Assa Abloy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Assa Abloy navigates a competitive landscape shaped by moderate supplier power and significant buyer bargaining. The threat of new entrants is tempered by high capital requirements and established brand loyalty, while the intensity of rivalry is driven by product innovation and global reach.

The complete report reveals the real forces shaping Assa Abloy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Assa Abloy sources a wide array of inputs, from common metals and plastics to sophisticated electronic components and specialized machinery. The availability of suppliers for basic materials is generally high, but for critical, specialized electronic parts used in their advanced digital and electromechanical locks, the supplier pool can be significantly smaller. This concentration in specialized areas can bolster supplier bargaining power.

For instance, a key supplier of advanced microcontrollers for Assa Abloy's smart lock technology might hold substantial leverage due to limited alternatives and high switching costs for Assa Abloy. While Assa Abloy’s sheer size and procurement volume do grant it considerable negotiating clout, the specialized nature of certain components means suppliers in those niches can still exert considerable influence over pricing and terms.

The quality and availability of critical components, especially for Assa Abloy's advanced digital and biometric access solutions, are absolutely vital for their product performance and ability to innovate. For instance, the precision engineering required for biometric scanners means that even minor disruptions or quality lapses from specialized semiconductor or sensor suppliers can directly affect the reliability and functionality of Assa Abloy's high-tech offerings.

This reliance on specialized suppliers for key technologies means that those suppliers can wield significant bargaining power. If a supplier provides a unique, high-performance chip essential for Assa Abloy's latest smart lock, they can often dictate pricing and contract terms because finding an equally capable alternative might be difficult or impossible.

For Assa Abloy, the bargaining power of suppliers is significantly influenced by switching costs. When customers need to change suppliers for highly integrated electronic systems or proprietary components, the expenses associated with redesign, re-certification, and modifying production lines can be substantial, thereby reinforcing the position of existing suppliers.

While switching costs for standard materials are typically lower, thereby reducing supplier leverage, the complexity of Assa Abloy's product ecosystem means that for specialized inputs, these switching costs can be a considerable factor in supplier negotiations.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, where they might start producing their own finished access solutions, is generally low for Assa Abloy. This is mainly due to the significant investments required in manufacturing capabilities, extensive distribution channels, and building brand recognition in the competitive security market. For instance, a supplier of advanced electronic components would face substantial hurdles in replicating Assa Abloy's established global presence and product portfolio.

While a supplier of highly specialized technology could theoretically attempt forward integration, the practical challenges are considerable. Developing the entire value chain, from product design and manufacturing to marketing and sales, is a complex undertaking. Instead of direct competition, Assa Abloy typically engages in strategic collaborations with key technology providers, ensuring access to innovation without facing direct integration threats.

The access solutions industry, particularly for established players like Assa Abloy, benefits from high switching costs for customers and significant brand loyalty. This makes it difficult for a new entrant, even a well-resourced supplier, to gain market share rapidly. Assa Abloy's 2024 revenue of approximately €5.0 billion underscores its market leadership and the barriers to entry for potential integrators.

- Low Likelihood of Supplier Forward Integration: Suppliers typically lack the scale and market access to compete directly with established access solution providers.

- High Barriers to Entry for Integrators: Significant capital investment in manufacturing, distribution, and brand building is required, making it a difficult path for suppliers.

- Focus on Strategic Partnerships: Assa Abloy's approach involves collaborating with technology suppliers rather than facing direct integration threats.

- Market Dominance as a Deterrent: Assa Abloy's substantial market share and brand reputation in 2024 act as a strong deterrent against potential supplier integration attempts.

Supplier's Ability to Differentiate Inputs

Suppliers of patented technologies or unique components, especially in the fast-paced digital access sector, can significantly boost their bargaining power by differentiating their products. Assa Abloy's commitment to research and development, alongside strategic acquisitions, allows it to maintain a competitive edge. However, its dependence on specific high-tech inputs means these suppliers can often dictate higher prices.

- Differentiated Inputs: Suppliers offering proprietary technology, such as advanced biometric sensors or unique encryption algorithms for digital locks, possess considerable leverage.

- R&D and Acquisitions: Assa Abloy's substantial investment in R&D, which saw its R&D expenses reach SEK 3.8 billion in 2023, and its active acquisition strategy are crucial for mitigating reliance on single suppliers and securing access to innovation.

- Digital Supply Chain: The company's ongoing digital supply chain transformation is a strategic move to enhance control and visibility over critical, often specialized, inputs, aiming to reduce supplier-specific risks and improve cost management.

Suppliers of specialized electronic components and patented technologies for Assa Abloy's advanced digital and biometric locks can wield significant bargaining power. This is due to limited alternative suppliers and high switching costs for Assa Abloy, particularly when these components are critical for product performance and innovation. For instance, the company's 2023 R&D expenditure of SEK 3.8 billion highlights its reliance on cutting-edge inputs.

| Factor | Impact on Assa Abloy | Supporting Data/Example |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized components | Limited suppliers for advanced microcontrollers and biometric sensors |

| Switching Costs | High for integrated electronic systems | Costs associated with redesign, re-certification, and production line modifications |

| Supplier Differentiation | High for patented technologies | Proprietary technology in digital and biometric access solutions |

| Forward Integration Threat | Low | High capital investment, distribution, and brand building required for competitors |

What is included in the product

Assa Abloy's Porter's Five Forces Analysis reveals the intense competition from established players and new entrants, the significant bargaining power of its large customers, and the moderate threat of substitutes like smart home devices.

Instantly visualize the competitive landscape of the door opening solutions industry, revealing key threats and opportunities for Assa Abloy.

Streamline strategic planning by clearly identifying the bargaining power of buyers and suppliers impacting Assa Abloy's profitability.

Customers Bargaining Power

Assa Abloy's customer base spans residential, commercial, and institutional sectors worldwide. This broad reach means that while individual residential customers have little power, larger entities wield significant influence. For instance, major construction firms or global hotel groups procuring in bulk can negotiate more favorable terms due to their substantial order volumes.

The bargaining power of these large commercial and institutional clients is amplified by their involvement in large-scale projects. These projects frequently undergo competitive bidding processes, and often require tailored product specifications. This dynamic directly impacts Assa Abloy's pricing strategies and the specific conditions of their contracts, as these clients can leverage alternative suppliers to secure better deals.

Customer price sensitivity for Assa Abloy's products isn't uniform. While homeowners looking for standard door locks might be more focused on price, businesses and institutions often look beyond the initial cost. They tend to prioritize features like advanced security, system integration, and long-term reliability, making them less susceptible to minor price fluctuations.

For sophisticated access control systems or high-security solutions, the overall cost of ownership becomes the key consideration. This includes expenses for installation, ongoing maintenance, and potential upgrades, which can significantly outweigh the upfront product price. This focus on total value rather than just the sticker price reduces the bargaining power of customers seeking these advanced solutions.

Assa Abloy's established brand and its reputation for delivering dependable and secure access solutions play a crucial role in lessening direct price competition. By offering perceived higher quality and greater trust, the company can command a premium and avoid being solely judged on price, thereby limiting customer power to drive down prices excessively.

Customers wield significant bargaining power when numerous substitute products are readily available. For Assa Abloy, this means buyers can easily switch to competitors offering similar mechanical locks, electromechanical solutions, and increasingly, digital door locks and advanced access control systems. This abundance of alternatives directly challenges Assa Abloy's pricing and market share.

The competitive landscape is populated by a multitude of vendors, ranging from smaller regional suppliers to large global players like Dormakaba. This broad base of alternatives empowers customers, as they can readily compare features, pricing, and service levels across different providers. For instance, the global smart lock market, a key area for Assa Abloy, was projected to reach over $3.5 billion in 2024, indicating a highly competitive environment with many entrants.

Assa Abloy strategically counters this by focusing on differentiation through continuous innovation in product development, offering integrated and comprehensive security solutions rather than just individual products, and by providing superior customer service and support. This approach aims to build customer loyalty and reduce the perceived substitutability of its offerings.

Customer Switching Costs

Customer switching costs significantly impact Assa Abloy's bargaining power. For complex, integrated access control systems used by commercial and institutional clients, the expense and disruption of switching are substantial. These costs include re-installation, integrating new systems with existing infrastructure, retraining staff, and managing potential security gaps during the transition. This effectively locks many customers into Assa Abloy's ecosystem, reducing their ability to switch to competitors easily.

In contrast, for simpler mechanical locks, the switching costs are negligible. Customers can readily replace these locks with offerings from other manufacturers without incurring significant expenses or operational disruptions. This low barrier to switching for basic hardware empowers these customers, as they can easily choose the most cost-effective or feature-rich option available in the market.

Consider the implications for Assa Abloy's revenue streams. In 2024, the company's extensive portfolio likely sees a bifurcation in customer loyalty based on system complexity. While high-switching-cost segments provide a stable revenue base, the low-switching-cost segments are more price-sensitive and prone to competitive pressure.

- High Switching Costs for Integrated Systems: Re-installation, integration, training, and transitional security risks deter customers from switching complex access control solutions.

- Low Switching Costs for Mechanical Locks: Minimal expenses and operational impact allow customers to easily change brands for basic lock hardware.

- Impact on Revenue Stability: Integrated systems offer greater customer lock-in and predictable revenue, while mechanical locks face more price competition.

Threat of Backward Integration by Customers

While large customers might theoretically consider developing their own basic security hardware, the specialized research and development, manufacturing expertise, and scale needed for advanced access solutions make backward integration highly improbable for most. Assa Abloy's 2023 revenue reached €5.0 billion, demonstrating the significant investment required to compete in this technologically advanced sector.

Instead, customers are more likely to seek integrated solutions and comprehensive support, compelling Assa Abloy to enhance its service offerings. This shift in customer demand is evident in strategic partnerships, such as those focused on campus security, which underscore the desire for unified and advanced security systems.

- Limited Likelihood of Backward Integration: The high R&D, manufacturing, and scale barriers make it impractical for most customers to produce advanced access solutions internally.

- Customer Demand for Integrated Solutions: Customers increasingly prefer comprehensive security systems and support, pushing providers like Assa Abloy to offer more complete packages.

- Partnerships as Evidence: Collaborations, especially in areas like campus security, highlight the trend of customers seeking integrated solutions rather than developing them independently.

Assa Abloy faces considerable bargaining power from its customers, particularly large commercial and institutional clients who can leverage bulk purchases and competitive bidding to negotiate favorable terms. The availability of numerous substitute products, from mechanical locks to advanced digital solutions, further empowers buyers to switch suppliers, especially in the growing smart lock market, which was projected to exceed $3.5 billion in 2024.

While price sensitivity varies, sophisticated buyers often focus on total cost of ownership, including installation and maintenance, which can mitigate extreme price pressure for advanced systems. However, for simpler mechanical locks, switching costs are minimal, increasing customer power in those segments. Assa Abloy's strategy to counter this involves product differentiation, integrated solutions, and superior service to build loyalty.

The company's strong brand reputation also helps reduce direct price competition, allowing it to command a premium. Despite this, the sheer number of vendors in the market, from regional to global players like Dormakaba, ensures customers have ample choices, keeping the bargaining power tilted towards them in many scenarios.

| Customer Segment | Bargaining Power Factors | Assa Abloy's Counter-Strategy |

|---|---|---|

| Large Commercial/Institutional | Bulk purchasing, competitive bidding, tailored specifications | Integrated solutions, service differentiation, loyalty programs |

| Residential (standard locks) | Low switching costs, price sensitivity, numerous alternatives | Brand reputation, innovation in basic security features |

| Users of Advanced Systems | Focus on total cost of ownership, integration needs | Superior R&D, comprehensive support, ecosystem building |

Preview Before You Purchase

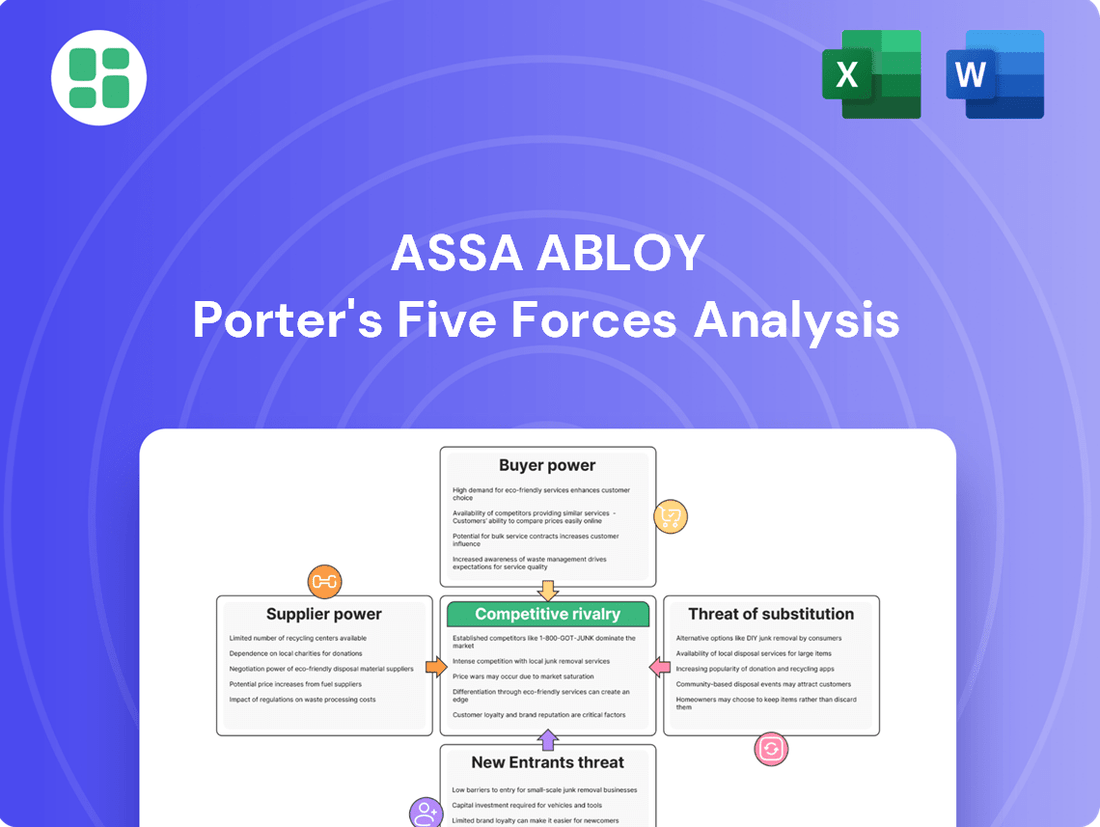

Assa Abloy Porter's Five Forces Analysis

This preview showcases the comprehensive Assa Abloy Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the access solutions industry. The document you see here is precisely what you'll receive immediately after purchase, offering an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry. Rest assured, there are no placeholders or generic content; you are viewing the exact, ready-to-use analysis that will be instantly accessible upon completing your transaction.

Rivalry Among Competitors

The access solutions market Assa Abloy operates in is a crowded one, with significant competition. You've got major global players like Allegion and dormakaba, but also a whole host of smaller companies focusing on specific areas, whether that's old-school locks or the latest smart tech. This means Assa Abloy is up against rivals everywhere they turn, across all their product lines and in every region they do business.

The market for access solutions is experiencing a dynamic shift. While traditional mechanical locks might see more modest growth, the digital and electromechanical segments are booming. This surge is fueled by the increasing adoption of smart home technologies and a broader demand for integrated, sophisticated security systems in buildings.

This robust growth in key segments naturally attracts and intensifies competition. Competitors are actively investing in research and development to create innovative products and are pushing to expand their market reach. Assa Abloy itself is prioritizing accelerated organic growth, with a particular focus on expanding its digital and electromechanical offerings to capitalize on these trends.

Assa Abloy differentiates itself in the access solutions market through relentless product innovation, focusing on technological advancements like biometrics and mobile access, alongside a strong brand reputation and extensive service packages. This commitment to R&D, evidenced by their consistent investment, aims to create integrated solutions that naturally raise the barriers for customers to switch to competitors.

However, the competitive landscape is dynamic, with rivals frequently launching new products and features, putting pressure on Assa Abloy's differentiation strategy and potentially eroding customer loyalty built on innovation alone. For instance, in 2023, the global smart lock market, a key segment for Assa Abloy, saw significant growth, with new entrants and established players alike introducing advanced features, highlighting the ongoing challenge of maintaining a distinct market position.

High Fixed Costs and Capacity

The access solutions industry, where Assa Abloy operates, is characterized by substantial fixed costs. These include significant investments in research and development, the establishment and maintenance of production facilities, and the creation of extensive distribution networks. These high upfront and ongoing expenses create a considerable barrier to entry for new players and influence the competitive landscape.

When demand softens, companies with high fixed costs may resort to aggressive pricing to ensure their production capacity is utilized. This can lead to price wars, squeezing profit margins across the industry. For instance, in 2023, the global construction market experienced fluctuations, impacting demand for building materials and access solutions, potentially intensifying price competition among established players.

Assa Abloy's strategic initiatives, such as its Manufacturing Footprint Program, are designed to mitigate the impact of these high fixed costs. By optimizing its production processes and improving operational efficiency, the company aims to reduce its cost base and enhance its competitiveness, even in challenging market conditions. This focus on efficiency is crucial for maintaining profitability when capacity utilization is a concern.

- High Fixed Costs: Significant investments in R&D, manufacturing plants, and distribution networks are inherent in the access solutions sector.

- Capacity Utilization Pressure: Competitors may engage in price reductions to fill excess production capacity, particularly during economic downturns.

- Assa Abloy's Strategy: The Manufacturing Footprint Program is a key initiative to enhance efficiency and manage operational costs.

- Market Dynamics: Fluctuations in global construction activity in 2023 highlighted the sensitivity of the industry to demand shifts, potentially increasing competitive pricing pressures.

Exit Barriers

Assa Abloy faces significant competitive rivalry, partly due to high exit barriers. These barriers, including specialized assets and long-term commitments, can trap less competitive firms in the market, prolonging intense rivalry. For instance, the significant investment in dedicated manufacturing facilities for specific locking mechanisms makes it costly for some players to exit the market gracefully.

The global reach of Assa Abloy means it must contend with diverse regional market dynamics. Some of these markets present persistent challenges, which can hinder consolidation and keep less efficient competitors active. This ongoing presence of weaker players, unable to exit easily, contributes to a more crowded and competitive landscape.

For example, in 2023, the global lock and hardware market was valued at approximately $70 billion, with a projected compound annual growth rate (CAGR) of around 5-6% through 2030. This growth, while positive, also attracts and sustains a multitude of players, some of whom are less agile.

- High capital investment in specialized manufacturing equipment creates significant exit barriers.

- Long-term supply agreements and customer contracts can also lock competitors into the market.

- The social and economic costs associated with workforce reductions further deter exits.

- Navigating varied regional market conditions, some of which are less robust, can slow industry consolidation.

The competitive rivalry within the access solutions market is intense, driven by a mix of large global players and numerous niche companies. Assa Abloy faces rivals across its entire product spectrum, from traditional mechanical locks to advanced electromechanical and digital solutions. This broad competition is amplified by the market's dynamic nature, with significant growth in digital segments attracting continuous innovation and market expansion efforts from competitors.

Assa Abloy differentiates through innovation, focusing on biometrics and mobile access, and building a strong brand. However, rivals frequently introduce new products, challenging Assa Abloy's market position and customer loyalty. For instance, the smart lock market saw substantial growth and new feature introductions by both established and emerging players in 2023, underscoring the constant pressure to maintain a competitive edge.

High fixed costs, including substantial R&D and manufacturing investments, characterize the industry. These costs can lead to price wars when demand falters, as seen with fluctuations in the global construction market in 2023. Assa Abloy's strategic focus on operational efficiency, such as its Manufacturing Footprint Program, is crucial for navigating these cost pressures and maintaining profitability.

High exit barriers, such as specialized manufacturing assets and long-term contracts, can keep less efficient competitors in the market, intensifying rivalry. The global lock and hardware market, valued at approximately $70 billion in 2023, continues to attract a wide range of players, some of whom are less agile, contributing to a persistently competitive environment.

SSubstitutes Threaten

While direct substitutes for physical locks are scarce, the broader security landscape presents alternatives that can lessen dependence on traditional access control. For instance, in 2023, the global security services market, encompassing surveillance and personnel, was valued at over $240 billion, indicating a significant customer spend on non-lock-based security measures.

Customers might choose to invest in sophisticated video surveillance systems, standalone alarm systems, or even enhanced security staffing instead of solely upgrading their lock hardware. This diversification in security spending means that a customer's budget allocated to security might not directly translate into demand for advanced lock mechanisms if other solutions are perceived as more effective or cost-efficient for their specific needs.

The increasing sophistication of smart home and building technologies presents a significant threat of substitutes for traditional access control systems. Biometric solutions, like facial recognition, and mobile-based access, where a smartphone acts as a key, offer alternative ways to grant entry. These innovations, often driven by tech-focused companies, can bypass the need for physical key cards or mechanical locks.

The appeal of substitute products is heavily influenced by how they stack up against existing offerings in terms of cost and performance. For everyday home security needs, readily available and more affordable DIY smart home security systems can easily replace professional access control solutions. These systems often provide a compelling entry-level option for consumers.

In the business realm, particularly for commercial properties, substitute solutions that integrate digital access with advanced features like data analytics and enhanced user convenience can become very attractive. Even if the upfront cost is higher, the total cost of ownership, coupled with the operational benefits, makes these integrated digital systems a strong contender against traditional access control methods. For instance, by 2024, the global smart home market, which includes security components, was projected to reach over $150 billion, indicating a significant shift towards accessible technology.

Customer Perception of Risk and Convenience

Customers often view security as paramount, placing a high value on dependability and trust in access solutions. This inherent caution can make them hesitant to adopt substitutes that might be perceived as less secure.

However, the growing desire for convenience, particularly in homes and modern workplaces, is pushing the adoption of alternatives such as mobile credentials and keyless entry systems. For instance, in 2024, the global smart lock market, a key area for substitutes, was projected to reach over $4 billion, indicating a significant shift driven by convenience.

Assa Abloy is actively navigating this by embedding convenience into its advanced product offerings, ensuring that enhanced user experience does not come at the expense of robust security. This strategy is reflected in their continuous investment in R&D, with a significant portion of their revenue allocated to innovation.

- Customer Priority: Security and reliability remain primary concerns for most users of access control systems.

- Demand for Convenience: Increasing consumer preference for ease of use is driving the adoption of substitute technologies.

- Market Growth: The smart lock market, a key substitute area, saw substantial growth in 2024, with shipments expected to increase by 15-20% year-over-year.

- Assa Abloy's Strategy: The company integrates convenience features into its secure solutions to meet evolving customer needs.

Regulatory and Industry Standards Impact

Changes in building codes, insurance mandates, or industry-wide security standards can significantly steer customers toward alternative solutions. For example, new regulations favoring smart building integration or remote access capabilities might hasten the move away from traditional mechanical locking systems. Assa Abloy's demonstrated commitment to sustainability and adherence to evolving standards highlights its understanding of this dynamic.

The threat of substitutes is amplified when regulatory shifts encourage the adoption of new technologies. For instance, a 2024 initiative by the European Union to standardize smart home security protocols could make integrated electronic access control systems a more attractive substitute for conventional locks. Assa Abloy's investment in IoT-enabled security, such as its HID Global division, positions it to capitalize on such trends, with HID reporting a 15% year-over-year growth in its access control solutions in the first half of 2024.

- Regulatory Influence: Evolving building codes and insurance requirements can favor technologically advanced security solutions over traditional ones.

- Smart Technology Adoption: Mandates or incentives for smart building integration can accelerate the shift towards electronic and remotely managed access systems.

- Assa Abloy's Proactive Stance: The company's focus on sustainability and compliance demonstrates an awareness of and adaptation to changing industry standards.

- Market Data: For example, a projected 18% CAGR for the global smart locks market through 2027, driven by smart home adoption, indicates a growing preference for substitute technologies.

The threat of substitutes for traditional locks is growing, driven by advancements in technology and changing consumer preferences. While physical security remains paramount, customers are increasingly exploring alternatives like biometric scanners and mobile access systems, especially in commercial and smart home environments. For instance, the global smart home market, which includes security components, was projected to exceed $150 billion in 2024, highlighting a significant shift towards integrated digital solutions.

Convenience is a major factor pushing consumers towards substitute technologies like keyless entry and mobile credentials. The smart lock market alone was projected to reach over $4 billion in 2024, with shipments expected to increase by 15-20% year-over-year, demonstrating a clear demand for easier access methods.

Regulatory changes can also accelerate the adoption of these substitutes. For example, a potential EU initiative in 2024 to standardize smart home security protocols could further boost integrated electronic access control systems. Assa Abloy's HID Global division, a key player in this space, reported a 15% year-over-year growth in its access control solutions in the first half of 2024, indicating strong market traction for these alternatives.

| Substitute Technology | Key Drivers | Market Growth Indicator (2024 Projections) |

|---|---|---|

| Biometric Scanners | Enhanced security, convenience | Part of the broader smart security market |

| Mobile Access Systems | Smartphone integration, keyless entry | Smart lock market projected over $4 billion |

| DIY Smart Home Security | Affordability, ease of installation | Smart home market projected over $150 billion |

Entrants Threaten

Entering the access solutions market, particularly on a global scale akin to Assa Abloy, demands significant capital. Think about the investment needed for research and development to create innovative security technologies, setting up advanced manufacturing plants, and building widespread distribution channels. For instance, companies looking to compete globally often need billions in upfront investment.

The requirement for specialized machinery to produce a wide array of products, from smart locks to complex electronic access systems, further elevates these entry costs. These high upfront expenses act as a considerable deterrent, making it difficult for smaller or less-funded companies to establish a foothold and challenge established players like Assa Abloy.

Established brand loyalty and reputation significantly deter new entrants. Security products, by their very nature, demand high levels of trust and reliability, which cultivates strong brand loyalty among customers. Assa Abloy, with its over 30-year history of building a global reputation, presents a formidable barrier, as new companies struggle to quickly earn the same level of customer confidence.

This challenge is amplified in commercial and institutional sectors where a proven track record is not just preferred but often a critical requirement for procurement. For instance, in 2023, Assa Abloy reported strong performance in its Access Solutions segment, indicating continued customer preference for established brands in demanding applications.

Assa Abloy's robust investment in research and development, evidenced by its extensive portfolio of patents covering both mechanical and digital access solutions, significantly deters new entrants. This strong intellectual property acts as a formidable barrier, making it difficult for newcomers to replicate Assa Abloy's innovative products and technologies.

The company's commitment to innovation is underscored by its impressive patent activity, with over 250 new patents registered in 2024. This continuous stream of new intellectual property further solidifies Assa Abloy's competitive advantage and raises the bar for any potential market entrants.

Access to Distribution Channels and Supply Chains

New entrants face significant hurdles in establishing access to critical distribution channels and supply chains. Assa Abloy's deeply entrenched relationships with distributors, system integrators, and installers worldwide represent a substantial barrier. Replicating this extensive network, built over years, is a daunting task for any newcomer.

The complexity and time investment required to build a comparable global distribution footprint are immense. Assa Abloy's established logistics and supply chain efficiencies, honed through decades of operation, further solidify its competitive position. For instance, in 2023, Assa Abloy reported sales of SEK 153.4 billion (approximately $14.5 billion USD), underscoring the scale of its operational reach and market penetration, which new entrants would find difficult to match.

- Established Global Network: Assa Abloy commands a vast network of over 300 subsidiaries in more than 70 countries, providing unparalleled market access.

- Supply Chain Integration: The company's integrated supply chain ensures efficient product delivery and cost management, a feat challenging for new entrants to replicate.

- Installer Relationships: Strong, long-standing relationships with installers are crucial for product adoption and maintenance, creating a loyalty barrier.

- Distribution Agreements: Securing favorable distribution agreements with key players in various regions is a significant upfront investment and negotiation challenge.

Regulatory Hurdles and Certifications

The security industry faces substantial regulatory hurdles and certification requirements that act as a significant deterrent to new entrants. Companies must invest heavily in testing, compliance, and obtaining approvals for their products, which can be a lengthy and costly process. For instance, Assa Abloy's commitment to standards like the Corporate Sustainability Reporting Directive (CSRD) highlights the complex regulatory landscape it navigates, a burden that new players must also bear.

These regulatory barriers are not uniform; they vary significantly by geographic region and the specific type of security product. Obtaining certifications for areas like data privacy, product safety, and cybersecurity requires specialized knowledge and resources. In 2024, the increasing focus on data security and privacy regulations globally means that new entrants face an even higher compliance bar.

- Stringent Regulations: The security sector is heavily regulated, demanding compliance with diverse national and international standards.

- High Compliance Costs: New entrants must allocate substantial capital to testing, certification, and ongoing regulatory adherence.

- Varied Requirements: Compliance needs differ based on product type (e.g., physical access vs. digital security) and market jurisdiction.

- Data Security Focus: Evolving data protection laws, such as GDPR and similar frameworks, add another layer of complexity for new companies.

The threat of new entrants in the access solutions market, particularly for a global player like Assa Abloy, is significantly mitigated by high capital requirements and established brand loyalty. The sheer investment needed for research, development, advanced manufacturing, and building extensive distribution networks presents a formidable barrier. For instance, replicating Assa Abloy's global reach, which saw sales of SEK 153.4 billion in 2023, demands billions in upfront capital.

Furthermore, Assa Abloy's robust intellectual property portfolio, with over 250 new patents registered in 2024, creates a technological moat that is difficult for newcomers to breach. This continuous innovation, coupled with strong installer relationships and deep-seated distribution agreements, solidifies its competitive advantage.

Regulatory hurdles and stringent certification requirements also act as significant deterrents, demanding substantial investment in compliance and testing. The increasing global focus on data security and privacy in 2024 adds another layer of complexity for potential entrants, requiring specialized knowledge and resources.

| Barrier Type | Description | Impact on New Entrants | Assa Abloy's Strength |

|---|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and distribution. | Significant deterrent due to substantial financial needs. | Vast financial resources and established infrastructure. |

| Brand Loyalty & Reputation | Customers prioritize trust and reliability in security products. | New entrants struggle to build immediate credibility. | Over 30 years of building a global reputation for trust. |

| Intellectual Property | Extensive patents covering mechanical and digital access solutions. | Makes replication of innovative products difficult. | Over 250 new patents registered in 2024. |

| Distribution & Supply Chain | Entrenched relationships with distributors, integrators, and installers. | Challenging to replicate the scale and efficiency of existing networks. | Global network of over 300 subsidiaries in 70+ countries. |

| Regulatory Compliance | Stringent and varied national/international security standards. | High costs and time investment for testing and certification. | Navigates complex regulations, including CSRD compliance. |

Porter's Five Forces Analysis Data Sources

Our Assa Abloy Porter's Five Forces analysis is built upon a robust foundation of data, including Assa Abloy's annual reports, investor presentations, and industry-specific market research from firms like IBISWorld. We also incorporate insights from macroeconomic data providers and competitor disclosures to ensure a comprehensive understanding of the competitive landscape.