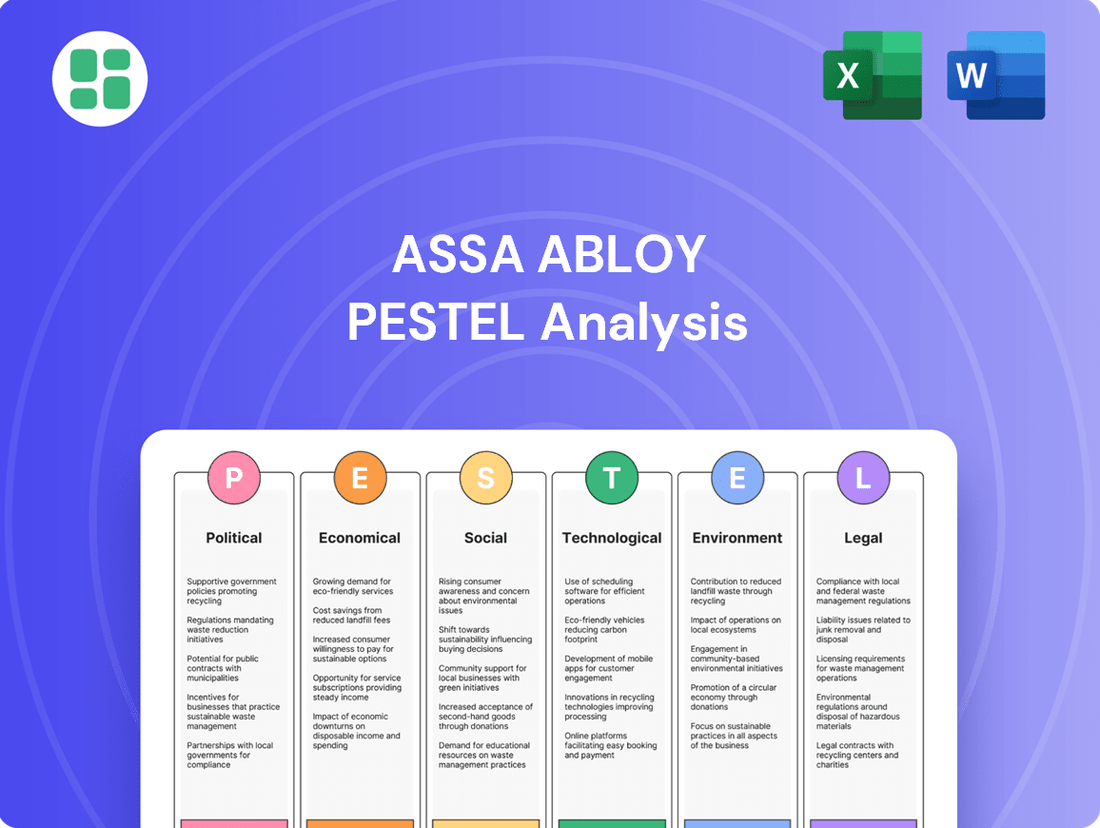

Assa Abloy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

The PESTLE analysis for Assa Abloy reveals critical external factors influencing its global security solutions business. From evolving political landscapes and economic shifts to technological advancements and environmental regulations, understanding these dynamics is key to strategic success. Equip yourself with these vital insights to anticipate market changes and refine your own business strategy.

Gain a competitive edge by delving into the comprehensive PESTLE analysis of Assa Abloy. Discover how political stability, economic growth, social trends, technological innovation, environmental concerns, and legal frameworks are shaping its operations. Download the full report now to unlock actionable intelligence and fortify your market approach.

Political factors

Governments globally are tightening rules for security products, especially for smart home tech and access control. For instance, the European Union's General Data Protection Regulation (GDPR) and similar data privacy laws in countries like the US and Canada significantly impact how Assa Abloy handles user data from connected devices. Failure to comply can lead to substantial fines, as seen with GDPR penalties which can reach up to 4% of global annual turnover.

Global trade policies, including tariffs and trade agreements, significantly impact Assa Abloy's international supply chain and market pricing. For instance, the ongoing trade friction between the US and China, which saw tariffs on various goods, could affect the cost of imported components for Assa Abloy's manufacturing operations in North America.

Geopolitical tensions and protectionist measures can lead to increased costs for raw materials or components, affect import/export duties, and alter the competitiveness of Assa Abloy's products in various markets. The company's global presence requires vigilance in monitoring these evolving trade landscapes, especially as countries like the UK navigate post-Brexit trade relationships, potentially introducing new customs procedures and duties for goods entering the EU market.

Political stability, or lack thereof, in regions where Assa Abloy operates significantly influences its business. Instability can disrupt supply chains, delay construction projects, and dampen demand for security products. For instance, Assa Abloy's Q1 2025 report highlighted 'geopolitical uncertainty fueled by tariff concerns and high interest rates' as a key challenge impacting its operating environment.

Government Procurement Policies

Government and public sector bodies represent a substantial customer base for security solutions, particularly in critical areas like infrastructure, public buildings, and defense. Assa Abloy's success in these segments hinges on navigating diverse government procurement policies, which often involve complex bidding processes and adherence to local content mandates in various nations. These regulations can significantly shape market entry strategies, as they frequently favor domestic suppliers or require specific product certifications.

For instance, in 2023, government spending on security infrastructure projects globally saw continued investment, with a notable emphasis on smart city initiatives and cybersecurity enhancements. Assa Abloy's ability to secure public contracts in 2024 and beyond will depend on its adaptability to these evolving procurement landscapes.

- Government procurement represents a key revenue stream for security providers like Assa Abloy, especially for large-scale projects.

- Compliance with local content requirements and specific certifications is crucial for winning public sector bids.

- Policies prioritizing domestic suppliers can present challenges and opportunities for international market entry.

- The global trend towards smart city development and enhanced infrastructure security continues to drive government spending in this sector.

Building Codes and Safety Regulations

Assa Abloy's business is heavily influenced by building codes and safety regulations, particularly concerning entrance systems and fire-rated doors. These standards directly impact product design, material selection, and manufacturing processes, requiring ongoing investment in research and development to ensure compliance.

Changes in these regulations, such as anticipated updates to US and Australian building codes for 2025, are critical. Assa Abloy must continuously adapt its product portfolio to meet these evolving safety requirements, which often include enhanced fire resistance, security features, and accessibility standards. Failure to do so can result in market exclusion and significant revenue loss.

For instance, the increasing stringency of fire safety regulations globally, with many regions aiming for zero-tolerance on fire-related building failures, means Assa Abloy's fire door and exit hardware segments are under constant scrutiny. The company’s ability to secure certifications for its products under these new frameworks is paramount for maintaining its competitive edge and market share in key regions.

Key considerations for Assa Abloy regarding building codes and safety regulations include:

- Compliance Costs: The expense associated with testing and certifying products to meet new or updated building codes.

- Product Innovation: The necessity to develop new solutions or modify existing ones to align with stricter safety and performance standards.

- Market Access: Ensuring that products meet the specific requirements of different jurisdictions to gain or maintain market access.

- Competitive Advantage: Leveraging early adoption of compliance with new regulations as a differentiator against competitors.

Government procurement is a significant revenue driver for Assa Abloy, particularly in large infrastructure and public building projects. The company's success in securing these contracts often depends on navigating complex bidding processes and adhering to local content requirements, as seen in government spending on smart city initiatives in 2023.

Stricter data privacy laws, like the EU's GDPR, directly impact Assa Abloy's connected devices, with non-compliance risking fines up to 4% of global annual turnover. Global trade policies and geopolitical tensions also influence supply chains and market pricing, with trade friction between major economies potentially increasing component costs.

Building codes and safety regulations are critical, dictating product design and requiring ongoing R&D investment. Anticipated updates to US and Australian building codes for 2025, for example, will necessitate product portfolio adaptation to meet enhanced fire resistance and security standards.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Assa Abloy, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape its strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, ensuring all stakeholders understand Assa Abloy's external environment and its implications.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear overview of the political, economic, social, technological, environmental, and legal factors affecting Assa Abloy.

Economic factors

Global economic growth significantly impacts Assa Abloy's performance. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 3.5% in 2023, indicating a moderating but still positive economic environment. This growth generally supports demand for construction and renovation, key drivers for Assa Abloy's access solutions.

However, the risk of recession remains a concern. A significant economic downturn could dampen construction activity and reduce discretionary spending on security upgrades. For example, if major economies experience a contraction in GDP, such as a projected 1% decline in the Eurozone in early 2025, Assa Abloy might see slower sales in its residential and commercial segments due to reduced investment and consumer confidence.

Elevated interest rates and a more restrictive credit environment significantly influence the construction sector and overall consumer sentiment. This directly affects demand for major purchases such as residential properties and commercial real estate projects. Assa Abloy's Q1 2025 earnings highlighted that 'persistently high interest rates and uncertainty weighed on consumer confidence' within its North America Residential division, underscoring the impact on their market.

Inflationary pressures and fluctuating raw material costs, such as metals, plastics, and electronic components, directly impact Assa Abloy's production expenses and overall profitability. For instance, the average price of steel, a key material, saw significant volatility throughout 2023 and into early 2024, impacting manufacturing overheads.

To navigate these challenges, Assa Abloy must employ strong supply chain management and adaptable pricing strategies. This approach is crucial for offsetting increased input expenses and preserving healthy profit margins, especially as global supply chain disruptions continue to influence material availability and cost.

Currency Exchange Rates

As a global entity, Assa Abloy's financial performance is inherently tied to the ebb and flow of currency exchange rates. Fluctuations can significantly influence both the company's revenues and its operational costs across diverse international markets. A strengthening local currency relative to the Swedish Krona (SEK) generally boosts reported sales figures, while a weakening trend can diminish the value of earnings repatriated from abroad.

For instance, Assa Abloy's Q1 2025 earnings report highlighted the relatively contained impact of currency movements, stating that 'currency effects were small at 1%' on sales. This suggests that while currency volatility is a constant consideration, its net effect on the company's top line during that period was minimal, indicating effective hedging strategies or favorable offsetting movements across its global operations.

- Impact on Sales: Stronger local currencies against SEK can inflate reported sales, while weaker ones can deflate them.

- Impact on Costs: Conversely, currency movements affect the cost of goods sold and operating expenses incurred in foreign currencies.

- Q1 2025 Data: Currency effects on sales were reported as a minimal 1% in the first quarter of 2025.

- Strategic Hedging: Companies like Assa Abloy often employ financial instruments to mitigate currency risks.

Disposable Income Levels

Consumer disposable income is a significant driver for ASSA ABLOY's product demand, particularly for its higher-end smart home security and access control systems. As disposable incomes rise, consumers are more likely to invest in premium features like digital door locks and integrated smart home solutions. Conversely, economic slowdowns can lead to a pivot towards more cost-effective security options.

In the United States, for example, real disposable income saw an increase in early 2024, with the Bureau of Economic Analysis reporting growth. This trend generally supports demand for ASSA ABLOY's advanced offerings. However, global economic uncertainties and inflation rates in key markets can temper consumer spending on non-essential upgrades.

- Disposable income growth: In Q1 2024, US real disposable income increased at an annual rate of 3.2%, potentially boosting demand for premium security solutions.

- Economic sensitivity: During periods of economic contraction, consumers may prioritize basic security functions over advanced smart home integration.

- Market segmentation: ASSA ABLOY's strategy often involves catering to different income brackets with a range of products, from entry-level to high-end smart locks.

- Global income disparities: Variations in disposable income across different countries impact the adoption rates of sophisticated security technologies.

Global economic conditions directly influence Assa Abloy's sales, with projected global growth of 3.2% in 2024 by the IMF suggesting a continued, albeit moderating, demand for construction and renovation. However, persistent high interest rates, as noted in Assa Abloy's Q1 2025 earnings regarding North America Residential, continue to dampen consumer confidence and investment in real estate, impacting demand for access solutions.

Inflationary pressures and volatile raw material costs, such as steel, directly affect Assa Abloy's manufacturing expenses and profitability, necessitating robust supply chain management and adaptable pricing strategies to maintain healthy margins. Furthermore, currency exchange rate fluctuations, while minimal at 1% on sales in Q1 2025 for Assa Abloy, remain a constant consideration for global revenue and cost management.

| Economic Factor | Assa Abloy Impact | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for construction/renovation | IMF projected 3.2% global growth in 2024. |

| Interest Rates | Dampens real estate investment and consumer confidence | Persistently high rates noted as a concern in Q1 2025 earnings. |

| Inflation & Raw Material Costs | Increases production expenses and impacts profitability | Steel price volatility in 2023-2024 impacted manufacturing overheads. |

| Currency Exchange Rates | Affects reported sales and operational costs | Q1 2025: Currency effects on sales were minimal at 1%. |

Full Version Awaits

Assa Abloy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Assa Abloy delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed understanding of the external forces shaping their strategic landscape.

Sociological factors

The world continues to urbanize at a rapid pace, with projections indicating that by 2050, 68% of the global population will reside in urban areas, a significant jump from 56% in 2021. This trend directly fuels demand for new construction, from homes to offices, expanding Assa Abloy's addressable market for its access solutions.

Population growth, projected to reach nearly 9.7 billion by 2050, further amplifies this demand. Densely populated urban centers also create a greater need for sophisticated security and access control systems in apartment buildings, public transit, and other shared spaces, areas where Assa Abloy holds a strong market position.

Consumers are increasingly aware of security risks, driving a demand for sophisticated access control. This heightened awareness, combined with a desire for convenience, is pushing the market towards smart home security and digital locking mechanisms.

The trend towards connected living means consumers want integrated systems, like mobile access solutions, that provide both robust security and user-friendly operation. For instance, the global smart lock market was valued at approximately $3.7 billion in 2023 and is projected to reach over $11 billion by 2028, showcasing a significant shift in consumer preference.

The global move towards hybrid and flexible work arrangements significantly reshapes the commercial real estate sector. This evolution drives demand for access control solutions that are not only secure but also highly adaptable to fluctuating occupancy levels and varied user profiles within modern office spaces and co-working environments. For instance, by mid-2024, many companies reported that 30-40% of their workforce were regularly working remotely, necessitating more dynamic building management.

Assa Abloy is well-positioned to leverage this trend by offering intelligent access management systems. These systems can efficiently handle the dynamic needs of spaces with changing personnel, ensuring seamless entry for authorized individuals while maintaining robust security. This adaptability is crucial as businesses increasingly prioritize flexible work policies to attract and retain talent.

Aging Population

The increasing age of the global population directly influences the demand for security products. Assa Abloy needs to focus on user-friendly, accessible designs, often incorporating smart home technology for remote monitoring by caregivers or family. For instance, by 2024, the number of people aged 65 and over is projected to reach 770 million globally, a significant market segment that values convenience and safety integration.

This demographic shift necessitates innovation in areas like voice-activated entry systems and simplified mobile app interfaces. Assa Abloy's product development must anticipate the needs of an older user base, ensuring ease of use and potential integration with assisted living solutions. By 2025, it's estimated that over 10% of European households will have someone over 80, highlighting the growing market for such specialized security features.

- Growing Elderly Demographic: By 2024, over 770 million people worldwide will be aged 65+, creating a substantial market for accessible security.

- Demand for Smart Integration: Assisted living technologies are increasingly sought after, requiring security solutions that can connect remotely for caregiver access.

- User Interface Innovation: Simplified controls and voice activation are key for older adults, driving Assa Abloy's need for intuitive product design.

Data Privacy Concerns

Societal concerns regarding data privacy are intensifying, particularly as smart devices, including those in access control systems, increasingly collect user data. This heightened awareness directly impacts consumer trust and the willingness to adopt new technologies. For instance, a 2024 survey indicated that over 70% of consumers are concerned about how their personal data is used by connected devices.

Assa Abloy must proactively address these anxieties by implementing stringent data security protocols and maintaining transparent privacy policies for its digital access solutions. Failing to do so could significantly hinder the adoption of their smart lock and access management systems. By prioritizing robust cybersecurity and clear communication, Assa Abloy can build and maintain consumer confidence in an era of growing digital surveillance.

- Growing public awareness of data privacy issues, amplified by smart device proliferation.

- Consumer trust is a critical factor for the adoption of Assa Abloy's digital access solutions.

- Assa Abloy's 2024 sustainability report highlighted investments in advanced data encryption technologies.

- Transparent privacy policies are essential for mitigating consumer concerns and fostering confidence.

The global population's increasing reliance on technology for daily tasks, including home security, drives demand for smart and connected access solutions. This trend is underscored by the projected growth of the smart home market, which was expected to reach over $150 billion globally by the end of 2024.

Consumer preferences are shifting towards integrated systems that offer convenience and enhanced security, such as mobile-based access. The increasing comfort with digital transactions and online services further supports the adoption of advanced electronic locks and access management platforms.

Societal emphasis on sustainability and environmental responsibility is also influencing product development. Consumers and businesses are increasingly looking for solutions that are energy-efficient and manufactured with eco-friendly materials.

Assa Abloy's focus on innovation in digital access, user experience, and sustainable practices aligns with these evolving societal expectations, positioning the company to capitalize on these demographic and behavioral shifts in the coming years.

Technological factors

The expanding Internet of Things (IoT) and smart home market offers Assa Abloy a prime opportunity to embed its access control systems into a wider network of connected devices. This integration allows for enhanced user convenience and automated home management, with smart locks becoming a central component of the connected living experience.

By developing smart locks that can communicate and coordinate with other smart home appliances, Assa Abloy can tap into the growing demand for seamless automation. For instance, a smart lock could automatically disarm a security system or adjust lighting upon a user's arrival, demonstrating the practical benefits of this technological convergence.

The global smart home market is projected to reach over $200 billion by 2025, with smart locks being a key driver of growth. Assa Abloy's ability to innovate in this space, ensuring interoperability with major smart home platforms like Google Home and Amazon Alexa, will be crucial for capturing market share and leveraging these technological advancements.

The escalating sophistication of cyber threats presents a significant hurdle for companies like Assa Abloy, which rely heavily on digital access solutions. This necessitates ongoing, substantial investment in advanced cybersecurity protocols to safeguard their operations and customer data.

Assa Abloy must prioritize the integrity and resilience of its software, cloud infrastructure, and internet-connected devices. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, underscoring the immense financial and reputational risk associated with security breaches.

The increasing use of biometric authentication, like fingerprint and facial recognition, is significantly boosting security and making access control much easier. This trend is reshaping how we think about personal and physical security across many sectors.

Assa Abloy, particularly through its HID Global unit, is making substantial investments in expanding its facial recognition and other biometric technologies. This strategic focus positions them to be a major player in the rapidly evolving advanced security market, with HID Global's biometric solutions seeing strong demand in 2024 for applications ranging from secure enterprise access to consumer electronics.

Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning are fundamentally reshaping the security landscape, particularly in access control. These technologies facilitate predictive analytics, allowing for the anticipation of potential threats, and anomaly detection to flag unusual activity. Furthermore, intelligent automation streamlines operations, enhancing efficiency and responsiveness within security systems.

Assa Abloy is actively integrating AI into its product offerings. For instance, their 'ecoLOGIC' system for automatic doors utilizes AI to optimize energy consumption and improve overall operational performance. The company is also investing in AI-driven data analysis to gain deeper customer insights, paving the way for more personalized and effective security solutions.

- AI in Security: Enhances access control through predictive analytics and anomaly detection.

- Assa Abloy's AI Adoption: 'ecoLOGIC' system optimizes energy for automatic doors.

- Customer-Centric AI: Exploring AI for tailored security solutions based on user behavior and needs.

- Market Growth: The global AI in security market was valued at approximately $15.2 billion in 2023 and is projected to reach over $70 billion by 2030, indicating significant investment and adoption trends.

Miniaturization and Wireless Communication

The relentless march of miniaturization and wireless communication is a significant technological driver for Assa Abloy. These advancements allow for the creation of smaller, more discreet, and adaptable access control systems. This translates to simpler installations, less reliance on extensive wiring, and a broader range of design possibilities, thereby unlocking new market opportunities and applications for the company's innovative solutions.

For instance, the increasing power efficiency of wireless chips, with some operating for years on a single coin cell battery, directly supports the development of long-lasting, low-maintenance smart locks. Furthermore, the proliferation of low-power wide-area networks (LPWAN) like LoRaWAN and NB-IoT, which saw significant network expansion and device deployments throughout 2024 and early 2025, provides robust connectivity for remote access management, even in challenging environments.

- Miniaturization: Enables sleeker, less obtrusive hardware, enhancing aesthetic integration in diverse settings.

- Wireless Communication: Reduces installation costs and complexity by eliminating the need for extensive cabling.

- New Market Segments: Facilitates entry into markets previously constrained by wiring infrastructure, such as retrofitting older buildings or deploying in remote locations.

- Design Versatility: Allows for more flexible product design, catering to varied architectural styles and user preferences.

Technological advancements are fundamentally reshaping the access control industry, creating both opportunities and challenges for Assa Abloy. The expanding Internet of Things (IoT) and smart home market presents a significant avenue for growth, with smart locks becoming integral to connected living experiences. The global smart home market's projected growth, expected to exceed $200 billion by 2025, underscores the potential for companies like Assa Abloy that can ensure interoperability with major smart home platforms.

The increasing sophistication of biometric authentication, such as facial recognition, is enhancing security and user convenience. Assa Abloy, through its HID Global unit, is actively investing in these technologies, recognizing their strong demand in 2024 for diverse applications. Furthermore, artificial intelligence and machine learning are transforming security by enabling predictive analytics and anomaly detection, with Assa Abloy integrating AI into systems like their 'ecoLOGIC' for automatic doors to optimize performance and gain customer insights. The global AI in security market, valued at approximately $15.2 billion in 2023, is set to grow substantially, highlighting the importance of these innovations.

Miniaturization and advanced wireless communication are also key technological drivers, allowing for smaller, more adaptable access control systems with reduced installation complexity. The development of long-lasting, low-maintenance smart locks is facilitated by the increasing power efficiency of wireless chips, and the expansion of low-power wide-area networks (LPWAN) through 2024 and early 2025 offers robust connectivity for remote access management.

| Technological Factor | Impact on Assa Abloy | Market Data/Projections |

| IoT & Smart Home Integration | Opportunity to embed access control into connected devices, enhancing convenience and automation. | Global smart home market projected to exceed $200 billion by 2025. |

| Biometric Authentication | Increased security and ease of use; strong demand for facial recognition and other biometric solutions. | HID Global unit seeing strong demand in 2024. |

| Artificial Intelligence (AI) | Enables predictive analytics, anomaly detection, and operational optimization. | Global AI in security market valued at ~$15.2 billion in 2023, projected significant growth. |

| Miniaturization & Wireless Tech | Facilitates smaller, discreet systems, reduces installation costs, and enables new applications. | LPWAN network expansion through 2024/early 2025 supports remote access. |

Legal factors

Assa Abloy must navigate a complex web of global data protection regulations. The General Data Protection Regulation (GDPR) in Europe, for instance, mandates stringent rules for handling personal data. This is further complicated by evolving state-level privacy laws in the United States, with new legislation set to take effect in 2025 across states like Delaware, Iowa, Maryland, Minnesota, New Hampshire, New Jersey, and Tennessee.

These regulations directly influence how Assa Abloy manages data collected from its digital access solutions, impacting everything from data collection practices to storage protocols. Non-compliance can lead to substantial fines, potentially impacting financial performance and brand reputation. For example, GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher.

Maintaining user trust is paramount, and adherence to these data protection frameworks is essential for Assa Abloy to operate its digital access businesses effectively and ethically. The company's ability to adapt to these changing legal landscapes is a critical factor in its ongoing success and market position.

Assa Abloy faces significant legal exposure through product liability laws worldwide, making it accountable for the safety and performance of its extensive range of access solutions. This global regulatory landscape demands robust product development processes, including comprehensive testing and stringent quality assurance measures to mitigate potential legal challenges and safeguard the company's brand integrity.

Failure to meet these exacting standards can result in costly recalls, lawsuits, and damage to Assa Abloy's reputation. For instance, in 2023, the global market for smart locks, a key segment for Assa Abloy, saw increased scrutiny regarding data security and potential vulnerabilities, highlighting the critical need for compliance with evolving product safety regulations.

Intellectual property rights are crucial for Assa Abloy's edge, especially with its innovation in smart locks and access control systems. The company diligently secures patents to protect its unique technologies and designs.

In the second quarter of 2024, Assa Abloy filed 37 patents specifically related to the 'future of work,' underscoring its commitment to safeguarding its advancements in this evolving sector.

Antitrust and Competition Laws

Assa Abloy, as a significant player in the global security solutions market, faces scrutiny under various antitrust and competition laws. These regulations are designed to prevent monopolies and ensure fair competition, impacting Assa Abloy's strategies for growth through mergers and acquisitions.

Failure to comply can lead to severe penalties. For instance, the European Commission has the power to impose significant fines, which can reach up to 10% of a company's total worldwide annual turnover for antitrust violations. In 2023, for example, the Commission fined companies billions for various competition law breaches, underscoring the financial risks involved.

- Merger Control: Assa Abloy's proposed acquisitions, such as its significant 2023 bid for a competitor, are subject to review by competition authorities in multiple jurisdictions.

- Market Dominance: Regulators monitor Assa Abloy's market share to ensure it does not abuse a dominant position, which could involve practices like predatory pricing or exclusive dealing.

- Regulatory Fines: Non-compliance can result in substantial fines; the EU's average fine for cartel infringements in 2023 was €139 million, illustrating the financial consequences of breaches.

- Divestiture Orders: In cases of significant market distortion, authorities may mandate the sale of certain business units or assets to restore competitive balance.

Building and Safety Certification Standards

Assa Abloy must legally adhere to stringent national and international building and safety certification standards for its products to be sold and installed. These regulations are not optional; they are a fundamental requirement for market access and customer trust.

These critical standards encompass a wide range of product attributes, including fire resistance ratings, security grades (such as those defined by EN 1627 for burglary resistance), and accessibility features for users with disabilities. Compliance necessitates ongoing investment in product development and rigorous, continuous certification processes to ensure ongoing adherence.

For instance, the company's commitment to meeting standards like UL (Underwriters Laboratories) for fire door hardware or ANSI (American National Standards Institute) for accessibility in the US market is a legal and operational imperative. Failure to maintain these certifications can lead to product recalls, fines, and significant reputational damage, impacting sales across its global operations.

- Fire Resistance: Assa Abloy products must meet specific fire ratings (e.g., 20-minute, 45-minute, 90-minute) as per standards like UL 10C and EN 1634.

- Security Grades: Compliance with security standards like EN 1627 (Europe) or BHMA Grades (USA) is essential for market acceptance.

- Accessibility: Adherence to ADA (Americans with Disabilities Act) in the US and similar regulations globally ensures products are usable by everyone.

- Product Lifecycles: Continuous testing and recertification are legally mandated as product designs evolve and standards are updated.

Assa Abloy's intellectual property strategy is crucial, with a focus on patents for its innovative access solutions. In Q2 2024 alone, the company filed 37 patents specifically related to the 'future of work,' demonstrating its commitment to protecting its technological advancements and maintaining a competitive edge in a rapidly evolving market.

Environmental factors

Assa Abloy is navigating a landscape of tightening global sustainability regulations and increasing corporate demands for reduced environmental impact. These pressures are directly influencing their product development, pushing for greater energy efficiency and a smaller ecological footprint across their offerings.

The company demonstrated its proactive stance by publishing its inaugural Corporate Sustainability Report Directive (CSRD) within its 2024 Annual Report. This preemptive disclosure, ahead of mandatory deadlines, underscores Assa Abloy's commitment to transparently reporting its sustainability initiatives and tracking its progress.

Regulations surrounding waste management, especially for electronic components in digital locks and automation systems, are increasingly stringent, pushing companies like Assa Abloy to develop robust recycling and end-of-life strategies. For instance, the European Union's Waste Electrical and Electronic Equipment (WEEE) directive mandates proper disposal and recycling of e-waste, impacting Assa Abloy's product lifecycle management.

Assa Abloy is actively working to reduce its waste intensity, aiming to minimize both hazardous and non-hazardous waste across its global operations. In 2023, the company reported a continued focus on improving its environmental performance, with waste reduction being a key operational target, though specific figures for waste intensity reduction were not publicly detailed in their latest sustainability reports.

The company is also exploring circular economy principles to enhance the sustainability of its products, which includes designing for durability, repairability, and eventual recyclability. This approach aligns with growing consumer and regulatory demand for products that minimize environmental impact throughout their entire lifecycle, a trend expected to accelerate through 2025.

Environmental regulations and consumer demand are pushing companies like Assa Abloy to significantly reduce their carbon footprint. Assa Abloy has responded with ambitious goals, aiming to cut emissions by half by 2030 and reach net zero by 2050. Impressively, they met their Scope 1 and 2 carbon emission reduction target in 2024, a year ahead of schedule.

Demand for Eco-Friendly Products

Growing environmental awareness is significantly boosting the demand for sustainable and energy-efficient security solutions. Consumers and businesses alike are increasingly prioritizing products that minimize their ecological footprint.

Assa Abloy is actively addressing this trend by innovating and developing eco-friendly products. For instance, their AI-powered automatic door solutions are designed to optimize energy consumption, contributing to reduced operational costs and environmental impact for their clients. This focus aligns with the broader market push towards greener building and operational practices.

- Growing Consumer Demand: Surveys in late 2023 and early 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions, a figure expected to rise.

- Corporate Sustainability Goals: Many businesses are setting ambitious targets for reducing energy usage and carbon emissions, creating a market for solutions that facilitate these goals.

- Assa Abloy's Innovation: The company's investment in AI for energy-saving door systems exemplifies their commitment to meeting this demand.

- Market Opportunity: The global market for green building materials and technologies is projected to reach hundreds of billions of dollars by 2030, with security solutions being a key component.

Resource Scarcity and Raw Material Sourcing

The potential for resource scarcity, particularly in metals like steel and aluminum for mechanical components, and rare earth minerals essential for electronic access solutions, directly impacts Assa Abloy's supply chain and cost structure. For instance, the London Metal Exchange (LME) saw significant price fluctuations for key industrial metals throughout 2024, with aluminum prices averaging around $2,300 per metric ton and steel prices remaining volatile due to global demand and production issues.

These price volatilities necessitate robust cost management strategies and a keen focus on supply chain resilience. Assa Abloy's commitment to sustainable sourcing and material efficiency is therefore not just an environmental consideration but a critical business imperative. By optimizing material usage and exploring alternative, more readily available materials, the company can better insulate itself from the unpredictable nature of commodity markets.

- Volatile Metal Prices: Assa Abloy relies on metals like steel and aluminum, whose prices can swing significantly based on global economic conditions and supply disruptions.

- Electronic Component Needs: The increasing integration of electronics in security solutions requires access to rare earth minerals, which can face supply constraints.

- Supply Chain Resilience: Proactive management of raw material sourcing is vital to ensure consistent production and prevent costly delays.

- Sustainable Practices: Implementing efficient material use and exploring recycled or alternative materials helps mitigate the impact of scarcity and price volatility.

Assa Abloy is responding to mounting pressure from stricter environmental regulations and a growing demand for sustainable products, pushing innovation towards energy efficiency and reduced ecological impact. The company's proactive approach is evident in its early adoption of transparent sustainability reporting, as seen in its 2024 Annual Report which included its first Corporate Sustainability Report Directive (CSRD).

Stringent waste management rules, particularly for electronic components in smart locks, necessitate robust recycling and end-of-life strategies, aligning with directives like the EU's WEEE. Assa Abloy is actively working to reduce its waste intensity, a key operational goal for 2023, and exploring circular economy principles for product design to enhance durability and recyclability.

The company has set ambitious targets to cut emissions by half by 2030 and achieve net zero by 2050, successfully meeting its Scope 1 and 2 carbon emission reduction goal in 2024, a year ahead of schedule. This commitment is driven by increasing consumer and corporate demand for eco-friendly security solutions, with AI-powered automatic doors designed for energy optimization being a prime example of their innovation.

Resource scarcity, especially for metals like steel and aluminum, and rare earth minerals for electronic components, poses a direct challenge to Assa Abloy's supply chain and costs. For instance, aluminum prices averaged around $2,300 per metric ton in 2024, with steel prices remaining volatile, underscoring the need for resilient sourcing and material efficiency strategies.

PESTLE Analysis Data Sources

Our Assa Abloy PESTLE Analysis is built on a robust foundation of data from official government publications, international organizations like the World Bank and IMF, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.