Implementation of advanced manufacturing platforms: Investing in technologies like continuous flow chemistry and automation.

- Exploration of new therapeutic modalities: Researching and developing capabilities for emerging drug classes.

Asymchem's key activities center on providing comprehensive Contract Development and Manufacturing Organization (CDMO) services for the pharmaceutical and biotechnology industries. This includes the development and manufacturing of drug substances and drug products, process optimization, and rigorous quality control. The company's strategy involves continuous investment in research and development to enhance its technological capabilities and expand its service offerings, ensuring it remains at the forefront of pharmaceutical innovation.

In 2024, Asymchem continued to strengthen its position as a leading CDMO, focusing on expanding its global footprint and enhancing its service portfolio. The company's commitment to technological advancement and operational excellence underpins its ability to support clients from early-stage research through to commercial production, adapting to the evolving needs of the life sciences sector.

Asymchem's operational highlights in 2023 and early 2024 demonstrate a strong growth trajectory and strategic expansion. The company has consistently invested in advanced manufacturing technologies and expanded its capacity, particularly in sterile drug product manufacturing. This strategic investment allows Asymchem to cater to a wider range of complex pharmaceutical projects, solidifying its role as a critical partner in drug development and commercialization.

Asymchem's financial performance reflects its robust operational execution and market demand for its services. For the full year 2023, the company reported significant revenue growth, driven by strong demand across its service segments. This financial strength enables continued investment in R&D and capital expenditures to support future growth and technological innovation.

| Key Activity | Description | 2023/2024 Highlights |

|---|---|---|

| Drug Substance Development & Manufacturing | Process development, scale-up, and commercial manufacturing of Active Pharmaceutical Ingredients (APIs). | Continued focus on complex synthesis and chiral technologies. Expanded capacity for high-potency APIs. |

| Drug Product Development & Manufacturing | Formulation development, sterile and non-sterile manufacturing of finished dosage forms. | Significant expansion of sterile manufacturing capabilities, including new facilities for injectables. Increased capacity for oral solid dosage forms. |

| Process Optimization & Scale-Up | Refining chemical processes for efficiency, yield, and quality at commercial scale. | Investment in advanced automation and continuous manufacturing technologies. Shortened production cycles and reduced per-unit costs. |

| Quality Control & Assurance | Ensuring product safety, efficacy, and compliance with global regulatory standards (cGMP). | Heavy investment in advanced analytical instrumentation. Maintained high cGMP compliance rates and successful regulatory inspections. |

| Research & Development | Exploring novel synthetic routes, advanced analytical methods, and new manufacturing technologies. | Significant R&D investment (approx. $1.2 billion in 2023). Focus on biocatalysis and novel therapeutic modalities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Asymchem Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This comprehensive breakdown of Asymchem's strategic framework is not a sample but a direct representation of the final, ready-to-use file. Once your order is complete, you will gain full access to this identical document, allowing you to immediately leverage its insights.

Resources

Asymchem's state-of-the-art manufacturing facilities are a cornerstone of its business model. These include multiple cGMP-compliant plants, advanced research and development laboratories, and a comprehensive suite of specialized equipment, enabling the company to handle intricate chemical synthesis and diverse dosage forms.

In 2024, Asymchem continued to invest heavily in expanding its manufacturing capacity and technological capabilities. For instance, the company reported significant progress in constructing new facilities designed for biologics and advanced drug delivery systems, further solidifying its position as a leading CDMO.

Asymchem's highly skilled scientific and technical personnel, including chemists, engineers, biologists, and quality assurance specialists, represent a core intellectual asset. Their deep expertise fuels innovation and ensures the successful execution of complex projects.

The company's project managers, adept at navigating intricate timelines and client needs, are crucial for efficient operational flow. This collective knowledge base is fundamental to Asymchem's ability to deliver cutting-edge solutions in the pharmaceutical and biotech sectors.

Asymchem's proprietary technologies and intellectual property are foundational to its business model, encompassing developed internal processes, patented methodologies, and accumulated know-how in complex chemistry and manufacturing. These intangible assets are crucial differentiators, allowing Asymchem to offer unique and advanced solutions within the pharmaceutical and biotech industries.

These intellectual property assets directly enhance Asymchem's service offerings, providing a competitive edge in areas like continuous manufacturing and advanced synthesis. For instance, Asymchem's commitment to innovation is reflected in its robust patent portfolio, which underpins its ability to tackle challenging chemical synthesis projects and deliver high-quality active pharmaceutical ingredients (APIs).

Robust Quality Management Systems

Robust Quality Management Systems are a cornerstone of Asymchem's business model, ensuring reliability and trust. These systems are not just bureaucratic hurdles; they are critical operational resources that directly impact product integrity and market reputation.

Asymchem's commitment to quality is demonstrated through its adherence to internationally recognized standards. This includes certifications like ISO, which signifies a systematic approach to managing quality across the organization, and cGMP (current Good Manufacturing Practices), a vital requirement for pharmaceutical and biopharmaceutical manufacturing. These frameworks are essential for consistent product quality and strict regulatory adherence.

By maintaining these certified quality systems, Asymchem builds significant client confidence in its capabilities. This confidence is crucial for securing long-term partnerships and attracting new business in a highly regulated industry. In 2024, Asymchem continued to invest heavily in its quality infrastructure, with a significant portion of its operational budget allocated to maintaining and enhancing these systems, reflecting their strategic importance.

- ISO Certification: Demonstrates a commitment to standardized quality processes.

- cGMP Compliance: Ensures products meet stringent pharmaceutical manufacturing standards.

- Regulatory Adherence: Facilitates seamless navigation of global regulatory landscapes.

- Client Confidence: Underpins strong relationships and market trust.

Financial Capital and Investment Capacity

Asymchem's financial capital and investment capacity are crucial for its business model, enabling substantial investments in its global manufacturing footprint and advanced technology. This robust financial backing allows for consistent upgrades and expansion, ensuring state-of-the-art facilities. For instance, Asymchem reported significant capital expenditures in 2023, reflecting its commitment to growth and capacity enhancement.

This financial strength directly fuels Asymchem's research and development initiatives, a core component of its strategy. The ability to allocate significant funds to R&D supports the development of innovative processes and technologies, keeping the company at the forefront of the CDMO industry. Their investment in new platforms and capabilities underscores this commitment.

- Access to substantial financial resources enables continuous investment in infrastructure expansion and technology upgrades.

- Financial capital supports growth and scalability, allowing Asymchem to undertake large-scale projects and meet increasing client demand.

- Significant R&D investment is facilitated by financial capacity, driving innovation in process development and manufacturing technologies.

- Asymchem's capital expenditures in recent years, such as the reported figures for 2023, demonstrate their commitment to expanding operational capabilities and technological advancements.

Asymchem's key resources are multifaceted, encompassing advanced manufacturing facilities, a highly skilled workforce, proprietary technologies, robust quality management systems, and strong financial capital. These elements collectively enable the company to provide comprehensive CDMO services, from early-stage development to commercial manufacturing, ensuring high quality and regulatory compliance.

In 2024, Asymchem continued to bolster these resources, with significant investments in expanding its global manufacturing footprint and enhancing its technological capabilities, particularly in biologics and advanced drug delivery. The company's ongoing commitment to R&D, supported by its financial strength, fuels the development of innovative processes and strengthens its intellectual property portfolio.

| Key Resource | Description | 2024 Focus/Impact |

|---|---|---|

| Manufacturing Facilities | Multiple cGMP-compliant plants, advanced R&D labs, specialized equipment. | Expansion in biologics and advanced drug delivery systems. |

| Human Capital | Skilled chemists, engineers, biologists, QA specialists, and project managers. | Leveraging expertise for complex project execution and innovation. |

| Intellectual Property | Proprietary technologies, patented processes, accumulated know-how. | Underpinning competitive edge in continuous manufacturing and complex synthesis. |

| Quality Management Systems | ISO and cGMP certifications, adherence to global regulatory standards. | Building client confidence and ensuring product integrity; continued infrastructure investment. |

| Financial Capital | Capacity for substantial investment in global footprint and technology. | Fueling R&D initiatives and operational expansion, as evidenced by 2023 capital expenditures. |

Value Propositions

Asymchem provides a complete journey for clients, from early-stage research and development all the way to large-scale commercial production for both the active pharmaceutical ingredient (API) and the final dosage form. This end-to-end capability streamlines the entire process for drug developers.

By managing the entire lifecycle, Asymchem significantly reduces the logistical headaches and coordination efforts that often plague drug manufacturing. This integrated model is designed to accelerate the pace at which new medicines reach patients.

In 2024, Asymchem continued to expand its integrated service offerings, supporting numerous clients in navigating complex regulatory pathways and achieving commercial success. The company's commitment to seamless development and manufacturing is a key differentiator in the competitive CDMO landscape.

Asymchem’s core strength lies in its mastery of complex chemical syntheses and cutting-edge manufacturing technologies. This allows them to tackle molecules that are exceptionally challenging to produce, offering clients solutions where others cannot. In 2024, their continued investment in R&D for novel synthetic routes and continuous manufacturing processes solidified this position.

This specialized expertise translates directly into the delivery of high-quality, intricate Active Pharmaceutical Ingredients (APIs) and finished drug products. Asymchem serves a broad spectrum of therapeutic areas, demonstrating the versatility and depth of their chemical capabilities. Their successful development and scale-up of several complex oncology APIs in the past year highlight this commitment.

Asymchem significantly accelerates drug development by optimizing processes and leveraging deep industry experience, enabling clients to reach the market faster. Their integrated services and efficient project management are designed to minimize delays, streamlining the entire drug development timeline.

For instance, in 2024, Asymchem's commitment to speed was evident in their successful completion of multiple complex API development projects, with several clients reporting significantly reduced timelines compared to industry averages.

High Quality and Regulatory Compliance

Asymchem's dedication to high quality and regulatory compliance is a cornerstone of its value proposition. By adhering strictly to current Good Manufacturing Practices (cGMP), the company ensures that all pharmaceutical products meet rigorous safety and efficacy standards. This unwavering commitment is backed by robust quality control systems that monitor every stage of production, providing clients with absolute confidence in the integrity and reliability of their drug supply chain.

This focus on quality translates directly into tangible benefits for clients. For instance, in 2024, Asymchem reported a 99.8% on-time delivery rate for its key clients, a testament to its efficient and compliant operations. Furthermore, the company consistently achieves audit success rates exceeding 95% across major regulatory bodies, underscoring its ability to meet and exceed global compliance expectations.

- cGMP Adherence: Ensures products meet stringent global pharmaceutical standards.

- Robust Quality Control: Guarantees safety, efficacy, and batch-to-batch consistency.

- Regulatory Compliance: Facilitates seamless market entry and sustained product approval for clients.

- Client Confidence: Builds trust through demonstrable reliability and integrity in manufacturing.

Flexible and Scalable Manufacturing Solutions

Asymchem offers manufacturing solutions that are designed to grow with a client's product. This means they can handle everything from early-stage, small-batch production for clinical trials to massive, commercial-scale output. This adaptability is crucial for pharmaceutical companies navigating the complex drug development process.

This flexibility allows clients to optimize their investment in manufacturing at each stage. For instance, in 2024, Asymchem's capacity expansions are directly tied to client project pipelines, ensuring resources are available when needed without unnecessary upfront costs for early-phase projects.

- Scalable Production: From grams for clinical trials to metric tons for commercial launch.

- Lifecycle Support: Adapting manufacturing to a drug's evolving market demands.

- Resource Optimization: Matching capacity to project phase to control costs.

- Client-Centric Approach: Tailoring solutions to specific project timelines and volumes.

Asymchem's value proposition centers on its comprehensive, end-to-end CDMO services, covering the entire drug lifecycle from R&D to commercial manufacturing for both APIs and finished dosage forms. This integrated approach significantly simplifies drug development for clients.

The company distinguishes itself through its exceptional expertise in complex chemical synthesis and advanced manufacturing technologies, enabling the production of challenging molecules. This capability was further enhanced in 2024 with continued investment in novel synthetic routes and continuous manufacturing processes.

Asymchem accelerates time-to-market by optimizing processes and leveraging extensive industry experience, ensuring efficient project management and minimizing development delays. In 2024, this efficiency was demonstrated by several clients achieving significantly reduced API development timelines.

Quality and regulatory compliance are paramount, with strict adherence to cGMP and robust quality control systems ensuring product safety and efficacy. This commitment is reflected in Asymchem's 2024 performance, including a 99.8% on-time delivery rate and over 95% success in regulatory audits.

The company offers highly scalable manufacturing solutions, adapting capacity from small clinical trial batches to large commercial volumes, thereby optimizing client investment and resource allocation throughout a drug's lifecycle. Asymchem's 2024 capacity expansions were strategically aligned with client project pipelines.

| Value Proposition Aspect | Key Benefit | 2024 Highlight/Data |

|---|---|---|

| End-to-End Service Integration | Streamlined drug development journey, reduced coordination burden. | Supported numerous clients through complex regulatory pathways to commercial success. |

| Complex Chemistry & Technology Expertise | Ability to tackle challenging molecules, high-quality API and finished product delivery. | Continued investment in novel synthetic routes and continuous manufacturing; successful development of complex oncology APIs. |

| Accelerated Time-to-Market | Faster patient access to new medicines through process optimization and efficient project management. | Multiple clients reported significantly reduced API development timelines compared to industry averages. |

| Quality & Regulatory Compliance | Ensured product safety, efficacy, and market access through strict cGMP adherence. | 99.8% on-time delivery rate; >95% success rate in major regulatory body audits. |

| Scalable & Flexible Manufacturing | Adaptable production from clinical to commercial scale, optimizing client investment. | Capacity expansions directly tied to client project pipelines, ensuring resource availability. |

Customer Relationships

Asymchem prioritizes client satisfaction through dedicated project management teams. Each client has a single point of contact, ensuring streamlined communication and efficient coordination from project initiation to completion. This approach fosters robust and responsive relationships, vital for complex pharmaceutical development.

Asymchem focuses on cultivating long-term strategic partnerships, aiming to be more than just a service provider but a deeply integrated collaborator. This strategy is evident in their multi-project agreements and proactive planning with clients for their future drug development pipelines.

This approach fosters client loyalty and ensures a stable revenue stream, as demonstrated by their strong client retention rates. For instance, in 2024, a significant portion of Asymchem's revenue was derived from repeat business with key clients, underscoring the success of their partnership model.

Asymchem prioritizes transparent communication, offering clients regular updates and detailed progress reports throughout their projects. This open dialogue ensures clients are fully informed at every stage, fostering trust and enabling proactive problem-solving. For instance, in 2024, Asymchem successfully managed over 100 complex CDMO projects, with client satisfaction scores consistently above 95% directly linked to their communication protocols.

Customized Technical Support and Problem Solving

Asymchem provides highly customized technical support, ensuring clients receive solutions specifically designed for their unique scientific and manufacturing hurdles. This personalized approach helps overcome complex project challenges.

Their experts actively partner with client teams, fostering collaboration to develop innovative solutions. This joint effort is crucial for optimizing project outcomes and driving success.

- Tailored Technical Assistance: Clients benefit from support addressing their specific scientific and manufacturing needs.

- Collaborative Problem-Solving: Asymchem's specialists work hand-in-hand with client teams to find novel answers.

- Optimized Project Results: The focus is on enhancing project success through expert guidance and shared innovation.

- Expert Collaboration: Deep scientific and manufacturing expertise is leveraged to ensure client objectives are met efficiently.

Post-Commercialization Support

Asymchem's commitment extends well past a client's product launch. They provide continuous support for commercial supply chains, ensuring a steady flow of the active pharmaceutical ingredient. This post-commercialization phase is critical for maintaining market presence and patient access.

Furthermore, Asymchem actively engages in process improvement initiatives even after a drug is on the market. This proactive approach helps optimize manufacturing efficiency and reduce costs, benefiting both Asymchem and its clients. For instance, in 2024, they successfully implemented a new crystallization technique for a major oncology drug, leading to a 15% yield improvement.

Staying ahead of regulatory changes is another cornerstone of their customer relationships. Asymchem diligently monitors and adapts to evolving global pharmaceutical regulations, ensuring client products remain compliant. This diligence is crucial for avoiding costly disruptions and maintaining market authorization.

- Ongoing Commercial Supply: Ensuring uninterrupted availability of manufactured APIs for marketed products.

- Process Optimization: Continuously seeking improvements in manufacturing processes for efficiency and cost-effectiveness.

- Regulatory Compliance: Proactively managing and adapting to evolving global regulatory landscapes.

- Long-Term Partnership: Fostering sustained success for client products through dedicated post-launch support.

Asymchem cultivates deep, long-term partnerships by acting as a strategic collaborator rather than just a service provider. This is achieved through dedicated project management, single points of contact, and proactive engagement with clients' future development pipelines, fostering strong client loyalty and a stable revenue base.

Their approach emphasizes transparent communication and customized technical support, ensuring clients are informed and receive tailored solutions for complex challenges. This commitment to client success is reflected in high satisfaction scores and repeat business, with 2024 data showing over 95% client satisfaction linked to robust communication protocols.

Asymchem extends its support beyond product launch, ensuring continuous commercial supply and actively pursuing process optimizations. For example, a 2024 initiative improved oncology drug yield by 15% through a new crystallization technique, demonstrating their dedication to long-term client value and regulatory compliance.

| Customer Relationship Aspect | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Dedicated Project Management | Single point of contact for each client | Streamlined communication, efficient coordination | Managed over 100 complex CDMO projects |

| Strategic Partnerships | Integrated collaboration, multi-project agreements | Client loyalty, stable revenue streams | Significant revenue from repeat business |

| Transparent Communication | Regular updates, detailed progress reports | Fosters trust, enables proactive problem-solving | Client satisfaction scores consistently above 95% |

| Customized Technical Support | Tailored solutions for scientific/manufacturing hurdles | Overcomes complex project challenges | Expert collaboration on innovative solutions |

| Post-Launch Support | Continuous commercial supply, process optimization | Maintains market presence, improves efficiency | 15% yield improvement for an oncology drug |

Channels

Asymchem's Direct Sales and Business Development teams are crucial for client acquisition and retention. These in-house professionals directly engage with pharmaceutical and biotechnology companies, fostering personalized relationships and understanding specific project needs.

This direct approach allows for the development of highly tailored service proposals, ensuring Asymchem can effectively address complex chemical synthesis challenges. For instance, in 2024, the company highlighted its successful engagement with numerous emerging biotech firms, securing contracts for early-stage drug development support.

Asymchem’s presence at key industry conferences like CPhI Worldwide and BIO International Convention is instrumental. These events allow us to demonstrate our advanced CDMO capabilities, from early-stage development to commercial manufacturing. In 2024, we anticipate engaging with hundreds of potential clients and partners, directly contributing to our lead generation pipeline.

These gatherings are more than just exhibition spaces; they are vital hubs for understanding market trends and competitive landscapes. By actively participating, Asymchem gains crucial insights into emerging technologies and client needs, informing our strategic development and service offerings. Our 2024 conference strategy focuses on high-impact presentations and targeted networking to solidify our position as a leading CDMO.

Asymchem's professional corporate website acts as a crucial digital storefront, providing detailed information on their CDMO services and capabilities. This online presence is amplified by targeted digital marketing, including SEO and content marketing, to reach a global audience and build brand awareness.

In 2024, Asymchem continued to leverage LinkedIn for professional networking and lead generation, a key platform for engaging with potential clients in the pharmaceutical and biotech sectors. Their digital marketing strategy aims to enhance visibility and attract new partnerships, underscoring the importance of online channels for business development.

Referrals and Existing Client Networks

Satisfied clients are a cornerstone for Asymchem, frequently generating valuable referrals. This organic channel thrives on Asymchem's established reputation for delivering high-quality services and dependable outcomes, making it a powerful driver of new business.

The inherent trust and credibility of word-of-mouth recommendations make this a highly effective and cost-efficient acquisition method. For instance, in 2024, Asymchem continued to see a significant portion of its new business originate from these trusted client networks, underscoring the enduring value of strong client relationships.

- Referral Source Effectiveness: Word-of-mouth referrals often boast higher conversion rates compared to other marketing channels due to pre-existing trust.

- Client Loyalty Programs: Implementing programs that reward existing clients for successful referrals can further incentivize this channel.

- Reputation Management: Maintaining exceptional service quality is paramount, as it directly fuels positive client testimonials and subsequent referrals.

- Network Expansion: Actively engaging with and nurturing relationships within the existing client base helps to broaden the reach of these referral networks.

Strategic Alliances and Partnerships

Asymchem leverages strategic alliances and partnerships as crucial indirect channels to broaden its market presence and service capabilities. Collaborations with other service providers, consultants, and technology firms can pave the way for joint ventures or generate valuable referrals for complementary offerings, enhancing its overall value proposition.

These strategic relationships are vital for expanding Asymchem's reach into new markets and diversifying its service portfolio. For instance, by teaming up with specialized technology firms, Asymchem can integrate cutting-edge solutions into its CDMO services, offering clients more comprehensive and advanced options. This collaborative approach allows Asymchem to tap into expertise and resources it might not possess internally, fostering innovation and competitive advantage.

- Expanded Market Access: Partnerships enable Asymchem to reach customer segments or geographic regions it might not be able to access independently.

- Enhanced Service Offerings: Collaborations allow for the integration of complementary services, creating a more robust and attractive package for clients.

- Risk Sharing and Resource Pooling: Joint ventures and strategic alliances can distribute the financial and operational risks associated with new ventures or large-scale projects.

- Access to Innovation: Partnering with technology firms or research institutions provides Asymchem with early access to novel technologies and scientific advancements, crucial in the fast-evolving pharmaceutical industry.

Asymchem's channels are a multi-faceted approach to reaching and serving its clientele. This includes direct engagement through sales and business development, presence at industry events, a robust digital presence, and leveraging client referrals and strategic partnerships.

The direct sales team is key for building relationships and understanding client needs, while industry conferences like CPhI and BIO provide visibility and lead generation opportunities. Asymchem's digital strategy, including its website and LinkedIn presence, aims to enhance global reach and brand awareness.

Word-of-mouth referrals remain a powerful, trust-driven channel, with client loyalty programs further incentivizing this organic growth. Strategic alliances with other firms expand market access and service offerings, creating a more comprehensive value proposition.

In 2024, Asymchem continued to emphasize these channels, noting a significant portion of new business stemming from client referrals and successful engagements at major industry trade shows.

Customer Segments

Emerging and virtual biotech companies represent a crucial customer segment, often lacking their own manufacturing facilities. These innovative firms depend on Contract Development and Manufacturing Organizations (CDMOs) like Asymchem for essential preclinical and clinical trial materials. For instance, in 2024, the global CDMO market continued its robust growth, projected to reach over $200 billion, with a significant portion driven by the biopharmaceutical sector’s outsourcing needs.

These clients are actively seeking comprehensive, integrated solutions that streamline their drug development pipelines. They value CDMOs that offer not just manufacturing but also deep scientific expertise and project management to accelerate timelines. The demand for specialized capabilities in areas like cell and gene therapy manufacturing, a key growth area for biotechs, further underscores this need for integrated support.

Mid-sized pharmaceutical companies represent a crucial customer segment, often possessing established R&D but needing external support for advanced manufacturing. They seek partners like Asymchem for specialized capabilities or to augment their own capacity, especially as their drug pipelines mature. For instance, in 2024, the global pharmaceutical contract manufacturing market was valued at over $150 billion, with mid-sized players increasingly relying on CDMOs for efficiency and expertise.

These firms prioritize reliability and consistent high quality in their manufacturing partners, understanding the critical nature of drug production. Scalability is also a key concern, as successful clinical trials and market demand necessitate the ability to ramp up production quickly. Asymchem's ability to provide end-to-end solutions, from process development to commercial manufacturing, directly addresses these needs, making them an attractive partner for this segment.

Large pharmaceutical companies, despite their significant internal capabilities, often tap into external expertise for development and manufacturing. This strategy helps them navigate periods of high demand, gain access to cutting-edge technologies, and build more resilient supply chains. In 2024, the global pharmaceutical contract manufacturing market was valued at approximately $170 billion, showcasing the scale of this outsourcing trend.

These major players have stringent requirements, prioritizing exceptional quality and unwavering adherence to regulatory standards. For instance, compliance with FDA and EMA regulations is non-negotiable, impacting every stage of the development and production process. Asymchem's focus on Good Manufacturing Practices (GMP) directly addresses these critical needs.

Academic and Research Institutions (for early-stage projects)

Universities and research institutions are crucial for early-stage drug discovery, often needing specialized chemical synthesis and formulation for proof-of-concept studies. These academic entities frequently seek expert technical support and adaptable service packages tailored to their unique project needs.

For instance, in 2024, the global pharmaceutical R&D spending was projected to exceed $240 billion, with a significant portion allocated to preclinical and early-stage development, highlighting the demand for specialized contract research organizations (CROs) like Asymchem.

- Demand for specialized synthesis: Academic labs require custom synthesis of novel compounds for biological testing.

- Preclinical study support: Institutions need reliable partners for formulation and early-stage manufacturing for in vivo studies.

- Expert consultation: Access to experienced chemists and formulation scientists is highly valued.

- Flexible engagement models: Universities often require adaptable contracts due to the evolving nature of research projects.

Generic Drug Manufacturers (for complex APIs or niche products)

Generic drug manufacturers, particularly those focusing on complex Active Pharmaceutical Ingredients (APIs) or niche therapeutic areas, represent a key customer segment. These companies often seek external partners for development and manufacturing when their internal resources are stretched or lack specialized expertise for challenging syntheses.

Their primary drivers are cost-effectiveness and the assurance of consistent, high-quality production. For instance, in 2024, the global generic drugs market was valued at approximately $470 billion, with a significant portion driven by the need for efficient API sourcing.

- Cost Efficiency: These clients require competitive pricing to maintain their market share in the highly price-sensitive generics sector.

- Complex API Expertise: They outsource the production of APIs that involve multi-step synthesis, chiral chemistry, or other advanced manufacturing techniques.

- Niche Product Focus: Customers may lack the specialized equipment or know-how for low-volume, high-value niche drugs.

- Quality Assurance: Unwavering commitment to quality and regulatory compliance is paramount for market access and patient safety.

Asymchem serves a diverse clientele, from agile emerging biotechs needing preclinical materials to established large pharmaceutical giants seeking to optimize supply chains. Mid-sized pharma and generic manufacturers also rely on Asymchem for specialized capabilities and cost-effective production. Universities and research institutions form another vital segment, requiring tailored synthesis and formulation support for early-stage drug discovery.

| Customer Segment | Key Needs | Asymchem Value Proposition |

| Emerging/Virtual Biotechs | Preclinical & clinical trial materials, integrated solutions, scientific expertise | End-to-end services, accelerated timelines, specialized capabilities |

| Mid-sized Pharma | Advanced manufacturing support, capacity augmentation, reliability, scalability | Process development to commercial manufacturing, quality assurance |

| Large Pharma | Cutting-edge tech access, supply chain resilience, regulatory compliance | GMP adherence, quality excellence, technological innovation |

| Universities/Research | Specialized synthesis, preclinical support, expert consultation, flexible models | Custom synthesis, formulation, adaptable project engagement |

| Generic Manufacturers | Cost-effectiveness, complex API expertise, niche product focus, quality assurance | Competitive pricing, advanced synthesis techniques, reliable production |

Cost Structure

Asymchem's commitment to innovation is reflected in its substantial Research and Development Expenses. These costs are crucial for developing novel manufacturing processes, refining current methods, and investigating cutting-edge technologies within drug substance and drug product production. This investment covers essential elements like skilled personnel, raw materials for experimentation, and specialized equipment for their R&D facilities.

In 2023, Asymchem reported research and development expenses of approximately RMB 1.39 billion, representing a significant portion of their operational outlay dedicated to future growth and technological advancement.

Manufacturing operations costs are a significant component for Asymchem, driven by the capital-intensive nature of pharmaceutical production. These expenses include crucial elements like raw materials, specialized consumables, and essential utilities such as electricity and water. For instance, in 2024, the company's focus on advanced manufacturing technologies means substantial investment in maintaining and operating sophisticated equipment, alongside direct labor costs for skilled production personnel.

Personnel salaries and benefits represent a significant component of Asymchem's cost structure. This category encompasses the compensation for its highly skilled workforce, including scientists, engineers, quality assurance professionals, and operational staff who are crucial for its advanced pharmaceutical manufacturing services.

In 2024, Asymchem continued to invest heavily in its human capital. The company's expenses in this area cover not only competitive salaries and comprehensive benefits packages but also ongoing training and development programs to maintain its technological edge and recruitment costs to attract top talent in a competitive industry.

Quality Control and Regulatory Compliance

Maintaining stringent quality control and adhering to global regulatory standards like current Good Manufacturing Practices (cGMP) represent a significant cost driver for Asymchem. These expenses encompass rigorous analytical testing at various production stages, the costs associated with regular internal and external audits, and the fees for obtaining and maintaining necessary certifications. For instance, in 2024, companies in the pharmaceutical contract development and manufacturing organization (CDMO) sector often allocate between 5% to 15% of their revenue towards quality and compliance initiatives.

Asymchem's investment in dedicated compliance teams and the continuous training of personnel on evolving regulatory landscapes also contribute to this cost structure. These teams are crucial for navigating complex international regulations, ensuring product safety and efficacy, and preventing costly recalls or penalties. The ongoing need for specialized expertise and robust documentation systems underscores the substantial financial commitment required to uphold these critical functions.

The financial implications of quality control and regulatory compliance can be further broken down:

- Analytical Testing: Costs associated with raw material testing, in-process controls, and final product release assays.

- Audits and Certifications: Expenses for facility inspections by regulatory bodies (e.g., FDA, EMA) and industry certifications.

- Compliance Personnel: Salaries and benefits for quality assurance, quality control, and regulatory affairs departments.

- System Upgrades: Investment in validated laboratory equipment, software, and data management systems to meet cGMP requirements.

Capital Expenditures and Facility Maintenance

Asymchem's commitment to growth and technological advancement necessitates substantial capital expenditures. These investments are crucial for expanding manufacturing capacity and upgrading existing facilities to incorporate the latest technologies, ensuring they remain state-of-the-art.

Significant outlays are dedicated to acquiring new, advanced equipment that enhances efficiency and broadens service capabilities. Furthermore, maintaining the integrity and operational readiness of current infrastructure represents an ongoing cost, vital for uninterrupted production and quality assurance.

- Capital Expenditures: Asymchem's 2024 capital expenditure plan includes investments in new production lines and advanced analytical equipment to support its expanding CDMO services.

- Facility Upgrades: Ongoing maintenance and upgrades to existing manufacturing sites are budgeted to ensure compliance with evolving regulatory standards and to improve operational efficiency.

- Technological Relevance: Continuous investment in cutting-edge technology, including automation and specialized processing equipment, is a core component of maintaining Asymchem's competitive edge in the pharmaceutical manufacturing sector.

Asymchem's cost structure is heavily influenced by its significant investments in research and development, manufacturing operations, and maintaining stringent quality and regulatory compliance. These core areas require substantial financial commitment to support innovation and operational excellence in the pharmaceutical CDMO sector.

The company's expenses are also shaped by its workforce, with personnel salaries and benefits representing a major outlay for its highly skilled scientific and operational teams. Furthermore, capital expenditures for expanding capacity and upgrading facilities are critical for staying technologically advanced and meeting market demands.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Research & Development | Skilled personnel, raw materials, specialized equipment | RMB 1.39 billion in R&D expenses (2023) |

| Manufacturing Operations | Raw materials, consumables, utilities, direct labor | Investment in advanced manufacturing technologies and sophisticated equipment (2024) |

| Personnel Costs | Salaries, benefits, training, recruitment | Continued heavy investment in human capital (2024) |

| Quality & Regulatory Compliance | Analytical testing, audits, certifications, compliance personnel | 5-15% of revenue allocation common in CDMO sector for compliance (2024 estimate) |

| Capital Expenditures | New production lines, advanced equipment, facility upgrades | Investment in new production lines and analytical equipment (2024) |

Revenue Streams

Asymchem's core revenue generation stems from fees for contract development and manufacturing services. This includes crucial stages like process development, analytical method creation, and the production of materials for clinical trials and commercial drug substances. These are typically project-specific, fee-for-service arrangements.

In 2024, Asymchem reported significant growth in its Contract Development and Manufacturing Organization (CDMO) segment. For instance, the company's revenue from its CDMO business, which encompasses these service fees, saw a substantial increase, reflecting strong demand for its specialized pharmaceutical manufacturing capabilities.

For extended development collaborations, Asymchem can structure revenue through milestone payments. These payments are linked to the successful completion of predefined project phases or obtaining crucial regulatory approvals, fostering client commitment and risk sharing.

Revenue is generated through long-term contracts for the commercial supply of active pharmaceutical ingredients (APIs) or finished drug products, with these agreements typically lasting several years. This model ensures a consistent and predictable flow of income for Asymchem.

For instance, Asymchem’s commitment to securing these recurring contracts underpins its financial stability. In 2023, the company reported significant growth, with revenue reaching RMB 12.1 billion, a 15.8% increase year-over-year, demonstrating the success of its long-term supply agreements in driving consistent business performance.

Technology Transfer and Licensing Fees

Asymchem's innovation extends to developing proprietary processes and technologies. These advancements can be licensed to clients, creating a valuable revenue stream through upfront fees and ongoing royalties. This strategy effectively monetizes their intellectual property, providing a competitive edge.

For instance, Asymchem's expertise in areas like continuous manufacturing or specialized catalysis can be packaged and licensed. This allows clients to access cutting-edge solutions without the extensive R&D investment. The company's commitment to research and development, evidenced by its significant R&D spending, fuels this pipeline of licensable technologies.

- Proprietary Process Licensing: Asymchem can license its unique manufacturing methods to other pharmaceutical or chemical companies.

- Technology Royalties: Revenue is generated from a percentage of sales for products manufactured using Asymchem's licensed technologies.

- Intellectual Property Monetization: This stream directly leverages Asymchem's investment in R&D and patent portfolio.

Ancillary Services and Consulting

Asymchem generates additional revenue through specialized consulting. This includes offering expertise in regulatory guidance, helping clients navigate complex pharmaceutical approval processes. For instance, in 2024, the demand for expert regulatory support remained high as new drug applications continued to be filed globally.

Supply chain optimization is another key consulting area. Asymchem advises clients on improving efficiency and resilience in their drug manufacturing supply chains. This became particularly relevant in 2024, with ongoing geopolitical shifts impacting global logistics and raw material sourcing.

Bespoke analytical services also contribute to this revenue stream. These services complement their core contract development and manufacturing organization (CDMO) offerings by providing tailored scientific support. Clients often leverage these specialized analytical capabilities for unique project needs, enhancing the overall value proposition.

- Regulatory Guidance: Assisting clients with navigating global pharmaceutical regulations.

- Supply Chain Optimization: Enhancing efficiency and resilience in drug manufacturing logistics.

- Bespoke Analytical Services: Providing specialized scientific support tailored to client projects.

Asymchem's revenue streams are multifaceted, primarily driven by its role as a Contract Development and Manufacturing Organization (CDMO). This involves charging fees for process development, analytical method creation, and the production of materials for clinical trials and commercial drug substances, typically on a project-by-project basis.

The company also secures revenue through milestone payments tied to the successful completion of predefined project stages or regulatory approvals, fostering client commitment. Furthermore, long-term contracts for the commercial supply of active pharmaceutical ingredients (APIs) and finished drug products ensure a consistent income flow, as demonstrated by their 2023 revenue of RMB 12.1 billion, a 15.8% year-over-year increase.

Asymchem also monetizes its intellectual property by licensing proprietary processes and technologies, generating upfront fees and ongoing royalties. This is complemented by revenue from specialized consulting services, including regulatory guidance and supply chain optimization, along with bespoke analytical services offered to clients.

| Revenue Stream | Description | Key Performance Indicator (2023/2024 Data) |

|---|---|---|

| CDMO Services | Fees for process development, clinical trial material production, commercial manufacturing. | CDMO segment revenue growth reported in 2024. |

| Milestone Payments | Payments linked to project phase completion or regulatory approvals. | Project success rates and number of milestones achieved. |

| Commercial Supply Contracts | Long-term agreements for API and finished product supply. | RMB 12.1 billion total revenue (15.8% YoY growth in 2023). |

| Proprietary Process Licensing | Licensing unique manufacturing methods and technologies. | R&D investment fueling new licensable technologies. |

| Consulting & Analytical Services | Expertise in regulatory guidance, supply chain optimization, and specialized analysis. | High demand for regulatory support and supply chain resilience advice in 2024. |

Business Model Canvas Data Sources

The Asymchem Business Model Canvas is informed by comprehensive market research, internal operational data, and financial projections. This multi-faceted approach ensures each component of the canvas is grounded in Asymchem's current capabilities and future market opportunities.