Ashtead Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

Unlock the strategic potential of Ashtead Group with a comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders (Stars), reliable profit generators (Cash Cows), underperforming assets (Dogs), or emerging opportunities (Question Marks). Purchase the full report for a detailed breakdown and actionable insights to optimize your investment strategy.

Stars

North American Specialty Equipment Rental, a key component of Ashtead Group's portfolio, is performing exceptionally well. In fiscal year 2025, rental-only revenue for this segment saw a robust 11% increase over the previous year. This upward trend is a direct result of both higher rental volumes and improved pricing, showcasing the effectiveness of Sunbelt Rentals' strategic expansion in specialty equipment.

Mega-Project Rental Services are a significant driver for Ashtead Group, with the value of these long-term projects, exceeding three years, projected to increase substantially in the coming years. Sunbelt Rentals, Ashtead's primary rental arm, is well-positioned to capture this growth.

The company's strategic focus on large-scale infrastructure and industrial developments, including data centers, semiconductor fabrication plants, and liquefied natural gas (LNG) facilities, places it in a high-growth segment of the market. For instance, the infrastructure spending in the US alone is expected to see robust growth through 2024 and beyond, directly benefiting companies like Sunbelt Rentals that cater to these massive undertakings.

Sunbelt Rentals' dominant market share in these mega-projects solidifies its position as a star performer within Ashtead Group's business portfolio. The company's extensive fleet and operational expertise are crucial for supporting the complex and extended timelines characteristic of such projects, ensuring continued strong performance.

Under its Sunbelt 4.0 strategy, Ashtead Group is aggressively pursuing strategic greenfield location expansion. The company plans to open between 300 and 400 new locations over a five-year span, with a significant portion, 180 to 240, dedicated to specialty rental segments and the remaining 120 to 160 focusing on general tool stores.

These new sites are anticipated to contribute substantially to Ashtead's growth, potentially accounting for up to 30% of its projected expansion. This ambitious plan is designed to enlarge Ashtead's total addressable market and enhance its penetration within existing and new rental markets, reflecting a strong focus on capturing new opportunities.

Advanced Technology and Digitalization in Rentals

Ashtead Group's investment in advanced technology and digitalization is a key driver of its success. The company is actively adopting sophisticated rental software to manage its extensive fleet, incorporating telematics for real-time equipment monitoring, and developing robust online platforms for seamless customer transactions. This focus on digital innovation is crucial in today's market where efficiency and remote management are paramount.

These technologically advanced rental solutions position Ashtead's offerings as a star within the BCG matrix. By developing and utilizing proprietary systems for customer management, inventory control, and delivery tracking, Ashtead is not only enhancing operational efficiency but also creating a significant competitive advantage. This proactive approach helps to drive rental penetration and meet the evolving demands of the construction equipment rental sector.

- Ashtead's digital investments are enhancing fleet management capabilities.

- Telematics and online platforms are improving customer experience and operational efficiency.

- Proprietary systems provide a competitive edge in rental penetration and inventory tracking.

- The company's technological advancements align with market demand for remote management and streamlined processes.

Sustainable Equipment Rental Solutions

Sustainable Equipment Rental Solutions represents a strong growth area for Ashtead Group. The company is strategically investing in eco-friendly equipment, with around 20% of its fleet already featuring battery, electric, hybrid, and solar-powered options. This focus on sustainability is not just about environmental responsibility; Ashtead views it as a key driver of competitive advantage.

This strategic direction is directly influenced by shifting customer preferences and increasing environmental regulations. By offering green rental fleets, Ashtead is positioning itself to capitalize on a high-growth market segment. For instance, in fiscal year 2024, Ashtead reported significant progress in its sustainability initiatives, aiming to further expand its portfolio of environmentally conscious equipment.

- Investment in Green Fleets: Approximately 20% of Ashtead's rental fleet currently consists of battery, electric, hybrid, and solar-powered assets.

- Competitive Advantage: The company believes that investing in sustainable, green rental fleets will provide a significant competitive edge in the market.

- Market Alignment: This strategy aligns with evolving customer demands for environmentally friendly solutions and increasing regulatory pressures.

- High-Growth Potential: Sustainable offerings are identified as a high-growth, high-potential area for Ashtead Group.

Stars in Ashtead Group's BCG Matrix represent business segments with high market share in a high-growth industry. These are the segments driving the company's current success and future potential. North American Specialty Equipment Rental and the company's digital transformation efforts are prime examples of these star performers.

Sunbelt Rentals' dominance in mega-projects, fueled by infrastructure spending, firmly places it in the star category. Furthermore, Ashtead's proactive investment in technology and digital solutions, enhancing fleet management and customer experience, creates a distinct competitive advantage, solidifying its star status.

The company's strategic greenfield expansion, with a focus on specialty rentals, and its growing sustainable equipment offerings also point towards star potential, tapping into high-growth market segments.

Ashtead Group's performance in fiscal year 2024 demonstrated strong momentum, with total revenue reaching $7.9 billion, a 7% increase year-over-year. The North American segment, in particular, saw rental revenue grow by 10% in the same period, underscoring its star performance.

What is included in the product

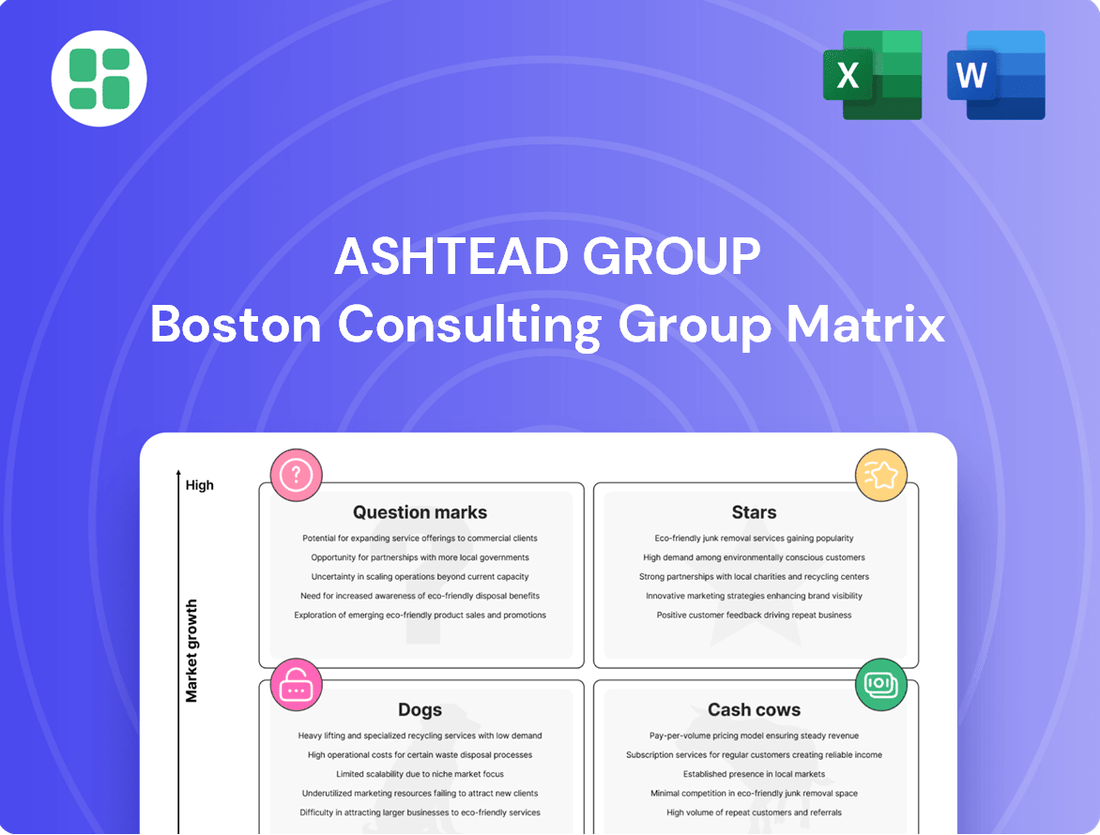

The Ashtead Group BCG Matrix analyzes its business units, identifying Stars, Cash Cows, Question Marks, and Dogs to guide investment and divestment strategies.

A clear BCG Matrix visualizes Ashtead's portfolio, alleviating the pain of strategic uncertainty.

Cash Cows

North American General Tool Rental, a key component of Ashtead Group's portfolio, functions as a cash cow. Despite facing slower growth than specialty segments, it generated an impressive $4,903 million in rental-only revenue in fiscal year 2025.

This segment benefits from Ashtead's dominant market share in a mature industry, translating into reliable and consistent cash flow for the company. The broad applicability of general tools ensures sustained demand from a wide array of customers.

Ashtead Group's Sunbelt Rentals dominates the US and Canadian equipment rental markets, boasting an 11% share in the US and 9% in Canada. These established positions are key to its cash cow status.

This strong market presence translates into consistent, reliable cash flows for Ashtead. The company benefits from significant brand recognition and an extensive rental network in these mature markets, requiring less aggressive investment in marketing and expansion compared to growth-stage businesses.

Ashtead's core construction and industrial sector rentals represent a classic cash cow. The company has deeply embedded itself in these mature markets, serving a broad customer base that relies on its general equipment offerings. This consistent demand, even through economic cycles, generates a steady and predictable cash flow for Ashtead.

For the fiscal year ending April 30, 2024, Ashtead reported revenue of $10.7 billion, with a significant portion stemming from these established segments. The rental segment’s strong performance, driven by this consistent demand, allows Ashtead to fund its investments in faster-growing areas.

Acquisition-Integrated Existing Locations

Acquisition-integrated existing locations are a cornerstone of Ashtead's 'Sunbelt 4.0' strategy, focusing on maximizing the value of mature sites. The company anticipates that 75% of its future growth will stem from these established locations, leveraging their scale and operational efficiencies.

Ashtead's aggressive acquisition strategy in fiscal 2024, which included 26 deals worth around $905 million, directly bolsters these cash cow segments. These acquisitions not only expand market reach but also seamlessly integrate new revenue streams into existing, highly profitable operations.

- Mature locations drive 75% of projected growth.

- Fiscal 2024 saw 26 acquisitions totaling approximately $905 million.

- Integration of acquired sites enhances profit margins and cash flow.

Operational Efficiency and Cost Management

Ashtead Group's operational efficiency and stringent cost management are key drivers of its success, particularly within its Cash Cow segments. This focus translates directly into impressive profit margins and substantial free cash flow generation, reinforcing its position as a reliable earner.

Even with some market headwinds, Ashtead's commitment to pricing discipline and enhancing operational metrics ensures its dominant market share businesses remain exceptionally cash-generative. For instance, in fiscal year 2024, Ashtead reported rental revenue growth of 12% year-on-year to $9.7 billion, showcasing their ability to maintain strong performance.

- Strong Profitability: Achieved an operating profit margin of 22% in FY24, demonstrating effective cost control.

- Robust Free Cash Flow: Generated $2.2 billion in free cash flow in FY24, highlighting efficient capital deployment.

- Market Share Dominance: Core businesses with high market share continue to be the primary sources of consistent cash generation.

- Yield Maximization: The company excels at maximizing returns from its established asset base through continuous efficiency improvements.

Ashtead's North American General Tool Rental segment, a significant cash cow, showcases robust performance. In fiscal year 2025, this segment delivered $4,903 million in rental-only revenue, underscoring its consistent cash generation capabilities. Its mature market position, bolstered by Ashtead's substantial market share, ensures a steady inflow of funds, allowing the company to reinvest in growth areas.

The company's strategic focus on optimizing its existing, mature locations is a key driver for these cash cows. Ashtead anticipates that a considerable 75% of its future growth will originate from these established sites, capitalizing on their inherent scale and operational efficiencies. This strategic emphasis, coupled with aggressive acquisition activity in fiscal 2024, which involved 26 deals totaling approximately $905 million, further solidifies the cash-generative nature of these segments.

| Segment | FY24 Rental Revenue (USD Millions) | FY24 Operating Profit Margin | FY24 Free Cash Flow Contribution (USD Billions) |

|---|---|---|---|

| North American General Tool Rental | ~9,700 (Total Rental Revenue) | 22% | ~2.2 (Total Group FCF) |

| Construction & Industrial Rentals | Included in above | Included in above | Included in above |

What You See Is What You Get

Ashtead Group BCG Matrix

The Ashtead Group BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks or demo content, just a professionally designed, analysis-ready report ready for immediate strategic application. The preview accurately represents the comprehensive market analysis and strategic insights contained within the complete Ashtead Group BCG Matrix, ensuring you get precisely what you expect to drive your business planning forward.

Dogs

Ashtead's UK operations, while contributing to the group's revenue, are positioned as a Question Mark in the BCG Matrix. Projected growth for the UK market is a modest 2-5% CAGR, significantly trailing North America's performance.

Furthermore, the UK segment exhibits a lower EBITDA margin compared to its North American counterpart. This suggests a less dominant market position and potentially lower operational efficiencies within certain UK branches.

The company needs to maintain a keen focus on enhancing operational efficiency across its UK business to improve profitability and potentially shift these operations towards a stronger market standing.

Older, less fuel-efficient, or high-maintenance equipment can be a drag on Ashtead’s performance, fitting the ‘Dog’ quadrant. These assets often see lower rental demand and incur higher operational expenses, diminishing profitability and tying up valuable capital that could be invested elsewhere. For instance, while Ashtead is actively modernizing its fleet, older units that don't meet modern efficiency standards might struggle to compete.

Smaller, non-strategic bolt-on acquisitions, while seemingly minor, can become cash cows if not managed effectively. These might be businesses acquired for their local market presence or a specific niche capability that doesn't align with Ashtead's broader growth strategy. If they operate in saturated, low-growth areas, their market share within those micro-markets could be minimal, making profitability a challenge. For example, a small regional equipment rental company acquired in 2023 for £5 million that primarily serves a mature construction market might fit this description.

Highly Cyclical and Volatile Niche Markets

Certain highly cyclical or volatile niche markets that Ashtead might have minor exposure to, where demand fluctuates significantly and market share is low, could be considered Dogs. These might include very specific, short-term project types that do not align with their broader mega-project focus or are highly susceptible to immediate economic downturns. Such segments often break even or incur losses.

For Ashtead, these could represent highly specialized equipment rentals for industries experiencing extreme seasonality or unpredictable demand, such as certain types of event production or short-lived construction projects. In 2024, while Ashtead's core markets like infrastructure and general construction remained robust, segments experiencing sharp, unpredictable downturns, perhaps related to specific regional regulatory changes or the winding down of unique, temporary industrial processes, could fall into this category. These areas would likely show minimal revenue contribution and potentially negative returns on investment.

- Low Market Share: Typically, Ashtead would hold a very small percentage of these niche, volatile markets.

- High Volatility: Demand in these segments can swing dramatically based on external economic or regulatory factors.

- Low Profitability: These areas are often characterized by break-even performance or outright losses due to inconsistent demand and high operating costs.

- Strategic Non-Alignment: They may not fit Ashtead's broader strategy of focusing on larger, more stable, and recurring revenue streams.

Used Equipment Sales (as a revenue stream)

Ashtead Group's used equipment sales represent a revenue stream that, while part of its operational cycle, falls into the 'Dog' category of the BCG Matrix. This is primarily due to its performance in fiscal year 2025, where revenue from this segment saw a substantial drop of 46% compared to the previous year.

This decline is attributed to softer demand and reduced pricing within the used equipment market. Although essential for managing its rental fleet rotation, this segment operates in a market characterized by low growth and thin margins for Ashtead.

The inherent volatility of used equipment sales further solidifies its 'Dog' status. Its inconsistency in profitability and strategic importance pales in comparison to the group's core rental operations, making it a less attractive area for significant investment or focus.

- Fiscal Year 2025 Used Equipment Sales Decline: 46% year-on-year decrease.

- Market Conditions: Lower demand and pricing in the used equipment sector.

- Strategic Position: Low-growth, low-margin segment for Ashtead.

- BCG Matrix Classification: Categorized as a 'Dog' due to volatility and limited strategic contribution compared to core rental business.

Ashtead's used equipment sales are a prime example of a 'Dog' in its BCG Matrix. This segment experienced a significant 46% revenue drop in fiscal year 2025 due to weaker demand and pricing pressures in the used market. While necessary for fleet management, it operates in a low-growth, low-margin environment, marked by inherent volatility and limited strategic contribution compared to its core rental business.

| BCG Category | Ashtead Segment | Market Share | Market Growth | Profitability | Strategic Consideration |

|---|---|---|---|---|---|

| Dog | Used Equipment Sales | Low | Low | Low/Volatile | Manage for cash, consider divestment if non-core |

| Dog | Older, Less Efficient Fleet Assets | Low (for specific units) | Low | Negative/Low | Retire or replace to improve efficiency |

| Dog | Highly Cyclical Niche Markets | Very Low | Volatile/Low | Break-even/Loss | Evaluate strategic fit, potential exit |

Question Marks

Ashtead Group's exploration into advanced technologies like AI for predictive maintenance and enhanced logistics places it in the Question Mark quadrant of the BCG Matrix. While telematics are already in use, the deeper integration of AI for optimizing fleet management and anticipating equipment failures represents a significant growth opportunity. For instance, AI-powered predictive maintenance could reduce downtime, a critical factor in the rental industry where efficiency is paramount.

The rental sector is seeing a surge in demand for technologically advanced solutions, making these emerging areas high-growth. However, Ashtead's current market penetration in fully autonomous equipment or highly sophisticated AI-driven logistics might still be nascent. This requires substantial investment in research and development or strategic acquisitions to build a competitive edge in these cutting-edge applications.

Expanding Ashtead Group into new, untapped international markets, beyond its established US, Canada, and UK presence, aligns with the question mark phase of the BCG matrix. These markets offer high-growth potential, akin to stars, but currently possess very low market share and high uncertainty.

Such expansion would necessitate significant upfront investment and carry substantial risk. For instance, entering a market like India or Brazil would involve navigating unfamiliar regulatory frameworks, understanding diverse consumer behaviors, and facing established local competitors. This is a classic high-risk, high-reward scenario.

Developing comprehensive digital platforms that offer a full-service rental ecosystem, integrating customer self-service, advanced inventory management, and real-time analytics, represents a significant opportunity for Ashtead Group. This move beyond basic online ordering taps into the industry's ongoing digitization, promising high growth.

However, Ashtead's current position in such holistic digital solutions might be considered a 'Question Mark'. The company would likely need substantial investment to establish a leading market share in this evolving digital space. For context, the global equipment rental market was valued at approximately $100 billion in 2023 and is projected to grow, with digital transformation being a key driver.

Specialized Rental for Renewable Energy Projects

Ashtead Group's Sunbelt Rentals is strategically positioned to capitalize on the burgeoning renewable energy sector. The global renewable energy market is experiencing significant expansion, driven by government mandates and increasing demand for sustainable power. In 2024, investments in renewable energy infrastructure are projected to reach new heights, creating a substantial need for specialized rental equipment.

This segment, while potentially representing a smaller portion of Ashtead's overall business currently, exhibits strong growth potential. The specialized nature of equipment required for wind turbine erection or large-scale solar farm installations means that companies like Sunbelt Rentals can command premium pricing and build strong customer relationships. Ashtead's focus on targeted investments in this area could significantly boost its market share in the coming years.

- High Growth Potential: The global renewable energy market is expanding rapidly, with significant capital expenditure expected in 2024 for wind and solar projects.

- Specialized Equipment Needs: Projects require unique, often heavy-duty equipment for installation and maintenance, creating a niche for specialized rental providers.

- Market Share Opportunity: Ashtead may hold a nascent but growing share in this specialized rental market, indicating a strong opportunity for focused investment and expansion.

- Strategic Investment Focus: Targeted capital allocation towards acquiring and maintaining advanced equipment for renewable energy projects is crucial for capturing this market's full potential.

Diversification into Adjacent Service Offerings Beyond Equipment Rental

Diversifying into adjacent service offerings, such as advanced site management or specialized training, could position Ashtead Group as a Question Mark in the BCG matrix. While these areas offer high growth potential, Ashtead would likely enter with a low market share, necessitating substantial investment to build a competitive edge.

For example, if Ashtead were to offer comprehensive project consulting, it would be entering a market where established players already have significant brand recognition and client relationships. This would require a strategic build-up, potentially through acquisitions or significant organic investment in expertise and marketing, to gain traction.

- Potential for High Growth: Adjacent services like advanced site management or specialized training can tap into growing market demands beyond traditional equipment rental.

- Low Initial Market Share: Entering these new service areas means Ashtead would likely start with a small footprint, facing established competitors.

- Significant Investment Required: Building expertise, marketing capabilities, and operational infrastructure for new services demands considerable capital outlay.

- Strategic Importance: Successfully developing these adjacent services could create new revenue streams and strengthen Ashtead's overall value proposition to customers.

Ashtead Group's ventures into AI-driven fleet management and comprehensive digital rental platforms represent classic Question Marks. These areas offer substantial growth potential within the rapidly digitizing rental sector, projected to see continued expansion. However, Ashtead's current market penetration in these advanced technological applications is likely limited, requiring significant investment to establish a dominant position.

The company's expansion into new international territories also fits the Question Mark profile. These markets present high growth prospects but come with considerable uncertainty and require substantial upfront investment to navigate diverse regulatory landscapes and competitive environments. For instance, the global equipment rental market was valued at approximately $100 billion in 2023, with digital transformation a key growth driver.

Ashtead's strategic focus on the renewable energy sector, while promising, also positions it as a Question Mark. The demand for specialized equipment in this expanding market is high, but Ashtead's current share may be nascent, necessitating targeted capital allocation to build a stronger foothold.

| Initiative | Growth Potential | Market Share | Investment Needs | Risk Level |

|---|---|---|---|---|

| AI for Fleet Management | High | Low/Nascent | High (R&D, Tech Integration) | High |

| Digital Rental Platforms | High | Low/Nascent | High (Platform Development, Marketing) | High |

| New International Markets | High | Very Low | Very High (Market Entry, Operations) | Very High |

| Renewable Energy Equipment | High | Nascent/Growing | High (Equipment Acquisition, Specialization) | Medium/High |

BCG Matrix Data Sources

Our Ashtead Group BCG Matrix leverages comprehensive data from annual reports, market research, and competitor analysis to accurately position business units.