Ashland Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ashland Bundle

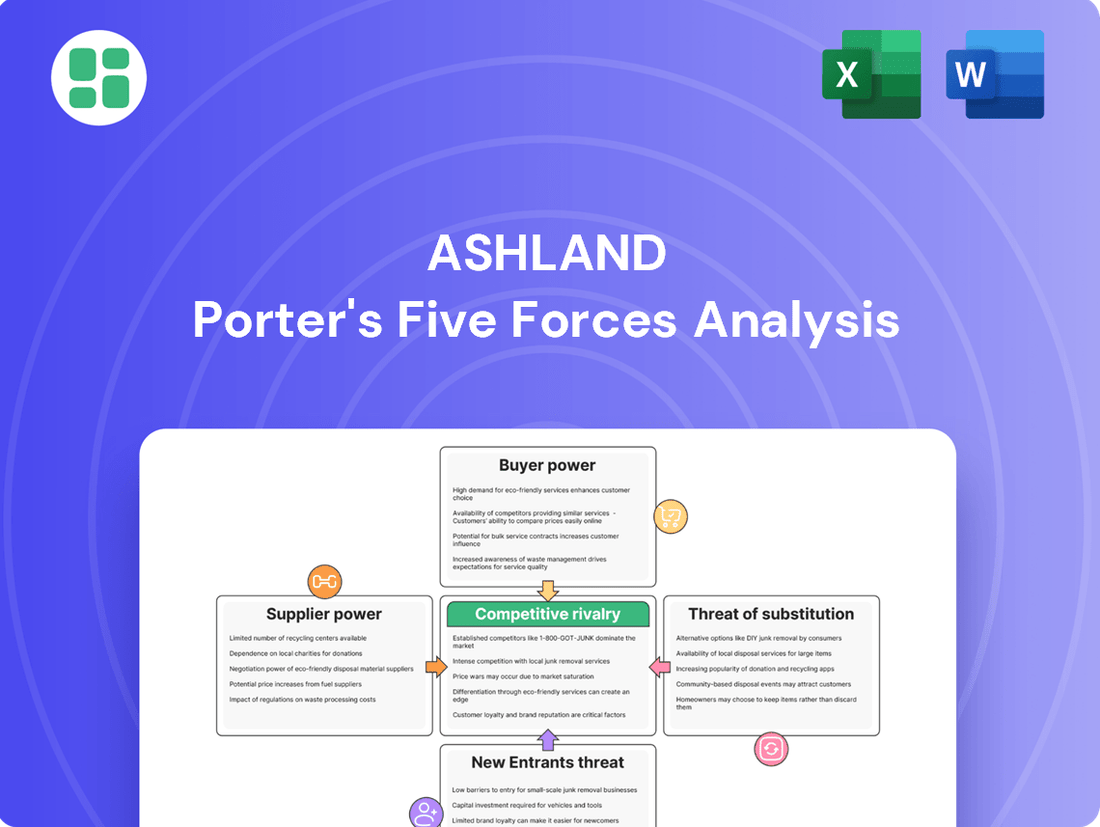

Ashland’s competitive landscape is shaped by formidable forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating its market effectively.

This brief overview only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ashland’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts Ashland's bargaining power. For instance, if Ashland relies on a limited number of suppliers for specialized inputs like natural and synthetic polymers derived from plant and seed extracts, or critical components like cellulose ethers and vinyl pyrrolidones, these suppliers gain considerable leverage. This can translate into higher raw material costs for Ashland, directly affecting its profitability.

The specialty chemicals sector, where Ashland operates, is susceptible to supply chain disruptions and price volatility. Feedstocks, often linked to global crude oil prices, can fluctuate unpredictably. In 2024, crude oil prices experienced volatility, with Brent crude averaging around $80-$85 per barrel for much of the year, impacting the cost of many petrochemical-derived inputs used by Ashland.

Ashland faces significant bargaining power from suppliers when switching costs are high. For specialized chemical inputs, the expense and complexity of changing suppliers can be substantial, impacting Ashland’s operational continuity and product quality.

If alternative suppliers necessitate extensive re-tooling, re-formulation of products, or lengthy re-qualification procedures, the existing suppliers gain leverage. This dependency allows them to potentially dictate terms, impacting Ashland's cost structure and market responsiveness.

Suppliers of unique or proprietary specialty chemical ingredients, or those with patented processes, hold significant power over Ashland. For instance, in 2024, Ashland's reliance on specific high-performance additives, often developed through specialized, patented chemical processes, directly translates to supplier leverage. If Ashland's innovative solutions heavily depend on such unique inputs, the supplier can command premium prices or impose stricter terms, impacting Ashland's cost structure and product development timelines.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Ashland's business, essentially becoming direct competitors by producing specialty materials themselves, can significantly bolster their bargaining power. This potential for suppliers to enter Ashland's market space means Ashland might need to offer more favorable terms or maintain stronger relationships to deter such moves. For instance, if a key supplier of a specialized chemical intermediate were to consider manufacturing the final formulated product, Ashland would face direct competition from its own supply chain.

This dynamic is particularly relevant when suppliers possess unique technical expertise or have identified unmet market demands that they can address by moving downstream. For example, a supplier of advanced polymers might see an opportunity to enter the market for finished composite materials, directly competing with Ashland's existing product lines. This forces Ashland to consider the strategic implications of its supplier relationships and potentially invest in securing its supply chain or developing alternative sourcing strategies to mitigate this risk.

- Supplier Forward Integration: Suppliers may leverage their expertise to produce finished specialty materials, directly competing with Ashland.

- Increased Bargaining Power: This threat compels Ashland to maintain strong supplier relationships and potentially accept less favorable terms to avoid direct competition.

- Industry Specificity: While less common for basic raw material providers, this threat is more pronounced for suppliers of highly specialized intermediate products or technologies.

Importance of Ashland to Suppliers

Ashland's bargaining power with its suppliers is influenced by how much of a supplier's business it represents. If Ashland is a minor client, a supplier might feel less pressure to offer competitive pricing or prioritize Ashland's orders. However, Ashland's significant annual spending on raw materials, totaling around $2.4 billion, suggests it is a substantial customer for many of its suppliers. This considerable purchasing volume can give Ashland more leverage in negotiations.

The company's substantial annual expenditure on raw materials, approximating $2.4 billion, underscores its importance as a customer to its supply base. This financial weight allows Ashland to potentially negotiate more favorable terms, pricing, and delivery schedules. Suppliers who rely heavily on Ashland's business are therefore likely to be more accommodating to its demands, enhancing Ashland's bargaining position.

- Ashland's annual raw material expenditure: Approximately $2.4 billion.

- Impact of customer volume: Larger customers often secure better terms from suppliers.

- Supplier dependence: Suppliers with high dependence on Ashland may offer more favorable conditions.

Suppliers of critical, specialized chemical inputs for Ashland wield significant bargaining power. This is amplified when these suppliers are few in number, or when switching to an alternative provider would incur substantial costs for Ashland in terms of re-tooling, product reformulation, or lengthy requalification processes. For example, suppliers of proprietary additives or those with patented production methods can command premium pricing, directly impacting Ashland's cost structure and product development timelines.

The threat of suppliers integrating forward into Ashland's business, thereby becoming direct competitors, also bolsters their leverage. This risk is more pronounced for suppliers of highly specialized intermediate products or technologies rather than basic raw material providers. This dynamic forces Ashland to carefully manage its supplier relationships to mitigate potential direct competition.

Ashland's substantial annual raw material expenditure, estimated at around $2.4 billion, positions it as a significant customer for many suppliers. This considerable purchasing volume grants Ashland leverage to negotiate more favorable pricing, terms, and delivery schedules, as suppliers with high dependence on Ashland's business are likely to be more accommodating.

| Factor | Impact on Ashland's Bargaining Power | Supporting Data/Example (2024 Context) |

|---|---|---|

| Supplier Concentration | Increases supplier power if few suppliers exist for specialized inputs. | Reliance on limited suppliers for polymers or cellulose ethers. |

| Switching Costs | High costs increase supplier leverage due to re-tooling/re-qualification needs. | Complex reformulation for specialty chemical inputs. |

| Supplier Forward Integration | Threatens Ashland by creating direct competition, increasing supplier leverage. | Supplier of intermediates considering producing finished specialty materials. |

| Ashland's Purchasing Volume | Increases Ashland's leverage as a significant customer. | Annual raw material expenditure of approx. $2.4 billion. |

What is included in the product

This analysis dissects Ashland's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Effortlessly identify and mitigate competitive threats with a visual breakdown of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Ashland operates across a broad spectrum of industries, from personal care and pharmaceuticals to food and beverage, coatings, and construction. This diversification inherently spreads customer influence. However, if a few major clients or specific sectors contribute disproportionately to Ashland's overall sales, these concentrated customers gain leverage to negotiate more favorable pricing and terms.

For instance, while Ashland's 2023 annual report doesn't break down revenue by individual customer, it does highlight portfolio adjustments. Declines in segments like Life Sciences and Personal Care, partly attributed to lower volumes, suggest that customer demand shifts or purchasing power in these areas can indeed impact Ashland's performance, indicating a degree of customer concentration in key markets.

Customer switching costs significantly influence their bargaining power. For Ashland, in sectors like pharmaceuticals and personal care, switching suppliers for specialty ingredients can be very costly. This is due to rigorous regulatory hurdles, the need for extensive product testing, and complex re-formulation efforts. These factors make it difficult and expensive for customers to change, thus increasing Ashland's product stickiness and diminishing customer leverage.

In 2023, the global pharmaceutical excipients market, where Ashland is a key player, was valued at approximately $10.5 billion, with a projected compound annual growth rate of over 6% through 2028. This growth is partly driven by the high switching costs associated with ensuring regulatory compliance and product efficacy when changing ingredient suppliers, reinforcing Ashland's position.

Conversely, for applications in less regulated industries, the costs and complexities associated with switching suppliers are considerably lower. This means customers in these segments have more freedom to negotiate prices or seek alternative providers, thereby increasing their bargaining power against Ashland.

Ashland's strategy of product differentiation, evident in offerings like advanced cellulose ethers and high-performance vinyl pyrrolidones, aims to reduce customer bargaining power. By providing unique functionalities and performance enhancements, Ashland creates products that are not easily substituted, thereby commanding greater pricing flexibility.

For instance, Ashland's investments in specialty adhesives, which offer superior bonding in demanding applications, exemplify this differentiation. In 2024, the company continued to emphasize its innovation pipeline, with a significant portion of its R&D budget allocated to developing next-generation materials that offer distinct advantages over standard chemical offerings.

However, the chemical industry is dynamic, and the threat of commoditization looms. If competitors can replicate Ashland's innovations or if market demand shifts towards more standardized solutions, the bargaining power of customers could increase, forcing price concessions.

Price Sensitivity of Customers

Customer price sensitivity for Ashland's products is a key factor in understanding the bargaining power of buyers. This sensitivity is directly linked to how significant Ashland's product cost is within the customer's overall expenses and its effect on the customer's final product's profitability. For instance, if Ashland's chemicals are a major component of a customer's manufacturing cost, any price change by Ashland will have a more pronounced impact on the customer's bottom line, leading to greater price sensitivity.

In markets where Ashland's customers operate under intense competition, they often face pressure to minimize their own production costs. This competitive environment inevitably translates into heightened price sensitivity for the inputs they purchase, including those from Ashland. If customers are struggling to maintain margins due to competitive pricing pressures in their own end markets, they will likely seek suppliers who can offer more favorable pricing, thereby increasing their bargaining power.

Recent financial data from 2024 highlights this dynamic. Ashland observed lower pricing trends in its Life Sciences segment, with revenue in this segment decreasing by 1.9% year-over-year to $377 million in the first quarter of 2024. Similarly, the Intermediates segment experienced a revenue decline of 11.5% to $204 million in the same period. These figures suggest that customers in these sectors may be exerting greater price pressure, potentially due to market conditions or the availability of alternative suppliers.

- Customer Cost Contribution: The proportion of Ashland's product cost to a customer's total production cost directly impacts price sensitivity.

- Downstream Market Competition: High competition in customer industries forces them to seek cost reductions, increasing their demand for lower-priced inputs.

- 2024 Segment Performance: Revenue declines in Life Sciences (-1.9%) and Intermediates (-11.5%) in Q1 2024 suggest increased customer price sensitivity in these areas.

Threat of Backward Integration by Customers

Customers might explore backward integration if Ashland's specialty chemicals represent a substantial portion of their costs and are crucial for their operations. For instance, if a major client relies heavily on a specific Ashland polymer and finds its production process manageable, they might consider bringing it in-house to gain cost control or supply security. However, the intricate nature of specialty chemical manufacturing, often requiring significant research and development investment and substantial capital outlay, typically renders this a less practical option for many of Ashland's diverse customer base.

The threat of backward integration is influenced by the ease with which customers can replicate Ashland's production processes. For example, while a large automotive manufacturer might possess the resources to produce certain basic chemicals, the specialized formulations and proprietary processes involved in Ashland's advanced materials are considerably more challenging to replicate. This complexity acts as a significant barrier, mitigating the risk of widespread backward integration across Ashland's customer segments.

Ashland's focus on high-value, technically demanding chemical solutions generally limits the appeal of backward integration for its customers. In 2024, the average R&D expenditure for specialty chemical companies was approximately 5-10% of revenue, highlighting the continuous innovation required. Customers typically lack the specialized expertise and infrastructure to match this, making it more cost-effective to source these critical components from Ashland rather than invest in their own complex manufacturing capabilities.

- Complexity of Specialty Chemical Production: High R&D intensity and proprietary processes make in-house manufacturing difficult for customers.

- Capital Requirements: Significant investment in specialized equipment and facilities deters backward integration.

- Cost-Effectiveness: Customers often find it more economical to purchase from Ashland than to develop their own production capabilities.

- Customer Dependence: While some customers may use critical Ashland products, the technical barriers limit their ability to integrate backward effectively.

The bargaining power of Ashland's customers is influenced by several factors, including customer concentration, switching costs, and price sensitivity. While Ashland serves a diverse customer base, significant sales to a few large clients can grant them considerable leverage. Conversely, high switching costs in sectors like pharmaceuticals, due to regulatory and reformulation complexities, tend to reduce customer power.

Price sensitivity is heightened when Ashland's products represent a substantial portion of a customer's costs or when customers operate in highly competitive downstream markets. For instance, Ashland's Q1 2024 revenue declines in Life Sciences and Intermediates suggest increased price pressure from buyers in these segments. The threat of backward integration is generally low for Ashland due to the complexity and capital investment required for specialty chemical production.

| Factor | Impact on Customer Bargaining Power | Ashland Context |

|---|---|---|

| Customer Concentration | High concentration increases power | Varies by sector; potential for leverage by key clients. |

| Switching Costs | High costs decrease power | Significant barriers in pharma/personal care due to regulation and reformulation. |

| Price Sensitivity | High sensitivity increases power | Influenced by cost contribution and downstream market competition. |

| Backward Integration Threat | High threat increases power | Generally low due to complexity and R&D intensity of specialty chemicals. |

What You See Is What You Get

Ashland Porter's Five Forces Analysis

This preview displays the complete Ashland Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning.

Rivalry Among Competitors

The specialty chemicals sector is a crowded arena, featuring a mix of giants and nimble specialists. Major global players such as Dow, BASF, DuPont, and Arkema operate alongside a multitude of smaller, highly focused companies. This diverse competitive landscape, with both broad-spectrum providers and niche innovators, fuels a high degree of rivalry.

The specialty chemicals market is poised for robust expansion, with projections indicating an annual growth rate of approximately 3% for both 2025 and 2026. This upward trend is fueled by increasing demand from key sectors such as automotive, electronics, and construction, suggesting a generally favorable market environment.

However, this growth doesn't entirely eliminate competitive pressures. Ashland, for instance, has navigated periods of sluggishness and varied demand, prompting strategic moves like portfolio optimization and cost reduction initiatives. These actions highlight that even in growing markets, companies must remain agile to manage competitive intensity effectively.

Ashland's focus on innovation and creating unique solutions for its customers helps set its products apart. This differentiation makes it harder for customers to switch to a competitor, as they might lose the specific benefits Ashland's products offer. This can lessen the intense rivalry based purely on price.

However, in certain segments of the specialty chemicals market, there's a growing trend towards commoditization. This means competitors can more easily offer products that are very similar to Ashland's. For instance, in 2024, the global specialty chemicals market experienced a rise in generic offerings, putting pressure on companies like Ashland to either further enhance their unique selling propositions or engage in price competition.

Exit Barriers

In the chemical industry, significant investments in manufacturing plants, specialized equipment, and compliance with stringent environmental regulations create substantial exit barriers. These high fixed costs mean that companies often continue operating even when profitability is low, contributing to persistent overcapacity and heightened competitive rivalry.

For instance, the capital expenditure for a new chemical production facility can easily run into hundreds of millions of dollars, with ongoing costs for maintenance, specialized labor, and environmental monitoring. This financial commitment makes exiting the market a financially punishing decision.

- High Capital Investment: The chemical sector typically requires massive upfront investments in plant and equipment, often exceeding $100 million for a single facility.

- Specialized Assets: Many chemical plants utilize highly specialized machinery and processes that have little to no resale value outside the industry.

- Environmental Compliance Costs: Meeting environmental regulations, such as those related to emissions and waste disposal, incurs significant ongoing expenses, making closure or repurposing complex and costly.

- Contractual Obligations: Long-term supply agreements and customer contracts can also lock companies into operations, further increasing the difficulty of exiting.

Strategic Stakes and Diversity of Competitors

The specialty chemicals sector is characterized by a wide array of strategic objectives among its players. Some companies prioritize aggressive market share growth, while others focus on maximizing profitability or establishing leadership in sustainability initiatives. This divergence in goals often results in unpredictable competitive actions, making the landscape dynamic.

The competitive intensity is further amplified by a growing influx of new entrants. Companies from emerging economies, notably China, India, and the Middle East, are increasingly entering the market. This expansion is contributing to accelerated commoditization and the addition of significant new capacity.

- Diverse Strategic Goals: Competitors may aim for market share, profitability, or sustainability leadership, leading to varied and sometimes unpredictable strategic moves.

- Emerging Market Entrants: Increased competition from companies in China, India, and the Middle East is a key factor. For instance, China's chemical industry output reached approximately $1.7 trillion in 2023, significantly impacting global supply dynamics.

- Capacity Expansion and Commoditization: New capacity additions, particularly from these emerging regions, are driving commoditization trends, putting pressure on pricing and margins across the sector.

Competitive rivalry in the specialty chemicals sector is intense, driven by a mix of large global players and specialized firms. Despite market growth, companies like Ashland face pressure from increasing commoditization and new entrants, particularly from emerging economies. High capital investment and exit barriers also contribute to sustained competition.

Companies differentiate through innovation and unique solutions, but the rise of similar products in 2024 has intensified price competition. The diverse strategic objectives of competitors, from market share grabs to profitability focus, create a dynamic and often unpredictable competitive environment.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Number of Competitors | Many global and specialized players exist. | High |

| Market Growth Rate (2025-2026 est.) | Approximately 3% annually. | Moderate (growth tempers, but doesn't eliminate, rivalry) |

| Product Differentiation | Ashland focuses on unique solutions. | Reduces price-based rivalry, but commoditization can counter this. |

| Exit Barriers | High capital investment, specialized assets, environmental compliance. | Increases rivalry by keeping firms in the market. |

| Emerging Market Entrants | Increased presence from China, India, Middle East. | Drives commoditization and capacity expansion, intensifying rivalry. |

SSubstitutes Threaten

Ashland's diverse product portfolio, including cellulose ethers and specialty additives, serves critical functions across personal care, pharmaceuticals, and construction. The threat of substitutes emerges when alternative materials or technologies can perform these same functions, potentially impacting Ashland's market share and pricing power.

For example, the increasing demand for bio-based alternatives to petroleum-derived chemicals in various industries poses a significant substitute threat. As of early 2024, the global bio-based chemicals market was projected to reach over $100 billion, indicating a growing preference for sustainable materials that could displace some of Ashland's traditional offerings.

Customers are always on the lookout for better value, meaning they'll switch to substitutes if they provide a superior price-performance ratio. For instance, in the paints and coatings sector, emerging formulations or eco-friendly options like Bermocoll flow cellulose ethers might offer enhanced features or greater sustainability, directly challenging existing offerings.

This dynamic necessitates that Ashland remains at the forefront of innovation. The company must consistently deliver products that not only meet but exceed customer expectations in terms of both performance and overall value to retain its market position against these evolving alternatives.

Customer willingness to switch to substitutes hinges on how easy it is to adopt them, the perceived risks involved, and any necessary regulatory approvals. For instance, in the pharmaceutical sector, switching to a new excipient or additive can be a significant hurdle, often requiring extensive and costly validation processes that can take years to complete, as seen in the rigorous drug approval pathways.

Emerging Technologies and Innovation

Rapid advancements in materials science and biotechnology are a significant threat, as they can birth entirely new product categories that fulfill similar customer needs. For example, the burgeoning field of green chemistry startups is actively developing sustainable alternatives to traditional chemical products, which could erode demand for Ashland's existing offerings.

The increasing focus on eco-friendly and biodegradable materials, driven by consumer demand and regulatory pressures, presents another avenue for substitution. Companies investing heavily in these areas may offer compelling alternatives that bypass the need for Ashland's specialized chemical solutions.

Ashland's strategic response hinges on its commitment to research and development. In 2023, Ashland reported $182.8 million in R&D expenses, a critical investment to stay ahead of these evolving threats. By fostering innovation platforms and exploring new material science frontiers, Ashland can proactively develop its own next-generation products or acquire promising technologies.

- Emerging Tech Threat: Green chemistry startups are developing sustainable alternatives.

- Biotech Impact: Advances in biotechnology could create novel substitutes.

- Ashland's R&D: $182.8 million invested in R&D in 2023 to counter threats.

- Strategic Imperative: Innovation platforms are key to developing next-gen products.

Indirect Substitution through Downstream Innovations

The threat of substitutes for Ashland extends beyond direct chemical replacements. Innovations in customers' end products or processes can significantly reduce or even eliminate the need for Ashland's current chemical offerings. For instance, advancements in coating technologies that require fewer additives or utilize entirely different binder systems could serve as indirect substitutes. This means Ashland must constantly monitor downstream industry trends.

Consider the automotive sector, a key market for Ashland. In 2024, there's a growing emphasis on lightweighting vehicles to improve fuel efficiency and electric vehicle range. This trend is driving innovation in materials science, potentially leading to new manufacturing processes that bypass the need for certain chemical treatments or adhesives that Ashland currently supplies. For example, advancements in composite materials or advanced joining techniques could reduce reliance on traditional chemical bonding agents.

- Downstream Innovation Impact: New coating technologies requiring fewer additives or alternative binders directly threaten Ashland's specialty chemical segments.

- Market Trend Example: Automotive lightweighting initiatives in 2024 are spurring material science innovations that could reduce demand for traditional chemical bonding agents.

- Indirect Substitution Mechanism: Innovations in customer processes, such as advanced composite manufacturing, can bypass the need for Ashland's chemical solutions.

The threat of substitutes for Ashland arises when alternative products or technologies can fulfill similar customer needs, potentially impacting market share and pricing. This is particularly relevant as industries seek cost-effective, higher-performing, or more sustainable solutions.

For instance, the increasing adoption of bio-based polymers in packaging and textiles, driven by environmental concerns, directly challenges Ashland's traditional chemical offerings. The global bioplastics market was estimated to reach approximately $13.7 billion in 2023 and is projected for significant growth, underscoring this substitution trend.

Customers are constantly evaluating the price-performance ratio of available options. If a substitute material offers comparable or superior functionality at a lower cost, or with added benefits like biodegradability, the incentive to switch increases. This makes continuous innovation and value proposition enhancement crucial for Ashland.

The ease of switching and the associated switching costs also play a vital role. In sectors like pharmaceuticals, where regulatory hurdles for new excipients are high, substitution might be slower. However, in more dynamic markets, the threat can materialize rapidly.

| Industry Segment | Potential Substitute | Impact on Ashland |

|---|---|---|

| Personal Care | Natural emulsifiers, plant-derived thickeners | Reduced demand for synthetic rheology modifiers and emollients |

| Pharmaceuticals | Novel drug delivery systems bypassing excipients | Potential decrease in demand for certain specialty additives |

| Construction | Advanced composite materials, self-healing concrete | Lower need for traditional binders and coatings |

| Paints & Coatings | Water-borne formulations, UV-curable coatings | Displacement of solvent-based additives and binders |

Entrants Threaten

The specialty chemicals sector demands massive upfront investment, creating a formidable barrier for newcomers. Companies need substantial capital for cutting-edge research and development, state-of-the-art manufacturing plants, and specialized machinery. For instance, establishing a new specialty chemical production facility can easily run into hundreds of millions of dollars, a figure that deters many potential entrants.

The chemical industry, particularly in specialty chemicals for pharmaceuticals and personal care, is heavily regulated by bodies like the EPA and FDA. These stringent environmental, health, and safety standards create significant barriers.

Obtaining the necessary approvals and navigating these complex regulatory frameworks is a lengthy and expensive undertaking. For instance, new chemical registrations under REACH in Europe can cost hundreds of thousands of euros and take years to complete, effectively deterring many potential new entrants.

Established players like Ashland benefit significantly from economies of scale in production, purchasing, and distribution. This allows them to achieve lower per-unit costs, a crucial advantage in competitive markets. For instance, in 2024, Ashland's substantial operational footprint likely translated into more favorable pricing for raw materials and optimized logistics compared to a nascent competitor.

New entrants would find it incredibly difficult to replicate these cost efficiencies. They would likely face higher initial capital expenditures and less favorable terms with suppliers, placing them at a considerable disadvantage from the outset. This cost barrier is a primary deterrent, making it challenging for new companies to gain a foothold.

Intellectual Property and Proprietary Knowledge

Ashland's business model heavily relies on its extensive portfolio of intellectual property, including patents and trade secrets, safeguarding its innovative chemical formulations and specialized solutions. This IP creates a substantial barrier for potential competitors seeking to replicate its offerings. For instance, Ashland has consistently invested in R&D, with research and development expenses totaling $320 million in 2023, underscoring its commitment to creating and protecting proprietary knowledge.

The creation of comparable products necessitates significant investment in research and development to either develop novel technologies or navigate existing patent landscapes. New entrants face the daunting task of building equivalent technical expertise and securing their own intellectual property, a process that is both time-consuming and capital-intensive. This inherent difficulty in replicating Ashland's specialized knowledge and patented technologies significantly reduces the immediate threat of new entrants.

- Patented Formulations: Ashland holds numerous patents covering its core technologies in areas like rheology modifiers and specialty additives.

- Trade Secrets: Proprietary manufacturing processes and specific formulation recipes are protected as trade secrets, offering a competitive edge.

- R&D Investment: Continued investment in research and development, as seen in its 2023 R&D spending, reinforces its IP moat.

- Market Expertise: Decades of accumulated technical knowledge and application expertise are difficult for newcomers to quickly acquire.

Access to Distribution Channels and Customer Relationships

New companies often struggle to secure reliable access to established distribution channels, a critical hurdle in reaching customers. Building and nurturing these relationships, particularly across varied industries, requires significant investment in time and resources. For instance, a new specialty chemicals firm would face immense difficulty replicating Ashland's existing network of distributors and direct customer partnerships, which have been cultivated over decades.

Ashland's extensive global footprint and deeply entrenched customer base present a substantial barrier to entry. New entrants must not only develop comparable product quality but also overcome the loyalty and trust Ashland has fostered. In 2024, Ashland's focus on customer-centric solutions, evident in their ongoing R&D investments aimed at specific industry needs, further solidifies these existing relationships, making it harder for newcomers to gain traction.

- Distribution Channel Access: New entrants face significant challenges in securing shelf space or partnership agreements with established distributors, who often prioritize long-standing relationships and proven sales volumes.

- Customer Relationship Investment: Developing deep, trust-based relationships with customers across diverse sectors, as Ashland has, requires sustained effort in technical support, tailored solutions, and reliable supply chains.

- Barriers to Market Acceptance: Ashland's established reputation and market penetration mean new competitors must offer demonstrably superior value or innovation to displace existing suppliers and win customer loyalty.

- Network Effects: The more customers and distributors Ashland engages, the stronger its network becomes, creating positive feedback loops that are difficult for new entrants to overcome.

The threat of new entrants in the specialty chemicals sector, particularly for companies like Ashland, is significantly mitigated by high capital requirements for R&D and manufacturing, stringent regulatory hurdles, and the difficulty of replicating established economies of scale. Furthermore, strong intellectual property protection and deeply entrenched customer relationships and distribution networks act as substantial barriers, making it challenging for newcomers to gain market share.

| Barrier Type | Description | Impact on New Entrants | Example (Ashland Context) |

|---|---|---|---|

| Capital Intensity | High upfront investment for R&D, plants, and machinery. | Deters new entrants due to substantial financial commitment. | Establishing a new specialty chemical plant can cost hundreds of millions of dollars. |

| Regulatory Compliance | Strict environmental, health, and safety standards (e.g., EPA, FDA). | Adds significant time and cost to market entry. | New chemical registrations can cost hundreds of thousands of euros and take years. |

| Economies of Scale | Lower per-unit costs for established players in production, purchasing, and distribution. | New entrants face higher initial costs and less favorable supplier terms. | Ashland's 2024 operational footprint likely provided cost advantages over nascent competitors. |

| Intellectual Property | Patents, trade secrets, and proprietary formulations. | Requires significant R&D investment and time for new entrants to develop comparable offerings. | Ashland's 2023 R&D spending of $320 million reinforces its IP protection. |

| Distribution & Customer Relationships | Established networks and customer loyalty. | New entrants struggle to secure distribution channels and win over customers. | Replicating Ashland's decades-old distributor and direct customer partnerships is difficult. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, industry-specific market research reports, and competitor news releases. This blend of sources allows for a comprehensive understanding of the competitive landscape.