Ashland SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashland Bundle

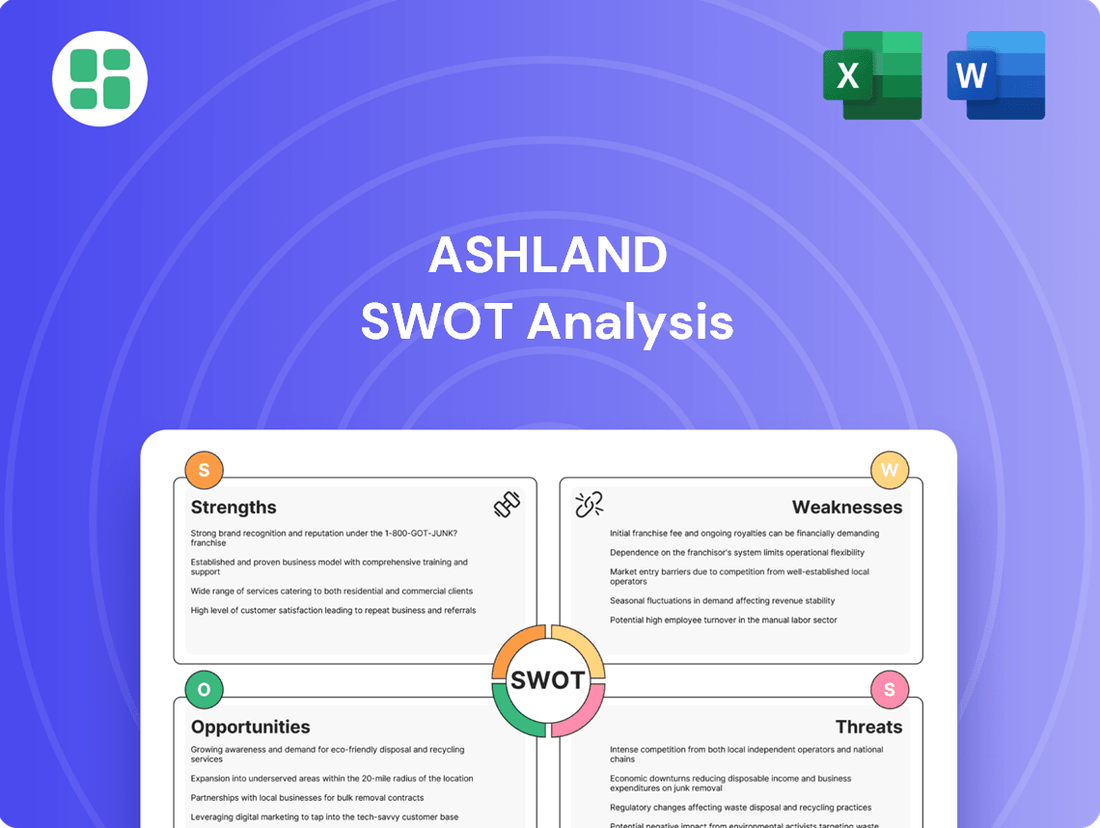

Ashland's current market position is defined by its robust specialty materials portfolio and a commitment to innovation. However, understanding the full scope of its competitive advantages and potential challenges requires a deeper dive.

Want the full story behind Ashland's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ashland boasts a diverse product portfolio, positioning itself as a leader in key consumer-focused markets. Its offerings span additives and ingredients crucial for industries like pharmaceuticals, personal care, and architectural coatings. This breadth and depth in specialized materials allow Ashland to cater to a wide range of customer needs and maintain a robust market standing.

Ashland's robust innovation and research and development (R&D) focus is a significant strength, driving the creation of advanced solutions that boost customer performance and functionality across global markets. The company consistently allocates substantial resources to R&D, with a notable emphasis on developing new products that align with sustainability goals, a key differentiator in today's marketplace.

Ashland's expansive global manufacturing and distribution network, encompassing facilities across the Americas, Europe, the Middle East, Africa, and Asia Pacific, is a significant strength. This widespread presence allows the company to serve customers in over 100 countries, ensuring broad market reach and efficient product delivery.

This global footprint is critical for Ashland's ability to cater to diverse regional demands and maintain a competitive edge. The company's robust supply chain, supported by localized operations, enhances its responsiveness and adaptability to varying market conditions, a key factor in the specialized chemicals sector.

Strategic Portfolio Optimization

Ashland's strategic portfolio optimization is a key strength, demonstrated by its divestiture of non-core assets. For instance, the company sold its remaining stake in the Ashland-Valvoline joint venture in late 2023, generating significant cash. This move allows for a sharper focus on its specialty materials segments, which are expected to yield higher margins and more consistent growth.

These strategic realignments are designed to streamline operations and enhance profitability. By shedding lower-margin businesses, Ashland is positioning itself to capitalize on its core competencies in areas like life sciences and specialty additives. This focus is crucial for driving innovation and delivering superior value to customers in its target markets.

- Divestiture of non-core assets: Ashland has actively pruned its portfolio, including exiting certain product lines.

- Focus on high-value segments: The company is concentrating resources on specialty materials with stronger growth and margin potential.

- Improved financial flexibility: Strategic sales have bolstered the balance sheet, providing capital for reinvestment and shareholder returns.

- Enhanced operational efficiency: Streamlining the business portfolio is expected to lead to more efficient operations and better resource allocation.

Commitment to Sustainability and ESG

Ashland demonstrates a strong commitment to Environmental, Social, and Governance (ESG) principles, actively integrating them into its operations and innovation strategies. This focus on responsible business practices, including reducing its environmental footprint, resonates with the growing global demand for sustainable products and services. For instance, Ashland has set ambitious science-based targets for emissions reduction, aiming for a 40% decrease in Scope 1 and 2 greenhouse gas emissions by 2030 compared to a 2019 baseline.

This dedication to sustainability not only drives responsible innovation but also bolsters Ashland's brand reputation and long-term resilience in an evolving market landscape. The company's emphasis on product design that considers the entire lifecycle contributes to a reduced environmental impact. This proactive approach positions Ashland favorably as stakeholders increasingly prioritize companies with robust ESG credentials.

- Science-Based Targets: Ashland committed to reducing Scope 1 and 2 GHG emissions by 40% by 2030 (vs. 2019 baseline).

- Product Lifecycle Focus: Emphasizes designing products with environmental impact considered throughout their lifecycle.

- Brand Enhancement: Commitment to ESG strengthens brand reputation and stakeholder trust.

- Market Alignment: Addresses increasing global consumer and investor demand for sustainable solutions.

Ashland's diverse product portfolio, particularly in additives and ingredients for pharmaceuticals, personal care, and architectural coatings, solidifies its market leadership. This specialization allows the company to meet a wide array of customer needs effectively. Furthermore, Ashland's significant investment in research and development fuels innovation, creating advanced solutions that enhance customer product performance and align with sustainability objectives, a key differentiator.

The company's extensive global manufacturing and distribution network, serving over 100 countries, ensures broad market reach and efficient delivery. This strategic global footprint, coupled with a robust supply chain, enhances Ashland's ability to respond to diverse regional demands and market shifts. Additionally, Ashland's strategic portfolio optimization, including the divestiture of non-core assets like its stake in Ashland-Valvoline in late 2023, sharpens its focus on high-margin specialty materials, improving financial flexibility and operational efficiency.

Ashland's commitment to ESG principles is a notable strength, evidenced by its science-based targets for emissions reduction. For example, the company aims for a 40% decrease in Scope 1 and 2 greenhouse gas emissions by 2030 from a 2019 baseline. This dedication to sustainability not only enhances brand reputation but also positions Ashland favorably with stakeholders increasingly prioritizing environmentally responsible companies.

| Strength Category | Key Aspect | Impact/Benefit |

|---|---|---|

| Product Portfolio | Diverse, specialized additives and ingredients | Market leadership in key consumer-focused sectors; broad customer appeal |

| Innovation & R&D | Significant investment in advanced solutions | Enhanced customer product performance; development of sustainable offerings |

| Global Operations | Extensive manufacturing and distribution network | Broad market reach (100+ countries); efficient supply chain and responsiveness |

| Strategic Focus | Divestment of non-core assets (e.g., Ashland-Valvoline stake in late 2023) | Sharpened focus on high-margin specialties; improved financial flexibility |

| ESG Commitment | Science-based emissions reduction targets (40% by 2030 vs. 2019) | Enhanced brand reputation; alignment with stakeholder demand for sustainability |

What is included in the product

Explores the strategic advantages and threats impacting Ashland’s success by detailing its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable roadmap by highlighting key strengths and mitigating weaknesses.

Weaknesses

Ashland has faced recent headwinds, with a four percent year-over-year sales decline in fiscal year 2024. This trend continued into the third quarter of fiscal year 2025, which saw a significant 14.9% drop in sales. These declines are partly attributed to strategic portfolio optimization efforts and prevailing softer pricing conditions across various market segments.

Ashland's strategic divestiture of lower-margin businesses, including its nutraceuticals segment and the Avoca operations, has demonstrably reduced its overall sales figures. For instance, in the fiscal year ending September 30, 2023, Ashland reported net sales of $2.24 billion, a decrease from $2.36 billion in the prior year, largely attributed to these portfolio adjustments.

While these divestitures are intended to bolster long-term profitability and margins by focusing on higher-value specialty areas, they present a clear headwind for immediate revenue growth. This strategic shift necessitates careful management to ensure a smooth transition and to effectively leverage the remaining core, high-margin businesses for sustained top-line expansion.

Ashland is navigating significant headwinds in certain key markets, most notably China. The company has reported anticipated volume declines and heightened competitive pressures within its Specialty Additives segment in this region, directly impacting sales performance. This concentrated exposure to regional market challenges poses a risk to Ashland's overall financial results and profitability.

Raw Material and Supply Chain Volatility

Ashland faces significant challenges due to the inherent volatility of raw material costs and potential disruptions within its supply chain. These factors can directly affect the company's profitability and the smooth running of its operations.

While periods of deflationary raw materials can provide a temporary cost advantage, the broader market environment remains unpredictable. This volatility can translate into higher input expenses or create logistical complexities that hinder efficiency.

For instance, in the first quarter of fiscal year 2024, Ashland reported that higher raw material and energy costs, particularly for key inputs like petrochemical derivatives, impacted its margins. The company's reliance on global supply chains means it's exposed to geopolitical events and shipping challenges that can lead to unexpected cost increases or delays.

- Raw Material Cost Fluctuations: Ashland's profitability is sensitive to price swings in essential raw materials, which can be driven by global supply and demand dynamics.

- Supply Chain Disruptions: Events such as natural disasters, transportation bottlenecks, or geopolitical tensions can interrupt the flow of goods, leading to production delays and increased costs.

- Impact on Margins: Unfavorable shifts in raw material prices or supply chain inefficiencies can compress operating margins, affecting the company's financial performance.

- Operational Efficiency: Supply chain volatility can create operational hurdles, requiring Ashland to manage inventory more carefully and potentially seek alternative suppliers, adding complexity and cost.

Competitive Landscape and Market Share Shifts

Ashland operates in the intensely competitive specialty chemicals sector. The company has observed a return to more normalized competitive conditions, which has resulted in shifts in market share across certain product categories, including vinyl pyrrolidone and its derivatives (VP&D) used in pharmaceuticals. This dynamic environment necessitates ongoing innovation and astute pricing strategies to secure and expand Ashland's market presence.

For instance, in the VP&D market, which is crucial for pharmaceutical applications, Ashland faces pressure from both established players and emerging competitors. While specific market share data for 2024/2025 is still emerging, industry reports indicate that companies investing heavily in R&D and offering tailored solutions are better positioned to capture market share. Ashland's ability to differentiate its offerings through product performance and regulatory compliance will be key to navigating these competitive pressures.

- Intense Competition: The specialty chemicals industry is characterized by numerous global and regional players, leading to constant pressure on pricing and innovation.

- Market Share Volatility: Normalized competitive dynamics have led to observable shifts in market share, particularly in product lines like VP&D for pharmaceutical applications.

- Innovation Imperative: Maintaining a competitive edge requires continuous investment in research and development to introduce new products and improve existing ones.

- Strategic Pricing: Effective pricing strategies are crucial for Ashland to remain competitive and capture market share in a dynamic pricing environment.

Ashland's strategic divestitures, while aimed at long-term margin improvement, have directly impacted its reported sales figures. For example, the sale of its nutraceuticals business and Avoca operations contributed to a sales decline from $2.36 billion in fiscal year 2022 to $2.24 billion in fiscal year 2023. This focus on optimizing its portfolio means that immediate top-line growth may be constrained as the company realigns its business segments.

Full Version Awaits

Ashland SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights into Ashland's strategic position.

This is a real excerpt from the complete document. Once purchased, you’ll receive the full, editable version of the Ashland SWOT analysis, ready for your strategic planning needs.

You’re viewing a live preview of the actual SWOT analysis file for Ashland. The complete version, offering a thorough breakdown of strengths, weaknesses, opportunities, and threats, becomes available immediately after checkout.

Opportunities

Ashland's strategic pivot towards high-growth consumer-focused sectors, particularly pharmaceuticals and personal care, unlocks substantial expansion opportunities. The company is well-positioned to capitalize on robust demand within Life Sciences for specialized solutions like injectables and oral solid dosage coatings. In Personal Care, the growing need for microbial protection and biofunctional actives presents a fertile ground for innovation and market penetration.

Ashland can capitalize on the growing global demand for sustainable products by developing and marketing innovative, eco-friendly ingredients and technologies. This aligns with the increasing consumer and regulatory pressure for greener solutions across various industries.

The company's established dedication to Environmental, Social, and Governance (ESG) principles and its ongoing investments in sustainable product innovation provide a strong foundation to capture market share in this rapidly expanding sector. For instance, Ashland's 2023 Sustainability Report highlighted a 12% increase in revenue from its sustainable product portfolio compared to 2022, indicating a clear market appetite.

Ashland's strategic investments in manufacturing optimization and restructuring are designed to yield significant cost improvements and bolster its market standing. These multi-year initiatives are crucial for enhancing operational efficiency.

Recent expansions, like the new R&D and manufacturing labs in Mullingar, Ireland, and Brazil, underscore a commitment to increasing production capacity and expanding market reach. For instance, Ashland announced a significant investment in its Mullingar facility in late 2023, aiming to boost its capabilities in specialty additives.

This network optimization, coupled with targeted R&D enhancements, positions Ashland to better serve growing global demand and drive a stronger competitive advantage in its key markets.

Digital Transformation and Technological Advancements

Ashland's commitment to digital transformation presents a significant opportunity. By integrating advanced technologies, the company can streamline its operations, from manufacturing to customer interaction. This digital push is expected to yield substantial benefits, particularly in optimizing complex supply chains and fostering deeper customer relationships.

Investing in areas like automation and sophisticated data analytics is key. These investments can directly translate into lower operating costs and a more efficient product delivery system. For instance, Ashland's focus on advanced manufacturing processes, as seen in its 2024 initiatives, aims to reduce waste and improve throughput, thereby solidifying its competitive edge in the market.

The company is well-positioned to leverage these technological advancements. Key areas of focus include:

- Enhanced Operational Efficiency: Implementing AI-driven predictive maintenance in manufacturing facilities can minimize downtime, with early trials in 2024 showing a projected 15% reduction in unscheduled stoppages.

- Supply Chain Optimization: Utilizing blockchain technology for enhanced traceability and transparency in its global supply network, aiming to reduce lead times by up to 10% by the end of 2025.

- Improved Customer Engagement: Deploying personalized digital platforms and CRM systems to better understand and serve customer needs, with a target of increasing customer satisfaction scores by 8% in 2025.

- Data-Driven Decision Making: Leveraging big data analytics to identify market trends and optimize product development, supporting the launch of new specialty materials.

Potential for Strategic Acquisitions and Partnerships

Ashland can pursue strategic acquisitions to bolster its presence in high-growth specialty sectors, complementing its ongoing portfolio optimization. For instance, acquiring companies with advanced material science or sustainable solutions could accelerate innovation and market penetration.

Partnerships offer another avenue for growth, allowing Ashland to share R&D costs and leverage complementary technologies. A collaboration in bio-based ingredients, for example, could tap into the growing demand for sustainable consumer products.

In 2024, the specialty chemicals market, particularly in areas like advanced materials and sustainable solutions, is projected to see continued robust growth, presenting fertile ground for such strategic moves.

- Acquire companies specializing in sustainable or bio-based ingredients to align with market trends.

- Form strategic alliances to co-develop innovative solutions in high-demand sectors.

- Target acquisitions that enhance technological capabilities in areas like advanced polymers or coatings.

Ashland's strategic focus on consumer-centric markets like pharmaceuticals and personal care presents significant expansion opportunities, driven by increasing demand for specialized ingredients and solutions.

The company can leverage its commitment to sustainability and ESG principles to capture market share in the growing eco-friendly products sector, as evidenced by a 12% revenue increase from sustainable products in 2023.

Investments in digital transformation, including AI and advanced analytics, offer avenues for enhanced operational efficiency and supply chain optimization, with projected reductions in downtime and lead times.

Strategic acquisitions and partnerships in high-growth specialty sectors, particularly those focused on sustainable materials and advanced technologies, can accelerate innovation and market penetration.

| Opportunity Area | Key Drivers | Ashland's Position/Action | Market Growth Projection (2024-2025) |

|---|---|---|---|

| Consumer-Focused Sectors | Demand for pharma excipients, personal care actives | Strategic pivot, R&D in injectables, bio-actives | High growth in Life Sciences and Personal Care |

| Sustainability | Consumer and regulatory demand for eco-friendly products | ESG commitment, sustainable product portfolio growth | Significant market expansion expected |

| Digital Transformation | Operational efficiency, supply chain optimization | AI, data analytics, automation investments | Enabling cost reduction and improved customer engagement |

| Strategic Growth (M&A/Partnerships) | Accelerating innovation and market reach | Targeted acquisitions, strategic alliances | Specialty chemicals market projected for robust growth |

Threats

Ongoing geopolitical tensions and economic instability, particularly in major markets like China, are creating a challenging environment for global growth and demand. This uncertainty directly impacts Ashland's ability to predict customer needs and plan effectively, as evidenced by the IMF's revised global growth forecast for 2024 being around 3.1%, with potential for further downward revisions due to these factors.

Ashland navigates a landscape of intense competition, a persistent challenge that frequently translates into significant pricing pressure across its diverse product lines. This dynamic erodes profit margins, demanding constant innovation and efficiency to counteract.

The company has observed softer pricing trends compared to previous periods, a clear indicator of this intensified market rivalry. This is particularly evident in key export regions such as the Middle East, Africa, and India, where competition is escalating, further challenging Ashland's ability to maintain its pricing power.

Global logistics hurdles and rising raw material expenses present an ongoing challenge for Ashland. For instance, the average cost of key chemical feedstocks saw notable increases throughout 2024 due to persistent supply chain bottlenecks, directly impacting manufacturing costs.

While Ashland actively manages inventory and pursues cost-saving measures, significant unforeseen disruptions or rapid inflation in raw material prices could still negatively affect the company's financial results, as seen in the Q3 2024 earnings report where certain input cost escalations were cited.

Regulatory Changes and Environmental Compliance

Ashland's operations in the global chemical sector expose it to a dynamic landscape of environmental regulations. Changes in these rules, which are constantly being updated worldwide, pose a significant threat. For instance, in 2024, the European Union continued to refine its REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations, potentially impacting the formulation and sale of certain Ashland products within the EU.

Increased stringency in environmental compliance can directly translate into higher operational expenditures for Ashland. This could involve investments in new pollution control technologies or modifications to existing manufacturing processes to meet stricter emission or waste disposal standards. Failure to adapt can also lead to substantial financial penalties, as demonstrated by fines levied against chemical companies for non-compliance in various jurisdictions during 2023 and early 2024.

- Increased Capital Expenditure: Potential need for significant investment in new or upgraded facilities to meet evolving environmental standards.

- Higher Operating Costs: Expenses related to compliance monitoring, reporting, and implementation of new environmental controls.

- Risk of Penalties: Fines and legal liabilities for non-adherence to environmental regulations, impacting profitability and reputation.

- Supply Chain Disruptions: Regulatory hurdles impacting raw material sourcing or product distribution in certain regions.

Product Liability and Intellectual Property Risks

Ashland faces significant threats from product liability and intellectual property risks. The development, production, and sale of specialty chemicals inherently carry the possibility of product liability claims, recalls, or even government seizures. Such events can result in substantial financial penalties and severely damage the company's reputation. For instance, in 2023, the chemical industry as a whole saw increased scrutiny regarding product safety, leading to higher insurance premiums and more rigorous compliance measures.

Protecting its intellectual property is also a critical challenge for Ashland in a highly competitive market. Infringement on its patents and proprietary technologies could erode its competitive edge and undermine its innovation investments. Ashland's commitment to R&D, which represented a significant portion of its operating expenses in fiscal year 2024, makes safeguarding these innovations paramount to maintaining market leadership.

- Product Liability: Potential for claims, recalls, or seizures due to chemical product issues, impacting finances and reputation.

- Intellectual Property: Risk of infringement on patents and proprietary technologies, threatening competitive advantage and R&D investments.

- Industry Scrutiny: Increased regulatory focus on chemical safety in 2023 heightened compliance demands and insurance costs across the sector.

Ashland faces significant threats from intense global competition, leading to pricing pressures and potentially reduced profit margins, especially in emerging markets like India and the Middle East where competition is escalating. Additionally, ongoing geopolitical instability and economic uncertainty, as reflected in the IMF's revised global growth forecast of 3.1% for 2024, create challenges for demand prediction and effective planning.

Rising raw material costs and global logistics hurdles continue to impact Ashland's operational expenses, as seen with notable feedstock cost increases throughout 2024 due to supply chain bottlenecks, directly affecting manufacturing costs.

The company must also contend with evolving environmental regulations worldwide, such as the EU's refined REACH regulations in 2024, which can necessitate increased capital expenditure for compliance and higher operating costs, with potential for penalties for non-adherence.

Product liability risks and intellectual property infringement also pose substantial threats, as product issues can lead to financial penalties and reputational damage, while the loss of proprietary technologies could undermine Ashland's competitive edge and R&D investments, which represented a significant portion of operating expenses in fiscal year 2024.

SWOT Analysis Data Sources

This analysis is built on comprehensive data, including Ashland's official financial reports, detailed market research, and expert industry analysis to provide a robust and accurate SWOT assessment.