Ashtead Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

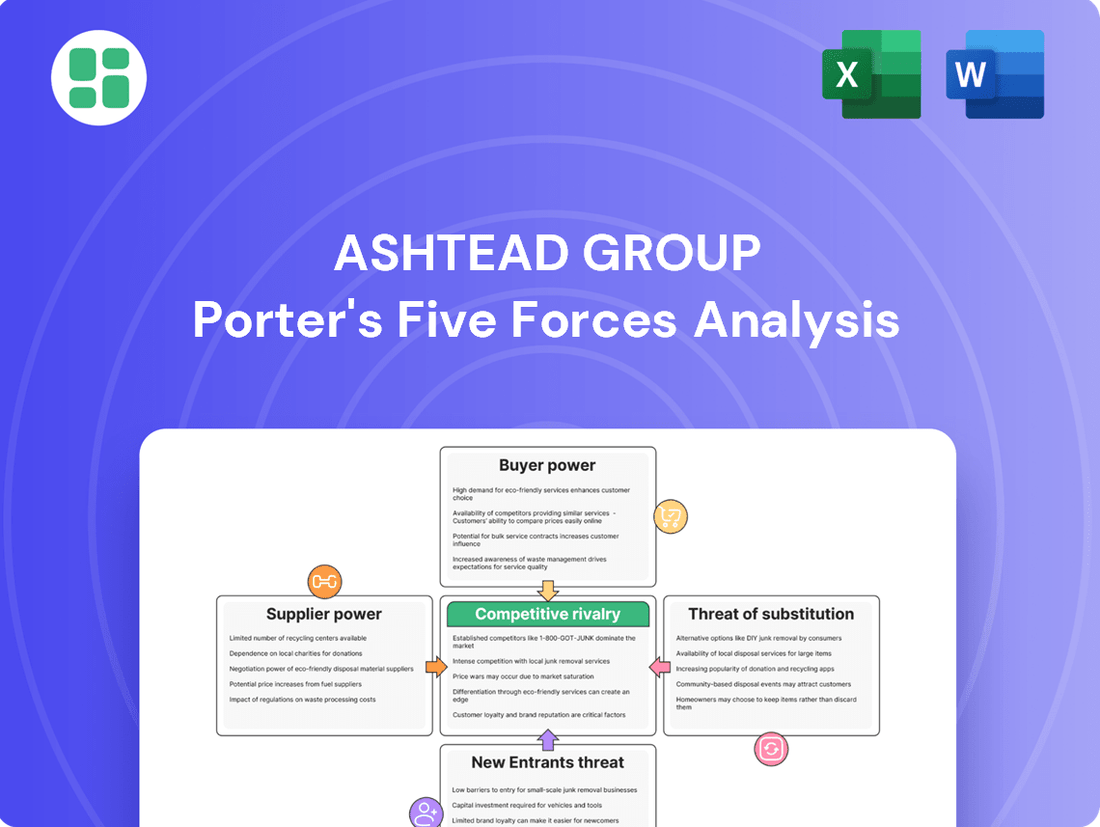

Ashtead Group operates in a dynamic rental market where bargaining power of buyers and suppliers can significantly impact profitability. The threat of new entrants is moderate, but the intensity of rivalry among existing players is a key consideration. Understanding these forces is crucial for any strategic evaluation.

The complete report reveals the real forces shaping Ashtead Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The equipment rental sector, which includes giants like Ashtead Group, depends on a select few global manufacturers for its heavy machinery needs. Companies such as Caterpillar, Komatsu, and John Deere are key players in this concentrated supply base.

This limited number of suppliers can translate into considerable bargaining power for them, impacting the prices and contractual terms for new equipment acquisitions. For instance, in 2023, Caterpillar reported revenues of $67.1 billion, highlighting its significant market presence and influence.

Despite this, Ashtead's sheer scale as a major purchaser of rental equipment does afford it a degree of leverage in its negotiations with these dominant manufacturers, helping to mitigate some of the supplier power.

Suppliers' ability to dictate terms is amplified by volatility in raw material prices, like steel and aluminum. These fluctuations directly impact the cost of acquiring new rental equipment for companies such as Ashtead Group. For example, in 2024, significant increases in steel prices have been observed, forcing manufacturers to pass these higher input costs onto their customers in the equipment rental sector.

This upward pressure on acquisition costs can compress Ashtead's profit margins if they are unable to fully pass these increases onto their customers through rental rate adjustments. The direct correlation between raw material costs and fleet acquisition expenses highlights a key vulnerability in managing operational expenses.

For highly specialized equipment, Ashtead's reliance on a limited number of manufacturers can significantly increase supplier bargaining power. This dependence restricts Ashtead's ability to negotiate favorable terms for unique or niche machinery crucial to its specialty rental segments, impacting cost structures and operational flexibility.

The quality and availability of such specialized equipment are paramount for Ashtead to meet diverse customer needs across its various rental sectors. For instance, in 2024, the demand for advanced construction and event technology, often requiring bespoke manufacturing, intensified the need for reliable access to these specialized assets, giving manufacturers leverage.

Technological Advancements in Equipment

Suppliers who develop and offer technologically advanced equipment can leverage this innovation to charge premium prices. This is because the enhanced features and operational efficiencies these machines provide represent significant added value for rental companies like Ashtead. For instance, the increasing integration of IoT and predictive maintenance in construction equipment means suppliers can justify higher costs for these sophisticated units.

Ashtead Group, to maintain its competitive edge and satisfy customer expectations for modern, efficient machinery, is compelled to invest in these upgraded fleets. This strategic necessity directly translates into increased capital expenditure for Ashtead and, consequently, bolsters the bargaining power of suppliers who control access to this cutting-edge technology. The ongoing trend in the equipment rental sector is a continuous push towards acquiring the latest technological advancements.

- Technological Integration: Suppliers are embedding advanced features like GPS tracking and telematics into their equipment.

- Efficiency Gains: Newer, technologically superior machines offer greater fuel efficiency and reduced downtime, justifying higher rental rates.

- Competitive Pressure: Rental companies must update their fleets to meet evolving customer demands for productivity and sustainability.

- Supplier Pricing Power: Companies that develop and patent these advanced technologies gain leverage in pricing negotiations.

Strong Supplier Relationships

Ashtead Group cultivates robust, long-term relationships with its primary equipment manufacturers. These enduring partnerships, built on substantial order volumes, act as a significant counterbalance to supplier power. This strategic approach allows Ashtead to negotiate favorable terms, including competitive pricing and priority access to the latest equipment models, which is vital for fleet modernization and availability.

The company's ability to place large orders provides leverage, potentially securing discounts and more advantageous payment schedules. For instance, in fiscal year 2024, Ashtead's capital expenditure reached $4.4 billion, underscoring the scale of its procurement activities and its capacity to influence supplier terms.

- Favorable Pricing: Large-scale purchasing power enables Ashtead to negotiate lower unit costs for equipment.

- Priority Access: Strong relationships can ensure early access to new and in-demand equipment models.

- Improved Payment Terms: Suppliers may offer extended payment periods, enhancing Ashtead's cash flow management.

- Reduced Risk: Consistent demand from Ashtead can lead suppliers to prioritize its orders, mitigating supply chain disruptions.

The bargaining power of suppliers for Ashtead Group is influenced by the concentrated nature of the heavy machinery manufacturing sector, where a few global players like Caterpillar dominate. These suppliers can exert significant influence over pricing and terms, especially given Ashtead's substantial capital expenditure, which was $4.4 billion in fiscal year 2024, indicating its significant purchasing volume.

Fluctuations in raw material costs, such as steel, directly impact equipment acquisition expenses for Ashtead, as seen with observed price increases in 2024, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

The demand for specialized, technologically advanced equipment further strengthens supplier leverage, as Ashtead must invest in these units to remain competitive, despite the higher costs associated with innovation.

However, Ashtead's scale and established relationships with manufacturers provide a degree of counter-leverage, enabling negotiation for competitive pricing and priority access to new equipment.

| Supplier Influence Factor | Impact on Ashtead Group | Mitigating Factor for Ashtead |

|---|---|---|

| Concentrated Supplier Base | Higher pricing power for manufacturers | Large order volumes |

| Raw Material Price Volatility (e.g., Steel in 2024) | Increased equipment acquisition costs | Negotiation for favorable payment terms |

| Technological Advancement in Equipment | Justification for premium pricing by suppliers | Strategic partnerships for priority access |

What is included in the product

This analysis unpacks the competitive forces shaping Ashtead Group's rental market, evaluating the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Quickly identify and mitigate competitive threats by visualizing Ashtead Group's industry landscape through an intuitive Porter's Five Forces analysis.

Customers Bargaining Power

Ashtead Group's diverse customer base, spanning small contractors to large national accounts in construction, industrial, and events, generally dilutes the bargaining power of individual customers. This broad reach means no single customer segment holds significant sway over Ashtead's overall revenue. For instance, in their 2024 fiscal year, Ashtead reported a strong performance with rental revenue growth, underscoring the stability provided by this varied clientele.

Customers, especially smaller businesses and those in local markets, can be quite sensitive to price, particularly when economic conditions are tough or interest rates are high. For instance, during periods of economic uncertainty, rental demand might shift towards more budget-conscious options.

The rental market is often crowded with many providers, giving customers plenty of choices to shop around for the best rates. This intense competition means Ashtead Group must remain competitive with its pricing to attract and retain business, pushing for more adaptable pricing models.

The availability of numerous equipment rental alternatives significantly bolsters customer bargaining power. With major players like United Rentals and Herc Rentals actively competing, customers can easily comparison shop for the best deals and services.

This competitive landscape forces Ashtead Group, operating as Sunbelt Rentals, to continually innovate and differentiate. For instance, United Rentals, a primary competitor, reported revenues of $14.7 billion in 2023, highlighting its substantial market presence compared to Sunbelt Rentals.

To maintain its customer base, Sunbelt must emphasize its unique selling propositions, such as a broader equipment selection, guaranteed reliability, and exceptional customer support, rather than solely competing on price.

Demand for Flexibility and Service

Customers are increasingly seeking rental arrangements that can adapt to their changing project scopes and equipment requirements. This demand for flexibility means rental companies must offer adaptable agreements, allowing for adjustments to rental periods as needed. For instance, Ashtead's focus on customizable rental terms directly addresses this customer need.

The ability to provide timely maintenance and responsive support is crucial for retaining customers who value operational continuity. This pressure to deliver consistent service can impact profitability if not managed efficiently. Surveys indicate a strong customer preference for rental solutions that permit straightforward extensions or modifications to existing agreements.

- Flexible rental terms are a key customer demand.

- Adaptable agreements cater to fluctuating project timelines.

- Responsive support and timely maintenance are vital for retention.

- Customer preference leans towards easy extensions and modifications.

Impact of Macroeconomic Conditions on Demand

Macroeconomic shifts significantly shape customer demand for equipment rental. For instance, changes in interest rates can have a dual effect. While higher rates might discourage outright equipment purchases, pushing businesses towards rental solutions, they can simultaneously dampen activity in sectors like construction, particularly affecting local commercial projects.

Ashtead Group's strategic positioning, with substantial investment in large-scale, resilient megaprojects, provides a crucial buffer against slowdowns experienced in more localized markets. This diversification helps maintain overall demand stability, even as broader economic conditions fluctuate.

- Interest Rate Sensitivity: Rising interest rates can make borrowing more expensive for potential equipment buyers, potentially increasing rental demand.

- Construction Sector Impact: Economic downturns or high borrowing costs can slow construction, directly reducing rental needs for related equipment.

- Megaproject Resilience: Ashtead's focus on large, often government-backed, infrastructure projects offers a more stable demand base compared to smaller, private commercial ventures.

- Economic Cycle Influence: Overall economic health directly correlates with the volume of projects requiring rental equipment, impacting Ashtead's revenue streams.

The bargaining power of Ashtead Group's customers is moderate, influenced by the competitive rental market and the availability of alternatives. While individual customers may not hold significant power due to Ashtead's diverse client base, the collective ability to switch providers or delay projects can impact pricing and service demands. For instance, in fiscal year 2024, Ashtead's rental revenue growth indicates successful navigation of these customer pressures.

| Factor | Impact on Ashtead | Supporting Data (FY24 Context) |

|---|---|---|

| Customer Price Sensitivity | Moderate pressure to offer competitive pricing, especially during economic downturns. | General market observation of price sensitivity in rental sectors. |

| Availability of Alternatives | Significant, as numerous competitors exist, allowing customers to compare. | Presence of major competitors like United Rentals ($14.7B revenue in 2023) and Herc Rentals. |

| Demand for Flexibility | Requires adaptable rental terms and responsive service to retain business. | Ashtead's strategic focus on customizable rental terms. |

Preview the Actual Deliverable

Ashtead Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Ashtead Group, detailing the competitive landscape and strategic positioning within the rental industry. You're viewing the exact document that will be delivered instantly upon purchase, ensuring full transparency and immediate access to this professionally formatted report. This analysis provides critical insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Ashtead's operating markets.

Rivalry Among Competitors

The equipment rental industry is a complex landscape, featuring major national companies like Ashtead, operating as Sunbelt Rentals, and United Rentals, alongside a vast number of smaller, localized businesses. This fragmentation means that while Ashtead is a substantial force, especially in the US where it holds the second-largest market share, the presence of many smaller competitors significantly heats up rivalry, particularly at the local level.

In the United States, for instance, the competitive intensity is further amplified because companies outside the top four operators collectively control more than two-thirds of the market. This indicates that while scale is important, the ability of numerous smaller entities to compete effectively creates a dynamic and challenging environment for all participants, including Ashtead.

Competitive rivalry within the equipment rental sector often boils down to price competition, especially for more common tools. However, major companies like Ashtead Group have shown a commitment to rate discipline. This means they prioritize profitable growth over simply capturing market share, which is a smart strategy in a competitive landscape.

This focus on profitability is crucial because the industry constantly faces upward pressure on rental rates. This is driven by increasing costs for new equipment and the general expenses of running operations. For instance, in 2023, the average cost of construction equipment saw significant increases, necessitating rental companies to adjust their pricing to maintain margins.

Ashtead Group's competitive rivalry is significantly shaped by strategic acquisitions, a trend that saw the company complete 26 acquisitions in fiscal 2024 alone. This aggressive expansion strategy not only broadens Ashtead's geographic reach and service capabilities but also consolidates its position within the equipment rental market.

This consolidation is not unique to Ashtead; rivals like United Rentals also actively pursue acquisitions, such as their purchase of H&E Equipment Services. Such moves by major players increase their operational scale and market leverage, thereby intensifying the competitive landscape among the leading entities in the industry.

Differentiation Through Specialty and Service

Competitive rivalry in the equipment rental sector is significantly influenced by a company's ability to differentiate itself through specialized offerings and exceptional customer service. This focus on niche markets and client satisfaction can reduce head-to-head competition within the broader general tool rental space.

Ashtead Group actively pursues this differentiation strategy by investing in the growth of its specialty equipment divisions and expanding into new end markets. For instance, in fiscal year 2024, Ashtead reported strong performance in its specialty segments, contributing to its overall revenue growth. This strategic approach allows Ashtead to command premium pricing and build customer loyalty, thereby softening the impact of intense rivalry.

- Specialty Focus: Ashtead's commitment to growing its specialty businesses, such as powered access and event services, creates distinct market positions.

- End Market Expansion: Broadening the application of its rental services across diverse industries, from construction to entertainment, diversifies revenue streams and reduces reliance on any single competitive arena.

- Service Excellence: Providing a comprehensive range of equipment coupled with timely and reliable customer support is a critical factor in winning and retaining business.

- Competitive Edge: This dual focus on specialized equipment and superior service allows Ashtead to stand out in a crowded market, mitigating direct competition.

Geographic and End-Market Focus

Ashtead Group's competitive rivalry is significantly shaped by its geographic and end-market focus. The company primarily operates in North America and the United Kingdom, concentrating its efforts on key sectors like construction, industrial, infrastructure, and events. This strategic concentration means Ashtead faces intense competition from other equipment rental providers within these specific regions and industries.

In 2024, the rental market, particularly in construction, experienced varied conditions. While large-scale infrastructure projects, often supported by government stimulus, provided consistent demand, the commercial construction segment faced some slowdowns due to economic uncertainties. Ashtead's ability to secure contracts for these megaprojects, such as those related to renewable energy infrastructure and transportation upgrades, is crucial for its competitive standing.

- Geographic Concentration: Ashtead's primary markets are North America (Sunbelt Rentals) and the UK (A-Plant), limiting its direct competition to players within these specific territories.

- End-Market Specialization: Focus on construction, industrial, infrastructure, and events creates a competitive landscape where specialized rental companies also vie for market share.

- Megaproject Influence: Competition for large, long-term rental contracts on major infrastructure and energy projects is fierce, often involving significant capital investment and operational capabilities.

- Market Headwinds: Localized downturns in commercial construction can intensify rivalry among rental firms as they compete for a smaller pool of available projects.

Competitive rivalry in the equipment rental sector is intense, driven by a fragmented market with numerous smaller players alongside national giants like Ashtead (Sunbelt Rentals) and United Rentals. This dynamic is amplified in the US, where companies outside the top four collectively hold over two-thirds of the market, indicating broad-based competition.

Ashtead's strategy of rate discipline, prioritizing profitable growth over market share, is a key differentiator in this environment. While price competition is common for standard equipment, Ashtead's focus on profitability helps navigate upward pressure on rental rates, which stems from rising equipment and operational costs. For instance, in 2023, construction equipment costs saw notable increases, impacting rental pricing.

Strategic acquisitions are a significant factor in competitive rivalry, with Ashtead completing 26 acquisitions in fiscal 2024, a move mirrored by rivals like United Rentals. This consolidation intensifies competition among leading entities by expanding scale and market leverage.

Differentiation through specialized offerings and superior customer service is crucial. Ashtead's investment in specialty divisions and new end markets, as evidenced by strong specialty segment performance in fiscal 2024, allows for premium pricing and customer loyalty, thereby mitigating direct competition.

| Factor | Description | Impact on Ashtead |

|---|---|---|

| Market Fragmentation | Numerous small, local competitors alongside large national players. | Intensifies rivalry, especially at the local level. |

| Price Competition | Common for standard equipment rentals. | Requires rate discipline to maintain profitability. |

| Acquisition Activity | Major players like Ashtead and United Rentals actively acquire smaller firms. | Consolidates market share and increases competitive leverage. |

| Specialization & Service | Focus on niche equipment and customer support. | Enables premium pricing and customer loyalty, reducing direct competition. |

SSubstitutes Threaten

The most significant substitute for Ashtead Group's equipment rental services is the direct purchase of equipment by businesses. This is particularly true for companies with predictable, long-term usage requirements.

While high interest rates in 2024 might deter some from purchasing, a future decrease in rates could make ownership more appealing, potentially drawing customers away from rentals. In fact, around 34% of construction businesses view owning equipment as a more cost-effective strategy over the long haul.

For smaller ventures or individual contractors, readily available DIY solutions and the option of manual labor present a viable substitute for renting specialized equipment. While this might not significantly impact Ashtead's core business in large-scale projects, it can certainly influence its general tool rental segment, particularly for lower-cost or less frequently needed items. This dynamic is especially noticeable among homeowners undertaking personal projects and small businesses managing minor operational needs.

Emerging Equipment as a Service (EaaS) models, which bundle equipment with comprehensive support and maintenance, represent a potential long-term threat to Ashtead Group's traditional rental model. These integrated, outcome-based services might offer a more appealing value proposition to customers seeking complete solutions rather than just equipment access.

While rental is inherently a service, the evolution towards EaaS signifies a deeper integration and a shift towards performance-based contracts. This could necessitate Ashtead adapting its service packages to compete with these more holistic offerings, especially as the EaaS market is projected for significant growth in the coming years, indicating a broader industry trend.

Technological Alternatives and Efficiency Gains

Technological advancements present a significant threat of substitutes for Ashtead Group. Innovations in construction, such as modular building or prefabrication, can reduce the reliance on traditional heavy equipment rentals. For instance, the growing adoption of Building Information Modeling (BIM) by construction firms can optimize project timelines and material usage, potentially decreasing rental needs.

Furthermore, the increasing efficiency and capability of existing equipment, boosted by digital integration and AI, could shorten rental periods. Companies are also prioritizing sustainability, with a growing demand for equipment powered by renewable fuels or electric alternatives, which could substitute for conventional diesel-powered machinery. In 2024, the global green building market is projected to continue its robust growth, indicating a sustained shift towards more environmentally friendly construction practices.

- Modular Construction: Reduces on-site assembly time and the need for extensive on-site equipment.

- Digital Solutions: AI and IoT integration in equipment can improve performance and reduce downtime, potentially lowering rental duration.

- Green Technologies: The increasing availability and adoption of electric and alternative-fuel equipment offer a substitute for traditional machinery.

Availability of Used Equipment

The availability of used equipment presents a notable threat of substitutes for rental companies like Ashtead. Businesses may choose to purchase pre-owned machinery, bypassing the need for rental altogether.

Ashtead Group's financial performance in FY2025 highlights this dynamic. A significant decline in the sales and pricing of used equipment by Ashtead suggests a weakening of this substitute market. This softening could potentially make Ashtead's rental services more appealing to customers.

- Used Equipment Market Dynamics: A strong used equipment market offers an alternative to renting, potentially diverting customers from rental services.

- FY2025 Impact: Ashtead's experience in FY2025, with a drop in used equipment sales and pricing, indicates a less competitive landscape for used machinery.

- Rental Attractiveness: The softening of the used equipment market may consequently increase the relative attractiveness of Ashtead's rental offerings.

The threat of substitutes for Ashtead Group's equipment rental services is multifaceted, ranging from direct purchase to evolving service models and technological shifts. While owning equipment can be more cost-effective for businesses with predictable, long-term needs, the rental model remains attractive for its flexibility and avoidance of capital expenditure. However, the rise of Equipment as a Service (EaaS) and advancements in modular construction and digital solutions present increasingly viable alternatives that could reduce reliance on traditional equipment rentals.

| Substitute Type | Key Characteristics | Potential Impact on Ashtead | 2024/2025 Relevance |

|---|---|---|---|

| Equipment Ownership | Cost-effective for long-term, predictable usage. | Directly competes with rental services. | High interest rates in 2024 may temper purchase decisions, but lower rates could boost ownership. Approximately 34% of construction businesses consider ownership more cost-effective long-term. |

| DIY & Manual Labor | Suitable for smaller projects or less complex tasks. | Impacts lower-end rental segments and smaller contractors. | Continues to be a relevant option for homeowners and small businesses for minor needs. |

| Equipment as a Service (EaaS) | Bundled equipment with support, maintenance, and outcome-based solutions. | Offers a more holistic value proposition, potentially shifting demand from pure rental. | Projected for significant growth, indicating a broader industry trend towards integrated services. |

| Technological Advancements (Modular Construction, Digitalization) | Reduces reliance on traditional heavy equipment, optimizes project timelines. | Can decrease overall rental duration and demand. | Growing adoption of BIM and AI integration in construction are key drivers. The global green building market's robust growth in 2024 signals a shift towards sustainable alternatives. |

| Used Equipment Market | A pre-owned asset can serve as an alternative to renting. | Diverts customers from rental services if prices are attractive. | Ashtead's FY2025 experience showed a decline in used equipment sales and pricing, potentially making rentals more competitive. |

Entrants Threaten

The equipment rental industry, particularly for heavy machinery, demands a massive initial outlay for acquiring and maintaining a broad inventory of equipment. This substantial capital requirement acts as a significant hurdle for aspiring new businesses, thereby restricting the number of potential entrants.

For instance, Ashtead Group, a major player, consistently invests billions in capital each year to expand and update its fleet, underscoring the capital-intensive nature of this sector.

Established players like Ashtead Group enjoy substantial economies of scale. This advantage stems from their bulk purchasing power for equipment, efficient maintenance operations, and optimized logistics networks. For instance, Sunbelt Rentals, a key part of Ashtead, leverages its vast national presence across the US, Canada, and the UK, creating a formidable barrier for newcomers.

The threat of new entrants is further diminished by powerful network effects. Ashtead's extensive depot network and broad geographic coverage mean they can serve a wider customer base more effectively than a new, smaller competitor. This established infrastructure and reach make it exceptionally challenging and time-consuming for new companies to build a comparable competitive advantage.

In 2024, the trend of larger national rental companies consolidating market share is expected to continue. This consolidation strengthens the position of incumbents like Ashtead, making it even harder for new, smaller players to gain traction and compete on price or service breadth.

The operational complexity inherent in managing a large, diverse equipment fleet, coupled with stringent maintenance and safety compliance demands, acts as a significant barrier to entry. New players must invest heavily in specialized systems and skilled labor, like mechanics and logistics experts, to achieve efficient utilization across varied customer needs.

Established Customer Relationships and Brand Loyalty

Established customer relationships and brand loyalty present a significant barrier for new entrants aiming to compete with incumbents like Ashtead Group, which operates under the well-recognized Sunbelt Rentals brand. These deep-rooted connections, often built over years, translate into a stable revenue stream and a reduced need for constant customer acquisition efforts for existing players.

Newcomers face the daunting task of not only matching the service offerings but also replicating the trust and reliability that Ashtead has cultivated. This necessitates substantial investment in marketing, sales infrastructure, and potentially aggressive pricing strategies to even begin chipping away at existing loyalty. For instance, Ashtead’s significant market share in North America, evidenced by its consistent revenue growth, underscores the strength of its customer base.

- Customer Retention: Ashtead’s focus on long-term rental contracts and preferred vendor status creates sticky customer relationships, making it difficult for new entrants to secure repeat business.

- Brand Equity: The Sunbelt Rentals brand is synonymous with quality and service in the equipment rental industry, a reputation that takes considerable time and resources to build.

- Switching Costs: For many customers, the perceived hassle and risk associated with switching rental providers, especially for critical equipment needs, act as a deterrent.

- Market Penetration: Breaking into established relationships requires new entrants to offer demonstrably superior value or specialized niche services that Ashtead currently doesn't address.

Regulatory Hurdles and Safety Standards

The equipment rental sector, especially for heavy machinery, faces significant regulatory burdens and compliance costs. New companies must master these intricate rules, secure certifications, and uphold safety standards, increasing entry barriers and operational expenses. For instance, in 2024, the cost of specialized certifications for operating advanced construction equipment can range from thousands to tens of thousands of dollars per piece of machinery.

Insurance requirements have also become more demanding, particularly for specialized rentals like cranes. In 2023, average insurance premiums for crane rental companies saw an increase of approximately 15-20% due to rising claims and stricter underwriting. This escalating cost of risk management presents a substantial hurdle for potential new entrants aiming to compete with established players like Ashtead Group.

- Stringent Safety Regulations: The industry is heavily regulated to ensure operator and public safety.

- Certification Costs: Obtaining necessary certifications for equipment and personnel can be a significant upfront investment.

- Increased Insurance Premiums: Higher insurance costs, especially for high-risk equipment, deter new entrants.

- Compliance Complexity: Navigating and adhering to evolving safety and environmental regulations requires dedicated resources.

The threat of new entrants in the equipment rental sector, particularly for heavy machinery, is significantly low due to substantial capital requirements for fleet acquisition and maintenance. Ashtead Group's consistent multi-billion dollar annual capital expenditure highlights this barrier. Furthermore, established players like Ashtead, through its Sunbelt Rentals brand, benefit from significant economies of scale in purchasing and operations, coupled with extensive geographic networks, making it difficult for newcomers to match their competitive advantages.

| Barrier Type | Description | Impact on New Entrants | Example (Ashtead/Sunbelt) |

|---|---|---|---|

| Capital Intensity | High cost of acquiring and maintaining diverse equipment fleets. | Substantial upfront investment required. | Billions invested annually in fleet expansion and upgrades. |

| Economies of Scale | Bulk purchasing power, efficient maintenance, optimized logistics. | Lower per-unit costs for established players. | Leveraging vast national presence across US, Canada, UK. |

| Brand Equity & Customer Loyalty | Established trust, long-term relationships, preferred vendor status. | Difficult to acquire customers and secure repeat business. | Sunbelt Rentals brand recognized for quality and service. |

| Regulatory & Compliance Costs | Adherence to safety, environmental standards, and certification. | Increased operational expenses and complexity. | Costs for specialized certifications can be thousands per machine. |

Porter's Five Forces Analysis Data Sources

Our Ashtead Group Porter's Five Forces analysis is built upon a foundation of robust data, including Ashtead's annual reports and investor presentations, alongside industry-specific market research from firms like IBISWorld and Statista. This blend ensures a comprehensive understanding of the rental industry's competitive landscape.