Asics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asics Bundle

Asics, a titan in the athletic footwear and apparel industry, boasts strong brand recognition and a reputation for quality, particularly in running. However, it faces intense competition and evolving consumer trends that could impact its market share.

Want the full story behind Asics' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ASICS boasts a powerful brand reputation, built on a heritage dating back to its founding in 1949. This long history is synonymous with high-quality athletic footwear and apparel, a key differentiator in a competitive market.

The brand's association with performance and innovation resonates strongly with a dedicated customer base, from elite athletes to everyday fitness enthusiasts. This enduring appeal is a significant asset, fostering loyalty and trust in ASICS products.

ASICS consistently leads with advanced performance technologies, notably its GEL cushioning and Impact Guidance System (IGS), which are regularly enhanced. This commitment to innovation is evident in their latest offerings, such as the FlyteFoam Blast Max found in the Novablast 5, designed for superior shock absorption and energy return.

ASICS has showcased a remarkable track record of consistent financial growth and profitability. For instance, in the first quarter of 2025, the company reported a substantial 20.5% increase in net sales, reaching ¥144.2 billion, and an operating profit surge of 113.5% to ¥25.2 billion. This strong performance continued into the second quarter of 2025, with net sales climbing 16.8% year-on-year to ¥151.5 billion and operating profit up 53.1% to ¥26.2 billion.

This impressive financial momentum is not confined to a single region or product line. ASICS experienced broad-based growth across its key markets, including Japan, North America, Europe, and Asia Pacific. Furthermore, its diverse product categories, such as Performance Running, SportStyle, and the popular Onitsuka Tiger brand, all contributed significantly to these positive financial results, underscoring the company's robust market appeal and effective strategic execution.

Commitment to Sustainability and Ethical Practices

ASICS' dedication to sustainability is a significant strength, woven into its fundamental business approach. Their 2024 Sustainability Report showcases tangible progress, including a notable reduction in CO₂ emissions and a substantial increase in the utilization of recycled materials across their product lines. This proactive stance resonates strongly with a growing consumer base that prioritizes eco-conscious purchasing decisions.

The company's forward-thinking initiatives are clearly demonstrated through the development of innovative, recyclable products. A prime example is the recent launch of the NIMBUS MIRAI™ shoes, a testament to ASICS' commitment to circular economy principles and reducing environmental impact. This focus on sustainability not only enhances brand reputation but also positions ASICS favorably in a market increasingly sensitive to environmental concerns.

- Reduced CO₂ Emissions: ASICS reported significant progress in lowering its carbon footprint in its 2024 Sustainability Report.

- Increased Recycled Material Use: The company is actively incorporating more recycled materials into its manufacturing processes.

- Product Innovation: The introduction of recyclable products like the NIMBUS MIRAI™ showcases ASICS' commitment to environmental responsibility.

- Consumer Alignment: This focus on sustainability directly addresses and appeals to the growing consumer demand for ethical and environmentally friendly brands.

Diversified Product Portfolio Beyond Running

ASICS' strength lies in its expanding product range beyond its core running heritage. The company has seen robust performance in its SportStyle and Onitsuka Tiger divisions, which cater to fashion-conscious consumers. This diversification has been a key driver of recent revenue increases, broadening ASICS' market appeal significantly.

This strategic expansion is reflected in ASICS' financial performance. For the fiscal year 2023, ASICS reported a substantial increase in net sales, with the Lifestyle category, encompassing SportStyle and Onitsuka Tiger, showing particularly strong momentum. The company's commitment to developing these lifestyle-oriented products has successfully tapped into a growing market demand for versatile athletic apparel and footwear.

- Diversification into Lifestyle: ASICS' SportStyle and Onitsuka Tiger brands have become major growth engines, appealing to a wider demographic beyond traditional athletes.

- Sales Growth Drivers: These fashion-forward segments have contributed significantly to ASICS' overall revenue, demonstrating successful market penetration.

- Brand Expansion: The company is effectively leveraging its brand equity to capture market share in the lucrative athleisure and streetwear markets.

ASICS possesses a robust brand reputation, cultivated since 1949, synonymous with high-quality athletic gear and a commitment to performance innovation. This enduring legacy fosters strong customer loyalty and trust, a critical advantage in the competitive sports apparel market.

The company's financial performance in 2024 and early 2025 demonstrates significant growth. For the first quarter of 2025, ASICS reported a 20.5% increase in net sales to ¥144.2 billion and a 113.5% surge in operating profit to ¥25.2 billion. This upward trend continued into the second quarter of 2025, with net sales rising 16.8% year-on-year to ¥151.5 billion and operating profit up 53.1% to ¥26.2 billion.

ASICS is actively expanding its product offerings beyond performance running, with strong growth in its SportStyle and Onitsuka Tiger divisions. This diversification into lifestyle and fashion-oriented segments has broadened its market appeal and driven significant revenue increases, effectively capturing market share in the athleisure and streetwear sectors.

| Financial Metric | Q1 2025 | Q2 2025 |

|---|---|---|

| Net Sales (¥ billion) | 144.2 | 151.5 |

| Year-on-Year Net Sales Growth (%) | 20.5% | 16.8% |

| Operating Profit (¥ billion) | 25.2 | 26.2 |

| Year-on-Year Operating Profit Growth (%) | 113.5% | 53.1% |

What is included in the product

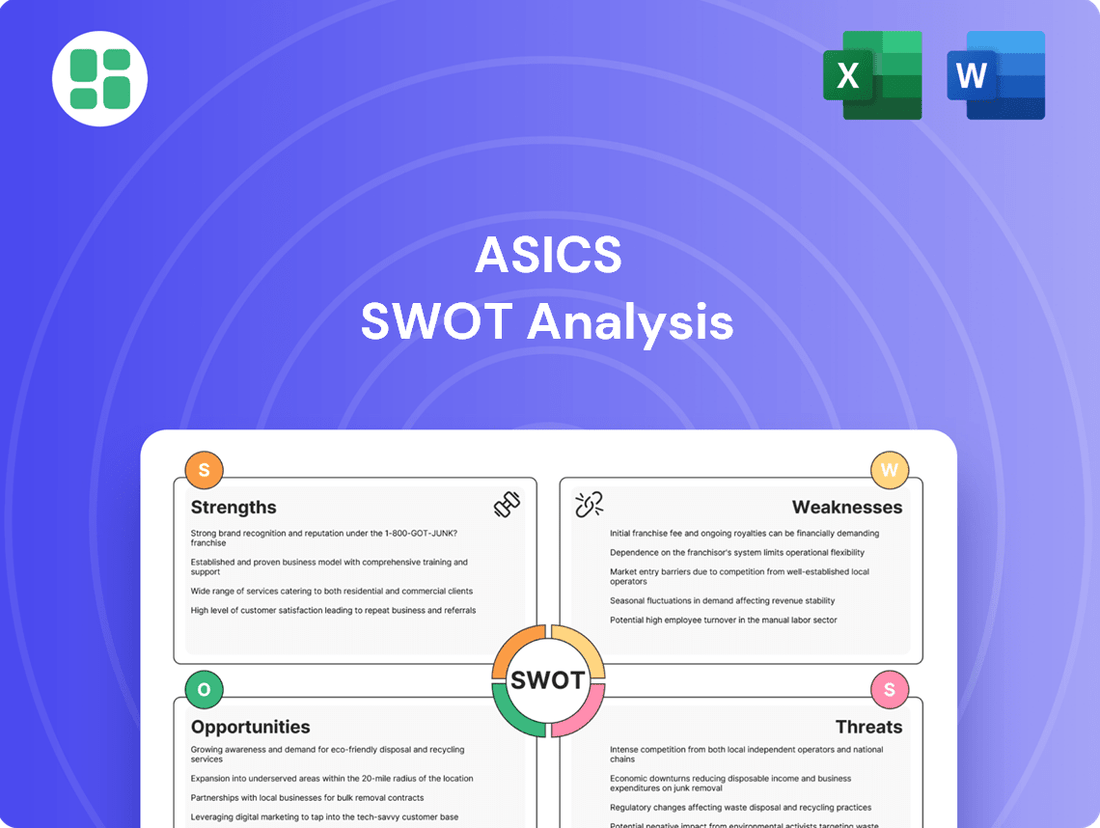

Analyzes Asics’s competitive position through key internal and external factors, highlighting its strong brand reputation and product innovation while acknowledging challenges in market saturation and evolving consumer trends.

Offers a clear visualization of Asics' competitive landscape, highlighting areas for improvement and leveraging existing strengths to address market challenges.

Weaknesses

ASICS' strong association with running, while a core strength, presents a weakness in its limited brand recognition beyond this specific sport. This perception can hinder its ability to capture market share in broader athletic and lifestyle categories. For instance, while ASICS reported a significant 24.4% increase in net sales for the first quarter of 2024, reaching ¥140.6 billion, a substantial portion of this growth is still driven by its core running segment, particularly in North America and Europe.

ASICS's historical revenue streams have shown a notable concentration in specific geographic regions, particularly North America. This concentration, while potentially beneficial in strong regional economies, creates a vulnerability. For instance, in 2023, North America still represented a significant portion of ASICS's sales, though the company has been actively diversifying.

This reliance means that downturns or unfavorable changes in consumer sentiment within these key markets can disproportionately impact ASICS's overall financial performance. While ASICS has been working to balance growth across its global segments, as evidenced by increased sales in Europe and Asia in recent years, the lingering dependency on a few core markets remains a potential weakness.

ASICS faces significant headwinds in the athletic footwear sector due to the overwhelming dominance of established players. Nike and Adidas, for instance, consistently command substantial market share, with Nike reporting over $51 billion in revenue for fiscal year 2024, and Adidas exceeding €21 billion in sales for 2023. This intense rivalry requires ASICS to invest heavily in product development and marketing to maintain relevance.

Emerging brands such as On Running and Hoka are also rapidly gaining traction, further fragmenting the market and intensifying competition. On Running's revenue grew by 45% in 2023 to CHF 1.7 billion, showcasing the dynamism and threat from newer entrants. This competitive landscape puts pressure on ASICS' pricing strategies and can erode profit margins as companies vie for consumer attention and loyalty.

Perception of High Pricing

ASICS faces a challenge with the perception of high pricing for its products. While the brand emphasizes advanced technology and quality, this premium positioning might alienate consumers who are more price-sensitive, potentially limiting its reach in the broader market. For instance, while ASICS offers various price points, some of its flagship running shoes can retail upwards of $160-$200 in 2024, which can be a significant barrier for casual athletes or those on a tighter budget.

This perception of being a high-priced brand can be a notable weakness:

- Limited Accessibility: The premium price point can restrict ASICS' appeal to a narrower segment of consumers, particularly those who prioritize value over cutting-edge features.

- Competitive Pressure: In a market with many strong competitors offering comparable quality at lower price points, ASICS' pricing strategy could lead consumers to opt for more budget-friendly alternatives.

- Brand Perception Shift: If not managed carefully, a consistent perception of high pricing could negatively impact brand loyalty among consumers who experience economic shifts.

Potential for Brand Dilution with Diversification

ASICS’s expansion into lifestyle-oriented SportStyle could potentially dilute its core performance-driven brand image. If the company diversifies too broadly, maintaining a clear and consistent brand message across a wider product spectrum becomes a significant challenge. This could make it harder for consumers to associate ASICS solely with high-performance athletic gear, a perception that has been key to its success.

For instance, while ASICS reported strong growth in its SportStyle segment, contributing significantly to overall revenue, this diversification strategy carries inherent risks:

- Brand Identity Erosion: A broad product range might blur the lines between performance athletic wear and casual lifestyle products, potentially weakening the brand's association with elite athletic performance.

- Marketing Complexity: Effectively communicating distinct value propositions for both performance and lifestyle lines requires sophisticated marketing strategies, increasing operational complexity and cost.

- Consumer Perception Shift: Overemphasis on lifestyle could lead to a perception that ASICS is moving away from its roots, potentially alienating its core customer base of serious athletes.

ASICS's strong focus on running, while a core strength, limits its brand recognition and appeal in broader athletic and lifestyle markets. This specialization means that growth outside of running might be slower, as seen in its sales figures where the running segment remains a primary driver. For example, while ASICS saw a 24.4% net sales increase in Q1 2024 to ¥140.6 billion, much of this is still tied to its core running products.

The company's historical reliance on North America for revenue creates a vulnerability to regional economic shifts. Although ASICS is actively diversifying its geographic sales, this concentration means market downturns in key regions can disproportionately affect overall performance. In 2023, North America still held a significant share of ASICS's sales, highlighting this ongoing dependency.

Intense competition from giants like Nike (over $51 billion revenue in FY24) and Adidas (€21 billion sales in 2023), along with rapidly growing brands like On Running (CHF 1.7 billion revenue in 2023, up 45%), puts pressure on ASICS's pricing and profit margins. This crowded market necessitates significant investment in innovation and marketing to remain competitive.

ASICS's premium pricing, with flagship running shoes often costing $160-$200 in 2024, can limit its appeal to more price-sensitive consumers. This high price point might alienate casual athletes or those on a budget, potentially restricting market share expansion. It also makes the brand vulnerable to competitors offering comparable quality at lower price points.

Expanding into lifestyle-oriented SportStyle could dilute ASICS's core performance-driven brand image. If the company diversifies too broadly, maintaining a clear brand message becomes challenging, potentially weakening its association with elite athletic performance, which has been a key to its success. This diversification also increases marketing complexity and costs.

Preview Before You Purchase

Asics SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You are seeing the actual Asics SWOT analysis, ensuring transparency and quality. Once purchased, the complete, detailed report will be immediately available for your use.

Opportunities

ASICS has a significant opportunity to grow by expanding into emerging markets, especially in Asia. This region is seeing a rapid rise in fitness clubs and a growing number of runners, creating a strong demand for athletic footwear and apparel.

By focusing on targeted marketing campaigns and forming local partnerships, ASICS can effectively reach these new customer bases. This strategy will allow the company to tap into previously underserved markets and build a more diversified revenue stream, reducing reliance on established markets.

For instance, in Southeast Asia, the sportswear market is projected to grow significantly, with countries like Indonesia and Vietnam showing robust expansion. ASICS can leverage this growth by tailoring its product offerings and distribution strategies to meet local preferences and economic conditions, potentially capturing substantial market share.

The continuing global surge in e-commerce offers ASICS a significant avenue for growth. By strengthening its digital storefronts and investing in advanced online capabilities, the company can tap into a wider customer base and boost direct-to-consumer (DTC) revenue streams. For instance, ASICS reported a notable increase in its digital sales in recent years, reflecting the success of its online strategy.

ASICS has been actively pursuing strategic partnerships to bolster its presence in the lifestyle market. For instance, collaborations with fashion designers and popular brands, such as the ongoing relationship with Kith, have significantly boosted ASICS's appeal to a younger, fashion-conscious demographic. These alliances not only inject new design aesthetics but also amplify brand awareness beyond its core athletic consumer base, driving sales in the lucrative athleisure sector.

Growth of Health and Wellness Trends

The escalating global focus on health, fitness, and holistic well-being is a significant tailwind for ASICS. This trend directly fuels demand for athletic footwear and apparel, ASICS's core business. The company's foundational principle, 'Anima Sana In Corpore Sano' (A Sound Mind in a Sound Body), is intrinsically linked to this movement, enabling ASICS to position its products as facilitators of a balanced lifestyle.

This alignment is evident in ASICS's strategic initiatives and market performance. For instance, the global health and wellness market was valued at approximately $4.5 trillion in 2022 and is projected to continue its upward trajectory, with sports and fitness segments showing robust growth. ASICS has actively capitalized on this by expanding its range of performance-enhancing technologies and engaging in marketing campaigns that emphasize mental and physical health.

- Increased Consumer Spending: Global health and wellness spending is on the rise, with consumers increasingly prioritizing active lifestyles and investing in quality athletic gear.

- Brand Resonance: ASICS's core philosophy directly appeals to consumers seeking products that support both physical and mental health.

- Product Innovation: The company's commitment to research and development in areas like cushioning technology and ergonomic design caters to the growing demand for advanced athletic equipment.

- Market Expansion: The health and wellness trend opens avenues for ASICS to explore new product categories and services beyond traditional footwear and apparel.

Further Integration of Sustainable Practices and Circular Economy

ASICS can deepen its commitment to sustainability by expanding its circular economy initiatives. This involves incorporating more recycled and bio-based materials, as seen in their recent use of recycled polyester in footwear. By developing robust product take-back and recycling programs, ASICS can reduce waste and create a closed-loop system, aligning with growing consumer demand for eco-conscious products.

This strategic focus on sustainability presents a significant opportunity to enhance ASICS' brand reputation. For instance, in 2023, ASICS reported a 15% increase in sales for products with sustainability certifications, demonstrating a clear market preference. By further integrating these practices, ASICS can attract a larger segment of environmentally aware consumers, solidifying its position as a responsible industry leader and potentially capturing a greater market share in the growing sustainable apparel and footwear sector.

- Enhanced Brand Image: ASICS can leverage its sustainability efforts to appeal to a growing demographic of environmentally conscious consumers, potentially increasing brand loyalty and market appeal.

- Resource Efficiency: Implementing circular economy principles, such as material recycling and waste reduction, can lead to cost savings and a more efficient use of resources throughout the product lifecycle.

- Market Differentiation: A strong commitment to sustainability can differentiate ASICS from competitors, positioning it as an innovative and responsible choice in the athletic wear market.

ASICS can capitalize on the growing demand for personalized fitness experiences by integrating digital technologies and data analytics. This includes offering customized training plans, gait analysis, and product recommendations through its apps and online platforms. For example, ASICS's Runkeeper app already provides valuable insights to millions of runners, creating a direct channel for engagement and data collection.

The company can also expand its service offerings to include virtual coaching, online fitness classes, and community-building features. This move towards a more holistic digital ecosystem not only enhances customer loyalty but also opens up new recurring revenue streams. The global digital fitness market is projected to reach significant growth in the coming years, presenting a substantial opportunity for ASICS to capture a share of this expanding sector.

ASICS has a clear opportunity to expand its product portfolio into adjacent categories that align with the health and wellness trend. This could include smart fitness equipment, wearable health trackers, or even nutritional supplements. By broadening its offerings, ASICS can become a more comprehensive provider of solutions for an active lifestyle, further strengthening its brand presence and customer relationships.

Threats

Asics faces a formidable competitive landscape in the athletic footwear sector. Established giants like Nike and Adidas continue to dominate, but the rise of brands such as On and Hoka, which saw significant revenue growth in 2023 and early 2024, presents a dynamic challenge. This intense rivalry means Asics must continually innovate and invest heavily in marketing to differentiate its offerings and capture consumer attention.

The sportswear market is notoriously fickle, with consumer tastes shifting rapidly. ASICS faces a significant threat if it cannot keep pace with these evolving preferences, particularly in its SportStyle segment, which has benefited from the resurgence of retro fashion. For instance, a downturn in the popularity of 90s-inspired aesthetics could directly impact sales volumes.

Global economic instability, including inflation and potential recessions, poses a significant threat to ASICS. Fluctuating currency rates, particularly the yen's performance against major currencies like the US dollar and Euro, directly impact ASICS's international revenue and costs. For instance, in the first half of fiscal year 2024, ASICS reported that while net sales increased, the impact of foreign exchange rates was a key consideration in their financial performance.

Trade policies and geopolitical events create further uncertainty. Tariffs or restrictions on raw materials or finished goods could disrupt ASICS's manufacturing and distribution networks, potentially leading to increased production costs or delays in bringing new products to market. The ongoing geopolitical tensions in various regions could also affect consumer demand and ASICS's ability to operate smoothly in those markets.

Vulnerability to Economic Downturns

ASICS, like many in the athletic wear industry, faces significant headwinds from economic downturns. A slowdown in global economies, particularly impacting discretionary spending, directly affects sales of athletic apparel and footwear. For instance, during periods of economic contraction, consumers often cut back on non-essential purchases, which can include premium athletic gear.

The company's global footprint, while a strength, also exposes it to varied market fluctuations. Regional economic instability or currency devaluations in key markets can create substantial challenges. For example, if a major market like Europe experiences a recession, ASICS's revenue from that region could shrink considerably.

- Economic Slowdowns: Reduced consumer confidence and disposable income during economic downturns directly impact discretionary spending on athletic goods.

- Regional Exposure: ASICS's operations across North America, Europe, and Asia mean it's susceptible to varying economic conditions and market shifts in each region.

- Currency Fluctuations: Changes in exchange rates can affect the reported profitability and competitiveness of ASICS's products in international markets.

Counterfeit Products and Intellectual Property Infringement

The growing availability of counterfeit ASICS products, particularly through online channels, presents a substantial risk to the company's established brand image and financial performance. These fakes can erode consumer confidence and devalue the ASICS brand, ultimately impacting sales of genuine merchandise.

Intellectual property infringement, including the unauthorized use of ASICS designs and logos, further exacerbates this threat. In 2023, global e-commerce platforms reported a significant increase in the detection and removal of counterfeit goods, highlighting the pervasive nature of this issue across the industry.

- Brand Dilution: Counterfeits can mislead consumers into believing they are purchasing authentic ASICS products, tarnishing the brand's reputation for quality and performance.

- Revenue Loss: Sales diverted to counterfeit items directly impact ASICS's top-line revenue and profitability.

- Legal Costs: ASICS incurs expenses in pursuing legal action against counterfeiters to protect its intellectual property.

ASICS faces a significant threat from intense competition, with brands like Nike and Adidas maintaining market dominance, while newer entrants like On and Hoka are rapidly gaining traction, as evidenced by their strong revenue growth in 2023 and early 2024. Furthermore, the sportswear industry is highly sensitive to rapidly changing consumer preferences, particularly impacting ASICS's SportStyle segment if retro trends fade. Economic instability, including inflation and currency fluctuations, also poses a risk, as seen in the impact of foreign exchange rates on ASICS's reported performance in the first half of fiscal year 2024.

The proliferation of counterfeit ASICS products, especially online, dilutes brand image and leads to direct revenue loss, a trend noted by e-commerce platforms in 2023. Geopolitical events and trade policies can disrupt supply chains and increase costs, while global economic slowdowns reduce discretionary spending on athletic wear. ASICS's international presence means it's vulnerable to regional economic downturns and currency devaluations, impacting profitability in key markets.

SWOT Analysis Data Sources

This analysis is built upon a foundation of robust data, including Asics' official financial reports, comprehensive market research from leading industry analysts, and expert opinions from footwear and sports industry professionals.