Astronics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astronics Bundle

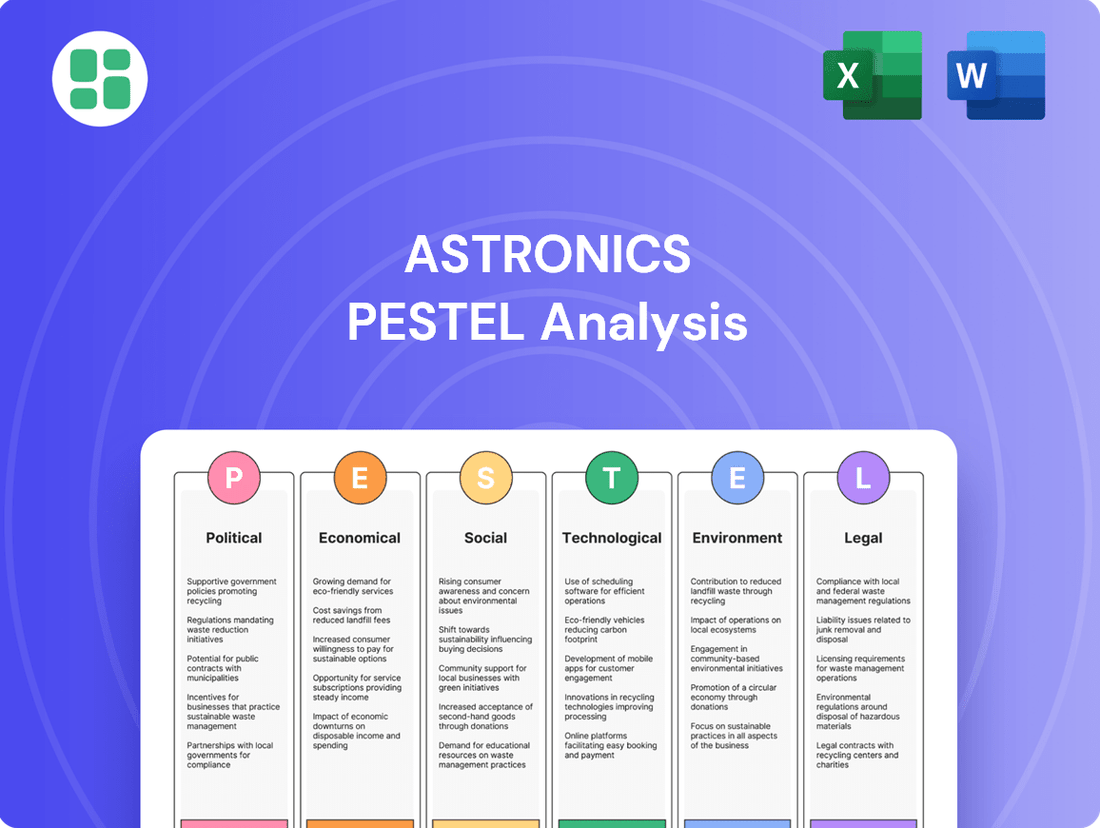

Unlock the critical external factors shaping Astronics's trajectory with our meticulously researched PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Equip yourself with actionable intelligence to refine your investment or business strategy. Download the full PESTLE analysis now for a competitive advantage.

Political factors

Government defense spending is a crucial political factor for Astronics, directly influencing its defense segment. Higher defense budgets, often spurred by global security concerns, can translate to increased demand for Astronics' advanced technologies. Conversely, budget reductions can limit growth prospects.

The U.S. Department of Defense's budget request for fiscal year 2025, totaling $849.8 billion, underscores the significant financial commitments that shape the market for defense contractors. This substantial allocation impacts procurement decisions and research and development funding, areas where Astronics operates.

Changes in international trade policies and tariffs directly impact Astronics' operational costs and market reach. For instance, increased tariffs on key electronic components, often sourced from Asia, can significantly inflate production expenses. In 2024, ongoing trade tensions and potential new tariffs could add to these pressures, affecting Astronics' ability to compete on price globally.

Furthermore, export controls implemented by governments can restrict Astronics' access to certain international markets, particularly for advanced aerospace and defense technologies. This can limit potential revenue streams and necessitate diversification of sales strategies. The global aerospace market in 2024 continues to be shaped by these geopolitical considerations, influencing aircraft manufacturing and defense spending patterns.

The aerospace sector operates under a rigorous regulatory framework, with bodies like the Federal Aviation Administration (FAA) constantly updating airworthiness and safety standards. For Astronics, adherence to these evolving certifications is paramount for market access and continued operation, directly impacting product development cycles and costs. For instance, the FAA's recent focus on cybersecurity for avionics systems, detailed in guidance released in late 2023, necessitates significant investment in secure design and manufacturing processes.

Geopolitical Stability and Conflicts

Global geopolitical stability and the prevalence of conflicts directly influence the demand for defense products and services, which is a key market for Astronics. Heightened tensions and ongoing wars, such as the protracted conflict in Ukraine and the complex situation in the Middle East, have historically driven increased defense spending. For instance, in 2023, global military expenditure reached an estimated $2.4 trillion, a 6.8% increase in real terms from 2022, marking the ninth consecutive year of growth, according to the Stockholm International Peace Research Institute (SIPRI). This trend suggests a potentially stronger market for Astronics' offerings.

This environment presents a dual-edged sword for Astronics. On one hand, increased global defense spending can create significant opportunities for the company's defense sector, potentially boosting sales of its avionics, communication, and electronic warfare systems. On the other hand, such volatile geopolitical landscapes introduce considerable challenges. These include potential supply chain disruptions, as seen with critical component shortages impacting various industries, and heightened operational risks that could affect manufacturing and delivery timelines. For example, the ongoing semiconductor shortage, exacerbated by geopolitical tensions, has impacted production across many sectors, including aerospace and defense.

- Increased Defense Spending: Global military expenditure reached an estimated $2.4 trillion in 2023, up 6.8% from 2022, indicating a growing market for defense contractors.

- Geopolitical Hotspots: Conflicts in Ukraine and the Middle East are primary drivers of heightened global defense spending and strategic reallocation of resources.

- Supply Chain Vulnerability: Geopolitical instability can disrupt global supply chains, affecting the availability and cost of essential components for Astronics' products.

- Operational Risks: Escalating conflicts can pose direct operational risks, including potential impacts on personnel, facilities, and the secure transport of goods.

Government Support for R&D in Aerospace

Government backing for aerospace research and development is a significant driver of innovation. Programs that fund advancements in areas like sustainable aviation, advanced air mobility (AAM), and AI offer Astronics avenues to create cutting-edge products. For example, the FAA's FAST program, launched in 2022 with an initial $4.3 billion investment, specifically targets accelerating SAF production and low-emission aviation technologies, directly benefiting companies like Astronics involved in these sectors.

These government initiatives translate into tangible opportunities for Astronics. The U.S. Department of Transportation's focus on AAM, including regulatory frameworks and infrastructure planning, creates a market for new systems and components. Furthermore, national defense spending, a consistent area of government investment, often includes funding for advanced aerospace technologies that Astronics can leverage.

- Government R&D funding directly fuels innovation in critical aerospace sectors.

- Sustainable aviation initiatives, like the FAA's FAST program, create market demand for new technologies.

- Advanced Air Mobility (AAM) development is supported by government regulatory and infrastructure planning.

- National defense budgets often allocate resources to advanced aerospace research, benefiting suppliers like Astronics.

Government defense spending significantly impacts Astronics' revenue, with the U.S. Department of Defense budget for FY2025 requesting $849.8 billion, a substantial figure influencing procurement. Geopolitical instability, such as conflicts in Ukraine and the Middle East, has historically driven up global military expenditure, which reached $2.4 trillion in 2023, benefiting defense contractors. Trade policies and export controls also play a role, with tariffs on components and restrictions on advanced technologies affecting Astronics' costs and market access.

Regulatory frameworks, like those from the FAA, are critical for Astronics, requiring adherence to evolving airworthiness and safety standards, including cybersecurity for avionics. Government R&D funding, exemplified by the FAA's FAST program investing in sustainable aviation, creates opportunities for innovation and new product development in sectors like Advanced Air Mobility (AAM).

| Political Factor | Impact on Astronics | Supporting Data/Trend (2024/2025 Focus) |

|---|---|---|

| Defense Spending | Directly influences demand for defense segment products. | US DoD FY2025 Budget Request: $849.8 billion. Global military expenditure in 2023: $2.4 trillion (up 6.8% from 2022). |

| Geopolitical Stability | Drives demand for defense solutions; creates supply chain risks. | Ongoing conflicts in Ukraine and the Middle East continue to shape global defense priorities. |

| Trade Policies & Export Controls | Affects operational costs, market access, and component sourcing. | Continued trade tensions and potential tariffs in 2024 could impact component costs. |

| Aerospace Regulations | Mandates compliance with safety and airworthiness standards. | FAA's increased focus on avionics cybersecurity necessitates ongoing investment in secure design. |

| Government R&D Funding | Spurs innovation in areas like sustainable aviation and AAM. | FAA's FAST program (launched 2022) targets sustainable aviation technology development. |

What is included in the product

This Astronics PESTLE analysis systematically examines the influence of external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing a comprehensive understanding of the business landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, alleviating the pain of lengthy, complex reports.

Helps support discussions on external risk and market positioning during planning sessions, offering clarity and actionable insights to ease strategic decision-making.

Economic factors

Global economic health is a major driver for Astronics, as a robust economy usually means more people flying, which translates to more aircraft being built and serviced. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a slight uptick from 2023, indicating a generally supportive environment for the aerospace industry.

When GDP expands, airlines tend to see higher passenger and cargo volumes. This increased demand encourages airlines to invest in new aircraft and upgrade existing fleets, directly benefiting Astronics through sales of its avionics, cabin electronics, and power systems. The rebound in air travel post-pandemic, with passenger traffic reaching 94% of pre-pandemic levels by late 2023 according to the International Air Transport Association (IATA), highlights this correlation.

Conversely, an economic downturn or recession can significantly dampen demand for air travel and, consequently, for new aircraft. Reduced airline profitability during such periods often leads to deferred or canceled orders, impacting Astronics' revenue streams. For example, the economic uncertainty in early 2024, marked by persistent inflation in some regions, posed a risk to sustained consumer spending on travel.

The financial well-being of airlines directly impacts Astronics' business, particularly its cabin lighting, power, and avionics divisions. When airlines are profitable, they are more likely to invest in new aircraft and upgrade their existing fleets. This, in turn, drives demand for Astronics' original equipment manufacturer (OEM) and aftermarket offerings.

The International Air Transport Association (IATA) forecasts a positive outlook for airline profitability, projecting continued gains through 2025. While challenges like ongoing supply chain disruptions persist, the overall trend suggests a healthy industry environment. For example, IATA reported a net profit margin of 2.7% for airlines in 2023, with expectations for this to improve slightly in 2024.

Astronics, operating within the aerospace sector, is particularly vulnerable to disruptions in its supply chain and shifts in the cost of raw materials. These issues can directly impact production timelines and profitability.

The aerospace and defense supply chain experienced notable disruptions throughout 2024. Factors such as factory fires and labor disputes contributed to these challenges, creating further pressure on manufacturers like Astronics.

Shortages of critical components, including semiconductors, and rising prices for essential raw materials have been ongoing concerns. These shortages can cause manufacturing delays, inflate production expenses, and hinder Astronics' capacity to fulfill customer orders effectively.

Inflation and Interest Rates

High inflation presents a significant challenge for Astronics, as it directly increases the cost of essential inputs like raw materials and skilled labor. For instance, the US Producer Price Index for intermediate goods, a key indicator of manufacturing costs, saw a notable increase in late 2023 and early 2024, impacting companies like Astronics. This rise in operational expenses can put downward pressure on Astronics' profit margins if these costs cannot be fully passed on to customers.

Furthermore, the global trend of rising interest rates, with central banks in major economies like the US and Europe maintaining or even increasing rates through much of 2024, directly affects Astronics. Higher borrowing costs can deter capital expenditures for both Astronics and its airline clients. This means that airlines might delay or scale back orders for new aircraft or significant avionics upgrades, a core market for Astronics, due to the increased expense of financing such projects.

However, there are mitigating factors. While global GDP growth forecasts for 2024 indicated a slowdown compared to previous years, airline industry profitability showed resilience. This improvement was largely attributed to a sustained period of lower oil prices and robust employment figures in key markets, which bolstered air travel demand. For example, IATA projected a significant increase in net airline profits for 2024, reaching an estimated $25.7 billion, up from $23.3 billion in 2023. This improved financial health for airlines can help them absorb some of the inflationary pressures and maintain investment in their fleets, indirectly benefiting Astronics.

- Inflationary Impact: Increased costs for materials and labor can squeeze Astronics' profit margins.

- Interest Rate Sensitivity: Higher borrowing costs may slow down capital investments by Astronics and its airline customers.

- Airline Profitability: Despite economic headwinds, improving airline profits, driven by lower fuel costs and strong demand, offer a buffer against some economic slowdowns.

- Global Economic Outlook: A projected slowdown in global GDP growth in 2024 necessitates careful management of operational costs and market demand for Astronics.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact Astronics as a global company. For instance, if the U.S. dollar strengthens against other major currencies, Astronics' products become pricier for international buyers, potentially dampening demand. Conversely, a weaker dollar can make its offerings more attractive abroad, boosting export sales.

Managing these currency shifts is vital for Astronics to ensure stable pricing and predictable revenue streams across its international operations. The company's financial reports often detail the impact of foreign currency translation adjustments on its earnings. For example, in the first quarter of 2024, many multinational corporations reported headwinds due to a relatively strong dollar, affecting their overseas sales volumes.

- Strong U.S. Dollar Impact: Makes Astronics' products more expensive for international customers, potentially reducing sales volume.

- Weak U.S. Dollar Benefit: Enhances export competitiveness, making Astronics' products more affordable and attractive in foreign markets.

- Revenue Predictability: Effective currency risk management is essential for maintaining stable pricing and predictable revenue in diverse global markets.

- Q1 2024 Trends: Many global businesses experienced challenges in Q1 2024 due to a strong dollar impacting international revenue realization.

Astronics' performance is closely tied to global economic health, with GDP growth directly influencing airline demand for new aircraft and services. The International Air Transport Association (IATA) projected a net airline profit of $25.7 billion for 2024, up from $23.3 billion in 2023, signaling industry resilience despite economic headwinds. However, persistent inflation and rising interest rates through 2024 presented challenges by increasing operational costs and the expense of capital for both Astronics and its customers.

Currency fluctuations also play a significant role, with a strong U.S. dollar in early 2024 making Astronics' products more expensive for international buyers. Managing these currency risks is crucial for maintaining stable pricing and predictable revenue across global markets.

| Economic Factor | Impact on Astronics | 2024/2025 Data/Trend |

|---|---|---|

| Global GDP Growth | Drives airline demand for aircraft and services. | IMF projected 3.2% global growth for 2024. |

| Airline Profitability | Influences airline investment in new fleets and upgrades. | IATA projected $25.7 billion net airline profit for 2024. |

| Inflation | Increases raw material and labor costs, impacting margins. | US PPI for intermediate goods showed increases in late 2023/early 2024. |

| Interest Rates | Raises borrowing costs for capital expenditures. | Major central banks maintained or increased rates through much of 2024. |

| Currency Exchange Rates | Affects international sales competitiveness. | Strong USD in Q1 2024 impacted international revenue realization for many firms. |

Preview the Actual Deliverable

Astronics PESTLE Analysis

The Astronics PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed PESTLE analysis of Astronics, covering Political, Economic, Social, Technological, Legal, and Environmental factors, is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

The content and structure of this comprehensive Astronics PESTLE Analysis shown in the preview is the same document you’ll download after payment, providing you with actionable insights.

Sociological factors

The willingness of people to travel by air is a critical driver for Astronics' commercial aviation segment. With air travel demand hitting new peaks in 2024 and projections indicating continued robust growth into 2025, this translates directly into an increased need for aircraft and the sophisticated cabin technologies Astronics provides.

Passenger confidence in the safety and convenience of air travel plays a significant role in sustaining this demand. Factors influencing this confidence, such as improved security measures and enhanced passenger experiences, are therefore vital for the sustained health of the aviation market.

The aerospace and defense sector, including companies like Astronics, grapples with a continuous need for specialized talent, particularly engineers and skilled technicians. A significant portion of the experienced workforce is nearing retirement, creating a knowledge transfer challenge. For instance, in 2024, reports indicated a critical shortage of aerospace engineers, with demand significantly outpacing supply.

This talent deficit is exacerbated by intense competition from other technology-driven industries vying for the same skilled professionals. The impact on Astronics could translate to slower product development cycles and potential limitations in scaling manufacturing to meet demand. A 2025 industry forecast suggests that addressing these skill gaps through robust apprenticeship programs and competitive compensation packages will be paramount for maintaining a competitive edge.

Passenger desire for a more engaging and comfortable flight is a significant driver for Astronics. This includes expectations for better entertainment systems, reliable Wi-Fi, and customizable lighting, pushing Astronics to innovate its cabin solutions.

Airlines are responding by investing heavily in these areas. For instance, in 2024, many carriers are upgrading their fleets with advanced IFE systems, with some projecting that over 80% of their long-haul aircraft will feature these by year-end, directly impacting demand for Astronics' offerings.

Corporate Social Responsibility (CSR) Initiatives

Societal expectations for corporate social responsibility are increasingly shaping business operations, pushing companies like Astronics to adopt more ethical practices. This includes a focus on responsible sourcing and sustainable manufacturing, which are becoming key differentiators in the market. For instance, in 2024, a significant portion of global consumers indicated they would pay more for products from companies committed to positive social and environmental impact.

Adherence to robust CSR standards can significantly bolster Astronics' brand image, making it more attractive to top talent and environmentally conscious consumers. This commitment also resonates with investors who are prioritizing Environmental, Social, and Governance (ESG) factors. Astronics' transparency in its supply chains and active community engagement are crucial elements in building this trust and enhancing its overall reputation.

- Reputation Enhancement: Strong CSR practices in 2024 led to a noticeable increase in positive brand sentiment for companies prioritizing ethical operations.

- Talent Acquisition: A 2025 survey revealed that over 60% of job seekers consider a company's CSR commitment when evaluating potential employers.

- Investor Appeal: ESG-focused investment funds saw substantial growth in 2024, with assets under management exceeding trillions globally, highlighting investor demand for responsible companies.

- Customer Loyalty: Consumers in 2024 demonstrated a growing preference for brands that actively engage in community support and environmental stewardship.

Public Perception of Aviation Safety

Public perception of aviation safety is a critical driver of passenger demand and overall industry confidence. A single high-profile incident can erode trust built over years of safe operations. For instance, while 2023 saw a global commercial aviation accident rate of approximately 0.17 per million departures, any increase in this figure, however small, can disproportionately affect public sentiment and booking behavior.

Astronics, through its advanced electronic systems that contribute to aircraft performance and safety, directly influences this perception. The company's commitment to innovation in areas like flight control systems and cabin safety technology helps bolster the industry's image. The Federal Aviation Administration (FAA) reported that in 2024, the average time for certification of new safety-critical avionics systems remained a key focus for efficiency, highlighting the rigorous standards Astronics must meet.

- Public Trust: Passenger confidence directly correlates with the perceived safety of air travel.

- Industry Impact: Negative safety perceptions can lead to reduced passenger numbers and revenue.

- Astronics' Role: The company's safety-enhancing products are vital for maintaining industry credibility.

- Regulatory Scrutiny: Continuous adherence to stringent safety regulations, like those from the EASA and FAA, is paramount.

Societal expectations for corporate social responsibility are increasingly shaping business operations, pushing companies like Astronics to adopt more ethical practices. This includes a focus on responsible sourcing and sustainable manufacturing, which are becoming key differentiators in the market. For instance, in 2024, a significant portion of global consumers indicated they would pay more for products from companies committed to positive social and environmental impact.

Adherence to robust CSR standards can significantly bolster Astronics' brand image, making it more attractive to top talent and environmentally conscious consumers. This commitment also resonates with investors who are prioritizing Environmental, Social, and Governance (ESG) factors. Astronics' transparency in its supply chains and active community engagement are crucial elements in building this trust and enhancing its overall reputation.

Public perception of aviation safety is a critical driver of passenger demand and overall industry confidence. A single high-profile incident can erode trust built over years of safe operations. For instance, while 2023 saw a global commercial aviation accident rate of approximately 0.17 per million departures, any increase in this figure, however small, can disproportionately affect public sentiment and booking behavior.

Astronics, through its advanced electronic systems that contribute to aircraft performance and safety, directly influences this perception. The company's commitment to innovation in areas like flight control systems and cabin safety technology helps bolster the industry's image. The Federal Aviation Administration (FAA) reported that in 2024, the average time for certification of new safety-critical avionics systems remained a key focus for efficiency, highlighting the rigorous standards Astronics must meet.

| Societal Factor | 2024/2025 Trend | Impact on Astronics | Supporting Data/Example |

| Corporate Social Responsibility (CSR) | Increasing consumer and investor demand for ethical and sustainable practices. | Enhances brand reputation, attracts talent, and appeals to ESG-focused investors. | In 2024, consumers showed willingness to pay more for products from socially responsible companies; ESG funds saw trillions in global AUM growth. |

| Public Perception of Aviation Safety | High importance for passenger confidence; negative incidents can severely impact demand. | Directly influences demand for Astronics' safety-enhancing products and overall market health. | While 2023 saw a low accident rate, public sensitivity remains high; FAA focused on efficient certification of safety-critical avionics in 2024. |

Technological factors

Rapid advancements in avionics, including integrated flight decks and sophisticated navigation systems, directly influence Astronics' product development cycles. For instance, the increasing complexity of modern aircraft systems necessitates continuous upgrades to their avionics solutions to ensure compatibility and enhanced performance.

The demand for faster, more reliable, and secure in-flight connectivity solutions is a significant driver for Astronics. With the global aviation market projected to see continued growth, airlines are investing heavily in passenger Wi-Fi and cabin connectivity, pushing Astronics to innovate its offerings in this space to meet evolving passenger expectations and operational needs.

The aviation industry's drive for sustainability, focusing on electric and hybrid propulsion and Sustainable Aviation Fuels (SAF), presents a dual-edged sword for Astronics. Its expertise in power generation and distribution is vital for the nascent electric aircraft sector, while existing product lines need to accommodate evolving fuel standards and emission reduction mandates.

Regulatory pressures, such as the European Union's ReFuelEU Aviation initiative mandating increasing SAF usage, are accelerating this transition. By 2030, ReFuelEU aims for a 6% SAF blend, a significant increase from current levels, requiring Astronics to innovate in fuel system compatibility and emissions control technologies.

Astronics' manufacturing and testing operations stand to gain significantly from the increasing integration of automation and AI. These technologies can streamline production lines, leading to reduced labor costs and faster turnaround times. For instance, AI-powered predictive maintenance can minimize equipment downtime, a critical factor in maintaining production schedules.

The aerospace and defense sector, where Astronics operates, is actively embracing AI to optimize complex supply chains. This optimization can translate into better inventory management and more efficient logistics, ultimately lowering operational expenditures for Astronics. Furthermore, AI's role in enhancing aftermarket services promises improved customer support and potentially new revenue streams.

The adoption of automated test solutions, driven by AI, is crucial for ensuring the high quality and reliability demanded in aerospace and defense. These systems can perform intricate tests with greater speed and accuracy than manual methods, reducing the likelihood of defects. By 2024, the global AI in manufacturing market was projected to reach over $20 billion, highlighting the significant investment and adoption trend in this area.

Miniaturization and Integration of Components

The ongoing trend of miniaturization and integration in aircraft components directly impacts Astronics. This push for smaller, lighter, and more consolidated systems allows for greater efficiency in aircraft design, freeing up valuable space and reducing overall weight. For instance, the increasing complexity of avionics systems, such as advanced flight displays and communication modules, necessitates highly integrated solutions to manage space and power constraints effectively. Astronics' ability to develop these compact, multi-functional units is crucial for staying competitive in the aerospace sector.

Astronics' investment in research and development is key to capitalizing on this technological shift. By focusing on creating highly integrated solutions, the company can offer products that enhance aircraft performance and reduce manufacturing complexity for their clients. This strategy aligns with the broader industry's move towards more sophisticated, yet streamlined, aircraft systems. For example, the development of System-on-Chip (SoC) technology in avionics allows for greater processing power in a smaller footprint, a trend Astronics is actively pursuing.

- Miniaturization: Enables more compact and lighter aircraft systems, improving fuel efficiency and payload capacity.

- Integration: Reduces the number of individual components, leading to simplified wiring, lower failure rates, and easier maintenance.

- Performance Enhancement: Integrated systems often offer improved processing power and functionality within a smaller package.

- Cost Reduction: While initial R&D can be high, integrated solutions can lead to lower manufacturing and assembly costs in the long run.

Cybersecurity Threats to Aerospace Systems

The increasing digitalization and interconnectedness of modern aviation systems create a fertile ground for cybersecurity threats. As the aviation sector embraces more sophisticated digital infrastructure, the attack surface for malicious actors expands significantly. This trend poses a direct challenge to companies like Astronics, which develop and integrate advanced technologies into these complex systems.

Astronics, as a key player in providing advanced technologies for the aerospace industry, faces the imperative to build robust cybersecurity into its product offerings and internal operations. The rise in cyberattacks targeting the aviation sector, including those aimed at disrupting flight operations and compromising sensitive data, underscores this necessity. For instance, reports in late 2024 highlighted a notable increase in phishing attempts and malware infections within airline IT infrastructures, directly impacting operational continuity and passenger trust.

Protecting critical flight systems, safeguarding passenger data, and ensuring the integrity of the aerospace supply chain are paramount concerns. A successful cyberattack could have catastrophic consequences, ranging from flight delays and cancellations to the compromise of national security interests. In 2024, the International Air Transport Association (IATA) reported that the financial impact of cyber incidents on airlines globally was estimated to be in the billions of dollars, emphasizing the significant economic and operational risks involved.

- Increased Attack Surface: Modern connected aircraft systems, from navigation to passenger entertainment, present numerous potential entry points for cyber threats.

- Data Breach Risks: The vast amounts of passenger and operational data handled by aviation technology providers like Astronics are attractive targets for data theft.

- Supply Chain Vulnerabilities: Compromising a single component or software update within the aerospace supply chain can have cascading effects on multiple aircraft and systems.

- Regulatory Scrutiny: Aviation authorities worldwide are intensifying their focus on cybersecurity standards, requiring stringent measures from technology providers.

Astronics' technological landscape is shaped by rapid advancements in avionics, driving continuous product upgrades for compatibility and performance. The increasing demand for faster, more secure in-flight connectivity fuels innovation in Wi-Fi and cabin systems, reflecting the global aviation market's growth. Furthermore, the industry's sustainability push towards electric propulsion and SAF presents opportunities for Astronics' power expertise while requiring adaptation to new fuel standards.

Legal factors

Astronics navigates a complex landscape of product liability laws and aviation safety standards, demanding rigorous quality control and comprehensive testing for all its aerospace products. Failure to adhere to these critical regulations can lead to significant legal repercussions, costly product recalls, and substantial damage to the company's reputation.

Central to Astronics' operations are the stringent regulations set forth by the Federal Aviation Administration (FAA). For instance, the FAA's Part 21 regulations govern the airworthiness and safety of aerospace products, impacting everything from design to manufacturing processes. In 2024, the FAA continued to emphasize enhanced oversight of safety management systems across the aviation industry, a trend expected to persist through 2025, directly influencing Astronics' compliance efforts.

Astronics' operations, particularly its defense sector, are heavily influenced by stringent export control regulations such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations (EAR). These rules dictate the stringent requirements for exporting defense articles and related technologies, directly impacting Astronics' ability to conduct international business and form global alliances.

Compliance with these complex legal frameworks is paramount for Astronics to maintain its global market access and operational integrity. For instance, in 2024, the U.S. Department of Commerce reported a significant increase in export control enforcement actions, highlighting the critical need for companies like Astronics to invest in robust compliance programs to avoid substantial penalties and reputational damage.

Astronics relies heavily on its intellectual property, including patents and trademarks, to protect its innovative technologies and maintain a competitive advantage in the aerospace and defense sectors. The company's significant investment in research and development, which reached $105.3 million in 2023, underscores the importance of robust IP protection to prevent rivals from exploiting its designs and proprietary solutions.

Global legal frameworks governing intellectual property are in constant flux, necessitating continuous monitoring and adaptation by Astronics to ensure its patents and trademarks remain effective safeguards. This dynamic legal landscape impacts how Astronics can secure and leverage its innovations across different international markets.

Data Privacy Regulations (e.g., GDPR, CCPA)

Astronics operates within a landscape increasingly shaped by data privacy regulations like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These frameworks govern the collection, storage, and processing of passenger data, directly affecting Astronics' cabin connectivity and passenger service systems. For instance, GDPR mandates strict consent mechanisms for data usage, potentially influencing how airlines deploy and monetize in-flight digital services. The FAA Reauthorization Act of 2024 also introduced data privacy provisions relevant to aircraft owners, adding another layer of compliance for companies like Astronics.

The impact of these regulations is significant. Astronics must ensure its solutions are designed with privacy-by-design principles. Failure to comply can result in substantial fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. This necessitates robust data security measures and transparent data handling policies across all its product lines that interact with passenger information.

- GDPR Fines: Potential penalties up to 4% of global annual revenue or €20 million.

- CCPA Scope: Grants California consumers rights regarding their personal information, impacting data collection practices.

- FAA Reauthorization Act of 2024: Introduces new data privacy stipulations for aircraft owners, creating a compliance burden.

- Privacy-by-Design: Astronics must integrate privacy considerations from the outset of product development.

Labor Laws and Employment Regulations

Astronics must navigate a complex web of national and international labor laws, covering everything from minimum wage and overtime to workplace safety and collective bargaining rights. For instance, in 2024, the Bureau of Labor Statistics reported an average hourly wage for manufacturing production workers that Astronics must consider when setting compensation. Failure to comply with these regulations, such as those outlined in the Fair Labor Standards Act in the US or similar legislation in other operating countries, can lead to significant fines and legal challenges.

The current competitive labor market, with ongoing challenges in retaining skilled employees and attracting new talent, amplifies the importance of fair employment practices. Astronics' ability to offer competitive benefits, ensure equitable treatment, and cultivate a positive workplace culture is directly tied to its legal obligations and its strategic success. As of early 2025, reports indicate a continuing tight labor market in aerospace manufacturing, making adherence to these principles crucial for maintaining a stable and productive workforce.

- Compliance with wage and hour laws

- Adherence to workplace safety standards

- Navigating union relations and collective bargaining

- Ensuring non-discriminatory hiring and employment practices

Astronics faces significant legal obligations concerning product safety and aviation regulations, particularly from bodies like the FAA. Compliance with standards such as FAA Part 21 is critical, with increased oversight expected through 2025. Failure to meet these requirements can result in severe penalties and operational disruptions.

Export control laws, including ITAR and EAR, directly impact Astronics' defense business and international partnerships. The U.S. Department of Commerce's heightened enforcement in 2024 underscores the necessity of robust compliance programs to avoid substantial fines and reputational damage.

Protecting its intellectual property through patents and trademarks is vital for Astronics, especially given its $105.3 million R&D investment in 2023. Navigating evolving global IP laws is essential to maintain its competitive edge and safeguard proprietary technologies.

Data privacy regulations like GDPR and CCPA affect Astronics' cabin connectivity systems, requiring privacy-by-design principles. The FAA Reauthorization Act of 2024 also introduced relevant data privacy stipulations. Non-compliance can lead to substantial fines, such as GDPR penalties up to 4% of global annual revenue.

| Legal Factor | Impact on Astronics | 2024/2025 Relevance |

|---|---|---|

| Aviation Safety Standards (e.g., FAA Part 21) | Mandatory for product design, manufacturing, and operation; ensures airworthiness. | Continued emphasis on safety management systems by FAA; increased oversight. |

| Export Controls (ITAR, EAR) | Governs international sales of defense articles and technologies. | Increased enforcement actions by U.S. Dept. of Commerce; critical for global business. |

| Intellectual Property Law | Protects R&D investments and competitive advantage. | Dynamic global landscape requires continuous monitoring and adaptation. |

| Data Privacy Regulations (GDPR, CCPA, FAA Act) | Affects handling of passenger data in connectivity systems. | Privacy-by-design is essential; potential for significant fines for non-compliance. |

Environmental factors

Astronics operates within an aerospace sector under intense scrutiny to curb carbon emissions, a direct response to worldwide climate objectives and tightening governmental mandates. The company's offerings, especially in power generation and aircraft cabin systems, are increasingly expected to support advancements in fuel efficiency.

Stricter environmental policies are becoming a significant operational factor. For instance, the EU Emissions Trading Scheme (EU ETS) is expanding its scope to include aviation, and the FAA has introduced new rules targeting carbon emissions from aircraft manufacturers, setting concrete reduction benchmarks for the industry.

Aircraft noise pollution remains a critical environmental challenge, especially for those living close to airports. For instance, in 2024, the FAA continued to implement programs aimed at reducing noise impacts on communities, such as the Airport Noise Compatibility Planning. These regulations directly affect how aircraft are designed and operated.

Astronics, while focused on internal systems, must ensure its power solutions and components contribute to aircraft that meet these stringent noise standards. This means supporting engine efficiency and operational profiles that minimize noise footprints, a trend expected to intensify with ongoing regulatory reviews and advancements in quieter engine technologies through 2025.

Astronics, like many aerospace manufacturers, faces growing pressure to adopt sustainable waste management and recycling. In 2024, the U.S. manufacturing sector generated approximately 145 million tons of solid waste, with a significant portion being non-hazardous. Companies like Astronics are increasingly investing in programs to reduce landfill waste, aiming for higher recycling rates, which can also lead to cost savings through material recovery.

Responsible disposal of hazardous materials is a critical environmental factor for Astronics. The aerospace industry often deals with chemicals, solvents, and electronic components that require specialized handling. Failure to comply with regulations like the Resource Conservation and Recovery Act (RCRA) can result in substantial fines and reputational damage. By implementing robust waste segregation and disposal protocols, Astronics strengthens its commitment to environmental stewardship and operational integrity.

Resource Scarcity and Material Sourcing

The availability and cost of critical raw materials for Astronics, such as specialized metals and composites used in aerospace and defense electronics, are susceptible to global resource scarcity and geopolitical tensions. For instance, the price of rare earth elements, crucial for advanced electronics, saw significant volatility in early 2024 due to supply chain disruptions and increased demand from emerging technologies.

Astronics' reliance on a diverse range of materials means that sustainable and ethically sourced components are increasingly important, driven by regulatory pressures and customer expectations. Companies are facing greater scrutiny regarding the environmental impact and labor practices involved in material extraction and processing.

To counter the risks of resource constraints and price fluctuations, Astronics is likely exploring strategies such as diversifying its supply chain across different geographic regions and investigating the use of alternative, more readily available materials. This proactive approach helps ensure production continuity and potentially reduces long-term material costs.

Key considerations for Astronics in 2024-2025 include:

- Monitoring commodity prices: Tracking fluctuations in key raw material markets, such as aluminum and copper, which are essential for electronic components.

- Supply chain mapping: Enhancing visibility into the origin and ethical sourcing of all materials to identify potential vulnerabilities.

- R&D investment: Allocating resources to research and develop products utilizing more sustainable or abundant materials.

- Supplier partnerships: Strengthening relationships with suppliers to secure stable, long-term material access and favorable pricing.

Climate Change Impact on Operations

Climate change presents a growing challenge for aviation, with extreme weather events increasingly impacting flight schedules and airport operations. For Astronics, this translates to potential disruptions in its supply chain and the delivery of its products, affecting everything from component sourcing to final assembly. The company's reliance on global manufacturing and logistics means it must assess and enhance the resilience of its operations against these environmental shifts.

The financial implications are also significant. For example, the Federal Aviation Administration (FAA) reported that weather was a factor in over 30% of air traffic control delays in 2023, costing the U.S. economy billions. Astronics, as a key supplier to the aerospace industry, faces indirect costs associated with these widespread operational disruptions, necessitating robust contingency planning.

- Increased operational disruptions: Extreme weather events like severe storms, heavy snowfall, and heatwaves can ground flights, leading to delays and cancellations that impact the aviation sector's overall activity.

- Supply chain vulnerabilities: Climate-related events can disrupt transportation routes and manufacturing facilities globally, potentially hindering Astronics' ability to procure raw materials and deliver finished goods on time.

- Need for enhanced resilience: Astronics must invest in strategies to mitigate the impact of climate change, such as diversifying its supplier base and exploring alternative logistics solutions to ensure business continuity.

Astronics faces increasing pressure to align with global climate objectives and stricter governmental mandates aimed at reducing carbon emissions. This includes developing products that enhance fuel efficiency and meet evolving noise pollution standards, as seen with FAA initiatives in 2024. The company must also manage waste responsibly, with a focus on recycling and the safe disposal of hazardous materials, adhering to regulations like RCRA.

The availability and cost of critical raw materials, such as rare earth elements, remain volatile due to supply chain disruptions and geopolitical factors, impacting production continuity. Climate change also poses risks through extreme weather events, potentially disrupting Astronics' supply chain and operations, with weather-related delays costing the U.S. economy billions annually as reported by the FAA.

| Environmental Factor | Impact on Astronics | 2024-2025 Considerations |

|---|---|---|

| Carbon Emissions Reduction | Need for fuel-efficient technologies and compliance with EU ETS and FAA regulations. | Invest in R&D for greener aerospace solutions. |

| Noise Pollution | Requirement for quieter aircraft components to meet community and regulatory standards. | Ensure power solutions contribute to reduced noise footprints. |

| Waste Management | Pressure to increase recycling rates and reduce landfill waste. | Implement robust waste segregation and disposal protocols. |

| Resource Scarcity | Volatility in raw material prices and supply chain disruptions. | Diversify supply chain and explore alternative materials. |

| Climate Change Impacts | Risk of operational disruptions from extreme weather events. | Enhance supply chain resilience and explore alternative logistics. |

PESTLE Analysis Data Sources

Our Astronics PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant.