Astronics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Astronics Bundle

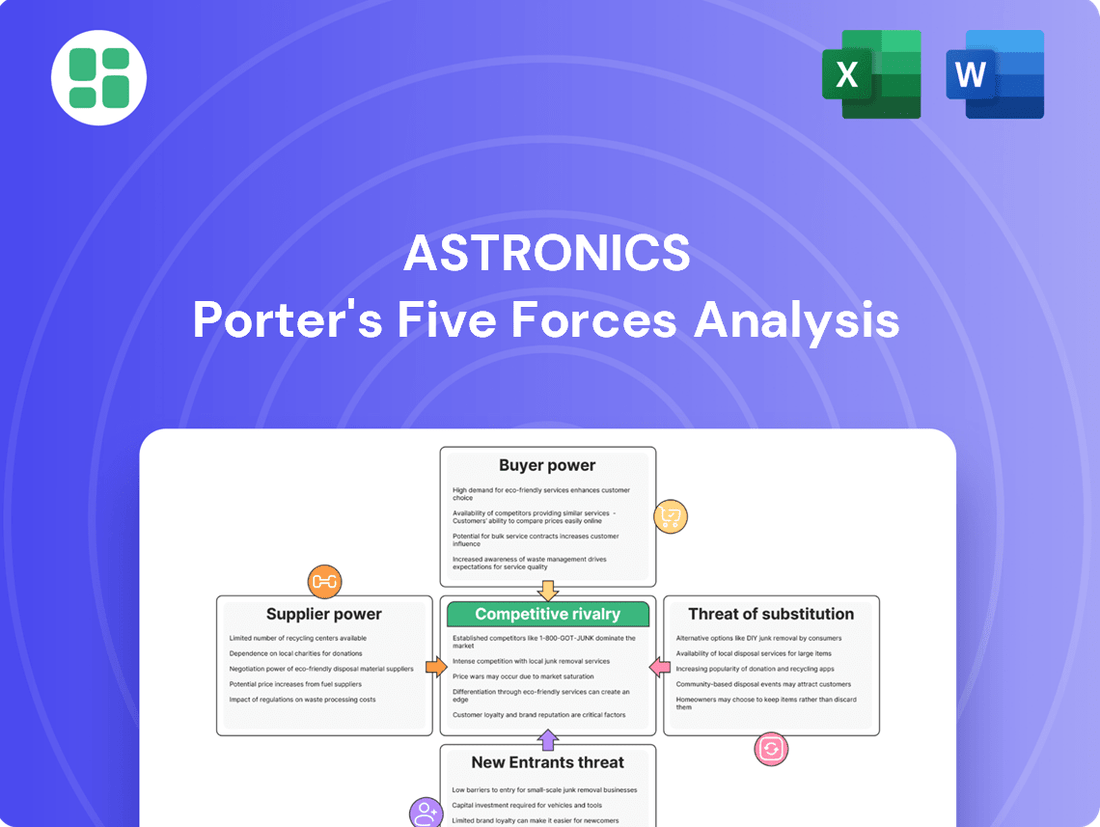

Astronics operates in a dynamic aerospace and defense market, where understanding the competitive landscape is crucial. Porter's Five Forces analysis reveals how buyer power, supplier bargaining, threat of new entrants, substitute products, and industry rivalry shape Astronics's strategic position.

The complete report reveals the real forces shaping Astronics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Astronics' reliance on highly specialized components and raw materials for its advanced aerospace and defense products inherently concentrates power with its suppliers. This specialization means fewer alternative sources, giving these suppliers significant leverage in negotiations. For example, in 2024, the aerospace industry continued to grapple with persistent parts shortages, a trend anticipated to continue into 2025, further amplifying the bargaining power of critical material and component providers.

Astronics faces significant supplier power due to long qualification cycles for critical aerospace components. These processes are exhaustive, ensuring adherence to strict industry standards and regulatory demands.

Once a supplier is qualified, the cost and complexity of switching are substantial for Astronics. This makes it difficult and expensive to change providers, effectively locking in existing relationships and bolstering supplier leverage.

These extended qualification periods act as a formidable barrier for new entrants, reinforcing the dominance of established suppliers within Astronics' supply chain.

For mission-critical aerospace systems, Astronics often faces a limited pool of approved suppliers due to specialized technology and stringent quality requirements. This scarcity, particularly for proprietary components, grants these suppliers significant leverage to dictate higher prices and more favorable contract terms.

The aerospace supply chain's intricate, multi-tiered structure means disruptions at any level can directly impact original equipment manufacturers like Astronics. For instance, in 2024, the global aerospace manufacturing sector experienced ongoing supply chain challenges, with lead times for certain specialized electronic components extending by up to 30% compared to pre-pandemic levels, directly increasing costs and impacting production schedules for companies like Astronics.

Impact of Supply Chain Disruptions

Ongoing global supply chain disruptions, including labor shortages and geopolitical tensions, continue to affect the aerospace and defense industry. These issues lead to longer lead times and reduced availability of essential components, directly impacting production schedules and costs for companies like Astronics.

These persistent challenges significantly bolster the bargaining power of suppliers who can reliably deliver. In 2024, the aerospace sector continued to grapple with these realities, with many manufacturers reporting extended delivery times for key materials such as specialized alloys and electronic components. For instance, some reports indicated lead times for certain avionics systems stretching to over 18 months, a substantial increase from pre-pandemic levels.

- Increased Lead Times: Many critical aerospace components saw lead times extend well into 2024, impacting production planning.

- Supplier Prioritization: Companies like Astronics are prioritizing suppliers with proven reliability to ensure continuity, giving those suppliers greater leverage.

- Cost Pressures: The scarcity and demand for raw materials and specialized components put upward pressure on prices, affecting Astronics' cost of goods sold.

- Geopolitical Impact: Ongoing international conflicts and trade disputes further complicate supply chains, creating uncertainty and reinforcing supplier power.

Supplier's Importance to Astronics' Innovation

Astronics' reliance on specialized suppliers for its innovative technology solutions, particularly in areas like aircraft electrification and advanced avionics, grants these suppliers considerable bargaining power. Companies providing critical components for these cutting-edge advancements are essentially co-developers, fostering a symbiotic relationship that allows them to negotiate from a strong position. The growing demand for more electric aircraft and sustainable aviation technologies further elevates the influence of suppliers offering advanced materials and unique technological capabilities. For instance, a 2024 market report indicated that the global aerospace materials market, including advanced composites and specialty alloys crucial for these innovations, is projected to reach over $20 billion by 2028, highlighting the value and leverage of key material providers.

Astronics' suppliers hold significant power due to the specialized nature of aerospace components and the lengthy, costly qualification processes involved. This creates high switching costs and limits alternative sourcing options for Astronics.

In 2024, extended lead times for critical aerospace parts, sometimes exceeding 18 months for avionics, further amplified supplier leverage. Geopolitical instability and ongoing supply chain disruptions also contributed to this power imbalance, increasing costs for manufacturers like Astronics.

The demand for advanced materials and technologies in areas like aircraft electrification strengthens the negotiating position of suppliers in these niche markets. For instance, the global aerospace materials market is projected for substantial growth, underscoring the value of these specialized providers.

| Factor | Impact on Astronics | 2024 Data/Trend |

|---|---|---|

| Component Specialization | Limited supplier options, increased reliance | High demand for proprietary avionics and electrification components |

| Qualification Cycles | High switching costs, supplier lock-in | Exhaustive, stringent regulatory and quality demands |

| Supply Chain Disruptions | Extended lead times, increased costs | Lead times for some components up to 30% longer than pre-pandemic |

| Market Demand for Innovation | Supplier leverage in advanced tech areas | Projected growth in aerospace materials market (over $20B by 2028) |

What is included in the product

This analysis dissects the competitive forces impacting Astronics, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and address competitive threats with a dynamic visualization of all five forces.

Quickly assess the impact of industry shifts on profitability by isolating and analyzing each force.

Customers Bargaining Power

Astronics' reliance on major Original Equipment Manufacturers (OEMs) like Boeing and Airbus for new aircraft programs creates a concentrated customer base. These powerful entities, placing substantial, long-term orders, wield significant leverage. For instance, Boeing's 2023 order backlog stood at over 4,000 aircraft, highlighting the scale of potential business for suppliers like Astronics and the negotiating power these large customers possess.

While individual airlines or maintenance providers might not wield immense power alone, their collective demand for aftermarket parts and services from companies like Astronics is substantial. This aggregated purchasing power allows them to influence pricing and service expectations, especially as they prioritize operational efficiency and cost savings. For instance, the global commercial aircraft aftermarket revenue was projected to reach over $1 trillion by 2024, highlighting the significant financial clout of this customer base.

Customers in the aerospace and defense sectors, especially airlines, are highly sensitive to the prices of Astronics' offerings due to persistent cost pressures from fuel and operations. This sensitivity translates into significant demand for competitive pricing and strong value, compelling Astronics to maintain efficient production and supply chain management. For instance, in 2024, the International Air Transport Association (IATA) reported that fuel costs remained a substantial portion of airline operating expenses, often exceeding 20%, directly impacting their purchasing decisions.

The current economic climate, marked by high operating costs and inflationary trends throughout 2024, is squeezing profit margins for both original equipment manufacturers (OEMs) and their suppliers. This financial strain restricts their capacity to absorb or pass on increased expenses, intensifying the bargaining power of customers who are actively seeking cost-effective solutions.

Customer Certification Processes and Delivery Schedules

Astronics' customers, particularly in the aerospace sector, frequently impose rigorous certification processes and demanding delivery schedules for new aircraft programs. These requirements mean that Astronics must adhere to strict quality and timeline standards to avoid penalties.

The power of these customers is amplified because any delays or quality failures on Astronics' part can result in substantial financial penalties or the forfeiture of future contracts. This leverage gives customers significant control over Astronics' compliance and operational performance.

Meeting these stringent demands is paramount for Astronics, especially considering the ongoing challenges within the aerospace production landscape and its complex supply chains. For instance, in 2024, many aerospace manufacturers reported production rate adjustments due to supply chain disruptions, highlighting the criticality of reliable delivery schedules.

- Stringent Certification Requirements: Customers dictate specific testing and validation protocols that Astronics must pass.

- Tight Delivery Schedules: Adherence to aircraft program milestones is non-negotiable.

- Financial Penalties: Non-compliance with delivery or quality can lead to significant financial repercussions.

- Risk of Lost Future Business: A single failure can jeopardize long-term customer relationships.

Availability of Alternative Suppliers or In-house Capabilities

While Astronics provides specialized aerospace solutions, large customers, especially major aircraft manufacturers, possess a degree of bargaining power. This stems from the potential, albeit often costly, for them to develop certain technologies in-house or to source them from a limited number of other highly qualified suppliers. This capacity for alternative sourcing or vertical integration can influence pricing and terms, particularly for less proprietary systems. For instance, in 2024, major aerospace players like Boeing and Airbus continue to evaluate their supply chains, seeking efficiency and cost-effectiveness, which indirectly strengthens their negotiating position with suppliers like Astronics.

The competitive landscape further amplifies this customer bargaining power. Key competitors such as Honeywell International Inc., Collins Aerospace (a Raytheon Technologies company), and Thales Group offer extensive portfolios of aerospace products and systems. This broad availability of alternatives means customers have multiple viable options for many components and subsystems, increasing their leverage in negotiations with any single supplier. The presence of these large, established competitors ensures that customers can often find comparable or alternative solutions, limiting any individual supplier's ability to dictate terms.

- Customer Leverage: Large customers can explore in-house development or alternative suppliers for certain technologies.

- Competitive Landscape: Major competitors like Honeywell, Collins Aerospace, and Thales offer diverse product ranges, increasing customer choice.

- Market Dynamics: The ongoing evaluation of supply chains by major aircraft manufacturers in 2024 influences their negotiating power.

The bargaining power of Astronics' customers is significant, primarily driven by the concentrated nature of its client base, particularly major Original Equipment Manufacturers (OEMs) like Boeing and Airbus. These large entities, responsible for substantial, long-term aircraft orders, hold considerable negotiation leverage. For example, Boeing's substantial order backlog in 2023, exceeding 4,000 aircraft, underscores the immense potential business and the negotiating sway these key customers possess.

Customers' price sensitivity, especially airlines facing persistent cost pressures from fuel and operations, further amplifies their bargaining power. In 2024, fuel costs represented over 20% of airline operating expenses, according to IATA, making them highly receptive to competitive pricing and value. This necessitates efficient operations and supply chain management from suppliers like Astronics.

The aerospace sector's stringent certification processes and demanding delivery schedules also contribute to customer leverage. Astronics must meet rigorous quality and timeline standards to avoid penalties, as failure can result in financial repercussions or the loss of future contracts. The complex aerospace production landscape in 2024, marked by supply chain disruptions, further emphasizes the criticality of reliable delivery schedules.

Moreover, the competitive environment, featuring players like Honeywell, Collins Aerospace, and Thales, provides customers with numerous alternatives, strengthening their negotiating position. This broad availability of comparable solutions limits any single supplier's ability to dictate terms.

| Factor | Impact on Astronics | Customer Leverage |

| Customer Concentration | High reliance on major OEMs | OEMs have significant negotiating power due to large order volumes. |

| Price Sensitivity | Customers seek cost-effective solutions | Airlines' focus on operational costs (e.g., fuel in 2024) drives demand for competitive pricing. |

| Supplier Alternatives | Presence of strong competitors | Customers can switch suppliers if terms are not met, increasing bargaining power. |

| Operational Demands | Need for strict adherence to schedules and quality | Penalties for non-compliance and risk of lost future business empower customers. |

Full Version Awaits

Astronics Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis for Astronics delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the aerospace and defense industry. You'll gain actionable insights into the strategic positioning and potential challenges facing Astronics.

Rivalry Among Competitors

Astronics faces intense competition from established global giants like Honeywell, Collins Aerospace (a Raytheon Technologies segment), Thales, and GE Aviation. These rivals often boast more extensive product lines and deeper pockets for research and development, giving them a significant edge in innovation and market penetration.

The sheer scale and financial might of these major competitors, many of which are diversified conglomerates, mean they can absorb market fluctuations and invest heavily in new technologies. For instance, Raytheon Technologies reported over $67 billion in revenue for 2023, highlighting the substantial resources available to its aerospace division, Collins Aerospace, which directly competes with Astronics in several key areas.

The aerospace and defense sector, where Astronics operates, demands substantial upfront investment in manufacturing infrastructure and advanced equipment. These high fixed costs, coupled with the critical need for continuous research and development to innovate, place significant pressure on industry players. For instance, the global aerospace market size was valued at USD 932.3 billion in 2023 and is projected to grow, underscoring the scale of investment required.

This cost structure compels companies like Astronics to pursue high production volumes to amortize their fixed expenses effectively. Consequently, intense competition arises as firms vie for market share to ensure profitability. Astronics itself highlights its commitment to ongoing R&D, with expenditures crucial for developing next-generation technologies and maintaining a competitive advantage in this capital-intensive industry.

Competitive rivalry within Astronics' sectors is significantly fueled by product differentiation, where advanced technology, unwavering reliability, and superior performance are paramount. Companies constantly strive to stand out by offering unique features and capabilities that meet evolving customer needs.

Astronics' capacity for innovation, particularly in critical areas such as power generation systems, sophisticated cabin management solutions, and cutting-edge avionics, is absolutely vital for preserving its competitive advantage. Staying ahead requires a continuous stream of new and improved offerings.

The aerospace market, especially for avionics, is experiencing a strong demand for more advanced and highly efficient systems. In 2024, this trend is driving companies to concentrate their efforts on introducing novel products and embracing digital transformation to enhance their market position.

Long Product Lifecycles and Aftermarket Support

The aerospace industry is characterized by exceptionally long product lifecycles, often spanning 20 to 30 years or more for aircraft. This longevity means that securing an initial design win with an Original Equipment Manufacturer (OEM) can translate into decades of revenue through aftermarket support, spare parts, and upgrades. For instance, Astronics, a key player in aerospace electronics, benefits from this dynamic, as their systems are integral to aircraft for their entire operational life.

This extended revenue potential intensifies the competition for new aircraft programs. Companies vie fiercely for these initial design wins, understanding that a successful bid can lock in a significant and stable revenue stream for many years, while a loss can severely hamper future growth prospects. The need to continuously modernize and upgrade existing aircraft fleets with advanced avionics systems further fuels this competitive landscape, creating ongoing opportunities and demands for innovation.

- Long Lifecycles: Aerospace products can remain in service for over two decades, providing sustained aftermarket revenue.

- Aftermarket Dominance: Initial design wins with OEMs are crucial for securing long-term income from support and upgrades.

- Intensified Competition: The prospect of decades of revenue makes winning new aircraft programs a high-stakes endeavor.

- Modernization Driver: Demand for upgraded avionics systems in existing fleets sustains competitive pressure and revenue opportunities.

Regulatory and Certification Hurdles

The aerospace and defense sector is defined by stringent regulatory frameworks, including critical certifications from bodies like the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These requirements act as a substantial barrier to entry for new competitors. Astronics, with its established track record, possesses the expertise and financial capacity to navigate these complex processes, thereby solidifying its competitive standing.

The rigorous certification process significantly impacts competitive rivalry. Companies that successfully manage these hurdles gain a distinct advantage. For instance, a single certification failure can lead to costly delays and reputational damage, a risk more readily absorbed by larger, established firms. Astronics' ability to consistently meet these standards is a key differentiator.

- Regulatory Complexity: The aerospace and defense industry is subject to extensive and evolving regulations, demanding significant investment in compliance.

- Certification Barriers: Obtaining certifications from agencies like the FAA and EASA is a time-consuming and expensive process, deterring new market entrants.

- Established Player Advantage: Companies like Astronics, with deep experience in navigating these requirements, possess a competitive edge over less experienced rivals.

- Consequences of Non-Compliance: Product failures or quality lapses can result in severe penalties, including grounding of aircraft and substantial financial losses, reinforcing the importance of robust compliance for all players.

The competitive rivalry for Astronics is fierce, driven by a few dominant players with substantial resources. Companies like Honeywell and Collins Aerospace, a segment of Raytheon Technologies, leverage their scale and R&D budgets to out-innovate and out-invest. For example, Raytheon Technologies' 2023 revenue exceeded $67 billion, illustrating the financial muscle of these rivals.

High fixed costs associated with advanced manufacturing and continuous R&D in the aerospace sector, valued at $932.3 billion in 2023, intensify this rivalry. Companies must achieve high production volumes to spread these costs. Astronics' own commitment to R&D underscores the necessity of innovation to maintain market position in this capital-intensive environment.

Product differentiation through advanced technology and reliability is key. The aerospace market's demand for efficient systems in 2024 pushes companies to introduce novel products and embrace digital transformation. Long product lifecycles, often 20-30 years, mean initial design wins with OEMs provide decades of revenue, making competition for these contracts particularly intense.

Stringent regulatory certifications, such as those from the FAA and EASA, act as significant barriers to entry, favoring established players like Astronics with proven compliance expertise. Navigating these complex requirements successfully provides a distinct competitive advantage, as failures can lead to costly delays and reputational damage.

| Competitor | 2023 Revenue (Approx.) | Key Areas of Competition |

| Honeywell | $36.7 billion | Avionics, Cabin Technologies, Power Systems |

| Collins Aerospace (Raytheon Technologies) | $67+ billion (Total Raytheon) | Avionics, Flight Controls, Connectivity |

| Thales | €18.4 billion | Avionics, Communications, Navigation |

| GE Aviation | (Part of GE Aerospace, $32.2 billion in 2023) | Power Systems, Avionics Integration |

SSubstitutes Threaten

For many of Astronics' core offerings, like aircraft power generation and distribution systems, avionics, and structural components, direct substitutes are scarce. These are vital for flight safety and performance, requiring any alternative technology to meet stringent aviation industry standards.

The demand for sophisticated avionics and electrical systems is on an upward trajectory, driven by the growth in air travel. For instance, the global commercial aircraft market is projected to reach $295.4 billion by 2025, underscoring the need for specialized, reliable components.

While direct product substitutes for Astronics' current offerings are relatively low, a significant threat emerges from the rapid evolution of aircraft design and propulsion. The push towards more electric aircraft (MEA) and the development of hybrid-electric and fully electric propulsion systems represent a fundamental shift.

These technological advancements could diminish the demand for traditional components Astronics currently supplies, while simultaneously creating entirely new product categories. For instance, the market for electrified aircraft propulsion systems is experiencing substantial growth, with projections indicating significant expansion in the coming years, necessitating strategic adaptation from Astronics.

In the automated test solutions market, a significant threat comes from alternative maintenance or test methodologies. Customers, particularly those with highly specialized or proprietary systems, may opt to develop their own in-house testing capabilities rather than relying on external providers like Astronics. This can be driven by a desire for greater control over the testing process, cost considerations, or the availability of internal expertise.

The decision to bring testing in-house is a direct substitute for Astronics' test system offerings. For instance, a large aerospace manufacturer might invest in developing custom diagnostic tools for their unique aircraft systems, bypassing the need to purchase or lease Astronics' advanced solutions. This trend is amplified when the perceived cost savings or strategic advantage of internal control outweighs the benefits of specialized external services.

Software-Defined Systems and Virtualization

The growing adoption of software-defined systems and virtualization in avionics presents a threat of substitutes by potentially diminishing the need for specialized hardware components. This shift could redirect value towards software developers, impacting companies like Astronics that operate in both hardware and software domains. For instance, the trend towards digital cockpits and AI integration in aviation means that core functionalities might be increasingly delivered through software, potentially reducing the demand for certain Astronics hardware products if their software offerings aren't sufficiently competitive or if they can't capture value from this evolving landscape.

This trend is evidenced by increasing investment in avionics software. In 2024, the global avionics market, which heavily relies on these systems, is projected to reach over $30 billion, with a significant portion of growth attributed to software advancements and digital integration.

- Software-Defined Avionics: Enables greater flexibility and reduced hardware dependency.

- Virtualization: Consolidates functions onto fewer hardware platforms, potentially reducing the need for specialized Astronics hardware.

- Digital Cockpits & AI: Drive demand for software solutions, shifting value away from traditional hardware providers.

- Market Trends: The avionics sector saw significant R&D spending on software solutions in 2024, indicating a clear shift.

Modular and Open Architecture Systems

The increasing adoption of modular and open architecture systems in aircraft design presents a significant threat of substitutes for Astronics. These systems enable greater interoperability, making it easier to integrate components from different suppliers. This reduces customer reliance on a single vendor, potentially allowing them to substitute components more readily, even if the core function remains the same.

This trend directly impacts Astronics by potentially weakening its competitive advantage if its proprietary solutions are easily replaced by standardized, interoperable alternatives. For instance, in the avionics sector, a move towards open architectures could allow airlines to source flight control systems or communication modules from a wider array of manufacturers, rather than being locked into a specific Astronics ecosystem.

- Interoperability Threat: Open architectures facilitate the integration of components from multiple vendors, reducing vendor lock-in.

- Component Substitution: Customers can more easily swap out one supplier's component for another's, provided it meets open standards.

- Market Dynamics: This shift can lead to increased price competition and pressure on Astronics' margins for integrated systems.

- Strategic Impact: Astronics must adapt its product development to embrace or compete within these open system frameworks to mitigate the substitution threat.

The threat of substitutes for Astronics' core aerospace products is generally low due to stringent safety and performance requirements. However, advancements in aircraft technology, such as more electric aircraft and new propulsion systems, represent a significant indirect substitute threat by potentially reducing demand for traditional components. In 2024, the global aviation industry continues to invest heavily in these next-generation technologies, signaling a potential shift in component needs.

Furthermore, in the automated test solutions market, customers may develop in-house testing capabilities as a substitute for Astronics' offerings, driven by cost or control considerations. The increasing prevalence of software-defined systems and virtualization in avionics also poses a threat, as it can decrease reliance on specialized hardware. The global avionics market, projected to exceed $30 billion in 2024, highlights the growing importance of software integration.

| Substitute Area | Nature of Substitute | Impact on Astronics | Example/Data Point |

|---|---|---|---|

| Aircraft Propulsion | More Electric Aircraft (MEA), Hybrid-Electric/Electric Propulsion | Reduces demand for traditional power generation/distribution components | Significant R&D investment in MEA technologies by major aerospace players in 2024. |

| Testing Solutions | In-house testing development | Directly replaces Astronics' test system offerings | Large aerospace manufacturers developing proprietary diagnostic tools. |

| Avionics Systems | Software-defined systems, Virtualization | Decreases reliance on specialized hardware | Global avionics market growth in 2024 driven by software advancements. |

Entrants Threaten

The aerospace and defense sector demands enormous upfront capital for state-of-the-art manufacturing plants, specialized equipment, and ongoing research and development. New companies entering this arena must overcome significant financial barriers to build the required infrastructure and create viable, competitive offerings.

For instance, Astronics, a key player, consistently allocates substantial funds to R&D, with their 2023 annual report detailing over $80 million dedicated to innovation, underscoring the industry's high cost of staying competitive.

The aerospace industry, where Astronics operates, faces a significant threat from new entrants due to stringent regulatory and certification requirements. Agencies like the Federal Aviation Administration (FAA) in the U.S. and the European Union Aviation Safety Agency (EASA) impose incredibly rigorous and often lengthy approval processes for new aerospace products and components. For example, the certification of a new aircraft system can easily span several years and involve millions of dollars in testing and documentation.

These complex and costly approval pathways act as a substantial barrier to entry. New companies must invest heavily in research, development, and compliance, often before generating any revenue. This regulatory environment inherently favors established players like Astronics, who have already navigated these hurdles and possess the infrastructure and expertise to manage ongoing compliance.

Astronics benefits from deeply entrenched, decades-long relationships with major aerospace Original Equipment Manufacturers (OEMs) and aftermarket clients. These relationships are founded on a bedrock of trust, consistent reliability, and a history of proven performance, making it exceptionally difficult for new players to penetrate.

New entrants face a significant hurdle in attempting to displace these established connections. Integrating into the complex, multi-tiered aerospace supply chains requires navigating rigorous qualification processes and demonstrating stability, areas where Astronics already holds a strong advantage.

The aerospace supply chain is notoriously intricate and demanding, posing substantial integration challenges for newcomers. Astronics' established presence and proven ability to meet these stringent requirements create a formidable barrier to entry for any potential competitor.

Proprietary Technology and Intellectual Property

Astronics' proprietary technology and intellectual property create a significant barrier to entry. Their specialized product lines, including advanced power generation systems and sophisticated cabin lighting solutions, are protected by patents and years of research. For instance, Astronics' commitment to innovation is reflected in their substantial investment in research and development, which stood at $76.4 million in 2023, a key factor in maintaining their technological lead.

New companies would face immense challenges in replicating Astronics' technological capabilities. The development of comparable or superior technologies necessitates substantial capital outlay and considerable time, alongside the inherent risk of infringing on existing intellectual property rights. This technological moat ensures that Astronics can maintain its competitive edge in specialized aerospace and defense markets.

- Proprietary Tech: Astronics holds patents for key technologies in power, lighting, and testing.

- R&D Investment: The company invested $76.4 million in R&D in 2023, fostering continuous innovation.

- High Entry Costs: New entrants require significant investment to develop equivalent technology.

- IP Risk: Developing competing technologies carries a substantial risk of intellectual property infringement.

Talent Shortages and Specialized Expertise

The aerospace and defense sector grapples with ongoing shortages of highly skilled engineers and technicians, especially those with specialized knowledge in intricate aerospace systems. This makes it difficult for new companies to recruit and keep the talent needed for product development, manufacturing, and certification, thereby raising the barrier to entry.

Workforce retention is a critical operational focus for many aerospace leaders. For instance, a 2024 survey indicated that over 70% of aerospace executives identified talent acquisition and retention as a primary challenge.

- Talent Scarcity: The demand for specialized aerospace engineers outstrips supply.

- Recruitment Hurdles: New entrants face significant competition for qualified personnel.

- Retention Challenges: Existing companies prioritize keeping their skilled workforce.

- Impact on Entry: Difficulty in staffing complex projects deters potential competitors.

The threat of new entrants for Astronics is generally low, primarily due to the immense capital required for advanced manufacturing and R&D, as highlighted by Astronics' 2023 R&D investment of $76.4 million. Stringent regulatory approvals, like those from the FAA and EASA, also present significant hurdles, often taking years and millions of dollars to navigate. Furthermore, Astronics benefits from established customer relationships and proprietary technologies, making it challenging for newcomers to gain a foothold.

| Barrier Type | Description | Astronics' Advantage | 2023 Data Point |

| Capital Requirements | High upfront investment for specialized facilities and equipment. | Established infrastructure and scale. | $76.4 million R&D investment. |

| Regulatory Hurdles | Lengthy and costly certification processes for aerospace products. | Existing compliance expertise and infrastructure. | Multi-year certification timelines common. |

| Customer Relationships | Deeply entrenched, long-term partnerships with OEMs. | Proven track record and trust. | Decades-long relationships. |

| Proprietary Technology | Patented technologies and significant R&D investment. | Technological lead and IP protection. | $76.4 million R&D investment. |

| Talent Acquisition | Shortage of specialized aerospace engineers and technicians. | Ability to attract and retain skilled workforce. | 70%+ aerospace execs cite talent as a primary challenge (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Astronics leverages data from their annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research reports and trade publications to capture competitive dynamics.