Astronics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astronics Bundle

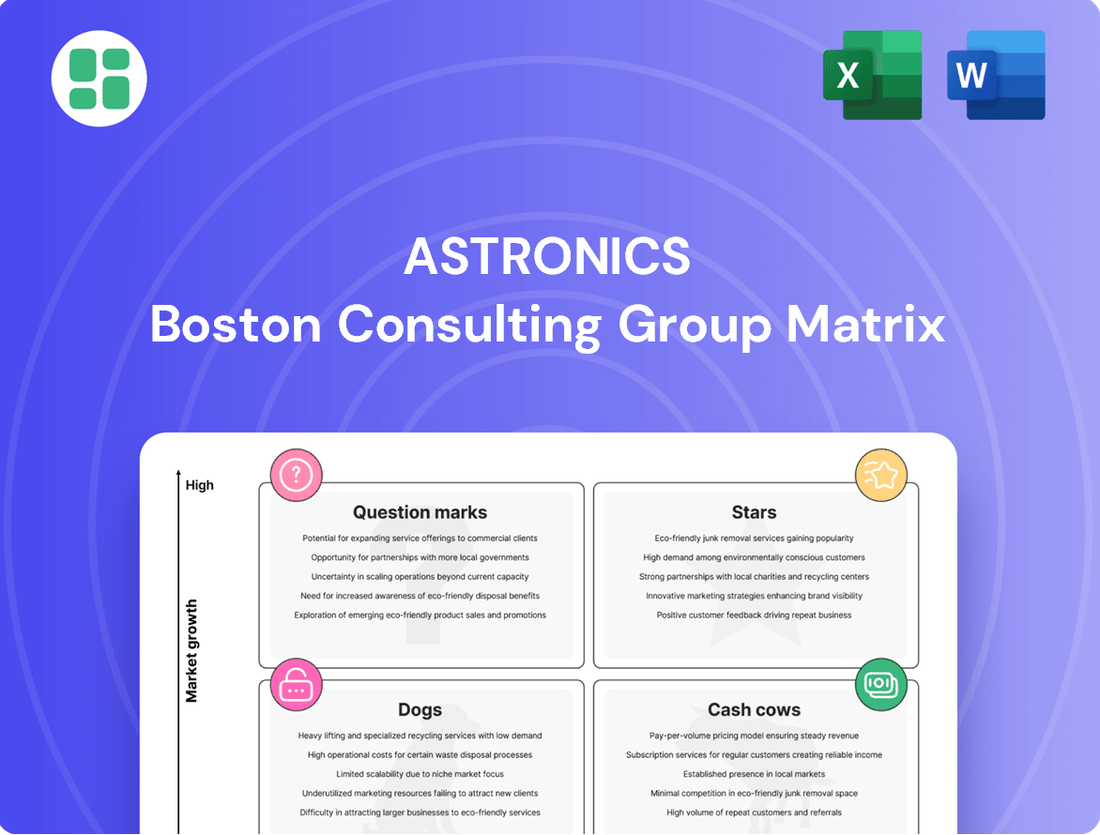

Curious about Astronics' strategic product portfolio? Our BCG Matrix preview offers a glimpse into how their offerings might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

To truly unlock the potential of this analysis and gain a comprehensive understanding of Astronics' market position, you need the full report. It's your key to making informed decisions about resource allocation and future growth.

Purchase the complete BCG Matrix today and equip yourself with the detailed insights and actionable strategies needed to navigate the competitive landscape with confidence.

Stars

Astronics' In-flight Entertainment & Connectivity (IFEC) products are a significant growth engine, especially in the commercial transport sector. Airlines are showing a strong appetite for these solutions, driving demand. This segment was a major contributor to Astronics' aerospace sales growth in 2024, and this trend continued into Q1 2025.

These IFEC offerings are crucial for improving the passenger experience, a key differentiator for airlines. As cabin technology continues to advance rapidly, Astronics' solutions are becoming increasingly vital. For instance, in 2024, the company reported substantial revenue increases in its Connectivity segment, largely fueled by IFEC demand.

Astronics' In-Seat Power Solutions for Commercial Transport are a clear star in their BCG matrix. These systems, offering passengers convenient charging options, are seeing robust demand, directly fueling Astronics' impressive aerospace revenue growth. In 2023, Astronics reported record aerospace sales, with in-seat power being a significant contributor to this success.

The company's dominance in this market is further solidified by recent accolades, including an award for Best In-Seat Power Solution, highlighting their strong market share and innovation. This segment is anticipated to continue its upward trajectory, justifying ongoing investment to maintain its star performer status.

Astronics is a major player in electrical power and motion systems for new aircraft, a segment that's fueling significant revenue increases in their Aerospace division. These advanced systems are essential for the performance and safety of modern aircraft, and their adoption in new programs points to a strong market position in a growing sector. As of the first quarter of 2024, Astronics reported a substantial Aerospace backlog, underscoring the demand for these critical components.

Military Aircraft Products for FLRAA Program

Astronics' involvement in the Future Long Range Assault Aircraft (FLRAA) program positions it strongly within a high-growth defense sector. Military sales saw a notable increase, nearly doubling in Q1 2025, largely driven by advancements in this and other key defense initiatives. This indicates a significant market opportunity where Astronics has established a leading presence, suggesting robust future revenue streams.

- FLRAA Program Contribution: Astronics is a key supplier for the FLRAA program, a critical next-generation military aircraft initiative.

- Q1 2025 Military Sales Growth: Military sales for Astronics nearly doubled in the first quarter of 2025, directly attributed to progress on FLRAA and other defense contracts.

- Market Position: The company holds a leading position in the high-growth defense market, specifically within programs like FLRAA.

- Revenue Projections: This strategic positioning is expected to generate substantial future revenue for Astronics.

Advanced Cabin Lighting Systems

Astronics' advanced cabin lighting systems are a prime example of a Stars category within the BCG Matrix. The interior aircraft lighting market is expanding, fueled by innovations like smart cabin technologies and the widespread adoption of LED lighting. Astronics is a significant contributor to this growth, providing lighting solutions that enhance both energy efficiency and passenger experience.

The company's offerings in this segment are designed to meet the increasing demand for sophisticated and comfortable cabin environments. This positions Astronics favorably to capture a substantial share of a market that is demonstrating robust upward momentum. For instance, the global aircraft cabin lighting market was valued at approximately $1.2 billion in 2023 and is projected to reach over $2.1 billion by 2030, growing at a CAGR of around 8.5%.

- Market Growth: The interior aircraft lighting sector is experiencing significant expansion.

- Technological Advancement: Smart cabin technologies and LED adoption are key drivers.

- Astronics' Position: The company is a key player with well-positioned advanced lighting solutions.

- Benefits: Astronics' systems improve energy efficiency and passenger comfort.

Astronics' In-Seat Power Solutions for Commercial Transport represent a clear Star in their BCG matrix. These systems, offering passengers convenient charging options, are experiencing robust demand, directly fueling Astronics' impressive aerospace revenue growth. In 2023, Astronics reported record aerospace sales, with in-seat power being a significant contributor to this success.

The company's dominance in this market is further solidified by recent accolades, including an award for Best In-Seat Power Solution, highlighting their strong market share and innovation. This segment is anticipated to continue its upward trajectory, justifying ongoing investment to maintain its star performer status.

Astronics' advanced cabin lighting systems are also a prime example of a Star category. The interior aircraft lighting market is expanding, driven by innovations like smart cabin technologies and widespread LED adoption. Astronics is a key contributor, providing solutions that enhance energy efficiency and passenger experience.

The global aircraft cabin lighting market was valued at approximately $1.2 billion in 2023 and is projected to grow significantly, demonstrating the strong potential for Astronics' well-positioned offerings in this expanding sector.

| Product Segment | BCG Category | Key Growth Drivers | 2024/2025 Performance Indicators |

|---|---|---|---|

| In-Seat Power Solutions (Commercial Transport) | Star | Passenger demand for charging, airline focus on passenger experience | Significant contributor to record aerospace sales (2023), strong revenue increases |

| Advanced Cabin Lighting Systems | Star | Smart cabin tech, LED adoption, energy efficiency, passenger comfort | Expanding market, Astronics' key player status |

| In-flight Entertainment & Connectivity (IFEC) | Star | Airline demand for enhanced passenger experience, cabin technology advancements | Major contributor to aerospace sales growth (2024), continued trend in Q1 2025 |

| Electrical Power & Motion Systems (New Aircraft) | Star | Essential for modern aircraft performance/safety, adoption in new programs | Substantial Aerospace backlog (Q1 2024) |

| FLRAA Program Contribution | Star | Next-generation military aircraft initiative, defense sector growth | Military sales nearly doubled in Q1 2025 |

What is included in the product

The Astronics BCG Matrix analyzes business units based on market growth and share, guiding strategic decisions.

Astronics BCG Matrix offers a clear visualization to identify underperforming units, relieving the pain of resource misallocation.

Cash Cows

Established Aircraft Structures Components are Astronics' Cash Cows. As a long-standing provider, Astronics likely commands a significant market share in this mature segment of the aerospace industry. This stability is further reinforced by consistent demand for both new aircraft production and essential maintenance, repair, and overhaul (MRO) activities. For instance, the global commercial aircraft MRO market was valued at approximately $80 billion in 2023 and is projected to grow at a CAGR of around 3% through 2030, indicating a steady demand for structural components.

Astronics' legacy power generation and distribution systems are the bedrock of their business, serving as reliable cash cows. These systems are integral to a vast number of existing aircraft, ensuring consistent, high-margin revenue streams because they are absolutely essential and widely implemented.

The market for these mature technologies exhibits low growth, which allows Astronics to generate significant profits with relatively little need for additional investment in marketing or research and development. In 2024, Astronics continued to benefit from the steady demand for these proven solutions, which underpin their financial stability.

Astronics' Routine Aftermarket & Certification Services, exemplified by its recent acquisition of Envoy Aerospace, clearly positions this segment as a Cash Cow. This strategic move bolsters Astronics' FAA certification capabilities, tapping into a stable and consistently in-demand market for aircraft modifications and lease returns. These services are crucial for maintaining aircraft airworthiness and compliance, generating predictable revenue streams for the company.

Standard Avionics Products for Mature Platforms

Standard avionics products for mature platforms within Astronics are likely positioned as Cash Cows. These are the reliable, established components powering a significant portion of the existing aircraft fleet, meaning they hold a substantial market share in a market that isn't expanding rapidly.

These products, essential for the ongoing operation of older aircraft, generate steady income from replacement parts and necessary upgrades. The revenue stream is predictable, as these systems require ongoing maintenance and support without the need for massive investments in new research and development.

- High Market Share: Astronics' established presence in the aftermarket for older aircraft models translates to a dominant position for these standard avionics.

- Low Market Growth: The market for new installations on these mature platforms is stable rather than growing, characteristic of a Cash Cow.

- Consistent Revenue: Demand for replacement parts and upgrades ensures a reliable and predictable revenue stream for Astronics.

- Limited Investment Needs: Unlike Stars or Question Marks, these products require minimal R&D, freeing up capital for other strategic areas.

Basic Lighting and Safety Products for Commercial Transport

Basic Lighting and Safety Products for Commercial Transport are Astronics' Cash Cows. These are fundamental components, like emergency lighting and exit signs, that are crucial for every commercial aircraft. While events such as the 2024 Boeing production slowdown, stemming from issues like the strike, can cause temporary dips, the underlying demand remains robust.

The market for these safety products is mature and stable, driven by ongoing regulatory mandates and the continuous need for replacements and upgrades across the global fleet. This consistent demand translates into reliable cash flow for Astronics, even if growth prospects are limited compared to more innovative product lines.

- Stable Demand: Regulatory requirements ensure a baseline demand for safety lighting and associated products on all commercial aircraft.

- Consistent Revenue: Despite potential production disruptions, the need for replacements and lifecycle management provides predictable revenue streams.

- Mature Market: This segment operates in a less dynamic part of the aerospace lighting market, characterized by steady, rather than rapid, growth.

- Cash Generation: The reliable cash flow generated by these essential products supports investment in other areas of Astronics' business.

Astronics' established Aircraft Structures Components are prime examples of their Cash Cows. These products, vital for aircraft integrity, benefit from a stable, mature market with consistent demand for both new builds and ongoing maintenance. The global commercial aircraft MRO market, valued around $80 billion in 2023 and projected for 3% annual growth, underscores this enduring need.

| Segment | BCG Category | Key Characteristics | Financial Implication |

| Aircraft Structures Components | Cash Cow | High market share, mature market, consistent demand (new builds & MRO) | Generates stable, predictable profits with low investment needs. |

| Legacy Power Generation & Distribution | Cash Cow | Integral to existing fleet, essential, widely implemented, low growth market | Provides consistent, high-margin revenue with minimal R&D spend. |

| Routine Aftermarket & Certification Services | Cash Cow | Stable demand for modifications, lease returns, FAA compliance | Predictable revenue streams from essential aircraft lifecycle services. |

| Standard Avionics for Mature Platforms | Cash Cow | Dominant share in aftermarket, stable market for older aircraft | Reliable income from replacement parts and upgrades, low R&D. |

| Basic Lighting & Safety Products | Cash Cow | Mandatory for all commercial aircraft, mature market, stable demand | Consistent cash flow despite potential production slowdowns. |

What You’re Viewing Is Included

Astronics BCG Matrix

The preview you're currently viewing is the definitive Astronics BCG Matrix report you will receive upon purchase, offering a complete and unwatermarked strategic analysis. This document has been meticulously prepared by industry experts to provide actionable insights into your product portfolio's performance. You can be confident that the exact file, fully formatted and ready for immediate integration into your business planning, will be delivered to you without any alterations or hidden content.

Dogs

Astronics' Test Systems segment has been a consistent laggard, grappling with declining sales and operating losses. For the first quarter of 2024, this segment reported a net sales decrease of 11.2% to $36.5 million, contributing to an operating loss of $2.1 million.

Despite Astronics' efforts to streamline operations and improve efficiency within the Test Systems division, the segment continues to hold a small market share in a challenging sector. The company's Q1 2024 report indicated that bookings for Test Systems were down 15.5% year-over-year, signaling ongoing demand weakness.

Within Astronics' Automated Test Equipment (ATE) portfolio, older or less competitive product lines likely represent the Dogs in the BCG Matrix. These segments typically exhibit low market share and slow growth, meaning they aren't significant revenue drivers. For instance, if a particular ATE system developed in the early 2010s hasn't seen substantial updates or market adoption compared to newer, more advanced solutions, it would fit this category.

These outdated ATE lines often require substantial capital to maintain, upgrade, or even continue production, yet they offer a limited return on investment. This makes them cash traps, consuming resources without contributing meaningfully to overall company growth or profitability. Consider the cost of maintaining legacy component inventories or the engineering effort needed to ensure compliance with evolving industry standards for a product that has minimal market demand.

Astronics is actively phasing out its non-core contract manufacturing arrangements. This strategic move suggests these operations likely possess low market share and limited growth potential, fitting the profile of 'Dogs' in a BCG matrix.

These divested or discontinued activities are not expected to contribute significantly to Astronics' future revenue or profitability, reinforcing their classification as underperforming assets.

Mass Transit Test Solutions

Mass Transit Test Solutions, within Astronics' Test segment, likely falls into the 'Dog' category of the BCG Matrix. In 2024, sales to this sector were notably low, indicating a limited market presence for Astronics.

The segment has encountered difficulties securing and executing long-term development contracts, particularly those tied to the mass transit industry. This struggle points to a challenging operational environment and potentially low profitability.

- Low Market Share: Sales figures for 2024 indicate a small footprint in the mass transit testing market.

- Profitability Concerns: Challenges with long-term contracts suggest difficulties in achieving consistent profitability.

- Struggling Development: The mass transit sector presents hurdles for Astronics' development and contract execution capabilities.

Specific Legacy Defense Test Programs

Within Astronics' defense testing segment, certain legacy programs may represent "Dogs" in the BCG matrix. These are typically older systems or specialized testing capabilities that, while historically important, now face declining demand and possess a low market share. Their strategic relevance might have diminished as newer technologies emerge or military priorities shift.

For instance, if Astronics maintains testing services for retired or soon-to-be-retired aircraft platforms, these specific test programs could fall into the Dog category. Such programs often generate minimal future revenue and require continued investment for maintenance or compliance without significant growth potential. As of late 2024, the defense industry is increasingly focused on next-generation capabilities, potentially sidelining investments in legacy testing infrastructure.

- Declining Demand: Legacy defense test programs, such as those supporting older generation avionics or specific legacy platform upgrades, are likely experiencing reduced demand as military branches prioritize modernization.

- Low Market Share: In specialized niche areas of defense testing, Astronics might hold a small market share for older technologies, especially if competitors have shifted focus to newer, more advanced testing solutions.

- Minimal Future Revenue: Programs that have completed their primary development or production cycles, like testing for systems no longer in widespread production or active deployment, are expected to yield very low future revenue streams.

- Resource Allocation: Continued investment in maintaining capabilities for these legacy programs may divert resources from more promising growth areas within Astronics' broader portfolio.

Astronics' Test Systems segment, particularly areas like Mass Transit Test Solutions and certain legacy defense programs, embodies the characteristics of "Dogs" in the BCG Matrix. These segments exhibit low market share and slow or declining growth, as evidenced by the 11.2% net sales decrease in Test Systems during Q1 2024, alongside a 15.5% drop in bookings.

These underperforming areas often consume resources without generating substantial returns, acting as cash traps. The strategic phasing out of non-core contract manufacturing further highlights Astronics' efforts to divest from such low-potential activities.

The challenges in securing long-term contracts in mass transit and the declining demand for legacy defense testing capabilities underscore the limited future revenue streams from these segments.

The financial performance of these "Dog" segments, characterized by declining sales and operating losses, necessitates careful resource allocation to avoid hindering investment in more promising business units.

| Segment/Area | BCG Category | 2024 Performance Indicators | Strategic Implications |

|---|---|---|---|

| Test Systems (Overall) | Dog | Q1 2024 Net Sales: -$11.2% YoY; Q1 2024 Bookings: -15.5% YoY; Operating Loss: $2.1M (Q1 2024) | Requires significant restructuring or divestment to free up capital. |

| Mass Transit Test Solutions | Dog | Low sales in 2024; Difficulty securing long-term contracts. | Limited market presence and profitability challenges. |

| Legacy Defense Programs | Dog | Declining demand; Small market share for older technologies. | Minimal future revenue, potential resource drain. |

| Non-core Contract Manufacturing | Dog | Being phased out. | Low growth potential, not contributing to future revenue. |

Question Marks

Astronics is strategically positioning itself in the burgeoning eVTOL (electric Vertical Take-Off and Landing) aircraft sector, evidenced by its substantial backlog and accepted purchase orders from various manufacturers. This signifies a strong entry into what is projected to be a high-growth market, with the eVTOL industry expected to reach tens of billions of dollars in value by the early 2030s. For example, projections for the urban air mobility market, which eVTOLs are a key component of, suggest a value exceeding $100 billion by 2030.

Despite this promising outlook, the eVTOL market remains in its early stages of development. Consequently, Astronics currently holds a relatively modest market share within this nascent industry. Significant investment will be necessary to scale operations and capture a more substantial portion of this evolving market as it matures and demand increases.

Astronics' recent selection to supply the Frequency Converter Unit (FCU) for NASA and Boeing's X-66 aircraft demonstrator positions them in a high-growth, technologically advanced aerospace segment. This partnership underscores Astronics' capability in developing sophisticated systems for next-generation aviation.

While the X-66 program represents significant future opportunity, it's a long-term endeavor with testing anticipated around 2028. This means the current financial returns from this specific project are likely to be low, characteristic of a question mark in the BCG matrix, requiring continued investment for future payoff.

The SkyShow Server, a new entrant in in-cabin moving map technology, launched in April 2025. Positioned within the burgeoning IFEC market, it's considered a Question Mark in the BCG matrix due to its nascent stage and low initial market share. Significant investment in marketing and sales will be crucial to drive adoption and potentially elevate it to a Star product.

New Land Mobile Radio Service Monitor

Astronics' new Land Mobile Radio Service Monitor, launched in July 2025, enters a specialized test equipment market. This segment often exhibits high growth potential due to technological advancements and evolving communication standards, even if current penetration is relatively low.

The introduction of this product suggests Astronics is targeting a niche with significant future revenue opportunities. For instance, the global land mobile radio market was valued at approximately $9.5 billion in 2023 and is projected to grow at a CAGR of around 5.2% through 2030, indicating a fertile ground for new entrants offering advanced solutions.

- Product Focus: Land Mobile Radio Service Monitor

- Launch Date: July 2025

- Market Characteristic: Specialized test equipment, potentially high growth, currently low penetration

- Market Context: Global LMR market valued at ~$9.5 billion (2023), projected 5.2% CAGR

Early-stage New Product Launches in Aerospace

Early-stage new product launches in aerospace, often categorized as Question Marks in the BCG Matrix, represent areas of high growth potential but uncertain market position. Astronics' experience with atypical warranty reserves in Q3 2024, stemming from new product introductions needing field modifications, highlights this dynamic. These situations typically involve significant cash expenditure for initial development, testing, and refinement as the product navigates its early adoption phase and seeks to capture market share.

These early-stage products are characterized by substantial investment and ongoing development to address unforeseen technical challenges and market feedback. For instance, a new avionics system launch might require extensive software updates and hardware adjustments post-deployment to ensure full functionality and reliability, thereby consuming capital without immediate substantial returns. The company must carefully manage these investments, balancing the need for product maturation with the objective of achieving profitability.

- High Growth Potential: Products are entering markets with significant projected expansion.

- Uncertain Market Share: Initial market penetration is low, and competitive positioning is not yet solidified.

- Cash Consumption: Substantial investment is required for R&D, production ramp-up, and addressing early-stage issues.

- Strategic Focus: Management must decide whether to invest further to gain market share or divest if prospects dim.

Question Marks represent new products or ventures with high growth potential but currently low market share, demanding significant investment. Astronics' involvement in the eVTOL sector and the X-66 program exemplifies this, requiring substantial capital for development and market penetration. The company must strategically decide whether to invest more to grow these ventures or potentially divest if they do not gain traction.

| Product/Venture | Market Potential | Current Market Share | Investment Needs | Strategic Outlook |

|---|---|---|---|---|

| eVTOL Sector Entry | High (>$100 billion by 2030 projected for UAM) | Low | Substantial for scaling | Invest to capture growth |

| X-66 Program (NASA/Boeing) | High (next-gen aviation) | N/A (demonstrator phase) | Ongoing R&D and testing | Long-term payoff, requires patience |

| SkyShow Server | High (IFEC market) | Low | Marketing and sales focus | Potential to become a Star |

| Land Mobile Radio Service Monitor | Moderate to High (~$9.5 billion market, 5.2% CAGR) | Low | Market penetration efforts | Targeting niche growth |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial statements, and industry expert interviews to provide a comprehensive view of business unit performance and market dynamics.