Asics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asics Bundle

Discover the strategic engine driving Asics's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how Asics connects with athletes, innovates its product lines, and builds strong customer relationships to maintain its competitive edge.

Unlock the full strategic blueprint behind Asics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

ASICS actively partners with technology providers and research bodies to infuse its footwear with advanced materials and biomechanical data. These collaborations are vital for creating sophisticated cushioning, such as their renowned GEL technology, and the Impact Guidance System (IGS), both designed to boost athletic performance and minimize injury potential.

ASICS leverages a vast network of third-party retailers, encompassing specialty sports shops, major sporting goods chains, and department stores. This strategy is crucial for achieving extensive market penetration and making their products accessible to a broad consumer base.

Despite a strategic pivot towards a direct-to-consumer (D2C) model, ASICS continues to rely heavily on its wholesale channels for global product distribution. In 2023, wholesale revenue still represented a substantial portion of their overall sales, underscoring its ongoing importance.

ASICS leverages key partnerships with professional athletes and sports organizations to bolster its brand image and market reach. Endorsements with elite athletes like tennis star Novak Djokovic and prominent figures in running, volleyball, and wrestling significantly boost ASICS' visibility and establish its credibility as a performance-focused brand.

Collaborations extend beyond individual athletes to encompass sports teams and event organizers. These partnerships reinforce ASICS' identity within the athletic community and actively promote active lifestyles. For instance, ASICS' commitment to supporting athletes contributed to its strong performance in 2024, with the brand reporting a 12.5% increase in net sales for the first quarter of 2024 compared to the same period in 2023, reaching ¥130.7 billion.

Sustainability and Environmental Organizations

ASICS collaborates with environmental organizations like One Tree Planted to bolster its sustainability efforts. This partnership underpins initiatives such as the 'Run for Reforestation Challenge,' directly contributing to ASICS' goal of enhancing recycled material content in its products. These alliances are crucial for ASICS' vision of a 'Sound Earth' that supports active lifestyles.

These key partnerships are instrumental in ASICS' commitment to environmental stewardship.

- One Tree Planted Collaboration: ASICS partnered with One Tree Planted for its 'Run for Reforestation Challenge,' aiming to plant trees for every kilometer run by participants.

- Recycled Materials Focus: These collaborations support ASICS' target to increase the use of recycled materials in its footwear and apparel, aligning with circular economy principles.

- 'Sound Earth' Vision: The alliances reinforce ASICS' core value of contributing to a healthy planet, essential for enabling movement and active living for future generations.

Logistics and Supply Chain Partners

Asics relies heavily on its key partnerships with manufacturers and logistics providers to ensure efficient production and timely global distribution. These collaborations are fundamental to managing inventory effectively and getting products to consumers worldwide. For instance, in 2024, Asics continued to strengthen its relationships with key manufacturing partners in Asia, aiming to optimize production cycles and maintain high-quality standards.

Maintaining a robust and sustainable supply chain is paramount for Asics to meet its environmental targets while delivering products to market. The company's commitment to sustainability means working closely with partners who share these values, focusing on reducing carbon emissions and waste throughout the logistics process. Asics has been actively exploring more eco-friendly transportation methods, such as increased use of sea freight over air freight for certain regions in 2024, contributing to a reduction in its overall carbon footprint.

- Manufacturing Partners: Collaborations with factories in Vietnam and Indonesia are crucial for Asics' production capacity, with these regions accounting for a significant portion of its footwear and apparel manufacturing.

- Logistics Providers: Partnerships with global logistics companies like DHL and FedEx are essential for efficient warehousing, transportation, and last-mile delivery across diverse markets.

- Sustainability Focus: Asics is increasingly partnering with logistics providers committed to reducing environmental impact, such as those investing in electric vehicles and optimizing shipping routes to minimize emissions.

- Inventory Management: These partnerships enable Asics to implement advanced inventory management systems, ensuring optimal stock levels and reducing the risk of stockouts or excess inventory globally.

ASICS' strategic alliances with technology developers and research institutions are foundational to its innovation pipeline. These partnerships enable the integration of cutting-edge materials and biomechanical insights into footwear, such as the advanced cushioning systems that define ASICS' performance offerings.

The company's extensive retail network, comprising specialty stores and major sporting goods outlets, is a critical component of its distribution strategy. This widespread presence ensures broad consumer access to ASICS products, a crucial element for maintaining market share, even as the brand expands its direct-to-consumer channels.

ASICS also cultivates vital relationships with professional athletes and sports organizations. These collaborations, including endorsements with prominent figures and team sponsorships, significantly enhance brand visibility and reinforce ASICS' reputation for athletic performance and quality.

Furthermore, ASICS collaborates with environmental organizations, such as One Tree Planted, to advance its sustainability objectives. These partnerships underscore ASICS' commitment to a 'Sound Earth' by supporting initiatives that promote reforestation and increase the use of recycled materials in its product lines.

ASICS' operational efficiency is heavily reliant on its partnerships with manufacturers and logistics providers. These collaborations are essential for maintaining robust production capabilities and ensuring timely global product delivery. For instance, ASICS continued to optimize its supply chain in 2024 by strengthening relationships with key Asian manufacturing partners to improve production cycles and quality control.

The company's commitment to sustainability extends to its logistics partnerships, with a focus on reducing environmental impact. In 2024, ASICS explored more eco-friendly shipping methods, such as increasing sea freight usage, to lower its carbon footprint.

| Key Partnership Type | Description | Strategic Importance | Example/Data Point |

| Technology & Research | Collaborations with tech firms and research bodies | Drives product innovation (e.g., advanced cushioning) | GEL technology, Impact Guidance System (IGS) |

| Retail Distribution | Network of third-party retailers | Ensures broad market penetration and accessibility | Specialty sports shops, major sporting goods chains |

| Athlete & Organization Endorsements | Partnerships with professional athletes and sports teams | Boosts brand image, credibility, and market reach | Novak Djokovic; 12.5% net sales increase Q1 2024 |

| Sustainability Initiatives | Alliances with environmental organizations | Supports 'Sound Earth' vision and recycled material goals | One Tree Planted, 'Run for Reforestation Challenge' |

| Manufacturing & Logistics | Partnerships with factories and shipping companies | Ensures efficient production and global distribution | Optimizing production in Vietnam/Indonesia; exploring eco-friendly transport in 2024 |

What is included in the product

A detailed Asics Business Model Canvas outlining its strategy for athletic footwear and apparel, focusing on innovation and performance-driven value propositions for athletes and active consumers.

This canvas details Asics' customer segments, channels, and key resources, emphasizing its commitment to quality and technological advancement in the sports industry.

The Asics Business Model Canvas provides a structured framework that helps identify and address customer pains by clearly defining value propositions and customer segments.

It offers a clear visual representation of how Asics solves customer problems, making it easier to communicate and refine their pain-relieving strategies.

Activities

ASICS dedicates substantial resources to Research and Development, a cornerstone of its strategy for creating cutting-edge athletic gear. This investment fuels innovation in areas like biomechanics and material science, leading to performance-enhancing technologies.

The company's commitment is evident in its proprietary systems, such as the renowned GEL cushioning technology and the Intelligent Guidance System (IGS), which are developed through rigorous R&D. For instance, ASICS reported R&D expenses of approximately 35.7 billion Japanese Yen in 2023, highlighting its focus on technological advancement.

Asics' product design and manufacturing is centered on creating high-performance athletic footwear, apparel, and accessories. This core activity ensures every item meets stringent durability and performance benchmarks, a commitment reflected in their substantial investment in research and development.

In 2024, Asics continued to emphasize innovation in materials and construction, aiming to enhance athlete experience and product longevity. This focus on quality manufacturing is crucial for maintaining their brand reputation in a competitive market, with a significant portion of their operational budget dedicated to these processes.

ASICS leverages global marketing campaigns, featuring prominent athlete endorsements, to solidify its brand identity and resonate with its core audience. In 2024, ASICS continued to invest heavily in digital platforms and experiential marketing to promote its 'Sound Mind, Sound Body' philosophy, aiming to foster deeper connections with consumers.

These initiatives are crucial for ASICS's brand building, driving recognition and loyalty. The company's commitment to community engagement, through various local and global events, further enhances its brand image and reinforces its core values.

Supply Chain Management and Distribution

ASICS navigates a complex global supply chain, encompassing everything from sourcing high-performance materials to manufacturing footwear and apparel, and finally distributing these products worldwide. This intricate network is crucial for meeting demand efficiently.

Optimizing logistics is a core activity, ensuring timely and cost-effective delivery to ASICS' extensive network of wholesale partners and its growing direct-to-consumer channels. This focus on efficient distribution directly impacts customer satisfaction and sales.

- Global Sourcing: ASICS secures raw materials and components from various international suppliers to maintain product quality and manage costs.

- Manufacturing Operations: The company operates and partners with manufacturing facilities across Asia, focusing on efficient production processes.

- Logistics & Warehousing: ASICS manages a network of warehouses and distribution centers globally to store and dispatch finished goods.

- Distribution Channels: Products are distributed through wholesale agreements with retailers and directly to consumers via e-commerce platforms and brand stores.

In 2024, ASICS continued to invest in supply chain resilience and digital transformation, aiming to improve visibility and responsiveness. For instance, the company has been enhancing its inventory management systems to better align supply with fluctuating consumer demand, a critical factor in the competitive sportswear market.

Direct-to-Consumer (D2C) Sales and E-commerce Management

ASICS is heavily invested in its direct-to-consumer (D2C) sales and e-commerce management. This strategy involves operating their own physical retail locations and robust online platforms to foster direct relationships with customers.

Key activities include enhancing the digital shopping journey and cultivating customer loyalty through programs like OneASICS. This direct engagement allows ASICS to gather valuable feedback and personalize offerings.

- Direct Sales Growth: ASICS reported that its D2C channel achieved a significant increase in sales, contributing substantially to its overall revenue.

- E-commerce Investment: The company continues to invest in its e-commerce infrastructure, aiming to provide a seamless and engaging online experience for consumers worldwide.

- Loyalty Program Expansion: The OneASICS loyalty program is central to building lasting customer relationships, offering exclusive benefits and personalized communications.

- Customer Engagement: ASICS prioritizes direct customer interaction through its digital platforms, enabling better understanding of consumer needs and preferences.

ASICS's key activities revolve around innovation and product excellence, supported by robust marketing and efficient operations. The company's commitment to R&D fuels the creation of advanced technologies, while meticulous product design and manufacturing ensure high performance and durability. Global marketing campaigns, including athlete endorsements and digital engagement, build brand strength, and a sophisticated supply chain ensures products reach consumers effectively. Finally, ASICS prioritizes direct-to-consumer sales and e-commerce, fostering stronger customer relationships and gathering valuable insights.

In 2024, ASICS continued its strategic focus on enhancing its innovation pipeline and expanding its direct-to-consumer channels. The company's investment in R&D aims to deliver next-generation performance gear, while its marketing efforts emphasize the 'Sound Mind, Sound Body' philosophy. Supply chain optimization remains critical, with a focus on digital transformation for improved responsiveness.

| Key Activity | Description | 2023 Data/Focus | 2024 Focus |

|---|---|---|---|

| Research & Development | Innovation in biomechanics, material science, and proprietary technologies. | 35.7 billion JPY in R&D expenses. | Continued investment in next-gen performance technologies. |

| Product Design & Manufacturing | Creating high-performance athletic gear with stringent quality benchmarks. | Emphasis on durability and performance in all products. | Enhancing athlete experience through material and construction advancements. |

| Marketing & Brand Building | Global campaigns, athlete endorsements, digital and experiential marketing. | Promoting 'Sound Mind, Sound Body' philosophy. | Deeper consumer connections via digital platforms and experiential marketing. |

| Supply Chain Management | Global sourcing, efficient manufacturing, logistics, and distribution. | Improving supply chain resilience and digital visibility. | Enhancing inventory management for better demand alignment. |

| Direct-to-Consumer (D2C) & E-commerce | Operating retail stores and online platforms for direct customer engagement. | Significant D2C sales growth; investment in e-commerce infrastructure. | Expanding loyalty programs and personalizing customer experiences. |

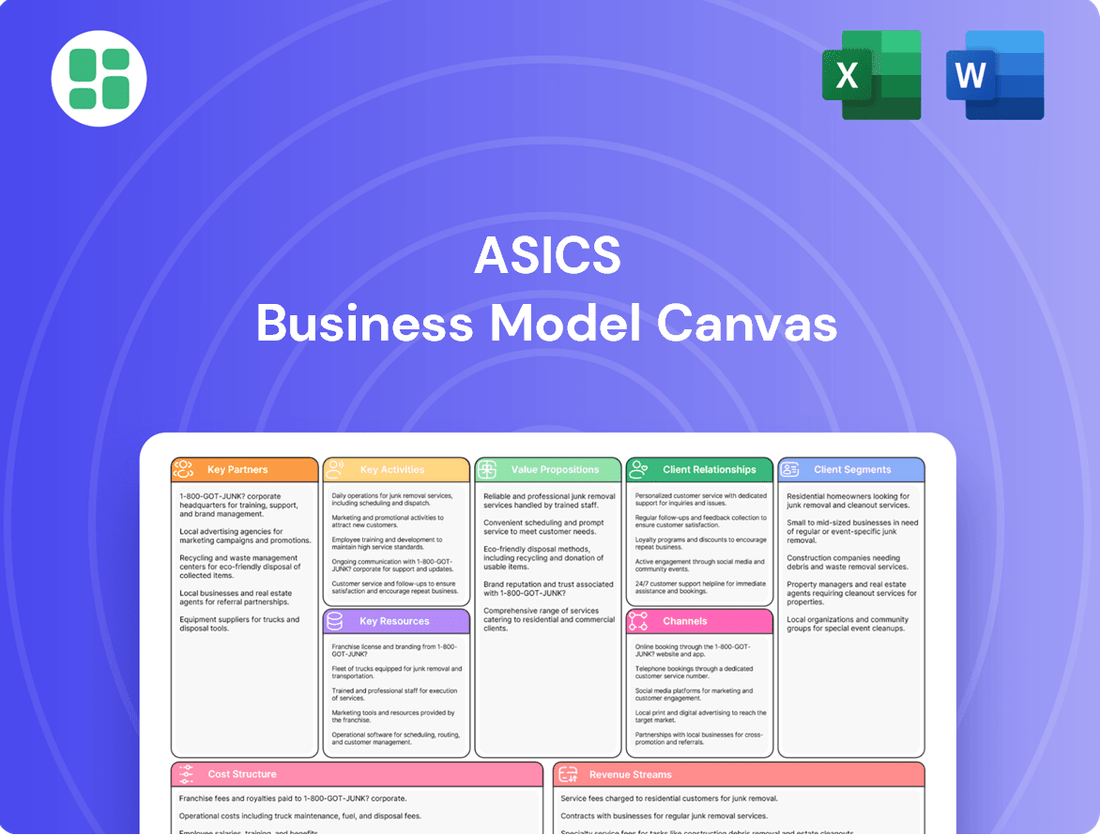

Delivered as Displayed

Business Model Canvas

This preview offers a direct glimpse into the Asics Business Model Canvas you will receive. It is not a mockup, but an authentic section of the complete document. Upon purchase, you will gain full access to this exact, professionally structured canvas, ready for your strategic analysis and planning.

Resources

ASICS boasts a robust intellectual property portfolio, featuring numerous patents that protect its core technologies. This legal shield is crucial for maintaining its market position and deterring competitors from replicating its innovations.

Proprietary technologies like the signature GEL cushioning system and the Impact Guidance System (IGS) are central to ASICS' performance-enhancing product lines. These innovations are not just product features; they are the technological bedrock of the brand's athletic credibility and appeal.

In 2023, ASICS continued to invest in R&D, with research and development expenses totaling approximately ¥34.5 billion (around $230 million USD based on average 2023 exchange rates). This investment underscores their commitment to developing and protecting new proprietary technologies.

The ASICS brand is a significant asset, deeply ingrained with its 'Sound Mind, Sound Body' philosophy. This resonates strongly with consumers, fostering a reputation for unwavering quality and peak performance, particularly within the competitive running community.

This established brand equity acts as a powerful magnet, drawing in new customers and fostering loyalty among existing ones. In 2023, ASICS reported a 19.7% increase in net sales, reaching ¥620.1 billion, a testament to the strength of its brand and product appeal.

ASICS' human capital is a cornerstone, featuring a dedicated team of sports scientists, innovative product designers, and skilled engineers. This expertise is crucial for developing cutting-edge footwear and apparel that meets the rigorous demands of athletes. For instance, ASICS invested heavily in R&D, with a significant portion of their workforce dedicated to innovation, driving the creation of technologies like GEL and FLYTEFOAM.

Furthermore, ASICS leverages a robust network of professional athletes and brand ambassadors. These individuals not only provide invaluable feedback for product refinement but also serve as authentic brand representatives, showcasing the performance capabilities of ASICS products in real-world competitive environments. This athlete endorsement strategy is vital for building credibility and connecting with the target market.

Global Manufacturing and Distribution Network

ASICS operates a robust global manufacturing and distribution network, crucial for its multi-tiered business model. This extensive infrastructure underpins their ability to produce and deliver a wide range of athletic footwear and apparel efficiently across the globe.

This network allows for strategic sourcing of materials and manufacturing close to key markets, enhancing responsiveness to consumer demand. For instance, ASICS has manufacturing facilities in Asia, including Vietnam and Indonesia, which are key hubs for production. Their distribution centers are strategically located in major regions like North America, Europe, and Asia-Pacific to ensure timely delivery to retailers and end consumers.

- Global Manufacturing Footprint: ASICS maintains manufacturing facilities across various countries, optimizing production costs and supply chain logistics.

- Extensive Distribution Network: The company leverages a widespread network of distribution centers and logistics partners to reach customers worldwide.

- Supply Chain Efficiency: This integrated network is designed for efficiency, enabling ASICS to manage inventory and fulfill orders effectively, supporting their direct-to-consumer and wholesale channels.

- Market Responsiveness: The global presence allows ASICS to adapt to regional market trends and demands, ensuring product availability and timely launches.

Financial Capital

Asics' robust financial performance, highlighted by record sales and profits in 2024, serves as its primary financial capital. This strong financial footing enables significant investments in research and development, crucial for maintaining its competitive edge in the athletic footwear and apparel market. For instance, in 2024, Asics reported a substantial increase in operating income, allowing for expanded marketing campaigns and strategic global expansion initiatives.

This financial strength directly fuels Asics' ability to undertake future growth projects. The capital generated supports everything from product innovation to enhancing supply chain efficiency.

- Record 2024 Sales: Asics achieved record-breaking sales figures in 2024, demonstrating strong market demand and effective sales strategies.

- Profitability Boost: The company reported significant profit growth in 2024, providing ample financial resources for reinvestment.

- R&D Investment: A portion of this capital is allocated to advanced research and development, ensuring continuous product improvement and innovation.

- Strategic Expansion Funding: Financial capital supports Asics' ongoing efforts to expand its market presence and explore new strategic opportunities globally.

ASICS' key resources are a blend of tangible and intangible assets. Its intellectual property, including patents for technologies like GEL and Impact Guidance System, forms a strong competitive barrier. The ASICS brand itself, synonymous with its 'Sound Mind, Sound Body' philosophy, is a significant intangible asset, fostering deep customer loyalty and perceived quality.

The company's human capital, comprising sports scientists, designers, and engineers, is vital for its innovation pipeline. Furthermore, ASICS benefits from a global manufacturing and distribution network, ensuring efficient production and market reach. This infrastructure, coupled with strong financial capital evidenced by record 2024 sales and profitability, underpins its ability to invest in R&D and strategic growth.

| Key Resource | Description | 2024 Relevance/Data |

| Intellectual Property | Patents protecting proprietary technologies (e.g., GEL, IGS) | Continues to be a core differentiator, enabling premium pricing and market share. |

| Brand Equity | Strong brand reputation linked to performance and 'Sound Mind, Sound Body' philosophy | Drives customer loyalty and premium perception, contributing to sales growth. |

| Human Capital | Expertise in sports science, product design, and engineering | Essential for ongoing innovation and development of advanced athletic products. |

| Global Manufacturing & Distribution | Worldwide production facilities and extensive logistics network | Ensures efficient product availability and responsiveness to global market demands. |

| Financial Capital | Strong sales and profitability | Record 2024 sales and profit growth provide resources for R&D, marketing, and expansion. |

Value Propositions

ASICS leverages cutting-edge technology, such as its signature GEL cushioning system and the Impact Guidance System (IGS), to deliver unparalleled shock absorption and stability. This focus on advanced engineering directly translates to enhanced athletic performance by promoting a smoother, more efficient gait and reducing the physical toll on athletes.

These technological innovations are crucial for injury prevention, offering athletes the confidence to push their limits. For instance, ASICS' commitment to research and development, evidenced by its ongoing investment in biomechanics, ensures its products provide superior support and comfort, a key factor for athletes across all disciplines aiming to optimize their training and competition results.

ASICS' core philosophy, Sound Mind in a Sound Body, directly translates into value propositions that champion both mental and physical well-being. This commitment extends beyond athletic achievement, focusing on holistic health for consumers.

The brand offers products designed to encourage an active lifestyle, thereby fostering physical health. For instance, ASICS' running shoes are engineered for comfort and performance, making movement more accessible and enjoyable for a wider audience.

Furthermore, ASICS actively promotes initiatives that support mental health, recognizing the intrinsic link between physical activity and psychological balance. This holistic approach aims to inspire a healthier, happier life for all.

ASICS products are celebrated for their superior quality and robust construction, translating into exceptional durability. This commitment to lasting performance means consumers get more wear and reliability from their athletic footwear and apparel, making it a smart long-term investment.

The brand's dedication to craftsmanship ensures that ASICS gear stands up to rigorous training and everyday use. For instance, ASICS invested heavily in material science research in 2024, aiming to further enhance the lifespan of their shoe components, a key differentiator for value-conscious athletes.

Diverse Product Range for Multiple Sports

ASICS’s value proposition extends beyond its renowned running specialization, offering a diverse product range that caters to a wide array of athletic pursuits. This commitment to variety ensures that athletes across multiple disciplines can find high-quality footwear, apparel, and accessories designed for their specific needs.

This strategic diversification allows ASICS to serve a broader athletic community, fostering loyalty and expanding market reach. For instance, ASICS is a significant player in sports like tennis, volleyball, and wrestling, providing specialized gear that enhances performance and comfort.

- Broad Athletic Appeal: ASICS provides specialized gear for sports beyond running, including tennis, volleyball, and wrestling, appealing to a wider customer base.

- Performance Enhancement: The company designs footwear and apparel with sport-specific technologies to improve athlete performance and prevent injuries.

- Market Penetration: By serving multiple sports, ASICS increases its market share and brand visibility across the global sporting goods industry.

- Revenue Diversification: Offering products for various sports helps ASICS diversify its revenue streams, reducing reliance on any single market segment.

Commitment to Sustainability

ASICS demonstrates a strong commitment to sustainability by incorporating eco-friendly materials and responsible manufacturing processes into its product offerings. This focus resonates deeply with a growing segment of consumers who prioritize environmental consciousness in their purchasing decisions.

The company actively utilizes recycled materials in its footwear and apparel, reducing waste and conserving resources. Furthermore, ASICS has implemented innovative take-back programs, allowing consumers to return old shoes for recycling, thereby closing the loop on product lifecycles.

- Eco-friendly Materials: ASICS is increasing its use of recycled polyester, with a target of 100% recycled polyester for all apparel and swimwear by 2030.

- Circular Economy Initiatives: The ASICS RE:BORN program collects used shoes for recycling and upcycling.

- Reduced Carbon Footprint: ASICS aims to reduce its CO2 emissions by 30% by 2030 compared to 2015 levels.

- Sustainable Packaging: The company is transitioning to paper-based packaging, aiming for 100% sustainable paper sourcing by 2025.

ASICS' value proposition centers on delivering high-performance athletic gear engineered with advanced technologies like GEL cushioning for superior comfort and injury prevention. This commitment to innovation ensures athletes can optimize their performance and train with confidence, supported by the brand's holistic philosophy of a "Sound Mind in a Sound Body."

Customer Relationships

ASICS cultivates customer loyalty by nurturing communities centered on movement and wellness. Initiatives like the 'Move Her Mind Hub' connect individuals, fostering a sense of shared purpose and belonging. This approach demonstrably strengthens the bond between ASICS and its customers.

Asics leverages its OneASICS loyalty program to craft personalized digital experiences. By unifying e-commerce, running data, and race registrations under a single ID, Asics gains a comprehensive view of its customers, enabling tailored interactions and offers.

This integrated digital ecosystem significantly strengthens Asics' direct customer touchpoints. For instance, in 2024, Asics reported a substantial increase in digital sales, underscoring the effectiveness of these personalized strategies in driving engagement and conversion.

Asics prioritizes customer satisfaction through a multi-channel support system. This includes readily available online resources, knowledgeable in-store staff, and efficient post-purchase assistance to address any queries or concerns.

In 2023, Asics saw a significant increase in digital engagement, with customer service inquiries via their website and app rising by 15%. This highlights the importance of their online support infrastructure.

The company aims to resolve product-related issues promptly, fostering trust and encouraging repeat business. This dedication to service excellence is a cornerstone of their brand experience.

Athlete and Influencer Engagement

Asics cultivates strong customer relationships by partnering with professional athletes and micro-influencers. These collaborations provide genuine endorsements and inspiration to both elite and everyday athletes, fostering a sense of community and aspiration.

These athlete and influencer partnerships serve as powerful product validation, showcasing Asics gear in real-world performance scenarios. They also create direct engagement channels, allowing fans to connect with their idols and, by extension, with the Asics brand.

- Authenticity: Collaborations with athletes like Novak Djokovic and Emma Raducanu lend credibility.

- Inspiration: Influencers showcase how Asics products support diverse athletic journeys.

- Validation: Professional use demonstrates product performance and durability.

- Engagement: Social media campaigns and meet-and-greets foster direct fan interaction.

Loyalty Programs and Exclusive Access

ASICS cultivates strong customer ties through its loyalty programs, offering perks like early access to new product drops and exclusive discounts. This approach is designed to encourage repeat business and build lasting relationships.

- Loyalty Program Benefits: ASICS' OneASICS loyalty program provides members with points for purchases, birthday rewards, and exclusive event invitations.

- Early Access: Members often receive advance notice and purchasing opportunities for highly anticipated ASICS releases, such as limited-edition running shoes.

- Customer Engagement: These initiatives aim to increase customer lifetime value by fostering a sense of belonging and rewarding consistent patronage.

ASICS strengthens customer relationships through a multi-faceted approach, combining digital personalization with community building and authentic endorsements. The OneASICS loyalty program, for example, drives engagement by offering tailored experiences and rewards, contributing to increased customer lifetime value. In 2024, ASICS reported a significant uplift in digital sales, a testament to the effectiveness of these personalized strategies in fostering deeper customer connections and driving conversions.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point |

|---|---|---|

| Digital Personalization & Loyalty | OneASICS Loyalty Program | Increased digital sales in 2024; personalized offers and early access to products. |

| Community Building | Move Her Mind Hub, online forums | Fosters shared purpose and belonging, strengthening brand affinity. |

| Authentic Endorsements | Athlete and Micro-Influencer Partnerships | Provides product validation and inspiration; facilitates direct fan interaction. |

Channels

ASICS strategically operates its own branded retail stores worldwide, offering customers a direct physical connection to their products and personalized expert guidance. These stores are crucial for building a strong brand experience and directly boosting sales.

In 2024, ASICS continued to expand its global retail footprint, with a particular focus on key markets in North America and Europe, aiming to capture a larger share of the premium athletic footwear and apparel market.

The direct-to-consumer channel, including these physical stores, is a significant revenue driver for ASICS, allowing for higher margins and direct customer relationship building, which is essential for brand loyalty and future product development.

The official ASICS website, ASICS.com, and its dedicated mobile applications are ASICS's core direct-to-consumer (DTC) sales channels. These platforms offer a full product range, personalized recommendations, and seamless integration with ASICS's loyalty programs, enhancing customer engagement and driving sales.

E-commerce has been a significant growth driver for ASICS. In 2023, ASICS reported robust digital sales, with DTC channels contributing a substantial portion of its revenue. This trend is expected to continue, with projections indicating further growth in online sales for 2024 as ASICS invests in enhancing its digital infrastructure and user experience.

ASICS leverages wholesale partnerships with specialty retailers, including dedicated running stores and broader athletic footwear chains, to reach a wide customer base. In 2024, ASICS continued to expand its presence in these crucial channels, aiming to capture a significant share of the performance athletic footwear market.

These collaborations are vital for ASICS's market penetration, allowing them to cater to various consumer needs and shopping habits. By working with large sporting goods chains alongside niche specialty stores, ASICS ensures broad accessibility for its product lines.

Online Marketplaces and Third-Party E-tailers

ASICS significantly expands its reach by partnering with prominent online marketplaces and third-party e-tailers. This strategy is crucial for tapping into established customer bases and driving sales beyond its direct-to-consumer channels.

These partnerships enhance product visibility and accessibility, allowing ASICS to connect with a wider demographic of online shoppers. In 2023, ASICS reported a substantial increase in digital sales, with a significant portion attributed to these third-party platforms, reflecting their growing importance in the overall sales mix.

- Expanded Reach: Accessing millions of active users on platforms like Amazon, Zalando, and others.

- Increased Sales Volume: Driving higher unit sales through the broad customer traffic these platforms attract.

- Brand Exposure: Gaining visibility among consumers who may not directly visit the ASICS website.

- Logistical Synergies: Potentially leveraging existing logistics and fulfillment capabilities of partners.

Sporting Events and Brand Activations

ASICS leverages sporting events, from major marathons like the Tokyo Marathon to local fun runs, as crucial channels. These events serve as platforms for direct product demonstration, allowing consumers to experience ASICS footwear and apparel firsthand. In 2023, ASICS reported significant growth in its performance running category, partly attributed to increased brand visibility and engagement at these grassroots and elite sporting events.

These activations foster deep community engagement, creating a personal connection between the brand and its audience. By participating in and sponsoring events, ASICS gathers invaluable customer feedback directly, informing future product development. For instance, ASICS' investment in the ASICS World Ekiden, a virtual relay race, saw participation from over 100,000 runners globally in 2023, showcasing the reach of digital and physical event integration.

- Event Sponsorship: ASICS actively sponsors numerous marathons and athletic competitions worldwide, increasing brand exposure.

- Product Trials: Events provide opportunities for runners to test new ASICS products, driving trial and purchase intent.

- Community Building: ASICS organizes its own events, like the ASICS FrontRunner program, to cultivate a loyal community.

- Data Collection: Direct interaction at events allows ASICS to collect valuable consumer insights and feedback.

ASICS utilizes a multi-channel strategy, encompassing its own retail stores and a robust online presence through ASICS.com and mobile apps. These direct-to-consumer (DTC) channels are vital for brand experience and higher margins.

Wholesale partnerships with specialty retailers and large sporting goods chains ensure broad market penetration. ASICS also leverages online marketplaces and third-party e-tailers to reach a wider online audience, a strategy that significantly boosted digital sales in 2023.

The brand actively engages with the athletic community through event sponsorships and participations, like marathons and virtual races. These events offer direct product engagement and valuable consumer feedback, contributing to ASICS's performance category growth.

| Channel | 2023 Performance Highlight | 2024 Strategic Focus |

|---|---|---|

| ASICS Retail Stores | Expanded global footprint in key markets | Enhancing in-store digital integration and personalized experiences |

| ASICS.com & Mobile Apps | Significant DTC revenue driver, robust digital sales growth | Investing in digital infrastructure and user experience for continued growth |

| Wholesale Partners | Continued expansion in specialty and sporting goods chains | Strengthening relationships with key retailers for market share gains |

| Online Marketplaces/Third-Party E-tailers | Substantial increase in sales attributed to these platforms | Optimizing product visibility and accessibility on partner sites |

| Sporting Events & Community Engagement | Growth in performance running category linked to event visibility; ASICS World Ekiden saw over 100,000 global participants in 2023 | Deepening community ties and gathering consumer insights at events |

Customer Segments

Performance-oriented athletes, including serious runners, tennis players, volleyball players, and wrestlers, form a key customer segment for ASICS. These individuals actively seek out gear that offers advanced technology and demonstrable performance enhancement. For instance, in 2024, the global sports apparel and footwear market saw continued growth, with specialized segments like running showing particular strength, indicating a sustained demand for high-performance products from dedicated athletes.

This segment is driven by a desire for products that contribute to peak performance and, crucially, aid in injury prevention. They are willing to invest in high-quality, technologically advanced equipment that provides a competitive edge. ASICS' focus on research and development, exemplified by their GEL technology, directly addresses this need, as evidenced by the consistent positive reception of their performance footwear lines in athletic communities.

Casual fitness enthusiasts and active individuals form a significant customer base for Asics. This group prioritizes comfort, durability, and reliable support in their athletic wear, whether for daily walks, light gym sessions, or simply an active lifestyle. They are looking for gear that performs well and holds up over time.

In 2024, the global athletic footwear market, a key indicator for this segment, was projected to continue its growth trajectory, with many consumers investing in versatile products that serve both athletic and casual needs. Asics' focus on cushioning technology and ergonomic design directly appeals to these individuals seeking everyday comfort and performance.

Fashion-conscious consumers are captivated by ASICS' SportStyle and Onitsuka Tiger brands, recognizing their fusion of athletic roots with contemporary urban fashion. These individuals prioritize not only the visual appeal and comfort of their footwear but also embrace the distinctive retro charm inherent in many of these designs.

In 2024, ASICS reported strong performance in its Lifestyle segment, which encompasses SportStyle, indicating a growing market for fashion-forward athletic wear. This segment’s success underscores the appeal of combining performance heritage with current fashion sensibilities, a key driver for this customer group.

Sustainability-Minded Consumers

Sustainability-minded consumers represent a significant and expanding customer segment for ASICS. These individuals actively seek out brands that demonstrate a genuine commitment to environmental responsibility and ethical production. Their purchasing decisions are often swayed by a company's efforts in areas like reducing its carbon footprint, utilizing recycled materials, and implementing circular economy initiatives such as product take-back programs. For instance, in 2023, a significant portion of global consumers, estimated to be around 60%, indicated they were willing to pay more for products from sustainable brands, highlighting the financial impact of this trend.

ASICS' focus on sustainability resonates deeply with this demographic. The brand's initiatives, such as increasing the use of recycled polyester in its apparel and footwear, and striving for greater transparency in its supply chain's carbon emissions, directly address the core values of these consumers. This segment is not just looking for performance; they are looking for products that align with their personal ethics and contribute positively to the planet. Reports from 2024 suggest that brands with strong sustainability credentials are seeing higher customer loyalty and engagement.

- Growing Demand: Consumers increasingly prioritize eco-friendly products, influencing purchasing behavior.

- Brand Influence: ASICS' use of recycled materials and carbon footprint transparency appeal directly to this segment.

- Willingness to Pay: A notable percentage of consumers are prepared to invest more in sustainable goods.

- Ethical Alignment: This segment seeks brands whose values mirror their own environmental concerns.

Youth and Developing Athletes

ASICS actively courts youth and developing athletes, recognizing their potential to shape future brand loyalty. They offer specialized footwear and apparel designed for a range of youth sports, ensuring performance and comfort for emerging talent.

This demographic significantly impacts family purchasing decisions, making them a crucial segment for long-term market penetration. For instance, in 2024, ASICS saw a notable increase in sales for its junior running shoe lines, indicating strong engagement with this younger audience.

- Targeting Future Loyalty: ASICS focuses on building brand affinity with young athletes who are likely to remain customers as they mature.

- Family Influence: Purchases made for youth athletes often involve parents, who are also key decision-makers and potential brand advocates.

- Market Growth: The youth sports market is substantial; in 2023, global spending on youth sports participation was estimated to be over $10 billion, a figure ASICS aims to capture.

ASICS caters to performance-focused athletes, casual fitness enthusiasts, fashion-conscious individuals, sustainability-minded consumers, and youth athletes. Each segment has distinct needs, from advanced technology for peak performance to comfort and style for everyday wear. The brand's diverse product lines and marketing efforts aim to resonate with these varied groups.

| Customer Segment | Key Motivations | ASICS' Appeal |

|---|---|---|

| Performance Athletes | Advanced technology, performance enhancement, injury prevention | GEL technology, specialized footwear for running, tennis, volleyball, wrestling |

| Casual Fitness Enthusiasts | Comfort, durability, reliable support, versatility | Cushioning technology, ergonomic design for daily activities |

| Fashion-Conscious Consumers | Style, comfort, urban fashion, retro charm | SportStyle and Onitsuka Tiger brands, fusion of athletic heritage and modern design |

| Sustainability-Minded Consumers | Environmental responsibility, ethical production, recycled materials | Use of recycled polyester, carbon footprint transparency, circular economy initiatives |

| Youth Athletes | Performance, comfort, brand loyalty development | Specialized junior sports gear, focus on future customer engagement |

Cost Structure

ASICS dedicates substantial financial resources to Research and Development, a cornerstone of its competitive strategy. In 2024, the company continued its commitment to sports science, exploring advanced materials and engineering innovative footwear technologies. This investment is crucial for maintaining ASICS's edge in performance and comfort.

Key R&D expenditures include the ongoing development of proprietary technologies such as GEL cushioning and the Intelligent Guidance System (IGS). These innovations are central to ASICS's product differentiation and command a premium in the market, justifying the significant upfront investment required for their creation and refinement.

Asics' manufacturing and production costs are significant, encompassing raw materials like recycled polyester, labor expenses across its global factories, and the operational overhead for producing footwear, apparel, and accessories. These costs are directly tied to maintaining quality and scaling production to meet global demand.

In 2024, Asics continued to invest in sustainable manufacturing processes, which can sometimes lead to higher initial costs but align with growing consumer preference for eco-friendly products. For instance, the use of recycled materials and energy-efficient factory operations are factored into their overall production expense.

ASICS dedicates significant resources to global marketing, advertising, and athlete endorsements, recognizing their crucial role in brand visibility and customer acquisition. In 2024, these expenditures are projected to remain a substantial portion of their operating costs, reflecting the competitive landscape of the athletic apparel industry.

These investments, including sponsoring major sporting events and high-profile athletes, are essential for maintaining ASICS's premium brand image and driving sales growth. The company's strategy relies heavily on these outreach efforts to connect with a broad consumer base and reinforce its commitment to performance and innovation.

Distribution and Logistics Costs

ASICS invests significantly in its distribution and logistics network to ensure efficient product flow. These costs encompass warehousing, transportation, and overall supply chain management, crucial for moving goods from production sites to various sales channels globally, including retail stores, wholesale partners, and direct-to-consumer e-commerce platforms.

- Warehousing: Costs associated with storing inventory in strategically located distribution centers worldwide.

- Transportation: Expenses for shipping products via sea, air, and land freight to reach diverse markets.

- E-commerce Fulfillment: Additional costs for picking, packing, and shipping individual orders directly to online customers.

- Supply Chain Technology: Investments in systems for tracking, managing, and optimizing the movement of goods, aiming to reduce lead times and costs.

In 2024, ASICS continued to refine its logistics operations, with a focus on optimizing inventory levels and delivery speeds, especially for its growing e-commerce segment. The company's commitment to sustainability also influences these costs, as it explores more eco-friendly transportation and packaging solutions.

Sales and Administrative Costs

Sales and administrative costs for ASICS encompass the significant operational expenses tied to running their retail footprint, managing their growing e-commerce channels, and maintaining robust customer service operations. These costs also cover essential corporate functions like human resources, finance, and legal departments, which are crucial for the company's overall governance and strategic direction.

These expenses are vital for supporting ASICS's global presence and customer engagement strategies. For instance, in 2023, ASICS reported that its selling, general, and administrative expenses amounted to approximately 37% of its total revenue, highlighting the substantial investment in these areas to drive sales and maintain brand operations.

- Retail Operations: Costs associated with staffing, store maintenance, and visual merchandising for ASICS's physical stores.

- E-commerce & Digital Infrastructure: Investments in website development, online marketing, and the technology powering their digital sales platforms.

- Customer Service: Expenses for call centers, online support, and managing customer inquiries and returns.

- Corporate Functions: Salaries and overhead for HR, finance, legal, and other administrative departments supporting the business.

ASICS's cost structure is heavily influenced by its commitment to innovation and quality, evident in its substantial investments in Research and Development and manufacturing. These core activities, along with extensive marketing and a robust distribution network, form the backbone of its operational expenses.

In 2023, ASICS reported selling, general, and administrative expenses at approximately 37% of its total revenue, underscoring the significant costs associated with global brand building and operational management. The company's focus on sustainable practices in 2024 also adds to its production expenses through the use of eco-friendly materials and processes.

Key cost drivers include raw material procurement, labor, global marketing campaigns, athlete endorsements, and the maintenance of an efficient supply chain. These expenditures are critical for ASICS to maintain its competitive edge and deliver high-performance products to a global market.

| Cost Category | Description | Impact on ASICS |

|---|---|---|

| Research & Development | Development of proprietary technologies (GEL, IGS), advanced materials | Drives product differentiation and premium pricing |

| Manufacturing & Production | Raw materials, labor, factory operations, sustainable practices | Ensures quality and scales production to meet demand |

| Marketing & Endorsements | Advertising, athlete sponsorships, event participation | Enhances brand visibility and customer acquisition |

| Distribution & Logistics | Warehousing, transportation, e-commerce fulfillment | Facilitates efficient product delivery to global markets |

| Sales & Administrative | Retail operations, e-commerce infrastructure, corporate functions | Supports global presence and customer engagement |

Revenue Streams

ASICS' main income comes from selling its high-performance running shoes. These are the shoes people know ASICS for, and they make up a big chunk of all the money the company brings in. Think of popular models that are famous for their great cushioning and support.

For instance, in 2023, ASICS saw its sales grow significantly, with performance footwear being a key driver. The company reported that its running category continued to perform strongly, reflecting the enduring demand for its specialized products in a competitive market.

Asics generates significant revenue from its SportStyle and Onitsuka Tiger product lines. These brands focus on lifestyle and fashion-oriented footwear and apparel, appealing to a broader consumer base beyond traditional athletic wear.

The SportStyle and Onitsuka Tiger segments have experienced robust growth, becoming key contributors to Asics' overall sales figures. This strategic focus on fashion-forward products has allowed Asics to tap into new markets and diversify its revenue streams effectively.

For instance, Asics reported that its lifestyle business, which encompasses these brands, demonstrated strong performance in 2023, with sales increasing by 11.4% to ¥195.8 billion (approximately $1.3 billion USD at the time of reporting). This highlights the substantial financial impact of these fashion-focused product categories.

Asics generates substantial income from selling athletic apparel and accessories. This includes items like running shorts, training tops, and performance socks, all designed to enhance the athletic experience. This segment of their business significantly diversifies their product portfolio beyond just footwear.

In 2023, Asics reported that its apparel and accessories segment contributed to a healthy portion of its overall revenue. While footwear remains the largest segment, the growth in apparel and accessories demonstrates a strategic expansion. For instance, sales in this category saw a notable increase year-over-year, reflecting strong consumer demand for their complete athletic offerings.

Wholesale Sales

Wholesale sales continue to be a cornerstone for ASICS, generating substantial revenue by supplying products to a diverse range of third-party retailers worldwide. This includes everything from specialized sports shops to major department store chains, showcasing the brand's broad market penetration.

Despite a strategic push towards direct-to-consumer (D2C) channels, wholesale remains a vital revenue stream. For instance, in the fiscal year 2023, ASICS reported total net sales of ¥577.4 billion (approximately $3.8 billion USD), with wholesale contributing a significant portion of this figure, demonstrating its enduring importance in the company's financial performance.

- Global Reach: ASICS products are distributed through numerous retail partners across continents, ensuring wide availability.

- Channel Diversity: Sales are generated through various retail formats, from niche sports stores to mass-market retailers.

- Financial Contribution: Wholesale remains a key driver of ASICS' overall revenue, even as D2C grows.

- Market Presence: This channel allows ASICS to maintain a strong physical presence and reach a broad customer base.

Direct-to-Consumer (D2C) Sales (Online and Retail Stores)

ASICS is significantly boosting its revenue by selling directly to customers through its own websites and physical stores. This direct approach allows ASICS to capture higher profit margins compared to selling through third-party retailers. In 2024, ASICS reported strong performance in its direct-to-consumer channels, highlighting a strategic shift towards greater control over customer experience and brand messaging.

This direct engagement fosters deeper customer relationships, providing valuable insights into consumer preferences and buying habits. These insights are crucial for product development and marketing strategies. For instance, ASICS' digital sales saw a notable increase in the first half of 2024, contributing to overall revenue growth.

- Higher Profit Margins: Eliminating intermediaries allows ASICS to retain a larger portion of the sale price.

- Direct Customer Relationships: Building loyalty and gathering direct feedback for product innovation.

- Brand Control: Ensuring a consistent brand experience across all touchpoints.

- Data Insights: Leveraging sales data for more effective marketing and inventory management.

ASICS also generates revenue from licensing its brand and technology to other companies. This can include collaborations on specific product lines or the use of ASICS' patented cushioning technologies in footwear produced by other brands.

While not as prominent as product sales, licensing agreements provide ASICS with an additional, often passive, income stream. These partnerships can extend brand reach and introduce ASICS' innovations to new markets without direct capital investment.

The company's commitment to innovation, particularly in areas like GEL technology, creates opportunities for such licensing deals. This strategy diversifies ASICS' revenue base and reinforces its position as a leader in athletic technology.

Business Model Canvas Data Sources

The Asics Business Model Canvas is informed by a blend of internal sales figures, extensive market research on athletic footwear trends, and competitive analysis of rival brands. These data sources ensure a robust and accurate representation of Asics' strategic positioning and operational realities.