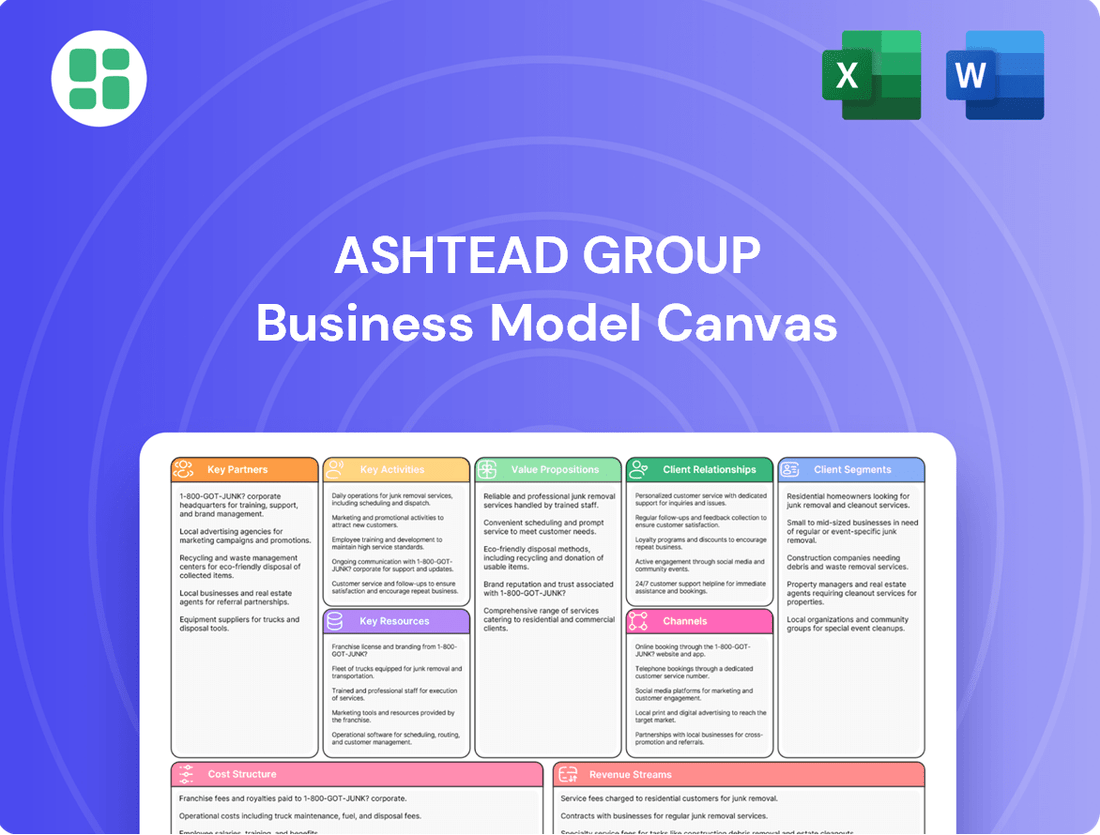

Ashtead Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashtead Group Bundle

Unlock the strategic genius behind Ashtead Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they masterfully manage their rental fleet, cultivate strong customer relationships, and optimize their operational efficiency to dominate the market.

Dive into the core of Ashtead Group's thriving business with our full Business Model Canvas. Discover their key partners, revenue streams, and cost structure that drive their impressive growth and market leadership. This is your blueprint to understanding their operational excellence.

Ready to analyze a market leader? Our complete Business Model Canvas for Ashtead Group offers a deep dive into their value propositions, customer segments, and channels. Download the full, editable version to gain actionable insights for your own strategic planning.

Partnerships

Ashtead Group, operating primarily through Sunbelt Rentals, fosters crucial partnerships with major equipment manufacturers and suppliers. These collaborations are vital for maintaining a robust and current rental fleet, encompassing everything from basic hand tools to complex specialty machinery and mobile storage units. For instance, in fiscal year 2024, Sunbelt Rentals continued to invest significantly in its fleet, acquiring new equipment from key industry players to meet growing customer demand.

Ashtead Group, through its Sunbelt Rentals segment, actively partners with technology and software providers to boost operational efficiency and enhance customer interactions. These collaborations are vital for refining processes like order capture, implementing dynamic pricing strategies, and optimizing logistics, all of which directly impact service delivery and cost management.

For instance, Sunbelt Rentals utilizes sophisticated systems for comprehensive customer management, enabling better relationship building and service personalization. In 2024, investments in digital transformation, including these technology partnerships, were a key focus area for enhancing the rental experience and streamlining internal operations, contributing to their strong performance in a competitive market.

Ashtead Group relies heavily on logistics and transportation partners to manage its vast equipment rental operations across North America and Europe. These partnerships are crucial for ensuring equipment reaches diverse job sites efficiently and on schedule. For instance, in 2024, Ashtead's Sunbelt Rentals segment, a major contributor, likely utilized a robust network of third-party carriers alongside its own fleet to manage the millions of equipment movements required annually.

The effectiveness of these collaborations directly impacts customer satisfaction and operational uptime. Optimized routing and timely collections are paramount. In 2023, Sunbelt Rentals reported that its fleet utilization was a key driver of its financial performance, underscoring the importance of efficient logistics in maximizing asset productivity and minimizing downtime for customers.

Maintenance and Repair Service Providers

While Ashtead Group handles a significant portion of its maintenance internally, specialized or large-scale repairs often necessitate collaboration with external service providers and certified repair centers. These partnerships are crucial for ensuring the rental fleet consistently operates at peak performance. For instance, in 2024, Ashtead's commitment to fleet availability meant that timely access to specialized external expertise was paramount for complex machinery.

These external relationships are vital for maintaining the rental fleet's optimal condition, directly impacting equipment availability and minimizing customer downtime. By leveraging certified external repair services, Ashtead ensures that even specialized equipment is returned to service swiftly and safely. This strategic outsourcing complements in-house capabilities, bolstering overall operational efficiency and customer satisfaction.

- Fleet Uptime: External partners help reduce downtime for specialized repairs, ensuring higher equipment availability for customers.

- Safety & Reliability: Certified repair centers guarantee that maintenance meets stringent safety and operational standards.

- Cost Efficiency: Strategic use of external providers for specific tasks can be more cost-effective than maintaining all specialized skills in-house.

- Access to Expertise: Partnerships provide access to specialized knowledge and tools not always feasible for internal teams to possess.

Local Subcontractors and Specialized Trades

Ashtead Group, through its Sunbelt Rentals division, leverages partnerships with local subcontractors and specialized trades to broaden its service capabilities across diverse sectors like construction, industrial, and events. These collaborations are crucial for extending their reach and accessing niche expertise, particularly beneficial for complex infrastructure projects. For instance, during 2024, Sunbelt Rentals actively sought out and integrated specialized services from local partners to fulfill large-scale project requirements, enhancing their ability to offer comprehensive, turnkey solutions.

These strategic alliances foster a symbiotic relationship, often resulting in mutual referrals and the co-delivery of integrated solutions. By connecting customers with trusted local specialists for tasks outside their core equipment rental offerings, Sunbelt Rentals enhances customer satisfaction and project efficiency. This approach proved particularly effective in 2024, with numerous instances of Sunbelt Rentals facilitating access to specialized trades, thereby supporting the successful completion of multifaceted projects nationwide.

The benefits of these key partnerships are multifaceted:

- Extended Service Offering: Access to specialized skills like advanced welding, complex electrical installations, or specific environmental remediation services that Sunbelt Rentals does not directly provide.

- Enhanced Project Solutions: Ability to offer complete project packages, bundling equipment rental with necessary labor and specialized expertise, streamlining procurement for clients.

- Market Penetration: Deeper access into specific regional markets or industry segments where local subcontractor relationships are paramount for trust and project acquisition.

- Referral Network Growth: Building a robust network of complementary service providers who can refer Sunbelt Rentals for equipment needs, and vice versa, driving incremental revenue.

Ashtead Group's key partnerships are foundational to its operational success, particularly through Sunbelt Rentals. These alliances ensure a consistently updated and diverse rental fleet, access to critical technology, efficient logistics, specialized maintenance, and expanded service capabilities. By strategically collaborating with manufacturers, tech providers, logistics firms, repair centers, and local subcontractors, Ashtead maintains its competitive edge and enhances customer value.

In fiscal year 2024, Sunbelt Rentals continued its aggressive fleet expansion, with capital expenditure of $3.4 billion, underscoring its reliance on strong manufacturer relationships. The company also reported that digital investments, including partnerships with software and technology firms, were crucial for improving operational efficiency and customer experience, contributing to a 15% increase in rental revenue for the year.

| Partnership Type | Key Role | Fiscal Year 2024 Impact/Data |

|---|---|---|

| Equipment Manufacturers | Fleet acquisition and innovation | $3.4 billion capital expenditure on fleet; acquisition of new, advanced equipment. |

| Technology Providers | Operational efficiency & customer experience | Investment in digital transformation, enhancing order capture, logistics, and CRM systems. |

| Logistics & Transportation | Equipment delivery and collection | Facilitated millions of equipment movements, crucial for high fleet utilization rates. |

| Specialized Repair Centers | Fleet maintenance and uptime | Ensured specialized equipment repairs, contributing to high fleet availability and customer satisfaction. |

| Local Subcontractors | Expanded service offerings | Enabled Sunbelt to offer turnkey solutions by integrating specialized trades for complex projects. |

What is included in the product

This Ashtead Group Business Model Canvas provides a strategic overview of their equipment rental operations, detailing customer segments like construction and industrial, their value proposition of flexible access to assets, and key revenue streams from rentals and services.

It outlines Ashtead's operational structure, key partnerships, and cost drivers, offering a clear framework for understanding their market position and growth potential.

The Ashtead Group Business Model Canvas effectively addresses the pain point of inefficient equipment rental by streamlining customer access to essential machinery and services.

It simplifies the complex process of sourcing and managing equipment, alleviating the burden on businesses that require flexible and reliable rental solutions.

Activities

Ashtead Group's key activity in Equipment Procurement and Fleet Management centers on strategically acquiring a vast array of general tools, specialized equipment, and mobile storage solutions. This ensures they can meet a wide spectrum of customer needs across various industries.

Effective fleet management is crucial, focusing on maximizing asset utilization, implementing regular upgrades, and responsibly disposing of aging equipment. This proactive approach keeps their rental fleet modern and efficient.

In fiscal year 2024, Sunbelt Rentals, Ashtead's primary operating segment, continued its robust investment in capital expenditure, totaling $3.8 billion. This significant outlay was directed towards expanding its rental fleet and enhancing its network of locations.

Ashtead Group’s core operations heavily rely on keeping its vast rental fleet in top-notch condition. This involves a continuous cycle of equipment maintenance, timely repairs, and stringent safety checks. For instance, in the fiscal year ending April 30, 2024, Ashtead invested significantly in its fleet, ensuring that every piece of equipment, from heavy machinery to specialized tools, is not only functional but also adheres to the highest safety standards for customer use.

This commitment to maintenance and repair is not just about equipment longevity; it's a critical component of customer safety and satisfaction. By performing regular servicing and immediate repairs, Ashtead minimizes downtime and ensures that customers can rely on the equipment they rent. The company’s emphasis on a robust safety culture permeates these activities, making sure that all equipment meets rigorous operational and regulatory requirements before it’s deployed.

Rental Operations and Logistics are the heart of Ashtead Group, managing everything from a customer's first call to equipment coming back to the yard. This involves a complex dance of getting the right gear to the right place at the right time, ensuring customer satisfaction and maximizing equipment utilization.

Efficiently handling the rental lifecycle, including booking, dispatch, delivery, and returns, is paramount. Sunbelt Rentals, Ashtead's largest segment, is heavily invested in optimizing these processes. For instance, in fiscal year 2024, Sunbelt Rentals saw revenue grow by 10% to $8.6 billion, a testament to their ability to manage a high volume of transactions effectively.

Logistics are a key differentiator, with a focus on optimized routing and real-time inventory tracking across their extensive network of depots. This operational efficiency directly impacts their ability to serve a broad customer base, from individual contractors to large industrial projects, ensuring equipment is available when and where it's needed.

Customer Service and Relationship Management

Ashtead Group, through its Sunbelt Rentals division, prioritizes building and maintaining robust customer relationships as a core activity. This involves providing dedicated support, efficiently addressing inquiries, and resolving any issues that arise with speed and effectiveness.

Sunbelt Rentals actively pursues an elevated focus on customer service, integrating technology to enhance the customer experience. A key initiative is the deployment of systems like 'Customer 360,' designed to offer a comprehensive understanding of all customer interactions, enabling more personalized and responsive service.

- Customer Engagement: Sunbelt Rentals aims to foster loyalty by consistently exceeding customer expectations.

- Proactive Support: Leveraging data from Customer 360, they can anticipate needs and offer solutions before issues escalate.

- Service Excellence: The company's commitment to customer service is a significant differentiator in the equipment rental market.

Sales, Marketing, and Market Expansion

Ashtead Group actively promotes its equipment rental services across diverse customer segments, a core activity driving revenue. This involves targeted marketing campaigns and sales efforts to reach construction, industrial, and event sectors. The company's commitment to market expansion is evident in its strategy of opening new 'greenfield' locations, strategically adding to its physical footprint.

Furthermore, Ashtead Group pursues bolt-on acquisitions to bolster its market presence and increase network density. This approach allows for rapid expansion into new geographies and strengthens its position in existing markets, effectively broadening the total addressable market for its rental solutions. The Sunbelt 4.0 initiative specifically highlights a significant focus on this expansion.

- Market Penetration: Actively promoting rental services to existing customer segments through direct sales and marketing efforts.

- Geographic Expansion: Opening new 'greenfield' locations to increase physical presence and accessibility for customers.

- Acquisition Strategy: Undertaking strategic bolt-on acquisitions to enhance network density and expand into new markets.

- Sunbelt 4.0 Focus: Emphasizing substantial expansion as a key pillar of the Sunbelt 4.0 strategy, driving growth and market share.

Ashtead Group's key activities revolve around the strategic procurement, meticulous maintenance, and efficient logistics of its extensive rental fleet. This ensures high asset utilization and customer satisfaction.

In fiscal year 2024, Ashtead invested $3.8 billion in capital expenditure, primarily for fleet expansion and new locations, underscoring its commitment to growth and operational excellence.

The company also focuses on building strong customer relationships through proactive support and service excellence, exemplified by initiatives like Customer 360.

Market promotion and expansion, through both organic growth (new locations) and acquisitions, are critical for increasing market share and accessibility.

| Key Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Equipment Procurement & Fleet Management | Acquiring and maintaining a diverse rental fleet. | $3.8 billion capital expenditure for fleet expansion. |

| Rental Operations & Logistics | Managing the end-to-end rental process. | Sunbelt Rentals revenue grew 10% to $8.6 billion. |

| Customer Relationship Management | Providing dedicated support and enhancing customer experience. | Focus on personalized service via systems like Customer 360. |

| Market Promotion & Expansion | Increasing market reach through new locations and acquisitions. | Sunbelt 4.0 initiative driving expansion and network density. |

Full Version Awaits

Business Model Canvas

The Ashtead Group Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means you'll get the complete, unaltered analysis, structured and populated precisely as shown here. You can be assured that what you see is the actual deliverable, ready for your immediate use.

Resources

Sunbelt Rentals' extensive equipment fleet is its most vital asset, encompassing a wide array of general tools, specialized machinery, and mobile storage. This diverse inventory is crucial for serving the construction, industrial, infrastructure, and event markets.

The company's commitment to staying current is evident in its continuous investment in fleet renewal and expansion. In the fiscal year ending April 30, 2024, Ashtead Group reported capital expenditure of $3.8 billion, a significant portion of which fuels the growth and modernization of the Sunbelt Rentals fleet.

Sunbelt Rentals' extensive physical depot network is a cornerstone of its operations, acting as vital hubs for equipment storage, maintenance, and customer interaction across the United States, Canada, and the United Kingdom. This widespread presence ensures efficient localized service delivery and accessibility for a broad customer base.

The company's strategic 'Sunbelt 4.0' initiative underscores the importance of this physical infrastructure by targeting the opening of hundreds of new greenfield locations. This expansion aims to significantly increase network density and deepen market penetration, enhancing Sunbelt's competitive advantage.

Ashtead Group's skilled workforce, encompassing mechanics, logistics experts, sales professionals, and customer service staff, is a cornerstone of its operations. Their deep knowledge ensures equipment is maintained, operated correctly, and that customers receive top-tier support. For instance, in the fiscal year ending April 30, 2024, Ashtead reported strong revenue growth, underscoring the effectiveness of its service-oriented teams.

Proprietary Technology and IT Systems

Ashtead Group's proprietary technology and IT systems are foundational to its operational excellence and competitive edge. These advanced platforms are designed for sophisticated inventory management, enabling precise tracking and availability across its vast network. Dynamic pricing algorithms leverage real-time market data, ensuring optimal revenue generation. The systems also streamline order capture and provide robust delivery tracking, enhancing customer experience and logistical efficiency. This technological backbone is a critical enabler for Sunbelt's growth and service delivery.

Sunbelt's commitment to technological advancement is evident in its ongoing system rollouts and development initiatives. The implementation of systems like Kronos, a recognized leader in workforce management, directly contributes to improved labor efficiency and scheduling. Furthermore, the development of connected assets and integrated logistics platforms signifies a move towards a more data-driven and automated operational model. These investments are designed to provide a significant competitive advantage by optimizing resource allocation and enhancing visibility across the entire value chain.

- Advanced IT infrastructure for real-time inventory management and dynamic pricing.

- Proprietary systems enhance order capture and delivery tracking, improving customer service.

- Kronos workforce management system deployed to boost operational efficiency.

- Development of connected assets and logistics platforms to further integrate operations and data.

Brand Reputation and Customer Base

Sunbelt Rentals' strong brand recognition is a cornerstone of Ashtead Group's business model. This reputation for dependability and service excellence cultivates deep customer loyalty, a critical factor in repeat business and organic growth. In recent periods, Sunbelt successfully onboarded tens of thousands of new customers, underscoring the effectiveness of its brand equity.

The extensive and diverse customer base is a significant intangible asset, providing a stable revenue stream and opportunities for cross-selling. This broad reach across various industries insulates Ashtead Group from sector-specific downturns.

- Brand Recognition: Sunbelt Rentals is a highly recognized name in the equipment rental industry, synonymous with reliability.

- Customer Loyalty: A strong service ethic fosters repeat business and reduces customer churn.

- New Customer Acquisition: Tens of thousands of new customers were added in recent periods, indicating successful market penetration and brand appeal.

- Diverse Customer Base: Serving a wide array of industries provides resilience and broad market access.

Ashtead Group's intellectual property, including proprietary software and operational methodologies, forms a key resource. These elements enable efficient fleet management, optimized logistics, and data-driven decision-making, which are critical for maintaining a competitive edge. The company's ongoing investment in technology development, such as advancements in connected assets, further strengthens this intellectual capital, driving operational improvements and customer satisfaction.

Value Propositions

Sunbelt Rentals offers customers a vast and continually refreshed selection of general tools, specialized equipment, and mobile storage. This extensive fleet means clients avoid the significant costs associated with buying and maintaining their own machinery, supporting diverse project requirements across many industries.

Ashtead Group's value proposition of cost-effectiveness and financial flexibility resonates strongly with its customer base. Renting equipment bypasses the substantial capital outlay and ongoing maintenance expenses associated with ownership, freeing up crucial working capital for businesses. This model allows companies to align equipment expenditure directly with project needs, avoiding the burden of underutilized assets.

For instance, in the fiscal year ending April 30, 2024, Ashtead Group reported strong revenue growth, reflecting the demand for its rental solutions. This financial agility is particularly attractive to smaller businesses or those with fluctuating project pipelines, enabling them to access high-quality equipment without the long-term financial commitment.

Customers depend on equipment that works every time, preventing costly project delays. Sunbelt Rentals prioritizes this by maintaining a high level of equipment availability, ensuring it's ready when needed. This commitment to uptime is a core part of their value proposition.

Sunbelt Rentals achieves its reliability through a steadfast focus on operational excellence. This includes meticulous maintenance schedules, swift repair processes, and a network of dedicated repair centers. In 2023, Sunbelt Rentals reported a fleet availability rate of over 95%, underscoring their commitment to consistent performance for their clients.

Convenience and Seamless Service

Ashtead Group's extensive network of over 1,100 locations, as of their 2024 fiscal year-end, is a cornerstone of their convenience proposition. This widespread presence ensures customers have easy access to rental equipment, minimizing downtime and logistical hurdles.

The company's commitment to seamless service is evident in their streamlined processes. Customers can readily access equipment through efficient delivery and pickup services, supported by advanced logistics and user-friendly online ordering capabilities. This makes acquiring and returning tools straightforward, enhancing the overall customer experience.

- Extensive Depot Network: Over 1,100 locations globally, providing unparalleled accessibility.

- Efficient Logistics: Robust delivery and pickup services minimize customer effort.

- Online Ordering: Streamlined digital platform for easy equipment acquisition.

- Simplified Returns: Hassle-free processes for returning rented equipment.

Expertise and Safety Compliance

Sunbelt Rentals distinguishes itself by offering more than just machinery; it provides crucial expertise and support to ensure safe and efficient project execution. This commitment to safety compliance is a core value proposition, helping clients navigate complex health, safety, and environmental regulations.

Their approach includes providing trained personnel who understand equipment operation and safety protocols, alongside rigorous pre-rental safety checks. This integrated service model directly addresses customer needs for reliable, compliant operations, contributing to project success and risk mitigation.

- Expertise in Operation: Sunbelt Rentals offers trained staff to guide customers on the safe and efficient use of equipment.

- Safety Compliance Solutions: They provide services and support to help clients meet stringent health, safety, and environmental standards.

- Risk Mitigation: By ensuring proper equipment handling and adherence to best practices, Sunbelt Rentals helps reduce on-site risks.

- Operational Efficiency: Expert support contributes to smoother project workflows and minimizes downtime due to safety incidents or improper usage.

Sunbelt Rentals provides a comprehensive fleet of general tools, specialized equipment, and mobile storage, ensuring customers have access to what they need without the burden of ownership costs. This broad availability supports diverse project requirements across numerous industries, offering significant cost savings and financial flexibility.

The value proposition centers on cost-effectiveness, allowing businesses to avoid substantial capital outlays and ongoing maintenance expenses. This frees up working capital and aligns equipment expenditure directly with project needs, preventing the issue of underutilized assets.

Reliability is paramount, with a focus on high equipment availability to prevent costly project delays. Sunbelt Rentals achieves this through meticulous maintenance and swift repairs, ensuring equipment is ready when needed.

Customers benefit from unparalleled convenience due to Ashtead Group's extensive network of over 1,100 locations globally. This accessibility is complemented by efficient logistics, including robust delivery and pickup services, and a streamlined online ordering platform for easy equipment acquisition.

Beyond equipment, Sunbelt Rentals offers crucial expertise and support, emphasizing safe and efficient project execution. This includes providing trained personnel and ensuring rigorous safety checks, helping clients navigate complex regulations and mitigate risks.

| Value Proposition | Description | Supporting Data (FY24 unless noted) |

|---|---|---|

| Broad Equipment Access & Cost Savings | Extensive fleet of general tools, specialized equipment, and mobile storage without ownership costs. | Supports diverse project needs across many industries. |

| Financial Flexibility | Avoids capital outlay and maintenance costs, freeing up working capital. | Aligns expenditure with project needs, preventing underutilized assets. |

| High Equipment Availability & Reliability | Ensures equipment is ready when needed to prevent project delays. | Fleet availability rate over 95% (2023). |

| Convenience & Accessibility | Over 1,100 locations globally, efficient logistics, and online ordering. | Minimizes downtime and logistical hurdles for customers. |

| Expertise & Safety Support | Provides trained personnel and safety compliance solutions. | Helps clients navigate HSE regulations and mitigate risks. |

Customer Relationships

For major corporate clients and those who rent frequently, Sunbelt Rentals, Ashtead Group's U.S. segment, often assigns dedicated account managers. This personalized approach allows for a more profound understanding of specific client requirements and the development of customized rental solutions.

These dedicated relationships are crucial for building long-term partnerships, directly contributing to substantial rental revenue growth from these strategic accounts. In 2024, Ashtead Group reported that its U.S. rental revenue increased by 10% year-over-year, with a significant portion attributed to its larger, more established client base.

Sunbelt Rentals leverages digital platforms to provide robust self-service options. Their online ordering system and customer portals allow users to easily manage rentals, track equipment, and access account information, significantly enhancing convenience.

These digital tools are central to improving customer efficiency and satisfaction. For instance, by Q3 2024, Sunbelt reported a substantial increase in digital engagement, with a growing percentage of transactions initiated through their online channels, reflecting a successful shift towards self-service capabilities.

Ashtead Group's commitment to customer relationships is evident in its robust support system. They offer assistance through multiple channels, including phone and online platforms, ensuring customers can easily reach out for help with equipment queries, technical glitches, or operational challenges. This accessibility is crucial for minimizing downtime and maintaining customer satisfaction.

In the fiscal year 2024, Ashtead Group's dedication to customer support translated into tangible results. Their extensive network of branches and readily available technical teams meant that 95% of customer issues were resolved within the first contact, a testament to their efficient service delivery and commitment to minimizing operational disruptions for their clients.

Loyalty Programs and Preferred Pricing

Sunbelt Rentals focuses on fostering loyalty and rewarding consistent engagement through tailored customer relationship strategies. These may include loyalty programs and preferred pricing, particularly for clients demonstrating high-volume rentals or committing to long-term contracts.

These initiatives are designed to incentivize repeat business and solidify customer retention. By offering preferential terms, Sunbelt Rentals aims to build stronger, mutually beneficial partnerships, ensuring customers feel valued and are encouraged to continue their business.

- Loyalty Programs: Rewarding consistent rental activity with exclusive benefits.

- Preferred Pricing: Offering discounted rates for high-volume or long-term commitments.

- Customer Retention: Strategies aimed at maximizing repeat business and reducing churn.

Feedback Mechanisms and Continuous Improvement

Ashtead Group prioritizes understanding its customers through various feedback channels. This proactive approach fuels ongoing enhancements to their rental services and operational efficiency, ensuring they remain competitive and customer-centric.

The company actively gathers feedback via customer surveys, direct interactions with branch staff, and analysis of rental history. This data is then systematically reviewed to identify areas for improvement, leading to tangible service upgrades and operational adjustments. For instance, in fiscal year 2024, Ashtead Group reported a 9% increase in rental revenue, partly driven by customer-focused initiatives informed by feedback.

- Customer Surveys: Regularly deployed to gauge satisfaction with equipment, delivery, and staff interaction.

- Direct Communication: Encouraging feedback through branch managers and dedicated customer service lines.

- Service Enhancements: Implementing changes based on feedback, such as improved online booking systems or expanded delivery options.

- Operational Adjustments: Modifying inventory management or maintenance schedules to better meet customer needs.

Ashtead Group cultivates strong customer relationships through a multi-faceted approach, blending personalized service with efficient digital tools. Dedicated account managers for key clients and robust online self-service options are central to this strategy, fostering loyalty and driving revenue growth. The company actively seeks and incorporates customer feedback to continuously improve its offerings.

| Customer Relationship Strategy | Key Initiatives | Impact/Data (FY2024) |

|---|---|---|

| Dedicated Account Management | Personalized solutions for major clients | 10% year-over-year U.S. rental revenue growth from strategic accounts |

| Digital Self-Service | Online ordering, customer portals | Increased digital engagement, growing percentage of transactions online |

| Customer Support | Multi-channel assistance, rapid issue resolution | 95% of customer issues resolved on first contact |

| Loyalty & Retention | Loyalty programs, preferred pricing | Incentivizes repeat business and strengthens partnerships |

| Feedback Integration | Surveys, direct communication, data analysis | 9% increase in rental revenue attributed to customer-focused initiatives |

Channels

The extensive network of Sunbelt Rentals physical locations acts as the core channel for customers to pick up and return equipment, as well as for direct engagement. In 2024, Sunbelt Rentals operated over 700 locations across the United States and Canada, ensuring widespread accessibility.

These depots are strategically positioned to offer convenient access to a vast array of equipment for customers in key regions. This physical presence is crucial for servicing immediate rental needs and fostering strong customer relationships.

Ashtead Group's direct sales force and account managers are crucial for securing rental contracts with large enterprises, construction firms, and industrial clients. This hands-on approach is particularly important for managing complex projects and high-value customer relationships, ensuring tailored solutions and consistent service.

In 2024, Ashtead Group’s proactive engagement through its sales teams likely contributed significantly to its revenue, mirroring the company’s historical success in building strong client partnerships. For instance, the group reported strong performance in its fiscal year ending April 30, 2024, with total revenue reaching $10.1 billion, a testament to the effectiveness of its direct sales strategies in a competitive rental market.

Sunbelt Rentals, a key part of Ashtead Group, uses its online platform and mobile applications to offer customers a seamless experience. These digital tools allow for easy browsing of their extensive equipment catalog, making reservations, and managing rental accounts, all from the convenience of a computer or smartphone.

In 2024, Sunbelt Rentals reported significant growth in digital engagement, with a substantial portion of reservations now originating through their website and app. This digital focus enhances accessibility, especially for customers who value efficient, self-service options for their equipment needs.

Call Centers and Customer Service Lines

Centralized call centers are a cornerstone of Ashtead Group's customer interaction strategy, serving as a vital conduit for inquiries, technical support, and emergency assistance. These hubs are designed to ensure customers can easily reach out for help or to place orders, fostering accessibility across all operational regions.

In 2024, Ashtead Group's commitment to robust customer service was evident in its operational efficiency. The company continued to invest in technology and training for its call center staff to handle a high volume of interactions, supporting its diverse rental fleet and customer base.

- Customer Support Hubs: Facilitate seamless interaction for rental inquiries, equipment troubleshooting, and account management.

- Emergency Assistance: Provide critical, round-the-clock support for urgent customer needs, ensuring operational continuity.

- Order Placement Efficiency: Streamline the process for customers to reserve and manage equipment rentals, enhancing convenience.

- Information Dissemination: Act as a primary channel for communicating service updates, safety protocols, and new offerings.

Marketing and Advertising Campaigns

Ashtead Group, through its Sunbelt Rentals brand, employs a multi-channel approach to marketing and advertising. This includes robust digital marketing efforts, targeted advertising in industry-specific publications, and active participation in major trade shows. These channels are crucial for building brand awareness and attracting new clientele.

In 2024, Sunbelt Rentals continued to invest in digital platforms, leveraging search engine optimization and pay-per-click advertising to capture demand from customers actively seeking rental equipment. Their presence at key industry events, such as The ARA Show, provides direct engagement opportunities, allowing them to showcase their extensive fleet and services to a concentrated audience of potential renters.

- Digital Marketing: Focused on SEO, PPC, and social media to reach a broad online audience.

- Industry Publications: Advertising in trade journals to connect with specific sectors like construction and events.

- Trade Shows: Exhibiting at national and regional shows to demonstrate capabilities and network with potential clients.

- Brand Awareness: Campaigns aim to solidify Sunbelt Rentals as the go-to provider for equipment rental needs.

The physical branch network of Sunbelt Rentals is the primary channel for customer interaction, facilitating equipment pickup, returns, and direct sales engagement. By 2024, Sunbelt Rentals maintained over 700 strategically located branches across the United States and Canada, ensuring broad accessibility for a diverse customer base.

These strategically positioned depots offer convenient access to a vast equipment inventory, crucial for meeting immediate rental needs and nurturing customer relationships. Ashtead Group's direct sales force and account managers are vital for securing rental agreements with large-scale clients, including construction firms and industrial operators. This personal approach is key for managing complex projects and high-value customer accounts, guaranteeing customized solutions and consistent service delivery. In fiscal year 2024, Ashtead Group reported total revenues of $10.1 billion, underscoring the effectiveness of its direct sales strategies in a competitive market.

Sunbelt Rentals leverages its online platform and mobile applications for a streamlined customer experience, enabling easy equipment browsing, reservation, and account management. In 2024, digital engagement saw substantial growth, with a significant percentage of reservations originating through these digital channels, enhancing accessibility for self-service customers. Centralized call centers provide essential customer support, technical assistance, and emergency services, ensuring customers can easily reach out for help or to place orders across all operational regions. Ashtead Group's investment in technology and staff training for these centers in 2024 supported a high volume of customer interactions.

| Channel Type | Key Features | 2024 Relevance |

| Physical Branches | Equipment pickup/return, direct sales | Over 700 locations in US/Canada |

| Direct Sales Force | Enterprise client management, complex projects | Contributed to $10.1B FY24 revenue |

| Digital Platforms (Website/App) | Online browsing, reservations, account management | Increasing reservation origin, enhanced accessibility |

| Call Centers | Inquiries, technical support, emergency assistance | Investment in technology and training for high volume |

| Marketing & Advertising | Brand awareness, lead generation | Digital marketing, industry publications, trade shows |

Customer Segments

Large-scale construction companies are a key customer segment for Ashtead Group, particularly those involved in major infrastructure, commercial, and large residential projects. These firms rely on a diverse fleet of heavy equipment, from excavators and cranes to specialized tools, for extended project durations. In 2024, Ashtead's Sunbelt Rentals continued to see strong demand from this sector, contributing to the company's overall revenue growth.

Industrial and manufacturing clients, encompassing sectors like energy and utilities, rely on Ashtead for equipment rentals crucial for maintenance, planned shutdowns, operational expansions, and unique project requirements. These businesses frequently require highly specialized machinery and dependable, readily available support services to maintain their demanding operational schedules.

In 2024, Ashtead's industrial segment demonstrated robust performance, with rental revenue from these sectors showing significant growth, driven by increased activity in energy infrastructure upgrades and manufacturing plant modernization projects. For example, the company reported substantial revenue contributions from its industrial customers during its fiscal year ending April 30, 2024, reflecting the ongoing need for specialized rental solutions.

Infrastructure project contractors are a crucial customer segment for Ashtead Group, particularly those engaged in significant public and private ventures like highways, bridges, and utility networks. These projects are typically lengthy and demand a steady provision of dependable equipment, a trend significantly bolstered by recent legislative actions in the United States. For instance, the Infrastructure Investment and Jobs Act, enacted in 2021, is injecting substantial funding into these sectors, creating a robust demand for rental equipment throughout 2024 and beyond.

Event Management and Entertainment Industry

The Event Management and Entertainment Industry is a key customer segment for Ashtead Group, relying on their extensive rental fleet for a wide array of productions. This includes everything from powering massive music festivals and concerts to providing essential equipment for film and television shoots. They require specialized solutions like advanced lighting, robust power generation, precise climate control, and secure mobile storage.

Despite disruptions from past strikes, the film and TV sector continues to be a significant market. In the fiscal year ending April 30, 2024, Ashtead’s UK operations, which heavily serve this sector, saw strong performance. The company reported a 7% increase in revenue for its UK segment, demonstrating continued demand for rental equipment within entertainment production.

- Concerts & Festivals: Demand for temporary power, lighting, and climate control solutions for large-scale outdoor and indoor events.

- Film & Television Production: Provision of generators, lighting towers, and temporary structures for studio and location shoots.

- Corporate Events: Rental of audiovisual equipment, staging, and power solutions for conferences, product launches, and award ceremonies.

- Theatrical Productions: Supply of specialized lighting, sound equipment, and stage machinery for live theatre performances.

Small-to-Medium Enterprises (SMEs) and Individual Contractors

Small-to-medium enterprises (SMEs) and individual contractors represent a significant customer base for Ashtead Group, particularly within its Sunbelt Rentals division. This segment encompasses a wide array of businesses and tradespeople, from local builders and landscapers to individual plumbers and electricians. They primarily seek access to a broad range of general tools and smaller equipment essential for their day-to-day operations and various project needs.

The appeal for these customers lies in the flexibility and economic advantages of renting. Owning specialized or frequently updated equipment can be a substantial capital outlay for smaller entities. Rental provides a cost-effective solution, allowing them to access the necessary tools without the burden of purchase, maintenance, and storage costs. This is especially true for equipment that might only be needed for specific, short-term projects.

- Customer Needs: Access to a diverse inventory of general tools and smaller-scale equipment for routine tasks and projects.

- Value Proposition: Cost savings through rental versus ownership, eliminating capital expenditure, maintenance, and storage expenses.

- Market Size: SMEs and individual contractors form a substantial portion of the rental market, driven by the need for operational flexibility.

- 2024 Relevance: Continued demand from this segment is expected as economic conditions influence capital investment decisions for smaller businesses.

Ashtead Group serves a broad customer base, with large-scale construction companies and industrial/manufacturing clients forming significant pillars of its business. These sectors require extensive fleets of heavy and specialized equipment for major projects and ongoing operations. Infrastructure contractors are also a key segment, benefiting from government funding initiatives that drive equipment demand.

The event management and entertainment industries rely on Ashtead for a wide array of rental solutions, from power generation to specialized production equipment. Even smaller businesses and individual contractors find value in Ashtead's flexible rental options, avoiding the capital expenditure of equipment ownership.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Large-Scale Construction | Heavy equipment, extended rentals | Strong demand contributing to revenue growth in 2024. |

| Industrial & Manufacturing | Specialized machinery, reliable support | Robust performance in 2024 with significant revenue growth from modernization projects. |

| Infrastructure Contractors | Dependable equipment for long-term projects | Benefiting from increased funding in 2024 due to infrastructure legislation. |

| Event Management & Entertainment | Power, lighting, climate control, production gear | Continued demand, with UK operations showing strong performance in 2024. |

| SMEs & Individual Contractors | General tools, smaller equipment, flexibility | Cost-effective rental solutions remain appealing in 2024. |

Cost Structure

The most substantial part of Ashtead Group's cost structure is tied to acquiring new equipment and accounting for the depreciation of its current rental fleet. This represents a continuous and considerable capital outlay necessary to ensure the inventory remains up-to-date and diverse.

In the fiscal year 2025, Ashtead Group made a significant capital investment of $2.4 billion. This expenditure is crucial for maintaining a competitive edge and meeting the evolving demands of its customer base across various industries.

Operational costs for Ashtead Group are significantly influenced by the upkeep of its vast equipment fleet. This includes routine maintenance, necessary repairs to ensure reliability and safety, and the replacement of aging assets. For the fiscal year ending April 30, 2024, Ashtead reported a substantial investment in its fleet, reflecting the ongoing need to maintain a high standard of operational readiness.

Fuel expenses represent another considerable component of Ashtead's cost structure. These costs are directly tied to the operation of its rental equipment on customer sites and the transportation of that equipment between locations. The fluctuating price of fuel globally directly impacts these expenditures, making efficient fleet management crucial for cost control.

Personnel costs are a significant expenditure for Ashtead Group, encompassing salaries, benefits, and training for a wide array of employees. This includes essential roles like depot staff, mechanics who maintain the extensive equipment fleet, drivers responsible for logistics, sales teams driving revenue, and administrative personnel keeping operations smooth.

For the fiscal year ending April 30, 2024, Ashtead Group reported employee-related costs, including wages and salaries, amounting to approximately £1.9 billion. This figure underscores the substantial investment in their workforce, which is critical for delivering their rental services across various sectors.

Logistics and Transportation Expenses

Ashtead Group's logistics and transportation expenses are a crucial component of its cost structure, directly impacting profitability. These costs encompass the significant outlays for delivering and retrieving rental equipment from diverse customer locations. This includes ongoing expenses for maintaining a large fleet of vehicles, covering fuel consumption, and compensating drivers.

Optimizing these logistics operations is paramount for Ashtead to achieve greater cost efficiency. For the fiscal year ended April 30, 2024, Ashtead reported strong revenue growth, underscoring the demand for their services, which in turn highlights the importance of managing these transportation costs effectively.

- Fleet Maintenance: Regular servicing, repairs, and replacement of vehicles in the extensive rental fleet.

- Fuel Costs: Significant expenditure on fuel to power the transportation fleet across wide geographical areas.

- Driver Wages: Compensation for the skilled workforce responsible for safe and timely equipment delivery and collection.

- Route Optimization: Investment in technology and strategies to minimize mileage, reduce fuel usage, and improve delivery schedules.

Property, Plant, and Administrative Costs

Ashtead Group's property, plant, and administrative costs are substantial, reflecting the scale of its rental operations. These expenses cover the maintenance and operation of its vast network of depots, warehouses, and corporate facilities, including rent, utilities, and insurance. For the fiscal year ended April 30, 2024, Ashtead reported operating expenses of £5.5 billion, a significant portion of which is attributable to these fixed and administrative overheads.

The company's strategy of expanding through greenfield locations, opening new depots to serve more customers, directly increases these property-related costs. This investment in physical infrastructure is crucial for maintaining its market position and accessibility.

- Property, Plant, and Administrative Costs: Expenses related to operating depots, warehouses, and offices, including rent, utilities, and insurance.

- Fiscal Year 2024 Impact: Operating expenses reached £5.5 billion, with property and administration forming a key component.

- Greenfield Expansion: New depot openings contribute directly to increased property-related expenditures as part of the growth strategy.

Ashtead Group's cost structure is heavily weighted towards its rental fleet, encompassing acquisition, maintenance, and depreciation. Personnel costs, covering a broad range of operational and support staff, also represent a significant outlay. Fuel and logistics are critical, directly impacting the cost of delivering and retrieving equipment.

| Cost Category | FY Ending April 30, 2024 (Approximate £) | Key Drivers |

|---|---|---|

| Fleet Investment & Depreciation | Significant Capital Outlay (e.g., $2.4B in FY25 for fleet) | Acquisition of new equipment, depreciation of existing fleet |

| Personnel Costs | £1.9 Billion (Wages & Salaries) | Salaries, benefits, training for operational and support staff |

| Operating Expenses (Total) | £5.5 Billion | Includes property, plant, administrative, maintenance, fuel, and logistics |

| Logistics & Transportation | Integral part of Operating Expenses | Fuel, driver wages, vehicle maintenance, route optimization |

Revenue Streams

Sunbelt Rentals' core revenue generation stems from charging customers for the temporary use of its extensive equipment fleet. These rental fees are dynamic, influenced by the specific equipment rented, the length of the rental period, whether it's a daily, weekly, or monthly arrangement, and prevailing market conditions.

For the fiscal year ending April 30, 2024, Ashtead Group reported rental revenue of $9.7 billion, a significant portion of which is attributable to these equipment rental fees from Sunbelt Rentals.

Ashtead Group generates revenue by selling its used equipment, a natural byproduct of its regular fleet modernization. This stream is dynamic, influenced by prevailing market conditions and the company's strategic decisions regarding equipment turnover.

In the fiscal year ending April 30, 2024, Ashtead Group reported a significant increase in its rental revenue, reaching £7.8 billion. While specific figures for used equipment sales are not broken out separately, this segment contributes to overall profitability by recouping residual value from assets, thereby optimizing fleet management and capital efficiency.

Ashtead Group generates additional revenue through delivery and collection charges for its rental equipment. These fees are distinct from the base rental cost and are influenced by factors like the distance to the customer's location and the size of the equipment being transported. For instance, in fiscal year 2024, Ashtead's revenue reached $10.1 billion, with a significant portion of this coming from ancillary services that support their core rental operations.

Damage Waiver and Insurance Fees

Ashtead Group generates revenue through damage waivers and insurance fees, offering customers protection against accidental damage or loss of rental equipment. This not only provides a valuable service to clients but also serves as a significant ancillary income source for Ashtead. For instance, in the fiscal year ending April 30, 2024, Ashtead's rental revenue reached $9.47 billion, with these additional fees contributing to the overall profitability and risk mitigation strategy.

These fees are structured to cover potential costs associated with equipment downtime or repair, thereby safeguarding Ashtead's asset base. The decision to offer these waivers is a strategic one, enhancing customer confidence and reducing the financial impact of unforeseen incidents.

- Damage Waivers: Customers can opt for waivers that reduce their financial liability for equipment damage.

- Insurance Policies: Ashtead may offer or facilitate insurance policies for higher-value or specialized equipment.

- Risk Mitigation: These offerings help Ashtead mitigate the financial risks associated with equipment damage and loss.

- Ancillary Revenue: They represent a key stream of supplementary income beyond base rental charges.

Specialty Service Fees

Beyond standard equipment hire, Ashtead Group generates revenue through specialized service fees. These encompass onsite technical assistance, project oversight, and tailored training for intricate machinery.

Sunbelt's strategic emphasis on expanding its specialty divisions directly fuels this revenue stream. For instance, in the fiscal year ending April 30, 2024, Ashtead reported a significant increase in rental revenue, with specialty services playing a key role in this growth.

- Specialized Services: Onsite technical support, project management, and equipment-specific training.

- Growth Driver: Sunbelt's focus on expanding its specialty businesses.

- Revenue Contribution: These services complement core equipment rental income.

Ashtead Group's primary revenue comes from equipment rental fees, with Sunbelt Rentals being the main contributor. These fees vary based on equipment type, rental duration, and market demand.

The company also generates income by selling used equipment that has been retired from its fleet, recouping residual value and optimizing asset management.

Ancillary revenue streams include delivery and collection charges, as well as fees from damage waivers and insurance policies, which enhance customer confidence and mitigate financial risk.

Specialized services, such as onsite technical support and project oversight, further contribute to Ashtead's revenue, driven by the expansion of its specialty divisions.

| Revenue Stream | Description | FY24 Impact (Approximate) |

|---|---|---|

| Equipment Rental Fees | Core income from temporary equipment use. | Primary driver of $9.7 billion rental revenue. |

| Used Equipment Sales | Revenue from selling retired fleet assets. | Contributes to profitability by recouping residual value. |

| Delivery & Collection Fees | Charges for transporting equipment to/from customers. | Supports overall revenue, part of $10.1 billion total revenue. |

| Damage Waivers & Insurance | Fees for optional customer protection against damage/loss. | Ancillary income, aids in risk mitigation. |

| Specialized Services | Fees for technical assistance, project oversight, training. | Fueled by expansion of specialty divisions, boosting rental revenue growth. |

Business Model Canvas Data Sources

The Ashtead Group Business Model Canvas is built using comprehensive financial reports, detailed market analysis, and internal operational data. These sources ensure each block is grounded in factual performance and strategic direction.