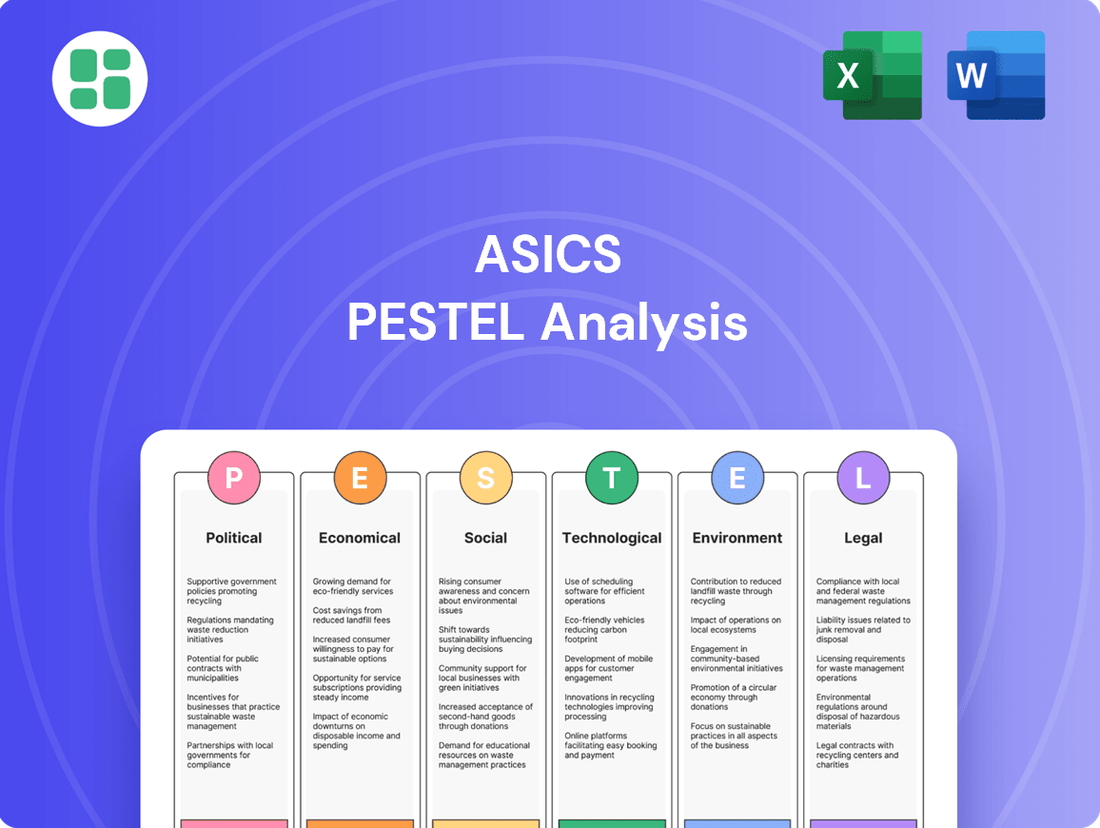

Asics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asics Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Asics's trajectory. Our meticulously researched PESTLE analysis provides the actionable intelligence you need to anticipate market shifts and refine your strategic approach. Download the full version now and gain a decisive advantage.

Political factors

Government trade policies, including tariffs and trade agreements, significantly influence ASICS's global operations. For instance, the US-China trade tensions and evolving trade relationships within the EU can directly impact the cost of sourcing materials and manufacturing finished goods. Changes in these policies can necessitate adjustments in ASICS's supply chain strategy, potentially increasing production costs or affecting market access.

In 2024, the ongoing recalibration of global trade relationships continues to present both challenges and opportunities. ASICS, like many global apparel companies, must remain agile in responding to shifts in import/export duties and trade bloc agreements. For example, a 10% tariff on footwear imported from Vietnam, a key manufacturing hub for many brands, could add millions in costs if not strategically managed through sourcing diversification or price adjustments.

Evolving labor laws, such as Cambodia's new minimum wage for footwear workers set to take effect in January 2025, directly impact ASICS's manufacturing costs. These changes can lead to increased operational expenses, requiring strategic adjustments in pricing and production.

Stringent supply chain regulations, like the US Uyghur Forced Labor Prevention Act (UFLPA) and the EU's upcoming ban on forced labor products, demand thorough vetting of ASICS's suppliers. Non-compliance could result in significant penalties and reputational damage, underscoring the need for robust ethical sourcing practices.

Governments worldwide are tightening environmental regulations, directly impacting ASICS's product development and manufacturing. The European Union's Ecodesign for Sustainable Products Regulation (ESPR), which began implementation in June 2024, sets new standards for product environmental performance across various sectors, including footwear. This regulation mandates improvements in durability, repairability, and recyclability, pushing ASICS to innovate in material sourcing and product design to meet these evolving requirements.

A significant aspect of these new regulations is the ban on destroying unsold textile goods, a measure designed to combat waste and promote circularity. For ASICS, this means a strategic shift away from traditional inventory management towards more sustainable practices, such as increased resale, donation, or recycling of surplus stock. This regulatory pressure encourages ASICS to explore and invest in circular business models, potentially impacting their supply chain and operational costs as they adapt to these environmental mandates.

Geopolitical Stability and Market Access

Geopolitical tensions, particularly in regions crucial for manufacturing and distribution, pose a significant risk to ASICS's global supply chain. For instance, the ongoing trade disputes and potential for regional conflicts in Asia, where a substantial portion of athletic wear is produced, could lead to production delays and increased costs. This instability can also dampen consumer spending on discretionary items like premium athletic footwear, impacting ASICS's sales performance.

Maintaining robust governmental relations and a keen understanding of evolving political landscapes are paramount for ASICS to ensure continued market access and operational stability. For example, navigating complex regulatory environments in emerging markets requires proactive engagement to mitigate potential disruptions. ASICS's ability to adapt to shifting political climates directly influences its capacity to operate seamlessly and serve its customer base effectively.

- Supply Chain Vulnerability: ASICS's reliance on Asian manufacturing hubs makes it susceptible to disruptions from geopolitical instability, potentially impacting product availability.

- Consumer Confidence Impact: Political unrest or economic uncertainty in key consumer markets can reduce discretionary spending on athletic apparel and footwear.

- Market Access Challenges: Evolving trade policies and geopolitical relationships can affect ASICS's ability to import and export goods, influencing market penetration and sales.

Government Initiatives in Sports and Health

Government initiatives focused on boosting sports participation and public health can significantly benefit ASICS. For example, the UK government's 'Active Lives Survey' reported that in the year ending September 2023, 63.5% of adults were meeting the Chief Medical Officers' guideline of 150 minutes of moderate-intensity physical activity per week, indicating a growing health-conscious population. This trend directly translates into increased demand for athletic footwear and apparel.

Governments are actively investing in expanding their domestic sports industries. In the United States, the sports industry contributed an estimated $377.5 billion to the GDP in 2022, according to Statista. Such expansionary policies create a more robust market for sporting goods manufacturers like ASICS, driving sales opportunities.

- Increased Participation: Government campaigns encouraging physical activity directly boost demand for ASICS products.

- Industry Growth: Public investment in sports infrastructure and events supports a thriving market for athletic wear.

- Health Focus: A greater societal emphasis on public health, often driven by government programs, favors brands like ASICS.

- Event Restrictions: Conversely, government-imposed restrictions on sports events or public gatherings can negatively impact ASICS' sales volumes.

Governmental support for sports and fitness initiatives directly fuels demand for ASICS products, as seen in the UK's Active Lives Survey where 63.5% of adults met physical activity guidelines by September 2023. This trend indicates a growing market for athletic wear. Furthermore, government investments in domestic sports industries, like the estimated $377.5 billion contribution of the US sports industry to GDP in 2022, create a more favorable environment for brands such as ASICS.

| Governmental Factor | Impact on ASICS | Supporting Data/Example |

|---|---|---|

| Sports Participation Initiatives | Increased demand for athletic footwear and apparel | UK: 63.5% of adults met physical activity guidelines (Year ending Sep 2023) |

| Domestic Sports Industry Investment | Expanded market opportunities for sporting goods manufacturers | US Sports Industry GDP Contribution: $377.5 billion (2022) |

| Trade Policy Adjustments | Potential impact on sourcing costs and market access | Hypothetical 10% tariff on footwear from Vietnam could add millions in costs. |

| Labor Law Changes | Direct influence on manufacturing expenses | Cambodia's new minimum wage for footwear workers (Jan 2025) |

What is included in the product

This Asics PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the company's operations and strategy.

It provides actionable insights for strategic decision-making by highlighting external opportunities and threats impacting Asics's market position.

A concise, actionable summary of Asics' PESTLE factors, enabling leadership to quickly identify and address external threats and opportunities that impact market strategy.

Economic factors

The overall health of the global economy is a critical factor for ASICS, directly influencing consumer discretionary spending, especially in their performance running and SportStyle segments. ASICS achieved impressive results, with FY2024 marking record sales and profits, demonstrating resilience.

However, the broader sportswear industry is anticipating a slowdown in growth for 2025, largely attributed to prevailing economic pressures and a more cautious approach to consumer spending. This trend suggests a need for strategic adjustments within the industry.

Consequently, ASICS will need to be agile in adapting its strategies to align with evolving consumer purchasing habits and heightened price sensitivity in the coming year.

Persistent inflation significantly impacts ASICS by raising expenses for raw materials, production, and shipping. For instance, global inflation rates remained elevated throughout 2023, with many economies experiencing consumer price index (CPI) increases above 5%. This directly squeezes ASICS' gross profit margins, making it harder to maintain profitability without adjusting prices.

ASICS must implement robust cost management and strengthen its supply chain to navigate these rising costs. The company's ability to absorb these increases or pass them onto consumers without alienating its customer base is crucial. Currency fluctuations also play a role; for example, a strong US dollar against the Japanese Yen can reduce the value of ASICS' international earnings when repatriated.

The global sportswear market is a fiercely contested arena, with ASICS facing significant challenges from agile competitors. Brands such as On, Hoka, and New Balance are steadily increasing their market share, driven by innovative product development and highly effective, targeted marketing campaigns. This heightened competition naturally translates into considerable pricing pressure across the industry.

To navigate this environment, ASICS must maintain a relentless focus on product innovation and differentiation. This is crucial not only for attracting new customers but also for retaining its existing base. The company's ability to offer unique value propositions while remaining price-competitive will be a key determinant of its success in the coming years.

Supply Chain Disruptions and Logistics Costs

Geopolitical tensions and evolving trade policies significantly impact global supply chains, driving up logistics costs for companies like ASICS. For instance, the ongoing conflicts and trade disputes in various regions have led to increased shipping rates and longer transit times throughout 2024 and into 2025. ASICS needs to proactively address these challenges by diversifying its sourcing strategies and optimizing its distribution networks to mitigate these rising expenses and ensure product availability.

These disruptions can directly affect ASICS's ability to meet consumer demand, potentially impacting sales and brand loyalty. Investing in supply chain resilience, such as exploring nearshoring options or securing longer-term contracts with logistics providers, is crucial. For example, the average cost of shipping a 40-foot container globally saw significant fluctuations in 2024, with some routes experiencing increases of over 50% compared to pre-pandemic levels, highlighting the need for strategic cost management.

- Supply Chain Diversification: ASICS is exploring manufacturing partnerships in regions with more stable geopolitical environments to reduce reliance on single sourcing locations.

- Logistics Cost Management: Investments in advanced route optimization software and exploring multimodal transportation options are key strategies to combat rising freight expenses.

- Inventory Optimization: Implementing more sophisticated inventory management systems helps ASICS maintain adequate stock levels while minimizing holding costs amidst unpredictable delivery schedules.

- Supplier Relationship Management: Strengthening ties with key suppliers and logistics partners through collaborative forecasting and risk-sharing agreements can enhance overall supply chain stability.

E-commerce Growth and Digital Sales Channels

The global e-commerce market continues its robust expansion, with digital sales channels becoming increasingly critical for athletic footwear brands like ASICS. This trend offers significant opportunities for revenue growth and direct customer engagement. For instance, global e-commerce sales were projected to reach approximately $6.3 trillion in 2024, a figure expected to climb further in 2025, underscoring the importance of a strong online presence.

ASICS's strategic focus on bolstering its direct-to-consumer (DTC) and digital sales capabilities directly addresses this evolving market landscape. While these channels drive sales, they necessitate substantial investment in areas such as website infrastructure, targeted digital marketing campaigns, and sophisticated logistics for last-mile delivery. The company aims to leverage these investments to enhance customer experience and capture a larger share of the online market.

- Global e-commerce sales are a significant driver of growth for the retail sector.

- ASICS's investment in digital channels aligns with consumer purchasing habits.

- DTC models require ongoing investment in technology and supply chain efficiency.

- The digital sales environment presents both competitive advantages and operational complexities.

Economic factors present a mixed outlook for ASICS. While the company achieved record sales in FY2024, the broader sportswear market anticipates a slowdown in 2025 due to economic pressures and cautious consumer spending. Persistent inflation continues to impact ASICS by increasing raw material, production, and shipping costs, potentially squeezing profit margins.

Currency fluctuations also pose a risk, as a strong US dollar can reduce the value of ASICS' international earnings. Navigating these economic headwinds requires ASICS to focus on cost management, supply chain resilience, and strategic pricing to maintain its competitive edge in a dynamic global market.

Preview Before You Purchase

Asics PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Asics PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to this detailed PESTLE analysis of Asics upon completing your purchase.

The content and structure shown in the preview is the same document you’ll download after payment. This Asics PESTLE analysis provides strategic insights into the external forces shaping its business environment.

Sociological factors

Consumers globally are increasingly prioritizing their health and fitness, a trend that directly benefits athletic wear companies like ASICS. This heightened awareness of well-being translates into a greater demand for products that support an active lifestyle, from running shoes to performance apparel.

In 2024, the global sports apparel market was valued at approximately $205 billion, with projections indicating continued growth driven by this health consciousness. ASICS, with its long-standing commitment to the 'Sound Mind, Sound Body' philosophy, is well-positioned to capitalize on this societal shift, offering innovative solutions for both physical performance and mental resilience.

The athleisure trend, blending athletic wear with everyday fashion, is a significant sociological force, broadening ASICS's potential market. This shift means consumers are prioritizing comfort and style in their daily lives, not just during workouts. For instance, the global athleisure market was valued at approximately $327 billion in 2023 and is projected to reach $463 billion by 2027, demonstrating substantial growth.

ASICS is strategically tapping into this by expanding its SportStyle division and engaging in lifestyle collaborations, like its 2023 partnership with Disney. These moves directly address the consumer desire for versatile apparel that transitions seamlessly from active pursuits to casual settings, effectively capturing a wider demographic beyond traditional athletes.

Consumers are increasingly scrutinizing the environmental and social footprint of their purchases, pushing brands like ASICS to prioritize sustainability. This heightened awareness translates into a demand for transparency regarding manufacturing processes, the use of recycled materials, and ethical supply chain management. For instance, a 2024 report indicated that over 60% of consumers consider sustainability when making purchasing decisions, directly impacting brand loyalty and market share.

Influence of Social Media and Digital Communities

Social media and online communities are powerful forces in the sportswear market, directly influencing what consumers want and how they see brands. ASICS actively uses platforms like Instagram and TikTok, where influencers showcase their products, to reach a wider audience. In 2023, ASICS reported a significant increase in digital sales, demonstrating the effectiveness of their online engagement strategies.

ASICS's 'OneASICS' loyalty program is a prime example of fostering digital community. This initiative allows ASICS to connect directly with customers, offering exclusive content and early access to products, which in turn strengthens brand loyalty. By mid-2024, the OneASICS program had seen a 15% growth in active members compared to the previous year, highlighting its success in building a dedicated consumer base.

- Digital engagement drives consumer preferences: Social media trends and influencer endorsements heavily impact purchasing decisions in sportswear.

- ASICS's digital strategy: The brand utilizes platforms to expand customer reach and build relationships.

- Loyalty programs foster community: ASICS's 'OneASICS' program enhances customer retention and brand advocacy.

- Growth in digital touchpoints: ASICS's focus on digital channels is reflected in its increasing online sales and membership growth.

Demographic Shifts and Sports Participation

Demographic changes are significantly reshaping sports participation. For instance, the global population is aging, yet a strong desire for active lifestyles persists among older demographics, driving demand for comfortable and supportive athletic wear. Simultaneously, the participation in sports like running, tennis, pickleball, and padel is experiencing a global surge, directly impacting the types of products consumers are seeking.

ASICS is well-positioned to capitalize on these trends. Their commitment to a diverse range of sports categories ensures they cater to evolving consumer preferences. Furthermore, ASICS's initiatives aimed at making sports more accessible to various communities, including those with limited resources or specific needs, directly address the sociological shift towards inclusivity in athletic activities.

- Aging Population: Globally, the 65+ population is projected to reach 1.6 billion by 2050, many of whom remain active and seek specialized athletic gear.

- Rising Sports Popularity: Pickleball, for example, saw a 39.3% growth in participation between 2021 and 2022 in the US, according to the Sports & Fitness Industry Association (SFIA).

- ASICS's Strategy: ASICS's product development, such as specialized footwear for tennis and running, directly aligns with these growing participation numbers.

- Community Focus: ASICS's efforts to promote running through events and partnerships, like their support for the World Athletics Continental Tour, foster broader engagement.

Societal shifts towards health and wellness are a primary driver for ASICS, with consumers increasingly investing in active lifestyles. This trend is further amplified by the booming athleisure market, where comfort and style blend, expanding the appeal of athletic wear beyond traditional sports. ASICS's strategic engagement with lifestyle divisions and collaborations directly addresses this evolving consumer preference for versatile apparel.

Demographic changes, such as an aging global population actively pursuing fitness, alongside the rising popularity of sports like pickleball and padel, present significant opportunities. ASICS's commitment to diverse sports categories and inclusivity in athletic activities positions it to meet these varied and growing consumer demands.

| Sociological Factor | Description | ASICS Relevance/Action | Data Point (2023-2025) |

|---|---|---|---|

| Health & Wellness Trend | Increased consumer focus on physical and mental well-being. | Drives demand for performance and supportive athletic wear. | Global sports apparel market valued at ~$205 billion in 2024. |

| Athleisure Movement | Integration of athletic wear into everyday fashion. | Expansion of SportStyle division and lifestyle collaborations. | Global athleisure market projected to reach $463 billion by 2027. |

| Demographic Shifts | Aging population seeking active lifestyles; rise of new sports. | Product development for diverse sports and age groups; inclusivity initiatives. | Pickleball participation grew 39.3% (2021-2022). |

| Sustainability Consciousness | Consumer demand for ethical and environmentally friendly products. | Focus on transparent supply chains and recycled materials. | Over 60% of consumers consider sustainability in purchasing (2024). |

Technological factors

ASICS's commitment to advanced material science fuels its product innovation, with technologies like GEL cushioning remaining a core strength. The introduction of new foam innovations, such as FF LEAP™, demonstrates their ongoing pursuit of enhanced performance. This focus on R&D in materials, including lightweight composites and integrated carbon plates, is vital for staying ahead in the competitive athletic footwear market.

Technological advancements are fundamentally reshaping how consumers buy athletic gear, with ASICS actively enhancing its digital sales channels and direct-to-consumer (DTC) strategy. The company is integrating e-commerce data with valuable running data to craft highly personalized customer experiences, a move that aligns with the broader trend of digital transformation in retail.

Wearable technology, particularly in smart footwear, is revolutionizing how ASICS gathers insights into athlete performance, health metrics, and fitness trends. This integration allows for granular data collection, providing a direct link between product usage and user outcomes.

ASICS' RUNNING ECOSYSTEM is designed to capitalize on this data flow. By analyzing information from wearables, ASICS can offer highly personalized product recommendations, tailored training plans, and even predictive insights to enhance user experience and athletic development. For instance, in 2024, ASICS saw a significant increase in engagement with its digital fitness platforms, directly correlating with the adoption of its smart shoe technology, indicating a strong market appetite for data-driven athletic support.

Manufacturing Process Automation and Efficiency

Technological advancements are significantly reshaping manufacturing, with automation and emerging technologies like 3D printing poised to boost efficiency, cut costs, and unlock intricate product designs. ASICS's investment in its innovation factory for Onitsuka Tiger underscores its dedication to leveraging these cutting-edge manufacturing techniques.

This focus on advanced manufacturing allows ASICS to explore new materials and production methods, potentially leading to lighter, more responsive footwear. For instance, the company has been integrating robotics and AI in its production lines to optimize quality control and speed up assembly, aiming to reduce lead times and improve customization capabilities.

- Robotic Integration: ASICS is increasingly deploying robots for repetitive tasks like stitching and sole attachment, enhancing precision and consistency.

- 3D Printing Exploration: The company is actively researching and piloting 3D printing for creating customized midsoles and intricate structural components, offering personalized performance.

- Data Analytics: Advanced data analytics are being used to monitor production processes in real-time, identifying bottlenecks and areas for optimization to drive down manufacturing expenses.

- Innovation Factory: The dedicated Onitsuka Tiger innovation factory showcases ASICS's commitment to pioneering new manufacturing technologies and pushing design boundaries.

AI and Data Analytics for Customization and Marketing

ASICS leverages AI and data analytics to deeply understand customer desires, refine product creation, and tailor marketing campaigns. This technological edge allows for hyper-personalization, a key differentiator in the competitive sportswear market.

The company's investment in these areas is paying off. For instance, in 2024, ASICS reported a significant increase in customer engagement metrics following the implementation of AI-driven personalized recommendations on its e-commerce platforms. This data-driven approach also informs ASICS' product development pipeline, ensuring offerings align with emerging consumer demands.

- Enhanced Personalization: AI algorithms analyze vast datasets to predict individual customer needs and preferences, leading to more effective product recommendations and targeted promotions.

- Optimized Marketing Spend: Data analytics enables ASICS to identify high-potential customer segments and allocate marketing resources more efficiently, maximizing return on investment.

- Product Innovation: Insights gleaned from consumer data help ASICS identify gaps in the market and develop innovative products that resonate with specific athletic communities.

- Wellness Integration: The application of AI extends to personalized wellness programs, connecting ASICS’ product ecosystem with broader health and fitness trends, further deepening customer relationships.

ASICS is leveraging advanced material science, exemplified by its GEL cushioning and new FF LEAP™ foam, to drive product innovation and maintain a competitive edge. The company's strategic investment in an innovation factory for Onitsuka Tiger highlights its commitment to exploring cutting-edge manufacturing techniques like 3D printing and robotics to enhance efficiency and product customization.

Legal factors

ASICS relies heavily on protecting its proprietary technologies, like the renowned GEL cushioning system and its advanced foam innovations, through patents and trademarks. This legal shield is paramount for maintaining its competitive edge and deterring counterfeit products, which can dilute brand value and erode market share. For instance, the company actively pursues patent protection for its latest material science advancements, ensuring that competitors cannot easily replicate its performance-enhancing features.

ASICS navigates a complex web of consumer protection laws and product safety standards worldwide. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must be safe. Similarly, the Consumer Product Safety Improvement Act (CPSIA) in the United States sets stringent standards for children's products, though ASICS' primary focus is adult athletic wear, general safety principles still apply.

Compliance ensures ASICS products meet quality and safety benchmarks, including accurate labeling regarding materials and performance. Failing to adhere to these regulations, such as those concerning misleading advertising or hazardous materials, can result in significant fines and damage to brand reputation. In 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over $1.4 billion in recalls, highlighting the financial and reputational risks of non-compliance.

ASICS must navigate a complex web of international and national labor laws, ensuring compliance with minimum wage, working hours, and fair employment practices across its global manufacturing bases. For instance, in 2024, countries like Vietnam, a key manufacturing hub for many apparel companies, continue to refine their labor regulations, impacting operational costs and supply chain management.

The increasing focus on ethical sourcing, exemplified by directives such as the proposed EU Corporate Sustainability Due Diligence Directive (CSDDD), mandates that ASICS proactively identify and mitigate human rights risks, including forced labor, within its extensive supply chains. Failure to comply can lead to significant reputational damage and legal penalties, impacting market access and investor confidence.

Data Privacy and Cybersecurity Regulations

ASICS' increasing reliance on digital platforms like OneASICS and its wearable technology necessitates strict compliance with evolving data privacy laws. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) impose significant obligations regarding the collection, processing, and storage of consumer data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Maintaining robust cybersecurity is not merely a best practice but a legal mandate to safeguard sensitive customer information from breaches. In 2023, the average cost of a data breach globally was $4.45 million, a figure ASICS must actively mitigate through stringent security protocols. This legal imperative extends to ensuring data integrity and preventing unauthorized access across all its digital touchpoints.

- Data Privacy Compliance: Adherence to GDPR and CCPA for consumer data collected via OneASICS and wearable devices.

- Cybersecurity Mandates: Legal obligation to implement strong security measures to protect sensitive customer information.

- Financial Penalties: Awareness of significant fines for non-compliance, such as up to 4% of global annual revenue under GDPR.

- Mitigating Breach Costs: Addressing the average global data breach cost of $4.45 million (2023) through proactive cybersecurity investments.

Advertising and Marketing Regulations

ASICS navigates a complex web of advertising and marketing regulations globally, adhering to truth-in-advertising standards and guidelines for endorsements and promotional activities. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its focus on deceptive advertising, impacting how brands like ASICS can communicate product benefits. This necessitates meticulous substantiation for all marketing claims.

Transparency, particularly concerning sustainability initiatives, is under intense regulatory and consumer scrutiny. ASICS must ensure its environmental claims are accurate and verifiable to avoid potential penalties and maintain consumer trust. Reports from organizations like the European Union's consumer protection authorities in late 2024 highlighted increased enforcement actions against misleading green marketing.

- Truth-in-Advertising Laws: ASICS must ensure all marketing claims are factual and substantiated across its operating regions.

- Endorsement and Promotion Rules: Compliance with regulations governing influencer marketing and promotional offers is critical.

- Sustainability Claims Scrutiny: Regulators and consumers are demanding greater transparency and accuracy in environmental marketing.

- Global Regulatory Landscape: ASICS must adapt its marketing strategies to comply with diverse international advertising standards.

ASICS' legal framework is shaped by intellectual property protection, ensuring its innovations like GEL cushioning remain exclusive. Compliance with global consumer protection laws and product safety standards is paramount, with adherence to regulations like the EU's General Product Safety Regulation and the US CPSIA being critical. The company must also navigate international labor laws, with particular attention to evolving regulations in manufacturing hubs like Vietnam in 2024, and address increasing demands for ethical sourcing under directives like the proposed EU Corporate Sustainability Due Diligence Directive.

Data privacy and cybersecurity are significant legal considerations, driven by regulations like GDPR and CCPA, with GDPR penalties potentially reaching 4% of global annual revenue. ASICS must also adhere to truth-in-advertising standards, with bodies like the FTC scrutinizing claims, and ensure transparency in sustainability marketing, facing increased enforcement actions against misleading green claims as noted by EU consumer protection authorities in late 2024.

| Legal Area | Key Regulations/Considerations | Impact/Risk Example | 2023/2024 Data Point |

|---|---|---|---|

| Intellectual Property | Patents, Trademarks (GEL cushioning) | Deters counterfeit products, maintains competitive edge | Active pursuit of patent protection for new material science advancements. |

| Consumer Protection & Product Safety | EU General Product Safety Regulation, US CPSIA | Ensures product safety and accurate labeling; fines for non-compliance | US CPSC reported over $1.4 billion in recalls in 2023. |

| Labor Laws | Minimum wage, working hours, fair employment | Impacts operational costs and supply chain management | Vietnam refining labor regulations in 2024. |

| Ethical Sourcing | Proposed EU Corporate Sustainability Due Diligence Directive | Mitigates human rights risks (e.g., forced labor); reputational damage | Focus on supply chain transparency and human rights. |

| Data Privacy | GDPR, CCPA (OneASICS, wearables) | Substantial fines for non-compliance | GDPR penalties up to 4% of global annual revenue. |

| Cybersecurity | Data breach prevention | Mitigates financial and reputational damage from breaches | Average global data breach cost was $4.45 million in 2023. |

| Advertising & Marketing | Truth-in-advertising, FTC guidelines | Requires substantiation for marketing claims; penalties for deception | FTC continued focus on deceptive advertising in 2024. |

| Sustainability Claims | Transparency and verifiability of environmental marketing | Avoids penalties and maintains consumer trust | Increased enforcement actions against misleading green marketing (late 2024). |

Environmental factors

ASICS is making significant strides in reducing its carbon footprint. The company achieved a 43.1% reduction in CO₂ emissions from its direct operations compared to 2015 levels, demonstrating a strong commitment to climate action. This dedication was recognized with ASICS being named to CDP's Climate 'A List' in 2024.

Looking ahead, ASICS has set ambitious goals for further greenhouse gas emission reductions as part of its comprehensive strategy to reach net-zero by 2050. This long-term vision underpins their ongoing efforts to minimize environmental impact across their value chain.

The footwear industry is experiencing a significant shift towards sustainability, driven by both consumer demand and regulatory pressures. ASICS is actively responding to this trend by increasing its use of recycled polyester, aiming for over 50% in its products. This commitment is exemplified by innovations like the NIMBUS MIRAI™, which is engineered for straightforward disassembly and recycling, underscoring ASICS' dedication to circular economy principles in product design.

ASICS is actively engaging in waste management through its global 'take-back' program for NIMBUS MIRAI™ running shoes, demonstrating a commitment to responsible product end-of-life handling.

Upcoming regulations, like the EU's Extended Producer Responsibility (EPR) for textiles and footwear, alongside the ban on destroying unsold goods, will increasingly compel companies to implement robust waste management and recycling strategies, impacting operational costs and supply chain logistics for brands like ASICS.

Renewable Energy Adoption in Supply Chain

ASICS is actively pushing for renewable energy adoption within its supply chain. The company has set a target to boost renewable electricity usage in its own business facilities. This commitment extends to its key suppliers, with ASICS requiring strategic Tier 1 footwear suppliers to develop and implement solid plans for sourcing renewable energy.

This strategic focus on clean energy is a core part of ASICS's environmental strategy, aiming to significantly reduce its overall carbon footprint. By 2023, ASICS reported that 34% of the electricity used at its directly managed facilities was from renewable sources, and the company aims to reach 100% by 2030. This initiative is crucial for meeting global climate goals and enhancing the sustainability of its operations.

- Renewable Energy Target: ASICS aims for 100% renewable electricity usage in its directly managed facilities by 2030.

- Supplier Engagement: Strategic Tier 1 footwear suppliers must have concrete renewable energy sourcing plans.

- Environmental Footprint Reduction: The initiative directly contributes to lowering ASICS's overall environmental impact.

- Progress Snapshot: In 2023, 34% of electricity at ASICS's directly managed facilities was from renewable sources.

Environmental Due Diligence and Transparency

New environmental regulations are significantly impacting ASICS's operational landscape. For instance, the EU Deforestation Regulation (EUDR), implemented in late 2024, mandates that companies must demonstrate their supply chains for commodities like rubber and leather are free from deforestation. This directly affects ASICS's sourcing practices, requiring enhanced due diligence to ensure compliance and responsible material procurement.

This increased regulatory scrutiny necessitates greater transparency throughout ASICS's entire supply chain. Companies like ASICS are now compelled to meticulously track and verify the origin of their raw materials. This commitment to transparency is not only driven by legal obligations but also by escalating consumer demand for ethically and sustainably produced goods. ASICS, like many global brands, is responding by investing in more robust traceability systems.

The push for environmental due diligence is becoming a critical factor in maintaining brand reputation and market access. ASICS's proactive approach to these evolving standards will be crucial for its long-term success. By 2025, reports indicate that over 70% of consumers are willing to pay more for sustainable products, underscoring the financial imperative behind environmental responsibility.

- EUDR Compliance: ASICS must ensure its rubber and leather sourcing avoids deforested land.

- Supply Chain Transparency: Enhanced due diligence is needed to prove responsible sourcing.

- Consumer Expectations: Growing demand for sustainable products influences ASICS's strategy.

- Market Access: Adherence to environmental regulations is key to maintaining global market presence.

Environmental factors are increasingly shaping ASICS's operations and strategy. The company is actively working to reduce its carbon footprint, having achieved a 43.1% reduction in CO₂ emissions from direct operations by 2023 compared to 2015. ASICS aims for 100% renewable electricity usage in its directly managed facilities by 2030, with 34% achieved in 2023. New regulations like the EU Deforestation Regulation (EUDR) are also pushing for greater supply chain transparency, impacting ASICS's sourcing of materials like rubber and leather.

| Environmental Factor | ASICS's Action/Impact | Data/Target |

|---|---|---|

| Carbon Emissions | Reduction in direct operations | 43.1% reduction by 2023 (vs. 2015) |

| Renewable Energy | Usage in managed facilities | 100% target by 2030; 34% achieved in 2023 |

| Supply Chain Regulations | EU Deforestation Regulation (EUDR) | Mandates deforestation-free sourcing for rubber/leather |

| Sustainable Materials | Increased use of recycled polyester | Aiming for over 50% in products |

PESTLE Analysis Data Sources

Our Asics PESTLE analysis is built upon a robust foundation of data from reputable sources, including official government publications, international economic bodies like the World Bank and IMF, and leading market research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, environmental regulations, and social trends to ensure a comprehensive and accurate assessment.