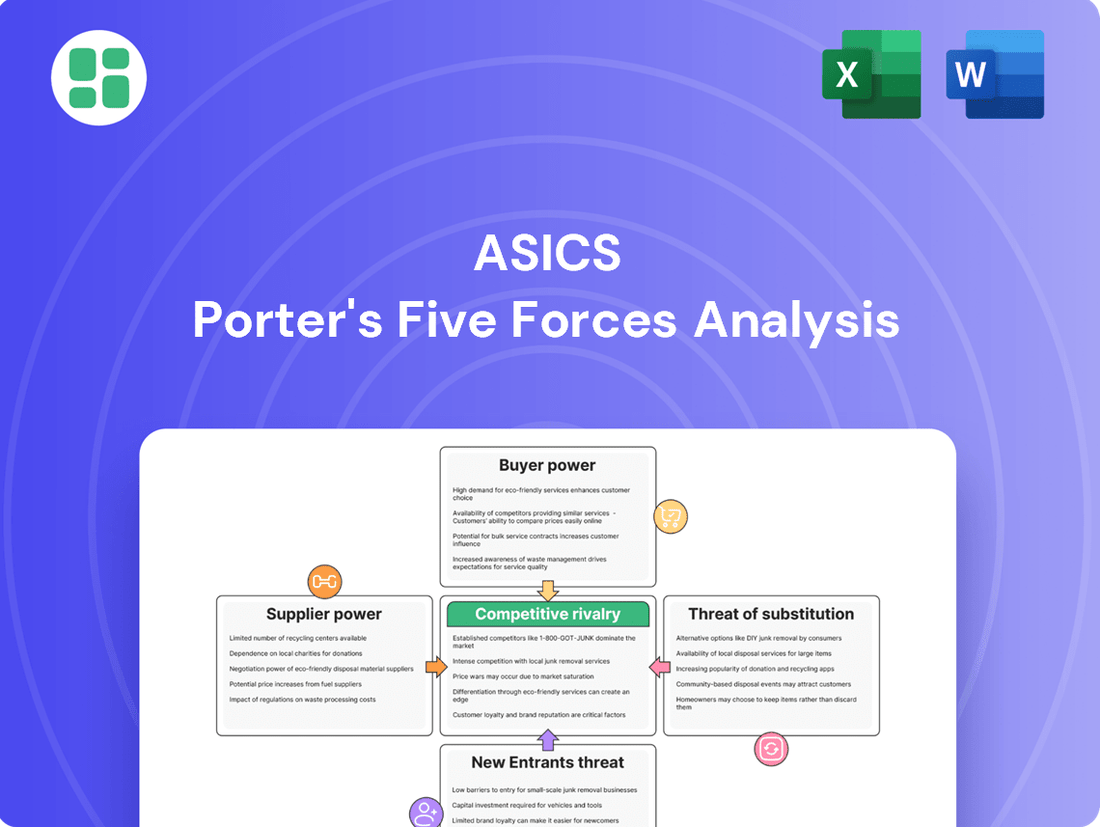

Asics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asics Bundle

Asics operates in a dynamic athletic footwear market, facing intense competition from established giants and agile newcomers. Understanding the bargaining power of buyers and the threat of substitute products is crucial for their sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Asics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ASICS's reliance on specialized material suppliers for advanced foams, gels, and performance textiles gives these suppliers significant bargaining power. If these materials are proprietary or have few alternatives, ASICS faces potential cost increases and innovation hurdles. For instance, a key supplier of a unique cushioning technology could command higher prices, directly impacting ASICS's gross margins.

The athletic footwear sector relies on intricate global supply chains with many manufacturers and component suppliers. ASICS's significant scale is a factor, but supplier power hinges on their production capacity, technological expertise, and how easily ASICS can find replacements. For instance, ASICS's 2023 sustainability report detailed ongoing efforts to diversify its supplier base, aiming to mitigate reliance on any single entity.

The bargaining power of labor and logistics providers significantly impacts ASICS. In 2024, the global logistics market experienced continued volatility, with freight rates fluctuating due to geopolitical events and demand shifts. Skilled labor availability in key manufacturing hubs, particularly in Asia, also presents a challenge, with wage pressures increasing as demand for specialized manufacturing skills grows.

Rising freight costs, for instance, directly affect ASICS's cost of goods sold. ASICS's strategy to mitigate this involves optimizing its supply chain network, exploring alternative transportation methods, and potentially nearshoring some production to reduce reliance on long-haul shipping. This focus on efficiency is crucial for maintaining competitive pricing and profitability.

Technology and Innovation Partners

ASICS's collaboration with technology and innovation partners, such as those providing AI-driven design tools, can significantly influence their bargaining power. If these partners offer proprietary or critical components essential for ASICS's performance-enhancing products, their leverage increases. ASICS's commitment to strengthening innovation, a core tenet of its Mid-Term Plan 2026, underscores the importance of these relationships.

- Critical Technology Dependence: ASICS relies on specialized partners for AI and advanced material research, which are vital for its product differentiation.

- Supplier Power in Innovation: Partners contributing unique R&D services or intellectual property can command higher prices or more favorable terms.

- Strategic Importance of Partnerships: ASICS's Mid-Term Plan 2026 highlights innovation as a key growth driver, making these supplier relationships strategically crucial.

Sustainability-Focused Suppliers

Sustainability-focused suppliers hold increasing sway as the footwear industry pivots towards eco-friendly options. Those offering recycled or bio-based materials, coupled with transparent ethical sourcing, enhance their bargaining power significantly. ASICS, recognizing this shift, is actively enhancing its supply chain visibility and reinforcing supplier accountability for ethical labor standards, a move supported by the growing consumer demand for sustainable products.

This trend is reflected in the market. For instance, the global sustainable footwear market was valued at approximately $10.9 billion in 2023 and is projected to grow substantially, with some estimates suggesting a compound annual growth rate (CAGR) of over 7% through 2030. This expansion underscores the importance of suppliers who can meet these evolving environmental and ethical demands.

- Growing Demand for Recycled Materials: The use of recycled polyester and other reclaimed materials in footwear is on the rise, giving suppliers of these components more leverage.

- Ethical Sourcing Scrutiny: Brands like ASICS are increasing their focus on supply chain transparency, making suppliers with proven ethical labor practices more valuable.

- Innovation in Bio-based Alternatives: Suppliers developing and providing innovative bio-based materials, such as those derived from algae or plant-based polymers, are gaining a competitive edge.

- Supplier Accountability: ASICS' commitment to strengthening supplier accountability means that suppliers who can demonstrate robust compliance with ethical and environmental standards are better positioned in negotiations.

ASICS's dependence on specialized material suppliers for advanced foams, gels, and performance textiles grants these suppliers considerable bargaining power. If these materials are proprietary or have limited alternatives, ASICS may face increased costs and innovation challenges. For example, a key supplier of a unique cushioning technology could dictate higher prices, directly impacting ASICS's profit margins.

The athletic footwear industry relies on complex global supply chains. While ASICS's scale is a factor, supplier power depends on their production capacity, technological expertise, and the availability of substitutes. ASICS’s 2023 sustainability report highlighted efforts to diversify its supplier base, aiming to reduce reliance on single entities.

In 2024, the global logistics market continued to experience volatility, with freight rates fluctuating due to geopolitical events and demand shifts. Skilled labor availability in key manufacturing regions, particularly in Asia, also presents a challenge, with wage pressures increasing as demand for specialized manufacturing skills rises. This directly impacts ASICS's cost of goods sold.

ASICS is actively working to mitigate these pressures by optimizing its supply chain network and exploring alternative transportation methods. The company's Mid-Term Plan 2026 emphasizes innovation and strengthening supplier relationships, particularly with those providing critical technologies like AI-driven design tools. Suppliers offering unique R&D services or intellectual property can leverage these partnerships for more favorable terms.

The bargaining power of suppliers offering sustainable and ethically sourced materials is increasing. The global sustainable footwear market, valued at approximately $10.9 billion in 2023, is projected to grow significantly. Suppliers providing recycled or bio-based materials, coupled with transparent ethical sourcing, are gaining leverage. ASICS is enhancing its supply chain visibility and supplier accountability to meet growing consumer demand for sustainable products.

| Factor | Impact on ASICS | ASICS's Mitigation Strategy |

|---|---|---|

| Proprietary Materials | Higher costs, innovation hurdles | Supplier diversification, R&D investment |

| Logistics Volatility (2024) | Increased freight costs, impacting COGS | Supply chain optimization, alternative transport |

| Skilled Labor Shortages | Wage pressures, production capacity concerns | Investment in training, exploring automation |

| Sustainable Material Demand | Increased leverage for eco-friendly suppliers | Enhanced supply chain transparency, supplier accountability |

| Critical Technology Partners | Potential for higher pricing on essential components | Strategic partnerships, in-house R&D capabilities |

What is included in the product

This analysis dissects the competitive forces impacting Asics, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the athletic footwear and apparel industry.

Instantly visualize the competitive landscape of the athletic footwear industry, identifying key threats and opportunities to strategically position Asics for sustained success.

Customers Bargaining Power

Individual performance athletes, ASICS's core demographic, demand specialized gear that directly impacts their athletic achievements. Their bargaining power is somewhat limited because while they value ASICS's advanced technology, the market offers many viable alternatives from competitors like Nike and Adidas, who also invest heavily in performance innovation.

These athletes often demonstrate loyalty to brands that consistently deliver superior performance, a factor ASICS leverages through its OneASICS platform. This ecosystem aims to foster deeper engagement and repeat purchases by offering personalized experiences and access to training resources, thereby strengthening the customer relationship and slightly mitigating their direct bargaining power.

General fitness and lifestyle consumers represent a growing segment for ASICS, driven by the athleisure trend. These customers seek a blend of comfort, style, and performance, expanding ASICS's market beyond traditional athletes. This broader appeal, however, also means they have more options, from specialized athletic brands to everyday fashion labels, potentially increasing their leverage.

The increased availability of alternatives for lifestyle-oriented consumers means they are often more price-sensitive. ASICS's success in its SportStyle and Onitsuka Tiger lines, which cater specifically to this market, highlights the importance of this segment. In 2023, ASICS reported a significant increase in net sales, with its lifestyle segment playing a crucial role in this expansion, demonstrating how ASICS is navigating this consumer power.

Large athletic goods retailers and department stores wield considerable bargaining power over ASICS. Their substantial purchase volumes and control over prime shelf space allow them to negotiate favorable terms, impacting ASICS' margins and product placement. This is a critical factor in ASICS' wholesale strategy.

The continued reliance on these large retailers is evident in ASICS' sales performance. For instance, in 2023, wholesale channels remained a dominant revenue stream for ASICS, contributing over 60% of its global sales, underscoring the significant leverage these buyers possess.

Online Retail Platforms and Direct-to-Consumer (DTC) Channels

The growing trend towards online retail and direct-to-consumer (DTC) channels significantly impacts the bargaining power of customers. This shift provides consumers with unprecedented convenience and the ability to easily compare prices across various platforms. For ASICS, this means customers can readily find alternatives and leverage price competition.

However, ASICS is actively working to counter this by strengthening its direct engagement with customers. By investing in its own online platforms and developing robust loyalty programs, ASICS aims to build direct relationships and exert more control over its pricing strategies. This direct channel allows for personalized experiences and can foster brand loyalty, thereby reducing customer reliance on third-party retailers.

ASICS's strategic focus on enhancing its online presence and driving e-commerce growth is a direct response to these evolving customer dynamics. In 2023, ASICS reported that its digital sales continued to grow, contributing a substantial portion to its overall revenue, underscoring the importance of these channels in managing customer relationships and mitigating their bargaining power.

- Increased Price Transparency: Online platforms allow customers to easily compare ASICS's prices with competitors, increasing their bargaining power.

- Direct-to-Consumer (DTC) Advantage: ASICS's own e-commerce channels enable direct customer engagement, fostering loyalty and providing data for personalized offers.

- Digital Sales Growth: ASICS's digital sales saw continued expansion in 2023, highlighting the success of its online strategy in building direct customer relationships.

- Loyalty Programs: The implementation of loyalty programs aims to retain customers and reduce their propensity to switch based solely on price.

Price Sensitivity and Brand Loyalty

Customers in the athletic footwear market are increasingly price-sensitive, frequently comparing prices online and seeking the best value. This trend means that while ASICS's strong brand and technological innovation can build loyalty, especially for its high-performance running shoes, price remains a significant factor for many consumers.

- Price Comparison: Consumers actively use online platforms to compare prices across different brands and retailers, putting pressure on manufacturers like ASICS to remain competitive.

- Brand Loyalty vs. Price: While ASICS's reputation for quality and advanced technology fosters loyalty, particularly for its premium offerings, the willingness to switch for a lower price point exists, especially for more casual athletic wear.

- Value Proposition: ASICS's top-selling models, often highlighted for stability and cushioning, also need to demonstrate clear value for money to capture a broad customer base, as seen in their performance on platforms like Amazon.

The bargaining power of customers for ASICS is influenced by several factors, including price sensitivity, the availability of alternatives, and the rise of online retail. While ASICS's performance-oriented products and brand loyalty can mitigate some of this power, a significant portion of consumers, particularly in the lifestyle segment, are highly attuned to price and readily compare options. ASICS's strategic investments in its direct-to-consumer channels and loyalty programs aim to build stronger customer relationships and reduce reliance on third-party price comparisons.

In 2023, ASICS saw continued growth in its digital sales, a testament to its successful DTC strategy. This channel allows for more direct customer engagement and data collection, enabling personalized offers that can enhance loyalty and reduce price-driven switching. The company's focus on enhancing its online presence is crucial for managing customer expectations and maintaining competitive pricing in an increasingly transparent market.

The athletic footwear market is characterized by a high degree of customer access to information and alternatives. Consumers can easily compare ASICS's offerings with those of major competitors like Nike and Adidas, especially online. This accessibility amplifies their bargaining power, as they can leverage price differences and promotional offers across various platforms to secure the best deals.

ASICS's wholesale channel, which accounted for over 60% of its sales in 2023, highlights the significant bargaining power held by large retailers. These entities can negotiate favorable terms due to their substantial order volumes and control over shelf space, directly impacting ASICS's profit margins and market reach.

Full Version Awaits

Asics Porter's Five Forces Analysis

The document you see here is the complete, professionally crafted Asics Porter's Five Forces Analysis, exactly as you will receive it upon purchase. This preview showcases the full depth of the analysis, including detailed insights into competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. You can be confident that the document you are reviewing is the final, ready-to-use report you will download immediately after completing your transaction.

Rivalry Among Competitors

The athletic footwear arena is incredibly crowded, featuring a multitude of global and local brands. Major players like Nike, holding a significant 46.28% market share in Q1 2025, and Adidas, with 33.48%, dominate, but emerging brands such as On and Hoka are also making waves, alongside established names like Puma at 9.74%.

Established brands like ASICS, Nike, and Adidas leverage decades of building strong brand recognition and deep customer loyalty. ASICS, while renowned for its performance running heritage, faces the hurdle of lower awareness in its broader product categories.

Competitive rivalry within the athletic footwear and apparel industry is intense, fueled by a relentless pursuit of product differentiation and innovation. Companies like ASICS stand out by investing heavily in proprietary performance-enhancing technologies, such as their signature GEL cushioning system, which aims to improve shock absorption and comfort. This focus on unique technological advancements is a key strategy to capture market share.

However, ASICS faces formidable competition from rivals who are also pouring significant resources into research and development. For instance, Nike's Air Max technology and Adidas's Boost cushioning are well-established differentiators. The industry also sees a growing emphasis on sustainable materials and ethical manufacturing processes, creating another avenue for brands to distinguish themselves and appeal to a conscious consumer base.

Marketing and Endorsement Strategies

Competitive rivalry in the athletic footwear industry is intense, with major players frequently deploying extensive marketing campaigns and high-profile celebrity endorsements to capture market share and consumer attention. For instance, Nike's Q1 2025 revenue reached $13.1 billion, a testament to its marketing prowess. ASICS counters this by investing significantly in its own marketing and strategic collaborations, particularly to boost the visibility and appeal of its SportStyle and Onitsuka Tiger lifestyle brands. This approach aims to resonate with a broader consumer base beyond core athletes.

ASICS' marketing efforts in 2024 have focused on connecting with consumers through storytelling and community engagement. The brand has continued its partnerships with athletes across various disciplines, aiming to highlight the performance benefits of its products. Furthermore, ASICS has been active in digital marketing, leveraging social media platforms to reach younger demographics and build brand loyalty. These strategies are crucial for ASICS to maintain its competitive edge against rivals with larger marketing budgets.

- Brand Visibility: Competitors like Adidas, with reported revenues of €21.4 billion in 2023, heavily rely on global marketing campaigns and high-profile athlete partnerships to maintain brand visibility.

- Endorsement Power: Celebrity endorsements, such as those by global pop stars or top athletes, can significantly influence purchasing decisions, as seen with the continued success of signature shoe lines from brands like Jordan Brand.

- ASICS' Strategy: ASICS invests in collaborations and marketing, particularly for its SportStyle and Onitsuka Tiger lines, to broaden its appeal and compete in the lifestyle segment.

- Market Share Impact: Effective marketing and endorsements are key drivers for capturing market share, with brands constantly innovating their promotional activities to stay ahead.

Market Share and Growth Aspirations

ASICS commands over 10% of the global performance running market, a strong position that fuels its competitive drive. However, its broader global sportswear market share, standing at approximately 5.38% as of Q1 2025, indicates significant room for expansion and intensifies the rivalry with larger, more diversified players.

The company's ambition to capture the top market share in the US performance running segment by 2025 directly challenges entrenched competitors. This strategic push means ASICS is actively seeking to displace established leaders, leading to heightened competition and increased marketing efforts.

- Global Performance Running Market Share: Over 10%

- Global Sportswear Market Share (Q1 2025): Approximately 5.38%

- US Performance Running Market Goal: Achieve top market share by 2025

The athletic footwear industry is characterized by intense competition, with brands like Nike and Adidas holding substantial market shares. Nike's Q1 2025 market share stood at 46.28%, while Adidas held 33.48%. ASICS, though a significant player in performance running with over 10% of that market, has a broader sportswear market share of approximately 5.38% as of Q1 2025, highlighting the competitive pressure from larger, more diversified brands.

Brands differentiate themselves through technological innovation, such as ASICS' GEL cushioning, Nike's Air Max, and Adidas' Boost. Marketing and celebrity endorsements are also critical, with Nike's Q1 2025 revenue reaching $13.1 billion, partly due to its strong promotional strategies. ASICS counters by investing in its lifestyle brands, Onitsuka Tiger and SportStyle, and engaging in community-focused marketing to broaden its appeal.

| Brand | 2023 Revenue (Approx.) | Key Differentiators | Market Share (Q1 2025) |

| Nike | $51.2 billion | Air Max, Celebrity Endorsements, Brand Recognition | 46.28% |

| Adidas | €21.4 billion | Boost Technology, Global Marketing, Established Heritage | 33.48% |

| ASICS | $4.5 billion (FY2023) | GEL Cushioning, Performance Running Focus, SportStyle/Onitsuka Tiger | 5.38% (Global Sportswear) / >10% (Performance Running) |

SSubstitutes Threaten

The rise of athleisure significantly blurs the lines between athletic and casual footwear, creating a substantial threat of substitutes for specialized athletic shoes. Consumers are increasingly choosing versatile, comfortable sneakers for everyday wear, often prioritizing style and general comfort over performance-specific features when not engaged in athletic activities. This trend means brands like ASICS, known for performance, must also cater to the lifestyle market to remain competitive.

Consumers have a wide array of physical activities available that don't necessitate specialized ASICS footwear. For instance, swimming requires only swimwear, cycling demands different gear like helmets and padded shorts, and bodyweight exercises like yoga or calisthenics need minimal to no equipment. This broad availability of alternatives can divert consumer spending and attention away from dedicated athletic shoe purchases, impacting ASICS' market share.

The rise of barefoot running and minimalist footwear presents a potential threat of substitutes for traditional athletic shoe manufacturers like ASICS. For some runners, these alternatives offer a different approach to running, emphasizing natural foot mechanics over extensive cushioning and technological support. This niche, though not mainstream, challenges the perceived necessity of highly engineered running shoes.

Lifestyle Apparel and Accessories

The threat of substitutes for ASICS is significant, particularly from lifestyle apparel and accessories. Consumers may opt to spend discretionary income on other athletic wear, such as performance tops, leggings, or casual athleisure items, rather than ASICS footwear. This is especially true as the lines blur between performance gear and everyday fashion.

For instance, the global activewear market was valued at approximately USD 350 billion in 2023 and is projected to grow steadily. This broad category encompasses a wide range of products that can directly compete for consumer dollars that might otherwise be allocated to ASICS shoes. Consumers often make purchasing decisions based on comfort, style, and brand perception, which can lead them to choose apparel over footwear, even within the athletic sector.

- The broader athletic apparel market, excluding footwear, presents a substantial substitute threat to ASICS.

- Consumer spending can be diverted towards activewear for comfort or style, bypassing ASICS footwear purchases.

- While ASICS offers apparel, its core business and brand identity are heavily rooted in footwear, making it vulnerable to shifts in consumer preference towards apparel.

DIY or Generic Footwear Solutions

In certain markets, particularly those with lower disposable incomes or a strong emphasis on cost savings, consumers might opt for generic or unbranded footwear. These alternatives primarily offer basic protection and comfort, falling short of the specialized performance features ASICS integrates into its athletic and lifestyle products. For instance, the global market for unbranded apparel and footwear, while difficult to quantify precisely due to its informal nature, represents a significant portion of consumption in emerging economies, potentially diverting a segment of price-sensitive buyers.

While these DIY or generic solutions don't directly compete on performance, their low price point can act as a substitute for consumers where the advanced technology and brand reputation of ASICS are not primary purchasing drivers. This threat is more pronounced in segments where footwear is viewed as a utilitarian item rather than an investment in athletic performance or style. The overall value proposition of ASICS, which includes innovation, durability, and brand heritage, is key to differentiating itself from these lower-cost alternatives.

- Market Penetration: Generic footwear often captures a larger share of the basic footwear market in developing regions, impacting overall volume potential for premium brands.

- Price Sensitivity: Consumers prioritizing cost over specialized features are more inclined to choose unbranded options, creating a price-based substitution threat.

- Performance Gap: The significant difference in technological features and material quality between ASICS products and generic alternatives limits direct substitution for performance-oriented consumers.

- Brand Value: ASICS's investment in research and development, brand marketing, and athlete endorsements creates a strong brand loyalty that mitigates the threat from lower-cost, unbranded substitutes.

The primary threat of substitutes for ASICS stems from the burgeoning athleisure trend and the wide array of alternative physical activities consumers can engage in. These substitutes range from other athletic apparel brands that compete for discretionary spending to entirely different forms of exercise that require minimal specialized footwear. Furthermore, the increasing popularity of minimalist or barefoot running styles presents a niche but relevant alternative to ASICS' technologically advanced shoe designs.

The global activewear market, valued at approximately USD 350 billion in 2023, highlights how consumer spending can easily be diverted towards general athletic apparel and lifestyle items rather than specific ASICS footwear. This broad market includes everything from performance tops to casual sneakers, directly competing for the same consumer dollar. While ASICS does offer apparel, its core strength and brand identity are in footwear, making it susceptible to shifts in consumer preference towards apparel-centric purchases.

The threat is amplified by price-sensitive consumers in certain markets who opt for generic or unbranded footwear. These alternatives offer basic functionality at a significantly lower cost, appealing to those who view footwear primarily as a utility rather than an investment in performance or brand. While these substitutes lack ASICS' technological innovation and brand prestige, their accessibility in emerging economies can capture a considerable segment of the market, particularly impacting volume potential.

| Substitute Category | Key Characteristics | Impact on ASICS | Example Data (2023/2024 Estimates) |

|---|---|---|---|

| Athleisure Footwear | Comfort, style, versatility | Diverts spending from performance shoes | Global Athleisure Market: Projected to reach over USD 600 billion by 2027 (from approx. USD 400 billion in 2023) |

| Alternative Physical Activities | Low equipment needs (e.g., yoga, swimming) | Reduces demand for specialized athletic shoes | Global Yoga Market: Valued at over USD 100 billion in 2023 |

| Minimalist/Barefoot Footwear | Natural foot mechanics, less cushioning | Niche challenge to performance shoe necessity | Minimalist Shoe Market: Growing segment, though precise global figures are difficult to isolate from broader athletic footwear data |

| Generic/Unbranded Footwear | Low cost, basic protection | Captures price-sensitive consumers, especially in emerging markets | Emerging Market Footwear Consumption: A significant portion of unit sales in developing economies are unbranded, estimated to be over 30% in some regions. |

Entrants Threaten

The athletic footwear industry presents a significant barrier to entry due to exceptionally high capital requirements. Companies looking to compete must allocate substantial funds towards cutting-edge research and development to create innovative performance technologies, establish efficient manufacturing operations, build strong brand recognition through extensive marketing campaigns, and create robust distribution networks. For instance, ASICS is making considerable investments in its Innovation Campus to bolster its R&D capabilities, underscoring the financial commitment needed to stay competitive.

Established brands such as ASICS, Nike, and Adidas benefit from decades of cultivated brand loyalty and widespread recognition. This deep-seated consumer trust presents a significant barrier for newcomers attempting to carve out market share. ASICS, in particular, leverages its rich heritage and strong athlete endorsements to reinforce this loyalty, making it challenging for new entrants to gain traction.

Asics benefits from established distribution channels, a significant hurdle for new entrants. Their wholesale partnerships with major global retailers and a well-developed direct-to-consumer e-commerce platform provide extensive reach. For instance, Asics reported a 10.7% increase in net sales for the first quarter of 2024, partly driven by strong performance in their retail and e-commerce segments.

Newcomers struggle to replicate this access, facing difficulties in securing prime shelf space in established brick-and-mortar stores and building efficient, cost-effective online fulfillment operations. This entrenched distribution network acts as a powerful barrier, making it challenging for emerging brands to gain visibility and market penetration against Asics.

Technological Expertise and R&D Investment

The threat of new entrants in the athletic footwear market, particularly concerning technological innovation, is significantly mitigated by the substantial R&D investment and specialized expertise required. ASICS, for instance, has built its reputation on proprietary technologies like its GEL cushioning system, which demanded years of research and development to perfect. This deep-seated technical know-how creates a formidable barrier for newcomers aiming to offer comparable performance benefits.

New competitors would need to not only replicate but also innovate beyond ASICS's established technological advantages to gain market traction. This necessitates substantial capital outlay for research and development, along with attracting highly skilled engineers and material scientists. For example, ASICS reported R&D expenses of approximately ¥21.8 billion (around $150 million USD based on average 2023 exchange rates) in their fiscal year ending March 2024, highlighting the scale of investment in innovation.

- High R&D Costs: Developing advanced cushioning and support systems demands significant financial resources, deterring smaller players.

- Proprietary Technology: ASICS's patented technologies, like GEL, are difficult and expensive to legally replicate.

- Talent Acquisition: Attracting and retaining top-tier sports science and engineering talent is crucial and competitive.

- Time to Market: Bringing truly innovative footwear technology from concept to consumer can take many years, providing ASICS with a sustained competitive edge.

Intellectual Property and Regulatory Hurdles

The threat of new entrants in the athletic footwear market is significantly mitigated by substantial intellectual property and regulatory hurdles. Established brands like ASICS possess extensive patent portfolios covering innovative cushioning technologies, ergonomic designs, and proprietary manufacturing techniques. For instance, ASICS' GEL technology, a cornerstone of its product line, is protected by numerous patents, making it difficult for newcomers to replicate without infringing on existing intellectual property. This IP protection acts as a formidable barrier, requiring significant investment in research and development to create truly novel and competitive offerings.

Navigating the complex web of international trade regulations and compliance standards also presents a considerable challenge for potential new entrants. Adhering to varying material sourcing regulations, labor laws, and product safety standards across different global markets demands specialized expertise and resources. For example, in 2024, the global footwear industry faced ongoing scrutiny regarding supply chain transparency and ethical labor practices, with stricter enforcement of import regulations in key markets like the European Union and the United States. Companies failing to meet these compliance requirements risk significant penalties, delays, or outright market exclusion, further deterring new players.

- Intellectual Property: ASICS holds a vast number of patents related to footwear design and performance technologies, creating a significant barrier to entry.

- Regulatory Compliance: New entrants must navigate complex international trade laws, material sourcing regulations, and labor standards, which can be costly and time-consuming.

- Market Access: Compliance with varying national safety and import regulations in 2024 added another layer of difficulty for companies seeking to enter global markets.

The threat of new entrants for ASICS is considerably low due to the immense capital required for research, development, and establishing a global brand presence. ASICS's significant investment in its Innovation Campus and its R&D spending of approximately ¥21.8 billion (around $150 million USD) in fiscal year 2023 highlight these high entry barriers.

Established brands like ASICS leverage decades of built-up brand loyalty and recognition, making it difficult for newcomers to gain consumer trust. ASICS's strong heritage and athlete endorsements, coupled with a reported 10.7% increase in net sales for Q1 2024, demonstrate the power of their established market position.

The threat is further diminished by ASICS's extensive distribution networks, including strong wholesale partnerships and a well-developed e-commerce platform. New entrants face challenges securing prime retail space and building efficient online fulfillment capabilities, as evidenced by ASICS's robust retail and e-commerce performance in early 2024.

Intellectual property and regulatory compliance also act as significant deterrents. ASICS's numerous patents, particularly for technologies like GEL, and the complex international trade regulations, including increased scrutiny on supply chain transparency in 2024, create substantial hurdles for potential competitors.

| Barrier Type | ASICS's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High (e.g., ¥21.8B R&D FY23) | Significant financial outlay needed for R&D and marketing. |

| Brand Loyalty/Recognition | Strong, built over decades | Difficult for new brands to gain consumer trust and market share. |

| Distribution Channels | Extensive global reach | Challenges in securing retail space and efficient e-commerce operations. |

| Intellectual Property | Extensive patent portfolio (e.g., GEL technology) | Legal and technical challenges in replicating proprietary innovations. |

| Regulatory Compliance | Navigates complex global regulations | Costly and time-consuming to meet varying international standards. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Asics is built upon a robust foundation of data, drawing from Asics' annual reports, investor presentations, and financial statements. We also incorporate insights from leading sports industry research firms and market intelligence platforms to capture competitive dynamics.