Assa Abloy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Assa Abloy Bundle

Unlock the strategic genius behind Assa Abloy's global dominance with our comprehensive Business Model Canvas. Discover how they masterfully integrate key partners, deliver innovative value propositions, and cultivate robust customer relationships to drive unparalleled growth. This detailed breakdown is your key to understanding their success.

Want to dissect the operational brilliance of Assa Abloy? Our full Business Model Canvas lays bare their core activities, essential resources, and cost structure, revealing the engine that powers their market leadership. Download it now to gain a competitive edge.

See how Assa Abloy crafts its revenue streams and customer value. This in-depth Business Model Canvas provides a clear, actionable roadmap of their customer segments, channels, and revenue strategies, perfect for anyone aiming to replicate their market-capturing success.

Partnerships

Assa Abloy actively partners with technology leaders to advance its access solutions. A prime example is their collaboration with Boston Dynamics, which focuses on enabling autonomous digital access for security patrol robots.

This innovative partnership allows robots to autonomously unlock and open access-controlled automated doors, seamlessly integrating advanced robotics with sophisticated security systems.

Such collaborations are crucial for Assa Abloy's strategy to remain at the forefront of smart access technology, driving innovation in physical security and automation.

Assa Abloy actively participates in industry associations like the Telecommunications Industry Association (TIA). This engagement allows them to influence standards development and technology programs, particularly for securing critical infrastructure such as cell towers and data centers. Their contributions help define best practices for secure access solutions.

Assa Abloy actively seeks strategic acquisitions to broaden its market presence and strengthen its product offerings. In 2024, the company completed 26 acquisitions, and as of mid-2025, it has already acquired 13 more companies.

These acquisitions, including notable ones like InVue and Uhlmann & Zacher, are crucial for reinforcing Assa Abloy's leadership in key growth areas such as connected asset protection, advanced access control systems, and remote care technologies.

Integrator and Specialist Networks

Assa Abloy's success hinges on its extensive network of security integrators and specialized door hardware partners. These crucial alliances ensure that their advanced access control solutions, including sophisticated mobile-enabled wireless systems, are deployed and supported effectively. For instance, their work with universities to implement campus-wide mobile access relies heavily on these partners for seamless installation and ongoing service.

This ecosystem of specialists provides critical on-the-ground expertise. They handle everything from the physical installation of door hardware to the intricate software integration required for complex systems. In 2024, Assa Abloy continued to strengthen these relationships, recognizing that the quality of deployment and post-installation support directly impacts customer satisfaction and the perceived value of their offerings.

The benefits of this partnership model are clear:

- Expert Installation: Partners possess the technical know-how to install hardware correctly, ensuring optimal performance and security.

- Seamless Integration: They bridge the gap between hardware and software, crucial for systems like mobile access where multiple technologies converge.

- Comprehensive Support: Customers receive dedicated service and troubleshooting, vital for maintaining the integrity of security systems.

- Market Reach: This network allows Assa Abloy to serve diverse markets and complex projects efficiently.

Campus Security Solution Providers

Assa Abloy collaborates with campus security solution providers like Transact + CBORD to upgrade security systems. This partnership focuses on replacing traditional mechanical locks with advanced mobile-enabled wireless access, a significant shift for educational institutions.

This strategic alliance has already benefited close to 100 campuses globally. The initiative not only bolsters safety and user convenience for students but also streamlines IT management for the institutions involved.

- Partnership Focus: Transitioning from mechanical locks to mobile-enabled wireless access.

- Global Reach: Supporting nearly 100 campuses worldwide.

- Benefits: Enhanced safety, student convenience, and simplified IT management.

Assa Abloy cultivates key partnerships with technology innovators and industry bodies to drive advancements in access solutions. Collaborations with robotics firms like Boston Dynamics enable autonomous digital access for security robots, while engagement with organizations such as the Telecommunications Industry Association (TIA) helps shape standards for critical infrastructure security.

Strategic acquisitions are also a cornerstone, with 26 acquisitions completed in 2024 and 13 more by mid-2025, bolstering leadership in areas like connected asset protection and advanced access control.

Furthermore, Assa Abloy relies on a robust network of security integrators and specialized door hardware partners for expert installation and comprehensive support, ensuring seamless deployment of their sophisticated systems across diverse projects.

What is included in the product

This Assa Abloy Business Model Canvas provides a comprehensive overview of their strategy, covering key elements like customer segments, value propositions, and revenue streams.

It offers a detailed look at their operational structure, including channels, key resources, and cost structure, designed for informed decision-making and stakeholder communication.

The Assa Abloy Business Model Canvas acts as a pain point reliever by providing a structured, one-page overview that simplifies the complex interdependencies of their global operations.

It allows for rapid identification of key value propositions and customer segments, streamlining strategic discussions and problem-solving across diverse business units.

Activities

Assa Abloy's commitment to Research and Development is a cornerstone of its strategy, with a significant portion of its revenue dedicated to this crucial area. In 2024, the company allocated approximately 4% of its annual sales to R&D efforts. This substantial investment fuels the continuous innovation pipeline, particularly in the rapidly evolving digital and electromechanical product sectors.

This focus on R&D is not just about creating new products; it's about anticipating future market needs and developing solutions that are both smart and sustainable. By consistently investing, Assa Abloy ensures it remains at the forefront of technological advancements, offering customers cutting-edge access solutions that enhance security, convenience, and efficiency.

Assa Abloy's strategic mergers and acquisitions are a cornerstone of its business model. In 2024 alone, the company completed 26 acquisitions, a testament to its aggressive growth strategy. These moves are designed to broaden its product offerings, strengthen its foothold in key markets, and integrate cutting-edge technologies.

The company actively pursues acquisitions in high-growth sectors, ensuring it stays at the forefront of innovation. This approach allows Assa Abloy to not only expand its market reach but also to absorb and leverage new technological advancements, thereby enhancing its overall scalability and competitive edge.

Assa Abloy's manufacturing and production optimization is central to its business. The company is dedicated to creating highly efficient production processes across its extensive global network. This commitment is further underscored by the Q1 2025 launch of its Manufacturing Footprint Program.

This strategic program is designed to streamline production and logistics, aiming to unlock substantial annual savings. With over 200 production facilities worldwide, the program is a key initiative to enhance the scalability and overall efficiency of Assa Abloy's global operations.

Global Sales and Distribution

Assa Abloy's global sales and distribution network is a cornerstone of its operations, reaching customers in over 70 countries. This extensive reach allows the company to navigate and capitalize on diverse market conditions across key regions such as the Americas, EMEIA (Europe, Middle East, India, and Africa), and Asia Pacific.

The company tailors its sales strategies to effectively serve distinct market segments, including residential, commercial, and institutional clients. This segmentation ensures that product offerings and sales approaches align with the specific needs and purchasing behaviors of each sector.

- Global Presence: Operates in over 70 countries, demonstrating a vast international footprint.

- Regional Adaptation: Manages diverse market conditions across Americas, EMEIA, and Asia Pacific.

- Segmented Approach: Adapts sales strategies for residential, commercial, and institutional markets.

Sustainability Initiatives and Reporting

A core activity for ASSA ABLOY is its dedication to sustainability. This includes making significant strides in reducing its environmental footprint. For instance, the company achieved its Scope 1 & 2 carbon emission reduction targets ahead of schedule, demonstrating a proactive approach to climate action.

ASSA ABLOY also prioritizes the development of sustainable products, ensuring that innovation goes hand-in-hand with environmental responsibility. Furthermore, the company actively optimizes its operations to minimize environmental impact across its value chain. This commitment is further underscored by the publication of its first Corporate Sustainability Report Directive (CSRD) in 2024, providing transparent reporting on its sustainability performance.

- Carbon Emission Reduction: Achieved Scope 1 & 2 carbon emission reduction targets ahead of schedule.

- Sustainable Product Development: Focus on creating environmentally friendly products.

- Operational Optimization: Efforts to reduce environmental impact in business operations.

- CSRD Reporting: Published its first Corporate Sustainability Report Directive (CSRD) in 2024.

Assa Abloy's key activities revolve around continuous innovation through substantial R&D investment, strategic acquisitions to expand market reach and technology portfolios, and optimizing global manufacturing for efficiency. The company also leverages its extensive worldwide sales and distribution network, adapting strategies for diverse market segments and prioritizing sustainability initiatives across its operations.

| Key Activity | Description | 2024 Data/Focus |

| Research & Development | Driving innovation in digital and electromechanical access solutions. | ~4% of annual sales invested in R&D. |

| Mergers & Acquisitions | Expanding product offerings and market presence through strategic acquisitions. | 26 acquisitions completed in 2024. |

| Manufacturing Optimization | Enhancing efficiency across global production facilities. | Launched Manufacturing Footprint Program in Q1 2025. |

| Global Sales & Distribution | Serving customers in over 70 countries across diverse market segments. | Tailored strategies for residential, commercial, and institutional clients. |

| Sustainability | Reducing environmental impact and developing sustainable products. | Achieved Scope 1 & 2 carbon emission targets ahead of schedule; published first CSRD in 2024. |

Full Document Unlocks After Purchase

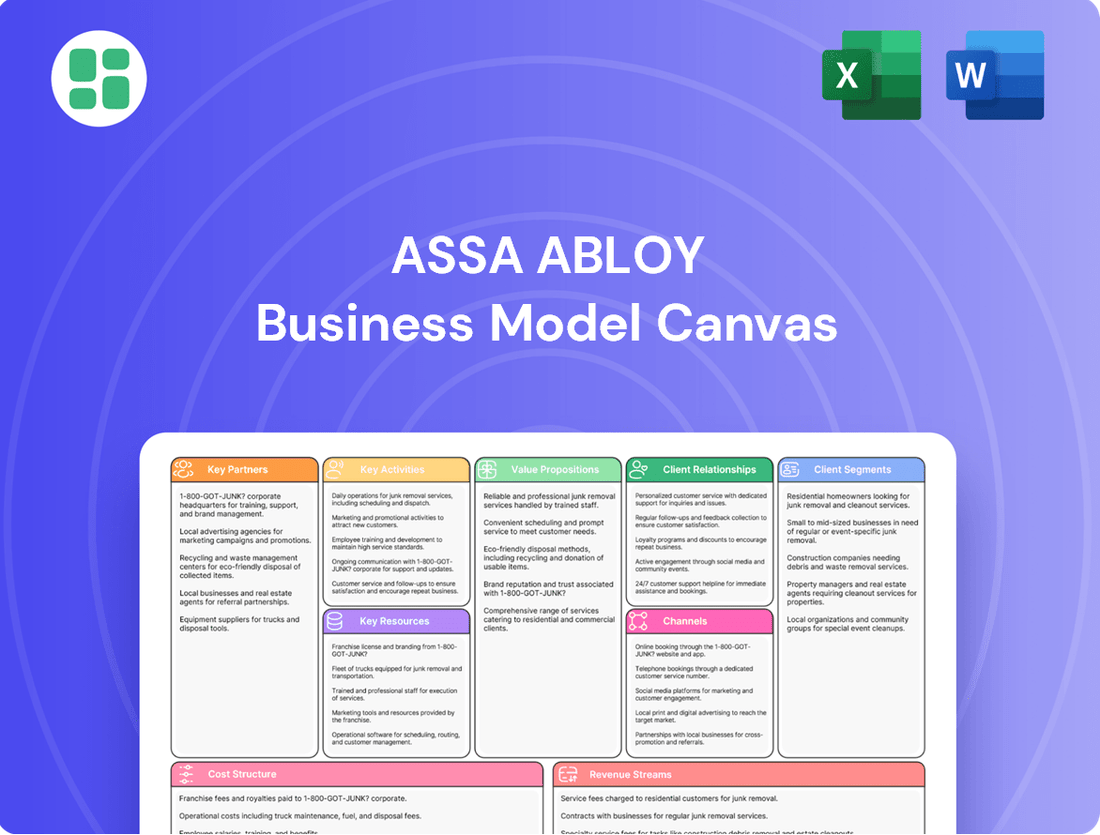

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, professionally structured file that will be yours. You'll gain full access to this comprehensive analysis of Assa Abloy's business strategy, ready for immediate use and further customization.

Resources

Assa Abloy's commitment to innovation is evident in its substantial intellectual property portfolio. In 2024 alone, the company secured over 250 new patents, underscoring its dedication to developing cutting-edge access solutions.

These patents cover a diverse range of technologies, including advanced sealing devices crucial for various industrial applications, sophisticated systems designed for autonomous vehicle control in logistics environments, and intelligent door lock systems that enhance security and convenience.

Assa Abloy's global brand portfolio is a cornerstone of its business model, featuring prominent names like Yale for residential security and HID Global for advanced electronic access solutions. This diverse brand strength allows the company to cater to a wide array of customer needs in different market segments.

These established brands are instrumental in securing Assa Abloy's leadership in key areas such as efficient door openings, ensuring trusted identities for individuals and organizations, and driving innovation in entrance automation. The company's strategic acquisition of brands further bolsters this powerful portfolio.

In 2023, Assa Abloy reported net sales of SEK 153,428 million, with a significant portion of this revenue directly attributable to the strong market presence and customer loyalty generated by its extensive brand portfolio across its various segments, including Access Solutions and Entrance Systems.

Assa Abloy's extensive manufacturing and R&D facilities are a cornerstone of its business model. The company boasts over 200 production sites and 195 R&D centers strategically located in more than 70 countries worldwide.

This global footprint allows for tailored product development that meets regional demands and ensures efficient, localized supply chains. For example, in 2024, Assa Abloy continued to invest in expanding its manufacturing capabilities in emerging markets, aiming to capture growing demand.

Skilled Workforce and Human Capital

Assa Abloy's extensive global presence is underpinned by its 63,000 employees, a vital resource representing significant human capital. This workforce possesses deep expertise across the entire value chain, from product development and manufacturing to on-site installation and ongoing customer service. Their collective knowledge is fundamental to the company's ability to deliver innovative and reliable access solutions.

The company's decentralized operational model is a key enabler for its human capital. This structure allows local teams to leverage their market-specific understanding and adapt swiftly to evolving customer needs and regional dynamics. This agility is crucial for maintaining competitiveness in diverse global markets.

Key aspects of Assa Abloy's skilled workforce include:

- Development and Innovation: Employees driving the creation of new security and access technologies.

- Manufacturing Excellence: Skilled production teams ensuring high-quality output across numerous facilities.

- Installation and Service: Technicians providing crucial on-site support, installation, and maintenance.

- Market Expertise: Local teams possessing in-depth knowledge of regional customer preferences and regulatory environments.

Financial Strength and Investment Capacity

Assa Abloy's financial strength is a cornerstone of its business model, directly fueling its investment capacity. The company consistently reports robust financial performance, which is crucial for sustaining its competitive edge. This financial health allows for significant reinvestment into research and development, driving innovation in its security solutions.

In 2024, Assa Abloy continued to demonstrate strong earnings power. For the first quarter of 2024, reported sales increased by 8% organically, reaching SEK 39,165 million. This growth, coupled with a healthy operating margin, directly translates into the capacity for strategic investments. The company's ability to generate substantial cash flow further underpins its investment strategy, enabling both organic growth initiatives and opportunistic acquisitions to expand its market reach and technological capabilities.

- Record Earnings: Assa Abloy's consistent delivery of strong financial results, including record earnings, provides the foundation for its investment activities.

- Healthy Operating Margin: Maintaining a robust operating margin in 2024, for instance, allows for greater financial flexibility to allocate resources towards innovation and strategic growth.

- Balance Sheet Strength: A solid balance sheet and strong cash flow generation in 2024 empower the company to pursue strategic acquisitions and invest in new technologies, reinforcing its market leadership.

- Investment in Innovation: The financial capacity directly supports Assa Abloy's commitment to investing in R&D, ensuring it remains at the forefront of security technology development.

Assa Abloy's intellectual property, encompassing over 250 new patents secured in 2024, forms a critical resource. These innovations span advanced sealing, autonomous vehicle control, and intelligent door locks, reinforcing its technological leadership.

The company's robust brand portfolio, featuring names like Yale and HID Global, is a key asset. This allows Assa Abloy to effectively address diverse customer needs across various market segments, driving strong customer loyalty and market penetration.

Its extensive global network of over 200 production sites and 195 R&D centers is another vital resource. This infrastructure enables localized product development and efficient supply chains, crucial for meeting regional demands and driving growth.

Assa Abloy's 63,000 employees represent significant human capital, bringing expertise across the entire value chain. This skilled workforce, empowered by a decentralized operational model, ensures agility and market-specific responsiveness.

The company's financial strength, evidenced by an 8% organic sales increase to SEK 39,165 million in Q1 2024, underpins its capacity for investment. This financial health supports ongoing innovation and strategic acquisitions.

| Key Resource | Description | 2024/2023 Data Point |

|---|---|---|

| Intellectual Property | Patents for innovative access solutions | Over 250 new patents in 2024 |

| Brand Portfolio | Acquired and developed brands (e.g., Yale, HID Global) | Drives market leadership and customer loyalty |

| Manufacturing & R&D Facilities | Global network of production and research centers | Over 200 production sites, 195 R&D centers |

| Human Capital | Skilled workforce across the value chain | 63,000 employees globally |

| Financial Strength | Revenue and profitability | 8% organic sales growth in Q1 2024 (SEK 39,165 million) |

Value Propositions

Assa Abloy delivers peace of mind through advanced access solutions, offering everything from robust mechanical locks to sophisticated electronic systems. These innovations are crucial for safeguarding both personal spaces and vital national assets. In 2023, the company continued its focus on security, a segment that underpins its broad appeal to customers prioritizing safety.

Assa Abloy's value proposition of convenience and seamless access is powerfully demonstrated through its digital door locks and mobile credential solutions. These innovations simplify daily life, allowing users to unlock doors with their smartphones, a significant upgrade from traditional keys. For instance, universities are adopting mobile credentials for dorm room access, streamlining student entry and enhancing security.

The company's focus on user-friendly technology extends to smart home applications, making home management more intuitive and flexible. This ease of access is crucial for services like efficient home deliveries, where secure, temporary access can be granted remotely. In 2023, the global smart lock market, a key segment for Assa Abloy, was valued at approximately $3.8 billion, with projections indicating continued robust growth driven by these convenience factors.

Assa Abloy is heavily invested in developing cutting-edge technologies like biometric access, IoT-integrated systems, and robotic security solutions. This commitment to innovation ensures their offerings remain at the forefront of the security industry.

Their emphasis on creating connected and upgradable systems means customers benefit from future-proof security that can adapt to changing needs. For instance, Assa Abloy's 2024 investments in R&D reflect a strategic push into advanced digital security, aiming to capture a larger share of the rapidly growing smart access market.

Comprehensive and Integrated Solutions

Assa Abloy’s value proposition centers on delivering comprehensive and integrated solutions that address a wide range of security and access needs. They offer a broad portfolio that includes everything from traditional mechanical locks to advanced electromechanical and digital locking systems, as well as sophisticated access control and entrance automation technologies.

This extensive product range allows Assa Abloy to provide truly integrated solutions, meaning customers can get a complete package for their door security and access control requirements. This is particularly valuable for diverse applications, from residential buildings to large commercial enterprises and critical infrastructure.

For instance, in 2024, the smart locks market, a key segment for Assa Abloy, was projected to reach over $2.5 billion globally, highlighting the demand for integrated digital access solutions. Assa Abloy’s ability to combine these digital offerings with their established mechanical and electromechanical expertise creates a powerful, one-stop-shop value proposition.

- Broad product portfolio: Mechanical, electromechanical, digital locks, access control, and entrance automation.

- Integrated solutions: Seamlessly combining different security technologies for comprehensive coverage.

- Diverse application suitability: Catering to residential, commercial, and industrial security needs.

Sustainability and Environmental Responsibility

Assa Abloy's commitment to sustainability is a core value proposition, offering products and processes designed to minimize environmental impact. This focus extends to providing customers with solutions that actively support their own sustainability goals.

For instance, Assa Abloy offers energy-efficient door systems that contribute to reduced energy consumption for building occupants. Furthermore, their range of hardware is developed with carbon-saving principles in mind, aligning with global efforts to combat climate change.

- Energy Efficiency: Products like automated doors and smart locks can reduce heating and cooling losses, contributing to lower building energy usage.

- Material Innovation: Assa Abloy focuses on using recycled materials and optimizing material usage in their manufacturing processes.

- Circular Economy: The company is exploring product lifecycles that support repair, refurbishment, and eventual recycling to reduce waste.

- Customer Solutions: By providing sustainable options, Assa Abloy enables its clients to enhance their own environmental credentials and meet regulatory requirements.

Assa Abloy provides peace of mind through advanced access solutions, encompassing everything from robust mechanical locks to sophisticated electronic systems, crucial for safeguarding both personal and vital national assets.

The company's value proposition of convenience is evident in its digital door locks and mobile credential solutions, simplifying daily life by allowing smartphone access, a trend seen in university dorms for enhanced security and student entry.

Assa Abloy's commitment to innovation is demonstrated through investments in biometric access, IoT-integrated systems, and robotic security solutions, ensuring their offerings lead the security industry, with 2024 R&D focusing on advanced digital security.

Their comprehensive and integrated solutions cater to diverse needs, from residential to commercial, offering a one-stop-shop for security and access control, a key factor in the projected over $2.5 billion global smart locks market in 2024.

Sustainability is a core value, with energy-efficient door systems and carbon-saving principles in hardware, enabling customers to meet their own environmental goals and regulatory requirements.

| Value Proposition | Description | 2023/2024 Data/Examples |

|---|---|---|

| Security & Peace of Mind | Robust mechanical to advanced electronic access systems for safeguarding assets. | Focus on security segment in 2023. |

| Convenience & Seamless Access | Digital locks and mobile credentials for simplified entry. | Universities adopting mobile credentials for dorms; global smart lock market ~$3.8 billion in 2023. |

| Innovation & Future-Proofing | Cutting-edge technologies like biometrics and IoT integration. | 2024 R&D investments in advanced digital security; smart lock market projected >$2.5 billion in 2024. |

| Integrated Solutions | Broad portfolio combining mechanical, electromechanical, and digital technologies. | Comprehensive security packages for residential, commercial, and industrial applications. |

| Sustainability | Energy-efficient and environmentally conscious products. | Reduced energy consumption via automated doors; focus on recycled materials and circular economy principles. |

Customer Relationships

Assa Abloy champions a consultative approach, actively engaging with customers to deeply understand their unique security needs and challenges. This dialogue is crucial for tailoring existing products and driving innovation, ensuring solutions are precisely aligned with customer requirements.

This solutions-oriented strategy allows Assa Abloy to co-create value, developing products that not only meet current demands but also anticipate future security landscapes. For instance, in 2024, their focus on smart access solutions reflects this by directly addressing the growing demand for integrated and user-friendly security systems.

Assa Abloy cultivates long-term partnerships through consistent support and service agreements, ensuring their access control systems remain reliable and future-ready. This focus on ongoing engagement, including system upgrade opportunities, underpins their strategy for sustained value creation for customers.

Assa Abloy's decentralized structure, with a strong emphasis on local teams, enables highly responsive customer engagement. This allows them to tailor interactions and quickly adapt to regional market shifts, a key advantage in diverse global markets.

This agile approach means local units can directly address customer needs and market specificities. For instance, in 2024, Assa Abloy's focus on localized innovation led to the introduction of several region-specific smart lock solutions, directly addressing unique consumer demands and regulatory environments in those areas.

Digital Engagement and Support

Assa Abloy actively uses digital channels to connect with customers, offering online portals for clients and specialized investor relations websites. These platforms are crucial for sharing information, providing product assistance, and fostering engagement across all stakeholder groups.

In 2024, Assa Abloy continued to enhance its digital customer relationships, recognizing the growing importance of online interaction. The company's focus on digital engagement aims to streamline customer service and improve accessibility to information.

- Online Portals: Dedicated client portals provide access to order tracking, product documentation, and support resources, simplifying the customer experience.

- Investor Relations Website: This site serves as a central hub for financial reports, news releases, and corporate governance information, ensuring transparency for investors.

- Digital Support Channels: Assa Abloy leverages digital tools for customer support, offering FAQs, chat functions, and online ticketing systems to address inquiries efficiently.

- Stakeholder Engagement: The company uses its digital presence to communicate its strategy, sustainability efforts, and financial performance to a broad audience.

Aftermarket Services and Upgrades

Assa Abloy places significant emphasis on aftermarket services and upgrades as a core component of its customer relationships. This involves actively engaging with its installed base, offering innovative digital and electromechanical solutions to enhance existing security systems.

These upgrades not only provide customers with improved security and convenience but also foster long-term engagement. This strategy is crucial for Assa Abloy’s recurring revenue generation, particularly through subscription-based models and ongoing service agreements, ensuring continuous value delivery and customer loyalty.

- Aftermarket Focus: Assa Abloy actively targets its existing customer base for upgrades and enhancements.

- Digital & Electromechanical Innovation: The company offers advanced digital and electromechanical products to modernize installed systems.

- Enhanced Value: These upgrades deliver improved security and convenience for end-users.

- Recurring Revenue: Subscription models and service agreements create predictable, ongoing revenue streams.

Assa Abloy cultivates deep customer relationships through a consultative, solutions-oriented approach, co-creating value by tailoring products and anticipating future security needs. This is exemplified in 2024 by their focus on smart access solutions, directly addressing market demand for integrated systems.

Long-term partnerships are fostered through consistent support, service agreements, and opportunities for system upgrades, ensuring reliability and future-readiness. This ongoing engagement is key to Assa Abloy's sustained value creation and customer loyalty.

The company leverages digital channels, including client portals and investor relations websites, for information sharing, product assistance, and stakeholder engagement. In 2024, enhancements to these digital platforms aimed to streamline customer service and improve information accessibility.

Assa Abloy prioritizes aftermarket services and upgrades, offering innovative digital and electromechanical solutions to enhance existing security systems, thereby driving recurring revenue through service agreements and subscription models.

| Customer Relationship Aspect | Description | 2024 Focus/Example |

| Consultative Approach | Understanding unique security needs to tailor solutions. | Co-creating value with smart access solutions. |

| Long-Term Partnerships | Consistent support, service agreements, and upgrade opportunities. | Ensuring system reliability and future-readiness. |

| Digital Engagement | Online portals, investor relations websites, digital support. | Streamlining service and improving information accessibility. |

| Aftermarket Services | Upgrades and enhancements for installed systems. | Driving recurring revenue via service agreements and subscriptions. |

Channels

Assa Abloy leverages a dedicated direct sales force to cultivate relationships with major commercial, institutional, and industrial clients. This approach is crucial for managing complex access solution projects that demand in-depth consultation and customized product integration.

This direct engagement model allows Assa Abloy to meticulously understand specific client needs, facilitating the development and delivery of highly tailored access control systems. For instance, in 2023, their EMEA region saw significant growth driven by large-scale project wins within the hospitality and healthcare sectors, underscoring the effectiveness of this direct sales strategy.

Assa Abloy leverages a vast global distributor and reseller network, a cornerstone of its business model. This extensive reach is crucial for making its mechanical and electromechanical lock products accessible to a wide array of customers worldwide.

This network ensures that Assa Abloy products are readily available in local markets, supported by localized expertise. For instance, in 2023, the company reported that its distribution channels played a significant role in its overall sales performance, reflecting the vital nature of these partnerships.

Assa Abloy relies heavily on security integrators and door-hardware specialists to bring its sophisticated access control systems to life. These partners are the hands-on experts who ensure the seamless installation and integration of Assa Abloy's technology into client environments.

This channel is particularly vital for complex deployments in demanding sectors such as education and commercial real estate, where precision and reliability are paramount. For instance, in 2023, the global access control systems market was valued at approximately $10.5 billion, with a significant portion of that growth driven by the integration of advanced solutions that require specialized installation expertise.

Online Portals and E-commerce

Assa Abloy is significantly investing in its online presence, developing dedicated client portals and exploring e-commerce options for specific product categories. This digital expansion aims to simplify how customers access product details, place orders, and receive support, making interactions more efficient. For instance, their commitment to digital transformation was evident in their 2023 performance, with strong growth reported in their Americas division, partly driven by enhanced digital customer engagement strategies.

These online channels are designed to offer a seamless experience, from initial product discovery to post-purchase service. By providing readily available information and streamlined ordering processes, Assa Abloy enhances customer satisfaction and operational efficiency. The company's focus on digital solutions is a key part of its strategy to adapt to evolving market demands and reach a wider customer base effectively.

- Digital Channel Expansion: Assa Abloy is actively developing online portals for clients and investigating e-commerce capabilities for select product lines.

- Enhanced Customer Access: These digital platforms provide easier access to product information, facilitate ordering, and streamline customer service interactions.

- Strategic Importance: The growth in digital channels is a critical component of Assa Abloy's strategy to improve customer experience and operational efficiency, aligning with market trends.

Original Equipment Manufacturer (OEM) Partnerships

Assa Abloy leverages Original Equipment Manufacturer (OEM) partnerships by supplying components and integrated solutions to other businesses. These partnerships are crucial for embedding Assa Abloy's security technology into a broader array of products, from smart home devices to industrial equipment. This indirect sales channel significantly expands their market penetration and brand visibility across diverse industries.

In 2024, Assa Abloy continued to solidify its position in the OEM market, recognizing the strategic importance of these collaborations for growth. By providing critical security components, they enable other manufacturers to enhance their own product offerings with advanced access control and security features.

- Component Supply: Assa Abloy provides specialized hardware and software components to OEMs for integration into their end products.

- Technology Embedding: This channel allows Assa Abloy's innovative security technology to be embedded in a wider range of applications, reaching new customer segments.

- Market Reach Expansion: OEM partnerships act as a force multiplier, extending Assa Abloy's market reach indirectly through the products of their partners.

- Strategic Alliances: These collaborations are key to Assa Abloy's strategy of becoming a foundational security provider across multiple sectors.

Assa Abloy's channel strategy is multifaceted, encompassing direct sales for large projects, a broad distributor network for product accessibility, and partnerships with security integrators for complex installations. The company is also actively expanding its digital channels and leveraging OEM collaborations to broaden its market footprint.

These diverse channels ensure Assa Abloy can serve a wide range of customer needs, from individual consumers to large enterprises, and reach new markets through embedded technology. In 2023, the company highlighted the performance of its distribution and digital engagement strategies as key drivers of growth.

The integration of these channels is crucial for Assa Abloy's overall market penetration and customer relationship management. For example, their digital initiatives in 2023 contributed to strong performance in the Americas region, demonstrating the growing importance of online engagement.

Looking ahead, Assa Abloy's continued investment in digital platforms and OEM partnerships in 2024 signals a commitment to adapting to evolving market dynamics and enhancing customer accessibility across all segments.

| Channel Type | Primary Focus | Key Benefit | 2023/2024 Relevance |

|---|---|---|---|

| Direct Sales | Large commercial, institutional, industrial clients | Customized solutions, strong client relationships | Drove growth in EMEA hospitality/healthcare sectors. |

| Distributors & Resellers | Broad customer base, global reach | Product accessibility, localized support | Significant contributor to overall sales performance. |

| Security Integrators | Complex installations, demanding sectors | Expertise in deployment and integration | Vital for advanced access control systems market. |

| Digital Channels | Client portals, e-commerce exploration | Efficiency, enhanced customer experience | Contributed to Americas growth via digital engagement. |

| OEM Partnerships | Component supply to other manufacturers | Expanded market penetration, technology embedding | Continued solidification of position in 2024. |

Customer Segments

Individual homeowners represent a core customer segment, prioritizing enhanced security and seamless convenience in their living spaces. They are increasingly adopting products such as digital door locks and integrated smart home applications to manage access and automate home functions. For instance, Yale, a prominent Assa Abloy brand, continues to see strong demand in this sector, even amidst localized economic headwinds.

Despite some regional economic slowdowns impacting new home construction, the residential market remains a substantial revenue driver for Assa Abloy. In 2024, the demand for smart locks and connected security solutions for existing homes is expected to remain robust, driven by consumer interest in DIY home improvement and increased awareness of digital security benefits.

Commercial Businesses and Enterprises, encompassing everything from small offices to major corporations, represent a core customer segment for Assa Abloy. These entities require robust access control systems, advanced high-security locks, and sophisticated entrance automation solutions to safeguard their premises and streamline operations. The demand for these products is fueled by an increasing emphasis on both physical security and the need to optimize workflow and energy efficiency within commercial spaces.

In 2024, the global commercial real estate market continued to see investment in security upgrades, with a particular focus on integrated solutions that offer centralized management and enhanced data analytics. Assa Abloy's commitment to innovation in areas like biometric access and smart building integration directly addresses the evolving needs of this segment, aiming to provide comprehensive security and operational management for diverse business environments.

Institutional clients like universities and hospitals need dependable, large-scale access control systems. These organizations, often managing thousands of doors and users, prioritize security and operational efficiency. In 2024, the education sector alone saw significant investment in campus-wide security upgrades, with many institutions looking to consolidate access management.

There's a clear trend towards mobile access solutions within this segment, allowing staff and students to use their smartphones for entry. For example, many large university systems are actively deploying or piloting mobile credentialing. Furthermore, the integration of access control with broader security platforms, such as video surveillance and alarm systems, is a key requirement for enhanced safety and centralized management in 2024.

Industrial and Logistics Sectors

Industrial and logistics businesses, encompassing manufacturing, warehousing, and distribution, represent a significant customer segment for ASSA ABLOY. These operations demand robust entrance automation, advanced perimeter security, and effective asset protection to ensure operational efficiency and safety. For instance, the global industrial automation market was valued at approximately $160 billion in 2023 and is projected to grow substantially, indicating a strong demand for sophisticated solutions in this sector.

This segment particularly benefits from ASSA ABLOY's innovations in high-speed industrial doors, which are crucial for maintaining climate control and optimizing workflow in busy manufacturing plants and distribution centers. Furthermore, advancements in autonomous vehicle control systems for logistics yards directly address the evolving needs of modern supply chains, improving safety and throughput. In 2024, the logistics industry continued to see significant investment in technology aimed at enhancing efficiency and security.

- Key Needs: Entrance automation, perimeter security, asset protection, operational efficiency.

- Beneficial Innovations: High-speed industrial doors, autonomous vehicle control systems for logistics.

- Market Context: Industrial automation market growth and logistics technology investment in 2023-2024.

Critical Infrastructure and Data Centers

Assa Abloy serves the critical infrastructure and data center market with highly specialized access and egress hardware. This segment requires robust security solutions to protect sensitive electronic information and ensure operational continuity. For instance, companies operating data centers are increasingly investing in advanced security measures to safeguard against physical and electromagnetic interference.

This niche demands solutions like EMI-RFI Shielding Door and Frame Assemblies. These are designed to prevent electromagnetic radiation from entering or leaving secure areas, a crucial requirement for data centers handling classified or proprietary information. The global data center market size was valued at approximately USD 240.5 billion in 2023 and is projected to grow significantly, indicating a strong demand for such specialized security hardware.

- Market Focus: Data centers and other critical infrastructure requiring advanced security.

- Key Solutions: EMI-RFI Shielding Door and Frame Assemblies for electromagnetic protection.

- Market Value: The global data center market reached roughly USD 240.5 billion in 2023, highlighting the segment's importance.

Assa Abloy caters to a diverse range of customer segments, each with unique security and access control needs. From individual homeowners seeking smart home integration to large institutions requiring scalable solutions, the company offers tailored products and services. Commercial businesses and industrial sectors also form significant segments, demanding robust physical security and operational efficiency.

The company's ability to serve these varied markets is a testament to its broad product portfolio and commitment to innovation. For instance, the residential sector sees consistent demand for digital door locks, while commercial clients prioritize advanced access control and entrance automation. Institutional clients, such as universities, benefit from large-scale access management systems, and industrial clients rely on high-speed doors for operational flow.

In 2024, the emphasis on integrated security solutions and mobile access continues to grow across all segments. This includes specialized needs like electromagnetic shielding for data centers, reflecting a broader trend towards sophisticated, connected security ecosystems. The company's strategic focus on these key segments positions it for continued growth in the evolving security landscape.

| Customer Segment | Key Needs | Relevant Assa Abloy Solutions | 2024 Market Context/Data Point |

|---|---|---|---|

| Individual Homeowners | Enhanced security, convenience, smart home integration | Digital door locks, smart home applications | Continued strong demand for DIY security upgrades. |

| Commercial Businesses | Robust access control, high-security locks, entrance automation | Integrated access systems, biometric access | Investment in security upgrades for commercial real estate. |

| Institutional Clients (e.g., Universities) | Large-scale access control, operational efficiency, mobile access | Campus-wide access management, mobile credentialing | Significant investment in campus security upgrades. |

| Industrial & Logistics | Entrance automation, asset protection, operational efficiency | High-speed industrial doors, autonomous vehicle control systems | Global industrial automation market projected for substantial growth. |

| Critical Infrastructure & Data Centers | Advanced security, operational continuity, electromagnetic protection | EMI-RFI Shielding Door and Frame Assemblies | Global data center market valued at approx. USD 240.5 billion in 2023. |

Cost Structure

Assa Abloy dedicates a substantial portion of its resources to Research and Development, recognizing its critical role in maintaining a competitive edge. In 2023, the company invested approximately 4% of its annual sales into R&D activities, a figure that underscores its commitment to innovation.

These investments fuel the development of cutting-edge, sustainable access solutions. This includes significant outlays for securing intellectual property through patents, refining product designs for enhanced functionality and aesthetics, and integrating advanced technologies to create smarter, more secure access systems.

Manufacturing and production represent a significant cost center for Assa Abloy, driven by the complex processes involved in creating mechanical and electromechanical locks, digital door locks, and entrance automation systems. These expenses encompass the procurement of raw materials, the wages of a skilled labor force, and the overhead associated with maintaining its extensive network of global production facilities.

Assa Abloy actively works to manage and reduce these manufacturing costs through strategic initiatives. For instance, the Manufacturing Footprint Program aims to optimize production locations and processes, enhancing efficiency and potentially lowering unit costs across its diverse product lines. This focus on operational excellence is crucial for maintaining competitiveness in the global security market.

Selling, General, and Administrative (SG&A) expenses for Assa Abloy are substantial, covering a wide array of functions crucial for global operations. These include costs associated with sales teams, marketing campaigns to promote their diverse product portfolio, and the logistics of distributing their products worldwide.

The company's decentralized structure, while fostering local responsiveness, also means that administrative costs are spread across numerous regional entities. This includes salaries for a large global workforce, essential for managing operations in different markets, as well as significant spending on advertising and general operational overhead to keep the business running smoothly.

In 2023, Assa Abloy reported SG&A expenses of SEK 28,814 million (approximately USD 2.6 billion at the average 2023 exchange rate). This figure reflects the significant investment in sales, marketing, and administrative functions necessary to support their vast global presence and product development.

Acquisition and Integration Costs

Assa Abloy’s aggressive acquisition strategy means that costs related to buying and absorbing new businesses are a major part of its expenses. These costs can include everything from the initial legal and due diligence work to the expenses involved in restructuring and aligning acquired companies with Assa Abloy’s existing operations. For instance, in 2023, Assa Abloy completed 18 acquisitions, contributing to significant integration expenditures.

These acquisition and integration costs can temporarily affect the company’s profitability. For example, the integration process often involves consolidating IT systems, streamlining supply chains, and harmonizing administrative functions, all of which require upfront investment. The financial impact of these activities is typically reflected in short-term reductions in operating margins before the full benefits of the acquisition are realized.

- Acquisition-related expenses: Legal fees, advisory services, and due diligence for potential targets.

- Integration costs: IT system consolidation, rebranding, restructuring, and employee severance.

- Impact on margins: Temporary reduction in operating margins due to upfront integration investments.

- Strategic investment: These costs are viewed as necessary investments to fuel growth and market share expansion.

Supply Chain and Logistics Costs

Assa Abloy's extensive global operations, spanning over 70 countries and managing a diverse product portfolio, necessitate substantial investment in supply chain and logistics. These costs encompass everything from sourcing raw materials and components to warehousing and delivering finished goods to a vast customer base.

The complexities of international trade, including fluctuating tariffs and the need for robust supply chain mitigation strategies, add further layers of cost and management overhead. For instance, in 2024, global shipping costs saw significant volatility, impacting companies like Assa Abloy that rely heavily on international freight.

- Procurement: Costs associated with sourcing raw materials, components, and finished goods from a global network of suppliers.

- Inventory Management: Expenses related to holding and managing inventory across various locations to meet demand while minimizing holding costs.

- Transportation & Logistics: Significant outlays for freight, warehousing, distribution, and last-mile delivery services worldwide.

- Tariffs & Trade Compliance: Costs incurred due to import/export duties, customs fees, and navigating international trade regulations, including mitigation efforts.

Assa Abloy's cost structure is heavily influenced by manufacturing and production expenses, encompassing raw material procurement and skilled labor wages. The company actively optimizes these costs through initiatives like its Manufacturing Footprint Program to enhance efficiency. Selling, General, and Administrative (SG&A) costs are also significant, covering global sales teams, marketing, and the administrative overhead of its decentralized structure. In 2023, SG&A expenses reached SEK 28,814 million, reflecting substantial investment in global operations and market presence.

Acquisition-related expenses, including integration costs for the 18 acquisitions made in 2023, represent another major cost component. These are viewed as strategic investments to drive growth, despite potentially impacting short-term margins. Supply chain and logistics costs are also considerable, given Assa Abloy's extensive global operations and the complexities of international trade, including managing volatile shipping costs observed in 2024.

| Cost Category | 2023 Data (SEK millions) | Key Drivers |

|---|---|---|

| Manufacturing & Production | Not explicitly disclosed, but a significant portion of COGS | Raw materials, labor, factory overhead |

| Selling, General & Administrative (SG&A) | 28,814 | Sales force, marketing, global administration |

| Acquisition & Integration | Not explicitly disclosed, but substantial due to 18 acquisitions in 2023 | Due diligence, legal fees, IT consolidation, restructuring |

| Supply Chain & Logistics | Not explicitly disclosed, but significant due to global operations | Procurement, inventory, transportation, tariffs |

Revenue Streams

Assa Abloy's core revenue is driven by the sale of mechanical and electromechanical locks. This encompasses a broad spectrum of security solutions for homes, businesses, and various institutions, including essential door hardware.

In 2023, Assa Abloy reported a significant portion of its sales stemming from its extensive lock and hardware portfolio. For instance, the company's Entrance Systems division, which includes many of these product lines, saw substantial revenue contributions, highlighting the enduring demand for physical security products.

Assa Abloy's revenue streams are significantly boosted by sales of digital and smart access solutions. This includes a range of products like digital door locks, smart home access systems, and sophisticated electronic access control systems for commercial applications. The company has identified its electromechanical products and solutions as a key engine for growth within its overall portfolio.

In 2024, the demand for these connected and automated access technologies continued to climb, reflecting a broader trend in smart building and home automation. Assa Abloy's strategic focus on these innovative solutions is a direct contributor to its expanding market presence and financial performance.

Revenue for Assa Abloy's Entrance Automation segment is primarily generated through the sale and installation of a wide range of automatic doors. These systems cater to diverse commercial and industrial environments, from retail spaces to manufacturing facilities. This core revenue stream is supported by ongoing demand for secure and efficient access solutions.

While certain market segments experienced a slowdown in 2023, the pedestrian and perimeter security sectors within entrance automation have demonstrated robust growth. This resilience is attributed to increasing investments in safety and security measures across various industries, driving demand for advanced automated entry systems. For instance, the global automatic doors market was projected to reach $41.2 billion by 2024, indicating continued expansion.

Service and Maintenance Contracts

Assa Abloy's revenue increasingly stems from service and maintenance contracts. These recurring agreements cover ongoing support, system upgrades, and remote monitoring for their installed access and entrance systems, fostering predictable cash flows.

For instance, in 2023, Assa Abloy reported that its Service business segment, largely driven by these contracts, continued to show strong performance, contributing significantly to the group's overall profitability and stability.

- Recurring Revenue: Service and maintenance contracts provide a stable, predictable income stream, reducing reliance on one-off product sales.

- Customer Retention: These contracts foster long-term customer relationships, increasing loyalty and opportunities for upselling.

- Value-Added Services: Beyond basic maintenance, these offerings include advanced support, software updates, and performance monitoring, enhancing the customer experience.

- Growth Driver: The company actively expands its service offerings, recognizing it as a key avenue for future revenue growth and margin improvement.

Subscription-Based and Recurring Revenue Models

Assa Abloy is strategically shifting towards subscription-based and recurring revenue models, particularly through its expanding digital solutions. This includes offerings like mobile access, which allows users to unlock doors with their smartphones, and remote monitoring services for enhanced security and management. These digital services are designed to create a consistent revenue stream beyond initial product sales.

The company saw significant growth in this area, with sales of subscription-based solutions increasing by 18% in 2024. This strong performance underscores the success of Assa Abloy's focus on digital transformation and its ability to capture recurring revenue in the smart access and security markets.

- Subscription Revenue Growth: 18% increase in subscription-based solution sales in 2024.

- Key Digital Offerings: Mobile access and remote monitoring services are primary drivers of recurring revenue.

- Strategic Focus: Assa Abloy is prioritizing digital solutions to build a more stable and predictable revenue base.

Assa Abloy's revenue streams are diversified across physical security products, digital access solutions, and service contracts. The sale of mechanical and electromechanical locks, along with door hardware, forms a foundational part of its income. Growth is increasingly driven by smart and connected access technologies, including mobile access and electronic access control systems.

The Entrance Automation segment contributes significantly through automatic door sales and installations, with a notable resilience in pedestrian and perimeter security sectors. Furthermore, recurring revenue from service and maintenance contracts is a key focus, providing predictable cash flows and customer retention. Subscription-based digital services, such as remote monitoring, are experiencing substantial growth, with an 18% increase in sales in 2024, highlighting the company's successful digital transformation strategy.

| Revenue Stream | Key Products/Services | 2024 Data/Trend |

|---|---|---|

| Mechanical & Electromechanical Locks | Door locks, hardware, security solutions | Core revenue driver, stable demand |

| Digital & Smart Access | Smart locks, mobile access, electronic access control | Key growth engine, 18% subscription sales increase in 2024 |

| Entrance Automation | Automatic doors for commercial/industrial use | Robust growth in pedestrian/perimeter security sectors |

| Service & Maintenance | Support, upgrades, remote monitoring contracts | Strong performance, predictable cash flow, customer retention |

Business Model Canvas Data Sources

The Assa Abloy Business Model Canvas is informed by a blend of internal financial reports, comprehensive market research on the access solutions industry, and strategic insights derived from competitive analysis. This multi-faceted approach ensures each component of the canvas is grounded in verifiable data and current market realities.