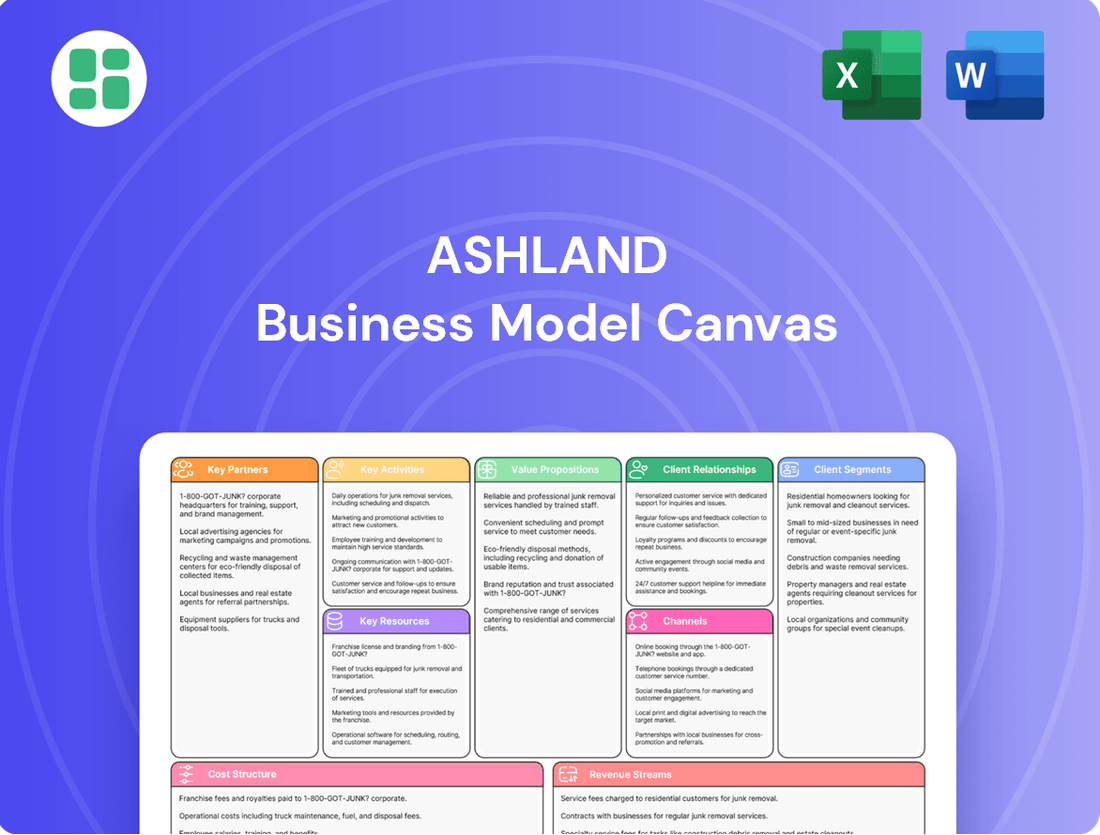

Ashland Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashland Bundle

Curious about the strategic engine driving Ashland's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap of their operations. Discover how Ashland creates and delivers value, and gain actionable insights to fuel your own business growth.

Partnerships

Ashland maintains a robust global network of raw material suppliers, crucial for its specialty chemical and ingredient production. These partnerships are vital for ensuring a consistent and cost-effective supply chain, directly impacting production continuity and input cost management.

The company sources a wide array of specialized chemicals, polymers, and natural extracts from these key partners. For instance, in 2024, Ashland continued to emphasize supplier diversification to mitigate risks and secure competitive pricing for its diverse product portfolio.

Ashland actively partners with universities and research institutes to drive innovation, as seen in their 2024 collaborations focused on advanced materials science. These alliances allow them to tap into specialized knowledge and share the financial burden of early-stage research, speeding up the development of novel solutions.

By collaborating with industry peers, Ashland gains access to complementary technologies and market insights, which is crucial for developing products that meet evolving customer needs. For instance, in 2024, they initiated joint projects to explore sustainable ingredient development.

Ashland relies heavily on its distribution and logistics partners to ensure its specialty materials reach customers worldwide. These collaborations are vital for navigating complex global supply chains, enabling delivery to over 100 countries. In 2024, for instance, maintaining robust logistics networks was key to Ashland's ability to meet demand and retain its competitive edge in diverse markets.

Technology and Equipment Providers

Ashland partners with leading technology and equipment providers to maintain state-of-the-art manufacturing capabilities. These collaborations are crucial for integrating advanced machinery and process optimization tools, ensuring high efficiency and product quality across its global operations. For example, in 2024, Ashland continued to invest in digital solutions for its production lines, aiming to further standardize and improve operational consistency.

These strategic alliances enable Ashland to leverage cutting-edge innovations, including specialized equipment for its core product lines and digital platforms that enhance data analytics and predictive maintenance. Such partnerships directly support Ashland's ongoing initiatives to optimize its manufacturing network, driving both cost efficiencies and enhanced output capabilities.

- Advanced Machinery Integration: Collaborations focus on acquiring and implementing specialized machinery for chemical synthesis and formulation processes.

- Process Optimization Tools: Partnerships provide access to software and hardware solutions that fine-tune manufacturing parameters for better yields and reduced waste.

- Digital Solutions: Ashland works with tech providers to implement Industry 4.0 technologies, such as IoT sensors and advanced analytics, to monitor and improve production in real-time.

- Manufacturing Network Optimization: These key partnerships are fundamental to Ashland's strategy of modernizing and streamlining its manufacturing footprint.

Industry Associations and Regulatory Bodies

Ashland cultivates vital connections with industry associations and actively engages with regulatory bodies. This ensures the company remains informed about evolving standards, compliance mandates, and nascent industry trends. For example, in 2024, Ashland's participation in key chemical industry forums allowed them to contribute to discussions on sustainable manufacturing practices, a growing area of regulatory focus.

These collaborations are instrumental in shaping best practices across the industry, reinforcing Ashland's commitment to product safety and quality. By staying ahead of regulatory curves, Ashland can more effectively navigate the intricate legal frameworks present in its global operating regions, mitigating risks and ensuring market access.

Key partnerships for Ashland include:

- American Chemistry Council (ACC): Engages in advocacy and promotes responsible care initiatives.

- European Chemical Industry Council (Cefic): Represents chemical companies across Europe, influencing policy and standards.

- National Association of Manufacturers (NAM): Advocates for manufacturing interests in the United States.

- Various national and international regulatory agencies (e.g., EPA, ECHA): Facilitates dialogue and ensures compliance with chemical regulations.

Ashland's key partnerships are foundational to its operational success and market positioning. These alliances span raw material suppliers, research institutions, technology providers, and industry associations, all contributing to innovation, supply chain resilience, and regulatory compliance.

In 2024, Ashland continued to strengthen its supplier network, emphasizing diversification to ensure stable input costs and mitigate supply chain disruptions. Collaborations with universities and research bodies advanced its R&D pipeline, particularly in sustainable materials. Furthermore, partnerships with logistics firms were critical for maintaining global reach, serving customers in over 100 countries efficiently.

| Partner Type | 2024 Focus Areas | Impact |

| Raw Material Suppliers | Diversification, competitive pricing | Supply chain stability, cost management |

| Universities & Research Institutes | Advanced materials science, sustainable ingredients | Innovation acceleration, shared R&D costs |

| Technology & Equipment Providers | Industry 4.0 integration, process optimization | Manufacturing efficiency, product quality |

| Distribution & Logistics Partners | Global network maintenance, timely delivery | Market access, customer service |

| Industry Associations & Regulatory Bodies | Best practices, compliance, policy influence | Risk mitigation, market access, industry standards |

What is included in the product

A detailed breakdown of how Ashland creates, delivers, and captures value, organized into the nine standard Business Model Canvas blocks.

The Ashland Business Model Canvas offers a structured approach to pinpoint and address business challenges, acting as a powerful pain point reliever by visualizing potential solutions.

Activities

Ashland’s core activities revolve around robust research and development, driving the creation of novel solutions and enriching its product offerings. This commitment fuels the development of specialized additives and ingredients designed to meet evolving customer demands and significant global trends like sustainability and health-focused consumption.

The company actively showcases its progress in scalable technology platforms through dedicated innovation days, highlighting its forward-thinking approach. For example, in fiscal year 2023, Ashland invested $330 million in research and development, a significant portion of which is directed towards these innovation efforts, demonstrating a clear prioritization of future growth and market leadership.

Ashland's manufacturing and production activities are central to its business, involving the creation of a wide array of specialty materials, additives, and ingredients. These are produced across its extensive network of global manufacturing sites, ensuring a broad reach and diverse product offering.

The company actively works to enhance its manufacturing operations, focusing on improving efficiency, reducing costs, and expanding production capacity. This strategic optimization is crucial for meeting market demand and maintaining a competitive edge in the specialty chemicals sector.

In 2024, Ashland continued to invest in its production capabilities. For instance, the company has been engaged in plant expansions and consolidation projects aimed at standardizing operations and improving overall output quality and consistency. These efforts are designed to streamline the supply chain and better serve its customer base.

Ashland's key activities heavily involve managing a complex global supply chain. This encompasses everything from sourcing raw materials to ensuring products reach customers efficiently worldwide.

A significant focus is placed on timely procurement and smart inventory management to meet global customer demand. For instance, in fiscal year 2023, Ashland reported net sales of $2.2 billion, underscoring the scale of operations requiring robust supply chain support.

Reliable logistics are paramount to this process, enabling Ashland to maintain competitive pricing and consistent product availability across its diverse markets. This operational efficiency directly impacts their ability to serve customers and achieve financial targets.

Sales, Marketing, and Technical Support

Ashland's sales and marketing teams are crucial for reaching its global customer base, focusing on specialized chemical solutions for diverse industries. In 2024, the company continued to invest in digital marketing and direct sales channels to highlight its performance-enhancing additives and ingredients.

Technical support and application expertise are integral to Ashland's strategy, ensuring customers can maximize the value of its products. This hands-on approach helps build loyalty and drives repeat business by solving complex formulation challenges.

- Global Reach: Ashland's sales network spans numerous countries, targeting key sectors like personal care, pharmaceuticals, and industrial applications.

- Customer Integration: Providing application development and troubleshooting services helps customers effectively incorporate Ashland's advanced materials.

- Relationship Building: Strong technical support fosters long-term partnerships, leading to increased customer retention and new product adoption.

- Market Focus: In 2024, a significant portion of marketing efforts were directed towards promoting sustainable and bio-based product lines.

Portfolio Optimization and Strategic Planning

Ashland actively refines its product mix, a key activity in its strategic planning. This involves shedding less profitable segments to concentrate on areas with higher consumer appeal and growth potential. For instance, in 2023, Ashland completed the divestiture of its Avoca business, a move aimed at sharpening its focus on core specialty ingredients.

The company's portfolio optimization is driven by a rigorous evaluation of market dynamics, evolving customer demands, and its own operational strengths. This ensures that Ashland's strategic direction remains aligned with its long-term vision for profitable expansion. The divestment of its nutraceuticals business also exemplifies this strategic pruning.

- Strategic Divestitures: Ashland has divested non-core assets like the nutraceuticals and Avoca businesses to enhance focus.

- Market Alignment: The company prioritizes high-margin, consumer-centric markets for growth.

- Capability Assessment: Internal strengths are continuously assessed to align with market opportunities.

- Future Growth Focus: Activities are geared towards ensuring long-term, sustainable expansion.

Ashland's key activities center on innovation through extensive R&D, focusing on specialty additives and ingredients that address global trends like sustainability. Manufacturing excellence across its global sites ensures a diverse product range, with ongoing investments in 2024 for plant upgrades and operational efficiency to meet market demand.

Effective supply chain management, including procurement and logistics, is vital for timely delivery and competitive pricing, supporting $2.2 billion in net sales reported in fiscal year 2023. Sales and marketing efforts in 2024 emphasized digital channels and technical support to build customer relationships and drive adoption of performance-enhancing solutions.

Strategic portfolio management, including divestitures of non-core assets like the nutraceuticals business, allows Ashland to concentrate on high-growth, consumer-centric markets, aligning capabilities with market opportunities for sustainable expansion.

| Key Activity Area | Description | 2023/2024 Data/Focus |

|---|---|---|

| Research & Development | Creating novel solutions and specialty ingredients. | $330 million invested in R&D (FY23); focus on innovation days. |

| Manufacturing & Production | Producing specialty materials across global sites. | Plant expansions and consolidation projects in 2024 for quality and output. |

| Supply Chain Management | Sourcing, logistics, and inventory to meet global demand. | Supports $2.2 billion net sales (FY23); focus on timely procurement. |

| Sales & Marketing | Reaching global customers with specialized solutions. | Investment in digital marketing and direct sales in 2024; focus on sustainable products. |

| Portfolio Optimization | Divesting non-core segments to focus on growth areas. | Divested Avoca and nutraceuticals businesses; prioritizing consumer-centric markets. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you'll receive upon purchase. This isn't a mockup; it's a direct snapshot of the file, ready for your immediate use. You'll get the full, unedited version, structured and formatted exactly as you see it here, ensuring no surprises and immediate applicability for your business strategy.

Resources

Ashland's intellectual property, encompassing a robust patent portfolio and proprietary formulations, is a cornerstone of its business model. This valuable asset underpins its ability to offer unique, high-performance specialty materials. In 2024, Ashland continued to invest heavily in R&D, aiming to expand this critical resource.

Ashland maintains a global network of manufacturing facilities, strategically positioned to efficiently serve its worldwide customer base. These sites are crucial for producing the company's diverse portfolio of specialty additives and ingredients, leveraging specialized technology for optimal output.

In 2024, Ashland continued to invest in its manufacturing infrastructure, with a focus on expanding capacity and improving operational efficiency at key global locations. These investments are designed to meet growing market demand and enhance the company's ability to deliver innovative solutions.

Ashland's core strength lies in its highly skilled workforce, a critical resource encompassing renowned scientists, research chemists, engineers, and adept plant operators. This talent pool is the engine behind the company's innovation, ensuring consistent product quality and delivering vital technical support to its global customer base.

The company actively invests in the continuous development of its employees, fostering an environment where complex challenges are met with sophisticated solutions. This commitment to talent cultivation is reflected in Ashland's ongoing R&D efforts, which are crucial for maintaining its competitive edge in the specialty materials sector.

Advanced Technology Platforms

Ashland utilizes sophisticated, scalable technology platforms that are fundamental to its innovation pipeline across diverse business areas. These platforms enable the development of tailored solutions and improved product features, directly supporting its strategic objectives.

The company's commitment to these advanced platforms was evident during its 2024 Innovation Day, where they showcased how these capabilities drive new product introductions and market differentiation. This technological backbone is crucial for Ashland's growth strategy.

- Technological Foundation: Ashland's advanced platforms facilitate rapid prototyping and the creation of high-performance ingredients.

- Scalability and Customization: These platforms are designed to scale efficiently, allowing for the development of bespoke solutions to meet specific customer needs.

- Innovation Showcase: The 2024 Innovation Day highlighted how these platforms translate into tangible product advancements in areas like personal care and pharmaceuticals.

Strong Financial Capital

Ashland's strong financial capital is a cornerstone of its business model, directly fueling its innovation pipeline and operational capacity. This robust financial backing allows the company to make substantial investments in research and development, which is critical for staying competitive in the specialty materials sector. For instance, in fiscal year 2024, Ashland continued to prioritize strategic investments in R&D to drive its growth agenda.

The company's financial strength also underpins its ability to expand manufacturing capabilities and pursue strategic mergers, acquisitions, or divestitures. This flexibility is crucial for adapting to evolving market demands and optimizing its portfolio. Ashland's financial health in 2024 provided the necessary resources to support these strategic moves, ensuring operational resilience and the capacity to pursue long-term growth objectives.

- Research & Development Funding: Ashland's financial capital directly supports its significant R&D expenditures, vital for developing new specialty materials and solutions.

- Operational Expansion: Access to strong capital enables the company to invest in and expand its manufacturing facilities, enhancing production capacity and efficiency.

- Strategic Flexibility: Robust financial resources grant Ashland the agility to pursue strategic acquisitions, divestitures, and other capital allocation decisions that drive long-term value.

- Shareholder Returns and Resilience: Financial strength allows Ashland to maintain operational resilience and provide consistent shareholder returns, even amidst market fluctuations.

Ashland's intellectual property, including patents and proprietary formulations, is a key resource enabling its unique specialty materials. The company's commitment to R&D in 2024 aimed to bolster this intellectual capital.

A global network of manufacturing facilities, supported by specialized technology, forms a critical operational resource for Ashland. Investments in 2024 focused on expanding capacity and efficiency at these sites to meet market demand.

Ashland's skilled workforce, comprising scientists, chemists, and engineers, is fundamental to its innovation and product quality. Continuous employee development in 2024 reinforced this talent pool's capacity to deliver advanced solutions.

Sophisticated, scalable technology platforms are vital for Ashland's innovation pipeline, allowing for tailored solutions and product enhancements. The 2024 Innovation Day showcased these platforms' role in driving new product introductions.

Strong financial capital is a cornerstone, funding R&D and operational expansion, as demonstrated by Ashland's strategic investments in fiscal year 2024. This financial strength also provides flexibility for strategic capital allocation.

| Key Resource | Description | 2024 Focus/Data |

|---|---|---|

| Intellectual Property | Patents, proprietary formulations | Continued R&D investment to expand |

| Manufacturing Facilities | Global network, specialized technology | Capacity expansion, efficiency improvements |

| Skilled Workforce | Scientists, chemists, engineers | Continuous employee development |

| Technology Platforms | Scalable innovation enablers | Showcased at 2024 Innovation Day |

| Financial Capital | Funding for R&D and operations | Strategic investments in growth agenda |

Value Propositions

Ashland's core value is delivering specialty materials that boost how well its customers' products work. This means making things more effective, easier to use, and longer-lasting.

For instance, in 2024, Ashland's advanced additives helped formulators achieve up to a 15% improvement in the stability of personal care products, a key performance enhancer.

The company's innovations tackle tough technical hurdles, ensuring customers gain a competitive edge through superior product outcomes.

Ashland excels at developing unique solutions designed to address precise customer requirements and evolving industry demands. This often involves close partnerships and technical collaboration, fostering innovation through shared expertise.

Leveraging robust research and development capabilities, Ashland consistently creates novel formulations and enhances product functionalities. For instance, in 2024, the company continued to invest heavily in R&D, with a significant portion of its revenue dedicated to developing next-generation materials for sectors like personal care and pharmaceuticals.

This dedication to bespoke solutions empowers Ashland's clients to achieve greater product differentiation within their respective competitive landscapes. By providing tailored ingredients and technical support, Ashland helps customers stand out and capture market share.

Ashland's global reach, spanning operations in over 100 countries, ensures consistent product supply and localized technical support for its customers worldwide. This expansive network means that clients, no matter where they are, can tap into Ashland's specialized knowledge and product offerings.

The company's strategic focus on 'globalizing' allows it to effectively leverage opportunities in rapidly expanding markets, enhancing its competitive position. For instance, in 2023, Ashland reported net sales of $2.2 billion, with a significant portion derived from its international operations, underscoring the success of its global strategy.

Sustainability and Eco-Conscious Offerings

Ashland is actively developing sustainable and eco-conscious solutions, responding to a growing global demand for greener products. This strategic focus is central to its value proposition, aiming to meet evolving customer needs and align with significant environmental megatrends.

The company's commitment extends to offering ingredients that are natural, derived from nature, and biodegradable. This approach not only caters to environmentally aware consumers but also positions Ashland as a leader in sustainable chemistry. By the end of 2023, Ashland reported that approximately 70% of its revenue was derived from products with a sustainability benefit, a testament to this strategic shift.

- Sustainable Product Portfolio: Offering natural, nature-derived, and biodegradable ingredients.

- Operational Efficiency: Optimizing operations to minimize environmental impact.

- Emissions Reduction: Committed to science-based targets for reducing greenhouse gas emissions.

- Market Alignment: Addressing global megatrends and increasing customer demand for eco-friendly solutions.

Reliability and Quality Assurance

Customers consistently choose Ashland for its unwavering dedication to delivering specialty materials with predictable quality and dependable supply. This commitment is underpinned by rigorous quality control protocols and adherence to Good Manufacturing Practices, especially crucial for sectors with strict regulatory demands like pharmaceuticals and personal care.

Ashland's focus on reliability fosters deep trust and cultivates enduring partnerships with its clientele. For instance, in 2024, Ashland reported strong performance in its Life Sciences segment, driven by demand for high-quality excipients, reflecting the market's premium on reliability.

- Consistent Quality: Ashland's materials meet exacting specifications, ensuring predictable performance in customer applications.

- Dependable Supply Chain: Robust logistics and manufacturing ensure timely delivery, minimizing disruptions for clients.

- Regulatory Compliance: Strict adherence to industry standards builds confidence, particularly in sensitive markets.

- Customer Trust: A proven track record of reliability solidifies long-term relationships and repeat business.

Ashland's value proposition centers on providing high-performance specialty materials that enhance customer product efficacy and longevity. This is achieved through tailored solutions and a commitment to innovation, ensuring clients gain a competitive advantage. The company's global presence and focus on sustainability further solidify its offerings, meeting evolving market demands for both performance and environmental responsibility.

| Value Proposition Area | Key Aspect | 2024/2023 Data Point |

|---|---|---|

| Product Performance Enhancement | Improving stability and effectiveness of customer products. | Up to 15% improvement in personal care product stability (2024). |

| Innovation & Customization | Developing unique solutions for precise customer needs. | Significant R&D investment, with a focus on next-gen materials (2024). |

| Global Reach & Support | Consistent supply and localized technical assistance worldwide. | Operations in over 100 countries; $2.2 billion net sales in 2023, with international strength. |

| Sustainability Focus | Offering natural, biodegradable, and eco-conscious ingredients. | Approx. 70% of revenue from products with a sustainability benefit (end of 2023). |

Customer Relationships

Ashland cultivates strong customer connections by offering specialized technical support. These teams help clients with product use, formulation hurdles, and boosting performance. For example, in 2023, Ashland's technical service teams engaged with thousands of customers globally, addressing specific application needs across various industries.

The company actively partners with customers on co-development initiatives, creating tailored solutions. This collaborative method, seen in their work with leading personal care brands in 2024 to develop novel sustainable ingredients, ensures products precisely meet client needs and solve intricate challenges.

Ashland cultivates long-term strategic partnerships, aiming to be more than just a supplier. They position themselves as a trusted advisor, deeply integrated into customer innovation processes. This focus on mutual growth and shared insights, evident in their collaborative R&D projects, helps secure recurring revenue streams and builds significant customer loyalty.

Ashland's customer relationships are heavily anchored by its dedicated global sales force, a direct engagement model that fosters deep understanding and personalized service. This approach allows for immediate feedback on customer needs and market shifts, enabling agile responses.

In 2024, Ashland's sales and marketing expenses amounted to $609 million, reflecting the significant investment in its direct sales force to cultivate and maintain these vital customer connections. This investment underpins their ability to identify emerging opportunities and effectively manage a broad portfolio of existing accounts.

Industry-Specific Consultations

Ashland offers industry-specific consultations, a key component of its customer relationships. This means they provide specialized advice tailored to the distinct needs of sectors like personal care, pharmaceuticals, and architectural coatings.

This deep understanding allows customers to effectively navigate complex regulations, streamline their operations, and innovate with new product development. For example, in 2024, Ashland continued to leverage its technical expertise to help clients in the personal care sector meet evolving sustainability demands and ingredient transparency requirements.

Their advisory capacity transforms Ashland from a mere supplier into a valuable strategic partner. This collaborative approach is crucial for fostering long-term engagement and mutual growth.

- Tailored Industry Expertise: Consultations are customized for sectors such as personal care, pharmaceuticals, and architectural coatings.

- Navigating Complexities: Assists clients with regulatory challenges and process optimization.

- Product Innovation Support: Helps customers in developing and launching new products.

- Strategic Partnership: Enhances Ashland's role as a trusted advisor, fostering deeper customer loyalty.

Digital Engagement and Information Sharing

Ashland leverages its corporate website and investor relations portal for robust digital engagement. These platforms offer customers immediate access to vital product specifications, technical data sheets, and timely company updates, fostering transparency and informed decision-making.

In 2024, Ashland reported a significant increase in website traffic, with over 1.5 million unique visitors seeking information on its specialty materials. This digital outreach directly supports customer needs by providing readily available resources.

- Digital Platforms: Corporate website, investor relations portal, online resource libraries.

- Information Provided: Product details, technical data, company news, sustainability reports.

- Customer Benefit: Enhanced transparency, informed purchasing decisions, accessible support.

- 2024 Data: Over 1.5 million unique website visitors seeking product and company information.

Ashland's customer relationships are built on a foundation of deep technical expertise and collaborative innovation. They act as strategic partners, offering tailored industry consultations to help clients navigate regulations and optimize operations. This advisory role, supported by a dedicated global sales force, fosters loyalty and ensures products meet specific market demands.

| Relationship Type | Key Activities | Customer Benefit | 2024 Data/Example |

|---|---|---|---|

| Technical Support & Consultation | Product use assistance, formulation problem-solving, industry-specific advice | Enhanced product performance, regulatory compliance, operational efficiency | Thousands of global customer engagements in 2023; continued focus in 2024 on sustainability demands in personal care |

| Co-development & Partnership | Joint R&D projects, tailored solution creation | Novel product development, precise need fulfillment, solving complex challenges | Collaboration with leading personal care brands in 2024 for sustainable ingredient development |

| Direct Sales Engagement | Personalized service, immediate feedback gathering | Agile response to market shifts, strong account management | $609 million in sales and marketing expenses in 2024, reflecting investment in sales force |

| Digital Engagement | Online resource libraries, product data access | Transparency, informed decision-making, accessible support | Over 1.5 million unique website visitors in 2024 seeking product and company information |

Channels

Ashland leverages a global direct sales force to engage directly with its core industrial and commercial clientele. This approach facilitates robust relationship management, enabling detailed technical consultations and the negotiation of significant volume agreements, which is vital for their specialized product portfolio.

Ashland leverages specialized distributors to expand its market reach, particularly for smaller customers and in specific geographic areas. These partners are crucial for managing local logistics and offering tailored regional support, ensuring broader accessibility for Ashland's diverse product portfolio.

In 2024, the chemical distribution sector saw continued growth, with specialized distributors playing a key role in reaching niche markets. For instance, companies focusing on specific end-use industries, like personal care or coatings, reported increased demand through these focused channels, indicating their effectiveness in penetrating less accessible customer segments.

Ashland's corporate website and extensive online resources are crucial for sharing information, showcasing product catalogs, and engaging with investors. This digital hub facilitates lead generation and provides essential technical data, bolstering transparency and accessibility.

In 2024, Ashland reported that its digital platforms played a significant role in customer engagement, with a notable increase in website traffic for technical data downloads, indicating a strong reliance on online channels for product information and support.

Industry Trade Shows and Conferences

Industry trade shows and conferences are vital channels for Ashland to connect with its audience. These events allow the company to unveil new products, highlight its technical expertise, and build relationships with both current and prospective customers. For instance, Ashland's participation in events like the American Coatings Show provides direct engagement opportunities.

These gatherings are crucial for understanding evolving market dynamics and customer needs. Ashland's own Innovation Day exemplifies this, offering a focused platform for showcasing advancements and fostering dialogue. Such events are instrumental in maintaining a competitive edge and driving future growth.

- Product Showcase: Trade shows enable direct demonstration of new chemical formulations and application technologies.

- Customer Engagement: Face-to-face interactions at conferences facilitate feedback and strengthen client relationships.

- Market Intelligence: Participation offers insights into competitor activities and emerging industry trends.

- Networking Opportunities: Conferences provide platforms for connecting with potential partners and distributors globally.

Technical Service Centers and Labs

Ashland's global network of technical service centers and R&D laboratories are crucial channels for deep customer interaction and innovation. These facilities are where customers can directly engage with Ashland's expertise, receiving hands-on support for product development and troubleshooting.

These centers facilitate collaborative problem-solving, allowing customers to test products and receive formulation assistance. This direct engagement showcases Ashland's commitment to providing tailored solutions and demonstrating its technical prowess in real-time.

- Global Reach: Ashland maintains a significant presence with technical centers strategically located worldwide to serve diverse customer needs.

- Customer Collaboration: These labs act as hubs for joint development projects, enabling customers to co-create solutions with Ashland's specialists.

- Demonstrated Expertise: By offering direct access to testing and formulation support, Ashland effectively highlights its advanced technical capabilities and product efficacy.

Ashland utilizes a multifaceted channel strategy, combining direct sales for key accounts with specialized distributors for broader market penetration. Its digital presence, including a corporate website and online resources, serves as a vital information hub and lead generation tool. Industry events and technical service centers further bolster customer engagement and collaborative innovation.

| Channel | Description | Key Functionality | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Global team engaging core industrial/commercial clients. | Relationship management, technical consultation, volume agreements. | Essential for specialized, high-volume product sales. |

| Specialized Distributors | Partners reaching smaller customers and specific regions. | Local logistics, tailored regional support, market access. | Crucial for niche market penetration and expanded reach. |

| Corporate Website/Online Resources | Digital hub for product information and investor relations. | Information sharing, product catalogs, lead generation, technical data. | Noted increase in website traffic for technical data downloads in 2024. |

| Trade Shows & Conferences | Industry events for product unveiling and networking. | Product demonstration, customer engagement, market intelligence, networking. | Key for showcasing advancements like new coatings formulations. |

| Technical Service Centers & R&D Labs | Global facilities for customer interaction and innovation. | Hands-on support, collaborative problem-solving, formulation assistance. | Facilitate joint development projects and demonstrate technical prowess. |

Customer Segments

Personal care product manufacturers, encompassing cosmetics, skincare, and haircare, rely on Ashland for additives and ingredients that boost texture, stability, and overall product performance. These companies are increasingly prioritizing natural, nature-derived, and sustainable ingredients in their formulations.

Ashland's strategic focus on high-value offerings within this segment is evident in its continued investment in innovative solutions that meet these evolving consumer demands. For instance, in 2024, the global personal care market was projected to reach over $700 billion, with a significant portion driven by demand for premium and sustainable products.

Ashland's pharmaceutical segment focuses on supplying essential excipients and ingredients crucial for drug formulation, advanced delivery systems, and effective tablet coatings. This sector requires unwavering commitment to stringent regulatory compliance and consistently high product quality, areas where Ashland has heavily invested.

In 2024, Ashland continued its strategic expansion of pharmaceutical manufacturing capacity, a testament to the growing demand from drug manufacturers. This investment aims to ensure a reliable supply chain and meet the evolving needs of this critical industry, reinforcing Ashland's position as a key partner.

Architectural coatings and construction industries are key customers for Ashland, encompassing manufacturers of paints, adhesives, and building materials. These businesses rely on Ashland's additives to boost rheology, enhance durability, and simplify application processes for their products. For instance, in 2024, the global architectural coatings market was valued at approximately $170 billion, with additive solutions playing a crucial role in achieving desired performance characteristics.

Food and Beverage Industry

Ashland serves the food and beverage industry by supplying specialized ingredients and additives designed to improve texture, stability, and overall product quality. The company exited some lower-margin nutrition product lines but remains committed to offering high-value solutions within this sector.

Key customer needs in this segment revolve around ingredients that comply with rigorous food safety regulations and quality standards. Ashland's offerings are tailored to meet these demands, ensuring product integrity and consumer trust.

- Market Focus: Enhancing texture, stability, and quality in food and beverage products.

- Product Strategy: Continued provision of specialized solutions after exiting some nutrition offerings.

- Regulatory Compliance: Meeting stringent food safety and regulatory requirements is paramount.

- Customer Value: Delivering ingredients that ensure product integrity and consumer confidence.

Specialty Additives and Industrial Applications

This segment encompasses a wide array of industrial manufacturers who rely on Ashland's specialty additives. These customers operate in diverse sectors like energy, performance materials, and various other industrial processes, seeking to enhance efficiency, lower costs, or boost the performance of their end products.

Ashland's approach here is to provide highly customized solutions tailored to specific industrial challenges. For instance, in the energy sector, their additives might be crucial for improving drilling fluid performance or enhancing the stability of fuels. In 2024, the industrial chemicals market, which includes specialty additives, saw continued demand driven by manufacturing output and infrastructure development.

- Energy Sector: Additives for oil and gas exploration, production, and refining.

- Performance Specialties: Enhancements for coatings, adhesives, and construction materials.

- Other Industrial Processes: Solutions for water treatment, textiles, and paper manufacturing.

- Customization Focus: Tailored formulations to meet unique performance and cost requirements.

Ashland's customer base is diverse, spanning personal care, pharmaceuticals, architectural coatings, food and beverage, and various industrial sectors. Each segment demands specialized ingredients and additives to enhance product performance, meet regulatory standards, and cater to evolving consumer preferences.

The company's strategic focus in 2024 was on high-value solutions, evident in its investments in pharmaceutical manufacturing and its continued provision of specialized ingredients for personal care and food industries, even after divesting some nutrition lines.

Key customer needs include natural and sustainable ingredients in personal care, stringent compliance in pharmaceuticals, and performance-enhancing additives across coatings, construction, and industrial applications.

| Customer Segment | Key Needs | 2024 Market Context |

|---|---|---|

| Personal Care | Natural, sustainable ingredients; texture, stability | Global market over $700 billion, driven by premium and sustainable products |

| Pharmaceuticals | Excipients, coatings; regulatory compliance, quality | Continued investment in manufacturing capacity to meet growing demand |

| Architectural Coatings & Construction | Rheology modifiers, durability enhancers | Global market valued at approx. $170 billion |

| Food & Beverage | Texture, stability; food safety compliance | Focus on high-value solutions meeting rigorous standards |

| Industrial | Customized additives for efficiency, performance | Demand driven by manufacturing output and infrastructure development |

Cost Structure

Raw material and procurement costs represent a substantial component of Ashland's expenses. These costs are directly tied to the specialty chemicals the company manufactures, making the sourcing of essential inputs critical to its financial performance. For instance, in fiscal year 2023, Ashland reported that changes in raw material costs, along with other factors, impacted its earnings.

Ashland's manufacturing and production expenses are substantial, encompassing labor, energy, and maintenance for its worldwide facilities. For fiscal year 2023, the company reported selling, general and administrative expenses of $1.05 billion, which includes a significant portion of these operational costs.

To tackle these costs, Ashland is pursuing manufacturing network optimization. This strategy involves streamlining operations through measures like plant closures and consolidations, aiming for greater efficiency and cost reduction in its production footprint.

Ashland dedicates significant resources to Research and Development (R&D), recognizing its vital role in fostering innovation and sustaining a competitive advantage. These investments encompass the costs associated with highly skilled scientists, advanced laboratory equipment, and rigorous product testing, including clinical trials where applicable.

For instance, in fiscal year 2024, Ashland reported R&D expenses of $278 million, a strategic allocation aimed at developing next-generation products and solutions. This expenditure is directly linked to the company's ability to introduce novel materials and technologies, ultimately driving future revenue growth and market leadership.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses for Ashland cover a broad range of operational costs. These include the salaries and commissions for their sales force, investments in marketing and advertising campaigns to promote their specialty chemicals and materials, and the logistics involved in distributing their products globally. Corporate overhead, such as executive salaries, legal fees, and IT support, also falls under this category.

Ashland actively pursues cost reduction initiatives to enhance its profitability. In 2024, the company continued its focus on optimizing these SG&A costs as part of its broader strategy to improve operational efficiency and financial performance. This often involves streamlining processes, leveraging technology, and making strategic decisions about resource allocation within these departments.

- Sales and Marketing: Costs associated with promoting and selling Ashland's diverse portfolio of specialty ingredients and materials.

- General and Administrative: Expenses related to the overall management and support functions of the company, including executive compensation and corporate services.

- Distribution and Logistics: Costs incurred in moving products from manufacturing facilities to customers worldwide.

- Cost Optimization: Ongoing efforts in 2024 to identify and implement savings within SG&A to boost profitability.

Logistics and Distribution Costs

Ashland's global operations necessitate significant investment in logistics and distribution. These costs encompass the transportation of raw materials to manufacturing sites and the shipment of finished goods to customers worldwide. For instance, in 2024, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40-foot container for key East-West trade routes, a notable increase from pre-pandemic levels.

Managing these expenses is crucial for Ashland's profitability and competitive edge. The company likely leverages strategic partnerships with logistics providers and invests in optimizing its distribution networks to mitigate rising fuel prices and international freight rates. Efficient warehousing solutions also play a key role in ensuring product availability and reducing inventory holding costs.

- Transportation Expenses: Costs associated with moving raw materials and finished products via sea, air, and land freight.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located distribution centers globally.

- Fuel Price Volatility: A significant factor impacting transportation costs, directly influencing shipping rates.

- Supply Chain Optimization: Investments in technology and partnerships to streamline distribution and reduce overall logistics expenditure.

Ashland's cost structure is heavily influenced by its significant investments in research and development to drive innovation in specialty chemicals. The company's commitment to R&D is demonstrated by its $278 million expenditure in fiscal year 2024, a strategic allocation aimed at developing next-generation products and maintaining a competitive edge.

Manufacturing and operational expenses, including labor and energy, form another core component of Ashland's cost base. The company's pursuit of manufacturing network optimization, including plant consolidation, reflects a strategic effort to enhance efficiency and reduce these substantial production costs.

Selling, General, and Administrative (SG&A) expenses, encompassing sales force, marketing, and corporate overhead, are managed through ongoing cost reduction initiatives. In 2024, Ashland continued its focus on optimizing these SG&A costs to improve overall operational efficiency and financial performance.

Global logistics and distribution also represent a considerable cost for Ashland, impacted by factors like fluctuating fuel prices and international freight rates. The company actively works to mitigate these expenses through strategic partnerships and supply chain optimization efforts.

| Cost Category | Fiscal Year 2024 Data (USD millions) | Key Drivers/Notes |

|---|---|---|

| Research & Development | 278 | Investment in innovation and next-generation products. |

| Selling, General & Administrative (SG&A) | (Estimated based on prior year trends and ongoing optimization efforts) | Sales force, marketing, corporate overhead; focus on efficiency. |

| Logistics & Distribution | (Impacted by global shipping costs, e.g., Drewry World Container Index averaging ~$1,700/40ft container for key routes in 2024) | Transportation, warehousing, fuel price volatility. |

Revenue Streams

Revenue flows from selling a diverse array of additives and ingredients crucial for personal care items, spanning skin, hair, and oral care applications. This sector stands as a significant contributor to Ashland's overall income, with a strategic emphasis on premium, naturally derived, and environmentally conscious offerings.

Even with strategic adjustments to its product lineup, the personal care ingredients segment demonstrates remarkable resilience in the marketplace. For instance, Ashland reported in their 2023 fiscal year that their Consumer Specialties segment, which heavily features these personal care ingredients, generated approximately $1.2 billion in net sales, underscoring its importance.

Ashland generates revenue by selling specialized pharmaceutical excipients, binders, and coatings to drug manufacturers. These essential components are crucial for various drug formulations and delivery systems, making this a high-margin business. The company's focus on stringent quality standards and fostering long-term customer relationships underpins this revenue stream. Recent investments in expanding manufacturing capacity are expected to further bolster sales in this key segment.

Revenue streams for Ashland's architectural coatings and construction additives are primarily generated through the sale of specialized chemicals that enhance product performance. These additives are crucial for manufacturers in the paint and construction sectors, improving characteristics such as viscosity control, durability, and ease of application for their end products.

While Ashland has strategically divested certain construction chemical segments to refine its portfolio, the architectural coatings market continues to represent a substantial revenue driver. For instance, in fiscal year 2024, Ashland reported strong performance in its Specialty Additives segment, which includes these key product lines, reflecting sustained demand from the coatings industry.

Sales of Specialty Additives for Industrial Applications

Ashland earns revenue by selling specialty additives crucial for various industrial sectors. This includes markets like energy, performance specialties, and general manufacturing, where their products enhance performance and efficiency.

These sales frequently involve tailored solutions, addressing specific client needs for product improvement or process optimization. For instance, in 2024, Ashland's Performance Adhesives segment, which relies heavily on such additives, saw continued demand driven by infrastructure and construction projects.

- Diversified Industrial Markets: Revenue streams are broad, covering energy, performance specialties, and other manufacturing sectors.

- Customized Solutions: Sales often feature bespoke additives designed to boost client product performance and manufacturing efficiency.

- Revenue Contribution: This segment plays a significant role in Ashland's overall diversified revenue generation.

Licensing and Technical Service Fees

Ashland's business model includes revenue from licensing its proprietary technologies and providing specialized technical services. This allows them to monetize their deep research and development capabilities and application expertise, offering value beyond direct product sales.

While typically a smaller portion of their overall income, these streams are crucial for leveraging Ashland's intellectual property. For instance, in fiscal year 2023, Ashland reported total revenue of $5.2 billion, with licensing and technical service fees contributing a smaller but significant element to this figure, reflecting their commitment to innovation and customer support.

- Technology Licensing: Ashland can license its patented chemical formulations and processes to other companies, generating royalty income.

- Technical Service Fees: Revenue is generated by charging for expert consultations, application development support, and troubleshooting for customers using Ashland's products.

- R&D Monetization: This stream directly capitalizes on the company's substantial investments in research and development, turning scientific advancements into revenue.

- Value-Added Services: These offerings complement product sales by providing customers with enhanced support and tailored solutions, fostering stronger client relationships.

Ashland's revenue streams are diverse, encompassing sales of additives and ingredients for personal care, pharmaceutical excipients, and specialized chemicals for architectural coatings and construction. They also generate income from specialty additives across various industrial sectors and from licensing proprietary technologies and technical services.

The company's strategic focus on high-margin segments like pharmaceuticals and premium personal care ingredients, coupled with its industrial additives, creates a robust financial foundation. For example, Ashland's Consumer Specialties segment, heavily featuring personal care ingredients, reported approximately $1.2 billion in net sales for fiscal year 2023, demonstrating its significant revenue contribution.

In fiscal year 2024, Ashland's Specialty Additives segment, which includes architectural coatings and construction additives, showed strong performance, reflecting sustained demand. This diversified approach, including revenue from licensing and technical services, contributed to Ashland's overall revenue of $5.2 billion in fiscal year 2023, highlighting the breadth of their income generation.

| Revenue Stream | Key Products/Services | Fiscal Year 2023/2024 Relevance |

|---|---|---|

| Personal Care Ingredients | Additives and ingredients for skin, hair, and oral care. | Consumer Specialties segment generated ~$1.2 billion in net sales (FY23). |

| Pharmaceutical Excipients | Binders, coatings, and other essential components for drug formulations. | High-margin business with ongoing investments in capacity expansion. |

| Architectural Coatings & Construction Additives | Specialized chemicals enhancing paint and construction materials. | Strong performance in Specialty Additives segment (FY24). |

| Industrial Specialty Additives | Additives for energy, performance specialties, and general manufacturing. | Performance Adhesives segment shows continued demand (FY24). |

| Technology Licensing & Technical Services | Licensing proprietary technologies and providing expert support. | Monetizes R&D capabilities, contributing to overall revenue (FY23 total revenue $5.2B). |

Business Model Canvas Data Sources

The Ashland Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and strategic operational insights. These diverse data sources ensure each component of the canvas is accurately represented and strategically aligned.