Ashtead Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

Ashtead Group's strengths lie in its dominant market position and strong operational efficiency, while its opportunities stem from ongoing infrastructure investment and potential market expansion. However, it faces challenges from increasing competition and economic downturns that could impact rental demand.

Want the full story behind Ashtead Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ashtead Group, largely via its Sunbelt Rentals division, commands a leading position in the equipment rental sector, particularly within North America. This extensive network, boasting over 700 locations across the US and Canada, translates into significant competitive strength and broad customer access.

The company's substantial scale, with Sunbelt Rentals operating a fleet valued at billions of dollars, allows for considerable economies of scale. This operational efficiency is further amplified by its infrastructure, facilitating cost-effective service delivery and a strong market presence.

Ashtead Group boasts a remarkably diverse equipment fleet, encompassing everything from basic tools to highly specialized machinery and mobile storage. This breadth allows them to serve a wide array of industries, including construction, industrial, infrastructure, and even the events sector. This diversification is a significant strength, as it reduces the company's vulnerability to downturns in any single market.

The company's ability to support projects of all sizes, from minor repairs to massive infrastructure developments, further solidifies its market position. Ashtead's strategic focus on growing its specialty rental divisions, coupled with a concerted effort to cross-sell services, is proving effective. For instance, in the third quarter of fiscal 2025, rental revenue from specialty divisions saw robust growth, contributing significantly to overall performance.

Ashtead Group showcased exceptional financial results in fiscal year 2025, achieving record rental revenues and a notable increase in adjusted EBITDA, reaching $7.6 billion. This strong performance translated into substantial free cash flow generation, amounting to $2.1 billion. This financial resilience allows Ashtead to fund ongoing capital expenditures and reward shareholders through dividends and share repurchases, demonstrating a healthy and sustainable business model.

Strategic Growth Initiatives (Sunbelt 4.0)

Ashtead's Sunbelt 4.0 strategy is a key strength, targeting over US$14 billion in revenue by 2029. This ambitious plan focuses on increasing market presence through new depot openings and a cluster strategy in important regions. The initiative also leverages existing infrastructure to boost operational efficiency and customer satisfaction via technology enhancements.

The strategic growth initiatives under Sunbelt 4.0 are designed to capitalize on market opportunities and drive significant revenue expansion. Key components include:

- Market Density Expansion: Opening new greenfield depots to increase geographical reach.

- Cluster Strategy: Concentrating resources and operations in key, high-potential markets.

- Operational Leverage: Utilizing existing infrastructure for improved performance and cost efficiencies.

- Technology Integration: Enhancing customer experience and streamlining operations through digital solutions.

Commitment to Sustainability and Safety

Ashtead Group demonstrates a robust commitment to sustainability, setting ambitious targets including the reduction of greenhouse gas emissions and achieving net-zero carbon emissions by 2050. This focus on environmentally responsible rental solutions resonates with a growing customer demand for greener alternatives.

The company's dedication to safety is equally strong, evidenced by record low incident rates. Initiatives like the 'Engage for Life' program are instrumental in enhancing employee well-being and upholding high operational standards across the business.

- Sustainability Targets: Aiming for net-zero carbon emissions by 2050, with interim greenhouse gas reduction goals.

- Customer Alignment: Offering eco-friendly rental options that meet evolving market preferences.

- Safety Performance: Achieved historically low incident rates through proactive safety programs.

- Employee Well-being: Programs like 'Engage for Life' contribute to a safer and more supportive work environment.

Ashtead Group's leading market position, particularly through its Sunbelt Rentals division in North America, is a significant strength. Its extensive network of over 700 locations provides broad customer access and substantial competitive advantages. The company's vast fleet, valued in the billions, enables significant economies of scale and operational efficiencies, further bolstered by its robust infrastructure.

The diversity of Ashtead's rental fleet, spanning from basic tools to specialized machinery and mobile storage, allows it to serve a wide array of industries. This breadth reduces reliance on any single sector, offering resilience against market fluctuations. Furthermore, Ashtead's ability to cater to projects of all scales, from minor repairs to major infrastructure, reinforces its market dominance.

Financially, Ashtead demonstrated exceptional strength in fiscal year 2025, achieving record rental revenues and a substantial increase in adjusted EBITDA to $7.6 billion. This robust performance generated $2.1 billion in free cash flow, providing ample capacity for capital expenditures, dividends, and share repurchases.

The Sunbelt 4.0 strategy is a key driver of future growth, targeting over US$14 billion in revenue by 2029 through market density expansion, a cluster strategy, operational leverage, and technology integration. Ashtead's commitment to sustainability, with a goal of net-zero carbon emissions by 2050, and its strong safety record, including historically low incident rates, further enhance its appeal and operational integrity.

| Metric | FY2025 Value | Significance |

|---|---|---|

| Rental Revenue | Record levels | Demonstrates strong market demand and execution |

| Adjusted EBITDA | $7.6 billion | Highlights operational profitability and efficiency |

| Free Cash Flow | $2.1 billion | Indicates financial flexibility for investment and shareholder returns |

| Sunbelt Locations | >700 (North America) | Underpins market leadership and customer reach |

| Sustainability Goal | Net-zero by 2050 | Aligns with market trends and ESG investor expectations |

What is included in the product

Delivers a strategic overview of Ashtead Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable SWOT analysis of Ashtead Group, pinpointing key strengths and mitigating potential weaknesses for strategic advantage.

Weaknesses

Ashtead Group's significant exposure to the construction and industrial sectors, especially in North America, presents a notable weakness. A slowdown in these key markets, which is a possibility for late 2024 and into 2025 according to various economic outlooks, could directly hinder rental revenue expansion.

While Ashtead benefits from diversification across various end markets, its core business remains sensitive to the cyclical nature of construction and industrial activity. For instance, a projected softening in non-residential construction spending in the US for 2025 could translate into reduced demand for rental equipment.

Although government infrastructure projects provide a degree of resilience, a widespread economic deceleration impacting these foundational sectors poses a tangible risk. This dependency means Ashtead's performance is closely tied to the health of these specific economic engines.

Ashtead Group operates in the equipment rental sector, which is closely tied to broader economic cycles. This means demand for their services can fluctuate significantly with changes in interest rates and overall GDP growth. For instance, during periods of economic slowdown, businesses may scale back their capital expenditures, leading to reduced rental needs.

While higher borrowing costs can sometimes encourage renting over buying, a sharp economic downturn or persistent high inflation presents a notable risk. Such conditions could dampen demand for equipment rentals and compress profit margins for Ashtead. In the fiscal year ending April 30, 2024, Ashtead reported revenue of $9.8 billion, highlighting the scale of its operations and its susceptibility to these economic swings.

Ashtead Group's commitment to maintaining a state-of-the-art and varied equipment fleet necessitates significant ongoing capital expenditure. This investment is crucial for staying competitive and meeting diverse customer demands.

Despite Ashtead's robust free cash flow generation, substantial investments in fleet expansion and strategic acquisitions have resulted in elevated net debt levels. For instance, as of the third quarter of fiscal year 2024, the company reported net debt of $7.8 billion.

While Ashtead has demonstrated progress in managing its financial leverage, with the net debt to adjusted EBITDA ratio improving, the company must remain vigilant. Navigating a landscape of potentially fluctuating interest rates requires careful debt management and strategic financing to mitigate associated costs.

Operational Efficiency and Technology Integration Challenges for Competitors

Many independent equipment rental companies, unlike national players like Ashtead, grapple with fragmented technology systems and manual workflows. This often translates to inefficiencies and increased operating expenses across the sector.

These technological gaps can result in revenue leakage and hinder the ability to scale effectively. For instance, a 2024 industry survey indicated that over 40% of smaller rental businesses still rely on manual inventory tracking, leading to potential overbooking or underutilization of assets.

While Ashtead's unified technology provides a competitive edge, this industry-wide challenge presents a hurdle for integrating acquired businesses and maintaining uniform operational standards across a broad network.

- Fragmented Systems: A significant portion of the rental industry operates with disparate software and manual processes, impacting overall efficiency.

- Revenue Leakage: Inefficient tracking and management systems can lead to lost revenue opportunities for smaller operators.

- Integration Hurdles: For larger entities, acquiring and integrating businesses with varied technological infrastructures poses a consistent challenge.

Competition in a Fragmented Market

The US equipment rental market, while seeing some consolidation, still presents a highly fragmented picture. This means Ashtead faces competition not only from major players like United Rentals and Herc Rentals, who are also bolstering their specialty offerings, but also from a multitude of smaller, localized operators. This intense competition necessitates continuous innovation and strict pricing strategies to protect market share and profitability.

Ashtead's competitive environment is characterized by this persistent fragmentation. For instance, while the top players are significant, a substantial portion of the market comprises businesses with a single location or only a few branches. This creates a dynamic where even smaller competitors can exert localized pressure, demanding agility from Ashtead.

- Fragmented US Market: Despite industry consolidation, the US equipment rental sector remains fragmented, featuring numerous single-store operators and smaller multi-location companies.

- Intensified Rivalry: Industry giants like United Rentals and Herc Rentals are actively expanding their specialty divisions, increasing competitive pressure on Ashtead.

- Strategic Imperatives: To maintain market share and profitability, Ashtead must consistently innovate and exercise pricing discipline in this challenging landscape.

Ashtead's significant reliance on the construction and industrial sectors, particularly in North America, makes it vulnerable to economic downturns. Projections for late 2024 and 2025 suggest a potential slowdown in these areas, which could directly impact Ashtead's rental revenue growth. For example, a projected dip in non-residential construction spending in the US for 2025 could reduce demand for their equipment.

The company's substantial ongoing capital expenditures to maintain a modern fleet, while necessary for competitiveness, strain its financial resources. This, coupled with strategic acquisitions, has led to elevated net debt levels, which stood at $7.8 billion as of the third quarter of fiscal year 2024. Managing this debt amidst potentially fluctuating interest rates is a key concern.

The equipment rental industry, including Ashtead, is inherently cyclical and sensitive to broader economic trends. Changes in interest rates and overall GDP growth can significantly affect demand for rental services. A sharp economic slowdown or persistent high inflation could dampen rental needs and compress Ashtead's profit margins, despite its $9.8 billion in revenue for the fiscal year ending April 30, 2024.

The fragmented nature of the US rental market, with many smaller operators, presents ongoing competitive challenges. Even with industry consolidation, localized competition remains intense, requiring Ashtead to maintain constant innovation and disciplined pricing to protect its market share and profitability.

Full Version Awaits

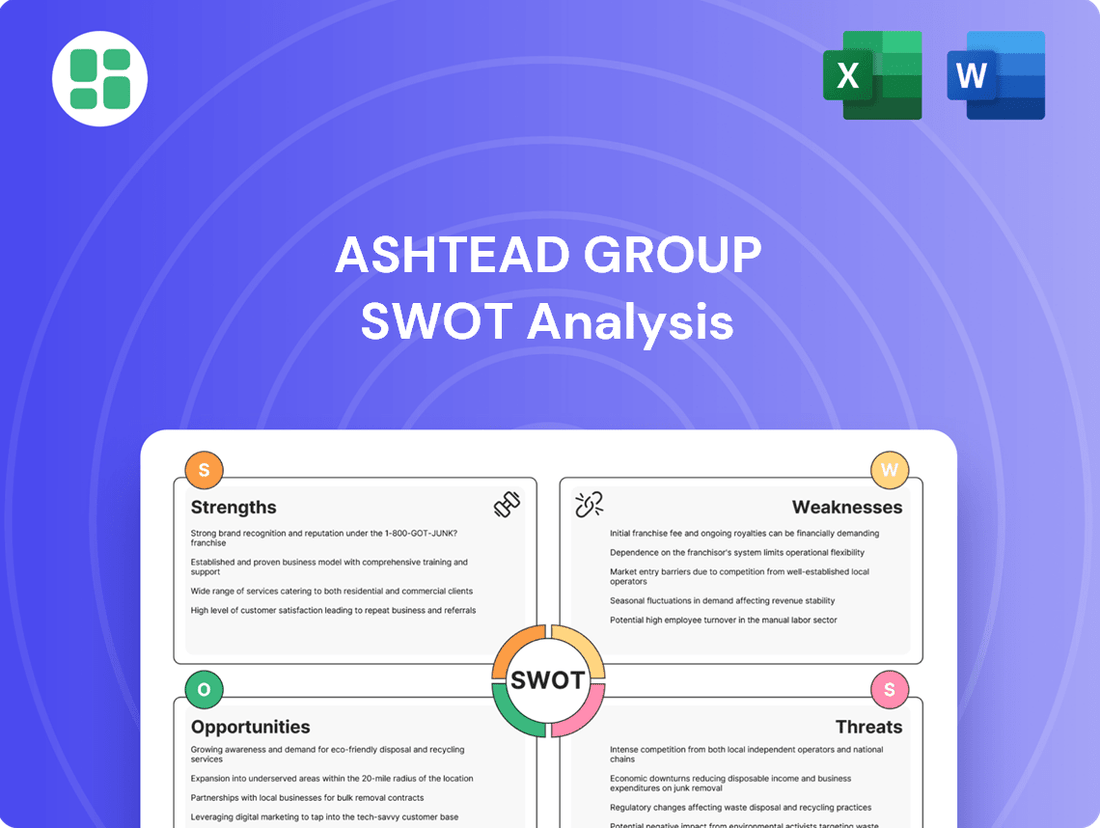

Ashtead Group SWOT Analysis

This is the actual Ashtead Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive breakdown of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights into Ashtead Group's strategic positioning.

Opportunities

Government initiatives like the US Infrastructure Investment and Jobs Act (IIJA) are fueling significant demand for rental equipment. This legislation, with billions allocated for transportation and utilities, directly benefits companies like Ashtead, anticipating sustained growth in infrastructure, manufacturing, and energy sectors through 2025.

Ashtead is strategically positioned to benefit from a robust pipeline of large-scale projects, including data centers, semiconductor fabrication plants, and liquefied natural gas (LNG) facilities. These 'mega projects' often have long development cycles and are generally more resilient to interest rate fluctuations, providing a stable revenue stream for rental providers.

Ashtead's Sunbelt 4.0 strategy is a key driver for expansion, focusing on opening greenfield locations and intensifying its cluster strategy to boost rental penetration in existing markets. This approach aims to capture a larger share of the rental market by strategically placing facilities and deepening relationships within specific geographic areas.

The company sees substantial growth potential in specialty rentals, projecting this segment to reach US$5 billion by 2029. This growth is expected to be particularly strong in areas like power generation, HVAC, climate control, and flooring solutions, indicating a strategic shift towards higher-margin, specialized services.

Ashtead can leverage technological advancements to boost efficiency and customer satisfaction. The company's investment in advanced rental software, telematics, and IoT sensors allows for better fleet management and real-time data insights. This digital transformation is crucial for optimizing operations.

The implementation of systems like the next-generation vehicle dispatch optimization system (VDOS 4.0) is a prime example of this opportunity. Such technologies streamline logistics, improve asset utilization, and can lead to significant cost savings. For instance, enhanced fleet visibility through telematics can reduce downtime and fuel consumption, directly impacting profitability.

Furthermore, Ashtead's focus on connected assets and online platforms creates new avenues for customer engagement and service delivery. By offering seamless online booking and tracking, Ashtead can attract and retain a broader customer base, particularly those who value digital convenience. This digital shift is a key differentiator in the competitive rental market.

Sustainability and Green Equipment Demand

The increasing demand for sustainable operations presents a significant opportunity for Ashtead Group. Customers are actively seeking eco-friendly equipment, such as compact electric machinery and alternative power options, reflecting a broader market shift towards environmental responsibility.

Ashtead's proactive investment in a greener rental fleet, aiming to reduce its own carbon footprint, directly aligns with this growing customer preference. This strategic focus not only helps meet current market needs but also positions Ashtead to capture a competitive edge as sustainability becomes a more critical factor in equipment rental decisions. For instance, by 2024, the company has been actively expanding its electric and hybrid equipment offerings across its Sunbelt Rentals and A-Plant divisions, responding to direct customer requests for lower-emission alternatives on job sites.

- Growing customer preference for sustainable and eco-friendly equipment.

- Ashtead's investment in greener rental fleets to reduce carbon footprint.

- Potential for competitive advantage by meeting evolving environmental demands.

- Expansion of electric and hybrid equipment offerings in 2024.

Strategic Acquisitions and Market Consolidation

The equipment rental sector, especially in the United States, is still quite fragmented. This presents a significant chance for Ashtead to keep acquiring smaller companies. These bolt-on acquisitions help them grow their presence and enter new markets, like expanding their reach in specialized construction or industrial sectors.

Mergers and acquisitions are anticipated to play a key role in the construction industry's growth trajectory in the coming years. Ashtead can leverage this trend to achieve both vertical integration, by acquiring suppliers or complementary service providers, and horizontal integration, by buying competitors, thereby strengthening its market position.

Ashtead's strategy of strategic acquisitions is well-positioned to capitalize on market consolidation. For instance, in 2023, the company completed several acquisitions, adding to its fleet and geographic coverage, demonstrating its commitment to this growth avenue.

- Fragmented US Market: The US equipment rental market continues to offer numerous smaller players ripe for acquisition.

- Construction M&A Trend: The construction industry's increasing reliance on M&A for growth provides a favorable environment for Ashtead's expansion strategy.

- Footprint Expansion: Acquisitions allow Ashtead to quickly enter new geographic regions or deepen its presence in existing ones.

- End Market Diversification: Buying businesses in different sectors helps Ashtead reduce its reliance on any single industry, such as general construction.

Ashtead is well-positioned to capitalize on the increasing demand for sustainable equipment, with customers actively seeking eco-friendly machinery. The company's investment in a greener fleet, including electric and hybrid options, directly addresses this trend. This focus on sustainability not only meets current market needs but also provides a competitive advantage as environmental considerations become more critical in rental decisions, with Ashtead expanding its green offerings across its divisions in 2024.

Threats

A significant economic slowdown, especially in key markets like North America and the UK, poses a substantial threat to Ashtead Group. Such a downturn would likely curb construction and industrial projects, directly reducing the demand for their rental equipment. For instance, if GDP growth in these regions falters, it could translate to lower utilization rates for Ashtead's fleet.

Furthermore, persistent inflationary pressures present a considerable challenge. Rising costs for new equipment acquisition, essential maintenance, and competitive labor markets could compress Ashtead's profit margins. If inflation outpaces their ability to pass on costs to customers, the company's profitability could be significantly impacted, as seen in recent supply chain cost increases impacting capital expenditures.

Rising interest rates present a significant hurdle for Ashtead Group. Higher borrowing costs directly impact the expense of acquiring new equipment, a core part of their business model. Furthermore, elevated rates can dampen customer demand, particularly in sectors sensitive to financing costs, potentially nudging some clients towards renting rather than purchasing, which could benefit Ashtead's rental segment but also increase their own debt servicing expenses. For instance, the Bank of England's base rate stood at 5.25% in early 2024, a notable increase from previous years, directly affecting borrowing power.

Conversely, while declining interest rates might stimulate demand in areas like residential construction, the ongoing volatility and uncertainty surrounding future rate movements create a challenging environment. This unpredictability can make businesses hesitant to commit to large capital expenditures, impacting the overall market stability. The Federal Reserve's monetary policy decisions, for example, continue to be closely watched by the construction and industrial sectors that Ashtead serves.

The equipment rental sector is fiercely competitive, with major players like United Rentals and Herc Rentals actively growing their specialty rental segments and overall market reach. This heightened competition can lead to downward pressure on rental pricing and Ashtead's market share, necessitating ongoing investment in its fleet and customer service to maintain its competitive edge.

Supply Chain Disruptions and Equipment Availability

While supply chains have improved, the risk of future disruptions remains, potentially affecting the availability of new equipment and spare parts for Ashtead Group. This could translate into increased costs or delays in updating their rental fleet, impacting their ability to meet demand and maintain competitive pricing.

Effective inventory management is paramount; any missteps could result in stockouts, leading to lost rental opportunities and dissatisfied customers, or overbooking, which strains resources and operational efficiency.

For instance, in the fiscal year ending April 30, 2024, Ashtead reported that supply chain normalization contributed to improved fleet availability, but the company continues to monitor geopolitical and economic factors that could reintroduce volatility.

- Future supply chain disruptions could increase equipment acquisition costs and lead times.

- Inefficient inventory management can lead to stockouts or overbooking, impacting customer service.

- Ashtead's fleet modernization efforts could be hampered by parts availability.

- Geopolitical and economic uncertainties pose ongoing risks to supply chain stability.

Skilled Labor Shortages

Ashtead Group, like many in the construction and equipment rental sectors, grapples with ongoing skilled labor shortages, especially for essential roles like mechanics and drivers. This scarcity directly impacts operational efficiency and can inflate labor costs as companies compete for a limited talent pool. For instance, in the UK, the construction sector alone reported a shortage of over 200,000 workers in 2024, highlighting the broader industry challenge.

These persistent talent gaps can constrain Ashtead's growth trajectory. Without enough skilled personnel to maintain and operate its vast fleet of equipment, the company may face limitations in expanding its service offerings or responding to increased customer demand. This directly affects their ability to capitalize on market opportunities and maintain competitive service levels.

- Mechanic Shortage: Difficulty in finding qualified technicians to service and repair complex machinery.

- Driver Shortage: A critical lack of HGV (Heavy Goods Vehicle) drivers impacts delivery and logistics efficiency.

- Increased Labor Costs: Competition for skilled workers drives up wages and benefits expenses.

- Operational Bottlenecks: Insufficient staff can lead to delays in equipment deployment and maintenance, affecting customer satisfaction.

Intensifying competition from established players and new entrants could erode Ashtead's market share and pricing power. Furthermore, adverse regulatory changes or increased environmental compliance costs could impact operational expenses and investment strategies. The ongoing volatility in global markets and potential geopolitical instability also present significant threats to Ashtead's business continuity and profitability.

SWOT Analysis Data Sources

This SWOT analysis for Ashtead Group is built upon a robust foundation of verified financial statements, comprehensive market research, and expert industry analysis. These sources provide the reliable, data-driven insights necessary for a thorough strategic assessment.