Astronics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astronics Bundle

Astronics leverages its strong technological foundation and diverse aerospace and defense portfolio, but faces challenges in supply chain disruptions and evolving market demands. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Astronics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Astronics Corporation's strength lies in its diverse product portfolio, encompassing critical aerospace and defense technologies like power generation, cabin lighting, and avionics. This broad offering, which also includes automated test solutions, caters to both original equipment manufacturers and aftermarket needs, creating a robust business model.

This diversification is a key advantage, insulating Astronics from downturns in any single market segment. For instance, in the first quarter of 2024, while some sectors might face headwinds, the company's presence across multiple areas helps to stabilize overall performance.

The company's global reach across aerospace, defense, and other mission-critical industries further solidifies this strength. This wide market penetration ensures a substantial and varied customer base, reducing reliance on any one client and providing a stable foundation for growth.

Astronics has shown impressive financial performance, with sales growing by double digits for three straight years. This momentum continued into 2024 with a 15.4% sales increase and a further 11.3% rise in the first quarter of 2025. This consistent growth highlights the company's ability to expand its revenue streams effectively.

The company's financial health is further bolstered by a record backlog of $673 million as of the first quarter of 2025. Coupled with a strong book-to-bill ratio, this indicates sustained demand for Astronics' products and services. This robust demand pipeline provides a clear revenue outlook for the remainder of 2025 and beyond.

Astronics' strength lies in its dominant market positions, particularly in In-Seat Power Systems (ISPS), where it holds an impressive over 90% market share. This leadership is a significant competitive advantage, allowing for strong pricing power and consistent revenue streams.

The company's differentiated offerings, backed by decades of engineering excellence, cater to diverse aerospace sectors including commercial, general aviation, and military aircraft. This broad reach and specialized technology are key drivers for both sales growth and margin expansion.

With a legacy of innovation spanning 50 years, Astronics has cultivated a reputation for quality and reliability. This deep-seated customer trust, combined with its technological prowess, solidifies its market leadership and underpins its ability to command premium pricing.

Robust Backlog and Future Revenue Visibility

Astronics demonstrates significant strength through its robust backlog, which stood at a record $673 million at the close of Q1 2025. This substantial order book provides exceptional revenue visibility, with roughly 76% of it slated for conversion into revenue within the next twelve months. This predictability is a key advantage, enabling more effective operational planning and resource management.

The strong backlog directly translates to enhanced revenue predictability, a crucial factor for investors and strategic planners alike. It allows Astronics to forecast its financial performance with greater accuracy, supporting informed decision-making regarding investments and operational scaling. This visibility is particularly beneficial in the cyclical aerospace industry.

- Record Backlog: $673 million as of Q1 2025.

- Near-Term Conversion: Approximately 76% expected within 12 months.

- Revenue Visibility: Provides strong predictability for financial planning.

- Customer Demand: Signals sustained demand, especially in Aerospace.

Improved Operational Efficiencies and Liquidity

Astronics has demonstrated a strong upward trend in operational efficiencies, with adjusted EBITDA showing significant growth in recent quarters. For instance, in Q1 2024, adjusted EBITDA reached $11.5 million, a substantial increase from the previous year, reflecting successful cost management and revenue optimization.

Strategic actions, such as the restructuring within the Test Systems segment, have directly contributed to these improved margins. Furthermore, refinancing efforts have bolstered the company's liquidity position, providing greater financial flexibility. This enhanced financial health is crucial for navigating market dynamics and pursuing growth avenues.

- Improved Profitability: Astronics' focus on operational efficiencies has translated into stronger financial performance, with adjusted EBITDA increasing by 45% year-over-year in Q1 2024.

- Enhanced Liquidity: Successful refinancing activities have strengthened the company's balance sheet, improving its ability to meet financial obligations and invest in future opportunities.

- Cost Management: Restructuring initiatives, particularly in the Test Systems segment, have yielded positive results in controlling operating expenses and boosting overall profitability.

Astronics' diversified product line, serving critical aerospace and defense needs, provides a significant competitive edge. This broad range of offerings, from power systems to lighting and avionics, ensures resilience against market fluctuations in any single sector.

The company's dominant market share, especially in In-Seat Power Systems (ISPS) with over 90% control, underscores its strong competitive positioning. This leadership allows for favorable pricing and a stable revenue base, further supported by a legacy of innovation and customer trust.

Astronics' financial performance is robust, marked by consistent double-digit sales growth for three consecutive years, continuing into 2024 with an 11.3% increase in Q1 2025. This upward trajectory is further solidified by a record backlog of $673 million as of Q1 2025, with approximately 76% expected to convert to revenue within the next twelve months.

| Metric | Value | Period |

|---|---|---|

| Sales Growth | 11.3% | Q1 2025 |

| Record Backlog | $673 million | Q1 2025 |

| ISPS Market Share | >90% | N/A |

| Adjusted EBITDA Growth | 45% | Q1 2024 (YoY) |

What is included in the product

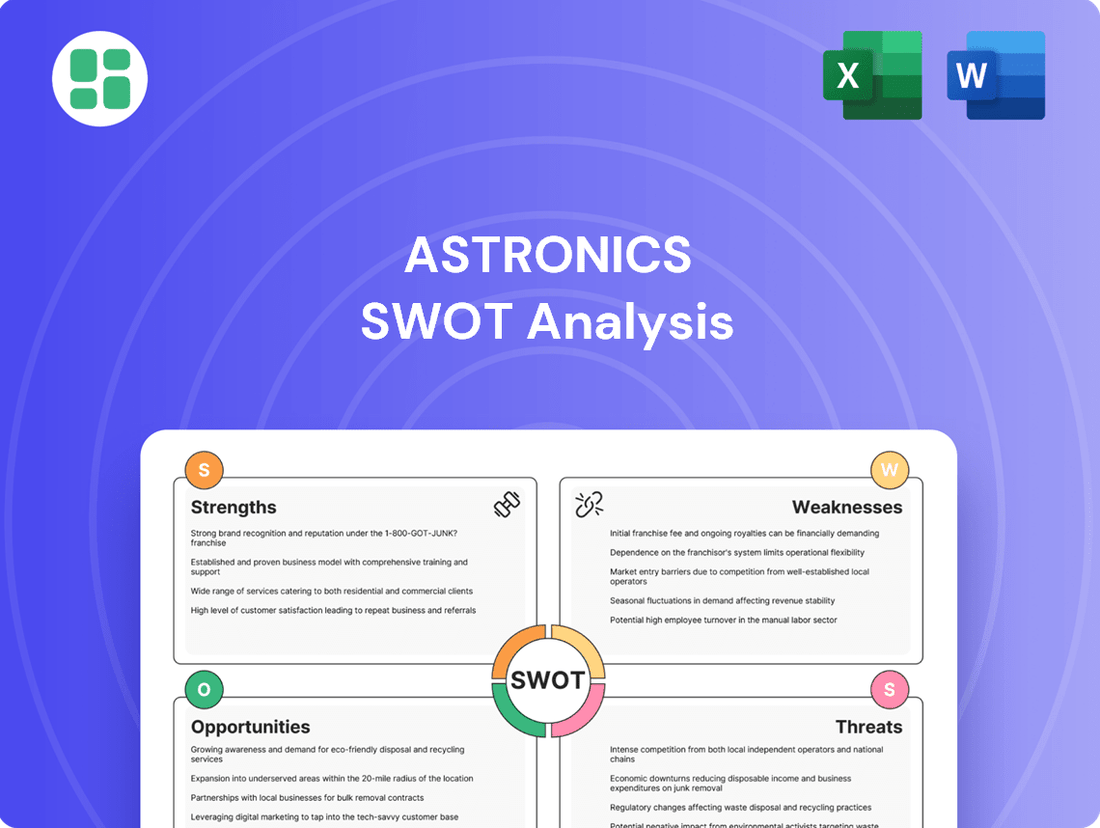

Delivers a strategic overview of Astronics’s internal and external business factors, highlighting its technological strengths and market opportunities while acknowledging potential weaknesses and competitive threats.

Simplifies complex market dynamics by highlighting Astronics' core strengths and potential vulnerabilities for targeted strategic action.

Weaknesses

Astronics' Test Systems segment has been a consistent weak point, experiencing sales declines and operating losses in recent quarters. This underperformance directly impacts the company's overall profitability. For instance, in the first quarter of 2024, this segment reported a net loss, a significant drag on Astronics' consolidated financial results.

Several factors contribute to this segment's struggles. Lower defense revenue, a key driver for Test Systems, has been a persistent issue. Additionally, the company has had to revise cost estimates on long-term contracts, leading to unexpected expenses. The under-absorption of fixed costs due to lower production volumes further exacerbates the financial strain.

While Astronics' management is actively pursuing restructuring initiatives to turn the Test Systems segment around, it continues to weigh down the company's consolidated performance. The ongoing challenges in this area remain a significant concern for investors and analysts monitoring Astronics' financial health.

Astronics faces considerable risk from ongoing patent infringement litigation, notably in the United Kingdom. These multi-jurisdictional cases have already led to substantial damages, significant legal expenses, and accrued interest, creating considerable financial strain.

The company's involvement in these legal battles introduces financial liabilities and diverts crucial management focus and resources away from core business operations. Successfully navigating and resolving these disputes is paramount for Astronics to stabilize its profit margins and alleviate financial uncertainty.

Astronics' reliance on a few major aircraft programs, particularly within its Aerospace segment, presents a notable weakness. A significant portion of its revenue is tied to the commercial transport market and specific original equipment manufacturer (OEM) production lines, such as those for Boeing's 737. This concentration means that any slowdowns or disruptions in these key programs, like production pauses or labor disputes at major manufacturers, can directly curtail Astronics' sales performance.

For instance, while specific 2024/2025 figures are still emerging, historical data shows that the commercial transport sector is a dominant revenue driver. A downturn in this sector, or issues with a single major OEM's output, could disproportionately affect Astronics' financial results, underscoring the vulnerability of this revenue concentration.

Vulnerability to Supply Chain Disruptions

Astronics, like many in the aerospace and defense sector, faces persistent supply chain vulnerabilities. Despite ongoing efforts to build resilience, the industry in 2024 and into 2025 continues to experience parts shortages and extended lead times, directly impacting Astronics' production capabilities.

These disruptions can significantly constrain output, leading to increased operational costs and delays in fulfilling customer orders. This directly affects Astronics' capacity to meet market demand and sustain its profitability targets.

- Extended Lead Times: Reports from industry analyses in late 2024 indicated that critical component lead times for aerospace manufacturing could stretch from months to over a year for certain specialized parts.

- Parts Shortages: A survey of aerospace manufacturers in early 2025 revealed that over 60% cited a lack of essential electronic components as a primary bottleneck.

- Cost Increases: The scarcity of materials and components has driven up prices, with some raw material costs for specialized alloys used in aerospace components seeing a 15-20% increase year-over-year through mid-2025.

Effectively managing these complex and often unpredictable supply chain challenges remains a critical ongoing operational hurdle for Astronics.

Impact of Tariff Volatility and Geopolitical Risks

Astronics is vulnerable to fluctuating global trade policies and potential import tariffs. These could lead to an estimated annual increase in material costs ranging from $10 million to $20 million, even after accounting for mitigation efforts. This volatility creates significant uncertainty for the company's international supply chain operations and its global customer relationships.

The ongoing geopolitical instability further compounds these risks. Such instability can disrupt supply chains, impact international sales, and affect the overall demand for Astronics' products. This makes long-term strategic planning and cost management particularly challenging.

- Tariff Impact: Potential annual material cost increase of $10 million to $20 million.

- Geopolitical Uncertainty: Threatens international supply chain and global customer base.

- Policy Evolution: Evolving trade policies create ongoing risk.

Astronics' Test Systems segment continues to be a significant weakness, experiencing sales declines and operating losses in recent quarters, impacting overall profitability. For example, the segment reported a net loss in Q1 2024, directly hindering consolidated financial results.

What You See Is What You Get

Astronics SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the complete report, ensuring transparency and value.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering comprehensive insights into Astronics' strategic position.

This preview reflects the real document you'll receive—professional, structured, and ready to use. Explore the detailed breakdown of Astronics' Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The aerospace and defense sector is robust, fueled by recovering global air travel and heightened defense budgets due to geopolitical tensions. This creates a fertile ground for Astronics, especially within its strong Aerospace segment, as demand for new aircraft, parts, and upgrades continues to climb.

Astronics is well-positioned to capitalize on this trend, with its products integral to both commercial and military aviation. The company's participation in programs like the Future Long-Range Assault Aircraft (FLRAA) is a prime example of how it's tapping into significant military growth opportunities.

The aerospace and defense sector is rapidly evolving with digital technologies, artificial intelligence (AI), and the emergence of advanced air mobility (AAM). Astronics is well-positioned to capitalize on these shifts by prioritizing investment in new product development and integrating cutting-edge technologies like AI. This strategic focus can enhance its existing product portfolio, streamline operations, and tackle long-standing industry challenges such as improving supply chain visibility and bolstering aftermarket services. Such innovation is key to unlocking new avenues for revenue growth.

The demand for enhanced passenger experiences, including robust cabin power, advanced inflight entertainment, and reliable connectivity, is a major tailwind for Astronics' commercial transport segment. Airlines are actively investing in cabin upgrades to attract and retain customers, creating a fertile ground for Astronics' IFEC and cabin systems. For instance, the global inflight entertainment market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly in the coming years, driven by these passenger-centric improvements.

Strategic Acquisitions and Partnerships

The aerospace and defense sector is poised for a surge in mergers and acquisitions (M&A) in 2025, with a particular focus on middle-market transactions. Astronics aims to enhance its value through both internal growth and strategic acquisitions. A prime example is their recent integration of Envoy Aerospace, which bolsters their FAA Certification Services and expands their overall market reach and technological expertise.

These strategic moves are crucial for Astronics' growth trajectory. By acquiring companies like Envoy Aerospace, Astronics can quickly gain new capabilities and market share, rather than developing them organically. This approach is particularly effective in a dynamic industry where staying ahead technologically is paramount. Partnerships also offer a pathway to new opportunities, granting access to previously untapped programs and markets.

- Increased M&A Activity: The aerospace and defense industry is projected to see heightened M&A in 2025, especially within the middle market.

- Astronics' Growth Strategy: The company prioritizes increasing value through organic development and strategic acquisitions.

- Envoy Aerospace Acquisition: This move significantly enhances Astronics' FAA Certification Services, expanding its offerings and technological base.

- Partnership Benefits: Collaborations can unlock access to new programs and markets, further diversifying Astronics' business.

Improving Operational Leverage and Cost Efficiencies

Astronics has shown a stronger ability to generate profit from increased sales, partly due to successful restructuring, especially within its Test Systems division. This improved operational leverage means that as sales grow, profits tend to grow even faster. For instance, in the first quarter of 2024, Astronics reported a significant increase in its operating income, demonstrating the positive effects of these efficiency gains.

To keep this momentum going, Astronics can focus on refining its production processes, carefully managing the costs of materials and labor, and continuing to implement cost-reduction strategies. These internal efforts are crucial for consistent profit growth and strengthening the company's position against competitors. By maintaining this focus on operational excellence, Astronics can unlock further margin expansion.

- Continued Optimization: Astronics can further enhance its profitability by streamlining manufacturing and supply chain operations.

- Cost Management: Vigilant control over input costs, such as raw materials and labor, is essential for margin improvement.

- Restructuring Benefits: The company's past restructuring efforts have laid the groundwork for sustained margin expansion as sales volumes increase.

- Competitive Edge: Improved operational efficiency directly translates into a stronger competitive advantage in the market.

The growing demand for advanced cabin technologies, including inflight entertainment and connectivity, presents a significant opportunity for Astronics. Airlines are investing in passenger experience, driving sales for Astronics' IFEC solutions. The global IFEC market was valued at approximately $6.5 billion in 2023 and is expected to see continued growth, benefiting companies like Astronics.

Threats

The aerospace and defense sector is fiercely competitive, with giants like Lockheed Martin, General Dynamics, and Northrop Grumman dominating market share. Astronics consistently faces pressure from these and other rivals across its diverse product lines. For instance, in the commercial aviation segment, companies like Collins Aerospace and Safran are major competitors, offering similar avionics and cabin solutions.

Astronics' ability to innovate and maintain competitive pricing is crucial. A failure in these areas, or in securing new, significant contracts, directly threatens its market share. This erosion can negatively impact revenue streams and overall profitability, as seen in the cyclical nature of defense procurement and the constant need for technological advancement in commercial aviation.

The aerospace sector, including Astronics, faces a significant threat from economic downturns. A slowdown in global economic activity can directly translate into reduced consumer spending on travel, leading airlines to postpone or cancel aircraft orders and reduce spending on cabin upgrades. For instance, during the COVID-19 pandemic's initial impact in 2020, global air passenger traffic plummeted by over 60%, severely affecting aircraft manufacturers and their suppliers like Astronics.

Furthermore, defense budgets are often among the first areas to see cuts during economic contractions. A decrease in government defense spending would directly impact Astronics' Defense segment, potentially leading to fewer contract awards and reduced demand for its specialized electronic systems and aircraft modifications. While defense spending has seen increases in recent years due to geopolitical tensions, a severe recession could reverse this trend.

Even with current positive trends in air travel and defense, persistent macroeconomic headwinds, including high inflation and rising interest rates in 2024 and projected into 2025, pose an ongoing concern. These factors can increase operating costs for airlines and governments, further pressuring their budgets and potentially dampening demand for new aerospace products and services that Astronics provides.

Even with some easing, the aerospace and defense sector still grapples with significant labor shortages and fragile supply chains. These persistent issues can constrain Astronics' ability to ramp up production, potentially driving up costs for essential materials and extending the time it takes to get products to customers.

These supply chain disruptions and labor gaps directly impact Astronics' operational rhythm, potentially causing delays in fulfilling customer orders and straining relationships. For instance, in the first quarter of 2024, many aerospace manufacturers reported extended lead times for critical components, a trend Astronics likely experienced as well, impacting its revenue realization.

Regulatory Changes and Certification Delays

The aerospace and defense sector operates under a stringent regulatory environment. Astronics, like its peers, faces potential disruptions from evolving regulations, certification timelines, and safety mandates, which can impact product development and market access.

Delays in customer certification or increased regulatory oversight on key aircraft manufacturers present a significant threat. For instance, a slowdown in the certification of new aircraft models by major OEMs could directly affect Astronics' production volumes and ability to meet delivery commitments, creating operational and financial uncertainties.

- Regulatory Hurdles: Changes in FAA or EASA regulations can necessitate costly product redesigns or extended testing phases.

- Certification Delays: A significant portion of Astronics' revenue is tied to specific aircraft programs; delays in the certification of these programs by manufacturers like Boeing or Airbus can directly impact Astronics' revenue recognition and cash flow. For example, the ongoing scrutiny of the Boeing 737 MAX program has had ripple effects across the supply chain.

- Safety Standards: Stricter safety standards can lead to increased compliance costs and longer development cycles for Astronics' advanced systems.

Intellectual Property Infringement and Legal Risks

Astronics faces significant threats from intellectual property infringement and related legal risks. The company experienced an adverse ruling in the UK court regarding patent infringement, which resulted in substantial damages. This legal battle underscores the financial and reputational vulnerabilities associated with IP disputes.

These ongoing legal challenges can lead to considerable financial penalties and escalating legal fees. For instance, the UK ruling involved significant damages, impacting the company's bottom line. Such outcomes can divert resources that would otherwise be used for innovation and growth.

- Ongoing Litigation: The UK court's adverse ruling highlights the immediate threat of patent infringement cases.

- Financial Penalties: Adverse rulings can result in substantial damages, as seen in the UK case, impacting financial health.

- Reputational Damage: Legal battles can harm the company's reputation, potentially affecting customer trust and market position.

- Future IP Disputes: The company remains susceptible to future intellectual property disputes, posing a continuous risk to its competitive standing.

Astronics operates in a highly competitive landscape, facing intense rivalry from established aerospace and defense giants. Economic downturns pose a significant threat, as reduced travel demand and defense budget cuts can directly impact sales. Persistent macroeconomic headwinds like inflation and rising interest rates in 2024 and 2025 continue to pressure operating costs and demand.

Persistent supply chain disruptions and labor shortages, evident in extended lead times for critical components throughout early 2024, constrain production capacity and increase costs for Astronics. The company also faces substantial risks from stringent regulatory environments and evolving safety standards, which can necessitate costly product redesigns and lengthen development cycles. Furthermore, ongoing litigation, such as the UK patent infringement ruling, exposes Astronics to significant financial penalties and reputational damage, highlighting a continuous vulnerability to intellectual property disputes.

SWOT Analysis Data Sources

This Astronics SWOT analysis is built upon a foundation of credible data, including the company's official financial filings, comprehensive market research reports, and insights from industry experts. This ensures a robust and accurate assessment of its strategic position.