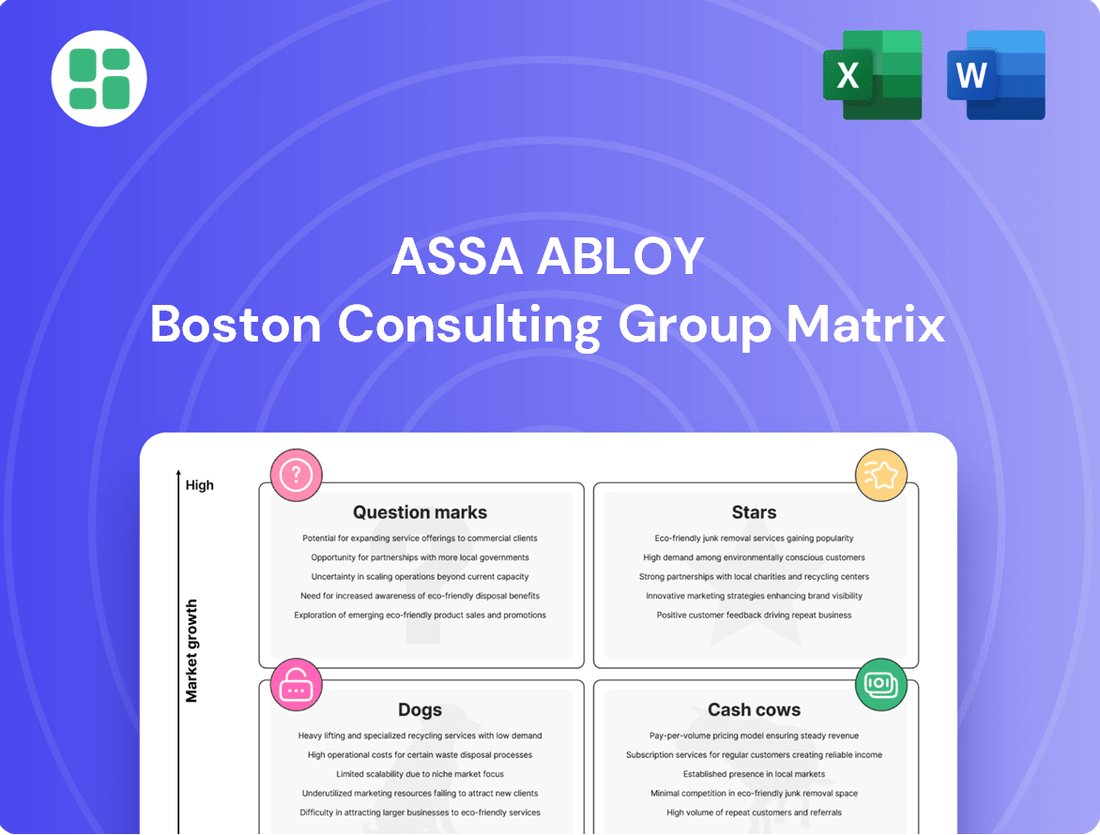

Assa Abloy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Discover how Assa Abloy's product portfolio stacks up using the powerful BCG Matrix. See which segments are driving growth and which might need a strategic rethink, all presented in a clear, visual format.

This glimpse into Assa Abloy's strategic positioning is just the beginning. Unlock the full potential of the BCG Matrix by purchasing the complete report for detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your investments and product development.

Stars

HID Global's advanced access control and biometrics, a significant player within Assa Abloy's Global Technologies segment, is experiencing robust growth. This area is a prime focus for the company's innovation efforts, with substantial investment in expanding the market reach of its facial biometrics and mobile credential solutions.

The market for secure and convenient identity verification is booming, directly benefiting HID Global's offerings. For instance, the global facial recognition market was projected to reach over $10 billion by 2024, highlighting the strong demand for these technologies.

The smart lock market is experiencing robust growth, driven by increasing consumer interest in smart home technology and the need for enhanced security and convenience. Assa Abloy, a dominant force in this sector, leverages its strong brand portfolio, including Yale, and strategic acquisitions like Level Lock, to capture this expanding market. In 2024, the global smart lock market was valued at approximately $3.5 billion and is expected to reach over $10 billion by 2030, demonstrating a compound annual growth rate of over 15%.

Assa Abloy is making significant strides in IoT-enabled security, a key area for growth. Their investment in securing connected devices, like using HID's PKI-as-a-Service for millions of IoT products, highlights this commitment. This focus is crucial as the market for intelligent, interconnected access solutions, including AI-driven security, is expanding rapidly.

Perimeter Security Systems

Within Assa Abloy's Entrance Systems division, the perimeter security segment experienced very strong growth in the first quarter of 2025. This robust performance is directly linked to the escalating global demand for comprehensive security solutions.

As security concerns continue to rise worldwide, the market for advanced perimeter security systems is expanding rapidly. Assa Abloy is well-positioned to capitalize on this trend, effectively capturing significant market share.

- Market Growth: The global perimeter security market is projected to reach USD 150 billion by 2027, growing at a CAGR of 8.5%.

- Assa Abloy's Performance: The company reported double-digit organic growth in its Entrance Systems division in 2024, with perimeter solutions being a key driver.

- Key Drivers: Increasing geopolitical instability and a rise in physical security threats are fueling demand for integrated perimeter protection.

Pedestrian Entrance Systems

Pedestrian Entrance Systems, a key component within Assa Abloy's Entrance Systems division, experienced robust growth in the first quarter of 2025, demonstrating a strong upward trajectory.

This segment's expansion is largely fueled by global urbanization trends and the increasing demand for automated, secure, and efficient access solutions in commercial buildings and public venues. Assa Abloy's strategic positioning in this high-growth market allows it to leverage its competitive advantages effectively.

The company's performance in this area is notable, with specific figures from Q1 2025 indicating a significant contribution to overall revenue. This growth underscores the market's receptiveness to advanced pedestrian access technologies.

- Market Driver: Urbanization and the need for automated building access are key growth catalysts.

- Assa Abloy's Position: The company holds a competitive edge in this high-growth segment.

- Performance Indicator: 'Good growth' was reported in Q1 2025 for Pedestrian Entrance Systems.

- Application Areas: Solutions are vital for commercial and public spaces requiring efficient entry.

Assa Abloy's HID Global, a leader in identity solutions, is a prime example of a Star in the BCG Matrix. Its strong market share in the rapidly expanding biometrics and secure identity verification sectors, driven by increasing demand for advanced access control, positions it for continued high growth. The global facial recognition market, for instance, was projected to exceed $10 billion by 2024, underscoring the significant opportunity.

What is included in the product

This BCG Matrix overview provides strategic insights into Assa Abloy's product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Assa Abloy's portfolio, easing the pain of strategic resource allocation.

Cash Cows

Established Mechanical Locking Systems represent Assa Abloy's historical foundation and continue to be a significant revenue driver. These products, like traditional deadbolts and mortise locks, dominate mature markets where brand recognition and established distribution channels are key. In 2023, Assa Abloy's mechanical solutions segment contributed substantially to its overall performance, reflecting the enduring demand for these reliable security products.

Mature electromechanical lock solutions, while part of a growing segment, act as Assa Abloy's cash cows. These established product lines, especially in developed markets, are substantial revenue generators. They represented about 30% of Assa Abloy's total sales in the fourth quarter of 2024, demonstrating their importance.

Assa Abloy's aftermarket services and maintenance represent a significant Cash Cow. This segment benefits from the company's extensive installed base of security solutions, generating stable and recurring revenue. In Q1 2025, this strong exposure contributed positively to organic sales growth, highlighting its consistent performance.

The aftermarket business requires relatively low investment for continuous cash generation. Unlike new product development, which demands substantial upfront capital, maintenance and service contracts leverage existing products. This efficiency allows Assa Abloy to efficiently monetize its installed base, ensuring a predictable cash flow stream.

Opening Solutions EMEIA (Western Europe)

The Opening Solutions division in EMEIA, focusing on Western Europe, saw its organic growth remain flat in 2024. This stability, however, is a testament to its position as a Cash Cow for Assa Abloy.

Assa Abloy’s deep roots and likely dominant market share in these mature Western European economies mean this segment continues to be a significant and dependable source of cash flow for the company. The consistent performance underpins its Cash Cow status, providing essential financial resources.

- Segment: Opening Solutions EMEIA (Western Europe)

- 2024 Performance: Flat organic growth.

- Strategic Role: Cash Cow, generating substantial and reliable cash flow.

- Key Drivers: High market share in mature, established markets.

Traditional Industrial Door & Automation Solutions

Traditional Industrial Door & Automation Solutions represent a classic Cash Cow for Assa Abloy. While the broader Entrance Systems division might see flat organic growth, specific mature sub-segments within industrial entrance systems consistently generate robust and stable cash flow. These are the reliable workhorses of the portfolio.

These solutions serve a well-established industrial clientele, often secured through lucrative long-term maintenance agreements and a substantial installed base. This means they require minimal incremental investment to maintain their market position and profitability, a hallmark of a Cash Cow.

- Stable Cash Generation: These mature industrial door and automation solutions consistently contribute significant cash flow to Assa Abloy.

- Low Investment Needs: Due to a strong installed base and long-term contracts, capital expenditure requirements are minimal.

- Established Market: The target market consists of established industrial clients with predictable needs.

- Profitability Driver: They are key profit centers, supporting other, more growth-oriented segments within the company.

Assa Abloy's mature electromechanical lock solutions, particularly those in developed markets, are key cash cows. These established product lines are substantial revenue generators, representing a significant portion of the company's sales. Their consistent performance and lower investment needs solidify their position as reliable cash providers.

The aftermarket services and maintenance segment is another prime example of a cash cow. By leveraging its extensive installed base, Assa Abloy generates stable, recurring revenue with minimal incremental investment. This efficiency in monetizing existing products ensures a predictable and robust cash flow stream.

The Opening Solutions division in EMEIA, specifically in Western Europe, demonstrates cash cow characteristics. Despite flat organic growth in 2024, its deep market penetration and established position provide a dependable source of cash flow, supporting the company's financial stability.

Traditional industrial door and automation solutions also function as cash cows. These mature segments, often supported by long-term maintenance agreements, require minimal capital expenditure to maintain profitability. They are essential profit centers, contributing significantly to Assa Abloy's overall financial health.

| Assa Abloy Cash Cow Segments | Key Characteristics | 2024/2025 Data Insight |

|---|---|---|

| Mature Electromechanical Locks | High revenue generation, established markets, lower investment needs | Represented ~30% of Q4 2024 sales |

| Aftermarket Services & Maintenance | Stable recurring revenue, leverages installed base, minimal capital expenditure | Contributed positively to organic sales growth in Q1 2025 |

| Opening Solutions EMEIA (Western Europe) | Dependable cash flow, high market share in mature economies | Flat organic growth in 2024, indicating stability |

| Traditional Industrial Door & Automation | Robust and stable cash flow, long-term contracts, minimal incremental investment | Consistent contribution to profitability |

What You’re Viewing Is Included

Assa Abloy BCG Matrix

The Assa Abloy BCG Matrix preview you are currently viewing is the exact, unadulterated document you will receive upon purchase. This comprehensive analysis, meticulously crafted to guide strategic decision-making, will be delivered in its final, fully formatted state, ready for immediate integration into your business planning processes. Rest assured, there are no hidden watermarks or placeholder content; what you see is precisely what you get – a professional-grade strategic tool designed for actionable insights.

Dogs

Assa Abloy divested the majority of its Citizen ID business in Q1 2025. The company cited its position as a distant third in the market and its misalignment with Assa Abloy's strategic goal of market leadership as key reasons for the sale.

This divestiture clearly places the Citizen ID business in the Dogs category of the BCG Matrix. It operated with a low market share within a mature and competitive landscape, a classic indicator for businesses that are not performing well and are unlikely to see significant future growth.

These are the older, traditional mechanical locks that haven't been updated with digital or smart features. Think of the classic deadbolt or doorknob that you still use a physical key for. In today's world, where smart home security is becoming the norm, these products are finding themselves in markets where demand is shrinking. For example, the global mechanical locks market, while still substantial, is projected to see a compound annual growth rate (CAGR) of only around 2.5% to 3.5% in the coming years, a significant slowdown compared to the electromechanical and smart lock segments which are growing much faster, potentially above 15% annually.

The North American residential market, a traditional segment for Assa Abloy, experienced a sales downturn in the first quarter of 2025. This decline is largely attributed to the sustained impact of elevated interest rates and ongoing consumer hesitancy.

Despite Assa Abloy's robust portfolio of smart lock technologies, the conventional portion of this market is characterized by sluggish growth. In this environment, maintaining or expanding market share presents a significant challenge for the company.

Asia Pacific (Chinese Residential Market)

Assa Abloy's presence in the Chinese residential market within the Asia Pacific region is currently facing headwinds. Organic sales in this segment saw a notable decrease of 5% in the first quarter of 2025, a direct result of subdued demand.

This sub-segment represents a minor portion of Assa Abloy's overall revenue. The persistent market challenges in China's residential sector suggest a landscape characterized by low growth potential and, consequently, a potentially low market share for the company in this specific area.

- Market Performance: Q1 2025 saw a 5% decline in organic sales for the Chinese residential market.

- Revenue Contribution: This segment contributes a small percentage to Assa Abloy's total sales.

- Growth Outlook: Ongoing market challenges indicate low growth prospects.

- Market Position: The segment likely holds a low market share due to these conditions.

Certain Niche, Underperforming Acquired Businesses

Within Assa Abloy's extensive portfolio, certain niche, underperforming acquired businesses can be categorized as Dogs in the BCG Matrix. These are typically smaller operations in mature or declining markets that haven't achieved significant market share or growth post-acquisition. For instance, if Assa Abloy acquired a specialized lock manufacturer in a region with decreasing demand for that specific product type, it might fall into this category if it doesn't show signs of revitalization or integration into a broader offering.

These businesses often require ongoing investment for maintenance or restructuring but yield minimal returns. Assa Abloy's commitment to innovation and market expansion means that underperforming units may be divested or restructured if they cannot demonstrate a path to profitability. As of early 2024, Assa Abloy continues to actively manage its diverse business units, with a focus on optimizing performance across its global operations, which naturally includes evaluating and addressing any underperforming segments.

- Underperforming Niche Acquisitions: Businesses acquired that operate in specialized, slow-growth, or declining market segments.

- Resource Drain: These units consume capital and management attention without generating substantial profits or contributing significantly to overall growth.

- Integration Challenges: Difficulties in integrating acquired niche businesses into Assa Abloy's broader operational structure or product lines.

- Potential for Divestment: Such businesses are candidates for divestment or restructuring if they cannot be turned around to meet performance targets.

Certain acquired businesses within Assa Abloy's portfolio, particularly those in mature or declining niche markets, can be classified as Dogs according to the BCG Matrix. These units often struggle with low market share and minimal growth potential, consuming resources without delivering significant returns. For example, a specialized lock manufacturer acquired for a specific regional market with decreasing demand for its unique product type would fit this description if it hasn't been successfully integrated or revitalized.

These segments typically require ongoing investment for maintenance or restructuring, offering little prospect of substantial profit. Assa Abloy's strategic focus on innovation and market leadership means that underperforming units are regularly evaluated for divestment or significant operational changes. As of early 2024, the company actively manages its diverse business units, prioritizing the optimization of performance across its global operations, which includes addressing any segments that fail to meet strategic objectives.

The divestiture of the Citizen ID business in Q1 2025 exemplifies a Dog category. Its position as a distant third in a competitive market, coupled with a lack of strategic alignment for market leadership, led to its sale. This move reflects Assa Abloy's strategy of shedding non-core or underperforming assets to focus on areas with higher growth and market potential.

The North American residential market, particularly its conventional lock segment, also shows characteristics of a Dog. Despite Assa Abloy's strong smart lock offerings, the traditional mechanical lock segment faces sluggish growth, with a projected CAGR of only 2.5% to 3.5% in the coming years, making it challenging to maintain or grow market share in this area.

| Business Segment | BCG Category | Market Growth | Market Share | Assa Abloy Strategy |

| Citizen ID Business | Dog | Low | Low | Divested (Q1 2025) |

| Conventional Mechanical Locks (North America) | Dog | Low (2.5%-3.5% CAGR projection) | Potentially Low | Focus on Smart Lock Transition/Management |

| Chinese Residential Market (Conventional Locks) | Dog | Low (5% organic sales decline Q1 2025) | Low | Restructuring/Divestment Consideration |

Question Marks

Assa Abloy's strategic acquisitions in 2024 and 2025, including tech-focused companies like InVue and Uhlmann & Zacher, place these newly integrated businesses in the Question Marks quadrant of the BCG Matrix. These companies operate in rapidly expanding technology markets, indicating strong future growth potential. For instance, InVue's focus on retail security solutions aligns with the growing demand for loss prevention technologies in an increasingly digital retail environment.

Assa Abloy is actively investing in AI-driven security solutions, a burgeoning market segment. Their collaboration with Microsoft Azure, for instance, highlights a strategic move into this high-potential area.

While these AI-powered offerings represent a future growth engine, Assa Abloy is likely in the early phases of capturing significant market share. The company's 2024 investments in R&D for these advanced technologies underscore their commitment to innovation in this nascent but rapidly expanding field.

HID's PKI-as-a-Service is a strong contender for enhancing security in emerging IoT sectors like smart agriculture or industrial automation, areas poised for significant growth. For instance, the global IoT market is projected to reach over $1.5 trillion by 2025, with industrial IoT alone expected to contribute substantially. This expansion presents a clear opportunity for PKI solutions.

However, extending HID's PKI-as-a-Service into these novel verticals represents a Question Mark for ASSA ABLOY's portfolio. While these markets offer high growth potential, they demand considerable upfront investment in research, development, and establishing a strong market presence to compete effectively. The complexity of integrating PKI into diverse, specialized IoT applications requires tailored solutions and significant go-to-market strategies.

New Product Launches (High-Tech, Untested)

Assa Abloy's new product launches, particularly in high-tech and untested areas, represent a significant portion of their 2024 innovation pipeline. With over 550 new products introduced this year, many are aimed at emerging, high-growth markets. However, the success of these ventures is not guaranteed, as their market acceptance and potential to gain substantial market share remain uncertain.

These new offerings are typically categorized as Question Marks in the BCG Matrix. This classification highlights the substantial investment required in marketing and sales to prove their viability and potential to become future Stars. Without successful market penetration, these products carry a risk of becoming Dogs or failing entirely.

- High Investment Needs: New high-tech products require significant capital for research, development, marketing, and sales to gain traction.

- Market Uncertainty: Despite innovation, the actual market demand and competitive response for untested products are unpredictable.

- Potential for Growth: If successful, these products could capture new market segments and drive future revenue growth for Assa Abloy.

Expansion into Specific Emerging Geographical Markets with Digital Solutions

Assa Abloy's strategic expansion into specific emerging geographical markets with digital solutions aligns with a "Question Mark" positioning in the BCG Matrix. These markets, often characterized by lower current penetration of advanced security technologies but significant future growth potential, represent key areas for investment. For instance, in many parts of Southeast Asia and Africa, the adoption of smart locks and access control systems is still nascent, yet the increasing urbanization and demand for enhanced security present a fertile ground for growth. Assa Abloy's investment in these regions aims to capture this burgeoning demand.

The company's approach focuses on introducing its digital and biometric offerings, which are often high-tech and require significant upfront investment. These initiatives are designed to establish a strong foothold in markets where Assa Abloy's current market share for these specific solutions is low, but the projected growth rate is substantial. This strategy is supported by global trends showing increased digital transformation and a growing middle class in emerging economies, driving demand for sophisticated security products. For example, by 2024, the global smart lock market was projected to reach significant figures, with emerging markets expected to contribute a growing percentage of this growth.

- Emerging Market Focus: Assa Abloy is actively targeting regions with low current penetration of digital security solutions but high growth potential.

- Digital Solutions Emphasis: The strategy prioritizes the introduction of advanced digital and biometric access control technologies in these new territories.

- High Growth, Low Share: These initiatives are classified as Question Marks due to their low current market share in these specific segments, coupled with significant anticipated future growth.

- Investment Rationale: Expansion is driven by global trends in digitalization, urbanization, and increasing demand for enhanced security in developing economies.

Assa Abloy's ventures into new, high-growth technology sectors, such as AI-driven security and specialized IoT applications, are prime examples of Question Marks. These areas demand substantial investment for market penetration and feature uncertain outcomes, despite their significant future potential. For instance, the company's R&D spending in 2024 on advanced technologies reflects this commitment to nurturing these nascent opportunities.

The success of Assa Abloy's over 550 new product introductions in 2024, many targeting emerging markets, remains a key consideration for their Question Mark status. While these innovations aim to capture new market segments, their ability to gain substantial market share is yet to be proven, requiring significant marketing and sales efforts to validate their viability.

Assa Abloy's strategic expansion into emerging geographical markets with digital solutions, like smart locks in Southeast Asia and Africa, also falls under the Question Mark category. These regions exhibit low current adoption of advanced security but present considerable future growth prospects, necessitating upfront investment to establish a strong market presence.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.